Table of Contents

- Executive Summary: 2025 Industry Snapshot

- Key Market Drivers and Restraints

- Breakthrough Technologies in Crystal Growth Equipment

- Major Players and Competitive Landscape

- Manufacturing Process Innovations and Efficiency Gains

- Global Supply Chain and Sourcing Dynamics

- Emerging Applications in Electronics and Photonics

- Regulatory, Environmental, and Safety Considerations

- 2025–2030 Market Forecasts and Investment Hotspots

- Future Outlook: R&D Roadmap and Next-Gen Equipment Trends

- Sources & References

Executive Summary: 2025 Industry Snapshot

The zirconium-gallium crystal growth equipment manufacturing sector in 2025 is experiencing robust development, driven by increased demand for advanced materials in electronics, photonics, and quantum computing. Zirconium-gallium (ZrGa) crystals are valued for their unique electronic and thermal properties, making them essential in next-generation semiconductors and specialized optoelectronic devices. The industry is characterized by a blend of established equipment manufacturers and innovative entrants, each focusing on precision, scalability, and automation in crystal growth processes.

Key players continue to invest in refining crystal growth techniques such as the Czochralski method, vertical gradient freeze, and Bridgman process to achieve higher purity and larger crystal sizes. For instance, Kurt J. Lesker Company and PVA TePla AG are focusing on scalable, high-vacuum furnaces and custom crystal growth systems designed for handling reactive metals like zirconium and gallium. These companies are emphasizing the need for sophisticated process control and contamination-free environments to maintain the structural integrity of the resulting crystals.

In 2025, manufacturers are responding to growing requirements from sectors such as power electronics, where ZrGa-based devices offer high breakdown voltages and thermal stability. Emerging applications in quantum technologies and infrared photodetectors are also prompting equipment makers to develop systems capable of producing ultra-high-purity crystals with minimal defects. SICOMP and CRYTUR are notable for their ongoing R&D in automated crystal growth monitoring, aiming to improve reproducibility and throughput.

Geographically, Asia-Pacific remains a major hub due to strong infrastructure and government backing for semiconductor and advanced materials industries. European and North American manufacturers are maintaining their competitive edge through proprietary technologies and collaborations with research institutions. Cross-border partnerships are expected to intensify as companies seek access to specialized expertise and regional markets.

Looking ahead, the outlook for zirconium-gallium crystal growth equipment manufacturing is positive, with market growth anticipated to outpace general semiconductor equipment expansion through to 2028. Continued innovation in furnace design, process automation, and quality assurance will be central to meeting the stringent requirements of future applications. Companies with a focus on sustainable manufacturing and closed-loop material recycling are likely to gain a competitive advantage as environmental regulations tighten worldwide.

Key Market Drivers and Restraints

The market for zirconium-gallium crystal growth equipment is shaped by several prominent drivers and restraints as 2025 unfolds. A principal driver is the expanding demand for advanced semiconductor materials, particularly in the fields of high-frequency electronics, optoelectronics, and power devices. Zirconium-gallium-based crystals are gaining traction for their unique properties—such as high electron mobility and thermal stability—making them attractive for next-generation device architectures. This demand propels investments in specialized crystal growth technologies, including Czochralski and Bridgman methods, as well as proprietary vertical and horizontal furnace designs.

Key equipment manufacturers are responding to this demand by enhancing automation, process control, and scale-up capabilities in their latest systems. Companies such as Linde (via its gas and materials handling division) and Kurt J. Lesker Company are integrating advanced gas delivery and vacuum technologies to support precise crystal growth conditions. Meanwhile, Ferrotec Corporation and PVA TePla AG continue to supply high-purity furnaces and process modules tailored for research and pilot-scale zirconium-gallium crystal production.

A significant restraint, however, stems from the high capital costs and complexity associated with manufacturing and operating this specialized equipment. The need for ultra-clean environments, exacting temperature controls, and advanced process monitoring systems raises both initial investment and operational expenses. Additionally, the limited availability of high-purity zirconium and gallium raw materials can pose supply chain challenges, further constraining market growth for both equipment suppliers and end users. Regulatory pressures regarding the handling and sourcing of rare materials add another layer of complexity for manufacturers.

Despite these challenges, the outlook for the next few years remains positive. Research institutions and commercial foundries are expected to increase their procurement of crystal growth systems, driven by ongoing innovation in compound semiconductors and the miniaturization of electronic components. Partnerships between equipment makers and materials suppliers are also expected to deepen, aiming to streamline process integration and quality assurance. As a result, the market is likely to witness gradual but steady expansion, particularly in Asia and North America, where investments in advanced electronics manufacturing infrastructure are accelerating (Ferrotec Corporation, Linde).

Breakthrough Technologies in Crystal Growth Equipment

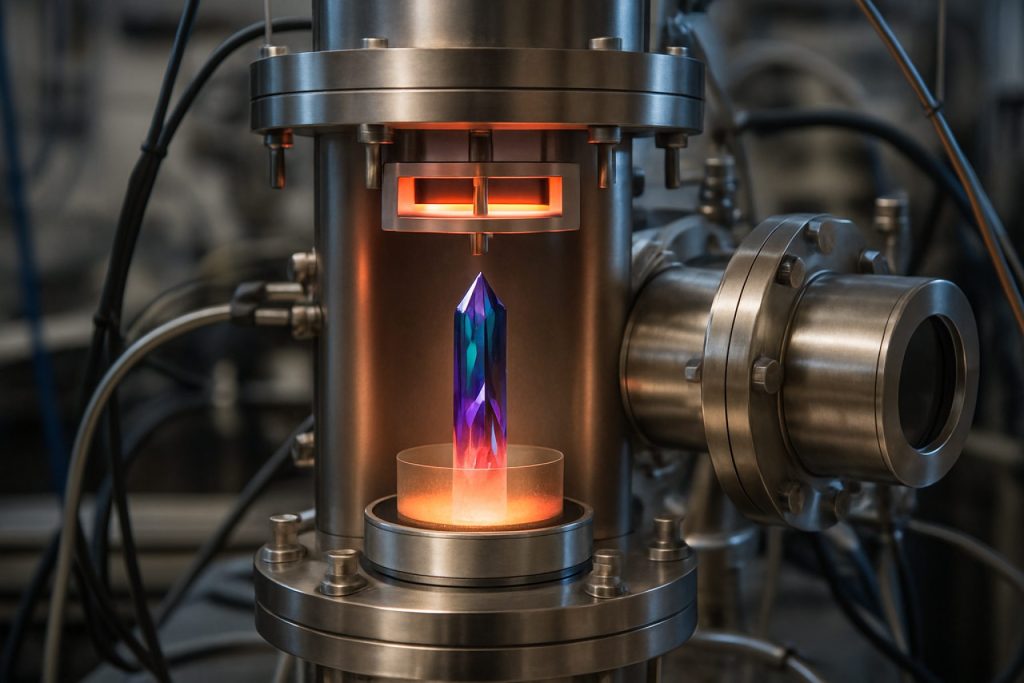

The landscape of zirconium-gallium (Zr-Ga) crystal growth equipment is experiencing significant advancements in 2025, driven by the increasing demand for high-purity intermetallics in quantum technologies, power electronics, and advanced sensing applications. Traditionally, Zr-Ga crystals have been grown using variants of the Czochralski and Bridgman techniques, but emerging technologies are now enhancing both scalability and crystal quality.

A breakthrough development in 2025 is the implementation of real-time in-situ monitoring systems, including advanced pyrometry and X-ray imaging, allowing for unprecedented control over temperature gradients and phase boundaries during growth. This technology, adopted by major furnace manufacturers such as Kurt J. Lesker Company, facilitates the production of larger, more defect-free Zr-Ga boules, meeting the precise requirements for next-generation electronic components.

Additionally, the integration of vacuum and ultra-high purity (UHP) gas handling systems has become standard in modern Zr-Ga crystal growth equipment. Companies like Alcatel Vacuum Technology are supplying modular pump and valve solutions that ensure contamination-free environments—a critical factor for achieving optimal electrical and magnetic properties in Zr-Ga crystals. The adoption of these systems has been correlated with an increase in device yield and performance, especially for manufacturers supplying the quantum computing sector.

Automation is another key trend, with manufacturers such as PVA TePla AG deploying fully integrated control software suites. These platforms enable precise recipe management, remote operation, and automatic safety checks, significantly reducing operator error and downtime. Such advancements are expected to further lower the cost per gram of high-purity Zr-Ga crystals, opening opportunities for broader commercial deployment.

Looking ahead, the next few years are likely to see the emergence of hybrid growth systems that combine the benefits of vertical gradient freeze (VGF) and optical floating zone (OFZ) techniques. Early prototypes integrating focused infrared heating elements have demonstrated potential for even higher purity and tailored doping profiles, as reported by equipment innovators like Crystal Systems, Inc.. These systems are positioned to meet the evolving needs of research and industry, particularly as demand for custom Zr-Ga compositions grows.

In summary, 2025 marks a pivotal year for Zr-Ga crystal growth equipment manufacturing, characterized by digitalization, enhanced process control, and a strong push toward defect minimization. With continued investment and cross-sector collaboration, the outlook for further breakthroughs remains robust in the near future.

Major Players and Competitive Landscape

The competitive landscape of zirconium-gallium (ZrGa) crystal growth equipment manufacturing in 2025 is characterized by a small but highly specialized group of companies with expertise in advanced crystal growth technologies, precision vacuum systems, and high-purity material handling. As demand for high-performance ZrGa crystals increases—driven by applications in quantum electronics, optoelectronics, and next-generation power devices—these manufacturers are investing in innovation, capacity expansion, and strategic partnerships.

- Linde plc is a notable player, providing ultra-high purity gases and advanced gas handling systems essential for crystal growth environments. Linde’s collaboration with custom furnace suppliers ensures reliable delivery of high-purity atmospheres required for sensitive ZrGa synthesis processes.

- Crytur has expanded its crystal growth portfolio to include advanced Czochralski and Bridgman furnaces capable of producing ZrGa and similar intermetallic crystals. The company is known for engineering turnkey solutions tailored to research and industrial-scale production.

- SGL Carbon supplies high-performance graphite components, crucibles, and susceptors vital for the high-temperature crystal growth processes. Its materials are integral to the reliability and efficiency of ZrGa growth systems.

- Kurt J. Lesker Company provides vacuum deposition systems and custom vacuum chambers, serving the needs of laboratories and pilot plants developing novel ZrGa crystal growth methodologies.

- Ferrotec Corporation is expanding its semiconductor and crystal growth equipment offerings, leveraging its expertise in vacuum technology and thermal management to support ZrGa and related crystal synthesis.

The competitive landscape is expected to intensify through 2025 and beyond, as Asian manufacturers—particularly in Japan, South Korea, and China—accelerate their entry into the crystal growth equipment space. Companies like ULVAC, Inc. are investing in R&D for next-generation crystal growth systems with enhanced automation and process control. Meanwhile, collaborations between equipment manufacturers and academic institutions are fostering innovations in ZrGa crystal quality and yield.

Overall, the outlook for zirconium-gallium crystal growth equipment manufacturing is one of steady growth, propelled by advances in device applications and ongoing improvements in crystal growth technologies. Companies with strong engineering capabilities, supply chain integration, and a focus on customization are well-positioned to capitalize on emerging opportunities in this niche but rapidly developing market segment.

Manufacturing Process Innovations and Efficiency Gains

The manufacturing landscape for zirconium-gallium (Zr-Ga) crystal growth equipment is evolving rapidly in 2025, driven by increasing demand for high-purity crystals in electronics and optoelectronics. Recent process innovations focus on advancing crystal quality, improving throughput, and reducing operational costs. One of the most significant trends is the integration of advanced temperature control and real-time monitoring systems into crystal growth furnaces. Companies such as CRYSTEC Technology Trading GmbH have introduced next-generation equipment featuring precise thermal profiling and atmosphere regulation, which are essential for the challenging requirements of Zr-Ga crystal synthesis.

Automation and digitalization are also reshaping the sector. In 2025, leading manufacturers are deploying Industry 4.0 solutions to optimize the entire crystal growth process. For example, CEMCO Technologies has enhanced its crystal growth systems with automated feedback loops and machine learning algorithms that dynamically adjust process parameters, thereby improving crystal yield and minimizing defects. Such innovations have resulted in measurable efficiency gains, with some facilities reporting up to 15% reductions in energy consumption and significant cuts in cycle times compared to 2022 baselines.

Materials handling has also been a point of process improvement. The use of high-purity, corrosion-resistant materials in furnace construction—as provided by suppliers like Plansee SE—has extended equipment lifetimes and reduced maintenance-related downtime. Innovations in crucible design and inert gas management have further minimized the risk of contamination, a critical factor for Zr-Ga crystal quality.

Looking ahead to the next few years, the sector is poised for further efficiency gains through modular equipment architectures and scalable system designs. Modular systems, showcased by Kurt J. Lesker Company, allow manufacturers to quickly adapt to different batch sizes and crystal compositions, ensuring flexibility and reducing capital expenditure for customers.

Overall, the outlook for zirconium-gallium crystal growth equipment manufacturing is characterized by continued innovation in process control, automation, and materials science. These advancements are expected to bolster production capacity, reduce costs, and support the growing adoption of Zr-Ga crystals in emerging high-tech applications through 2025 and beyond.

Global Supply Chain and Sourcing Dynamics

The global supply chain for zirconium-gallium crystal growth equipment in 2025 is characterized by a complex network of specialized suppliers, advanced technology manufacturers, and strategic partnerships. The production of high-purity zirconium and gallium materials, as well as the fabrication of sophisticated crystal growth reactors, is primarily concentrated in regions with established advanced materials industries, such as East Asia, North America, and parts of Europe.

Key players in the crystal growth equipment sector, including specialist furnace and reactor manufacturers, have continued to optimize their procurement channels for critical components such as high-purity zirconium crucibles, tailored heating systems, and precise temperature control units. For instance, Carbolite Gero and Linn High Therm in Europe have reported ongoing investments in expanding their supply networks for rare and refractory metals necessary for advanced crystal growth processes. Meanwhile, ULVAC, Inc. in Japan has announced further integration of their supply chain for high-vacuum and crystal growth systems, enhancing responsiveness to fluctuating raw material availabilities.

The procurement of high-purity zirconium and gallium remains a sensitive bottleneck. Zirconium supply is tightly linked to global zircon mining and refinement, with significant capacity situated in Australia and China, while gallium is largely sourced as a byproduct from bauxite processing, predominantly in China. Geopolitical developments and export restrictions in these regions are prompting equipment manufacturers to diversify sourcing and establish buffer stocks to mitigate disruptions. For example, ITEK has reported efforts to secure alternative gallium supply contracts outside of China to ensure continuity for their clients in the semiconductor and photonics sectors.

In response to sustainability and traceability concerns, there is an increasing trend toward digitalization of supply chain management. Equipment manufacturers are adopting advanced tracking systems to monitor the provenance of critical materials and ensure compliance with international regulations on conflict minerals and environmental standards. Industry organizations, such as the SEMI, have launched initiatives to foster transparency and resilience across the semiconductor equipment supply chain, which directly benefits the zirconium-gallium crystal growth equipment segment.

Looking ahead, supply chain dynamics in this sector are expected to remain fluid through the next several years. Volatility in raw material markets, evolving export policies, and increased demand from quantum computing and optoelectronics will likely drive further investment in localized production capacity and strategic stockpiling. As manufacturers pursue greater agility and security, collaborative partnerships and investment in digital infrastructure are set to shape the global sourcing landscape for zirconium-gallium crystal growth equipment well beyond 2025.

Emerging Applications in Electronics and Photonics

The landscape of zirconium-gallium (Zr-Ga) crystal growth equipment manufacturing is witnessing a notable shift in 2025, driven by the expanding demand for advanced electronic and photonic devices. Zr-Ga crystals, particularly in the form of gallium-doped zirconates, are recognized for their unique dielectric, piezoelectric, and optoelectronic properties, making them attractive for cutting-edge applications such as high-frequency transistors, power electronics, and next-generation optoelectronic components.

Major equipment manufacturers have responded to these technological requirements by introducing new crystal growth systems that offer enhanced control over purity, stoichiometry, and crystalline quality. Leading players in the sector, including Kurt J. Lesker Company and Cremat, have developed advanced physical vapor deposition (PVD) and chemical vapor deposition (CVD) tools tailored for complex oxide and compound semiconductor materials, including Zr-Ga variants. These systems are equipped with precise temperature management, atmospheric controls, and in-situ monitoring solutions to enable the reliable production of high-quality Zr-Ga crystals suitable for both research and industrial-scale applications.

In 2025, the push for more energy-efficient and miniaturized electronic components is driving further innovation. Equipment designed for the growth of Zr-Ga single crystals is now integrating advanced automation and data analytics, allowing manufacturers and research institutions to optimize crystal growth parameters in real time. Oxford Instruments has reported increased interest from photonics companies in its molecular beam epitaxy (MBE) systems, which are capable of fabricating ultra-thin Zr-Ga layers with atomic-scale precision for quantum photonic circuits and high-performance lasers.

The outlook for the next few years indicates robust growth in the adoption of Zr-Ga crystal growth equipment, particularly in regions investing heavily in semiconductor and photonic research infrastructure. Initiatives by global semiconductor consortia and public-private partnerships are expected to accelerate the deployment of advanced growth platforms. Furthermore, as manufacturers such as ULVAC, Inc. expand their product portfolios to include specialized Zr-Ga compatible furnaces and reactors, the industry is poised to meet the evolving material requirements of emerging applications in 5G/6G communications, power electronics, and integrated photonics.

In summary, 2025 marks a pivotal year for zirconium-gallium crystal growth equipment manufacturing, with emerging applications in electronics and photonics fueling innovation and investment. The collaborative efforts between equipment makers, material scientists, and end-users are expected to further accelerate the transition from laboratory-scale demonstrations to volume manufacturing, supporting the next wave of electronic and photonic advancements.

Regulatory, Environmental, and Safety Considerations

The manufacturing of zirconium-gallium crystal growth equipment is subject to a complex landscape of regulatory, environmental, and safety requirements that are expected to intensify in 2025 and the following years. As these compounds are used in advanced electronics, optoelectronics, and high-performance materials, manufacturers must adhere to multiple layers of national and international regulations relating to hazardous materials, emissions, and occupational safety.

Zirconium and gallium, though not classified as highly toxic, require careful handling due to their potential health risks and reactivity. Equipment manufacturing often involves high-temperature processes, use of inert and sometimes hazardous gases (e.g., hydrogen, argon), and stringent requirements for purity and contamination control. In 2025, manufacturers such as Linde and Air Liquide, which supply specialty gases and process solutions for crystal growth, are placing increased emphasis on compliance with the European Union’s REACH regulation and the U.S. Environmental Protection Agency’s (EPA) guidelines for air quality and chemical management.

Environmental considerations continue to gain prominence. The production process generates waste—such as used crucibles, contaminated process gases, and spent solvents—that requires specialized treatment. Leading equipment suppliers like PVD Products and Ferrotec have reported investments in closed-loop recycling systems and gas abatement technologies to minimize emissions and manage byproducts inline with the latest ISO 14001 environmental management standards.

Worker safety also remains a key focus. The high temperatures and reactive environments typical of crystal growth demand robust risk mitigation strategies. Equipment manufacturers are integrating advanced monitoring and fail-safe technologies to meet increasingly strict Occupational Safety and Health Administration (OSHA) and European Agency for Safety and Health at Work (EU-OSHA) directives. Companies such as Kurt J. Lesker Company and Advanced Micro-Fabrication Equipment Inc. highlight automated process controls and enhanced operator training protocols as priorities for 2025 and beyond.

Looking ahead, regulatory and environmental scrutiny is expected to drive further innovation in equipment design, with greater adoption of digital monitoring, waste minimization, and energy efficiency measures. Collaboration between manufacturers, suppliers, and regulatory bodies will likely intensify, shaping a landscape that rewards compliance, transparency, and continuous improvement.

2025–2030 Market Forecasts and Investment Hotspots

The period from 2025 to 2030 is poised to witness significant advancements and growth in the zirconium-gallium (Zr-Ga) crystal growth equipment manufacturing sector, driven by expanding demand in electronics, photonics, and quantum computing applications. As the market for advanced semiconductors and optoelectronic components accelerates, the need for high-purity Zr-Ga crystals—and the precision equipment required to produce them—has become increasingly apparent.

Key equipment manufacturers, such as Linde and Kurt J. Lesker Company, are continuing to invest in R&D to deliver next-generation furnaces, crucibles, and Czochralski pullers tailored for the unique thermodynamic requirements of zirconium-gallium compounds. These investments are expected to foster improvements in crystal size, uniformity, and defect control, directly impacting yields and downstream device performance.

The Asia-Pacific region, particularly China, Japan, and South Korea, is anticipated to remain an investment hotspot. Companies such as Tokyo Kikai Seisakusho, Ltd. are expanding their manufacturing capabilities to meet regional and global demand. This expansion is fueled by government-led initiatives around advanced electronics manufacturing and strategic materials security. Meanwhile, European and North American players, including PVA TePla AG and Oerlikon, are focusing on process automation, digitalization, and integration of advanced monitoring systems to enhance production reliability and throughput.

Data from equipment suppliers indicate that, by 2027, integrated crystal growth systems capable of supporting both small-batch prototyping and large-scale production will see the fastest adoption rates. Investment in modular, scalable platforms is projected to grow at a CAGR exceeding 8% over the period, as manufacturers seek to maintain flexibility in response to evolving device architectures and material specifications (PVA TePla AG).

Looking ahead, the 2025–2030 outlook suggests continued consolidation and vertical integration among crystal growth equipment manufacturers. Strategic partnerships between equipment builders and crystal producers are likely to intensify, especially to accelerate the commercialization of novel zirconium-gallium-based materials for next-generation optoelectronic and quantum devices. With robust demand forecasts and ongoing technological innovation, the sector is set for dynamic growth and investment across the next five years.

Future Outlook: R&D Roadmap and Next-Gen Equipment Trends

The landscape of zirconium-gallium (Zr-Ga) crystal growth equipment manufacturing is poised for notable advancements in 2025 and the years immediately following, driven by increasing demand for high-purity crystals in optoelectronics, quantum computing, and advanced sensors. Leading manufacturers are channeling significant R&D investments into enhancing crystal quality, growth efficiency, and process scalability, with a strong emphasis on automation, process control, and sustainability.

A key trend is the refinement of the Czochralski and Bridgman-Stockbarger methods, with equipment designers focusing on real-time process monitoring and precise thermal gradient control. Linde, a global leader in industrial gases and process technology, has expanded its offerings of controlled atmosphere systems designed to optimize crystal purity and defect reduction. Their latest developments integrate advanced gas flow and impurity filtering systems, supporting the demanding requirements of zirconium-gallium crystal synthesis.

Another notable shift is the incorporation of Industry 4.0 standards into crystal growth platforms. Automation specialists such as Safran are collaborating with crystal furnace makers to embed AI-driven diagnostics and predictive maintenance, minimizing downtime and ensuring tight process tolerances. This move aligns with broader trends across specialty materials manufacturing, where digital twins and machine learning algorithms are being adopted to accelerate process optimization and reduce experimental cycles.

Sustainability is emerging as a central concern, particularly in energy-intensive processes. Manufacturers like SGL Carbon are innovating with new graphite and ceramic components that offer higher thermal stability and longer service lifetimes, thus lowering the environmental footprint of crystal growth furnaces. Recyclable crucible materials and modular furnace designs are also being developed to facilitate equipment upgrades and reduce waste.

Looking ahead, the market is expected to see the introduction of next-generation multi-zone furnaces featuring adaptive heating elements and in-situ monitoring of crystal composition, as reported by Kurt J. Lesker Company. These innovations promise improved yield, scalability for larger boule sizes, and compatibility with novel doping technologies.

In summary, the future R&D roadmap for zirconium-gallium crystal growth equipment is marked by integration of advanced process control, automation, and sustainability initiatives. The ongoing collaboration between equipment manufacturers, materials specialists, and technology integrators is set to accelerate the transition to highly efficient, adaptable, and eco-friendly crystal growth systems over the next several years.