Table of Contents

- Executive Summary: 2025 Outlook on Zinc-Junction Nanowire Fabrication

- Key Market Drivers and Challenges for the Next 5 Years

- Technological Innovations in Nanowire Fabrication Processes

- Emerging Applications: Electronics, Energy, and Biomedicine

- Competitive Landscape: Leading Companies and Industry Alliances

- Global Supply Chain Dynamics and Sourcing Strategies

- Regulatory Environment and Industry Standards (ieee.org, asme.org)

- Market Forecast and Growth Projections Through 2030

- Investment Trends and Funding Opportunities in Zinc-Junction Nanowires

- Future Outlook: Disruptive Potential and Long-Term Industry Impacts

- Sources & References

Executive Summary: 2025 Outlook on Zinc-Junction Nanowire Fabrication

The field of zinc-junction nanowire fabrication is experiencing notable momentum in 2025, driven by advances in synthesis techniques and expanding applications within electronics, optoelectronics, and energy devices. Zinc oxide (ZnO) nanowires, in particular, are at the forefront due to their unique semiconducting and piezoelectric properties, as well as cost-effective, scalable fabrication routes. Major manufacturers and research institutes are intensifying efforts to optimize junction quality, reproducibility, and integration into device architectures.

Current developments center on scalable bottom-up fabrication techniques, such as chemical vapor deposition (CVD), hydrothermal synthesis, and vapor-liquid-solid (VLS) growth. Companies specializing in nanomaterial supply and device prototyping, including Merck KGaA (through its Sigma-Aldrich brand), are reporting increased demand for high-purity ZnO nanowire materials, reflecting growing commercial and academic interest. Also, equipment manufacturers like Oxford Instruments are advancing CVD and atomic layer deposition (ALD) toolsets, enabling higher uniformity and throughput for nanowire arrays with controlled junction characteristics.

Collaborations between industry and academia are accelerating pilot-scale demonstrations of zinc-junction nanowire integration in next-generation devices. For example, several consortia in Asia and Europe are leveraging partnerships to develop flexible photodetectors, UV sensors, and low-power transistors based on ZnO nanowire junctions. As per industry reports, yields exceeding 90% for vertically aligned nanowire arrays are now routinely achieved in controlled environments, with ongoing efforts to translate this reliability to roll-to-roll and wafer-scale manufacturing.

In terms of intellectual property and supply chain, leading suppliers such as NanoAmor and SkySpring Nanomaterials Inc. are broadening their portfolios of ZnO nanowire products, catering to custom specifications for device and research needs. Concurrently, organizations like National Institute of Standards and Technology (NIST) are working to establish measurement standards and best practices for nanowire junction characterization, further supporting commercial deployment.

Looking ahead, the next few years are set to witness further cost reductions and quality improvements in zinc-junction nanowire fabrication, buoyed by investments in automation, in-situ process monitoring, and AI-driven process optimization. As major electronics and sensor manufacturers increase their engagement, the sector is poised for accelerated commercialization, particularly in advanced sensing, energy harvesting, and transparent electronics applications.

Key Market Drivers and Challenges for the Next 5 Years

The zinc-junction nanowire fabrication sector is experiencing a pivotal phase in 2025, driven by the convergence of advanced materials science, clean energy initiatives, and semiconductor miniaturization. Key market drivers are rooted in both technological innovation and strategic policy shifts, while several challenges persist as the industry seeks to scale production and maintain high-performance standards.

Market Drivers

- Energy Storage and Conversion Demand: Zinc-based nanowires are increasingly central to next-generation batteries and solar cells due to their favorable electrochemical properties, low toxicity, and abundance. The global push for sustainable energy, exemplified by government incentives in the US, EU, and Asia-Pacific, is accelerating R&D and pilot manufacturing efforts. Firms like Samsung Electronics and Panasonic Corporation are actively exploring nanowire-enhanced batteries, aiming for higher capacity and improved cyclability.

- Semiconductor Device Miniaturization: As the semiconductor industry advances towards sub-5nm nodes, zinc-junction nanowires offer unique advantages in transistor gating, photodetectors, and nanoelectronics. The ability to tune bandgaps and exhibit high electron mobility is fostering research partnerships between device makers and academic consortia.

- Manufacturing Innovation: The adoption of scalable, solution-based processes such as hydrothermal synthesis and vapor–liquid–solid (VLS) growth is reducing costs and improving yield. Equipment manufacturers like Oxford Instruments are introducing tools tailored for high-throughput nanowire fabrication, supporting industrial-scale implementation.

Key Challenges

- Quality Control and Uniformity: Large-area, uniform growth of zinc-junction nanowires remains a technical bottleneck. Controlling defect densities and junction interfaces at scale is critical for consistent device performance, and even leading suppliers are investing in process metrology and inline inspection solutions.

- Integration with Existing Infrastructure: Compatibility with established CMOS manufacturing lines and energy systems poses a significant hurdle. Companies must ensure that zinc-junction nanowires integrate seamlessly into current workflows without requiring costly retrofits.

- Intellectual Property and Supply Chain: Patent landscapes are becoming increasingly crowded, especially as more players enter the market. Ensuring access to high-purity zinc and precursor materials may also face geopolitical and logistical challenges, requiring robust supplier partnerships and risk mitigation strategies.

Outlook (2025–2030)

Over the next five years, the zinc-junction nanowire fabrication market is expected to progress from pilot lines to early-stage mass production, particularly in energy storage and optoelectronic domains. Continued investment from major electronics and materials companies, along with collaborative efforts between industry and academia, will likely accelerate breakthroughs in cost reduction and reliability, shaping the sector’s growth trajectory and enabling broader commercial deployment.

Technological Innovations in Nanowire Fabrication Processes

Zinc-junction nanowire fabrication is undergoing rapid transformation, driven by advancements in material synthesis, device integration, and scalable manufacturing. As of 2025, the focus is on refining bottom-up and top-down approaches to achieve precise control over nanowire dimensions, doping profiles, and junction characteristics, all critical for high-performance optoelectronic and sensor applications.

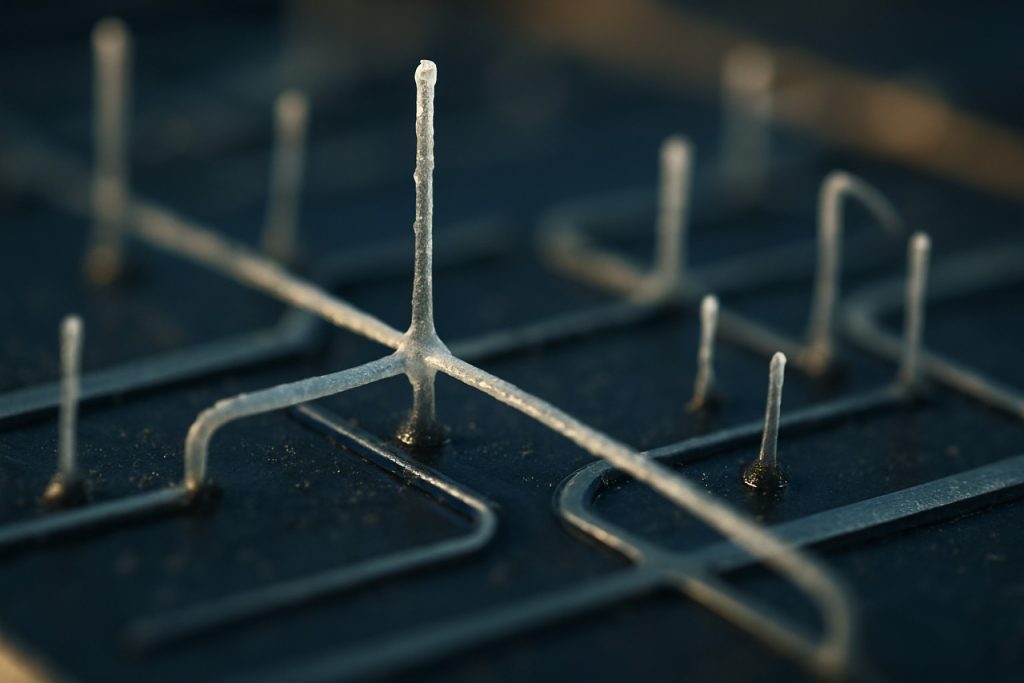

One of the most significant recent innovations in zinc-junction nanowire fabrication is the enhancement of vapor-liquid-solid (VLS) growth methods. Companies and research institutes are optimizing catalyst selection and growth parameters to minimize defect density and control junction placement at nanoscale accuracy. For example, leading suppliers of nanomaterials and semiconductor fabrication equipment, such as Oxford Instruments, are developing advanced chemical vapor deposition (CVD) systems with real-time monitoring, enabling more uniform and reproducible zinc oxide (ZnO) nanowire growth.

Simultaneously, atomic layer deposition (ALD) is seeing increased adoption for conformal coating and heterojunction creation on zinc nanowires, allowing for improved interface quality and device reliability. This is particularly impactful for applications like photodetectors and nano-LEDs, where junction sharpness and material purity are paramount. Innovations in ALD toolsets, such as those offered by Beneq, are enabling batch processing and scale-up, addressing both research and commercial production needs.

Electrochemical deposition techniques are also being refined for low-temperature, scalable fabrication of zinc-based nanowires and their junctions, offering compatibility with flexible substrates and large-area electronics. Companies specializing in nanomaterial supply, such as Nanocs, are expanding their portfolios with high-purity zinc nanowires and custom surface functionalizations to meet emerging device integration requirements. Furthermore, direct-write printing technologies—pioneered by equipment manufacturers like Nanoscribe—are becoming increasingly viable for patterned nanowire arrays with embedded junctions, enhancing design flexibility for next-generation sensors and energy harvesters.

Looking ahead to the next few years, the outlook for zinc-junction nanowire fabrication is promising. Continued collaboration between equipment manufacturers, material suppliers, and device developers is expected to further push the boundaries of scaling, repeatability, and integration. Efforts are underway to standardize quality metrics and testing protocols through industry organizations such as the Semiconductor Industry Association, which will help accelerate commercial adoption across photonics, electronics, and emerging quantum technologies.

Emerging Applications: Electronics, Energy, and Biomedicine

Zinc-junction nanowire fabrication is gaining significant traction in the fields of electronics, energy, and biomedicine, with ongoing advancements expected to accelerate throughout 2025 and the subsequent years. The unique properties of zinc oxide (ZnO) nanowires—such as high electron mobility, biocompatibility, and room-temperature synthesis—have positioned them at the forefront of next-generation device engineering.

In electronics, the integration of ZnO nanowires into nanoscale junctions is enabling the development of more efficient and miniaturized field-effect transistors (FETs), sensors, and photodetectors. Companies like Advanced Micro-Fabrication Equipment Inc. are actively investing in research and pilot-scale production of nanowire-based device platforms, with a focus on scalable chemical vapor deposition (CVD) and hydrothermal growth techniques. These fabrication routes allow precise control over nanowire alignment and junction quality, which are critical for device reproducibility and performance. The transition from laboratory to commercial-scale processes is expected to solidify by 2025, with pilot lines targeting the integration of nanowire arrays on silicon and flexible substrates.

In the energy sector, ZnO nanowire junctions are increasingly considered for next-generation photovoltaic and piezoelectric applications. The development of hybrid solar cells leveraging ZnO nanowire scaffolds has been a focal point for manufacturers such as First Solar, Inc. and Panasonic Corporation. These companies are exploring methods to enhance light absorption and charge separation using vertical nanowire arrays, with pilot modules demonstrating conversion efficiencies that rival conventional thin-film technologies. Additionally, ZnO nanowire-based piezoelectric nanogenerators are being developed for powering wearable and implantable devices, benefiting from the material’s mechanical flexibility and non-toxic nature.

Biomedicine stands to benefit from zinc-junction nanowire fabrication as well. The biocompatibility of ZnO, combined with its piezoelectric and optoelectronic properties, has spurred interest in implantable biosensors and drug delivery systems. Firms such as Medtronic plc are researching ZnO nanowire arrays for in vivo monitoring of physiological signals and targeted therapeutic delivery. The ability to fabricate high-sensitivity, minimally invasive devices is expected to drive clinical trials and early-stage commercialization by 2026.

Outlook for the next few years remains robust, driven by ongoing investment in scalable fabrication, improved junction control, and interdisciplinary collaboration between electronics, energy, and biomedical sectors. Regulatory considerations regarding nanomaterial safety and device integration will also shape the adoption trajectory as more products approach commercialization.

Competitive Landscape: Leading Companies and Industry Alliances

The competitive landscape for zinc-junction nanowire fabrication in 2025 is shaped by a strategic convergence of established electronics manufacturers, advanced materials suppliers, and emerging nanotechnology startups. Industry leaders are leveraging proprietary synthesis methods and forming alliances to accelerate commercialization, improve device integration, and secure supply chains for next-generation applications in photodetectors, photovoltaics, and sensors.

Several major semiconductor and materials companies have established dedicated research divisions for nanowire growth and device fabrication. Companies such as AMETEK—through its Materials Analysis Division—are actively collaborating with research institutions and industrial partners to refine chemical vapor deposition (CVD) and hydrothermal synthesis techniques for scalable zinc oxide (ZnO) nanowire production. Similarly, Oxford Instruments is supplying advanced plasma-enhanced CVD and atomic layer deposition tools, supporting the integration of zinc-junction nanowires into prototype optoelectronic devices.

Startups specializing in nanotechnology, such as those supported by international incubators and university spin-offs, are focusing on innovations that enable wafer-scale uniformity and defect control. These firms are often entering into joint development programs with established component suppliers to accelerate the transfer of laboratory-scale processes to high-volume manufacturing. For instance, alliances between nanowire innovators and companies like DuPont, known for its specialty materials expertise, are expected to advance encapsulation and interface engineering for robust device performance.

Industry alliances and consortia are also playing a significant role in standardizing quality metrics and promoting best practices for zinc-junction nanowire fabrication. Organizations such as the SEMI industry association are facilitating collaboration between equipment vendors, materials suppliers, and device manufacturers to address challenges in upscaling, reproducibility, and environmental impact. These efforts are anticipated to yield standardized protocols and compatibility guidelines, benefiting the broader ecosystem.

Looking ahead, the competitive landscape is likely to intensify as intellectual property portfolios mature and pilot lines transition to commercial manufacturing. Key players are expected to differentiate themselves through advancements in process throughput, nanowire uniformity, and integration with established semiconductor platforms. Strategic partnerships, cross-licensing agreements, and participation in global R&D consortia will remain crucial for maintaining leadership, with the outlook for 2025 and beyond characterized by increased collaboration, rapid innovation cycles, and expanding application domains.

Global Supply Chain Dynamics and Sourcing Strategies

The global supply chain dynamics for zinc-junction nanowire fabrication in 2025 are rapidly evolving in response to surging demand for advanced electronic, optoelectronic, and energy devices. Zinc-based nanowires—primarily zinc oxide (ZnO)—are pivotal in next-generation sensors, solar cells, and flexible electronics due to their unique semiconducting and piezoelectric properties. As commercial interest intensifies, supply chain strategies are being reshaped by both upstream material sourcing and downstream fabrication scalability.

At the raw materials level, a steady global zinc supply is foundational. Major zinc producers such as Nyrstar and Glencore continue to anchor the supply of high-purity zinc required for nanowire synthesis. These companies have invested in refining capacities to meet the specific purity demands of electronics-grade zinc, which remains critical for defect-minimized nanowire growth. In parallel, regional supply diversification is emerging as a strategy to mitigate geopolitical risks, with countries in Asia, Europe, and North America bolstering their domestic refining and recycling capabilities.

On the fabrication front, companies specializing in nanomaterials synthesis—such as Nano-Works and American Elements—are scaling up chemical vapor deposition (CVD), hydrothermal, and electrodeposition processes. These firms are responding to increased demand from manufacturers of transparent electronics and UV photodetectors, sectors experiencing double-digit growth rates in 2025. Collaborative partnerships between materials suppliers and device manufacturers are now standard, with joint ventures designed to ensure both supply continuity and rapid innovation cycles.

The supply chain is also being shaped by increased transparency and traceability requirements. End-users, especially in consumer electronics and renewable energy, are demanding ethically sourced and environmentally sustainable materials. Companies like Umicore are expanding their recycling operations to recover zinc from end-of-life electronics, providing a circular economy component that reduces reliance on primary mining and aligns with global sustainability standards.

Looking ahead to the next few years, the outlook is for further vertical integration. Major device manufacturers are expected to secure upstream stakes in zinc refining or nanowire production to lock in supply and control quality. Simultaneously, advances in automation and in-line characterization will streamline fabrication, reducing costs and improving yield. These trends point toward a maturing, resilient supply chain for zinc-junction nanowire fabrication—one capable of supporting the volume and quality requirements of the fast-growing nanoelectronics market.

Regulatory Environment and Industry Standards (ieee.org, asme.org)

The regulatory environment and industry standards for zinc-junction nanowire fabrication are rapidly evolving in 2025, driven by the increasing integration of these nanostructures in advanced electronics, sensors, and energy devices. As zinc-junction nanowires transition from laboratory-scale research to commercial and industrial applications, regulatory bodies and standards organizations are working to ensure quality, safety, and interoperability across the sector.

One of the primary organizations influencing the standards landscape is the IEEE (Institute of Electrical and Electronics Engineers). Through its Nanotechnology Council and Standards Association, IEEE is actively developing frameworks for the characterization, testing, and qualification of semiconductor nanowires, including zinc-based heterojunctions. In 2024 and continuing into 2025, IEEE has prioritized the establishment of reference methodologies for measuring electrical performance, defect density, and material purity in zinc-junction nanowires, given their impact on device reliability and scalability. Draft standards and working groups, such as those under the IEEE P1650 series, are expected to mature over the next few years, with wider industry adoption anticipated as nanowire-based devices approach mass production.

In parallel, the ASME (American Society of Mechanical Engineers) has identified nanomaterial manufacturing, including zinc-junction nanowires, as a priority area for standardization. ASME is focusing on the mechanical characterization of nanowire arrays, including adhesion, tensile strength, and thermal stability—properties critical for robust device integration. In 2025, ASME is collaborating with industry participants and research institutions to draft guidelines for process safety, equipment calibration, and environmental considerations specific to nanowire fabrication facilities, addressing both operator safety and product consistency.

The regulatory landscape is also shaped by global harmonization efforts. Both IEEE and ASME are engaging with international bodies to align definitions, test methods, and reporting requirements. These efforts aim to minimize trade barriers and facilitate the global supply chain for zinc-junction nanowire components. As regulatory visibility increases, manufacturers are encouraged to implement traceability systems and robust quality management protocols conforming to emerging standards, which are expected to become prerequisites for market entry by the late 2020s.

Outlook for the next few years includes the finalization and publication of key standards, the expansion of accredited testing laboratories, and the incorporation of zinc-junction nanowire requirements into broader regulatory frameworks for nanomaterials. The proactive involvement of standards bodies such as IEEE and ASME is expected to accelerate safe commercialization and foster innovation in zinc-junction nanowire fabrication.

Market Forecast and Growth Projections Through 2030

The zinc-junction nanowire fabrication market is poised for robust growth through 2030, driven by escalating demand in electronics, optoelectronics, and energy harvesting applications. In 2025, the sector is witnessing significant investments in research and pilot-scale production, particularly from semiconductor manufacturers seeking advanced materials for next-generation devices. The market trajectory is influenced by improvements in fabrication techniques, notably vapor-liquid-solid (VLS) growth and template-assisted electrodeposition, which enhance scalability and yield of high-quality zinc nanowires.

A key driver for growth is the integration of zinc-junction nanowires into transparent conductive films and high-performance sensors. Companies such as 3M and TE Connectivity are expanding their advanced materials portfolios to address the increasing requirement for nanostructured components in flexible electronics and touch displays. Additionally, ongoing collaborations between leading manufacturers and research institutions are accelerating the transition from laboratory-scale prototypes to commercial manufacturing, with pilot lines expected to increase output capacity over the next several years.

Data from 2025 indicates that Asia-Pacific remains the dominant region for both production and consumption, led by established electronics manufacturing hubs in China, South Korea, and Taiwan. Major players in these regions are investing in automated nanowire synthesis and assembly lines to achieve precise junction formation and reproducibility, critical for device integration. North America and Europe are also experiencing growth, particularly in the context of emerging applications in quantum computing and bioelectronics, where zinc-junction nanowires offer unique electrical and optical properties.

Current projections suggest a double-digit compound annual growth rate (CAGR) for the zinc-junction nanowire fabrication market from 2025 to 2030, spurred by advancements in process control and surface engineering. The introduction of eco-friendly fabrication methods, such as water-based electrochemical deposition, aligns with the sustainability goals of manufacturers including DuPont and BASF, further expanding market appeal.

By 2030, the market outlook anticipates widespread adoption of zinc-junction nanowires in commercial optoelectronic devices, energy storage systems, and biosensing platforms. Strategic partnerships and continued investment in scalable, cost-effective fabrication technologies will be critical to meet rising industry demand and to maintain momentum in global growth.

Investment Trends and Funding Opportunities in Zinc-Junction Nanowires

The landscape of investment and funding in zinc-junction nanowire fabrication is rapidly evolving as the field gains traction across electronics, energy storage, and optoelectronics. In 2025, venture capital and public funding are both increasingly directed at nanowire technologies, reflecting their potential to disrupt established sectors such as photovoltaics, sensors, and next-generation transistors.

Several key events have marked this surge in activity. Notably, established nanomaterials manufacturers and startups have announced new funding rounds targeting the scale-up of zinc-junction nanowire production. For example, NanoWire Solutions, a supplier specializing in semiconductor nanowires, reported a mid-2024 Series B funding round exceeding $30 million, earmarked for expanding its zinc-based nanowire fabrication lines and pilot plant capabilities. Similarly, Nanotech Energy has increased its R&D budget for zinc oxide nanowire-based batteries and transparent conductors, a move aligned with automotive and wearable electronics partners seeking to commercialize new devices.

Public sector support is also accelerating. Governments in North America, Europe, and East Asia have introduced funding initiatives to bolster domestic nanowire manufacturing capacities, reduce reliance on imported critical materials, and foster local supply chains. For instance, the U.S. Department of Energy’s 2025 “Advanced Materials Manufacturing Program” includes specific grants for the development and scaling of zinc-junction nanowire processes, particularly for their integration into energy-efficient devices and flexible electronics. Meanwhile, the European Union’s Horizon Europe program features calls for proposals in nanomaterial-based green tech, where zinc-junction nanowires are highlighted as a key enabling platform.

Corporate venture arms of major electronics and materials companies are also entering the space. BASF and Samsung Electronics have both disclosed investments in startups developing scalable vapor-liquid-solid (VLS) and chemical vapor deposition (CVD) techniques for zinc-junction nanowire arrays. These investments are motivated by strategic interests in securing new materials for advanced displays, sensors, and battery technologies.

Looking ahead to the next few years, analysts expect continued growth in both private and public capital flowing into zinc-junction nanowire fabrication. The main drivers include the relentless demand for miniaturized components, the need for eco-friendly alternatives to traditional semiconductors, and the promising performance metrics shown in recent prototypes. Strategic partnerships between nanomaterials developers and device manufacturers are likely to intensify, accelerating the commercialization timeline and opening additional funding opportunities across the value chain.

Future Outlook: Disruptive Potential and Long-Term Industry Impacts

As of 2025, zinc-junction nanowire fabrication stands at the threshold of significant technological disruption, poised to reshape several sectors ranging from advanced electronics to renewable energy. The convergence of scalable synthesis techniques and improved control over nanowire morphology has led to enhanced performance in optoelectronic and sensor applications. The increasing maturity of bottom-up approaches, such as chemical vapor deposition (CVD) and hydrothermal synthesis, enables manufacturers to produce uniform zinc oxide (ZnO) nanowires with reliable electrical junctions on flexible and transparent substrates. This is particularly evident in pilot lines operated by leading semiconductor equipment suppliers and specialty materials manufacturers, who are refining large-area deposition and alignment processes for integration into next-generation devices.

The disruptive potential of zinc-junction nanowires is particularly notable in the photovoltaic and sensor markets. Their high aspect ratio and direct bandgap make ZnO nanowires excellent candidates for use in efficient photodetectors and low-cost solar cells. Companies with a focus on advanced materials and nanoelectronics are accelerating the transition from laboratory prototypes to manufacturable products, leveraging the favorable electron mobility and large surface area of nanowires to surpass the limitations of conventional thin-film technologies. These advances are driving collaborations between academic research groups and major industry players, as seen in joint ventures aimed at commercializing ZnO nanowire-based photonic devices.

Looking ahead, the next few years are expected to witness the scaling up of zinc-junction nanowire fabrication, driven by demand for miniaturized, high-performance components in Internet of Things (IoT) devices, wearable electronics, and biomedical sensors. Major industry bodies and standards organizations are beginning to issue guidelines for nanowire synthesis and junction quality, signaling impending standardization that will ease large-scale adoption. Equipment manufacturers are also investing in process automation and in-line quality monitoring, which are critical for ensuring device reliability and reproducibility at commercial volumes.

Long-term, the integration of zinc-junction nanowires into flexible and transparent electronics could transform the design of displays, energy harvesters, and environmental sensors, offering new form factors and energy efficiencies. The sustained efforts by established semiconductor and specialty chemical companies to optimize nanowire growth methods and junction engineering are expected to accelerate market penetration and enable disruptive applications that were previously impractical due to material and fabrication constraints. The ongoing commitment to innovation in this area underscores the strategic importance attributed to nanowire technologies by global industry leaders such as BASF and Merck KGaA, who are actively expanding their advanced materials portfolios to capitalize on the unique properties of zinc-junction nanowires.