2025 X-ray Pixel Imaging Sensors Market Report: In-Depth Analysis of Growth Drivers, Technology Innovations, and Global Opportunities. Explore Key Trends, Forecasts, and Competitive Insights Shaping the Industry.

- Executive Summary & Market Overview

- Key Technology Trends in X-ray Pixel Imaging Sensors

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

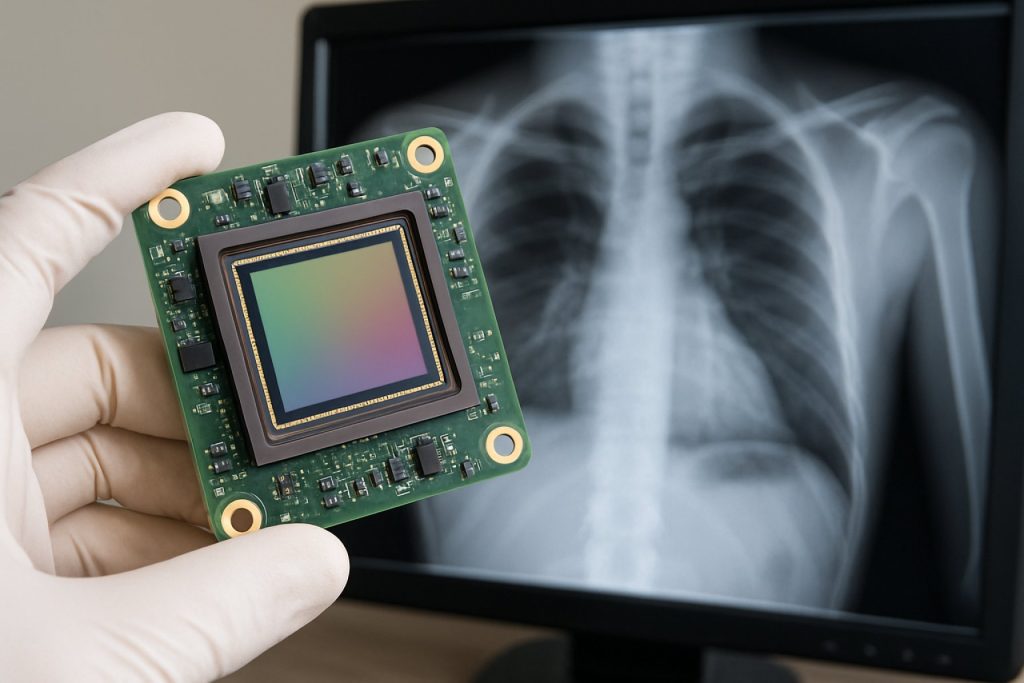

X-ray pixel imaging sensors are advanced semiconductor devices designed to convert X-ray photons into electrical signals, enabling high-resolution digital imaging for medical, industrial, and security applications. As of 2025, the global market for X-ray pixel imaging sensors is experiencing robust growth, driven by technological advancements, increasing healthcare digitization, and expanding applications in non-destructive testing and security screening.

The market is characterized by a shift from traditional analog X-ray detectors to digital flat-panel detectors (FPDs) and complementary metal-oxide-semiconductor (CMOS) sensors, which offer superior image quality, faster processing, and lower radiation doses. The adoption of direct conversion materials such as amorphous selenium and cadmium telluride is further enhancing sensor performance, particularly in medical diagnostics and dental imaging.

According to MarketsandMarkets, the global X-ray detector market—including pixel imaging sensors—is projected to reach USD 4.1 billion by 2025, growing at a CAGR of approximately 5.5% from 2020. The medical segment remains the largest end-user, accounting for over 60% of total demand, fueled by rising incidences of chronic diseases, increased imaging volumes, and the global push for early and accurate diagnostics. Industrial applications, such as electronics inspection and aerospace component testing, are also expanding, supported by stricter quality standards and automation trends.

Regionally, North America and Europe dominate the market due to advanced healthcare infrastructure, significant R&D investments, and early adoption of digital imaging technologies. However, the Asia-Pacific region is witnessing the fastest growth, propelled by healthcare modernization in China and India, government initiatives to improve diagnostic capabilities, and the expansion of manufacturing industries requiring non-destructive testing solutions (Grand View Research).

- Key players in the X-ray pixel imaging sensor market include Canon Inc., Varex Imaging Corporation, Teledyne Technologies, and Hamamatsu Photonics, all of which are investing in next-generation sensor technologies and expanding their product portfolios.

- Challenges include high initial costs, regulatory hurdles, and the need for continuous innovation to address evolving end-user requirements.

In summary, the X-ray pixel imaging sensor market in 2025 is marked by technological innovation, expanding application scope, and strong growth prospects, particularly in emerging economies and advanced healthcare markets.

Key Technology Trends in X-ray Pixel Imaging Sensors

X-ray pixel imaging sensors are at the forefront of innovation in medical diagnostics, industrial inspection, and security screening. As of 2025, several key technology trends are shaping the evolution and adoption of these sensors, driven by demands for higher resolution, faster imaging speeds, and lower radiation doses.

- Direct Conversion Materials: The shift from traditional scintillator-based (indirect) detectors to direct conversion materials such as cadmium telluride (CdTe) and cadmium zinc telluride (CZT) is accelerating. These materials enable direct transformation of X-ray photons into electrical signals, resulting in improved spatial resolution and energy discrimination. This trend is particularly prominent in medical and dental imaging, where clarity and diagnostic accuracy are paramount (ZEISS Meditec).

- Photon-Counting Technology: Photon-counting X-ray detectors are gaining traction due to their ability to count individual photons and measure their energy. This technology reduces electronic noise, enhances contrast, and enables spectral imaging, which is valuable for tissue characterization and material differentiation. Major industry players are investing in commercializing photon-counting CT systems, with regulatory approvals and clinical adoption expected to expand in 2025 (Siemens Healthineers).

- CMOS Sensor Integration: The integration of complementary metal-oxide-semiconductor (CMOS) technology into X-ray pixel sensors is enabling faster frame rates, lower power consumption, and on-chip processing capabilities. CMOS-based X-ray detectors are increasingly replacing traditional charge-coupled device (CCD) sensors in both medical and industrial applications, supporting real-time imaging and advanced analytics (Teledyne DALSA).

- Miniaturization and Portability: Advances in microfabrication and packaging are leading to smaller, lighter, and more portable X-ray imaging systems. This trend is facilitating the deployment of point-of-care and mobile diagnostic devices, especially in remote or resource-limited settings (Carestream Health).

- Artificial Intelligence (AI) Integration: AI-driven image reconstruction and analysis are being embedded directly into X-ray sensor platforms. This enables automated anomaly detection, dose optimization, and workflow enhancements, further improving diagnostic efficiency and patient outcomes (GE HealthCare).

These technology trends are collectively driving the X-ray pixel imaging sensor market toward higher performance, broader application scope, and improved accessibility in 2025.

Competitive Landscape and Leading Players

The competitive landscape for X-ray pixel imaging sensors in 2025 is characterized by rapid technological innovation, strategic partnerships, and a strong focus on expanding application areas such as medical diagnostics, industrial inspection, and security screening. The market is moderately consolidated, with a handful of global leaders dominating, while several emerging players are leveraging niche technologies to carve out specialized segments.

Key players in the X-ray pixel imaging sensor market include Canon Inc., Sony Semiconductor Solutions Corporation, Teledyne Technologies Incorporated, Hamamatsu Photonics K.K., and ams OSRAM AG. These companies have established robust R&D pipelines and extensive patent portfolios, enabling them to maintain technological leadership and respond swiftly to evolving customer requirements.

Canon Inc. continues to lead in the medical imaging segment, leveraging its proprietary flat-panel detector (FPD) technology to deliver high-resolution, low-dose X-ray imaging solutions. The company’s focus on digital radiography and computed tomography (CT) applications has solidified its position in hospitals and diagnostic centers worldwide. Sony Semiconductor Solutions, on the other hand, is recognized for its advancements in CMOS-based X-ray sensors, which offer superior speed and integration capabilities for real-time imaging in both medical and industrial settings.

Teledyne Technologies has expanded its market share through strategic acquisitions and the development of hybrid pixel sensors, which combine high sensitivity with fast readout speeds. This has made Teledyne a preferred supplier for demanding applications such as non-destructive testing and security screening. Hamamatsu Photonics is notable for its expertise in photodiode arrays and scintillator integration, catering to both high-end scientific research and commercial imaging markets.

Emerging players and startups are increasingly focusing on innovations such as direct-conversion sensors, flexible substrates, and AI-driven image processing. These advancements are intensifying competition and driving down costs, particularly in price-sensitive regions. Strategic collaborations between sensor manufacturers and system integrators are also becoming more prevalent, aiming to deliver turnkey solutions tailored to specific end-user needs.

Overall, the competitive landscape in 2025 is defined by a blend of established giants and agile innovators, with ongoing investments in R&D and partnerships shaping the future trajectory of X-ray pixel imaging sensor technology.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The global market for X-ray pixel imaging sensors is poised for robust growth between 2025 and 2030, driven by technological advancements, expanding applications in medical diagnostics, industrial inspection, and security screening, as well as increasing investments in healthcare infrastructure. According to projections by MarketsandMarkets, the X-ray detector market—which includes pixel imaging sensors—is expected to register a compound annual growth rate (CAGR) of approximately 6.5% during this period. This growth is underpinned by the rising adoption of digital X-ray systems, which rely heavily on high-resolution pixel sensors for enhanced image quality and diagnostic accuracy.

Revenue forecasts indicate that the global X-ray pixel imaging sensor market will surpass USD 4.2 billion by 2030, up from an estimated USD 2.9 billion in 2025. This revenue expansion is attributed to the increasing demand for advanced medical imaging solutions, particularly in emerging economies where healthcare modernization is accelerating. The medical segment remains the largest revenue contributor, accounting for over 60% of total market share, as reported by Grand View Research.

In terms of volume, the shipment of X-ray pixel imaging sensors is projected to grow at a CAGR of 7.1% from 2025 to 2030. This volume growth is fueled by the proliferation of portable and point-of-care X-ray devices, which require compact, efficient, and high-sensitivity pixel sensors. The industrial and security sectors are also expected to witness significant volume increases, with applications ranging from non-destructive testing to baggage scanning, as highlighted by Fortune Business Insights.

- Medical Imaging: The transition from analog to digital radiography is a key driver, with hospitals and diagnostic centers upgrading to flat-panel detectors and CMOS-based pixel sensors for improved workflow and patient outcomes.

- Industrial Inspection: Growth in manufacturing and infrastructure sectors is boosting demand for X-ray pixel sensors in quality control and safety inspections.

- Security Applications: Heightened security concerns globally are leading to increased deployment of advanced X-ray imaging systems at airports and border checkpoints.

Overall, the 2025–2030 period is expected to witness sustained double-digit growth in both revenue and unit shipments for X-ray pixel imaging sensors, with innovation and expanding end-use applications serving as primary catalysts.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global market for X-ray pixel imaging sensors is experiencing dynamic growth, with regional trends shaped by healthcare infrastructure, technological innovation, and regulatory environments. In 2025, North America, Europe, Asia-Pacific, and the Rest of the World (RoW) each present distinct opportunities and challenges for market participants.

- North America: North America remains a leading market, driven by advanced healthcare systems, high adoption of digital radiography, and robust R&D investments. The United States, in particular, benefits from strong reimbursement frameworks and a high prevalence of chronic diseases necessitating diagnostic imaging. Major players such as GE HealthCare and Teledyne Technologies continue to innovate in sensor technology, while regulatory clarity from the U.S. Food and Drug Administration accelerates product launches. The region is also witnessing increased demand for portable and point-of-care X-ray systems, further boosting sensor adoption.

- Europe: Europe’s market is characterized by strong government support for digital health initiatives and a focus on reducing radiation exposure. Countries like Germany, France, and the UK are investing in upgrading hospital imaging infrastructure. The presence of established manufacturers such as Siemens Healthineers and Philips ensures a steady pipeline of advanced X-ray pixel imaging sensors. The European Union’s Medical Device Regulation (MDR) is shaping product development and market entry strategies, emphasizing safety and performance.

- Asia-Pacific: The Asia-Pacific region is the fastest-growing market, propelled by expanding healthcare access, rising investments in medical technology, and increasing awareness of early disease detection. China, Japan, and South Korea are at the forefront, with local companies like Canon and Shimadzu Corporation scaling up production and innovation. Government initiatives to modernize healthcare infrastructure and a growing middle class are key demand drivers. However, price sensitivity and regulatory diversity across countries present challenges.

- Rest of World (RoW): In regions such as Latin America, the Middle East, and Africa, market growth is moderate but accelerating. Efforts to improve diagnostic capabilities and address infectious diseases are spurring investments in digital X-ray systems. International aid and public-private partnerships are facilitating technology transfer and adoption, though infrastructure limitations and budget constraints remain hurdles.

Overall, regional dynamics in 2025 reflect a blend of technological advancement, policy frameworks, and healthcare priorities, with North America and Asia-Pacific leading in adoption and innovation of X-ray pixel imaging sensors.

Future Outlook: Emerging Applications and Investment Hotspots

The future outlook for X-ray pixel imaging sensors in 2025 is marked by rapid technological advancements and expanding application domains, driving both innovation and investment. As healthcare, industrial, and security sectors increasingly demand higher resolution, faster imaging, and lower radiation doses, X-ray pixel imaging sensors are positioned at the forefront of next-generation imaging solutions.

Emerging applications are particularly prominent in medical diagnostics, where digital radiography and computed tomography (CT) are shifting toward direct-conversion, pixelated sensors. These sensors, leveraging materials such as cadmium telluride (CdTe) and amorphous selenium, offer superior spatial resolution and energy discrimination, enabling earlier disease detection and more personalized treatment planning. The integration of artificial intelligence (AI) with X-ray pixel data is also expected to enhance diagnostic accuracy and workflow efficiency, further accelerating adoption in clinical settings (Siemens Healthineers).

Beyond healthcare, industrial non-destructive testing (NDT) is a significant growth area. Sectors such as aerospace, automotive, and electronics manufacturing are investing in advanced X-ray imaging for quality assurance, defect detection, and process optimization. The miniaturization of pixel sensors and improvements in real-time imaging capabilities are enabling new use cases, such as inline inspection and 3D metrology (GE Digital).

Security and homeland defense are also emerging as investment hotspots. The need for high-throughput, high-resolution baggage and cargo screening at airports and border crossings is driving demand for advanced X-ray pixel sensors. These sensors facilitate rapid threat detection with lower false positive rates, supporting global security initiatives (Smiths Detection).

- Asia-Pacific is anticipated to be a key investment region, fueled by expanding healthcare infrastructure, government initiatives, and a burgeoning electronics manufacturing base (Frost & Sullivan).

- North America and Europe continue to lead in R&D and early adoption, with strong support from public and private funding for medical imaging innovation (MarketsandMarkets).

In summary, 2025 will see X-ray pixel imaging sensors at the nexus of technological convergence and market expansion, with medical diagnostics, industrial NDT, and security screening as the primary drivers of emerging applications and investment activity.

Challenges, Risks, and Strategic Opportunities

The X-ray pixel imaging sensors market in 2025 faces a complex landscape of challenges, risks, and strategic opportunities shaped by technological, regulatory, and competitive dynamics. One of the primary challenges is the high cost of advanced sensor development and manufacturing. The transition from traditional analog to digital pixel-based X-ray sensors requires significant investment in R&D, cleanroom facilities, and precision fabrication equipment. This cost barrier can limit market entry for smaller players and slow adoption in price-sensitive segments such as public healthcare systems and emerging markets.

Another critical risk is the stringent regulatory environment governing medical imaging devices. Compliance with standards set by agencies such as the U.S. Food and Drug Administration and the European Commission for medical devices can delay product launches and increase development costs. Additionally, evolving data privacy regulations, particularly concerning patient imaging data, require robust cybersecurity measures, adding further complexity and cost.

Supply chain vulnerabilities also pose significant risks. The X-ray pixel imaging sensor industry relies on a global network for sourcing high-purity silicon wafers, rare earth materials, and specialized electronics. Disruptions—such as those experienced during the COVID-19 pandemic—can lead to production delays and increased costs. Geopolitical tensions and export restrictions on critical materials further exacerbate these risks, as highlighted by recent supply chain analyses from Gartner.

Despite these challenges, strategic opportunities abound. The growing demand for high-resolution, low-dose imaging in medical diagnostics, security screening, and industrial inspection is driving innovation. Companies investing in next-generation CMOS and hybrid pixel sensor technologies can differentiate themselves by offering superior image quality and faster readout speeds. The integration of artificial intelligence (AI) for automated image analysis presents another avenue for value creation, as noted by IDC.

Strategic partnerships and mergers—such as those between sensor manufacturers and medical device OEMs—can accelerate market penetration and innovation. Furthermore, expanding into emerging markets with tailored, cost-effective solutions offers growth potential, especially as healthcare infrastructure improves in Asia-Pacific and Latin America. Companies that proactively address regulatory compliance, invest in supply chain resilience, and leverage digital transformation are well-positioned to capitalize on the evolving landscape of X-ray pixel imaging sensors in 2025.

Sources & References

- MarketsandMarkets

- Grand View Research

- Varex Imaging Corporation

- Teledyne Technologies

- Hamamatsu Photonics

- ZEISS Meditec

- Siemens Healthineers

- Teledyne DALSA

- Carestream Health

- GE HealthCare

- Canon Inc.

- ams OSRAM AG

- Fortune Business Insights

- Philips

- Shimadzu Corporation

- GE Digital

- Smiths Detection

- Frost & Sullivan

- European Commission

- IDC