Wood-Derived Nanocellulose Electronics Market Report 2025: In-Depth Analysis of Growth Drivers, Innovations, and Global Opportunities

- Executive Summary & Market Overview

- Key Technology Trends in Wood-Derived Nanocellulose Electronics

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

The global market for wood-derived nanocellulose electronics is poised for significant growth in 2025, driven by increasing demand for sustainable, lightweight, and flexible electronic components. Nanocellulose, extracted from wood pulp, offers unique properties such as high mechanical strength, biodegradability, and excellent film-forming capabilities, making it an attractive alternative to petroleum-based materials in electronic applications. The integration of nanocellulose into electronics enables the development of flexible displays, sensors, energy storage devices, and substrates for printed electronics, aligning with the electronics industry’s shift toward eco-friendly and renewable materials.

According to MarketsandMarkets, the global nanocellulose market is projected to reach USD 1.1 billion by 2025, with a compound annual growth rate (CAGR) of over 20%. A significant portion of this growth is attributed to the electronics sector, where nanocellulose’s transparency, flexibility, and compatibility with conductive inks are being leveraged for next-generation devices. Leading electronics manufacturers and research institutions are investing in R&D to scale up production and enhance the performance of nanocellulose-based components.

Asia-Pacific is expected to dominate the market in 2025, fueled by robust electronics manufacturing ecosystems in countries such as Japan, South Korea, and China. These regions benefit from strong government support for green technologies and a well-established supply chain for wood pulp and cellulose derivatives. North America and Europe are also witnessing increased adoption, particularly in the development of sustainable packaging for electronic devices and the integration of nanocellulose in flexible printed circuits.

Key industry players, including Stora Enso, The University of Queensland, and Nippon Paper Group, are actively collaborating with electronics companies to commercialize nanocellulose-based solutions. Strategic partnerships, patent filings, and pilot projects are accelerating the transition from laboratory-scale innovations to mass-market products.

In summary, the wood-derived nanocellulose electronics market in 2025 is characterized by rapid technological advancements, increasing commercialization, and a strong emphasis on sustainability. The sector is expected to play a pivotal role in the evolution of green electronics, offering both environmental and performance benefits that align with global trends toward circular economy and resource efficiency.

Key Technology Trends in Wood-Derived Nanocellulose Electronics

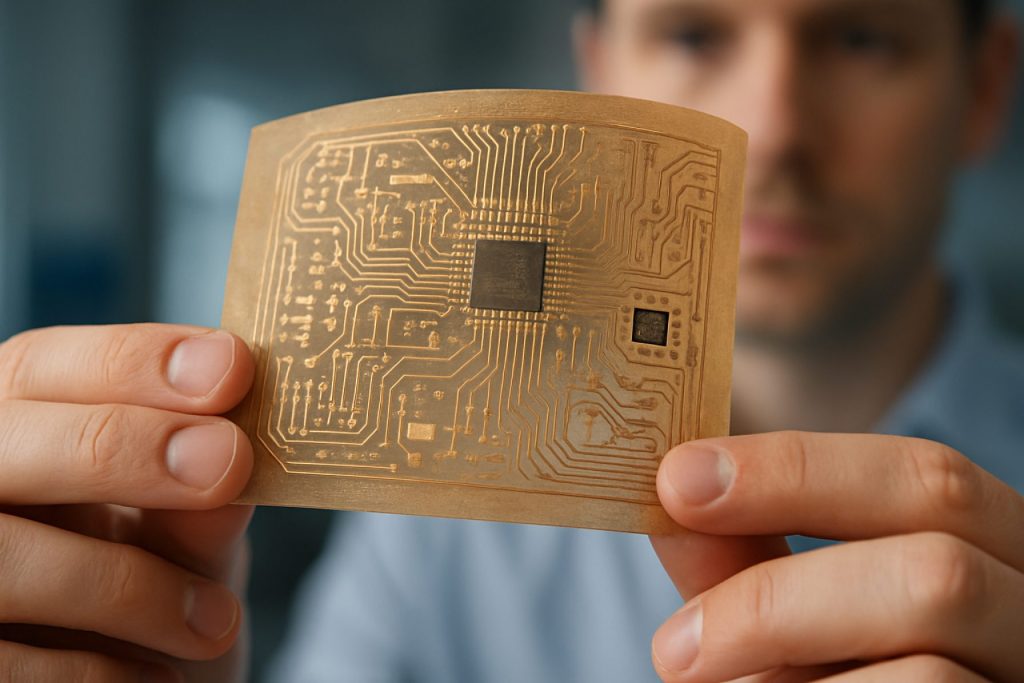

Wood-derived nanocellulose electronics represent a rapidly evolving frontier in sustainable materials science, leveraging the unique properties of nanocellulose—such as high mechanical strength, flexibility, and biodegradability—to create next-generation electronic devices. As the industry moves into 2025, several key technology trends are shaping the development and commercialization of these materials.

- Advanced Functionalization Techniques: Researchers are increasingly focusing on surface modification and chemical functionalization of nanocellulose to enhance its compatibility with conductive materials and semiconductors. This enables the integration of nanocellulose into flexible displays, sensors, and energy storage devices. For instance, the use of conductive polymers and metal nanoparticles is improving the electrical performance of nanocellulose-based substrates, as highlighted by Fraunhofer-Gesellschaft.

- Scalable Manufacturing Processes: The transition from laboratory-scale to industrial-scale production is a major trend. Roll-to-roll processing and inkjet printing technologies are being adapted for nanocellulose substrates, allowing for high-throughput fabrication of flexible electronic components. VTT Technical Research Centre of Finland has demonstrated pilot-scale production lines for nanocellulose films, paving the way for commercial applications.

- Integration with Biodegradable Electronics: There is a growing emphasis on fully biodegradable electronic devices, where nanocellulose serves as both the substrate and, in some cases, the active material. This trend is driven by increasing regulatory and consumer demand for sustainable electronics, as noted in market analyses by IDTechEx.

- Enhanced Barrier and Dielectric Properties: Innovations in nanocellulose processing are yielding materials with improved moisture and oxygen barrier properties, as well as superior dielectric performance. These advancements are critical for the reliability and longevity of organic and printed electronics, according to research from Elsevier.

- Hybrid Material Systems: Combining nanocellulose with other bio-based or synthetic nanomaterials is enabling the creation of hybrid systems with tailored electrical, optical, and mechanical properties. Such composites are being explored for use in transparent electrodes, wearable sensors, and energy harvesting devices, as reported by Nature Publishing Group.

These technology trends underscore the dynamic innovation landscape in wood-derived nanocellulose electronics, positioning the sector for significant growth and broader adoption in 2025 and beyond.

Competitive Landscape and Leading Players

The competitive landscape for wood-derived nanocellulose electronics in 2025 is characterized by a dynamic mix of established material science companies, innovative startups, and collaborative research initiatives. The sector is driven by the growing demand for sustainable, flexible, and biodegradable electronic components, with nanocellulose emerging as a promising alternative to conventional petroleum-based materials.

Key players in this market include Stora Enso, a Finnish-Swedish company that has invested heavily in nanocellulose research and production, positioning itself as a leader in supplying nanocellulose for electronic substrates and flexible displays. Université du Québec à Chicoutimi (UQAC) and its spin-offs have also made significant strides, particularly in developing transparent and conductive nanocellulose films for sensors and wearable devices.

Japanese firms such as Nippon Paper Industries and Daicel Corporation are notable for their vertically integrated approaches, leveraging in-house pulp production to ensure a stable supply of high-quality nanocellulose for electronics applications. These companies have formed strategic partnerships with electronics manufacturers to accelerate commercialization.

In North America, Forest Products Laboratory (FPL), a division of the U.S. Forest Service, has played a pivotal role in advancing nanocellulose research, fostering public-private collaborations, and supporting startups such as CelluForce. CelluForce, based in Canada, is recognized for its proprietary CelluForce NCC® technology, which is being explored for use in flexible printed circuits and energy storage devices.

The competitive environment is further shaped by joint ventures and consortia, such as the Vinnova-backed Swedish research programs and the European Union’s Bio-based Industries Joint Undertaking (BBI JU), which fund collaborative projects to scale up nanocellulose electronics manufacturing.

Overall, the market is witnessing increased patent activity, with leading players focusing on proprietary processing methods, surface modification techniques, and integration of nanocellulose with conductive inks and polymers. The competitive edge is often determined by the ability to deliver consistent quality at scale, secure supply chains, and establish partnerships with electronics OEMs. As the technology matures, new entrants are expected, particularly from the Asia-Pacific region, intensifying competition and accelerating innovation.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The market for wood-derived nanocellulose electronics is poised for robust expansion between 2025 and 2030, driven by increasing demand for sustainable, lightweight, and flexible electronic components. According to projections from MarketsandMarkets, the global nanocellulose market is expected to achieve a compound annual growth rate (CAGR) of approximately 20% during this period, with the electronics segment representing one of the fastest-growing applications due to its alignment with green technology trends and the miniaturization of devices.

Revenue generated from wood-derived nanocellulose electronics is forecasted to surpass USD 1.2 billion by 2030, up from an estimated USD 350 million in 2025. This surge is attributed to the rapid adoption of nanocellulose-based substrates in flexible displays, sensors, and energy storage devices, as well as the integration of these materials into printed and wearable electronics. The Asia-Pacific region, led by Japan, South Korea, and China, is expected to dominate both production and consumption, accounting for over 45% of global revenues by 2030, as reported by Grand View Research.

In terms of volume, the consumption of wood-derived nanocellulose in electronics is projected to reach approximately 60,000 metric tons by 2030, growing from around 18,000 metric tons in 2025. This volume growth is underpinned by advancements in scalable production technologies and the increasing availability of high-purity nanocellulose suitable for electronic applications. Key industry players such as Stora Enso and Nippon Paper Industries are investing heavily in capacity expansion and R&D to meet the anticipated surge in demand.

- CAGR (2025–2030): ~20% for wood-derived nanocellulose electronics

- Revenue (2030): >USD 1.2 billion

- Volume (2030): ~60,000 metric tons

- Regional Leaders: Asia-Pacific (notably Japan, South Korea, China)

Overall, the market outlook for wood-derived nanocellulose electronics from 2025 to 2030 is highly optimistic, with strong growth prospects supported by technological innovation, sustainability imperatives, and expanding end-use applications.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The regional market dynamics for wood-derived nanocellulose electronics in 2025 reveal distinct growth trajectories and adoption patterns across North America, Europe, Asia-Pacific, and the Rest of the World. Each region’s progress is shaped by its industrial base, research ecosystem, regulatory environment, and sustainability priorities.

- North America: The North American market, led by the United States and Canada, is characterized by robust R&D investments and early commercialization of nanocellulose-based electronic components. Major universities and research institutes, in collaboration with industry leaders, are driving innovations in flexible displays, sensors, and biodegradable electronic substrates. The region benefits from strong government support for sustainable materials and electronics, as evidenced by funding initiatives from agencies such as the National Science Foundation. The presence of established electronics manufacturers and a growing focus on green electronics are expected to accelerate market penetration in 2025.

- Europe: Europe’s market is propelled by stringent environmental regulations and ambitious circular economy goals. Countries like Sweden, Finland, and Germany are at the forefront, leveraging their advanced forestry sectors and expertise in nanocellulose production. The European Commission has prioritized bio-based materials in its Green Deal and Horizon Europe programs, fostering public-private partnerships and pilot projects for nanocellulose electronics. European firms are particularly active in developing sustainable packaging with embedded electronics and eco-friendly printed circuit boards.

- Asia-Pacific: The Asia-Pacific region, especially Japan, China, and South Korea, is witnessing rapid commercialization of wood-derived nanocellulose electronics. Japan’s electronics giants and China’s scale in manufacturing are driving cost reductions and mass adoption. Government-backed initiatives, such as Japan’s New Energy and Industrial Technology Development Organization (NEDO) projects, are accelerating R&D and pilot-scale production. The region’s focus on next-generation flexible electronics and wearable devices positions it as a global leader in both innovation and volume production.

- Rest of World: In other regions, including Latin America and the Middle East, adoption remains nascent but is gaining traction through international collaborations and technology transfer. Countries with significant forestry resources, such as Brazil, are exploring value-added applications for nanocellulose, supported by organizations like Embrapa. However, limited infrastructure and investment may constrain short-term growth compared to the leading regions.

Overall, 2025 is expected to see North America and Europe leading in innovation and regulatory frameworks, while Asia-Pacific dominates in manufacturing scale and commercialization of wood-derived nanocellulose electronics.

Future Outlook: Emerging Applications and Investment Hotspots

The future outlook for wood-derived nanocellulose electronics in 2025 is marked by rapid innovation, expanding application domains, and increasing investor interest. Nanocellulose, extracted from wood pulp, offers a unique combination of biodegradability, mechanical strength, and transparency, making it a promising material for next-generation electronic devices. As sustainability becomes a central theme in electronics manufacturing, nanocellulose-based components are gaining traction as eco-friendly alternatives to petroleum-based plastics and metals.

Emerging applications are particularly notable in flexible and wearable electronics. Researchers and companies are developing nanocellulose substrates for flexible displays, sensors, and energy storage devices, capitalizing on the material’s flexibility and compatibility with printed electronics. For instance, nanocellulose films are being integrated into organic light-emitting diodes (OLEDs) and thin-film transistors, enabling lightweight, bendable devices suitable for smart textiles and medical monitoring patches. The high surface area and tunable surface chemistry of nanocellulose also support its use in advanced supercapacitors and batteries, where it serves as a scaffold for active materials, enhancing energy density and charge/discharge rates IDTechEx.

Investment hotspots are emerging in regions with strong forestry industries and advanced materials research ecosystems, such as Scandinavia, Japan, and North America. Strategic partnerships between pulp and paper companies, electronics manufacturers, and research institutions are accelerating commercialization. Notably, Finland’s VTT Technical Research Centre and Sweden’s RISE Research Institutes are at the forefront of pilot-scale production and device prototyping. In Asia, Japanese firms are leveraging their expertise in cellulose nanofiber production to develop transparent conductive films and biodegradable circuit boards Nippon Paper Group.

Looking ahead to 2025, the market is expected to benefit from regulatory incentives for green electronics and growing consumer demand for sustainable products. Venture capital and corporate investments are flowing into startups focused on scalable nanocellulose processing and device integration. According to MarketsandMarkets, the global nanocellulose market is projected to grow at a double-digit CAGR, with electronics representing a key growth segment. As technical challenges—such as moisture sensitivity and large-scale manufacturing—are addressed, wood-derived nanocellulose electronics are poised to transition from niche prototypes to mainstream commercial products.

Challenges, Risks, and Strategic Opportunities

The integration of wood-derived nanocellulose into electronics presents a unique set of challenges, risks, and strategic opportunities as the market moves into 2025. Nanocellulose, extracted from wood pulp, offers remarkable properties such as high mechanical strength, flexibility, biodegradability, and transparency, making it a promising material for next-generation electronic devices. However, several hurdles must be addressed for widespread adoption.

Challenges and Risks

- Scalability and Cost: While laboratory-scale production of nanocellulose is well-established, scaling up to industrial volumes remains a significant challenge. The processes for extracting and purifying nanocellulose are energy-intensive and costly, which can hinder commercial viability. According to IDTechEx, cost reduction and process optimization are critical for market growth.

- Material Consistency: Achieving uniform quality and performance in nanocellulose materials is difficult due to variations in wood sources and processing methods. This inconsistency can impact the reliability of electronic components, such as flexible displays and sensors.

- Integration with Existing Technologies: Incorporating nanocellulose into established electronic manufacturing processes requires overcoming compatibility issues with current substrates, inks, and encapsulation materials. The lack of standardized protocols further complicates integration.

- Regulatory and Environmental Concerns: Although nanocellulose is biodegradable, the environmental impact of its production, including chemical usage and water consumption, is under scrutiny. Regulatory frameworks are still evolving, and compliance may pose additional hurdles for manufacturers.

Strategic Opportunities

- Sustainability-Driven Innovation: The push for greener electronics creates a strategic opening for nanocellulose-based components, especially in applications like flexible displays, wearable sensors, and biodegradable packaging. Companies that can demonstrate a reduced carbon footprint and circular economy benefits may gain a competitive edge (Frost & Sullivan).

- Collaborative Ecosystems: Partnerships between forestry, chemical, and electronics sectors can accelerate R&D, standardization, and commercialization. Joint ventures and public-private initiatives are emerging as key drivers for overcoming technical and market barriers.

- Emerging Markets and Niche Applications: Early adoption is likely in niche markets where sustainability is a premium, such as eco-friendly consumer electronics and medical devices. As production scales and costs decrease, broader applications in mainstream electronics are anticipated (MarketsandMarkets).

Sources & References

- MarketsandMarkets

- Nippon Paper Group

- Fraunhofer-Gesellschaft

- VTT Technical Research Centre of Finland

- IDTechEx

- Elsevier

- Nature Publishing Group

- Université du Québec à Chicoutimi (UQAC)

- Daicel Corporation

- CelluForce

- Vinnova

- Bio-based Industries Joint Undertaking (BBI JU)

- Grand View Research

- Nippon Paper Industries

- National Science Foundation

- European Commission

- New Energy and Industrial Technology Development Organization (NEDO)

- Embrapa

- Frost & Sullivan