VFX-Driven Synthetic Data Generation for Autonomous Vehicle Training: 2025 Market Analysis and Strategic Outlook. Explore Key Trends, Growth Drivers, and Competitive Insights Shaping the Next 5 Years.

- Executive Summary & Market Overview

- Key Technology Trends in VFX-Driven Synthetic Data Generation

- Competitive Landscape and Leading Solution Providers

- Market Size, Growth Forecasts & CAGR Projections (2025–2030)

- Regional Analysis: North America, Europe, Asia-Pacific & Emerging Markets

- Challenges, Risks, and Barriers to Adoption

- Opportunities and Strategic Recommendations

- Future Outlook: Innovations and Market Evolution

- Sources & References

Executive Summary & Market Overview

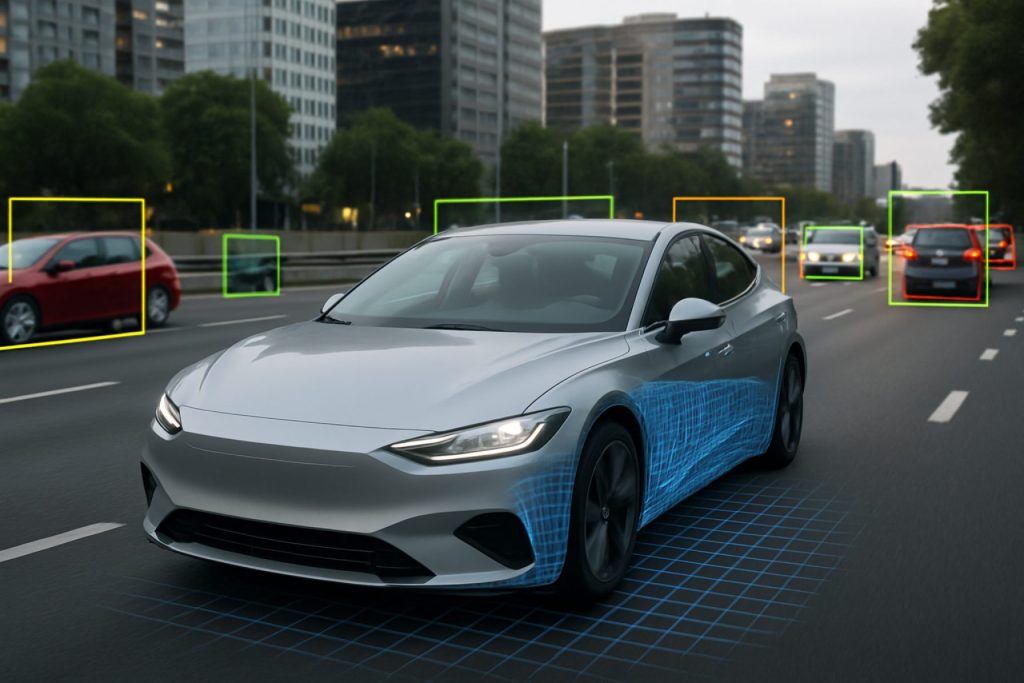

The VFX-driven synthetic data generation market for autonomous vehicle (AV) training is experiencing rapid growth, driven by the escalating demand for high-quality, diverse, and scalable datasets to power machine learning algorithms in self-driving systems. Synthetic data, created using advanced visual effects (VFX) technologies, enables the simulation of complex driving scenarios that are difficult, costly, or unsafe to capture in the real world. This approach addresses critical challenges in AV development, such as the need for rare event data, edge cases, and comprehensive environmental variability.

In 2025, the global market for synthetic data generation in the autonomous vehicle sector is projected to surpass $1.2 billion, with a compound annual growth rate (CAGR) exceeding 35% from 2023 to 2028, according to Gartner and MarketsandMarkets. The adoption of VFX-driven synthetic data is particularly prominent among leading AV developers and automotive OEMs, who leverage these tools to accelerate perception model training, validation, and regulatory compliance.

Key industry players such as NVIDIA, Cognata, and Baidu Apollo have invested heavily in simulation platforms that integrate photorealistic rendering, physics-based modeling, and procedural content generation. These platforms enable the creation of vast, annotated datasets that reflect real-world complexity, including diverse weather conditions, lighting variations, and unpredictable road user behaviors. The integration of VFX pipelines with AI-driven scenario generation further enhances the realism and utility of synthetic data for AV training.

Regulatory bodies and safety organizations, such as the National Highway Traffic Safety Administration (NHTSA) and UNECE, are increasingly recognizing the value of synthetic data in supporting the validation and certification of autonomous systems. This regulatory acceptance is expected to further fuel market expansion and innovation in 2025 and beyond.

- Market size (2025): $1.2 billion+

- Key growth drivers: Data diversity, cost efficiency, regulatory acceptance

- Leading vendors: NVIDIA, Cognata, Baidu Apollo

- Primary applications: Perception model training, scenario testing, safety validation

Key Technology Trends in VFX-Driven Synthetic Data Generation

VFX-driven synthetic data generation is rapidly transforming the landscape of autonomous vehicle (AV) training, with 2025 poised to see significant advancements in both realism and scalability. This approach leverages advanced visual effects (VFX) technologies—originally developed for the film and gaming industries—to create highly detailed, photorealistic virtual environments and scenarios. These synthetic datasets are crucial for training, validating, and testing AV perception systems, especially in edge cases and rare events that are difficult or dangerous to capture in the real world.

One of the most prominent trends is the integration of real-time rendering engines, such as Unreal Engine and Unity, which enable the generation of vast, diverse, and interactive driving scenarios. These engines support physically accurate lighting, weather, and material properties, allowing for the simulation of complex urban and rural environments under varying conditions. Companies like Unreal Engine and Unity Technologies are actively collaborating with automotive OEMs and AV startups to tailor their platforms for synthetic data generation.

- Procedural Content Generation: Automated tools now create diverse road layouts, traffic patterns, and pedestrian behaviors, reducing manual effort and increasing dataset variability. This procedural approach ensures that AV systems are exposed to a broader spectrum of scenarios, improving generalization and robustness.

- Domain Randomization and Adaptation: VFX pipelines increasingly incorporate domain randomization—systematically varying scene parameters (e.g., lighting, object textures, weather)—to help machine learning models generalize from synthetic to real-world data. Advanced domain adaptation techniques, including generative adversarial networks (GANs), are also being used to bridge the visual gap between synthetic and real images, as highlighted by NVIDIA and Wayve.

- Sensor Simulation: Beyond visual realism, VFX-driven platforms now simulate multi-modal sensor data, including LiDAR, radar, and thermal imaging, with high fidelity. This enables comprehensive training and validation of sensor fusion algorithms, as demonstrated by ANSYS and Cognata.

Looking ahead to 2025, the convergence of VFX artistry, AI-driven automation, and high-performance computing is expected to further accelerate the adoption of synthetic data in AV development. This will not only reduce the reliance on costly and time-consuming real-world data collection but also enhance the safety and reliability of autonomous driving systems as they approach commercial deployment.

Competitive Landscape and Leading Solution Providers

The competitive landscape for VFX-driven synthetic data generation in autonomous vehicle (AV) training is rapidly evolving, with a mix of established visual effects (VFX) studios, AI startups, and automotive technology companies vying for market leadership. As the demand for high-fidelity, diverse, and scalable training datasets intensifies, solution providers are leveraging advanced VFX pipelines, real-time rendering engines, and procedural content generation to simulate complex driving environments and rare edge cases.

Key players in this space include Epic Games, whose Unreal Engine is widely adopted for photorealistic simulation, and Unity Technologies, offering a robust platform for synthetic scene creation and sensor simulation. Both companies have formed strategic partnerships with automotive OEMs and AV startups to deliver tailored simulation solutions.

Specialized synthetic data providers such as CVEDIA and Synthesis AI focus on generating labeled datasets for perception model training, utilizing VFX techniques to ensure realism and annotation accuracy. Tesla and Waymo have also invested heavily in proprietary simulation platforms, integrating VFX-driven synthetic data into their end-to-end AV development pipelines.

Emerging startups like Parallel Domain and AEye are pushing the boundaries with procedural world generation, dynamic weather and lighting conditions, and sensor-accurate data outputs. These capabilities are critical for training robust AV perception systems capable of handling real-world variability and rare events.

- Market Differentiators: Leading providers differentiate through the realism of their synthetic data, scalability of their platforms, integration with AV development toolchains, and support for multi-modal sensor simulation (camera, LiDAR, radar).

- Strategic Partnerships: Collaborations between VFX studios, simulation software vendors, and automotive OEMs are accelerating innovation and adoption. For example, NVIDIA’s DRIVE Sim platform leverages VFX technology for end-to-end AV simulation.

- Industry Trends: The market is witnessing increased investment in generative AI for scene creation, real-time rendering, and automated annotation, further enhancing the value proposition of VFX-driven synthetic data solutions.

As of 2025, the competitive landscape is characterized by rapid technological advancements, strategic alliances, and a growing emphasis on simulation realism and scalability to meet the evolving needs of autonomous vehicle training.

Market Size, Growth Forecasts & CAGR Projections (2025–2030)

The market for VFX-driven synthetic data generation tailored to autonomous vehicle (AV) training is poised for robust expansion between 2025 and 2030. As the automotive industry accelerates its shift toward higher levels of vehicle autonomy, the demand for high-fidelity, diverse, and scalable training datasets has surged. Visual effects (VFX) technologies—traditionally used in film and gaming—are now being leveraged to create photorealistic, scenario-rich synthetic data, addressing the limitations of real-world data collection in terms of cost, safety, and edge-case coverage.

According to a 2024 market analysis by Gartner, the global synthetic data market for autonomous systems was valued at approximately $450 million in 2024, with VFX-driven solutions accounting for an estimated 35% share. This segment is projected to grow at a compound annual growth rate (CAGR) of 38% from 2025 to 2030, outpacing the broader synthetic data market due to the increasing sophistication of VFX tools and the rising complexity of AV perception systems.

Several factors underpin this growth trajectory:

- OEM and Tier 1 Supplier Adoption: Major automotive OEMs and suppliers are scaling investments in synthetic data platforms to accelerate AV development cycles and regulatory validation, as reported by IDC.

- Regulatory Pressures: Stricter safety and validation requirements in the US, EU, and China are driving the need for extensive, diverse datasets that can only be feasibly generated through advanced VFX pipelines (NHTSA).

- Technological Advancements: The integration of real-time rendering engines (e.g., Unreal Engine, Unity) and AI-driven procedural content generation is reducing production costs and enabling rapid scenario iteration (Epic Games).

By 2030, the VFX-driven synthetic data segment is forecasted to surpass $2.5 billion in annual revenue, with North America and Europe leading adoption, followed by rapid growth in Asia-Pacific as local AV initiatives mature (Statista). The market’s CAGR is expected to remain above 35% throughout the forecast period, reflecting both the expanding scope of AV applications and the critical role of synthetic data in achieving safe, scalable autonomy.

Regional Analysis: North America, Europe, Asia-Pacific & Emerging Markets

The regional landscape for VFX-driven synthetic data generation in autonomous vehicle (AV) training is rapidly evolving, with North America, Europe, Asia-Pacific, and emerging markets each exhibiting distinct growth trajectories and adoption patterns.

- North America: The United States remains at the forefront, driven by the presence of leading AV developers and a robust ecosystem of VFX and AI technology providers. Companies such as NVIDIA and Tesla are leveraging advanced synthetic data pipelines to accelerate perception model training. The region benefits from strong venture capital investment and regulatory support for AV testing, fostering partnerships between VFX studios and automotive OEMs. According to Grand View Research, North America accounted for over 40% of the global synthetic data market share in 2024, with continued double-digit growth projected through 2025.

- Europe: European adoption is propelled by stringent safety regulations and a collaborative R&D environment. Countries like Germany, the UK, and France are investing in simulation-based AV validation, with firms such as Oxbotica and Renault Group integrating VFX-driven synthetic data to meet Euro NCAP standards. The European Commission’s funding for digital twin and smart mobility initiatives further accelerates market maturity. Statista reports that Europe’s synthetic data market is expected to grow at a CAGR of 28% from 2023 to 2025, outpacing global averages.

- Asia-Pacific: The Asia-Pacific region, led by China, Japan, and South Korea, is witnessing rapid expansion due to government-backed smart city projects and aggressive AV deployment timelines. Chinese tech giants like Baidu and AutoX are investing heavily in VFX-based simulation environments to localize AV perception systems for complex urban scenarios. The region’s large-scale data generation capabilities and cost-effective VFX talent pool are key competitive advantages. Mordor Intelligence forecasts Asia-Pacific to be the fastest-growing market for synthetic data in AV training through 2025.

- Emerging Markets: While adoption is nascent, emerging markets in Latin America, the Middle East, and Southeast Asia are beginning to explore VFX-driven synthetic data for AV pilots, particularly in logistics and public transport. Local startups are partnering with global VFX providers to bridge data scarcity and regulatory gaps. Growth is expected to accelerate as infrastructure and digitalization initiatives mature.

Overall, regional dynamics in 2025 reflect a convergence of technological innovation, regulatory frameworks, and investment priorities, positioning VFX-driven synthetic data as a critical enabler for scalable and safe autonomous vehicle deployment worldwide.

Challenges, Risks, and Barriers to Adoption

The adoption of VFX-driven synthetic data generation for autonomous vehicle (AV) training presents a range of challenges, risks, and barriers that could impact its widespread implementation in 2025. While synthetic data offers the promise of scalable, diverse, and cost-effective datasets, several critical issues must be addressed to ensure its effectiveness and acceptance in the AV industry.

- Realism and Domain Gap: One of the primary challenges is achieving photorealism and behavioral fidelity in synthetic data. Even with advanced VFX tools, subtle discrepancies between synthetic and real-world data—known as the “domain gap”—can lead to poor model generalization and reduced performance in real-world scenarios. Bridging this gap requires significant investment in rendering technology and domain adaptation techniques, as highlighted by NVIDIA and Epic Games.

- Validation and Regulatory Acceptance: Regulatory bodies and safety organizations have yet to establish clear standards for the use of synthetic data in AV validation. The lack of consensus on how synthetic data should be validated and integrated into safety cases poses a risk for manufacturers seeking regulatory approval, as noted by SAE International and UNECE.

- Bias and Scenario Coverage: Synthetic data generation tools may inadvertently introduce biases or fail to capture the full diversity of real-world driving scenarios, especially rare or edge cases. Ensuring comprehensive scenario coverage and unbiased data generation remains a technical and methodological barrier, as discussed in reports by McKinsey & Company.

- Computational and Resource Costs: High-fidelity VFX-driven simulation requires substantial computational resources, specialized talent, and ongoing investment in software and hardware infrastructure. This can be a significant barrier for smaller AV developers or startups, as outlined by Gartner.

- Intellectual Property and Data Security: The use of proprietary VFX assets and simulation platforms raises concerns about intellectual property rights and data security, particularly when collaborating with third-party vendors or cloud-based services, as noted by IDC.

Addressing these challenges will be crucial for the broader adoption and trust in VFX-driven synthetic data as a cornerstone of AV training pipelines in 2025 and beyond.

Opportunities and Strategic Recommendations

The market for VFX-driven synthetic data generation in autonomous vehicle (AV) training is poised for significant expansion in 2025, driven by the escalating demand for high-quality, diverse, and scalable datasets. As real-world data collection faces challenges related to cost, privacy, and edge-case rarity, synthetic data—created using advanced visual effects (VFX) pipelines—offers a compelling alternative. This section explores key opportunities and strategic recommendations for stakeholders in this rapidly evolving segment.

-

Opportunity: Addressing Data Scarcity and Edge Cases

VFX-driven synthetic data enables the creation of rare and hazardous driving scenarios that are difficult or unsafe to capture in real life. This capability is crucial for training AV perception systems to handle edge cases, such as unusual weather, lighting, or accident scenarios, thereby improving safety and robustness. Companies like Tesla and Waymo are increasingly investing in synthetic data to supplement real-world datasets. -

Opportunity: Cost and Time Efficiency

Generating synthetic data via VFX pipelines significantly reduces the time and expense associated with manual data collection and annotation. According to Gartner, synthetic data can cut data acquisition costs by up to 80%, accelerating AV development cycles and enabling more frequent model updates. -

Opportunity: Regulatory Compliance and Privacy

Synthetic data inherently avoids privacy concerns tied to real-world video and sensor data, facilitating compliance with stringent data protection regulations such as GDPR. This is particularly relevant for global AV developers seeking to deploy solutions across multiple jurisdictions. -

Strategic Recommendation: Invest in Realism and Domain Adaptation

To maximize the utility of synthetic data, stakeholders should prioritize investments in photorealistic rendering, accurate sensor simulation, and domain adaptation techniques. Collaborations with leading VFX studios and AI companies, such as Unreal Engine and NVIDIA, can enhance the fidelity and transferability of synthetic datasets. -

Strategic Recommendation: Develop Customizable Scenario Libraries

Offering modular, customizable scenario libraries tailored to specific geographies, vehicle types, and regulatory requirements can differentiate providers and address the diverse needs of AV developers. -

Strategic Recommendation: Foster Industry Partnerships

Forming alliances with OEMs, Tier 1 suppliers, and regulatory bodies can accelerate adoption and standardization of synthetic data practices, as highlighted by initiatives from ANSYS and Oxbotica.

In summary, the convergence of VFX technology and synthetic data generation presents a transformative opportunity for the AV sector in 2025. Strategic investments in realism, customization, and partnerships will be key to capturing value in this dynamic market.

Future Outlook: Innovations and Market Evolution

The future outlook for VFX-driven synthetic data generation in autonomous vehicle (AV) training is marked by rapid innovation and evolving market dynamics as the industry approaches 2025. The convergence of advanced visual effects (VFX) technologies with artificial intelligence (AI) and simulation platforms is enabling the creation of hyper-realistic, diverse, and scalable datasets that are critical for training and validating AV perception systems.

Key innovations are emerging in the fidelity and variability of synthetic data. Next-generation VFX engines, such as those powered by Unreal Engine and Unity Technologies, are now capable of simulating complex urban environments, rare edge cases, and diverse weather and lighting conditions with photorealistic accuracy. These advancements address the limitations of real-world data collection, particularly in capturing rare or hazardous scenarios that are essential for robust AV performance.

The integration of procedural content generation and generative AI models is further enhancing the scalability and diversity of synthetic datasets. Companies like Datagen and Synthesis AI are leveraging these technologies to automate the creation of millions of unique driving scenes, reducing the time and cost associated with manual data annotation and collection. This is particularly significant as the industry faces increasing regulatory scrutiny and the need for extensive validation before commercial deployment.

Market evolution is also characterized by the emergence of end-to-end simulation platforms that combine VFX-driven data generation with scenario management, sensor simulation, and performance analytics. Leading AV developers, including Tesla and Waymo, are investing heavily in proprietary simulation ecosystems, while third-party providers such as Cognata and Baidu Apollo are offering scalable, cloud-based solutions to the broader market.

Looking ahead to 2025, the synthetic data market for AV training is expected to experience double-digit growth, driven by the escalating demand for safer, more reliable autonomous systems and the need to accelerate time-to-market. According to Gartner, synthetic data will comprise a significant portion of all data used for AI model training by 2025, underscoring its critical role in the future of autonomous mobility.

Sources & References

- MarketsandMarkets

- NVIDIA

- Baidu Apollo

- Unity Technologies

- Wayve

- CVEDIA

- Synthesis AI

- Waymo

- AEye

- IDC

- Statista

- Grand View Research

- Oxbotica

- Renault Group

- Baidu

- AutoX

- Mordor Intelligence

- McKinsey & Company