Unmanned Underwater Vehicle Swarm Coordination Systems in 2025: Transforming Maritime Operations with Next-Gen AI and Networked Autonomy. Explore the Breakthroughs, Market Growth, and Strategic Impacts Shaping the Future of Undersea Missions.

- Executive Summary & Key Findings

- Market Size, Growth Forecasts, and CAGR (2025–2030)

- Core Technologies: AI, Communication Protocols, and Sensor Fusion

- Leading Players and Industry Initiatives (e.g., lockheedmartin.com, boeing.com, saabs.com, navsea.navy.mil)

- Defense, Security, and Civilian Applications

- Challenges: Communication, Navigation, and Environmental Constraints

- Recent Innovations and Patent Landscape

- Regulatory, Ethical, and Interoperability Considerations

- Investment Trends and Strategic Partnerships

- Future Outlook: Emerging Opportunities and Disruptive Trends

- Sources & References

Executive Summary & Key Findings

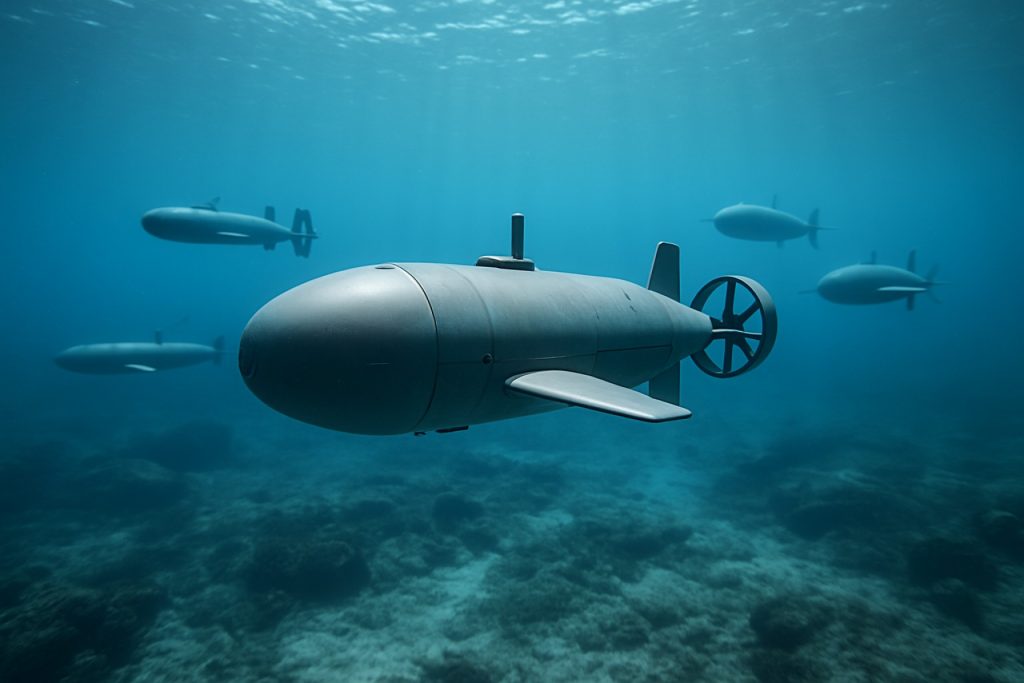

The Unmanned Underwater Vehicle (UUV) Swarm Coordination Systems sector is entering a pivotal phase in 2025, driven by rapid advances in autonomy, underwater communications, and artificial intelligence. UUV swarms—multiple autonomous vehicles operating collaboratively—are increasingly prioritized for defense, scientific, and commercial applications, including mine countermeasures, environmental monitoring, and subsea infrastructure inspection. The ability to coordinate large numbers of UUVs in complex, GPS-denied underwater environments is a key technological and operational challenge, but recent breakthroughs are accelerating real-world deployments.

Leading defense contractors and technology firms are at the forefront of UUV swarm development. Northrop Grumman and Lockheed Martin have both demonstrated multi-vehicle coordination in recent naval exercises, leveraging advanced acoustic communication protocols and distributed AI for real-time decision-making. Saab’s AUV62-AT and Kongsberg’s HUGIN Endurance platforms are being adapted for swarm operations, with modular payloads and open architectures to support collaborative missions. In 2024, Boeing announced successful trials of its Echo Voyager UUV in coordinated operations, highlighting the growing maturity of swarm control algorithms and underwater networking.

A key enabler for UUV swarms is robust underwater communication. Companies such as Teledyne Marine and Bluefin Robotics (a General Dynamics subsidiary) are advancing acoustic modems and networking solutions to facilitate reliable inter-vehicle data exchange. These technologies are critical for distributed sensing, adaptive mission planning, and resilience against single-point failures. The integration of machine learning for adaptive behavior and fault tolerance is also a major trend, with several NATO and allied navies conducting joint trials to validate interoperability and scalability.

Looking ahead to the next few years, the UUV swarm coordination market is expected to see increased procurement and operational deployment, particularly in the Asia-Pacific and North American regions. The U.S. Navy’s Large Displacement UUV (LDUUV) and the UK’s Project CETUS are set to incorporate swarm capabilities, while commercial operators in offshore energy and environmental monitoring are piloting multi-UUV solutions for persistent, wide-area coverage. The convergence of autonomy, secure communications, and modular design is likely to define the competitive landscape, with ongoing investments from both established defense primes and innovative startups.

- 2025 marks a transition from experimental to operational UUV swarms in defense and commercial sectors.

- Major players include Northrop Grumman, Lockheed Martin, Saab, Kongsberg, Boeing, Teledyne Marine, and Bluefin Robotics.

- Key challenges remain in underwater communications, AI-driven autonomy, and system interoperability.

- Outlook: Accelerated adoption, with growing emphasis on modular, scalable, and resilient swarm systems.

Market Size, Growth Forecasts, and CAGR (2025–2030)

The market for Unmanned Underwater Vehicle (UUV) Swarm Coordination Systems is poised for significant expansion from 2025 through 2030, driven by increasing defense investments, advances in autonomous systems, and the growing need for persistent maritime surveillance. As of 2025, the global UUV market—encompassing both Autonomous Underwater Vehicles (AUVs) and Remotely Operated Vehicles (ROVs)—is estimated to be valued in the multi-billion dollar range, with swarm coordination systems representing a rapidly growing segment within this broader market.

Key defense contractors and technology leaders such as Northrop Grumman, Lockheed Martin, and Saab are actively developing and integrating swarm coordination capabilities into their UUV portfolios. These companies are leveraging advances in artificial intelligence, underwater communications, and distributed sensor networks to enable collaborative behaviors among multiple UUVs, which is expected to be a major market driver through 2030.

The compound annual growth rate (CAGR) for the UUV swarm coordination systems market is projected to exceed 15% between 2025 and 2030, outpacing the overall UUV market growth. This acceleration is attributed to several factors:

- Rising demand for multi-vehicle operations in anti-submarine warfare, mine countermeasures, and intelligence, surveillance, and reconnaissance (ISR) missions.

- Increased procurement and R&D funding from navies in the United States, Europe, and Asia-Pacific, with programs such as the U.S. Navy’s Large Displacement Unmanned Undersea Vehicle (LDUUV) and European collaborative defense initiatives.

- Technological breakthroughs in underwater mesh networking and autonomy, enabling robust swarm behaviors even in GPS-denied and high-interference environments.

Commercial applications, including offshore energy, environmental monitoring, and subsea infrastructure inspection, are also expected to contribute to market growth. Companies like Kongsberg and Teledyne Marine are expanding their offerings to include swarm-capable UUVs for these sectors, further broadening the addressable market.

Looking ahead, the market outlook for UUV swarm coordination systems remains robust, with increasing adoption anticipated as navies and commercial operators seek to enhance operational efficiency, reduce risk to human life, and achieve greater mission flexibility. The period from 2025 to 2030 is expected to see not only strong revenue growth but also a shift toward more standardized, interoperable swarm solutions, as industry leaders and defense agencies collaborate on open architectures and common protocols.

Core Technologies: AI, Communication Protocols, and Sensor Fusion

The evolution of Unmanned Underwater Vehicle (UUV) swarm coordination systems in 2025 is being driven by rapid advancements in artificial intelligence (AI), robust underwater communication protocols, and sophisticated sensor fusion technologies. These core technologies are enabling UUV swarms to operate with greater autonomy, resilience, and mission effectiveness in complex maritime environments.

AI is at the heart of modern UUV swarm coordination, providing the decision-making frameworks necessary for distributed autonomy and adaptive mission planning. Leading defense and marine technology companies are integrating advanced machine learning algorithms to facilitate real-time data analysis, threat detection, and dynamic task allocation among swarm members. For example, BAE Systems and Saab AB are actively developing AI-driven UUV platforms that can collaboratively map the seafloor, detect anomalies, and respond to changing mission parameters without direct human intervention. These AI systems are increasingly leveraging reinforcement learning and multi-agent coordination models to optimize swarm behaviors in unpredictable underwater conditions.

Communication remains a significant technical challenge for UUV swarms due to the inherent limitations of underwater environments, such as high signal attenuation and multipath effects. In 2025, the industry is focusing on hybrid communication protocols that combine acoustic, optical, and, where feasible, electromagnetic modalities to enhance reliability and bandwidth. Companies like Kongsberg Gruppen are pioneering underwater acoustic modems and networking solutions that support low-latency, multi-node communication essential for coordinated swarm maneuvers. Additionally, research into adaptive communication protocols is enabling UUVs to dynamically switch between channels and adjust transmission parameters based on environmental feedback, further improving swarm cohesion and operational security.

Sensor fusion is another cornerstone of effective UUV swarm coordination. By integrating data from diverse onboard sensors—such as sonar, inertial measurement units, magnetometers, and environmental sensors—UUVs can achieve a comprehensive situational awareness that is critical for navigation, obstacle avoidance, and collaborative mapping. Leonardo S.p.A. and L3Harris Technologies are among the companies advancing multi-sensor integration frameworks, enabling UUV swarms to share and synthesize sensor data in real time. This collective intelligence not only enhances individual vehicle performance but also allows the swarm to function as a cohesive, adaptive system capable of complex tasks such as distributed surveillance and coordinated search-and-rescue operations.

Looking ahead, the convergence of AI, advanced communication protocols, and sensor fusion is expected to further empower UUV swarms, with ongoing investments from both defense and commercial sectors. As these technologies mature, UUV swarms will play an increasingly vital role in subsea infrastructure inspection, environmental monitoring, and maritime security missions worldwide.

Leading Players and Industry Initiatives (e.g., lockheedmartin.com, boeing.com, saabs.com, navsea.navy.mil)

The field of Unmanned Underwater Vehicle (UUV) swarm coordination systems is rapidly evolving, with several leading defense contractors and naval organizations spearheading technological advancements and operational deployments. As of 2025, the focus is on enhancing autonomy, interoperability, and mission flexibility for UUV swarms, with significant investments and collaborative initiatives shaping the industry landscape.

Among the most prominent players, Lockheed Martin continues to advance its UUV portfolio, leveraging its experience in autonomous systems and underwater technologies. The company has been involved in the development of swarm-enabled UUVs capable of collaborative behaviors, such as distributed sensing, coordinated search, and adaptive mission execution. Lockheed Martin’s efforts are often in partnership with the U.S. Navy, aiming to deliver scalable solutions for mine countermeasures, intelligence gathering, and undersea warfare.

Boeing is another key industry leader, particularly through its Echo Voyager and Echo Seeker platforms. Boeing’s approach emphasizes modularity and long-endurance capabilities, with ongoing research into swarm algorithms that enable multiple UUVs to operate cohesively in complex maritime environments. The company is actively collaborating with defense agencies to integrate advanced communication protocols and real-time data sharing among UUV swarms, addressing challenges related to underwater networking and autonomy.

European defense giant Saab is also at the forefront, with its Sea Wasp and Sabertooth UUVs forming the basis for swarm experimentation and deployment. Saab’s initiatives focus on interoperability and open architecture, allowing for integration with allied systems and rapid adaptation to evolving mission requirements. The company is engaged in several multinational projects aimed at standardizing swarm coordination protocols and enhancing cross-platform compatibility.

On the governmental side, the U.S. Navy’s Naval Sea Systems Command (NAVSEA) is a central driver of UUV swarm research and acquisition. NAVSEA oversees programs such as the Large Displacement Unmanned Underwater Vehicle (LDUUV) and collaborates with industry partners to test and field swarm-enabled UUVs for a range of operational scenarios. The command’s focus includes robust command-and-control frameworks, resilient communications, and the integration of artificial intelligence for autonomous decision-making within swarms.

Looking ahead to the next few years, the industry is expected to see increased field trials, expanded multinational exercises, and the gradual transition of swarm coordination systems from experimental to operational status. The convergence of AI, advanced sensors, and secure underwater communications will likely drive further innovation, with leading players continuing to shape the future of undersea autonomy and collaborative operations.

Defense, Security, and Civilian Applications

Unmanned Underwater Vehicle (UUV) swarm coordination systems are rapidly advancing, with significant implications for defense, security, and civilian applications as of 2025 and looking ahead. The ability to deploy and manage coordinated groups of UUVs—often referred to as “swarms”—is transforming underwater operations by enabling persistent surveillance, distributed sensing, and complex mission execution in challenging maritime environments.

In the defense sector, leading navies are investing heavily in UUV swarm technologies to enhance anti-submarine warfare (ASW), mine countermeasures, and maritime domain awareness. The U.S. Navy, through its Unmanned Maritime Systems Program, is actively developing and testing swarm-enabled UUVs capable of autonomous collaboration, adaptive mission planning, and real-time data sharing. These systems are designed to operate in contested environments, providing force multiplication and reducing risk to human operators. Notably, Northrop Grumman and Lockheed Martin are key contractors, delivering advanced autonomy and communication solutions for UUV swarms. Northrop Grumman’s experience in distributed autonomous systems and Lockheed Martin’s expertise in undersea vehicles position them at the forefront of this field.

Internationally, the United Kingdom’s Royal Navy is also progressing with its “Project Cetus,” which aims to develop large, autonomous UUVs with swarm capabilities for surveillance and reconnaissance missions. BAE Systems is a principal partner, leveraging its background in naval systems and autonomy. Similarly, Saab is advancing its Sea Wasp and Sabertooth platforms, integrating swarm coordination features for both military and security operations.

On the civilian front, UUV swarms are being adapted for environmental monitoring, subsea infrastructure inspection, and disaster response. Companies like Kongsberg and Teledyne Marine are integrating swarm algorithms into their commercial UUV fleets, enabling coordinated mapping of large ocean areas, rapid response to oil spills, and efficient inspection of pipelines and cables. These systems utilize advanced underwater communication protocols and distributed decision-making to maximize coverage and data collection efficiency.

Looking forward, the next few years are expected to see further integration of artificial intelligence and machine learning into UUV swarm coordination, enabling greater autonomy, resilience, and adaptability. Interoperability standards are also under development, aiming to allow swarms from different manufacturers to operate together seamlessly. As these technologies mature, UUV swarms will become a critical asset for both military and civilian maritime operations, offering unprecedented capabilities in underwater environments.

Challenges: Communication, Navigation, and Environmental Constraints

Unmanned Underwater Vehicle (UUV) swarm coordination systems are rapidly advancing, yet they face persistent and complex challenges in communication, navigation, and environmental adaptation—issues that are expected to remain central through 2025 and the following years. The underwater domain imposes unique constraints that differ significantly from those encountered by aerial or terrestrial autonomous systems.

Communication is perhaps the most critical challenge. Radio frequency (RF) signals, the backbone of terrestrial and aerial communication, attenuate rapidly in seawater, rendering them ineffective for UUVs. Instead, UUVs rely on acoustic communication, which is limited by low bandwidth, high latency, and susceptibility to multipath effects and ambient noise. These limitations hinder real-time data exchange and coordinated decision-making within swarms. Leading UUV manufacturers such as Hydroid (a subsidiary of Huntington Ingalls Industries) and Saab are actively developing advanced acoustic modems and networking protocols to improve reliability and throughput, but the fundamental physical constraints of the medium remain a bottleneck.

Navigation is another significant hurdle. GPS signals do not penetrate underwater, forcing UUVs to rely on inertial navigation systems (INS), Doppler velocity logs (DVL), and acoustic positioning systems. These methods can accumulate errors over time or require external infrastructure, which is not always feasible in contested or remote environments. Companies like Kongsberg and L3Harris are investing in sensor fusion and collaborative localization techniques, where swarm members share navigation data to improve collective accuracy. However, these approaches are still limited by the aforementioned communication constraints and the dynamic nature of underwater environments.

Environmental constraints further complicate UUV swarm operations. Variability in salinity, temperature, and pressure affects both vehicle performance and acoustic signal propagation. Additionally, underwater obstacles, currents, and biofouling can disrupt planned trajectories and sensor readings. Swarm algorithms must be robust to these uncertainties, requiring real-time adaptation and fault tolerance. Boeing and Leonardo are among the organizations exploring AI-driven adaptive control systems to enhance swarm resilience in unpredictable conditions.

Looking ahead to 2025 and beyond, the outlook for overcoming these challenges is cautiously optimistic. Incremental improvements in acoustic communication, sensor integration, and adaptive algorithms are expected, but no single breakthrough is anticipated to fully resolve the fundamental constraints of the underwater environment. The focus will likely remain on hybrid solutions that combine improved hardware, smarter software, and innovative operational concepts to enable more effective UUV swarm coordination in real-world missions.

Recent Innovations and Patent Landscape

The field of Unmanned Underwater Vehicle (UUV) swarm coordination systems has witnessed significant innovation in recent years, with 2025 marking a period of rapid technological maturation and increased patent activity. Swarm coordination—enabling multiple UUVs to operate collaboratively—has become a focal point for both defense and commercial applications, driving a surge in proprietary solutions and intellectual property filings.

A key trend is the integration of advanced artificial intelligence (AI) and machine learning algorithms to facilitate decentralized decision-making and adaptive mission planning among UUV swarms. Companies such as Lockheed Martin and Northrop Grumman have publicly demonstrated and filed patents for systems that allow UUVs to autonomously share sensor data, dynamically assign roles, and reconfigure formations in response to environmental changes or mission objectives. These innovations are underpinned by robust underwater communication protocols, including acoustic and optical modems, which are critical for reliable swarm coordination in challenging subsea environments.

In 2024 and 2025, Saab has advanced its Sea Wasp and Sabertooth platforms with swarm-enabling software, focusing on modularity and interoperability. Patent filings from Saab emphasize secure, low-latency communication and distributed control architectures, reflecting a broader industry shift toward open standards and cross-vendor compatibility. Similarly, Kongsberg Gruppen has introduced new swarm management modules for its HUGIN and REMUS UUV lines, with patents covering adaptive path planning and collaborative target identification.

The patent landscape is also shaped by the emergence of dual-use technologies. For example, Boeing has filed patents related to both military and commercial swarm operations, including coordinated seabed mapping and infrastructure inspection. These filings often detail methods for energy-efficient navigation and fault-tolerant swarm behaviors, addressing the operational constraints of long-duration underwater missions.

Looking ahead, the outlook for UUV swarm coordination systems is characterized by continued innovation and competitive patent activity. The next few years are expected to see further advances in AI-driven autonomy, secure underwater networking, and multi-domain integration—where UUV swarms operate in concert with aerial and surface unmanned systems. As major industry players and emerging startups vie for technological leadership, the patent landscape will likely become more crowded, with a growing emphasis on interoperability, resilience, and mission flexibility.

Regulatory, Ethical, and Interoperability Considerations

The rapid advancement and deployment of Unmanned Underwater Vehicle (UUV) swarm coordination systems are prompting urgent regulatory, ethical, and interoperability considerations as we move through 2025 and into the next several years. The proliferation of UUV swarms—capable of autonomous, collaborative missions—raises complex questions for both civilian and military stakeholders.

On the regulatory front, there is currently no unified international framework specifically governing the operation of UUV swarms. Existing maritime laws, such as the United Nations Convention on the Law of the Sea (UNCLOS), provide only broad guidelines for underwater activities and do not address the unique challenges posed by autonomous, networked vehicles. As a result, leading UUV manufacturers and operators, including Saab AB and Kongsberg Gruppen, are actively engaging with national maritime authorities to shape emerging standards for safe operation, collision avoidance, and data sharing. The International Maritime Organization (IMO) has begun preliminary discussions on the integration of autonomous systems, but concrete regulations for UUV swarms are not expected before 2027.

Ethical considerations are also at the forefront, particularly as UUV swarms are increasingly integrated into defense applications. The potential for autonomous decision-making in contested environments raises concerns about accountability, proportionality, and unintended escalation. Companies such as Leonardo S.p.A. and L3Harris Technologies are investing in robust fail-safe mechanisms and human-in-the-loop controls to address these issues. There is growing pressure from international bodies and non-governmental organizations to ensure that UUV swarm deployments adhere to established norms of armed conflict and environmental protection.

Interoperability is another critical challenge, as UUV swarms are often required to operate alongside legacy systems and platforms from multiple vendors. The lack of standardized communication protocols and data formats can hinder mission effectiveness and increase operational risk. Industry leaders, including The Boeing Company and Thales Group, are collaborating through consortia and working groups to develop open architectures and modular software frameworks. The adoption of standards such as the NATO STANAG 4586 for unmanned vehicle control is expected to accelerate, enabling greater cross-platform compatibility by 2026.

Looking ahead, the regulatory, ethical, and interoperability landscape for UUV swarm coordination systems will remain dynamic. Stakeholders across industry, government, and civil society are likely to intensify their efforts to establish clear guidelines and technical standards, ensuring that the benefits of UUV swarms are realized while minimizing risks to safety, security, and the marine environment.

Investment Trends and Strategic Partnerships

The investment landscape for Unmanned Underwater Vehicle (UUV) swarm coordination systems is experiencing significant momentum in 2025, driven by both defense imperatives and the expanding commercial applications of autonomous underwater technologies. Major defense contractors and technology firms are intensifying their focus on collaborative autonomy, with a particular emphasis on multi-vehicle coordination, real-time data sharing, and resilient communications in contested maritime environments.

A notable trend is the surge in direct investments and strategic partnerships between established defense primes and innovative startups specializing in artificial intelligence (AI), underwater communications, and robotics. BAE Systems has continued to expand its portfolio in maritime autonomy, leveraging its experience in naval systems to develop advanced UUV swarm solutions. In 2024 and early 2025, BAE Systems announced collaborations with smaller AI firms to accelerate the integration of machine learning algorithms for adaptive swarm behaviors.

Similarly, Northrop Grumman has increased its investment in underwater autonomy, with a focus on scalable swarm architectures and secure communications. The company’s ongoing partnerships with academic institutions and technology incubators are aimed at maturing distributed control systems and robust underwater networking protocols. These efforts are supported by government funding, particularly from the U.S. Navy, which has identified UUV swarms as a critical capability for future undersea dominance.

On the commercial side, companies like Saab are leveraging their experience in underwater robotics to develop swarm-enabled UUVs for applications such as offshore energy, environmental monitoring, and subsea infrastructure inspection. Saab’s investments in modular UUV platforms and open-architecture control systems are designed to facilitate interoperability and rapid deployment of multi-vehicle teams.

Strategic partnerships are also emerging between UUV manufacturers and communications technology providers. For example, Kongsberg has entered into joint ventures with subsea communications specialists to enhance the reliability and range of acoustic and optical links essential for swarm coordination. These collaborations are expected to yield new products and system upgrades by 2026, further expanding the operational envelope of UUV swarms.

Looking ahead, the outlook for investment and partnership activity in UUV swarm coordination systems remains robust. The convergence of defense requirements, commercial demand, and rapid advances in autonomy and communications is expected to drive continued capital inflows and cross-sector alliances. As a result, the next few years will likely see accelerated development cycles, increased field trials, and the emergence of standardized platforms capable of supporting large-scale, heterogeneous UUV swarms.

Future Outlook: Emerging Opportunities and Disruptive Trends

The future of Unmanned Underwater Vehicle (UUV) swarm coordination systems is poised for significant transformation as technological advancements and strategic imperatives converge in 2025 and the years immediately following. The increasing complexity of underwater missions—ranging from maritime security and anti-submarine warfare to environmental monitoring and subsea infrastructure inspection—demands robust, scalable, and intelligent swarm coordination capabilities.

A key trend is the integration of artificial intelligence (AI) and machine learning (ML) algorithms to enable real-time, decentralized decision-making among UUV swarms. This shift is expected to enhance autonomy, resilience, and adaptability in dynamic underwater environments. Companies such as Saab AB, with its Sabertooth and Sea Wasp platforms, are actively investing in AI-driven control systems to facilitate collaborative behaviors, such as adaptive formation, target tracking, and distributed sensing. Similarly, Kongsberg Gruppen is advancing its HUGIN and REMUS UUV lines with enhanced swarm communication protocols and onboard processing power, aiming to support multi-vehicle operations for both defense and commercial applications.

Another disruptive trend is the development of standardized, interoperable communication frameworks that allow heterogeneous UUVs from different manufacturers to operate cohesively as a swarm. The adoption of open architectures and modular payloads is being championed by industry leaders like L3Harris Technologies, which is working on scalable swarm solutions for mine countermeasures and persistent surveillance. These efforts are supported by international defense collaborations and initiatives, such as NATO’s Defence Innovation Accelerator for the North Atlantic (DIANA), which is fostering cross-border R&D in autonomous maritime systems.

Energy management and underwater wireless power transfer are also emerging as critical enablers for long-duration swarm missions. Companies like Teledyne Marine are exploring advanced battery technologies and docking solutions that allow UUVs to recharge autonomously, thereby extending operational endurance and reducing the need for surface intervention.

Looking ahead, the convergence of AI, advanced communications, and energy autonomy is expected to unlock new operational concepts, such as large-scale, persistent UUV swarms capable of self-organizing and executing complex tasks with minimal human oversight. This evolution will likely disrupt traditional naval operations and open new commercial opportunities in offshore energy, environmental monitoring, and undersea exploration. As these technologies mature, regulatory frameworks and interoperability standards will become increasingly important to ensure safe and effective deployment of UUV swarms across global maritime domains.

Sources & References

- Northrop Grumman

- Lockheed Martin

- Saab

- Kongsberg

- Boeing

- Teledyne Marine

- Leonardo S.p.A.

- L3Harris Technologies

- Thales Group