Table of Contents

- Executive Summary: Key Insights & 2025 Highlights

- Market Size and Forecast (2025–2030): Growth Trajectories & Projections

- Latest Technological Innovations Transforming Nanocrystallography

- Synchrotron Facilities & Leading Industry Players (e.g., esrf.fr, diamond.ac.uk)

- Emerging Applications in Materials Science, Pharma, and Beyond

- Competitive Landscape: Strategies of Top System Manufacturers

- Investment Trends & Funding for R&D Initiatives

- Regulatory Environment and Industry Standards (e.g., lightsources.org)

- Challenges, Bottlenecks, and Risk Factors

- Future Outlook: Disruptive Technologies & Next-Gen Market Opportunities

- Sources & References

Executive Summary: Key Insights & 2025 Highlights

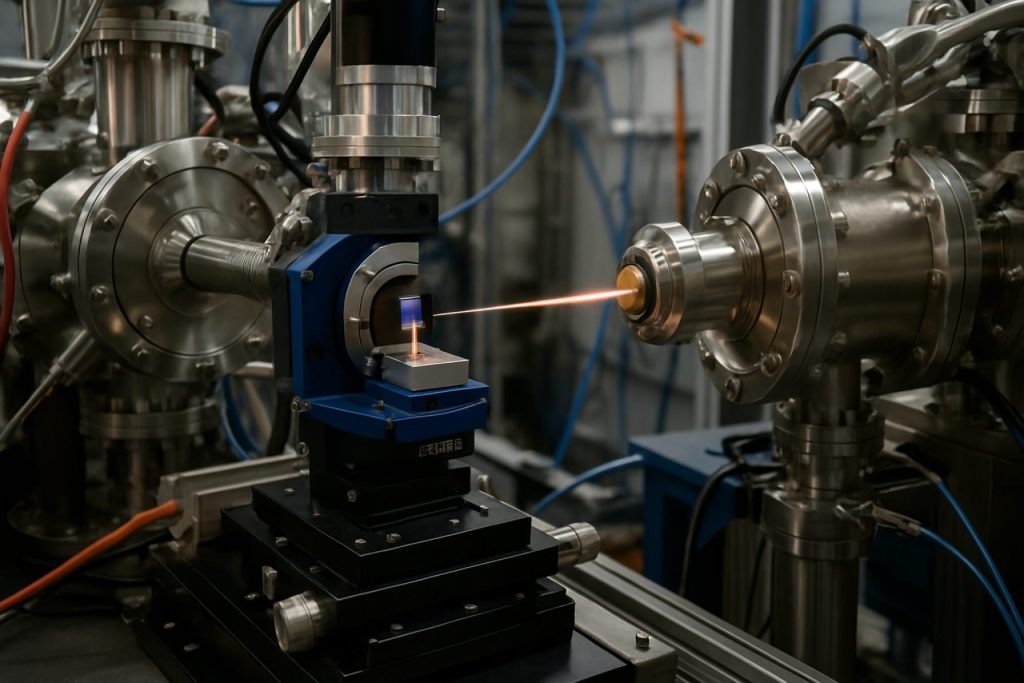

Synchrotron nanocrystallography systems are at the forefront of structural biology and materials science, leveraging the unique properties of synchrotron-generated X-rays to investigate the atomic and nanoscale structures of crystalline materials. In 2025, the field is experiencing significant advancements driven by the commissioning of next-generation synchrotron light sources, enhanced detector technologies, and integrated automation solutions.

A core milestone in the sector is the ongoing upgrade and expansion of major synchrotron facilities worldwide. For example, the European Synchrotron Radiation Facility (ESRF) continues to develop its Extremely Brilliant Source (EBS), which delivers a 100-fold increase in X-ray brilliance compared to previous generations. This upgrade has enabled more precise and rapid data collection from nanocrystals, supporting breakthroughs in protein structure determination and advanced materials research. Similarly, the Diamond Light Source in the UK is progressing with its Diamond-II upgrade, aiming for completion by 2026, which will further enhance nanocrystallography capabilities through improved beam coherence and higher throughput.

Technological innovation is also being seen in sample delivery and detection. DECTRIS, a leading producer of photon-counting X-ray detectors, has released new generations of hybrid pixel detectors tailored for faster, high-resolution data acquisition in nanocrystallography experiments. These detectors support the trend toward high-throughput, automated workflows, which are increasingly integrated by system suppliers like Rigaku and Bruker, both of whom have introduced nanocrystallography-compatible instrumentation with streamlined software for synchrotron beamlines.

Demand for synchrotron nanocrystallography is being propelled by pharmaceutical and materials sectors, with growing use cases in drug discovery—facilitated by the ability to analyze micro- and nanocrystals of challenging targets—and in advanced materials characterization. Collaborative efforts between industry and public research centers, such as those seen at the Advanced Photon Source in the US, are fostering innovation in both hardware and data processing pipelines.

Looking ahead, the outlook for 2025 and the following years is robust. New synchrotron facilities in Asia, such as upgrades at the SPring-8 center in Japan, are expected to expand global access to state-of-the-art nanocrystallography. The convergence of brighter sources, advanced detectors, and AI-driven data analysis is anticipated to further reduce experiment times and broaden the range of samples amenable to nanocrystallographic study, cementing these systems as indispensable tools for nanoscale discovery.

Market Size and Forecast (2025–2030): Growth Trajectories & Projections

The global market for synchrotron nanocrystallography systems is poised for significant growth from 2025 through 2030, driven by increasing investments in advanced materials research, pharmaceuticals, and structural biology. As synchrotron facilities expand worldwide, demand for state-of-the-art nanocrystallography instruments is rising to support breakthroughs in nanomaterials, drug discovery, and protein structure determination.

Leading synchrotron facilities, such as the European Synchrotron Radiation Facility (ESRF), Advanced Photon Source (APS) at Argonne National Laboratory, and SPring-8, are actively upgrading their beamlines to enhance resolution and throughput. These upgrades fuel the need for cutting-edge nanocrystallography detectors, sample delivery robots, and data processing software. For instance, ESRF’s Extremely Brilliant Source (EBS) upgrade, completed in 2024, positions it as a leader in nanometer-scale crystallography and is expected to drive instrument procurements and collaborations well into the forecast period.

Manufacturers such as Rayonix and DECTRIS continue to innovate with faster, more sensitive X-ray detectors tailored for synchrotron-based experiments. Their latest generations of hybrid photon counting detectors and large-area CCDs enable higher data rates, lower noise, and improved spatial resolution—key requirements for advancing nanocrystallography applications. Demand for these instruments is projected to accelerate as more synchrotrons adopt automated, high-throughput nanocrystallography pipelines, especially for time-resolved and serial crystallography experiments.

Regionally, Europe, North America, and East Asia will remain the largest markets through 2030, supported by strong governmental funding and expansive user communities. New synchrotron projects in China, such as the Shanghai Synchrotron Radiation Facility (SSRF), are expected to create additional market pull in the Asia-Pacific region, with substantial investments allocated for both infrastructure and advanced instrumentation.

Looking forward, the market outlook is robust. The ongoing integration of artificial intelligence for real-time data analysis, as seen in collaborations between instrument suppliers and large facilities, is anticipated to further drive adoption and system upgrades. The market for synchrotron nanocrystallography systems is thus expected to exhibit steady double-digit annual growth rates through 2030, reflecting the confluence of scientific demand, technological innovation, and expanding synchrotron capacity worldwide.

Latest Technological Innovations Transforming Nanocrystallography

Synchrotron nanocrystallography systems are entering a new era in 2025, driven by advancements in beamline instrumentation, detector technology, and automation. These innovations are fundamentally enhancing the resolution, throughput, and accessibility of nanocrystal structure determination, impacting fields from structural biology to materials science.

One major development is the integration of hybrid pixel array detectors, such as the EIGER and JUNGFRAU series, which deliver faster frame rates, higher dynamic range, and improved noise performance. Facilities like Paul Scherrer Institut and European Synchrotron Radiation Facility (ESRF) have implemented these detectors in their latest beamlines, enabling rapid serial data collection from micron- and submicron-sized crystals. In 2024, ESRF’s ID29 beamline was upgraded to support fully automated serial crystallography, leveraging advanced nano-focused beams and high-speed detectors to facilitate high-throughput screening of nanocrystals for drug discovery and protein research.

Beamline automation and robotics have also matured, with companies such as DECTRIS and ARINAX contributing modular sample changers, precise goniometers, and microfluidic sample delivery systems. These tools minimize manual intervention, reduce sample consumption, and maximize experimental efficiency. The Diamond Light Source in the UK has launched the VMXm (Versatile Micro-crystallography) beamline, which employs fully automated workflows for in situ data collection from nano- and microcrystals, supporting both academic and industrial users.

Meanwhile, software and data processing pipelines are evolving to handle the vast data rates generated by these advanced systems. Synchrotron facilities are deploying machine learning algorithms for real-time feedback, hit-finding, and data quality assessment—further streamlining the path from experiment to structure. Advanced Photon Source (APS) has incorporated AI-based tools into its new beamlines, facilitating smarter data acquisition and processing.

Looking forward, the next few years will see continued miniaturization of beam sizes down to the nanometer scale, integration of time-resolved pump-probe capabilities, and expanded remote experiment control. The trend toward open-access, user-friendly platforms is expected to lower barriers for smaller research teams and accelerate discoveries in nanocrystallography. With global upgrades to major synchrotrons, such as the ESRF-EBS and APS-U projects, researchers anticipate even greater sensitivity and throughput, ensuring that synchrotron nanocrystallography remains at the frontier of structural analysis through 2025 and beyond.

Synchrotron Facilities & Leading Industry Players (e.g., esrf.fr, diamond.ac.uk)

Synchrotron nanocrystallography systems are at the forefront of structural biology and materials science, enabling atomic-level structural determination from nanometer-sized crystals. As of 2025, leading synchrotron facilities across Europe, North America, and Asia are pushing advancements in both hardware and software to meet rising demand for high-throughput, high-resolution nanocrystallography.

- European Synchrotron Radiation Facility (ESRF): The European Synchrotron Radiation Facility in Grenoble, France, operates the ESRF-EBS, the world’s first fourth-generation synchrotron light source. Its beamlines—such as ID23-2 and ID29—are equipped for serial crystallography and micro/nano-focus X-ray diffraction, supporting experiments on crystals as small as a few micrometers, and in some setups, down to nanometer scale. ESRF is actively upgrading its automation and detector systems in 2025, focusing on advancing serial femtosecond crystallography capabilities and integrating AI-driven data processing pipelines.

- Diamond Light Source: The UK’s Diamond Light Source continues to operate the I24 microfocus macromolecular crystallography beamline, renowned for its pioneering contributions to micro- and nanocrystallography. In 2025, Diamond is further refining its beam optics and developing automated sample handling robots and ultra-fast detectors (like EIGER2 and PILATUS series) for high-throughput data acquisition and real-time processing. These upgrades are driven by increasing demand from pharmaceutical and biotechnology sectors.

- Advanced Photon Source (APS): The Advanced Photon Source at Argonne National Laboratory (USA) is in the final stages of a major upgrade (APS-U), scheduled to complete in 2024/2025. The upgrade will deliver X-ray beams up to 500 times brighter, transforming the capabilities of nanocrystallography stations such as 24-ID-E and 23-ID-D. APS is collaborating with detector manufacturers to deploy next-generation hybrid pixel array detectors and improve automation.

- MAX IV Laboratory: Sweden’s MAX IV Laboratory is Europe’s first operational fourth-generation synchrotron. Its BioMAX beamline is being adapted for advanced micro- and nanocrystallography, with a focus on in situ data collection and sample environments compatible with fragile nanocrystals.

- Industry Players: Detector manufacturers such as DECTRIS Ltd. are integral to these advances, supplying high-frame-rate, low-noise hybrid pixel detectors optimized for small-beam, fast-scan applications. Robotics companies, including Arinax, are delivering automated goniometers and sample changers designed for nanocrystallography.

Looking ahead over the next few years, these leading facilities and industry partners are expected to enable routine room-temperature nanocrystallography, real-time data-driven feedback, and integration with cryo-electron microscopy pipelines. These advances are poised to accelerate structure-based drug discovery and materials design throughout the late 2020s.

Emerging Applications in Materials Science, Pharma, and Beyond

Synchrotron nanocrystallography systems are rapidly transforming research in materials science, pharmaceuticals, and adjacent fields, offering atomic-level structural insights for samples previously inaccessible to traditional crystallography. As of 2025, advances in source brilliance, detector speed, and micro-focusing optics are converging to expand the frontiers of what is possible with these state-of-the-art systems.

In materials science, synchrotron nanocrystallography is enabling the detailed study of nanoscale heterogeneity in advanced alloys, battery materials, and quantum materials. Facilities such as European Synchrotron Radiation Facility (ESRF) and Argonne National Laboratory’s Advanced Photon Source (APS) are deploying next-generation beamlines with sub-micron focusing and ultrafast detectors. These upgrades, part of multi-year modernization programs, are anticipated to facilitate real-time tracking of phase transitions and defect dynamics at unprecedented spatial and temporal resolutions.

Pharmaceutical applications are also expanding, particularly with the emergence of serial femtosecond crystallography (SFX) and microcrystal electron diffraction. Diamond Light Source and DESY are collaborating with pharmaceutical companies to streamline high-throughput screening of drug targets using nanocrystals, an approach vital for proteins that do not form large crystals. Recent innovations in sample delivery, such as fixed-target supports and high-viscosity injectors, are reducing sample consumption and speeding up data collection—key factors for drug discovery pipelines.

Beyond materials and pharma, synchrotron nanocrystallography is finding new roles in environmental science (e.g., mapping trace element distributions in polluted soils), cultural heritage (e.g., analyzing pigment nanostructures in artworks), and even biotechnology. The SOLEIL Synchrotron and SPring-8 have initiated multidisciplinary user programs to support these diverse research communities.

Looking ahead, the next few years will likely see further democratization of synchrotron nanocrystallography through automated workflows, remote access, and AI-driven data analysis, as already piloted at the Canadian Light Source. With major upgrades and new beamlines set to come online by 2026, the sector is poised for broader accessibility and accelerated innovation across scientific domains.

Competitive Landscape: Strategies of Top System Manufacturers

The competitive landscape for synchrotron nanocrystallography systems in 2025 is characterized by rapid technological innovation, international collaboration, and strategic investments by leading manufacturers and facility operators. As demand for high-resolution structural analysis in fields such as materials science, pharmaceuticals, and catalysis intensifies, major players are focusing on equipment upgrades, integrated software solutions, and expanded user access.

Key system manufacturers and facility operators—such as Bruker, Rigaku Corporation, and Oxford Instruments—are concentrating on improving detector sensitivity, automating data acquisition, and reducing sample volumes. For instance, Bruker has recently enhanced its D8 Venture platform to support advanced micro- and nano-focused beamlines, emphasizing modular upgrades and compatibility with leading synchrotron sources. Meanwhile, Rigaku’s Synchrotron Solutions division is collaborating closely with beamline operators to refine instrument components for sub-micron crystal analysis, supporting both standalone and integrated beamline deployments.

Globally, synchrotron facility operators—such as European Synchrotron Radiation Facility (ESRF) and Diamond Light Source—are investing in next-generation nanofocus beamlines, leveraging partnerships with equipment manufacturers to deliver high-throughput nanocrystallography capabilities. In 2024, ESRF launched its upgraded NanoMX beamline, featuring a bespoke goniometer and state-of-the-art photon-counting detectors, developed in collaboration with leading hardware suppliers. Similarly, Diamond Light Source has extended its VMXm beamline, targeting workflows for pharmaceutical and protein microcrystal studies, with ongoing input from Oxford Instruments and Rigaku.

Strategically, companies are also emphasizing software integration and remote operation features to address growing demand for distributed research and data-driven science. Automation and artificial intelligence tools for crystal detection, data collection, and analysis are emerging as differentiators. For example, Bruker and Oxford Instruments are both developing AI-powered pipelines to streamline the handling of nanocrystallography datasets, reducing turnaround times and broadening access for non-specialist users.

Looking ahead, the next few years will likely see further consolidation among system manufacturers, deeper collaborations between industry and major synchrotron facilities, and increased deployment of modular, upgradeable platforms. With the proliferation of new beamlines in Asia and North America and rising demand from biotech and energy sectors, competition will shift toward flexible, scalable solutions that can support both bespoke research and high-throughput industrial workflows.

Investment Trends & Funding for R&D Initiatives

Investment in synchrotron nanocrystallography systems continues to accelerate in 2025, driven by advancements in beamline technology, detector sensitivity, and automation, as well as growing demand from materials science, structural biology, and pharmaceutical research. Major public funding bodies and research consortia remain central to the growth of this sector, while industry partnerships are becoming more common as companies seek to commercialize new applications and technologies.

National governments and pan-national organizations have significantly increased funding for synchrotron upgrades and new beamline construction. For example, the European Synchrotron Radiation Facility (ESRF) continues to invest in its Extremely Brilliant Source (EBS), the world’s first high-energy fourth-generation synchrotron. The EBS has attracted substantial funding from the European Union and its member states, underlining the strategic importance of nanocrystallography capabilities for fields ranging from drug discovery to advanced materials.

Similarly, North America has witnessed rising support for synchrotron infrastructure. The Canadian Light Source is executing several multimillion-dollar upgrades to beamlines specifically designed for nanocrystallography and microfocus applications. In the United States, the Advanced Photon Source (APS) Upgrade project at Argonne National Laboratory is one of the largest current investments in X-ray science globally, with more than $800 million committed by the U.S. Department of Energy to improve spatial resolution and throughput, directly benefiting nanocrystallography research.

On the industry side, detector and automation companies are receiving increased venture and strategic investment. DECTRIS, a leader in X-ray detectors, has expanded its product lines with new hybrid-pixel detectors optimized for synchrotron nanocrystallography, supported by sustained R&D funding and collaboration with major synchrotron facilities. Similarly, Rigaku Corporation is investing in automation platforms and collaborating with government agencies to make nanocrystallography more accessible and high-throughput.

Looking forward, the outlook for R&D investment in this field remains robust. Continued support from government agencies, increased cross-sector partnerships, and the commercialization of next-generation instrumentation are expected to further expand the capabilities and accessibility of synchrotron nanocrystallography systems through the latter half of the 2020s.

Regulatory Environment and Industry Standards (e.g., lightsources.org)

The regulatory environment and industry standards for synchrotron nanocrystallography systems are evolving in response to the rapid technological advancements and increasing deployment of these tools in materials science, pharmaceuticals, and structural biology. As of 2025, the sector is characterized by a collaborative approach among international synchrotron facilities, scientific organizations, and equipment manufacturers to harmonize best practices, data integrity, and safety standards.

A central coordinating platform is lightsources.org, representing a global network of synchrotron and free-electron laser (FEL) facilities. This consortium plays a critical role in disseminating updates on facility regulations, user access protocols, and technical guidelines. Member facilities, such as the Diamond Light Source (Diamond Light Source) in the UK, the European Synchrotron Radiation Facility (ESRF) in France, and the Advanced Photon Source (Advanced Photon Source) at Argonne National Laboratory in the US, implement rigorous operational standards for nanocrystallography beamlines, including radiation safety, quality assurance, and data management.

A significant regulatory driver in 2025 is the requirement for reproducible and FAIR (Findable, Accessible, Interoperable, Reusable) data, especially as nanocrystallography experiments generate vast and complex datasets. Organizations such as the International Union of Crystallography (IUCr) actively develop and update data standards and validation criteria. This ensures that results obtained from advanced synchrotron platforms like the EIGER X detector series by Dectris or the PILATUS systems are consistent, traceable, and compatible across international research infrastructures.

Manufacturers of synchrotron nanocrystallography equipment are increasingly required to comply with both facility-specific and international standards for hardware interoperability, cybersecurity, and user safety. Companies such as Rigaku and Bruker incorporate these requirements into their latest instrumentation, allowing seamless integration into beamline environments while meeting stringent regulatory expectations.

Looking ahead over the next few years, the industry anticipates further convergence on open-source control software, remote experiment protocols, and automated data pipelines, in line with recommendations from organizations like lightsources.org and the IUCr. Additionally, as new synchrotron sources such as MAX IV (MAX IV Laboratory) and the upgraded European XFEL (European XFEL) come online, regulatory frameworks will be updated to address increased experimental throughput, higher data rates, and cross-border data sharing, ensuring continued scientific excellence and compliance.

Challenges, Bottlenecks, and Risk Factors

Synchrotron nanocrystallography systems are at the forefront of structural biology and materials science, but several key challenges, bottlenecks, and risk factors continue to shape their development and deployment as of 2025.

- Beamline Availability and Throughput: Synchrotron facilities worldwide are experiencing unprecedented demand for nanocrystallography beamtime, particularly with the rapid progress of micro- and nano-focused X-ray beamlines. This creates bottlenecks in scheduling, as even advanced facilities such as the European Synchrotron Radiation Facility and Advanced Photon Source operate near full capacity. High demand for time-resolved and high-throughput experiments exacerbates these constraints, leading to long wait times and potential delays for time-sensitive research.

- Sample Preparation and Delivery: Preparing nanocrystals in appropriate size and quantities and delivering them reliably into the X-ray beam remains a critical technical challenge. Automated sample delivery systems, such as those developed at EMBL Hamburg and Diamond Light Source, have improved throughput but are not universally available or compatible with all types of samples. The risk of sample loss, damage, or inefficient usage during injection or mounting remains a significant bottleneck.

- Radiation Damage: Despite advances in fast detectors and data collection strategies, radiation damage to nanoscale crystals is still a limiting factor in data quality. Facilities like Canadian Light Source and SPring-8 are investigating ultrafast data collection and cryogenic preservation techniques, but the fundamental physics of radiation interaction with small crystals remains a risk for structural integrity, particularly for delicate biological samples.

- Data Management and Processing: Modern nanocrystallography generates massive datasets—often several terabytes per experiment. Efficient data management, storage, and real-time processing are major challenges, as highlighted by the ongoing upgrades to data infrastructure at Paul Scherrer Institute. There is a growing risk of bottlenecks in data transfer, analysis, and archiving, especially as automation increases experiment throughput.

- Access and Equity: High operating costs and limited facility access can create disparities between well-funded research institutions and smaller labs or developing regions. Efforts by organizations like Lightsources.org to promote collaborative access models are ongoing, but equity of access remains a concern for the global research community.

Looking ahead to the next few years, the sector is expected to mitigate some bottlenecks through targeted investments in automation, upgraded detector technologies, and streamlined data management. However, overcoming fundamental challenges such as sample delivery, radiation damage, and equitable access will require coordinated efforts across the international synchrotron community.

Future Outlook: Disruptive Technologies & Next-Gen Market Opportunities

The landscape of synchrotron nanocrystallography systems is poised for significant transformation through 2025 and beyond, as both technological innovation and facility expansion accelerate. Next-generation synchrotron sources are being commissioned globally, delivering unprecedented brilliance, coherence, and spatial resolution that directly impact the capabilities of nanocrystallography.

One of the most notable developments is the rollout of upgraded “diffraction-limited storage rings” (DLSRs) at leading synchrotron facilities. The European Synchrotron Radiation Facility (ESRF) has completed its ESRF-EBS upgrade, offering a 100-fold increase in brightness and enabling more detailed structural studies on nanocrystals as small as tens of nanometers. Over the next few years, similar upgrades are planned or underway at facilities such as Advanced Photon Source (APS) in the USA, Diamond Light Source in the UK, and MAX IV Laboratory in Sweden.

In parallel, hardware and software vendors are introducing disruptive technologies tailored to nanocrystallography. DECTRIS is advancing hybrid photon counting detectors with higher frame rates and smaller pixel sizes, crucial for capturing diffraction data from extremely small or weakly diffracting crystals. Instrumentation companies like Arinax are integrating robotic sample delivery and automated crystal centering systems, reducing turnaround times and increasing throughput for high-demand nanocrystal screening.

Emerging software—such as those developed by Global Phasing Ltd—is harnessing AI and advanced algorithms for real-time data processing, facilitating automated analysis even with challenging nanocrystal datasets. These advances are expected to further democratize access to nanocrystallography for pharmaceutical, materials science, and structural biology researchers, reducing the expertise barrier and opening doors to non-specialist users.

Looking ahead, the convergence of these disruptive technologies will foster new market opportunities. The pharmaceutical sector is likely to benefit from high-throughput screening of nanocrystals for drug discovery and polymorph studies, while materials science applications will extend to nanoengineered catalysts and quantum materials. As global demand for nanoscale structural data grows, vendors and synchrotron facilities are expected to expand their offerings, including remote and automated services, over the next several years.

Overall, the next few years will see synchrotron nanocrystallography systems become faster, more precise, and more accessible, underpinning a wave of innovation across multiple scientific and industrial sectors.