2025 Spark Plasma Sintering Equipment Manufacturing Market Report: In-Depth Analysis of Growth Drivers, Technology Innovations, and Global Opportunities

- Executive Summary & Market Overview

- Key Technology Trends in Spark Plasma Sintering Equipment

- Competitive Landscape and Leading Manufacturers

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities for Stakeholders

- Sources & References

Executive Summary & Market Overview

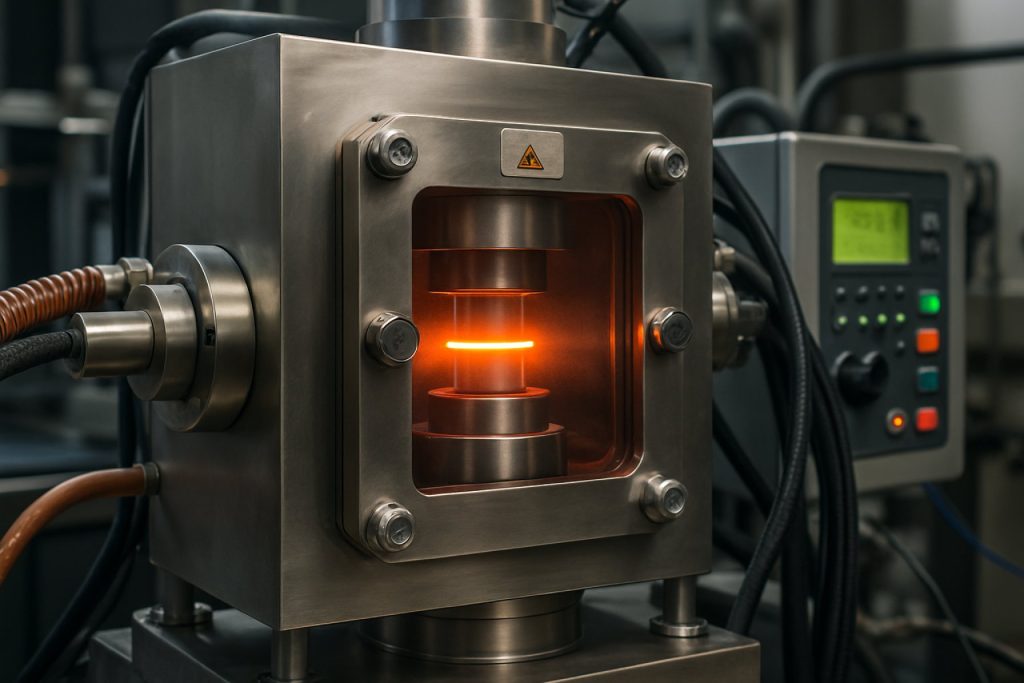

The global spark plasma sintering (SPS) equipment manufacturing market is poised for robust growth in 2025, driven by increasing demand for advanced materials across industries such as automotive, aerospace, electronics, and energy. Spark plasma sintering, also known as field-assisted sintering technique (FAST), is a powder metallurgy process that enables rapid densification of materials at lower temperatures and shorter times compared to conventional sintering methods. This technology is particularly valued for its ability to produce high-performance ceramics, composites, and metals with superior mechanical and functional properties.

In 2025, the SPS equipment market is expected to benefit from ongoing investments in research and development, particularly in regions such as Asia-Pacific, North America, and Europe. The Asia-Pacific region, led by China and Japan, continues to dominate the market due to strong government support for advanced manufacturing and the presence of leading SPS equipment manufacturers such as Sinter Land Inc. and Sumitomo Chemical Co., Ltd.. North America and Europe are also witnessing increased adoption, fueled by the need for lightweight, high-strength materials in electric vehicles and renewable energy applications.

According to recent market analyses, the global SPS equipment market size was valued at approximately USD 120 million in 2023 and is projected to reach USD 170 million by 2025, registering a compound annual growth rate (CAGR) of over 18% during the forecast period MarketsandMarkets. Key growth drivers include the rising demand for next-generation electronic components, the proliferation of additive manufacturing, and the push for sustainable, energy-efficient production processes.

- Automotive and aerospace sectors are increasingly utilizing SPS for lightweight, high-performance parts.

- Research institutions and universities are significant end-users, leveraging SPS for novel material development.

- Technological advancements, such as automation and digital process control, are enhancing equipment capabilities and throughput.

Despite the positive outlook, the market faces challenges such as high initial capital investment, limited awareness in emerging economies, and the need for skilled operators. However, ongoing collaborations between equipment manufacturers and research organizations are expected to address these barriers and further accelerate market adoption in 2025 and beyond.

Key Technology Trends in Spark Plasma Sintering Equipment

Spark plasma sintering (SPS) equipment manufacturing is undergoing significant technological transformation as the demand for advanced materials in sectors such as aerospace, automotive, and electronics accelerates. In 2025, several key technology trends are shaping the design, production, and performance of SPS systems, with a focus on precision, scalability, and digital integration.

- Advanced Process Control and Automation: Manufacturers are increasingly integrating sophisticated sensors, real-time monitoring, and closed-loop feedback systems into SPS equipment. These advancements enable precise control over temperature, pressure, and electric current, resulting in improved reproducibility and material properties. Automation also reduces human error and enhances throughput, a trend highlighted in recent industry reports by Frost & Sullivan.

- Scalability and Modular Design: Responding to the need for both research-scale and industrial-scale production, equipment manufacturers are developing modular SPS systems. These allow for flexible configuration, easy upgrades, and adaptation to different batch sizes. Companies such as Sinter Land Inc. and FCT Systeme GmbH are at the forefront, offering scalable solutions that cater to diverse application requirements.

- Digitalization and Data Analytics: The integration of Industry 4.0 principles is becoming standard in SPS equipment manufacturing. Digital twins, predictive maintenance, and cloud-based data analytics are being adopted to optimize equipment performance and minimize downtime. According to MarketsandMarkets, digitalization is expected to drive operational efficiency and provide valuable insights for process optimization.

- Energy Efficiency and Sustainability: With growing emphasis on sustainability, manufacturers are focusing on reducing the energy consumption of SPS systems. Innovations include improved insulation materials, optimized power supplies, and energy recovery systems. These efforts align with global sustainability goals and are increasingly demanded by end-users, as noted by IDTechEx.

- Enhanced Safety and User Experience: Modern SPS equipment features improved safety interlocks, ergonomic interfaces, and user-friendly software. These enhancements not only protect operators but also streamline workflow, making advanced sintering technology more accessible to a broader range of users.

Collectively, these trends are driving the evolution of spark plasma sintering equipment manufacturing in 2025, enabling higher performance, greater flexibility, and more sustainable operations across the materials processing industry.

Competitive Landscape and Leading Manufacturers

The competitive landscape of the spark plasma sintering (SPS) equipment manufacturing sector in 2025 is characterized by a mix of established global players and emerging regional manufacturers, each vying for technological leadership and market share. The SPS equipment market is driven by increasing demand from advanced ceramics, powder metallurgy, and research institutions, with a particular focus on applications in aerospace, automotive, electronics, and energy storage.

Key global manufacturers include Sinter Land Inc., SPEX SamplePrep, FCT Systeme GmbH, and Sumitomo Heavy Industries, Ltd.. These companies are recognized for their robust R&D capabilities, broad product portfolios, and strong after-sales support. For instance, FCT Systeme GmbH is known for its high-capacity SPS systems tailored for industrial-scale production, while Sumitomo Heavy Industries, Ltd. leverages its expertise in precision engineering to offer advanced, automated SPS solutions.

In Asia, particularly in China and Japan, domestic manufacturers such as Shanghai Kejin Industrial Co., Ltd. and Sumitomo Heavy Industries, Ltd. are expanding rapidly, supported by government initiatives to boost local advanced manufacturing capabilities. These companies are increasingly competitive in both price and technology, challenging the dominance of European and North American firms in the mid-range and entry-level segments.

Strategic partnerships and collaborations with research institutions are a hallmark of the industry, enabling manufacturers to stay at the forefront of innovation. For example, Sinter Land Inc. frequently collaborates with universities and national laboratories to develop next-generation SPS systems with enhanced energy efficiency and process control.

Market entry barriers remain high due to the capital-intensive nature of SPS equipment manufacturing and the need for specialized technical expertise. However, the growing adoption of SPS technology in emerging markets is attracting new entrants, particularly from Asia-Pacific, who are leveraging cost advantages and local market knowledge.

Overall, the competitive landscape in 2025 is marked by technological differentiation, global expansion strategies, and a dynamic interplay between established leaders and agile newcomers, all seeking to capitalize on the expanding applications of spark plasma sintering technology.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The global spark plasma sintering (SPS) equipment manufacturing market is poised for robust growth between 2025 and 2030, driven by increasing demand for advanced materials in sectors such as aerospace, automotive, electronics, and energy. According to recent projections, the SPS equipment market is expected to register a compound annual growth rate (CAGR) of approximately 7.5% during this period, with market revenues anticipated to reach over USD 250 million by 2030, up from an estimated USD 160 million in 2025 MarketsandMarkets.

Volume-wise, the number of SPS units shipped globally is forecasted to grow steadily, with annual shipments expected to increase from around 350 units in 2025 to nearly 600 units by 2030. This growth is underpinned by the expanding adoption of SPS technology for the rapid densification of ceramics, composites, and metal powders, which enables the production of high-performance components with superior mechanical and functional properties Fortune Business Insights.

Regionally, Asia-Pacific is projected to maintain its dominance in both revenue and volume, accounting for over 45% of the global market share by 2025, fueled by significant investments in research and development, particularly in China, Japan, and South Korea. Europe and North America are also expected to witness healthy growth, driven by the increasing integration of SPS in advanced manufacturing and materials research Grand View Research.

- CAGR (2025–2030): ~7.5%

- Revenue (2025): USD 160 million

- Revenue (2030): USD 250+ million

- Volume (2025): ~350 units

- Volume (2030): ~600 units

Key growth drivers include the rising need for lightweight, high-strength materials in electric vehicles and renewable energy applications, as well as ongoing advancements in SPS process control and scalability. Leading manufacturers are expected to invest in automation, digitalization, and the development of larger, more energy-efficient SPS systems to meet evolving industry requirements Sinter Land Inc..

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global spark plasma sintering (SPS) equipment manufacturing market demonstrates distinct regional dynamics, shaped by technological adoption, research intensity, and industrial demand. In 2025, North America, Europe, Asia-Pacific, and the Rest of the World (RoW) each present unique growth trajectories and competitive landscapes.

North America remains a significant hub for SPS equipment, driven by robust investments in advanced materials research and aerospace applications. The United States, in particular, benefits from strong collaborations between universities, national laboratories, and private sector manufacturers. Key players such as Dynamic Systems Inc. and FCT Systeme GmbH (with a strong North American presence) are capitalizing on demand for high-performance ceramics and metal matrix composites. The region’s market is further supported by government funding for defense and energy innovation, fostering steady growth through 2025.

Europe is characterized by a focus on sustainability and high-value manufacturing. Countries like Germany, France, and the UK are investing in SPS technology for automotive lightweighting, renewable energy, and biomedical applications. European manufacturers, including Sinterland Srl and FCT Systeme GmbH, are leveraging advanced automation and digitalization to enhance process efficiency. The European Union’s emphasis on green technologies and circular economy principles is expected to drive further adoption of SPS equipment in 2025, particularly in the context of reducing energy consumption and material waste.

- Asia-Pacific is the fastest-growing region, led by China, Japan, and South Korea. The region’s rapid industrialization, expanding electronics sector, and government-backed R&D initiatives are fueling demand for SPS equipment. Chinese manufacturers, such as Heye Technology Co., Ltd., are increasing their global footprint, while Japanese firms like Sumitomo Chemical are integrating SPS into advanced material production lines. The region’s competitive pricing and scale advantages are expected to intensify market competition in 2025.

- Rest of World (RoW) markets, including Latin America and the Middle East, are in earlier stages of SPS adoption. Growth is primarily driven by academic research and pilot projects in advanced manufacturing. While market share remains limited, increasing awareness and technology transfer initiatives are laying the groundwork for future expansion.

Overall, regional disparities in SPS equipment manufacturing reflect differences in industrial maturity, research priorities, and policy support, with Asia-Pacific poised for the most rapid growth in 2025, while North America and Europe maintain leadership in innovation and high-value applications.

Future Outlook: Emerging Applications and Investment Hotspots

The future outlook for spark plasma sintering (SPS) equipment manufacturing in 2025 is shaped by a convergence of technological innovation, expanding application domains, and strategic investments. As industries increasingly demand advanced materials with superior properties, SPS technology is gaining traction for its ability to produce high-density, fine-grained materials at lower temperatures and shorter cycle times compared to conventional sintering methods.

Emerging applications are a key driver of market growth. The aerospace and defense sectors are leveraging SPS for the fabrication of lightweight, high-strength components, particularly in the production of titanium alloys and ceramic matrix composites. The automotive industry is adopting SPS to develop next-generation electric vehicle (EV) components, such as high-performance magnets and battery materials, which require precise microstructural control. Additionally, the electronics sector is utilizing SPS for the rapid prototyping and mass production of advanced ceramics and functional materials, including thermoelectric and piezoelectric devices Frost & Sullivan.

Investment hotspots are emerging in regions with robust advanced manufacturing ecosystems and strong government support for innovation. Asia-Pacific, led by China, Japan, and South Korea, continues to dominate SPS equipment manufacturing due to significant R&D investments and the presence of leading material science institutes. Europe is also a focal point, with the European Union funding collaborative projects aimed at scaling up SPS technology for industrial applications. North America, particularly the United States, is witnessing increased venture capital and public funding for startups and research centers focused on additive manufacturing and advanced ceramics MarketsandMarkets.

- Technological Advancements: The integration of automation, real-time process monitoring, and digital twin technologies is expected to enhance process reliability and scalability, making SPS more attractive for high-volume manufacturing IDTechEx.

- Strategic Partnerships: Collaborations between equipment manufacturers, research institutions, and end-users are accelerating the commercialization of novel SPS applications, particularly in energy storage, biomedical implants, and quantum materials.

- Market Expansion: The SPS equipment market is projected to grow at a CAGR exceeding 6% through 2025, with new entrants and established players expanding their portfolios to address the evolving needs of high-tech industries Grand View Research.

In summary, 2025 will see spark plasma sintering equipment manufacturing positioned at the forefront of advanced materials innovation, with emerging applications and targeted investments driving both technological progress and market expansion.

Challenges, Risks, and Strategic Opportunities for Stakeholders

The spark plasma sintering (SPS) equipment manufacturing sector faces a complex landscape of challenges, risks, and strategic opportunities as it moves into 2025. The industry, which serves advanced ceramics, powder metallurgy, and emerging materials markets, is shaped by rapid technological evolution, supply chain volatility, and shifting end-user demands.

Challenges and Risks

- High Capital Intensity and R&D Costs: SPS equipment manufacturing requires significant investment in precision engineering, automation, and process control. The need for continuous R&D to improve sintering speed, energy efficiency, and scalability puts pressure on margins, especially for smaller players (Grand View Research).

- Supply Chain Disruptions: The sector is vulnerable to disruptions in the supply of high-grade graphite dies, advanced sensors, and power electronics. Geopolitical tensions and raw material shortages, particularly for rare earths and specialty metals, can delay production and inflate costs (MarketsandMarkets).

- Technical Complexity and Skilled Labor Shortage: Operating and maintaining SPS systems requires specialized knowledge. The shortage of skilled engineers and technicians can hinder adoption and after-sales support, impacting customer satisfaction and repeat business (Frost & Sullivan).

- Regulatory and Environmental Pressures: Stricter regulations on energy consumption and emissions in manufacturing environments are prompting equipment makers to innovate, but also increase compliance costs and complexity.

Strategic Opportunities

- Expansion into New Applications: Growth in electric vehicles, aerospace, and biomedical implants is driving demand for advanced materials that benefit from SPS processing. Manufacturers can capitalize by developing tailored solutions for these high-growth sectors (IDTechEx).

- Digitalization and Automation: Integrating IoT sensors, AI-driven process optimization, and remote diagnostics can differentiate offerings and reduce total cost of ownership for end-users, creating new revenue streams through service contracts and data analytics.

- Strategic Partnerships and Vertical Integration: Collaborating with material suppliers, research institutes, and end-users can accelerate innovation and reduce time-to-market for next-generation SPS systems.

- Geographic Diversification: Expanding manufacturing and service networks into Asia-Pacific and other emerging markets can mitigate regional risks and tap into fast-growing demand for advanced manufacturing technologies (Research and Markets).

In summary, while the SPS equipment manufacturing industry faces notable headwinds in 2025, proactive investment in innovation, partnerships, and market expansion can unlock significant value for stakeholders.

Sources & References

- Sumitomo Chemical Co., Ltd.

- MarketsandMarkets

- Frost & Sullivan

- FCT Systeme GmbH

- IDTechEx

- SPEX SamplePrep

- Fortune Business Insights

- Grand View Research

- Dynamic Systems Inc.

- Research and Markets