Silicon Photonic Interconnects Market Report 2025: In-Depth Analysis of Growth Drivers, Technology Innovations, and Global Opportunities

- Executive Summary & Market Overview

- Key Technology Trends in Silicon Photonic Interconnects

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

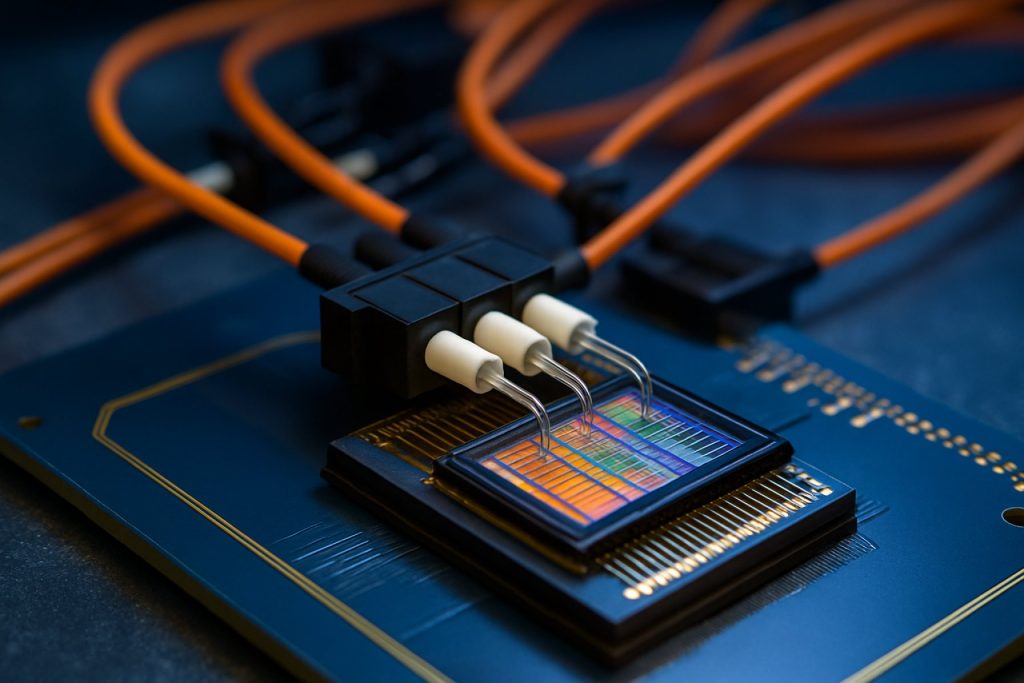

Silicon photonic interconnects represent a transformative technology in the field of data transmission, leveraging the optical properties of silicon to enable high-speed, energy-efficient communication between and within electronic devices. As data centers, high-performance computing (HPC), and artificial intelligence (AI) workloads continue to scale, traditional copper-based interconnects face limitations in bandwidth, latency, and power consumption. Silicon photonics addresses these challenges by integrating optical components onto silicon chips, facilitating faster data transfer rates and reduced energy usage.

In 2025, the global silicon photonic interconnects market is poised for robust growth, driven by surging demand for cloud computing, the proliferation of AI and machine learning applications, and the ongoing expansion of hyperscale data centers. According to MarketsandMarkets, the silicon photonics market is projected to reach USD 4.6 billion by 2025, growing at a CAGR of over 20% from 2020. This growth is underpinned by the technology’s ability to deliver high bandwidth density, scalability, and compatibility with existing CMOS manufacturing processes, which lowers production costs and accelerates adoption.

Key industry players such as Intel Corporation, Cisco Systems, Inc., and Rockley Photonics are investing heavily in research and development to advance silicon photonic interconnect solutions. These efforts are focused on improving integration, reducing power consumption, and enabling new architectures for next-generation data centers and network infrastructure. The adoption of 400G and 800G optical transceivers, as well as the development of co-packaged optics, are notable trends shaping the competitive landscape in 2025.

- Data Center Expansion: Hyperscale operators are rapidly deploying silicon photonic interconnects to meet escalating bandwidth and efficiency requirements.

- AI & HPC Workloads: The exponential growth in AI model complexity and HPC tasks is accelerating the shift toward optical interconnects for faster, more reliable data movement.

- Manufacturing Synergies: Compatibility with CMOS fabrication processes enables cost-effective mass production and integration with existing semiconductor ecosystems.

In summary, silicon photonic interconnects are at the forefront of next-generation data communication, offering a compelling solution to the bandwidth and energy challenges of modern computing environments. The market outlook for 2025 is characterized by rapid innovation, strategic investments, and expanding deployment across key verticals.

Key Technology Trends in Silicon Photonic Interconnects

Silicon photonic interconnects are at the forefront of next-generation data transmission technologies, leveraging the unique properties of silicon to enable high-speed, low-power optical communication within and between data centers, high-performance computing (HPC) systems, and advanced networking equipment. As the demand for bandwidth and energy efficiency intensifies, several key technology trends are shaping the silicon photonic interconnect landscape in 2025.

- Integration of Co-Packaged Optics (CPO): The shift from traditional pluggable optical modules to co-packaged optics is accelerating. CPO integrates optical engines directly with switch ASICs, reducing electrical interconnect distances and power consumption. This trend is driven by hyperscale data center operators and is supported by industry initiatives such as the Optical Internetworking Forum (OIF) and Open Compute Project (OCP).

- Advancements in Wavelength Division Multiplexing (WDM): Silicon photonics is enabling dense WDM on-chip, allowing multiple wavelengths to be transmitted simultaneously over a single fiber. This significantly increases aggregate bandwidth and is critical for scaling to 800G and 1.6T interconnects, as highlighted by Intel and Cisco in their latest product roadmaps.

- Monolithic and Heterogeneous Integration: The integration of lasers, modulators, and detectors onto a single silicon substrate (monolithic integration) or through advanced packaging techniques (heterogeneous integration) is reducing cost and complexity. Companies like Ayar Labs and GlobalFoundries are pioneering these approaches to enable scalable, manufacturable solutions.

- Energy Efficiency and Thermal Management: As data rates climb, managing power consumption and heat dissipation becomes critical. Innovations in low-loss waveguides, efficient modulators, and integrated thermal control are being adopted to meet the stringent requirements of next-generation interconnects, as reported by LightCounting.

- Standardization and Ecosystem Development: The rapid evolution of silicon photonics is supported by industry-wide standardization efforts, ensuring interoperability and accelerating adoption. Organizations such as the IEEE and Connectivity Standards Alliance are actively developing specifications for optical interconnects.

These trends collectively position silicon photonic interconnects as a foundational technology for the future of high-speed, energy-efficient data communication, with 2025 marking a pivotal year for commercial deployment and ecosystem maturation.

Competitive Landscape and Leading Players

The competitive landscape for silicon photonic interconnects in 2025 is characterized by a dynamic mix of established semiconductor giants, specialized photonics firms, and emerging startups, all vying for leadership in a market driven by the exponential growth of data centers, high-performance computing (HPC), and artificial intelligence (AI) workloads. The sector is witnessing rapid innovation, with companies focusing on increasing bandwidth, reducing power consumption, and improving integration with existing CMOS processes.

Key players dominating the silicon photonic interconnects market include Intel Corporation, which has been a pioneer in commercializing silicon photonics for data center applications. Intel’s optical transceivers and co-packaged optics solutions are widely adopted by hyperscale cloud providers, and the company continues to invest in next-generation photonic integration. Cisco Systems, Inc. is another major player, leveraging its acquisitions and in-house R&D to deliver high-speed optical interconnects for networking equipment.

Other significant contributors include Rockley Photonics, which focuses on integrated photonic solutions for both data communications and emerging applications such as biosensing, and Ayar Labs, a startup specializing in chip-to-chip optical interconnects that address the bandwidth and energy bottlenecks of traditional electrical connections. Inphi Corporation (now part of Marvell Technology) is also a notable competitor, providing high-speed optical and networking solutions that incorporate silicon photonics for cloud and telecom markets.

- Intel Corporation: Market leader in silicon photonics transceivers and co-packaged optics, with a strong focus on data center and cloud infrastructure.

- Cisco Systems, Inc.: Integrates silicon photonics into networking hardware, benefiting from a broad customer base in enterprise and hyperscale environments.

- Rockley Photonics: Innovator in integrated photonic platforms, expanding into both communications and health monitoring.

- Ayar Labs: Startup advancing chip-to-chip optical connectivity, targeting AI and HPC markets.

- Marvell Technology (Inphi): Delivers high-speed optical interconnects for cloud and telecom, leveraging Inphi’s silicon photonics expertise.

The competitive environment is further intensified by strategic partnerships, mergers, and acquisitions, as companies seek to expand their technological capabilities and market reach. For example, Marvell Technology’s acquisition of Inphi has strengthened its position in the high-speed optical interconnect segment. As demand for faster, more energy-efficient data transmission grows, the market is expected to see continued consolidation and innovation among leading players.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The silicon photonic interconnects market is poised for robust growth between 2025 and 2030, driven by escalating demand for high-speed data transmission in data centers, telecommunications, and high-performance computing. According to projections by MarketsandMarkets, the global silicon photonics market is expected to register a compound annual growth rate (CAGR) of approximately 23% during this period, with interconnects representing a significant share of this expansion due to their critical role in enabling faster and more energy-efficient data transfer.

Revenue forecasts indicate that the silicon photonic interconnects segment will see its market value rise from an estimated $1.2 billion in 2025 to over $3.3 billion by 2030. This surge is attributed to the increasing adoption of optical transceivers and switches in hyperscale data centers, as well as the integration of silicon photonics in next-generation server and storage architectures. International Data Corporation (IDC) highlights that the proliferation of artificial intelligence (AI) workloads and cloud computing is accelerating the need for high-bandwidth, low-latency interconnect solutions, further fueling market growth.

In terms of volume, the shipment of silicon photonic interconnect modules is projected to grow at a CAGR exceeding 25% from 2025 to 2030, as reported by Omdia. The volume increase is underpinned by the rapid scaling of data center infrastructure and the transition from copper-based to optical interconnects, which offer superior performance and energy efficiency. The adoption curve is particularly steep in North America and Asia-Pacific, where major cloud service providers and telecom operators are investing heavily in next-generation network upgrades.

- CAGR (2025–2030): ~23% for silicon photonic interconnects

- Revenue (2025): $1.2 billion

- Revenue (2030): $3.3 billion+

- Volume Growth: >25% CAGR in module shipments

Overall, the market outlook for silicon photonic interconnects from 2025 to 2030 is highly positive, with technological advancements, cost reductions, and the relentless growth of data-centric applications acting as primary catalysts for both revenue and volume expansion.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global market for silicon photonic interconnects is witnessing robust growth, with significant regional variations in adoption, innovation, and investment. In 2025, North America continues to lead the market, driven by the presence of major technology companies, advanced data center infrastructure, and strong R&D investments. The United States, in particular, is home to key players such as Intel Corporation and Cisco Systems, which are actively developing and deploying silicon photonic solutions for high-speed data transmission in cloud computing and AI workloads. The region benefits from early commercialization and a mature ecosystem, with government initiatives supporting photonics research and manufacturing.

Europe follows as a significant market, propelled by collaborative research projects and a focus on energy-efficient data centers. The European Union’s Horizon Europe program and initiatives by organizations like imec and STMicroelectronics are fostering innovation in silicon photonics. The region’s emphasis on digital sovereignty and green technologies is accelerating the adoption of photonic interconnects in telecommunications and high-performance computing sectors. However, the market is somewhat fragmented due to varying national policies and investment levels across member states.

The Asia-Pacific region is experiencing the fastest growth rate, fueled by rapid expansion of cloud services, 5G deployment, and government-backed semiconductor initiatives. Countries such as China, Japan, and South Korea are investing heavily in photonics R&D and manufacturing capacity. Chinese companies, including Huawei Technologies, are integrating silicon photonic interconnects into next-generation data centers and telecom networks. Japan’s focus on advanced packaging and integration, supported by firms like NTT Communications, is also contributing to regional market expansion. The Asia-Pacific market is characterized by aggressive scaling and increasing domestic demand for high-speed, low-latency interconnects.

- North America: Market leadership, strong R&D, early adoption.

- Europe: Innovation through collaboration, energy efficiency focus, fragmented market.

- Asia-Pacific: Fastest growth, large-scale investments, expanding manufacturing base.

- Rest of World: Emerging adoption, primarily in research and pilot projects, with potential for future growth as digital infrastructure matures.

Overall, regional dynamics in 2025 reflect a combination of technological leadership, policy support, and market demand, positioning silicon photonic interconnects as a critical enabler for next-generation digital infrastructure worldwide.

Future Outlook: Emerging Applications and Investment Hotspots

Looking ahead to 2025, silicon photonic interconnects are poised to play a transformative role in data center architectures, high-performance computing (HPC), and emerging AI workloads. The convergence of exponential data growth, energy efficiency imperatives, and the limitations of traditional copper-based interconnects is accelerating the adoption of silicon photonics across multiple sectors.

One of the most promising emerging applications is in AI and machine learning clusters, where the need for ultra-high bandwidth and low-latency communication between GPUs and accelerators is critical. Major cloud service providers and hyperscale data centers are actively investing in silicon photonic solutions to address these requirements. For instance, Intel and NVIDIA have both announced next-generation silicon photonic interconnects designed to support AI supercomputing fabrics, with commercial deployments expected to ramp up in 2025.

Another hotspot is the integration of silicon photonics in co-packaged optics (CPO), where optical transceivers are embedded directly with switch ASICs. This approach is gaining traction as a means to overcome the power and density limitations of pluggable optics in switches operating at 800G and beyond. According to Credence Research, the CPO market is projected to grow at a CAGR of over 35% through 2028, with silicon photonics as a key enabling technology.

Telecommunications is also emerging as a significant application area, particularly with the rollout of 5G and the anticipated evolution toward 6G. Silicon photonic interconnects are being explored for fronthaul and backhaul networks, where they can deliver the high bandwidth and low latency required for next-generation mobile infrastructure. Light Reading reports that several Tier 1 operators are piloting silicon photonic-based solutions in metro and edge networks, with broader adoption expected as standards mature.

From an investment perspective, venture capital and corporate funding are flowing into startups and scale-ups focused on silicon photonic design, packaging, and manufacturing. Notable recent investments include rounds led by AMD and Cisco in photonic integration firms, signaling strong confidence in the sector’s growth potential. As the ecosystem matures, strategic partnerships and M&A activity are likely to intensify, particularly around intellectual property and supply chain capabilities.

Challenges, Risks, and Strategic Opportunities

Silicon photonic interconnects are poised to revolutionize data transmission in high-performance computing, data centers, and telecommunications by enabling faster, more energy-efficient communication. However, the sector faces a complex landscape of challenges and risks, even as it presents significant strategic opportunities for stakeholders in 2025.

Challenges and Risks

- Manufacturing Complexity: Integrating photonic components with existing CMOS processes remains a significant hurdle. Achieving high yield and uniformity at scale is difficult, leading to higher production costs and potential delays in commercialization. According to Intel, process integration and wafer-level testing are persistent bottlenecks.

- Thermal Management: Silicon photonic devices are sensitive to temperature fluctuations, which can affect performance and reliability. Effective thermal management solutions are required, especially as data rates and integration densities increase (Synopsys).

- Standardization and Interoperability: The lack of universally accepted standards for silicon photonic interconnects impedes widespread adoption. Interoperability between products from different vendors is not guaranteed, complicating deployment in heterogeneous environments (International Electrotechnical Commission).

- Cost Competitiveness: While silicon photonics promises long-term cost savings, initial investments in R&D, equipment, and skilled labor are substantial. Competing with mature copper and traditional optical solutions on price remains a challenge in the near term (IDC).

- Supply Chain Vulnerabilities: The sector is exposed to global semiconductor supply chain disruptions, which can impact the availability of critical materials and components (Gartner).

Strategic Opportunities

- Data Center and AI Acceleration: The exponential growth in data center traffic and AI workloads is driving demand for high-bandwidth, low-latency interconnects. Silicon photonics is uniquely positioned to address these needs, with major cloud providers investing in the technology (Microsoft).

- Integration with Next-Gen Processors: Co-packaged optics and on-chip photonic interconnects offer opportunities for tighter integration with CPUs and GPUs, reducing power consumption and increasing throughput (AMD).

- Telecommunications Upgrades: The rollout of 5G and future 6G networks will require advanced optical interconnects for fronthaul and backhaul, creating new markets for silicon photonics (Ericsson).

- Strategic Partnerships: Collaborations between foundries, system integrators, and hyperscalers are accelerating innovation and reducing time-to-market for new solutions (GlobalFoundries).

In summary, while silicon photonic interconnects face technical and market risks in 2025, the sector’s strategic opportunities—driven by data-centric applications and ecosystem collaboration—are expected to fuel robust growth and innovation.

Sources & References

- MarketsandMarkets

- Cisco Systems, Inc.

- Rockley Photonics

- Optical Internetworking Forum (OIF)

- Open Compute Project (OCP)

- Ayar Labs

- LightCounting

- IEEE

- Connectivity Standards Alliance

- Inphi Corporation

- Marvell Technology (Inphi)

- International Data Corporation (IDC)

- Omdia

- imec

- STMicroelectronics

- Huawei Technologies

- NVIDIA

- Synopsys

- Microsoft