Quantum Semiconductor Manufacturing Industry Report 2025: Market Dynamics, Technology Innovations, and Strategic Forecasts. Explore Key Growth Drivers, Regional Trends, and Competitive Insights Shaping the Next 5 Years.

- Executive Summary & Market Overview

- Key Technology Trends in Quantum Semiconductor Manufacturing

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Opportunities

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

Quantum semiconductor manufacturing represents a transformative frontier in the global semiconductor industry, leveraging quantum mechanical phenomena to enable devices with unprecedented computational power, energy efficiency, and miniaturization. As of 2025, the market for quantum semiconductors is at an inflection point, driven by surging investments in quantum computing, advanced materials research, and the integration of quantum technologies into mainstream electronics.

The quantum semiconductor market is characterized by rapid innovation and significant capital inflows from both public and private sectors. According to International Data Corporation (IDC), global spending on quantum technologies—including quantum semiconductors—is projected to surpass $10 billion by 2025, with a compound annual growth rate (CAGR) exceeding 30% from 2022 to 2025. This growth is fueled by the increasing demand for quantum processors, quantum dots, and single-photon sources, which are essential for quantum computing, secure communications, and advanced sensing applications.

Key industry players such as IBM, Intel, and Toshiba are accelerating their quantum semiconductor manufacturing capabilities, focusing on scalable fabrication techniques and the development of error-corrected quantum bits (qubits). Startups and research institutions are also contributing to breakthroughs in materials science, particularly in the use of silicon, superconducting circuits, and compound semiconductors like gallium arsenide and indium phosphide.

Geographically, North America and Asia-Pacific dominate the quantum semiconductor landscape, with significant R&D hubs in the United States, Japan, South Korea, and China. Government initiatives, such as the U.S. National Quantum Initiative and the Japanese Quantum Technology Innovation Strategy, are catalyzing ecosystem development and fostering public-private partnerships.

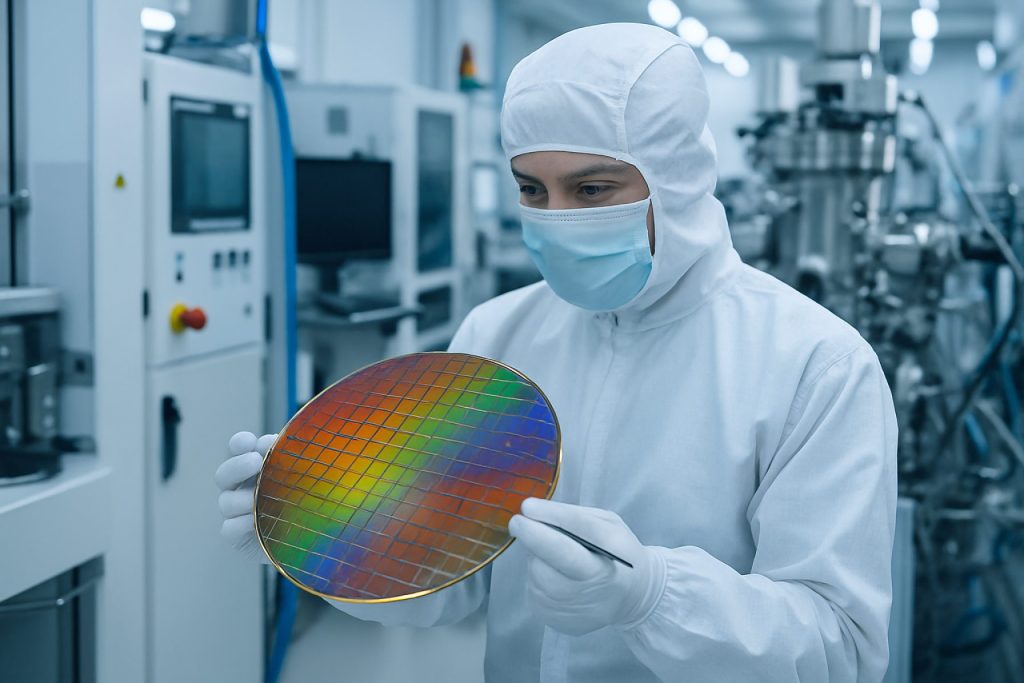

Despite the promise, the market faces challenges including high manufacturing costs, technical complexity, and the need for ultra-clean fabrication environments. However, ongoing advancements in lithography, cryogenic engineering, and quantum error correction are expected to mitigate these barriers, paving the way for commercial-scale production by the late 2020s.

In summary, quantum semiconductor manufacturing in 2025 stands as a high-growth, strategically critical sector, poised to redefine the future of computing, communications, and sensing technologies worldwide.

Key Technology Trends in Quantum Semiconductor Manufacturing

Quantum semiconductor manufacturing is rapidly evolving, driven by the need to produce devices that can harness quantum mechanical phenomena for computation, sensing, and secure communications. In 2025, several key technology trends are shaping this sector, reflecting both advances in materials science and the integration of novel fabrication techniques.

- Atomically Precise Fabrication: The push for qubits with longer coherence times and higher fidelity has led to the adoption of atomically precise manufacturing methods. Techniques such as atomic layer deposition (ALD) and molecular beam epitaxy (MBE) are being refined to create ultra-pure, defect-free materials essential for quantum devices. These methods enable the controlled placement of single atoms, which is critical for silicon-based and donor-based qubits (IBM, Intel).

- Heterogeneous Integration: Quantum chips increasingly require the integration of diverse materials—such as superconductors, semiconductors, and photonic components—on a single substrate. Advanced 3D packaging and hybrid bonding techniques are being deployed to combine these materials at the wafer level, improving scalability and device performance (TSMC).

- Advanced Lithography: The demand for sub-10nm feature sizes in quantum devices is accelerating the adoption of extreme ultraviolet (EUV) lithography and electron beam lithography. These technologies allow for the precise patterning required for quantum dots, Josephson junctions, and other quantum structures (ASML).

- Material Purity and Isotopic Engineering: Quantum coherence is highly sensitive to material impurities and isotopic composition. Manufacturers are investing in isotopically purified silicon-28 and ultra-high-purity superconducting materials to minimize decoherence and noise, a trend supported by collaborations between foundries and materials suppliers (GlobalFoundries).

- Process Automation and AI-Driven Yield Optimization: As quantum device fabrication becomes more complex, AI and machine learning are being leveraged to optimize process parameters, predict defects, and enhance yield. This is particularly important for scaling up production while maintaining the stringent quality requirements of quantum hardware (Applied Materials).

These trends underscore the convergence of advanced semiconductor manufacturing with quantum engineering, setting the stage for the commercialization of quantum technologies in the coming years.

Competitive Landscape and Leading Players

The competitive landscape of quantum semiconductor manufacturing in 2025 is characterized by a dynamic interplay between established semiconductor giants, specialized quantum technology firms, and emerging startups. The sector is witnessing rapid innovation, driven by the race to achieve scalable, fault-tolerant quantum computing and to commercialize quantum devices for applications in cryptography, sensing, and advanced computation.

Leading the field are major players such as Intel Corporation and IBM, both of which have made significant investments in quantum semiconductor research and fabrication. Intel’s focus on silicon-based spin qubits leverages its advanced CMOS manufacturing infrastructure, aiming for compatibility with existing semiconductor processes. IBM, meanwhile, continues to push the envelope with superconducting qubit technology, recently unveiling quantum processors with over 100 qubits and outlining a roadmap toward error-corrected quantum systems.

Other notable incumbents include Samsung Electronics and Taiwan Semiconductor Manufacturing Company (TSMC), both exploring quantum device integration within their foundry services. TSMC, in particular, is collaborating with academic and industry partners to develop fabrication techniques for quantum dots and superconducting circuits, leveraging its leadership in advanced process nodes.

Specialized quantum technology firms are also shaping the competitive landscape. Rigetti Computing and D-Wave Quantum Inc. are prominent for their proprietary quantum chip architectures and in-house fabrication capabilities. Rigetti’s hybrid quantum-classical approach and D-Wave’s focus on quantum annealing have attracted significant commercial and government interest, positioning them as key innovators in the sector.

Startups and university spin-offs, such as PsiQuantum and Quantinuum, are leveraging venture capital and strategic partnerships to accelerate the development of photonic and trapped-ion quantum semiconductors. These firms are often at the forefront of novel materials research and device miniaturization, challenging incumbents with disruptive approaches.

Strategic alliances and consortia, such as the European Quantum Industry Consortium (QuIC) and the U.S. National Quantum Initiative, are fostering collaboration across the value chain, from materials science to device fabrication and system integration. This collaborative environment is expected to intensify competition and accelerate commercialization as the market matures through 2025 and beyond.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The quantum semiconductor manufacturing market is poised for significant expansion between 2025 and 2030, driven by accelerating investments in quantum computing, advanced materials, and next-generation chip fabrication technologies. According to projections by International Data Corporation (IDC), the global quantum semiconductor market is expected to achieve a compound annual growth rate (CAGR) of approximately 28% during this period, reflecting both surging demand and rapid technological advancements.

Revenue forecasts indicate that the market, valued at an estimated $1.2 billion in 2025, could surpass $4.1 billion by 2030. This growth is underpinned by increasing adoption of quantum processors in research, cryptography, and high-performance computing, as well as the integration of quantum devices into commercial and defense applications. Gartner highlights that the volume of quantum semiconductor units shipped is projected to grow from fewer than 10,000 units in 2025 to over 60,000 units by 2030, as manufacturing yields improve and new fabrication techniques mature.

- North America is expected to maintain its lead, accounting for over 45% of global revenue by 2030, fueled by robust R&D funding and the presence of key players such as IBM and Intel.

- Asia-Pacific is forecasted to exhibit the fastest CAGR, exceeding 32%, as countries like China, Japan, and South Korea ramp up investments in quantum technology infrastructure and local semiconductor ecosystems (McKinsey & Company).

- Europe is also set for steady growth, supported by EU initiatives and collaborations among research institutions and semiconductor manufacturers (European Commission).

Key growth drivers include advancements in materials such as silicon-germanium and superconducting circuits, the scaling of quantum bit (qubit) architectures, and the emergence of specialized foundries. However, the market’s trajectory will depend on overcoming fabrication challenges, improving device reliability, and establishing scalable manufacturing processes. Overall, the 2025–2030 period is expected to mark a transition from pilot-scale production to early commercialization, setting the stage for broader adoption in the following decade.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The quantum semiconductor manufacturing market is experiencing dynamic growth across key regions, driven by increasing investments in quantum computing, government initiatives, and the presence of leading technology firms. In 2025, regional trends are shaping the competitive landscape and innovation trajectory of this sector.

- North America: North America, particularly the United States, remains at the forefront of quantum semiconductor manufacturing. The region benefits from robust R&D funding, a strong ecosystem of quantum startups, and strategic government support, such as the National Quantum Initiative Act. Major players like IBM, Intel, and Rigetti Computing are advancing fabrication techniques for superconducting and silicon-based qubits. According to IDC, North America is expected to account for over 40% of global quantum semiconductor investments in 2025, driven by both public and private sector demand.

- Europe: Europe is accelerating its quantum ambitions through coordinated initiatives like the Quantum Flagship program, which allocates over €1 billion for quantum technologies. Countries such as Germany, France, and the Netherlands are investing in quantum foundries and collaborative research centers. Companies like Infineon Technologies and SEMI are leading efforts in scalable quantum chip production. The European market is characterized by strong academic-industry partnerships and a focus on photonic and trapped-ion qubit technologies, as highlighted by Statista.

- Asia-Pacific: The Asia-Pacific region, led by China, Japan, and South Korea, is rapidly expanding its quantum semiconductor capabilities. China’s government-backed programs and investments in companies like Origin Quantum are propelling advancements in quantum chip fabrication. Japan’s NTT and South Korea’s Samsung Electronics are also making significant strides. According to Mordor Intelligence, Asia-Pacific is projected to be the fastest-growing region, with a CAGR exceeding 30% through 2025.

- Rest of World: Other regions, including Australia, Israel, and select Middle Eastern countries, are emerging as niche players. Australia’s Silicon Quantum Computing and Israel’s QuantWare are notable for their research-driven approaches and government-backed initiatives. While the Rest of World segment remains smaller in scale, targeted investments and international collaborations are fostering innovation hubs outside the traditional powerhouses.

Overall, regional dynamics in 2025 reflect a competitive and collaborative global landscape, with each region leveraging its unique strengths to advance quantum semiconductor manufacturing.

Future Outlook: Emerging Applications and Investment Opportunities

The future outlook for quantum semiconductor manufacturing in 2025 is marked by accelerating innovation, expanding application domains, and a surge in investment activity. As quantum technologies transition from laboratory research to commercial deployment, the semiconductor manufacturing sector is poised to play a pivotal role in enabling scalable, reliable quantum devices. Key drivers include the demand for quantum computing, quantum communication, and quantum sensing, each requiring specialized semiconductor components such as superconducting qubits, silicon spin qubits, and photonic chips.

Emerging applications are rapidly diversifying. In quantum computing, semiconductor-based qubits are gaining traction due to their compatibility with existing CMOS fabrication processes, which could facilitate mass production and integration with classical electronics. Companies like Intel and IBM are investing heavily in silicon-based quantum processors, aiming to overcome scalability and error correction challenges. In quantum communication, semiconductor photonic chips are being developed to enable ultra-secure data transmission, with firms such as Xanadu and PsiQuantum leading advancements in integrated photonics for quantum networks.

Quantum sensing is another promising frontier, with semiconductor-based sensors offering unprecedented sensitivity for applications in medical imaging, navigation, and materials analysis. The integration of quantum sensors into mobile and industrial devices is expected to open new markets and revenue streams, as highlighted by IDTechEx in their recent market analysis.

Investment opportunities are expanding across the value chain. Venture capital and corporate investments are flowing into startups and established players focused on quantum chip design, fabrication equipment, and materials engineering. According to McKinsey & Company, global private investment in quantum technology surpassed $2.35 billion in 2023, with a significant portion directed toward semiconductor manufacturing capabilities. Governments are also ramping up funding, with initiatives such as the U.S. National Quantum Initiative and the European Quantum Flagship supporting infrastructure and R&D for quantum semiconductor manufacturing.

Looking ahead to 2025, the convergence of advanced semiconductor manufacturing techniques with quantum technology requirements is expected to catalyze breakthroughs in device performance and scalability. Strategic partnerships between foundries, quantum hardware startups, and research institutions will be critical in overcoming technical barriers and accelerating commercialization. As the ecosystem matures, quantum semiconductor manufacturing is set to become a cornerstone of the next wave of technological innovation and investment.

Challenges, Risks, and Strategic Opportunities

Quantum semiconductor manufacturing in 2025 faces a complex landscape of challenges, risks, and strategic opportunities as the industry seeks to transition from laboratory-scale innovation to scalable, commercial production. The primary challenge lies in the extreme sensitivity of quantum devices to environmental noise and defects, which demands ultra-clean fabrication environments and unprecedented precision in material deposition and patterning. Even minor imperfections at the atomic level can significantly degrade qubit coherence times, directly impacting device performance and yield. This necessitates substantial investments in advanced lithography, cryogenic testing, and error-correction integration, driving up both capital and operational expenditures.

Supply chain risks are also pronounced. Quantum semiconductor manufacturing relies on rare materials such as isotopically pure silicon-28, high-purity superconducting metals, and specialized substrates, all of which have limited global suppliers. Geopolitical tensions and export controls further exacerbate the risk of supply disruptions, as seen in recent semiconductor shortages and trade disputes. Companies must therefore develop robust supplier diversification strategies and consider vertical integration to secure critical inputs Semiconductor Industry Association.

Intellectual property (IP) risks are heightened in this nascent field. The race to develop proprietary quantum architectures and manufacturing techniques has led to a surge in patent filings and, consequently, an increase in litigation and cross-licensing negotiations. Firms must balance aggressive R&D with careful IP management to avoid costly legal entanglements and ensure freedom to operate World Intellectual Property Organization.

Despite these challenges, strategic opportunities abound. Governments worldwide are ramping up funding for quantum technology, with initiatives such as the U.S. National Quantum Initiative and the EU’s Quantum Flagship providing billions in research and commercialization support National Quantum Initiative, Quantum Flagship. Early movers can leverage public-private partnerships to offset R&D costs and accelerate time-to-market. Additionally, collaboration with leading academic institutions and quantum software firms can help manufacturers co-develop error mitigation techniques and scalable architectures, positioning them at the forefront of the quantum value chain.

In summary, while quantum semiconductor manufacturing in 2025 is fraught with technical, supply chain, and IP risks, proactive investment in advanced fabrication, strategic partnerships, and government engagement can unlock significant competitive advantages as the quantum era approaches.

Sources & References

- International Data Corporation (IDC)

- IBM

- Toshiba

- ASML

- Rigetti Computing

- D-Wave Quantum Inc.

- Quantinuum

- U.S. National Quantum Initiative

- McKinsey & Company

- European Commission

- Infineon Technologies

- Statista

- Mordor Intelligence

- Silicon Quantum Computing

- QuantWare

- Xanadu

- IDTechEx

- Semiconductor Industry Association

- World Intellectual Property Organization