Quantum Metrology Technologies Market Report 2025: In-Depth Analysis of Growth Drivers, Innovations, and Global Opportunities. Explore Market Size, Leading Players, and Strategic Forecasts for the Next 5 Years.

- Executive Summary & Market Overview

- Key Technology Trends in Quantum Metrology (2025–2030)

- Competitive Landscape and Leading Players

- Market Growth Forecasts and Revenue Projections (2025–2030)

- Regional Analysis: Key Markets and Emerging Regions

- Future Outlook: Innovations and Strategic Roadmaps

- Challenges, Risks, and Emerging Opportunities

- Sources & References

Executive Summary & Market Overview

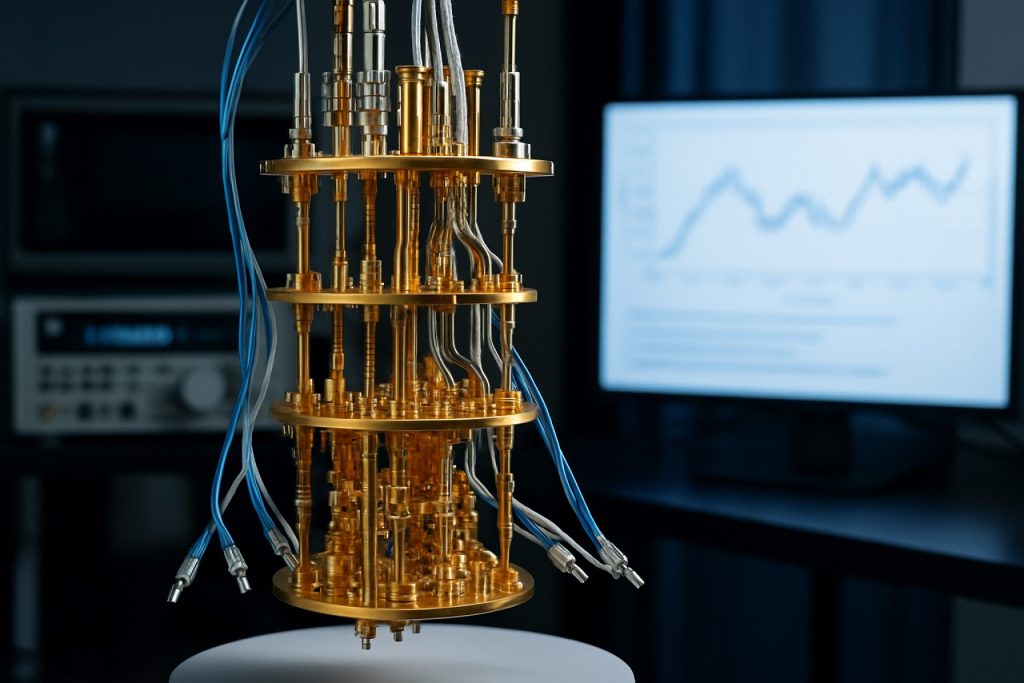

Quantum metrology technologies represent a rapidly advancing field that leverages quantum phenomena—such as superposition, entanglement, and squeezing—to achieve measurement precision beyond classical limits. As of 2025, the global quantum metrology market is experiencing robust growth, driven by increasing demand for ultra-precise measurement tools in sectors such as telecommunications, healthcare, defense, and fundamental science. Quantum metrology underpins critical applications including atomic clocks, quantum gravimeters, quantum-enhanced imaging, and next-generation sensors for navigation and geophysical exploration.

According to IDTechEx, the quantum technologies market—including metrology—was valued at over $500 million in 2023, with projections indicating a compound annual growth rate (CAGR) exceeding 20% through 2030. This expansion is fueled by both public and private investment, with governments in the US, EU, China, and Japan launching national quantum initiatives to accelerate research and commercialization. For instance, the European Union’s Quantum Flagship program has allocated over €1 billion to quantum research, with metrology as a key pillar (European Commission).

The competitive landscape is characterized by a mix of established instrumentation companies and agile quantum startups. Major players such as Thales Group, Lockheed Martin, and National Institute of Standards and Technology (NIST) are investing heavily in quantum-enhanced measurement systems. Meanwhile, startups like Muquans and ColdQuanta are pioneering commercial quantum sensors and gravimeters.

Key market drivers include the miniaturization of quantum devices, advances in photonics and cryogenics, and the integration of quantum sensors into existing industrial and scientific workflows. However, challenges remain, such as the need for robust error correction, environmental isolation, and scalable manufacturing processes. The market is also shaped by evolving standards and regulatory frameworks, as international bodies work to harmonize quantum measurement protocols (Bureau International des Poids et Mesures).

In summary, quantum metrology technologies are poised to transform precision measurement across multiple industries, with 2025 marking a pivotal year for commercialization, standardization, and global market expansion.

Key Technology Trends in Quantum Metrology (2025–2030)

Quantum metrology technologies are poised for significant advancements between 2025 and 2030, driven by breakthroughs in quantum information science, photonics, and materials engineering. These technologies leverage quantum phenomena—such as superposition, entanglement, and squeezing—to achieve measurement precision beyond classical limits. The following key technology trends are expected to shape the quantum metrology landscape in 2025:

- Quantum Sensors and Atomic Clocks: Quantum sensors, particularly those based on cold atoms and trapped ions, are becoming increasingly precise and compact. Next-generation atomic clocks, such as optical lattice clocks, are expected to achieve timing accuracies at the 10-18 level, enabling new standards in timekeeping and navigation. Organizations like the National Institute of Standards and Technology (NIST) and Physikalisch-Technische Bundesanstalt (PTB) are at the forefront of these developments.

- Quantum-Enhanced Imaging and Spectroscopy: Quantum metrology is revolutionizing imaging and spectroscopy through the use of entangled photons and squeezed light. These techniques allow for sub-shot-noise imaging and ultra-sensitive detection of weak signals, with applications in biomedical diagnostics, materials science, and environmental monitoring. Companies such as QNAMI and MagiQ Technologies are commercializing quantum-enhanced imaging solutions.

- Integrated Photonic Quantum Sensors: The integration of quantum sensors onto photonic chips is a major trend, enabling scalable, robust, and cost-effective quantum metrology devices. Silicon photonics platforms are being developed to support on-chip generation, manipulation, and detection of quantum states, as seen in research from Imperial College London and industry initiatives by Paul Scherrer Institute.

- Quantum Gravimeters and Magnetometers: Quantum gravimeters and magnetometers, utilizing atom interferometry and nitrogen-vacancy (NV) centers in diamond, are achieving unprecedented sensitivity for geophysical exploration, mineral prospecting, and security applications. Startups like Muquans and Element Six are advancing commercial deployment of these instruments.

- Standardization and Interoperability: As quantum metrology technologies mature, efforts toward standardization and interoperability are intensifying. International bodies such as the International Bureau of Weights and Measures (BIPM) are working to define quantum-based measurement standards, ensuring global consistency and fostering industry adoption.

These trends indicate that 2025 will mark a pivotal year for quantum metrology technologies, with rapid progress toward practical, scalable, and commercially viable solutions across multiple sectors.

Competitive Landscape and Leading Players

The competitive landscape of the quantum metrology technologies market in 2025 is characterized by a dynamic mix of established technology conglomerates, specialized quantum startups, and research-driven collaborations. The sector is witnessing rapid innovation, with companies vying to commercialize quantum-enhanced measurement solutions for applications in timekeeping, navigation, sensing, and fundamental physics research.

Leading players include IBM, which leverages its quantum computing expertise to develop advanced quantum sensors and metrology platforms. Lockheed Martin and Northrop Grumman are investing in quantum metrology for defense and aerospace, focusing on ultra-precise gyroscopes and gravimeters. In Europe, Thales Group and Bosch are prominent, with significant R&D in quantum sensors for industrial and automotive applications.

Startups are also shaping the competitive landscape. ColdQuanta (now Infleqtion) is a leader in cold atom-based quantum sensors, while Muquans (acquired by iXblue) specializes in quantum gravimeters and atomic clocks. Qnami focuses on quantum diamond-based magnetometry, targeting materials science and biomedical markets. These companies are often supported by government grants and partnerships with academic institutions, accelerating technology transfer and commercialization.

Collaborative initiatives are pivotal. The Quantum Flagship program in the EU and the National Institute of Standards and Technology (NIST) in the US foster public-private partnerships, driving standardization and interoperability. Strategic alliances, such as the partnership between Toshiba and BT Group for quantum-secured communications, also extend into metrology, leveraging shared quantum infrastructure.

Market competition is further intensified by the race to achieve quantum advantage in real-world metrology tasks. Companies differentiate through proprietary quantum hardware, integration with classical systems, and software for data analysis. As quantum metrology moves from laboratory prototypes to deployable solutions, the competitive landscape is expected to consolidate, with mergers, acquisitions, and strategic investments shaping the market’s evolution through 2025 and beyond.

Market Growth Forecasts and Revenue Projections (2025–2030)

The quantum metrology technologies market is poised for robust growth between 2025 and 2030, driven by accelerating investments in quantum research, increasing demand for ultra-precise measurement solutions, and expanding applications across sectors such as telecommunications, healthcare, and defense. According to a 2024 market analysis by International Data Corporation (IDC), the global quantum metrology market is projected to achieve a compound annual growth rate (CAGR) of approximately 18% during the forecast period, with revenues expected to surpass $2.1 billion by 2030, up from an estimated $900 million in 2025.

Key growth drivers include the integration of quantum sensors in next-generation navigation systems, the adoption of quantum-enhanced imaging in medical diagnostics, and the deployment of quantum gravimeters for geophysical exploration. The telecommunications sector is anticipated to be a significant revenue contributor, leveraging quantum metrology for secure data transmission and network synchronization. Gartner highlights that government-backed quantum initiatives in the United States, European Union, and China are catalyzing both public and private sector investments, further accelerating market expansion.

Regionally, North America is expected to maintain its leadership position through 2025, accounting for over 40% of global revenues, fueled by strong R&D ecosystems and the presence of major quantum technology firms. However, Asia-Pacific is forecasted to exhibit the fastest growth rate, with countries like China and Japan ramping up quantum infrastructure spending and fostering industry-academia collaborations. MarketsandMarkets projects that Asia-Pacific’s share of the quantum metrology market could rise from 25% in 2025 to nearly 33% by 2030.

- Quantum sensors and atomic clocks are expected to represent the largest product segments, collectively generating over 60% of total market revenue by 2030.

- Healthcare and life sciences are forecasted to be the fastest-growing end-user segments, with a CAGR exceeding 20% as quantum-enabled imaging and diagnostics gain traction.

- Strategic partnerships and mergers among technology providers, research institutions, and end-users are anticipated to drive innovation and commercialization.

In summary, the quantum metrology technologies market is set for significant expansion from 2025 to 2030, underpinned by technological advancements, cross-sector adoption, and supportive policy frameworks. Stakeholders should anticipate heightened competition and rapid product evolution as the market matures.

Regional Analysis: Key Markets and Emerging Regions

Regional dynamics in the quantum metrology technologies market are shaped by varying levels of investment, research infrastructure, and industrial adoption across key markets and emerging regions. As of 2025, North America, Europe, and Asia-Pacific remain the primary hubs for quantum metrology innovation and commercialization, while regions such as the Middle East, Latin America, and parts of Africa are beginning to establish foundational capabilities.

North America—led by the United States—continues to dominate the quantum metrology landscape, driven by robust federal funding, a strong ecosystem of quantum startups, and collaborations between academia and industry. The National Institute of Standards and Technology (NIST) and leading universities are at the forefront of developing quantum-enhanced measurement standards, with significant investments in quantum sensors for defense, navigation, and advanced manufacturing. The presence of major technology companies and defense contractors further accelerates commercialization and deployment.

Europe is characterized by coordinated public-private initiatives, such as the Quantum Flagship program, which fosters cross-border collaboration and funds research in quantum metrology. Germany, the UK, and France are particularly active, with national metrology institutes like PTB and NPL spearheading advancements in quantum clocks, gravimeters, and magnetometers. The European Union’s regulatory emphasis on precision and traceability in industrial processes further drives adoption.

Asia-Pacific is rapidly closing the gap, with China and Japan making substantial investments in quantum research infrastructure. China’s Chinese Academy of Sciences (CAS) and Japan’s RIKEN institute are leading efforts in quantum-enhanced timekeeping and navigation systems, with government-backed programs supporting commercialization. South Korea and Singapore are also emerging as innovation centers, leveraging strong semiconductor and electronics sectors.

Emerging regions such as the Middle East and Latin America are in the early stages of quantum metrology adoption. The King Abdulaziz City for Science and Technology (KACST) in Saudi Arabia and Brazil’s INMETRO are initiating pilot projects and international collaborations to build local expertise. These regions are expected to benefit from technology transfer and capacity-building initiatives over the next five years.

Overall, while established markets continue to lead in R&D and early adoption, emerging regions are poised for growth as global partnerships and knowledge transfer accelerate the diffusion of quantum metrology technologies worldwide.

Future Outlook: Innovations and Strategic Roadmaps

The future outlook for quantum metrology technologies in 2025 is shaped by rapid innovation, increased investment, and the strategic alignment of public and private sector roadmaps. As quantum technologies mature, metrology—the science of measurement—stands at the forefront of applications that promise to redefine precision across industries such as telecommunications, defense, healthcare, and advanced manufacturing.

Key innovations expected in 2025 include the deployment of quantum-enhanced sensors and measurement devices that leverage quantum entanglement and superposition to achieve sensitivities unattainable by classical means. For instance, quantum gravimeters and magnetometers are anticipated to see broader commercial adoption, enabling breakthroughs in geophysical exploration and medical diagnostics. The integration of quantum clocks into navigation and timing systems is also projected to enhance the accuracy of global positioning and synchronization networks, with organizations like the National Institute of Standards and Technology (NIST) and Physikalisch-Technische Bundesanstalt (PTB) leading research and standardization efforts.

- Strategic Roadmaps: National and regional quantum strategies are increasingly emphasizing metrology as a foundational pillar. The European Quantum Communication Infrastructure (EuroQCI) initiative, for example, includes quantum metrology as a core component to ensure secure and precise data transmission. Similarly, the U.S. National Quantum Initiative is funding collaborative projects between academia, government labs, and industry to accelerate the commercialization of quantum measurement technologies.

- Industry Partnerships: Leading technology firms such as IBM and Thales Group are investing in quantum metrology R&D, often in partnership with startups and research institutions. These collaborations are expected to yield new product lines and services, particularly in quantum sensing and secure communications.

- Standardization and Interoperability: As quantum metrology devices move toward commercialization, standardization bodies like the International Organization for Standardization (ISO) are working to develop protocols that ensure interoperability and reliability across global markets.

Looking ahead, the convergence of quantum metrology with artificial intelligence and advanced data analytics is poised to unlock new capabilities in real-time monitoring and predictive maintenance. By 2025, the sector is expected to transition from proof-of-concept demonstrations to scalable, market-ready solutions, underpinned by robust strategic roadmaps and a dynamic innovation ecosystem.

Challenges, Risks, and Emerging Opportunities

Quantum metrology technologies, which leverage quantum phenomena such as entanglement and superposition to achieve unprecedented measurement precision, are poised for significant growth in 2025. However, the sector faces a complex landscape of challenges and risks, even as new opportunities emerge.

One of the primary challenges is the technical complexity inherent in quantum systems. Maintaining quantum coherence and minimizing environmental noise are critical for accurate measurements, yet these remain difficult to achieve outside controlled laboratory settings. This limits the scalability and commercial deployment of quantum metrology devices. Additionally, the need for cryogenic environments and ultra-stable lasers increases both the cost and operational complexity, posing barriers for widespread adoption in industries such as healthcare, aerospace, and telecommunications (Nature Physics).

Another significant risk is the lack of standardized protocols and interoperability. As various organizations and countries develop proprietary quantum metrology solutions, the absence of common standards could hinder integration and global market growth. Intellectual property disputes and regulatory uncertainties further complicate the landscape, potentially slowing innovation and commercialization (OECD).

Cybersecurity is an emerging concern, as quantum sensors and measurement devices could become targets for sophisticated attacks. Ensuring the integrity and confidentiality of quantum-generated data is crucial, especially in defense and critical infrastructure applications (National Institute of Standards and Technology).

Despite these challenges, several opportunities are emerging. Advances in integrated photonics and solid-state quantum systems are reducing the size, cost, and complexity of quantum metrology devices, making them more accessible for commercial use. The growing demand for ultra-precise timing, navigation, and sensing in sectors such as autonomous vehicles, financial services, and environmental monitoring is driving investment and innovation (IDTechEx).

- Collaborative initiatives between academia, industry, and government are accelerating the development of standards and best practices.

- Public and private funding is increasing, with major economies prioritizing quantum technologies in their innovation agendas.

- Emerging markets in Asia-Pacific and Europe are fostering regional hubs for quantum research and commercialization.

In summary, while quantum metrology technologies in 2025 face notable technical, regulatory, and security challenges, the sector is also characterized by robust investment, cross-sector collaboration, and expanding application opportunities.

Sources & References

- IDTechEx

- European Commission

- Lockheed Martin

- National Institute of Standards and Technology (NIST)

- Bureau International des Poids et Mesures

- Physikalisch-Technische Bundesanstalt (PTB)

- QNAMI

- MagiQ Technologies

- Imperial College London

- Paul Scherrer Institute

- IBM

- Northrop Grumman

- Bosch

- Quantum Flagship

- Toshiba

- BT Group

- International Data Corporation (IDC)

- MarketsandMarkets

- NPL

- Chinese Academy of Sciences (CAS)

- RIKEN

- International Organization for Standardization (ISO)

- Nature Physics