Polymer Electrolyte Fuel Cell Membrane Development in 2025: Unveiling the Next Wave of High-Performance, Sustainable Energy Solutions. Explore How Advanced Materials and Market Forces Are Shaping the Future of Clean Power.

- Executive Summary & Key Findings

- Market Overview: Size, Segmentation, and 2025–2030 Growth Projections

- Technology Landscape: Innovations in Polymer Electrolyte Membranes

- Competitive Analysis: Leading Players and Emerging Innovators

- Drivers & Challenges: Regulatory, Environmental, and Economic Factors

- Application Trends: Automotive, Stationary Power, and Portable Devices

- Regional Insights: North America, Europe, Asia-Pacific, and Rest of World

- Market Forecast: 2025–2030 CAGR, Revenue, and Volume Analysis (18% CAGR Expected)

- Future Outlook: Next-Gen Materials, Manufacturing, and Commercialization Pathways

- Strategic Recommendations for Stakeholders

- Sources & References

Executive Summary & Key Findings

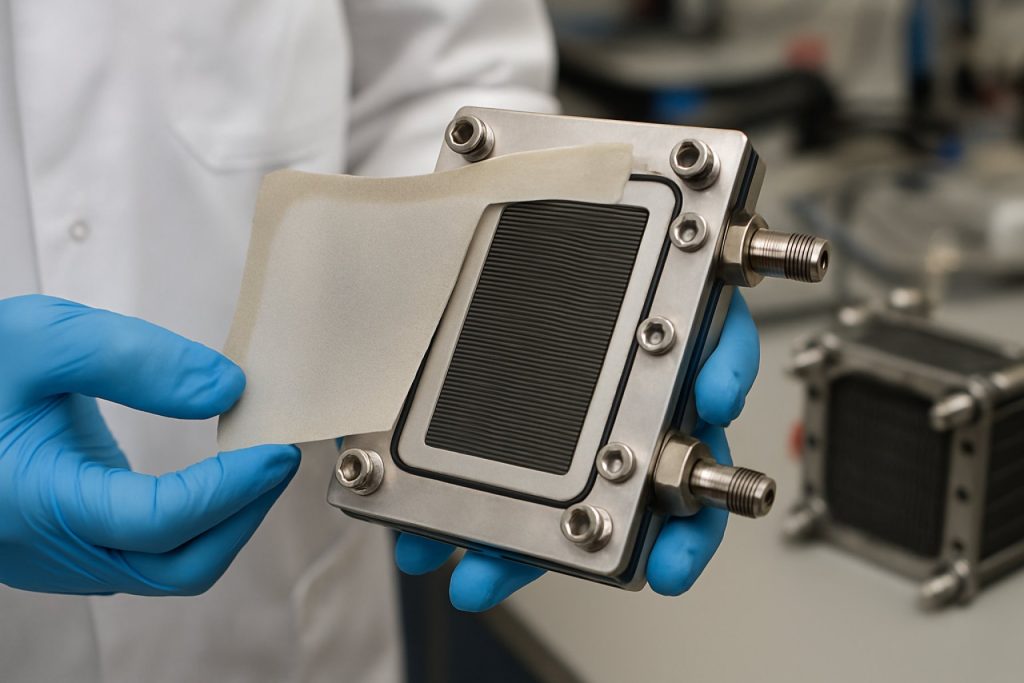

Polymer electrolyte fuel cells (PEFCs), also known as proton exchange membrane fuel cells (PEMFCs), are a cornerstone technology in the transition to clean energy, offering high efficiency and low emissions for applications ranging from automotive to stationary power. The membrane, a critical component, governs ion conductivity, durability, and overall cell performance. In 2025, research and development in PEFC membranes is accelerating, driven by the need for higher power density, lower costs, and improved operational lifetimes.

Key findings in 2025 highlight significant advancements in both material science and manufacturing processes. Leading organizations such as 3M Company, W. L. Gore & Associates, Inc., and Dow Inc. have introduced next-generation membranes with enhanced proton conductivity and mechanical stability. These innovations are largely attributed to the incorporation of advanced fluoropolymers, composite structures, and novel reinforcement techniques, which collectively address the traditional trade-off between conductivity and durability.

A major trend is the shift toward membranes that operate efficiently at higher temperatures (above 100°C), which improves tolerance to impurities such as carbon monoxide and enables simplified system designs. Research from National Renewable Energy Laboratory (NREL) and Fuel Cell Store demonstrates that sulfonated aromatic polymers and composite membranes with inorganic fillers are showing promise in this area, offering both thermal and chemical stability.

Cost reduction remains a central focus, with manufacturers like Toray Industries, Inc. and DuPont developing scalable production methods and exploring alternative, non-fluorinated polymers. These efforts are supported by global initiatives and funding from organizations such as the U.S. Department of Energy Hydrogen and Fuel Cell Technologies Office, which prioritize the commercialization of affordable, high-performance membranes.

In summary, 2025 marks a pivotal year for PEFC membrane development, characterized by breakthroughs in material innovation, operational flexibility, and cost-effectiveness. These advances are expected to accelerate the adoption of fuel cell technologies across multiple sectors, supporting global decarbonization goals and the growth of the hydrogen economy.

Market Overview: Size, Segmentation, and 2025–2030 Growth Projections

The global market for polymer electrolyte fuel cell (PEFC) membranes is poised for significant growth between 2025 and 2030, driven by increasing demand for clean energy solutions in transportation, stationary power, and portable applications. PEFC membranes, also known as proton exchange membranes (PEMs), are critical components in fuel cells, enabling efficient proton conduction while acting as a barrier to gases. The market is segmented by membrane material (perfluorosulfonic acid, hydrocarbon-based, composite, and others), application (automotive, stationary, portable), and region (North America, Europe, Asia-Pacific, and Rest of World).

In 2025, the PEFC membrane market is expected to reach a value of approximately USD 1.2 billion, with the automotive sector accounting for the largest share due to the accelerating adoption of fuel cell electric vehicles (FCEVs) by major automakers such as Toyota Motor Corporation and Hyundai Motor Company. Stationary power applications, including backup power and distributed generation, are also contributing to market expansion, supported by initiatives from organizations like Ballard Power Systems and Plug Power Inc..

Material innovation remains a key driver, with leading suppliers such as The Chemours Company and W. L. Gore & Associates, Inc. investing in next-generation membranes that offer improved durability, higher proton conductivity, and lower cost. The Asia-Pacific region, led by Japan, South Korea, and China, is projected to witness the fastest growth, fueled by government policies supporting hydrogen infrastructure and local manufacturing.

From 2025 to 2030, the market is forecast to grow at a compound annual growth rate (CAGR) of 12–15%, potentially surpassing USD 2.5 billion by 2030. This growth will be underpinned by continued advancements in membrane technology, cost reductions through scale, and expanding end-use applications. Strategic collaborations between automakers, material suppliers, and research institutions—such as those fostered by the California Fuel Cell Partnership—are expected to accelerate commercialization and adoption of advanced PEFC membranes worldwide.

Technology Landscape: Innovations in Polymer Electrolyte Membranes

The technology landscape for polymer electrolyte fuel cell (PEFC) membranes in 2025 is marked by rapid innovation, driven by the demand for higher performance, durability, and cost-effectiveness in fuel cell applications. Central to these advancements is the ongoing evolution of polymer electrolyte membranes (PEMs), which serve as the critical ion-conducting layer in PEFCs, enabling proton transport while acting as a barrier to gases.

Recent years have seen significant progress in the development of advanced PEM materials. Traditional perfluorosulfonic acid (PFSA) membranes, such as those pioneered by Chemours Company (Nafion™), remain industry benchmarks due to their high proton conductivity and chemical stability. However, their performance at elevated temperatures and under low humidity conditions is limited, prompting research into alternative materials.

Innovations in hydrocarbon-based membranes, including sulfonated poly(ether ether ketone) (SPEEK) and polybenzimidazole (PBI) derivatives, are gaining traction. These materials offer improved thermal stability and mechanical strength, making them suitable for high-temperature fuel cell operation. Companies like Toray Industries, Inc. are actively developing and commercializing such next-generation membranes.

Composite and hybrid membranes represent another frontier. By incorporating inorganic fillers—such as silica, zirconia, or graphene oxide—into polymer matrices, researchers are enhancing membrane durability, water retention, and proton conductivity. This approach addresses the degradation issues associated with pure polymer membranes, especially under harsh operating conditions.

Additionally, the push for sustainability is influencing membrane development. Bio-based polymers and recyclable membrane materials are being explored to reduce environmental impact and align with global decarbonization goals. Organizations like Fuel Cell Standards are working to establish guidelines for the performance and safety of these emerging materials.

Looking ahead, the integration of advanced PEMs into commercial fuel cell stacks is expected to accelerate, supported by collaborative efforts between industry leaders, research institutions, and government agencies. The focus remains on achieving membranes that combine high conductivity, chemical and mechanical robustness, and cost efficiency, paving the way for broader adoption of fuel cell technologies in transportation, stationary power, and portable applications.

Competitive Analysis: Leading Players and Emerging Innovators

The landscape of polymer electrolyte fuel cell (PEFC) membrane development in 2025 is shaped by a dynamic interplay between established industry leaders and a new wave of innovative startups. The market is primarily driven by the demand for high-performance, durable, and cost-effective membranes, which are critical for the efficiency and commercial viability of fuel cell technologies in automotive, stationary, and portable applications.

Among the leading players, 3M Company and DuPont continue to dominate with their advanced perfluorosulfonic acid (PFSA) membranes, such as 3M’s ion exchange membranes and DuPont’s Nafion™. These companies leverage decades of expertise in fluoropolymer chemistry, large-scale manufacturing, and global distribution networks. Their products are widely adopted in commercial fuel cell stacks due to proven reliability and performance under a range of operating conditions.

Japanese firms, notably Toray Industries, Inc. and Asahi Kasei Corporation, have made significant strides in developing hydrocarbon-based membranes, which offer potential cost and environmental advantages over traditional PFSA materials. These companies invest heavily in R&D to improve membrane conductivity, mechanical strength, and chemical stability, aiming to meet the stringent requirements of automotive OEMs and energy providers.

Emerging innovators are reshaping the competitive landscape by focusing on next-generation materials and manufacturing techniques. Startups and university spin-offs are exploring composite membranes, incorporating inorganic fillers or nanomaterials to enhance proton conductivity and durability. For example, Ballard Power Systems Inc. is actively collaborating with research institutions to commercialize advanced membrane electrode assemblies (MEAs) that integrate novel membrane chemistries.

Collaborative efforts are also evident in public-private partnerships and consortia, such as those coordinated by the U.S. Department of Energy Hydrogen and Fuel Cell Technologies Office and the Fuel Cells and Hydrogen Joint Undertaking in Europe. These initiatives accelerate innovation by funding research, standardizing testing protocols, and facilitating knowledge exchange between academia and industry.

In summary, the competitive environment for PEFC membrane development in 2025 is characterized by the continued leadership of established chemical giants, the rapid progress of Asian manufacturers, and the disruptive potential of emerging innovators. Strategic collaborations and sustained investment in R&D remain essential for maintaining technological leadership and meeting the evolving demands of the global fuel cell market.

Drivers & Challenges: Regulatory, Environmental, and Economic Factors

The development of polymer electrolyte fuel cell (PEFC) membranes is shaped by a complex interplay of regulatory, environmental, and economic drivers and challenges. Regulatory frameworks, particularly those targeting emissions reduction and clean energy adoption, are significant motivators. Governments in regions such as the European Union and Japan have set ambitious targets for hydrogen and fuel cell deployment, directly influencing research priorities and commercialization efforts. For example, the European Commission has established the European Hydrogen Strategy, which includes support for fuel cell technologies, while Japan’s Ministry of Economy, Trade and Industry (METI) continues to promote the widespread adoption of fuel cell vehicles and stationary systems.

Environmental considerations are central to PEFC membrane development. The push for decarbonization and the reduction of greenhouse gas emissions has increased demand for fuel cells as a clean energy solution. However, the environmental impact of membrane materials themselves is under scrutiny. Traditional perfluorosulfonic acid (PFSA) membranes, such as those produced by The Chemours Company and 3M, are durable and efficient but raise concerns due to the persistence of perfluorinated compounds in the environment. This has spurred research into alternative, more sustainable membrane chemistries, including hydrocarbon-based and composite membranes, to align with evolving environmental standards and public expectations.

Economically, the cost of membrane materials remains a major barrier to widespread PEFC adoption. High-performance membranes are expensive to produce, and their cost contributes significantly to the overall price of fuel cell systems. Companies such as W. L. Gore & Associates, Inc. and Toray Industries, Inc. are investing in manufacturing innovations and material optimization to reduce costs while maintaining or improving performance. Additionally, the scaling up of production and the development of recycling or end-of-life management strategies are seen as essential to achieving cost competitiveness with incumbent technologies.

In summary, the trajectory of PEFC membrane development in 2025 is being shaped by tightening regulations, heightened environmental scrutiny, and the ongoing need to reduce costs. Success in this field will depend on the ability of manufacturers and researchers to innovate in response to these multifaceted drivers and challenges, ensuring that new membrane technologies are not only high-performing but also sustainable and economically viable.

Application Trends: Automotive, Stationary Power, and Portable Devices

Polymer electrolyte fuel cell (PEFC) membranes are at the forefront of clean energy innovation, with their development directly influencing the adoption of fuel cells across diverse sectors. In 2025, application trends for these membranes are shaped by the evolving requirements of automotive propulsion, stationary power generation, and portable electronic devices.

In the automotive sector, the push for zero-emission vehicles has intensified the demand for PEFC membranes that offer high proton conductivity, durability, and resistance to contaminants. Leading automakers and suppliers, such as Toyota Motor Corporation and Honda Motor Co., Ltd., are investing in advanced membrane materials to improve cold-start performance and extend operational lifetimes. The focus is on reducing membrane thickness and enhancing mechanical strength, which allows for higher power densities and more compact fuel cell stacks—key for commercial vehicle integration.

For stationary power applications, such as backup power systems and distributed energy resources, the emphasis is on long-term stability and cost-effectiveness. Utilities and energy companies, including Siemens Energy AG and Ballard Power Systems Inc., are exploring membranes that can operate efficiently at higher temperatures and lower humidity. This enables simplified system designs and reduces the need for complex humidification subsystems, making stationary PEFCs more attractive for grid support and remote installations.

In the realm of portable devices, such as laptops, drones, and emergency power units, PEFC membrane development is driven by the need for lightweight, flexible, and miniaturized solutions. Companies like Intelligent Energy Limited are pioneering compact fuel cell systems that leverage thin, robust membranes to deliver reliable power in off-grid or mobile scenarios. The trend is toward integrating membranes with novel electrode architectures and hybrid energy storage, enhancing both energy density and operational flexibility.

Across all these applications, the 2025 landscape is marked by a convergence of performance, durability, and manufacturability. Collaborative efforts between material suppliers, automotive OEMs, and energy companies are accelerating the commercialization of next-generation PEFC membranes, supporting the global transition to sustainable energy systems.

Regional Insights: North America, Europe, Asia-Pacific, and Rest of World

The development of polymer electrolyte fuel cell (PEFC) membranes is experiencing significant regional variation, driven by differing policy priorities, industrial capabilities, and market demands across North America, Europe, Asia-Pacific, and the Rest of the World. In U.S. Department of Energy and Natural Resources Canada have prioritized hydrogen and fuel cell technologies as part of their clean energy transition strategies, resulting in robust funding for research and demonstration projects. North American companies and research institutions are focusing on improving membrane durability and reducing platinum group metal content to lower costs and enhance commercial viability.

Europe, led by initiatives from the European Commission and organizations such as Clean Hydrogen Partnership, is emphasizing the integration of PEFCs into transportation and stationary power sectors. European research is notable for its focus on sustainability, including the development of membranes from renewable or recyclable materials and the implementation of strict environmental standards. Collaborative projects between industry and academia are common, aiming to accelerate the commercialization of next-generation membranes.

The Asia-Pacific region, particularly Japan, South Korea, and China, is at the forefront of large-scale deployment and manufacturing of PEFC systems. Companies like Toyota Motor Corporation and Hanwha Group are investing heavily in membrane innovation to support the rollout of fuel cell vehicles and backup power solutions. Government support, such as Japan’s “hydrogen society” roadmap and China’s fuel cell vehicle subsidies, is fostering rapid advancements in membrane performance, cost reduction, and mass production capabilities.

In the Rest of the World, including regions such as the Middle East and Latin America, PEFC membrane development is emerging, often through partnerships with established players in other regions. These areas are exploring fuel cell applications for distributed energy and off-grid solutions, leveraging local resources and addressing unique energy challenges.

Overall, while the pace and focus of PEFC membrane development vary by region, global collaboration and knowledge exchange are accelerating innovation. The interplay between government policy, industrial investment, and academic research is shaping a dynamic landscape for the advancement of polymer electrolyte fuel cell membranes worldwide.

Market Forecast: 2025–2030 CAGR, Revenue, and Volume Analysis (18% CAGR Expected)

The global market for polymer electrolyte fuel cell (PEFC) membranes is poised for robust expansion between 2025 and 2030, with an anticipated compound annual growth rate (CAGR) of approximately 18%. This surge is driven by accelerating adoption of fuel cell technologies in transportation, stationary power, and portable applications, as governments and industries intensify efforts to decarbonize energy systems. The market’s revenue is projected to reach several billion USD by 2030, with volume shipments of membranes scaling rapidly to meet demand from automotive and industrial sectors.

Key factors underpinning this growth include ongoing advancements in membrane durability, conductivity, and cost-effectiveness, which are critical for the commercial viability of fuel cell vehicles and backup power systems. Major automotive manufacturers, such as Toyota Motor Corporation and Hyundai Motor Company, are expanding their fuel cell vehicle portfolios, directly increasing demand for high-performance PEFC membranes. Additionally, government initiatives in regions like Europe, North America, and Asia-Pacific—such as the European Union’s Hydrogen Strategy and Japan’s Green Growth Strategy—are fostering large-scale deployment of hydrogen infrastructure and fuel cell systems, further propelling market growth.

From a revenue perspective, the market is expected to see a shift from research-driven, low-volume sales to high-volume, cost-competitive supply as membrane manufacturers scale up production. Leading suppliers, including The Chemours Company and W. L. Gore & Associates, Inc., are investing in new manufacturing lines and process innovations to meet the anticipated surge in demand. Volume analysis indicates that the transportation sector—particularly commercial vehicles, buses, and passenger cars—will account for the largest share of membrane consumption, followed by stationary and portable power applications.

Looking ahead, the market’s trajectory will be shaped by continued R&D in next-generation membrane materials, such as hydrocarbon-based and composite membranes, which promise improved performance and lower costs. Strategic collaborations between automakers, material suppliers, and research institutions are expected to accelerate commercialization timelines and expand the addressable market. As a result, the 2025–2030 period is set to be a transformative phase for the polymer electrolyte fuel cell membrane industry, marked by rapid revenue and volume growth at an estimated 18% CAGR.

Future Outlook: Next-Gen Materials, Manufacturing, and Commercialization Pathways

The future of polymer electrolyte fuel cell (PEFC) membrane development is poised for significant transformation, driven by advances in materials science, manufacturing technologies, and evolving commercialization strategies. As the demand for clean energy solutions intensifies, next-generation membranes are being engineered to address the critical challenges of durability, proton conductivity, and cost-effectiveness.

Material innovation remains at the forefront, with research focusing on alternatives to traditional perfluorosulfonic acid (PFSA) membranes. New classes of hydrocarbon-based polymers, composite membranes incorporating inorganic fillers, and reinforced structures are under development to enhance chemical and mechanical stability, especially under high-temperature and low-humidity conditions. For instance, organizations like 3M Company and W. L. Gore & Associates, Inc. are actively exploring advanced ionomer chemistries and composite architectures to extend membrane lifetimes and reduce reliance on expensive fluorinated materials.

On the manufacturing front, scalable and cost-efficient processes are being prioritized. Roll-to-roll fabrication, precision coating, and automated quality control systems are enabling higher throughput and consistency in membrane production. These advancements are critical for meeting the volume demands of automotive and stationary fuel cell markets. Industry leaders such as Toray Industries, Inc. and Toyochem Co., Ltd. are investing in process optimization to lower production costs while maintaining stringent performance standards.

Commercialization pathways are also evolving, with strategic partnerships between membrane developers, fuel cell stack manufacturers, and end-users accelerating market entry. Governmental support and international collaborations, such as those fostered by the U.S. Department of Energy Hydrogen and Fuel Cell Technologies Office and the Fuel Cells and Hydrogen Joint Undertaking, are catalyzing pilot projects and early deployments. These initiatives are expected to drive down costs through economies of scale and facilitate the integration of next-gen membranes into commercial fuel cell systems.

Looking ahead to 2025 and beyond, the convergence of advanced materials, innovative manufacturing, and robust commercialization strategies is set to accelerate the adoption of high-performance PEFC membranes. This progress will be instrumental in realizing the widespread deployment of fuel cell technologies across transportation, industrial, and grid applications.

Strategic Recommendations for Stakeholders

The advancement of polymer electrolyte fuel cell (PEFC) membrane technology is pivotal for the broader adoption of fuel cells in transportation, stationary power, and portable applications. Stakeholders—including manufacturers, research institutions, policymakers, and end-users—should consider the following strategic recommendations to accelerate innovation and commercialization in this field.

- Prioritize Research on Durability and Performance: Stakeholders should invest in the development of membranes with enhanced chemical and mechanical stability, particularly under high-temperature and low-humidity conditions. Collaborations with leading research centers, such as the National Renewable Energy Laboratory, can facilitate access to advanced testing protocols and material characterization tools.

- Foster Industry-Academia Partnerships: Joint ventures and consortia between industry leaders and academic institutions can accelerate the translation of laboratory breakthroughs into scalable manufacturing processes. Entities like 3M and W. L. Gore & Associates, Inc. have demonstrated the value of such collaborations in developing next-generation membrane materials.

- Standardize Testing and Certification: Establishing uniform testing standards and certification processes, in collaboration with organizations such as the SAE International, will ensure that new membrane materials meet industry requirements for safety, reliability, and performance, thereby reducing barriers to market entry.

- Support Supply Chain Development: Stakeholders should work with suppliers to secure reliable sources of high-purity raw materials and critical components. Engaging with global suppliers like DuPont can help mitigate risks associated with material shortages and quality inconsistencies.

- Encourage Policy and Funding Support: Policymakers should provide targeted funding, tax incentives, and regulatory support to stimulate R&D and early-stage commercialization. Programs administered by agencies such as the U.S. Department of Energy have been instrumental in advancing fuel cell technologies.

- Promote Sustainability and Recycling: Integrating life-cycle assessment and end-of-life recycling strategies into membrane development will address environmental concerns and align with global sustainability goals, as advocated by organizations like the United Nations Environment Programme.

By implementing these strategic recommendations, stakeholders can collectively drive the development and deployment of advanced PEFC membranes, supporting the transition to a low-carbon energy future.

Sources & References

- W. L. Gore & Associates, Inc.

- National Renewable Energy Laboratory (NREL)

- Fuel Cell Store

- DuPont

- Toyota Motor Corporation

- Hyundai Motor Company

- Ballard Power Systems

- Asahi Kasei Corporation

- European Commission

- Toyota Motor Corporation

- Siemens Energy AG

- Intelligent Energy Limited

- Natural Resources Canada

- United Nations Environment Programme