Polymethylmethacrylate (PMMA) Microfluidics Fabrication in 2025: Unveiling Market Acceleration and Technological Breakthroughs. Explore How PMMA is Shaping the Future of Microfluidic Devices.

- Executive Summary & Key Findings

- Market Overview: PMMA Microfluidics Fabrication in 2025

- Growth Drivers and Restraints

- Market Size, Segmentation & 2025–2030 Forecast (CAGR: 12.8%)

- Emerging Technologies and Innovations in PMMA Microfluidics

- Competitive Landscape: Key Players & Strategic Initiatives

- Applications: Healthcare, Diagnostics, Research, and Beyond

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Supply Chain, Manufacturing Trends, and Cost Analysis

- Regulatory Environment and Standards

- Future Outlook: Opportunities, Challenges, and Disruptive Trends

- Conclusion & Strategic Recommendations

- Sources & References

Executive Summary & Key Findings

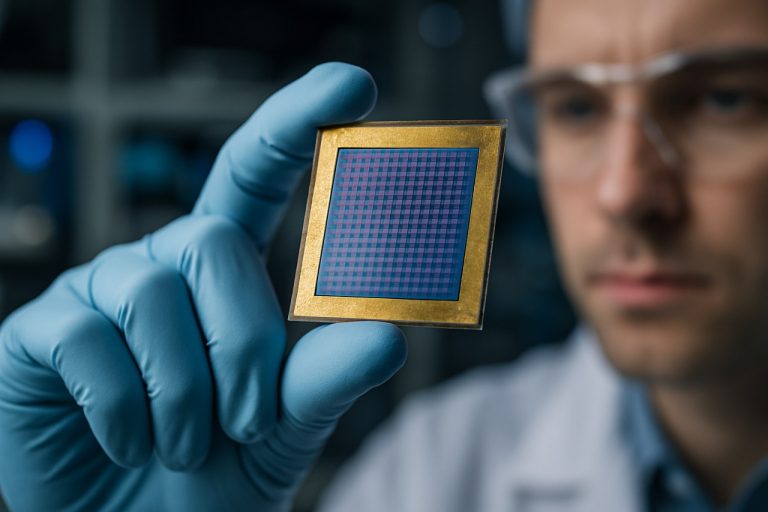

Polymethylmethacrylate (PMMA) microfluidics fabrication has emerged as a pivotal technology in the development of lab-on-a-chip devices, biomedical diagnostics, and chemical analysis systems. PMMA, a transparent thermoplastic, is favored for its optical clarity, biocompatibility, and ease of processing compared to traditional materials like glass and silicon. In 2025, the field continues to advance, driven by innovations in fabrication techniques, material modifications, and integration with emerging technologies.

Key findings in 2025 highlight the growing adoption of PMMA in both research and commercial microfluidic applications. The material’s compatibility with rapid prototyping methods—such as laser ablation, hot embossing, and injection molding—has significantly reduced development time and costs. Notably, EV Group and microfluidic ChipShop GmbH have expanded their offerings of PMMA-based microfluidic platforms, supporting a broader range of applications from point-of-care diagnostics to environmental monitoring.

Recent advancements include the refinement of surface modification techniques to enhance PMMA’s hydrophilicity and chemical resistance, addressing previous limitations in fluid handling and reagent compatibility. Collaborative efforts between industry and academia have led to the development of hybrid devices, combining PMMA with other polymers or functional coatings to improve device performance and durability. For example, Dolomite Microfluidics has introduced new surface treatment protocols that extend the operational lifespan of PMMA chips in demanding analytical workflows.

Sustainability and scalability are also key trends. Manufacturers are increasingly focusing on recyclable PMMA grades and greener fabrication processes, aligning with global sustainability goals. The scalability of PMMA microfluidics production, particularly through injection molding, has enabled cost-effective mass manufacturing, making disposable diagnostic devices more accessible in resource-limited settings.

In summary, PMMA microfluidics fabrication in 2025 is characterized by enhanced material properties, streamlined manufacturing, and expanded application domains. The ongoing collaboration between material suppliers, device manufacturers, and end-users is expected to further accelerate innovation, positioning PMMA as a cornerstone material in the next generation of microfluidic technologies.

Market Overview: PMMA Microfluidics Fabrication in 2025

The market for Polymethylmethacrylate (PMMA) microfluidics fabrication is poised for significant growth in 2025, driven by the expanding adoption of microfluidic technologies across healthcare, diagnostics, and life sciences. PMMA, known for its optical clarity, biocompatibility, and ease of fabrication, has become a preferred substrate for microfluidic device manufacturing. The material’s compatibility with rapid prototyping techniques, such as CNC micromilling, hot embossing, and injection molding, enables scalable production and cost-effective device development.

Key industry players, including ZEON CORPORATION and Ensinger GmbH, continue to innovate in PMMA material formulations, offering grades tailored for microfluidic applications with enhanced chemical resistance and improved surface properties. The demand for point-of-care diagnostic devices, lab-on-a-chip systems, and organ-on-chip platforms is fueling investments in PMMA-based microfluidics, particularly in regions with robust biomedical research and healthcare infrastructure.

In 2025, the Asia-Pacific region is expected to witness the fastest market expansion, supported by government initiatives in biotechnology and the presence of leading contract manufacturers such as microfluidic ChipShop GmbH. North America and Europe remain strongholds for innovation, with academic and industrial collaborations accelerating the translation of PMMA microfluidic prototypes into commercial products.

Sustainability and regulatory compliance are increasingly influencing material selection and fabrication processes. PMMA’s recyclability and established safety profile make it attractive for single-use diagnostic devices, aligning with evolving environmental and health standards set by organizations like the International Organization for Standardization (ISO). Additionally, advancements in surface modification and bonding techniques are addressing challenges related to fluidic sealing and biomolecule adsorption, further broadening PMMA’s applicability in complex microfluidic architectures.

Overall, the PMMA microfluidics fabrication market in 2025 is characterized by technological innovation, expanding end-use applications, and a dynamic global supply chain. As research and commercial demand converge, PMMA is set to maintain its pivotal role in the evolution of microfluidic device manufacturing.

Growth Drivers and Restraints

The market for polymethylmethacrylate (PMMA) microfluidics fabrication is shaped by a combination of growth drivers and restraints that influence its adoption and technological evolution. One of the primary growth drivers is the increasing demand for point-of-care diagnostics and lab-on-a-chip devices, which require precise, cost-effective, and scalable fabrication methods. PMMA’s optical clarity, biocompatibility, and ease of machining make it a preferred substrate for microfluidic devices used in medical diagnostics, environmental monitoring, and chemical analysis. The material’s compatibility with various fabrication techniques, such as hot embossing, injection molding, and laser ablation, further supports its widespread use in both prototyping and mass production settings.

Another significant driver is the ongoing miniaturization trend in life sciences and analytical instrumentation. As research and industry seek to reduce sample volumes and reagent consumption, PMMA-based microfluidic platforms offer a viable solution due to their low cost and adaptability. Additionally, the growing investments in healthcare infrastructure and personalized medicine, particularly in emerging economies, are expanding the application scope for PMMA microfluidics. Support from academic and industrial collaborations, as well as funding from organizations such as the National Institutes of Health, further accelerates research and commercialization efforts.

However, several restraints temper the growth of PMMA microfluidics fabrication. One notable challenge is the material’s limited chemical resistance compared to alternatives like cyclic olefin copolymer (COC) or polydimethylsiloxane (PDMS), which can restrict its use with certain solvents and reagents. Additionally, PMMA is prone to surface fouling and can exhibit autofluorescence, potentially interfering with sensitive optical detection methods. The fabrication process itself, while versatile, may require specialized equipment and expertise, posing barriers for smaller laboratories or startups.

Environmental concerns related to the recyclability and disposal of PMMA-based devices are also gaining attention, prompting manufacturers such as Evonik Industries AG and Arkema S.A. to explore more sustainable production methods and materials. Regulatory compliance and the need for rigorous quality assurance in medical and analytical applications further add to the complexity and cost of PMMA microfluidics fabrication.

In summary, while the PMMA microfluidics fabrication market is poised for growth due to its material advantages and expanding application base, ongoing challenges related to chemical compatibility, environmental impact, and regulatory requirements must be addressed to fully realize its potential in 2025 and beyond.

Market Size, Segmentation & 2025–2030 Forecast (CAGR: 12.8%)

The global market for Polymethylmethacrylate (PMMA) microfluidics fabrication is poised for robust growth, with a projected compound annual growth rate (CAGR) of 12.8% from 2025 to 2030. This expansion is driven by increasing demand for cost-effective, high-precision microfluidic devices in applications such as diagnostics, drug delivery, and environmental monitoring. PMMA, known for its optical clarity, biocompatibility, and ease of fabrication, is becoming a preferred substrate in the microfluidics industry, particularly as alternatives like glass and silicon face higher costs and more complex processing requirements.

Market segmentation reveals that the healthcare and life sciences sector remains the dominant end-user, accounting for the largest share of PMMA microfluidics demand. This is attributed to the widespread adoption of lab-on-a-chip devices for point-of-care diagnostics and molecular analysis. The research and academic segment is also significant, leveraging PMMA’s versatility for prototyping and experimental microfluidic platforms. Geographically, North America and Europe lead in market share due to advanced research infrastructure and strong investments in biomedical engineering, while the Asia-Pacific region is expected to witness the fastest growth, fueled by expanding healthcare access and manufacturing capabilities.

From a fabrication perspective, injection molding and hot embossing are the most widely adopted techniques for PMMA microfluidics, offering scalability and reproducibility for mass production. Emerging methods such as laser ablation and micro-milling are gaining traction for rapid prototyping and custom device development. Key industry players, including Dolomite Microfluidics and Microfluidic ChipShop GmbH, are investing in advanced manufacturing technologies to meet the growing demand for high-quality PMMA microfluidic components.

Looking ahead to 2030, the market is expected to benefit from ongoing innovations in surface modification, bonding techniques, and integration with electronic and optical components. The convergence of PMMA microfluidics with digital health and personalized medicine is anticipated to open new avenues for growth, particularly in decentralized diagnostics and wearable biosensors. As regulatory frameworks evolve and standardization improves, the adoption of PMMA-based microfluidic devices is likely to accelerate, solidifying their role in next-generation analytical and medical technologies.

Emerging Technologies and Innovations in PMMA Microfluidics

The field of polymethylmethacrylate (PMMA) microfluidics fabrication is experiencing rapid advancements, driven by the demand for cost-effective, scalable, and high-performance lab-on-a-chip devices. In 2025, several emerging technologies and innovations are shaping the landscape of PMMA microfluidics, focusing on improving device functionality, manufacturing efficiency, and integration with other materials and systems.

One significant trend is the adoption of advanced micromachining techniques, such as femtosecond laser ablation and high-precision CNC milling, which enable the creation of complex microchannel geometries with sub-micron accuracy. These methods offer greater design flexibility compared to traditional hot embossing or injection molding, allowing for rapid prototyping and customization of microfluidic devices. Additionally, the use of direct laser writing has facilitated the fabrication of three-dimensional microstructures within PMMA substrates, expanding the range of possible device architectures.

Another area of innovation is the development of novel surface modification strategies to enhance the chemical and biological compatibility of PMMA microfluidic devices. Techniques such as plasma treatment, UV-ozone exposure, and the deposition of functional polymer coatings are being optimized to improve surface wettability, reduce non-specific adsorption, and enable the immobilization of biomolecules. These modifications are critical for applications in diagnostics, cell culture, and biosensing, where surface properties directly impact device performance.

Integration of PMMA microfluidics with electronic and optical components is also advancing, enabling the creation of hybrid devices for real-time sensing and data acquisition. For example, embedding thin-film electrodes or optical waveguides within PMMA chips is becoming more feasible due to improved bonding and patterning techniques. This integration supports the development of point-of-care diagnostic platforms and portable analytical instruments.

Sustainability and scalability are further driving innovation, with research focusing on recyclable PMMA formulations and solvent-free bonding methods to reduce environmental impact and facilitate mass production. The adoption of roll-to-roll manufacturing and automated assembly lines is being explored to meet the growing demand for disposable microfluidic devices in healthcare and environmental monitoring.

These technological advancements are supported by collaborations between academic institutions, industry leaders, and standardization bodies such as the International Organization for Standardization and Microfluidics Association, which are working to establish best practices and quality standards for PMMA microfluidics fabrication.

Competitive Landscape: Key Players & Strategic Initiatives

The competitive landscape of polymethylmethacrylate (PMMA) microfluidics fabrication in 2025 is characterized by a dynamic mix of established material suppliers, microfluidic device manufacturers, and technology innovators. Key players in this sector include Evonik Industries AG, a leading PMMA resin supplier, and Arkema S.A., which markets PMMA under the Plexiglas and Altuglas brands. These companies provide high-purity PMMA grades tailored for microfluidic applications, supporting device manufacturers with consistent material quality and technical support.

On the device fabrication side, companies such as Dolomite Microfluidics and microfluidic ChipShop GmbH have established themselves as leaders in the design and production of PMMA-based microfluidic chips. Their strategic initiatives include expanding rapid prototyping services, investing in advanced micromachining and hot embossing technologies, and developing standardized chip formats to accelerate adoption in diagnostics and research.

Strategic collaborations are a hallmark of the industry’s evolution. For example, partnerships between material suppliers and device manufacturers aim to optimize PMMA formulations for improved optical clarity, biocompatibility, and chemical resistance. Additionally, alliances with academic institutions and research organizations foster innovation in fabrication techniques, such as laser ablation and micro-milling, to achieve higher precision and throughput.

Another significant trend is the integration of PMMA microfluidics with complementary technologies. Companies are increasingly working with electronics and sensor manufacturers to develop hybrid devices for point-of-care diagnostics and environmental monitoring. This cross-sector collaboration is supported by organizations like the Microfluidics Association, which promotes industry standards and best practices.

To maintain competitiveness, leading players are also focusing on sustainability initiatives, such as developing recyclable PMMA grades and reducing fabrication waste. These efforts align with broader industry goals for greener manufacturing and regulatory compliance.

Overall, the PMMA microfluidics fabrication market in 2025 is shaped by a combination of material innovation, strategic partnerships, and a focus on scalable, high-quality manufacturing processes, positioning key players to address the growing demand in healthcare, life sciences, and industrial applications.

Applications: Healthcare, Diagnostics, Research, and Beyond

Polymethylmethacrylate (PMMA) microfluidics fabrication has become increasingly significant in a wide range of applications, particularly in healthcare, diagnostics, and research. The unique properties of PMMA—such as optical transparency, biocompatibility, and ease of fabrication—make it an attractive material for developing microfluidic devices that are both cost-effective and scalable.

In healthcare, PMMA-based microfluidic chips are widely used for point-of-care testing (POCT) and rapid diagnostics. These devices enable the miniaturization and integration of complex laboratory processes onto a single chip, allowing for the detection of diseases such as infectious pathogens, cancer biomarkers, and metabolic disorders with minimal sample volumes. For example, PMMA microfluidic platforms have been utilized in the development of lab-on-a-chip systems for blood analysis and immunoassays, providing rapid and accurate results at the patient’s bedside or in remote settings. The optical clarity of PMMA is particularly advantageous for fluorescence and colorimetric detection methods, which are commonly employed in diagnostic assays.

In the field of research, PMMA microfluidics supports a variety of applications, including cell culture, single-cell analysis, and organ-on-chip models. The material’s compatibility with standard biological protocols and its ability to be easily modified with surface treatments allow researchers to create tailored microenvironments for studying cellular behavior, drug responses, and tissue engineering. PMMA’s machinability also facilitates the rapid prototyping of custom microfluidic designs, accelerating the pace of innovation in biomedical research.

Beyond healthcare and research, PMMA microfluidic devices are finding roles in environmental monitoring, food safety testing, and chemical synthesis. Their robustness and chemical resistance make them suitable for handling a range of samples and reagents. For instance, PMMA chips are used in water quality analysis and detection of contaminants in food products, providing portable and user-friendly solutions for field testing.

The continued advancement of PMMA microfluidics fabrication techniques, such as hot embossing, laser ablation, and injection molding, is expanding the scope and accessibility of these devices. Organizations like the National Institute of Standards and Technology and Carl Zeiss AG are actively involved in developing standards and imaging solutions that further enhance the performance and reliability of PMMA-based microfluidic systems.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The regional landscape for polymethylmethacrylate (PMMA) microfluidics fabrication in 2025 reflects distinct trends shaped by technological capabilities, market demand, and regulatory environments across North America, Europe, Asia-Pacific, and the Rest of the World.

North America remains a leader in PMMA microfluidics, driven by robust investments in biomedical research, diagnostics, and point-of-care testing. The presence of major research institutions and collaborations with industry players such as Corning Incorporated and Thermo Fisher Scientific Inc. fosters innovation in microfluidic device design and rapid prototyping. The region also benefits from a mature regulatory framework and strong intellectual property protections, encouraging startups and established companies to advance PMMA-based solutions.

Europe demonstrates significant growth, particularly in the development of PMMA microfluidic platforms for environmental monitoring and pharmaceutical applications. Initiatives supported by the European Commission and collaborations among universities and companies such as Dolomite Microfluidics have accelerated the adoption of PMMA due to its optical clarity and biocompatibility. Stringent environmental regulations in the European Union also drive the demand for sustainable fabrication processes and recyclable materials.

Asia-Pacific is emerging as a dynamic hub for PMMA microfluidics fabrication, propelled by expanding healthcare infrastructure, government funding, and a growing base of contract manufacturers. Countries like China, Japan, and South Korea are investing in advanced manufacturing technologies and automation, with companies such as Microfluidic ChipShop and Tosoh Corporation playing pivotal roles. The region’s cost-competitive production and rapid prototyping capabilities make it attractive for both domestic and international clients.

Rest of the World (including Latin America, the Middle East, and Africa) is witnessing gradual adoption of PMMA microfluidics, primarily in academic research and pilot-scale projects. While market penetration is lower compared to other regions, increasing awareness of microfluidic technologies and international collaborations are expected to stimulate growth. Local initiatives and partnerships with global suppliers are beginning to address challenges related to technical expertise and supply chain limitations.

Overall, regional dynamics in 2025 highlight North America and Europe as innovation centers, Asia-Pacific as a manufacturing powerhouse, and the Rest of the World as an emerging market for PMMA microfluidics fabrication.

Supply Chain, Manufacturing Trends, and Cost Analysis

The supply chain and manufacturing landscape for Polymethylmethacrylate (PMMA) microfluidics fabrication in 2025 is shaped by evolving material sourcing, advanced processing technologies, and cost optimization strategies. PMMA, valued for its optical clarity, biocompatibility, and ease of machining, remains a preferred substrate for microfluidic devices in diagnostics, life sciences, and chemical analysis.

Key suppliers of PMMA, such as Evonik Industries AG and Röhm GmbH, continue to ensure a stable global supply of high-purity PMMA sheets and pellets. These materials are distributed through established networks, with regional hubs in North America, Europe, and Asia, minimizing lead times and supporting just-in-time manufacturing models. The supply chain has also become more resilient, with manufacturers diversifying sources and maintaining buffer inventories to mitigate disruptions.

Manufacturing trends in 2025 emphasize precision, scalability, and sustainability. Traditional fabrication methods such as CNC micromilling and hot embossing are now complemented by advanced techniques like ultrafast laser ablation and micro-injection molding. These methods enable rapid prototyping and high-volume production with sub-micron feature resolution. Automation and digitalization, including the use of AI-driven process control and in-line quality monitoring, have further improved yield and reduced labor costs. Leading microfluidics manufacturers, such as Dolomite Microfluidics and Microfluidic ChipShop GmbH, have integrated these technologies to offer custom and standardized PMMA microfluidic platforms.

Cost analysis reveals that material expenses account for approximately 30–40% of the total device cost, with PMMA prices remaining relatively stable due to mature production processes. The main cost drivers are tooling (especially for injection molding), process automation, and post-fabrication assembly. However, economies of scale and modular design approaches have reduced per-unit costs for high-volume applications. Environmental considerations, such as solvent recycling and waste minimization, are increasingly factored into cost structures, aligning with regulatory and customer sustainability goals.

Overall, the PMMA microfluidics sector in 2025 is characterized by robust supply chains, adoption of cutting-edge manufacturing technologies, and a focus on cost efficiency and sustainability, ensuring its continued relevance in the expanding microfluidics market.

Regulatory Environment and Standards

The regulatory environment and standards governing the fabrication of microfluidic devices using polymethylmethacrylate (PMMA) are evolving in response to the expanding applications of these devices in diagnostics, life sciences, and industrial processes. PMMA, valued for its optical clarity, biocompatibility, and ease of fabrication, is widely used in microfluidic chip production. Regulatory oversight primarily focuses on ensuring material safety, device performance, and manufacturing quality, especially for applications in healthcare and diagnostics.

In the United States, the U.S. Food and Drug Administration (FDA) regulates microfluidic devices intended for medical use under the medical device framework, which includes requirements for material biocompatibility (ISO 10993), device sterility, and manufacturing process validation. PMMA-based devices must demonstrate that they do not leach harmful substances and maintain structural integrity under intended use conditions. The FDA also encourages adherence to Good Manufacturing Practices (GMP) as outlined in 21 CFR Part 820.

In Europe, the European Commission enforces the Medical Device Regulation (MDR 2017/745), which requires conformity assessment, risk management, and clinical evaluation for microfluidic devices, including those fabricated from PMMA. Manufacturers must provide evidence of compliance with harmonized standards such as ISO 13485 for quality management systems and ISO 14644 for cleanroom environments, which are often necessary for microfluidic device fabrication.

Material standards for PMMA are set by organizations such as the International Organization for Standardization (ISO) and the ASTM International. ISO 20795-1 specifies requirements for PMMA used in medical applications, while ASTM D788 and D638 outline testing methods for mechanical and physical properties. These standards ensure that PMMA materials used in microfluidics meet stringent criteria for purity, mechanical strength, and chemical resistance.

As microfluidic technologies advance, regulatory bodies are increasingly collaborating with industry stakeholders to update standards and guidance documents, addressing emerging fabrication techniques such as laser ablation, hot embossing, and injection molding. Ongoing dialogue between manufacturers, regulators, and standards organizations is essential to ensure that PMMA microfluidic devices remain safe, effective, and compliant with global regulatory expectations.

Future Outlook: Opportunities, Challenges, and Disruptive Trends

The future of polymethylmethacrylate (PMMA) microfluidics fabrication is shaped by a dynamic interplay of technological advancements, market opportunities, and emerging challenges. As the demand for rapid, cost-effective, and scalable microfluidic devices grows—particularly in diagnostics, drug development, and environmental monitoring—PMMA remains a material of choice due to its optical clarity, biocompatibility, and ease of processing.

One of the most promising opportunities lies in the integration of PMMA microfluidics with digital health and point-of-care diagnostics. The global push for decentralized healthcare solutions is accelerating the adoption of lab-on-a-chip devices, where PMMA’s properties enable high-throughput manufacturing and reliable performance. Innovations in fabrication techniques, such as laser ablation, hot embossing, and advanced bonding methods, are further enhancing device complexity and miniaturization, opening new avenues for multiplexed assays and personalized medicine applications.

However, several challenges persist. Achieving robust, leak-free bonding between PMMA layers without compromising channel integrity remains a technical hurdle, especially as device architectures become more intricate. Additionally, while PMMA is generally chemically resistant, its susceptibility to certain solvents and long-term biofouling can limit its use in some applications. Addressing these issues requires ongoing research into surface modification and hybrid material integration.

Disruptive trends are also on the horizon. The convergence of PMMA microfluidics with additive manufacturing (3D printing) is poised to revolutionize prototyping and customization, enabling rapid iteration and on-demand production of complex devices. Furthermore, the integration of PMMA microfluidics with emerging biosensing technologies and artificial intelligence-driven data analysis could transform real-time diagnostics and environmental monitoring.

Sustainability is another critical consideration. As environmental regulations tighten, the recyclability and life-cycle impact of PMMA-based devices are under scrutiny. Industry leaders such as Evonik Industries AG and Arkema S.A. are investing in greener production processes and exploring bio-based PMMA alternatives to address these concerns.

In summary, the outlook for PMMA microfluidics fabrication in 2025 is marked by significant opportunities for innovation and market expansion, tempered by technical and environmental challenges. The sector’s trajectory will depend on continued advances in materials science, fabrication technology, and sustainable manufacturing practices.

Conclusion & Strategic Recommendations

The evolution of polymethylmethacrylate (PMMA) microfluidics fabrication has positioned this material as a cornerstone in the development of cost-effective, transparent, and biocompatible lab-on-a-chip devices. As the field advances into 2025, PMMA’s favorable properties—such as optical clarity, ease of machining, and chemical resistance—continue to drive its adoption in biomedical diagnostics, environmental monitoring, and chemical analysis. However, challenges remain in achieving high-resolution features, robust bonding, and scalable manufacturing.

Strategically, stakeholders should prioritize the integration of advanced fabrication techniques, such as precision micromilling, hot embossing, and laser ablation, to enhance feature fidelity and throughput. Collaborations with equipment manufacturers like Mikron Switzerland AG and material suppliers such as Röhm GmbH (Plexiglas) can facilitate access to high-quality PMMA substrates and state-of-the-art processing tools. Additionally, leveraging surface modification technologies—such as plasma treatment and UV activation—can improve channel hydrophilicity and bonding strength, addressing common limitations in device assembly.

For organizations aiming to scale production, adopting standardized design protocols and quality control measures is essential. Engagement with industry consortia like the Microfluidics Association can provide access to best practices, regulatory guidance, and collaborative research opportunities. Furthermore, investment in automation and in-line inspection systems will be critical for maintaining consistency and reducing costs in high-volume manufacturing.

In summary, the future of PMMA microfluidics fabrication lies in a balanced approach that combines material innovation, process optimization, and strategic partnerships. By focusing on these areas, companies and research institutions can accelerate the commercialization of PMMA-based microfluidic devices, meeting the growing demand for rapid, reliable, and affordable analytical solutions across diverse sectors.

Sources & References

- EV Group

- microfluidic ChipShop GmbH

- Dolomite Microfluidics

- ZEON CORPORATION

- Ensinger GmbH

- International Organization for Standardization (ISO)

- National Institutes of Health

- Evonik Industries AG

- Arkema S.A.

- Microfluidics Association

- National Institute of Standards and Technology

- Carl Zeiss AG

- Thermo Fisher Scientific Inc.

- European Commission

- Röhm GmbH

- ASTM International

- Mikron Switzerland AG

- Röhm GmbH (Plexiglas)