Piezoelectric Microfluidic Devices in 2025: Unleashing Next-Gen Precision for Diagnostics, Drug Delivery, and Lab Automation. Explore How This Disruptive Technology is Set to Transform Healthcare and Research Over the Next Five Years.

- Executive Summary: 2025 Market Snapshot and Key Trends

- Technology Overview: Principles and Innovations in Piezoelectric Microfluidics

- Market Size and Forecast (2025–2030): Growth Drivers and Projections

- Key Applications: Diagnostics, Drug Delivery, and Lab-on-a-Chip

- Competitive Landscape: Leading Companies and Strategic Initiatives

- Recent Breakthroughs: Materials, Miniaturization, and Integration

- Regulatory Environment and Industry Standards

- Challenges and Barriers: Technical, Commercial, and Regulatory

- Emerging Opportunities: AI Integration, Personalized Medicine, and Beyond

- Future Outlook: Strategic Recommendations and Long-Term Impact

- Sources & References

Executive Summary: 2025 Market Snapshot and Key Trends

The global market for piezoelectric microfluidic devices is poised for significant growth in 2025, driven by rapid advancements in precision medicine, point-of-care diagnostics, and lab automation. These devices leverage the unique properties of piezoelectric materials—such as lead zirconate titanate (PZT) and quartz—to enable highly accurate fluid manipulation at the microscale, supporting applications in genomics, drug discovery, and cell analysis. The integration of piezoelectric actuation in microfluidic platforms allows for non-contact, programmable, and energy-efficient control of droplets and particles, which is increasingly valued in both research and commercial settings.

Key industry players are expanding their portfolios and manufacturing capabilities to meet rising demand. PI Ceramic, a division of Physik Instrumente (PI), is recognized for its advanced piezoelectric components, supplying actuators and transducers that are integral to microfluidic device performance. Piezomechanik and Piezo Systems, Inc. are also notable for their specialized piezoelectric elements, which are increasingly incorporated into microfluidic pumps, valves, and droplet generators. Meanwhile, Dolomite Microfluidics continues to innovate in modular microfluidic systems, offering platforms that integrate piezoelectric actuation for precise droplet and particle control.

In 2025, the adoption of piezoelectric microfluidic devices is particularly strong in the biomedical and pharmaceutical sectors. The ability to handle minute liquid volumes with high repeatability is accelerating the development of next-generation diagnostic tools and personalized therapies. For example, piezo-driven droplet generators are enabling high-throughput screening and single-cell analysis, which are critical for genomics and immunology research. Additionally, the miniaturization and automation enabled by piezoelectric actuation are reducing reagent consumption and operational costs, making these technologies attractive for both established laboratories and emerging biotech startups.

Looking ahead, the market outlook remains robust, with continued investment in R&D and manufacturing scale-up. The trend toward integration of piezoelectric microfluidics with digital and AI-driven platforms is expected to further enhance device functionality and data analytics capabilities. Regulatory support for rapid diagnostic development and the ongoing need for decentralized healthcare solutions are likely to sustain demand. As leading manufacturers such as PI Ceramic and Dolomite Microfluidics expand their global reach, the sector is set to see increased standardization, interoperability, and broader adoption across life sciences and industrial applications through 2025 and beyond.

Technology Overview: Principles and Innovations in Piezoelectric Microfluidics

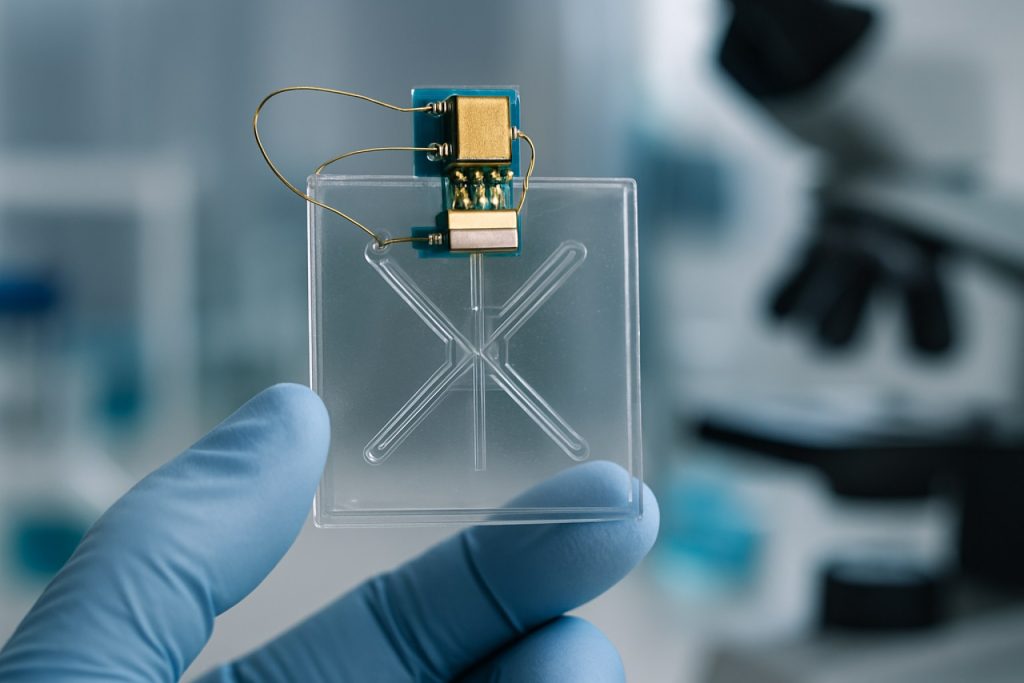

Piezoelectric microfluidic devices leverage the unique properties of piezoelectric materials—substances that generate an electric charge in response to mechanical stress—to manipulate fluids at the microscale. The core principle involves integrating piezoelectric actuators, often made from lead zirconate titanate (PZT) or similar ceramics, into microfluidic chips. When an electric field is applied, these actuators deform, producing precise mechanical vibrations or displacements that can pump, mix, or sort fluids and particles within microchannels.

As of 2025, the field is witnessing rapid innovation, driven by the demand for compact, energy-efficient, and highly controllable fluid handling systems in diagnostics, drug delivery, and cell manipulation. Piezoelectric actuation offers several advantages over traditional pneumatic or electrokinetic methods, including low power consumption, rapid response times, and compatibility with a wide range of fluids and biological samples.

Recent device architectures include surface acoustic wave (SAW) microfluidics, where interdigitated transducers (IDTs) on a piezoelectric substrate generate acoustic waves that propagate along the surface, enabling contactless manipulation of droplets and particles. Companies such as Veredus Laboratories and Dolomite Microfluidics are actively developing and commercializing piezo-driven microfluidic platforms for applications ranging from point-of-care diagnostics to high-throughput screening. Dolomite Microfluidics, for example, offers modular systems that integrate piezoelectric pumps and valves, enabling precise control over droplet generation and reagent mixing.

Another area of innovation is the miniaturization and integration of piezoelectric components with complementary technologies such as microelectromechanical systems (MEMS) and lab-on-a-chip platforms. piezosystem jena and Physik Instrumente (PI) are notable for their advanced piezo actuator technologies, which are increasingly being adapted for microfluidic applications, offering sub-micron precision and high reliability.

Looking ahead, the next few years are expected to see further advances in material science, with the development of lead-free piezoelectric ceramics and flexible piezoelectric polymers, addressing environmental and biocompatibility concerns. Integration with digital control systems and artificial intelligence is also anticipated, enabling adaptive, automated microfluidic workflows. The convergence of piezoelectric microfluidics with biosensing and single-cell analysis is poised to unlock new possibilities in personalized medicine and rapid diagnostics, solidifying the role of piezoelectric devices as a cornerstone technology in the evolving microfluidics landscape.

Market Size and Forecast (2025–2030): Growth Drivers and Projections

The global market for piezoelectric microfluidic devices is poised for robust growth from 2025 through 2030, driven by expanding applications in biomedical diagnostics, drug delivery, inkjet printing, and advanced materials processing. Piezoelectric actuation offers precise, low-power, and rapid control of fluids at the microscale, making these devices increasingly attractive for both research and commercial applications.

Key growth drivers include the rising demand for point-of-care diagnostic tools, the miniaturization of laboratory equipment, and the need for high-throughput screening in pharmaceutical development. The integration of piezoelectric microfluidics into lab-on-a-chip platforms is accelerating, particularly in the context of personalized medicine and rapid pathogen detection. The COVID-19 pandemic has further underscored the importance of portable, accurate, and scalable diagnostic solutions, a trend expected to persist and expand through the forecast period.

Major industry players are investing in the development and commercialization of piezoelectric microfluidic technologies. TDK Corporation is a leading supplier of piezoelectric materials and actuators, supporting the fabrication of high-precision microfluidic pumps and valves. piezosystem jena GmbH specializes in piezoelectric actuators and systems, with a portfolio that includes components for microfluidic dispensing and droplet generation. Physik Instrumente (PI) is another prominent manufacturer, offering piezo-based motion and positioning solutions that are integral to advanced microfluidic device platforms. These companies are expanding their product lines and collaborating with device manufacturers to address emerging needs in healthcare, biotechnology, and industrial automation.

From a regional perspective, North America and Europe are expected to maintain leadership in both research and commercialization, supported by strong investments in healthcare innovation and microfabrication infrastructure. However, the Asia-Pacific region, led by countries such as Japan, South Korea, and China, is rapidly increasing its market share due to significant investments in electronics manufacturing and biomedical research.

Market projections for 2025–2030 indicate a compound annual growth rate (CAGR) in the high single to low double digits, reflecting both the expanding application base and ongoing technological advancements. The adoption of next-generation piezoelectric materials, such as lead-free ceramics and flexible composites, is anticipated to further enhance device performance and open new market segments. As regulatory pathways for microfluidic diagnostics become more streamlined, and as manufacturing costs decrease, the accessibility and ubiquity of piezoelectric microfluidic devices are expected to increase substantially over the next five years.

Key Applications: Diagnostics, Drug Delivery, and Lab-on-a-Chip

Piezoelectric microfluidic devices are rapidly advancing as pivotal tools in diagnostics, drug delivery, and lab-on-a-chip applications, with 2025 marking a period of accelerated commercialization and integration into clinical and research workflows. These devices leverage the unique ability of piezoelectric materials—such as lead zirconate titanate (PZT) and aluminum nitride (AlN)—to generate precise acoustic waves and mechanical actuation at the microscale, enabling highly controlled manipulation of fluids and particles.

In diagnostics, piezoelectric microfluidic platforms are being adopted for point-of-care (POC) testing, where their high sensitivity and rapid response are critical. Companies like Veredus Laboratories are developing integrated microfluidic chips that utilize piezoelectric actuation for sample preparation and nucleic acid extraction, streamlining workflows for infectious disease detection. Similarly, Dolomite Microfluidics is advancing modular systems that incorporate piezoelectric pumps and valves, enabling multiplexed assays and real-time biomarker analysis. These innovations are expected to reduce diagnostic turnaround times and improve accessibility in decentralized healthcare settings.

In drug delivery, piezoelectric microfluidic devices are enabling the precise generation and sorting of micro- and nano-droplets, which serve as carriers for pharmaceuticals and biologics. Dolomite Microfluidics and Bartels Mikrotechnik are notable for their piezo-driven droplet generators and micropumps, which are being integrated into wearable and implantable drug delivery systems. These technologies allow for programmable dosing and on-demand release, supporting the trend toward personalized medicine and minimally invasive therapies.

Lab-on-a-chip (LOC) applications are also benefiting from the scalability and versatility of piezoelectric microfluidics. Bartels Mikrotechnik is a leader in commercializing piezoelectric micropumps and microvalves, which are essential for automating complex biochemical assays on compact platforms. Their devices are being adopted in environmental monitoring, food safety, and cell-based research, where precise fluid handling is paramount. The integration of piezoelectric components with microelectronic sensors is anticipated to further enhance the analytical capabilities of LOC systems in the coming years.

Looking ahead, the outlook for piezoelectric microfluidic devices is robust, with ongoing improvements in material science, device miniaturization, and system integration. The next few years are expected to see broader adoption in clinical diagnostics, expansion into new therapeutic modalities, and the emergence of fully autonomous lab-on-a-chip solutions. Industry leaders such as Dolomite Microfluidics and Bartels Mikrotechnik are poised to drive innovation, supported by collaborations with academic and healthcare institutions.

Competitive Landscape: Leading Companies and Strategic Initiatives

The competitive landscape for piezoelectric microfluidic devices in 2025 is characterized by a dynamic mix of established multinational corporations, innovative startups, and specialized component suppliers. These entities are leveraging advances in piezoelectric materials, microfabrication, and system integration to address growing demand in biomedical diagnostics, drug delivery, cell sorting, and lab-on-a-chip applications.

Among the global leaders, Olympus Corporation continues to play a significant role, building on its expertise in precision optics and microfluidic instrumentation. The company’s ongoing investments in piezoelectric actuator technology have enabled the development of highly sensitive and miniaturized fluid handling systems, which are increasingly adopted in clinical and research laboratories worldwide.

Another major player, PI Ceramic (a division of Physik Instrumente), is recognized for its advanced piezoelectric ceramics and actuators. The company supplies critical components for microfluidic pumps, valves, and droplet generators, supporting both OEMs and end-users in the life sciences and analytical instrumentation sectors. Their recent strategic partnerships with microfluidics platform developers have accelerated the commercialization of next-generation devices with improved throughput and precision.

In the United States, PiezoMetrics Inc. and Piezomechanik GmbH are notable for their focus on custom piezoelectric solutions tailored to microfluidic applications. These companies have expanded their product lines to include high-frequency actuators and integrated control electronics, addressing the need for rapid, programmable fluid manipulation in point-of-care diagnostics and single-cell analysis.

Emerging startups are also shaping the competitive landscape. For example, Dolomite Microfluidics specializes in modular microfluidic systems and has introduced piezo-driven droplet generators that enable precise control over droplet size and frequency. Their collaborations with academic and industrial partners are fostering innovation in digital microfluidics and personalized medicine.

Strategic initiatives across the sector include increased investment in R&D, cross-industry collaborations, and the pursuit of regulatory approvals for medical and diagnostic devices. Companies are also focusing on scalable manufacturing processes to meet anticipated demand from the biotechnology and pharmaceutical industries. Looking ahead, the competitive environment is expected to intensify as new entrants bring disruptive technologies and as established players expand their portfolios through acquisitions and technology licensing.

Overall, the next few years will likely see accelerated innovation, with leading companies leveraging their core competencies in piezoelectric materials and microfluidic integration to capture emerging opportunities in healthcare, environmental monitoring, and industrial automation.

Recent Breakthroughs: Materials, Miniaturization, and Integration

In 2025, the field of piezoelectric microfluidic devices is witnessing significant advancements, particularly in materials science, device miniaturization, and system integration. These breakthroughs are driven by the demand for more sensitive, compact, and multifunctional lab-on-chip platforms for biomedical diagnostics, drug delivery, and environmental monitoring.

A major trend is the adoption of advanced piezoelectric materials beyond traditional lead zirconate titanate (PZT). Lead-free alternatives such as potassium sodium niobate (KNN) and barium titanate (BaTiO3) are gaining traction due to environmental and regulatory pressures. Companies like Murata Manufacturing Co., Ltd. and TDK Corporation are actively developing and commercializing these next-generation piezoelectric ceramics, which offer improved biocompatibility and integration potential for microfluidic applications.

Miniaturization is another area of rapid progress. The integration of piezoelectric thin films onto silicon and polymer substrates has enabled the fabrication of highly compact actuators and sensors. STMicroelectronics and Robert Bosch GmbH are leveraging MEMS (Micro-Electro-Mechanical Systems) technology to produce piezoelectric micro-pumps and droplet generators with footprints suitable for portable and wearable devices. These components are now being embedded into point-of-care diagnostic systems, enabling real-time sample manipulation and analysis with minimal reagent consumption.

Integration with electronics and wireless communication modules is also advancing. Companies such as Kyocera Corporation are developing hybrid platforms that combine piezoelectric microfluidics with on-chip signal processing and wireless data transmission. This integration is crucial for remote health monitoring and decentralized testing, where compactness and connectivity are essential.

Recent years have also seen the emergence of flexible and stretchable piezoelectric microfluidic devices, thanks to innovations in polymer-based piezoelectric composites. Piezotech (an Arkema company) is at the forefront of this trend, offering piezoelectric polymers that can be printed or laminated onto flexible substrates, opening new possibilities for wearable biosensors and soft robotics.

Looking ahead, the convergence of advanced materials, MEMS fabrication, and system-level integration is expected to accelerate the deployment of piezoelectric microfluidic devices in clinical, industrial, and environmental settings. The next few years will likely see further reductions in device size, increased multifunctionality, and broader adoption in decentralized and personalized healthcare.

Regulatory Environment and Industry Standards

The regulatory environment and industry standards for piezoelectric microfluidic devices are evolving rapidly as these technologies gain traction in biomedical diagnostics, drug delivery, and analytical instrumentation. In 2025, regulatory frameworks are primarily shaped by the intended application of the device—whether for research, clinical diagnostics, or therapeutic use. For medical and diagnostic applications, piezoelectric microfluidic devices are subject to stringent oversight by agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). These agencies require compliance with established standards for safety, efficacy, and manufacturing quality, including ISO 13485 for medical device quality management systems and ISO 10993 for biocompatibility testing.

Industry standards are also influenced by organizations such as the International Electrotechnical Commission (IEC) and the International Organization for Standardization (ISO), which provide guidelines for the electrical safety and performance of piezoelectric components. For instance, IEC 60601-1 is widely referenced for the safety of electrical medical equipment, including devices incorporating piezoelectric actuators and sensors. As microfluidic devices become more integrated with digital health platforms, cybersecurity and data integrity standards—such as those outlined by the U.S. National Institute of Standards and Technology (NIST)—are increasingly relevant.

Leading manufacturers and suppliers, including PI Ceramic (a division of Physik Instrumente), Bartels Mikrotechnik, and TDK Corporation, are actively engaged in shaping and adhering to these standards. These companies participate in industry consortia and standardization committees to ensure that their piezoelectric microfluidic modules and components meet both current and anticipated regulatory requirements. For example, Bartels Mikrotechnik is known for its modular microfluidic platforms that are designed to be compliant with both European and international safety and quality standards, facilitating their adoption in regulated markets.

Looking ahead, the regulatory landscape is expected to become more harmonized globally, with increased emphasis on device interoperability, traceability, and lifecycle management. The emergence of new application areas—such as point-of-care diagnostics and personalized medicine—will likely prompt updates to existing standards and the development of new guidelines specific to microfluidic and piezoelectric technologies. Industry stakeholders are also anticipating more explicit requirements for environmental sustainability and recyclability of device materials, in line with broader trends in electronics and medical device regulation.

Overall, the regulatory and standards environment for piezoelectric microfluidic devices in 2025 is characterized by a dynamic interplay between technological innovation, evolving application domains, and the ongoing efforts of manufacturers and industry bodies to ensure compliance and safety in a rapidly advancing field.

Challenges and Barriers: Technical, Commercial, and Regulatory

Piezoelectric microfluidic devices, which leverage the deformation of piezoelectric materials to manipulate fluids at the microscale, are gaining traction in diagnostics, drug delivery, and lab-on-a-chip applications. However, as the sector moves into 2025 and beyond, several technical, commercial, and regulatory challenges persist, potentially impeding broader adoption and commercialization.

Technical Challenges remain significant. The integration of piezoelectric materials—such as lead zirconate titanate (PZT) or aluminum nitride (AlN)—into microfluidic platforms requires precise microfabrication techniques. Achieving reliable, repeatable actuation at small scales is complicated by material fatigue, delamination, and the need for biocompatibility, especially in medical and life science applications. Companies like PI (Physik Instrumente) and Bartels Mikrotechnik are actively developing piezoelectric pumps and actuators, but scaling these devices for mass production while maintaining performance and cost-effectiveness remains a hurdle. Additionally, the miniaturization of control electronics and the integration of sensors for closed-loop feedback are ongoing engineering challenges.

Commercial Barriers are closely tied to manufacturing complexity and cost. The specialized materials and cleanroom processes required for piezoelectric device fabrication can drive up production expenses, limiting accessibility for startups and smaller research labs. While established players such as piezosystem jena and TDK Corporation have the infrastructure to support higher volumes, the broader market is still developing. Furthermore, the lack of standardized device architectures and interfaces complicates system integration for end-users, slowing adoption in fields like point-of-care diagnostics and personalized medicine.

Regulatory Hurdles are particularly pronounced in healthcare and life sciences, where piezoelectric microfluidic devices are often subject to stringent approval processes. Demonstrating long-term reliability, safety, and biocompatibility is essential for regulatory clearance in major markets such as the US, EU, and Asia-Pacific. The evolving landscape of medical device regulations, including the EU Medical Device Regulation (MDR) and the US FDA’s requirements, adds complexity and uncertainty for manufacturers. Companies must invest in extensive validation and documentation, which can extend time-to-market and increase development costs.

Looking ahead, the outlook for piezoelectric microfluidic devices is cautiously optimistic. Advances in material science, such as the development of lead-free piezoelectrics and improved thin-film deposition techniques, are expected to address some technical limitations. Industry collaboration and the emergence of modular, standardized platforms may help lower commercial barriers. However, regulatory compliance will remain a critical factor shaping the pace and scope of market expansion through the next few years.

Emerging Opportunities: AI Integration, Personalized Medicine, and Beyond

Piezoelectric microfluidic devices are poised to play a transformative role in the convergence of artificial intelligence (AI), personalized medicine, and advanced diagnostics over the next few years. These devices leverage the unique properties of piezoelectric materials—such as lead zirconate titanate (PZT) and aluminum nitride (AlN)—to enable precise, programmable manipulation of fluids at the microscale. This capability is increasingly critical as the healthcare and biotechnology sectors seek to automate and miniaturize complex laboratory processes.

In 2025, the integration of AI with piezoelectric microfluidic platforms is accelerating, driven by the need for real-time data analysis and adaptive control in diagnostic and therapeutic applications. AI algorithms are being deployed to optimize droplet generation, sorting, and mixing, enhancing the throughput and reliability of assays. Companies like Dolomite Microfluidics and Fluidigm Corporation are at the forefront, offering modular microfluidic systems that can be paired with machine learning tools for automated sample handling and analysis. These systems are increasingly used in genomics, proteomics, and cell-based assays, where rapid, high-fidelity processing is essential.

Personalized medicine is another area where piezoelectric microfluidic devices are unlocking new opportunities. The ability to process minute biological samples with high precision enables the development of patient-specific diagnostics and therapies. For example, microfluidic chips equipped with piezoelectric actuators can isolate circulating tumor cells or exosomes from blood samples, facilitating early cancer detection and monitoring. imec, a leading research and innovation hub, is actively developing piezoelectric microfluidic platforms for single-cell analysis and liquid biopsy applications, aiming to bring these technologies closer to clinical adoption.

Looking ahead, the next few years are expected to see further miniaturization and integration of piezoelectric microfluidic devices with on-chip sensors and wireless communication modules. This will enable point-of-care diagnostics and remote health monitoring, supporting the broader trend toward decentralized healthcare. Additionally, the use of advanced materials such as thin-film piezoelectrics is anticipated to improve device performance and manufacturability, as seen in the product pipelines of companies like STMicroelectronics, which supplies MEMS and piezoelectric components for medical and industrial applications.

Overall, the synergy between piezoelectric microfluidics, AI, and personalized medicine is set to drive significant innovation, with the potential to reshape diagnostics, drug development, and patient care by 2030.

Future Outlook: Strategic Recommendations and Long-Term Impact

The future outlook for piezoelectric microfluidic devices is shaped by rapid advancements in materials science, miniaturization, and integration with digital technologies. As of 2025, the sector is poised for significant growth, driven by increasing demand in biomedical diagnostics, drug delivery, and point-of-care testing. The unique ability of piezoelectric actuators to provide precise, rapid, and programmable fluid manipulation at the microscale underpins their strategic importance in next-generation lab-on-a-chip systems.

Key industry players such as piezosystem jena and Physik Instrumente (PI) are actively developing advanced piezoelectric components tailored for microfluidic applications. These companies are focusing on improving actuator efficiency, reducing power consumption, and enhancing integration with microelectronic systems. Their efforts are expected to lower barriers for adoption in both research and commercial settings, particularly in the life sciences and analytical instrumentation markets.

Strategically, stakeholders should prioritize the following recommendations to capitalize on emerging opportunities:

- Invest in Material Innovation: Continued research into novel piezoelectric materials, such as lead-free ceramics and flexible polymers, will be crucial for expanding device functionality and biocompatibility. Companies like Murata Manufacturing are already exploring advanced materials for miniaturized actuators, which could set new industry standards.

- Enhance System Integration: Seamless integration of piezoelectric microfluidics with sensors, data analytics, and wireless communication will be essential for smart diagnostics and real-time monitoring. Collaborations between actuator manufacturers and microfluidic chip designers are expected to accelerate, fostering the development of fully integrated platforms.

- Focus on Scalability and Manufacturability: To meet growing demand, scalable manufacturing processes must be developed. Companies with expertise in high-volume piezoelectric component production, such as TDK Corporation, are well-positioned to lead in this area.

- Address Regulatory and Standardization Challenges: As piezoelectric microfluidic devices move toward clinical and industrial deployment, compliance with international standards and regulatory requirements will be critical. Industry consortia and standards bodies should be engaged early to streamline certification and market entry.

Looking ahead, the long-term impact of piezoelectric microfluidic devices is expected to be transformative. Their adoption will enable more accessible, decentralized healthcare, facilitate high-throughput screening in drug discovery, and support the development of portable analytical tools. As the ecosystem matures, partnerships between device manufacturers, material suppliers, and end-users will be key to unlocking the full potential of this technology in the coming years.

Sources & References

- PI Ceramic

- Piezomechanik

- Dolomite Microfluidics

- Veredus Laboratories

- Physik Instrumente (PI)

- Bartels Mikrotechnik

- Olympus Corporation

- Murata Manufacturing Co., Ltd.

- STMicroelectronics

- Robert Bosch GmbH

- Piezotech (an Arkema company)

- imec

- Physik Instrumente (PI)