Optogenetic Neural Interface Technologies Market Report 2025: In-Depth Analysis of Growth Drivers, Innovations, and Global Opportunities. Explore Market Size, Leading Players, and Future Trends Shaping the Next 5 Years.

- Executive Summary & Market Overview

- Key Technology Trends in Optogenetic Neural Interfaces

- Competitive Landscape and Leading Companies

- Market Size, Growth Forecasts, and CAGR Analysis (2025–2030)

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Opportunities, Challenges, and Regulatory Considerations

- Future Outlook: Emerging Applications and Investment Hotspots

- Sources & References

Executive Summary & Market Overview

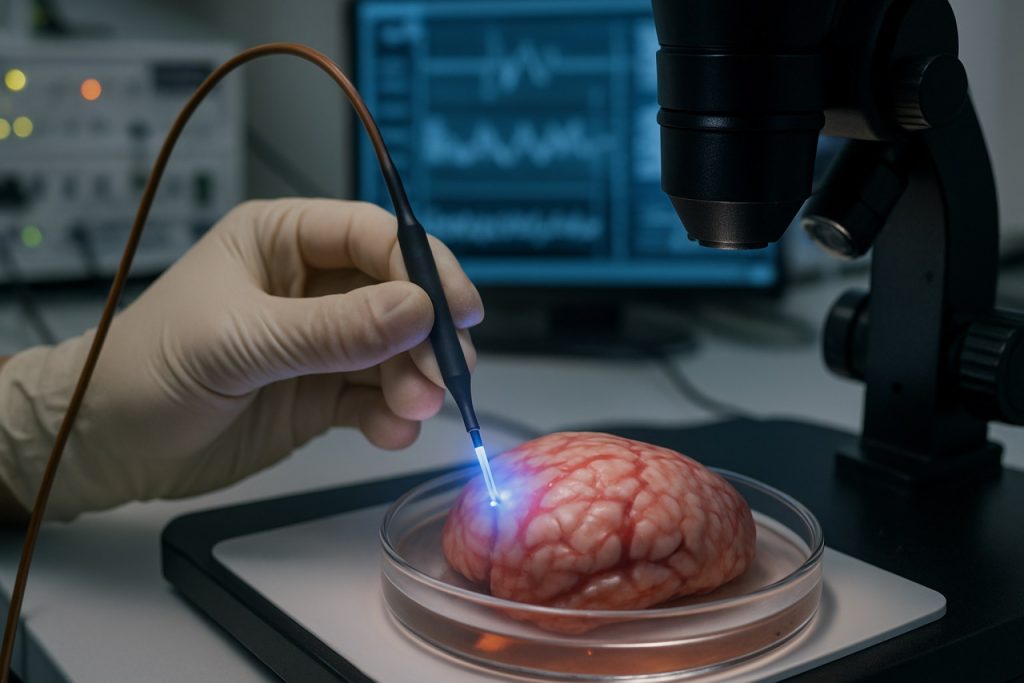

Optogenetic neural interface technologies represent a rapidly advancing segment within the broader neurotechnology and brain-computer interface (BCI) markets. These systems leverage optogenetics—a technique that uses light to control neurons genetically modified to express light-sensitive ion channels—to achieve precise, minimally invasive modulation of neural circuits. As of 2025, the global optogenetic neural interface market is experiencing robust growth, driven by increasing investments in neuroscience research, expanding applications in both basic and translational medicine, and the convergence of photonics, genetic engineering, and microelectronics.

The market is characterized by a dynamic ecosystem of academic research institutions, biotechnology firms, and medical device manufacturers. Key players are focusing on the development of next-generation optogenetic tools, including wireless implantable devices, advanced viral vectors for gene delivery, and high-resolution optical stimulation systems. The integration of these technologies is enabling unprecedented spatiotemporal control over neural activity, with significant implications for the treatment of neurological disorders such as Parkinson’s disease, epilepsy, and vision loss.

According to recent analyses, the optogenetics market—including neural interface applications—is projected to reach a valuation of over USD 900 million by 2025, with a compound annual growth rate (CAGR) exceeding 15% from 2020 to 2025. This growth is underpinned by rising demand for innovative neuromodulation therapies, increased funding for brain research initiatives (such as the U.S. BRAIN Initiative and the European Human Brain Project), and the expanding adoption of optogenetic methods in preclinical and clinical research settings (Grand View Research).

- North America remains the largest regional market, attributed to strong research infrastructure, significant public and private investment, and the presence of leading biotechnology companies.

- Europe is witnessing accelerated growth, supported by collaborative research programs and regulatory support for advanced neurotechnologies.

- Asia-Pacific is emerging as a high-potential region, driven by increasing R&D expenditure and growing interest in neurotherapeutics.

Despite the promising outlook, the market faces challenges related to regulatory approval, ethical considerations, and the technical complexity of integrating optogenetic systems into clinical practice. Nevertheless, ongoing advancements in gene editing, miniaturized optics, and wireless power delivery are expected to further expand the scope and impact of optogenetic neural interface technologies in the coming years (MarketsandMarkets).

Key Technology Trends in Optogenetic Neural Interfaces

Optogenetic neural interface technologies are at the forefront of neuroscience, enabling precise control and monitoring of neural circuits using light-sensitive proteins. As of 2025, several key technology trends are shaping the evolution and application of these interfaces, driven by advances in genetic engineering, photonics, and materials science.

- Miniaturization and Wireless Operation: Recent years have seen a shift toward miniaturized, wireless optogenetic devices that can be fully implanted in animal models and, potentially, humans. These systems eliminate the need for tethered optical fibers, reducing tissue damage and enabling more naturalistic behavioral studies. Companies and research groups are leveraging micro-LED arrays and flexible electronics to create devices that are both lightweight and biocompatible (Nature Nanotechnology).

- Multiplexed and Multicolor Stimulation: The development of opsins responsive to different wavelengths has enabled simultaneous, independent control of multiple neural populations. This multiplexing capability is further enhanced by advances in multi-wavelength light sources and integrated photonic circuits, allowing for complex experimental paradigms and more nuanced therapeutic interventions (Neuron).

- Integration with Neural Recording: There is a growing trend toward combining optogenetic stimulation with high-density electrophysiological or optical recording. Hybrid devices can both modulate and monitor neural activity in real time, providing closed-loop feedback for research and potential clinical applications. This integration is critical for understanding circuit dynamics and optimizing therapeutic protocols (Nature Biotechnology).

- Advanced Genetic Targeting: Progress in viral vector engineering and gene editing has improved the specificity and efficiency of opsin delivery to targeted cell types. This enables more precise interventions with reduced off-target effects, expanding the potential for translational research and future clinical use (Addgene).

- Translational and Clinical Progress: While optogenetics has been primarily a research tool, 2025 marks increased efforts toward clinical translation, particularly in vision restoration and neuroprosthetics. Early-stage human trials and regulatory engagement are underway, signaling a shift from laboratory innovation to real-world therapeutic applications (Genetic Engineering & Biotechnology News).

Competitive Landscape and Leading Companies

The competitive landscape for optogenetic neural interface technologies in 2025 is characterized by a dynamic mix of established biotechnology firms, innovative startups, and academic spin-offs, all vying for leadership in a rapidly evolving field. The market is driven by the convergence of advances in genetic engineering, photonics, and neural interface hardware, with companies focusing on both research applications and the development of clinical therapies for neurological disorders.

Key players include Circuit Therapeutics, a pioneer in translating optogenetic discoveries into therapeutic solutions, particularly for pain management and psychiatric disorders. Genus Neurotech has gained attention for its proprietary opsin engineering platforms, enabling more precise and less invasive neural modulation. Neuralink, while primarily known for its brain-computer interface (BCI) work, has invested in optogenetic modules to enhance the specificity and bidirectionality of neural communication.

Academic spin-offs such as GenSight Biologics are leveraging optogenetics for vision restoration, with clinical trials underway for inherited retinal diseases. Meanwhile, Inscopix provides integrated optogenetic imaging and stimulation platforms, supporting both basic neuroscience research and translational studies.

The competitive environment is further shaped by strategic partnerships and licensing agreements. For example, Circuit Therapeutics has entered collaborations with major pharmaceutical companies to co-develop optogenetic-based drug discovery platforms. Similarly, Inscopix has partnered with academic institutions to expand the adoption of its all-in-one optogenetic systems.

Barriers to entry remain high due to the technical complexity of integrating genetic, optical, and electronic components, as well as regulatory hurdles for clinical applications. However, the field is witnessing increased venture capital investment, with funding rounds in 2024 and 2025 supporting the growth of early-stage companies and the commercialization of next-generation devices.

- Market leaders are distinguished by robust intellectual property portfolios, multidisciplinary R&D teams, and early clinical trial successes.

- Emerging players are focusing on miniaturization, wireless control, and the development of red-shifted opsins for deeper brain penetration.

- Collaborations between device manufacturers and gene therapy companies are accelerating the translation of optogenetic neural interfaces from bench to bedside.

Overall, the competitive landscape in 2025 is marked by rapid innovation, strategic alliances, and a clear trajectory toward clinical adoption, with leading companies positioned to shape the future of neurotechnology.

Market Size, Growth Forecasts, and CAGR Analysis (2025–2030)

The global market for optogenetic neural interface technologies is poised for significant expansion between 2025 and 2030, driven by advances in neuroscience research, increasing investment in neurotechnology, and the growing prevalence of neurological disorders. In 2025, the market is estimated to be valued at approximately USD 120 million, with projections indicating a compound annual growth rate (CAGR) of 17–20% through 2030. This robust growth trajectory is underpinned by the rising adoption of optogenetic tools in both academic and commercial research settings, as well as the emergence of early-stage clinical applications targeting conditions such as Parkinson’s disease, epilepsy, and chronic pain.

Key drivers of market expansion include the development of next-generation light-sensitive proteins, miniaturized implantable devices, and wireless control systems, which collectively enhance the precision and scalability of optogenetic interventions. The North American region, led by the United States, is expected to maintain the largest market share due to substantial funding from agencies such as the National Institutes of Health and the presence of leading neurotechnology firms. Europe and Asia-Pacific are also anticipated to witness accelerated growth, fueled by government-backed brain research initiatives and increasing collaboration between academic institutions and industry players.

According to recent analyses by Grand View Research and MarketsandMarkets, the optogenetics market as a whole is projected to surpass USD 500 million by 2030, with neural interface technologies representing a rapidly growing segment within this broader landscape. The CAGR for optogenetic neural interfaces specifically is expected to outpace that of traditional optogenetic tools, reflecting heightened demand for integrated systems capable of both stimulation and real-time monitoring of neural activity.

- Academic and research institutions will remain primary end-users, but the clinical segment is forecast to grow at the fastest rate as regulatory pathways for human trials become clearer.

- Device manufacturers are investing in scalable production and biocompatibility improvements, which will further drive market penetration.

- Strategic partnerships between biotechnology firms and medical device companies are expected to accelerate commercialization efforts, particularly in the context of brain-computer interface (BCI) development.

Overall, the optogenetic neural interface technologies market is set for dynamic growth from 2025 to 2030, with innovation, regulatory progress, and cross-sector collaboration serving as key catalysts for expansion.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global market for optogenetic neural interface technologies is experiencing dynamic growth, with regional trends shaped by research intensity, funding availability, and the pace of clinical translation. In 2025, North America, Europe, Asia-Pacific, and the Rest of World (RoW) regions each present distinct market characteristics and growth drivers.

- North America: North America, led by the United States, remains the largest and most advanced market for optogenetic neural interface technologies. The region benefits from robust funding for neuroscience research, a high concentration of leading academic institutions, and active participation from biotechnology firms. The National Institutes of Health and private investors continue to support translational research, accelerating the development of clinical applications for neurological disorders. The presence of established players and a favorable regulatory environment further bolster market growth.

- Europe: Europe is characterized by strong academic collaboration and significant public funding, particularly through initiatives like the European Commission’s Horizon Europe program. Countries such as Germany, the UK, and France are at the forefront, with research centers focusing on both fundamental neuroscience and translational optogenetics. Regulatory harmonization across the EU is facilitating cross-border clinical trials, while partnerships between universities and medtech companies are driving innovation in neural interface devices.

- Asia-Pacific: The Asia-Pacific region is emerging as a high-growth market, propelled by increasing investments in life sciences and a rapidly expanding base of neuroscience research. China, Japan, and South Korea are leading the charge, with government-backed initiatives to advance brain science and neurotechnology. According to Mordor Intelligence, the region is expected to witness the fastest CAGR through 2025, driven by rising demand for advanced neurotherapeutics and growing collaborations with Western research institutions.

- Rest of World (RoW): In the RoW segment, including Latin America, the Middle East, and Africa, market penetration remains limited but is gradually increasing. Growth is primarily supported by international collaborations and technology transfer from established markets. As awareness of neurological disorders rises and healthcare infrastructure improves, these regions are expected to see incremental adoption of optogenetic neural interface technologies, albeit at a slower pace compared to North America, Europe, and Asia-Pacific.

Overall, while North America and Europe currently dominate the optogenetic neural interface market, Asia-Pacific’s rapid growth and the gradual emergence of RoW markets are reshaping the global landscape in 2025.

Opportunities, Challenges, and Regulatory Considerations

Optogenetic neural interface technologies are at the forefront of neuroscience and neuroengineering, offering transformative opportunities for both research and clinical applications. The ability to precisely control and monitor neural activity using light-sensitive proteins has opened new avenues for treating neurological disorders, advancing brain-computer interfaces, and deepening our understanding of brain function. As the field matures in 2025, several key opportunities, challenges, and regulatory considerations are shaping its trajectory.

-

Opportunities:

- Therapeutic Innovation: Optogenetics holds promise for treating conditions such as Parkinson’s disease, epilepsy, and vision loss by enabling targeted neuromodulation with minimal off-target effects. Clinical trials are underway to assess the efficacy of optogenetic therapies for inherited retinal diseases, with companies like GenSight Biologics reporting encouraging results in vision restoration.

- Advanced Brain-Computer Interfaces (BCIs): The integration of optogenetics with BCIs could enable more precise and less invasive neural control, enhancing applications in prosthetics and communication for paralyzed patients. Research initiatives, such as those funded by the National Institutes of Health (NIH), are exploring these synergies.

- Drug Discovery and Basic Research: Optogenetic tools are accelerating drug screening and functional mapping of neural circuits, providing pharmaceutical companies and academic labs with powerful platforms for discovery (Nature Biotechnology).

-

Challenges:

- Delivery and Targeting: Efficiently delivering light-sensitive proteins to specific brain regions remains a technical hurdle, often requiring viral vectors or invasive procedures. Ensuring long-term expression and minimizing immune responses are ongoing concerns (Neuron).

- Device Miniaturization and Biocompatibility: Developing implantable light delivery systems that are both effective and safe for chronic use is a significant engineering challenge. Companies like Neuralink are investing in miniaturized, wireless optoelectronic devices, but widespread clinical adoption requires further innovation.

- Ethical and Social Implications: The potential for cognitive enhancement and privacy concerns related to neural data are prompting calls for robust ethical frameworks (Nature).

-

Regulatory Considerations:

- Approval Pathways: Regulatory agencies such as the U.S. Food and Drug Administration (FDA) are developing new guidelines for gene therapies and neural devices, but the combination of genetic modification and implantable hardware presents unique challenges for safety and efficacy assessment.

- International Harmonization: Differences in regulatory frameworks between regions (e.g., European Medicines Agency (EMA) vs. FDA) may impact global commercialization strategies and clinical trial design.

- Long-term Monitoring: Post-market surveillance and requirements for long-term patient monitoring are likely to become more stringent as optogenetic therapies move toward broader clinical use.

In summary, while optogenetic neural interface technologies present significant opportunities for innovation in neuroscience and medicine, their advancement in 2025 is closely tied to overcoming technical, ethical, and regulatory challenges.

Future Outlook: Emerging Applications and Investment Hotspots

Looking ahead to 2025, optogenetic neural interface technologies are poised for significant expansion beyond their foundational applications in basic neuroscience. The convergence of advanced genetic engineering, miniaturized optics, and real-time data analytics is catalyzing new frontiers in both research and clinical domains. Several emerging applications and investment hotspots are drawing attention from industry leaders, venture capital, and public research agencies.

One of the most promising areas is the development of next-generation brain-computer interfaces (BCIs) that leverage optogenetics for precise, cell-type-specific neural modulation. Unlike traditional electrical BCIs, optogenetic systems offer the potential for higher spatial and temporal resolution, enabling more nuanced control of neural circuits. This is particularly relevant for therapeutic interventions in neurodegenerative diseases, epilepsy, and psychiatric disorders, where targeted modulation could yield superior outcomes with fewer side effects. Companies such as Neuralink and Paradromics are actively exploring optogenetic integration in their BCI pipelines, signaling robust commercial interest.

Another emerging application is in the field of vision restoration. Optogenetic therapies are being developed to restore light sensitivity in retinal cells for patients with degenerative blindness. Clinical-stage companies like GenSight Biologics and Novartis have ongoing trials, and recent results suggest that optogenetic approaches could complement or surpass traditional gene therapies in efficacy and safety by offering tunable, reversible interventions.

From an investment perspective, the optogenetics market is expected to grow at a CAGR of over 15% through 2028, driven by both private and public funding. According to Grand View Research, North America and Europe remain the primary investment hotspots, with Asia-Pacific rapidly catching up due to increased government support and a burgeoning biotech sector. Strategic partnerships between academic institutions and industry players are accelerating technology transfer and commercialization, as evidenced by collaborations involving National Institutes of Health (NIH) and leading universities.

In summary, 2025 will likely see optogenetic neural interface technologies transition from experimental tools to mainstream platforms for both research and therapeutic applications. The sector’s future outlook is underpinned by a robust innovation pipeline, expanding clinical indications, and a dynamic investment landscape focused on high-impact, scalable solutions.

Sources & References

- Grand View Research

- MarketsandMarkets

- Nature Nanotechnology

- Addgene

- Neuralink

- GenSight Biologics

- National Institutes of Health

- European Commission’s Horizon Europe

- Mordor Intelligence

- GenSight Biologics

- European Medicines Agency (EMA)

- Paradromics

- GenSight Biologics

- Novartis