Engineering the Future: How Nanosatellite Antenna Systems Will Transform Space Communications in 2025 and Beyond. Explore the Innovations, Market Growth, and Strategic Shifts Shaping the Next Era of Satellite Connectivity.

- Executive Summary: Key Trends and Market Drivers in 2025

- Market Size and Forecast (2025–2030): Growth Projections and CAGR Analysis

- Technology Innovations: Miniaturization, Materials, and Design Advances

- Leading Players and Strategic Partnerships (e.g., gomspace.com, isro.gov.in, esa.int)

- Application Spectrum: Earth Observation, IoT, and Communications

- Regulatory Landscape and Spectrum Allocation (itu.int, fcc.gov)

- Manufacturing Ecosystem: Supply Chain, Integration, and Testing

- Challenges: Power, Bandwidth, and Environmental Constraints

- Investment, Funding, and M&A Activity in Nanosatellite Antenna Systems

- Future Outlook: Disruptive Technologies and Long-Term Opportunities

- Sources & References

Executive Summary: Key Trends and Market Drivers in 2025

The nanosatellite sector is experiencing rapid evolution in antenna systems engineering, driven by the surging demand for high-throughput, low-latency communications and Earth observation capabilities. In 2025, key trends include the miniaturization of high-gain antennas, integration of phased array technologies, and the adoption of advanced materials to enhance performance within the strict mass and volume constraints of nanosatellites.

A major driver is the proliferation of large-scale nanosatellite constellations for applications such as IoT connectivity, remote sensing, and global broadband. Companies like ISISPACE Group and GomSpace are at the forefront, offering modular antenna solutions tailored for CubeSat platforms. These systems are increasingly leveraging deployable and reconfigurable designs to maximize gain and coverage while stowed during launch and deployed in orbit.

The integration of electronically steerable antennas, particularly phased arrays, is gaining momentum. This technology enables dynamic beam steering without mechanical movement, crucial for maintaining robust links with ground stations and inter-satellite networks. Kymeta Corporation and Astrocast are notable for their work in flat-panel and low-profile antenna systems, which are being adapted for nanosatellite use to support agile, multi-beam operations.

Material innovation is another key trend. The use of lightweight composites, flexible substrates, and additive manufacturing is enabling more complex antenna geometries and higher integration densities. Tecnavia and EnduroSat are developing antennas with improved thermal and radiation tolerance, addressing the harsh space environment and extending mission lifespans.

Looking ahead, the market outlook for nanosatellite antenna systems is robust. The continued expansion of commercial and governmental small satellite missions, coupled with the rollout of 5G/6G and direct-to-device services, will sustain high demand for innovative antenna solutions. Industry bodies such as the Space & Satellite Professionals International are forecasting increased collaboration between antenna manufacturers and satellite integrators to accelerate the deployment of next-generation nanosatellite networks.

In summary, 2025 will see nanosatellite antenna systems engineering characterized by rapid technological advancement, cross-sector collaboration, and a focus on scalable, high-performance solutions to meet the evolving needs of the global space economy.

Market Size and Forecast (2025–2030): Growth Projections and CAGR Analysis

The nanosatellite antenna systems engineering market is poised for robust growth between 2025 and 2030, driven by the accelerating deployment of nanosatellites for Earth observation, communications, scientific research, and defense applications. As of 2025, the global nanosatellite launch rate continues to rise, with hundreds of new units expected annually, each requiring advanced, miniaturized, and high-performance antenna solutions. The market is characterized by increasing demand for compact, lightweight, and power-efficient antennas capable of supporting high data rates and multi-band operations.

Key industry players such as ISISPACE Group, a leading supplier of nanosatellite components, and GomSpace, a prominent manufacturer of nanosatellite platforms and subsystems, are actively expanding their antenna product portfolios to address evolving mission requirements. EnduroSat is also notable for its modular nanosatellite solutions, including advanced antenna systems tailored for CubeSat and small satellite missions. These companies are investing in research and development to enhance antenna efficiency, deployability, and integration with software-defined radios, reflecting a broader industry trend toward flexible and reconfigurable payloads.

From a quantitative perspective, the nanosatellite antenna systems market is projected to achieve a compound annual growth rate (CAGR) in the range of 18–22% through 2030, according to industry consensus and shipment data from leading manufacturers. This growth is underpinned by the proliferation of commercial satellite constellations, such as those being developed by SpaceX and Planet Labs PBC, which rely on advanced antenna technologies for inter-satellite links and ground communications. The increasing adoption of phased array and deployable antenna architectures is expected to further expand market opportunities, particularly as mission profiles demand higher throughput and more agile beam steering capabilities.

Looking ahead, the market outlook remains positive, with significant investments anticipated in both hardware innovation and manufacturing capacity. The emergence of standardized antenna modules and plug-and-play solutions is likely to reduce integration times and costs, making nanosatellite missions more accessible to new entrants and research institutions. Additionally, regulatory support for small satellite spectrum allocation and the ongoing miniaturization of RF components will continue to drive demand for next-generation nanosatellite antenna systems. As a result, the sector is set to play a pivotal role in the broader expansion of the global space economy over the next five years.

Technology Innovations: Miniaturization, Materials, and Design Advances

The field of nanosatellite antenna systems engineering is undergoing rapid transformation, driven by the demands for higher data rates, multi-band operation, and the extreme constraints of size, weight, and power (SWaP) inherent to CubeSats and other nanosatellites. As of 2025, several technological innovations are converging to redefine the capabilities and deployment of nanosatellite antennas.

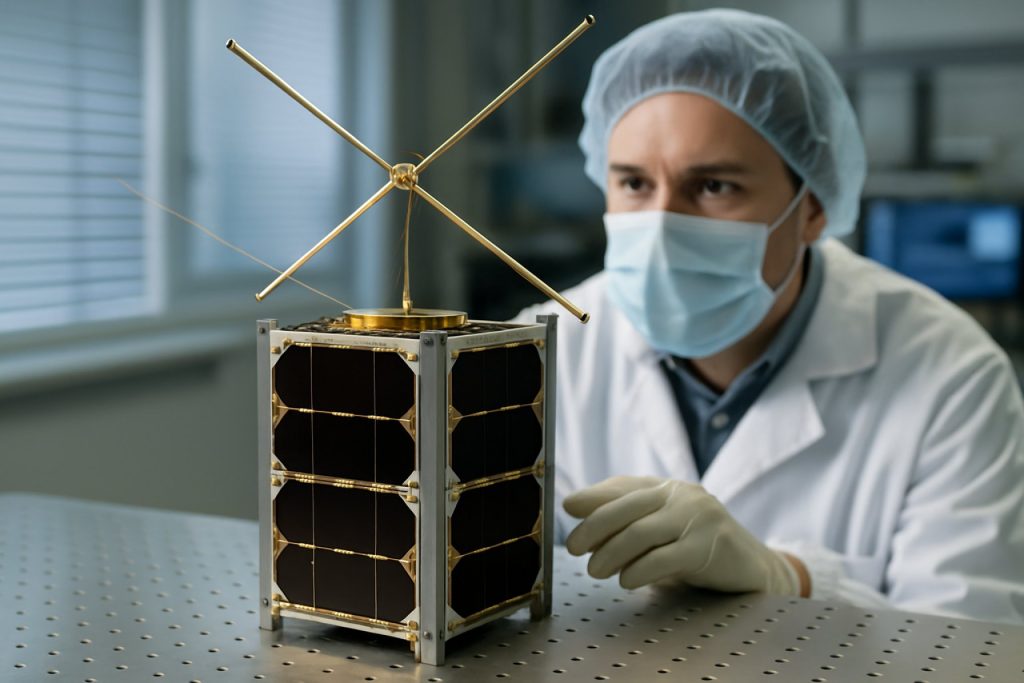

Miniaturization remains a central challenge and focus. Recent advances in microelectromechanical systems (MEMS) and additive manufacturing are enabling the production of antennas with complex geometries and reconfigurable elements, all within the tight form factors required for 1U to 6U CubeSats. Companies such as ISISPACE Group and GomSpace are at the forefront, offering deployable and body-mounted antenna solutions that maximize surface area while minimizing stowage volume. For example, ISISPACE’s deployable UHF and VHF antennas are widely adopted in academic and commercial missions, providing reliable communications in LEO.

Material science is also playing a pivotal role. The adoption of advanced polymers, shape-memory alloys, and flexible substrates is allowing for antennas that can be stowed compactly and deployed reliably in orbit. Astronautical Development, LLC and EnduroSat are notable for integrating such materials into their antenna products, enhancing both durability and performance. These materials are also enabling the development of frequency-agile and multi-band antennas, which are increasingly in demand for missions requiring interoperability across different ground stations and networks.

Design innovations are accelerating, particularly in the realm of phased array and electronically steerable antennas. While traditionally reserved for larger satellites, recent demonstrations by Kymeta Corporation and research collaborations with academic institutions are bringing flat-panel, low-profile phased arrays closer to practical deployment on nanosatellites. These systems promise dynamic beam steering and higher data throughput, critical for real-time Earth observation and IoT constellations.

Looking ahead to the next few years, the integration of artificial intelligence for adaptive beamforming and the use of metamaterials for ultra-compact, high-gain antennas are expected to further push the boundaries. Industry roadmaps from GomSpace and EnduroSat indicate ongoing R&D into modular, software-defined antenna payloads, which will allow future nanosatellites to reconfigure their communications capabilities in orbit, responding to mission needs and spectrum availability.

In summary, the period through 2025 and beyond is set to witness a convergence of miniaturization, advanced materials, and intelligent design, enabling nanosatellite antenna systems to support more ambitious and data-intensive missions than ever before.

Leading Players and Strategic Partnerships (e.g., gomspace.com, isro.gov.in, esa.int)

The nanosatellite antenna systems engineering sector is witnessing rapid evolution, driven by the increasing demand for high-throughput, miniaturized, and reconfigurable communication solutions. As of 2025, several leading organizations and strategic partnerships are shaping the landscape, focusing on both commercial and scientific missions.

Among the most prominent players is GomSpace, a Denmark-based company recognized for its advanced nanosatellite platforms and subsystem engineering. GomSpace has developed a range of deployable and body-mounted antenna solutions tailored for CubeSats and small satellites, supporting UHF, VHF, S-band, and X-band frequencies. Their modular approach enables rapid integration and customization, which has made them a preferred supplier for both governmental and private sector missions. In recent years, GomSpace has entered into strategic collaborations with satellite operators and research institutions to co-develop next-generation phased array antennas, aiming to enhance data rates and enable inter-satellite links.

On the institutional front, the Indian Space Research Organisation (ISRO) continues to advance indigenous nanosatellite technologies, including compact antenna systems for Earth observation and communication. ISRO’s recent launches have demonstrated the use of miniaturized helical and patch antennas, with ongoing research into deployable reflectors and electronically steerable arrays. These efforts are part of India’s broader strategy to expand its small satellite constellation and foster international partnerships for technology exchange.

In Europe, the European Space Agency (ESA) plays a pivotal role in fostering innovation through its ARTES (Advanced Research in Telecommunications Systems) program. ESA has supported the development of flat-panel and metamaterial-based antennas for nanosatellites, collaborating with both established aerospace firms and emerging startups. Notably, ESA’s partnerships with companies such as GomSpace and other European integrators have accelerated the adoption of high-gain, low-profile antennas suitable for large-scale constellations.

Looking ahead, the sector is expected to see intensified collaboration between commercial manufacturers and space agencies, with a focus on standardizing interfaces and improving in-orbit reconfigurability. The integration of AI-driven beamforming and software-defined radio (SDR) technologies is anticipated to further enhance the flexibility and performance of nanosatellite antenna systems. As the market matures, leading players are likely to form new alliances to address emerging challenges such as spectrum congestion, regulatory compliance, and interoperability across multi-orbit networks.

Application Spectrum: Earth Observation, IoT, and Communications

Nanosatellite antenna systems engineering is rapidly evolving to meet the diverse requirements of Earth observation, Internet of Things (IoT), and communications applications. As of 2025, the sector is characterized by a push for higher data rates, miniaturization, and adaptability, driven by the proliferation of nanosatellite constellations and the expanding scope of their missions.

In Earth observation, nanosatellites are increasingly tasked with delivering high-resolution imagery and near-real-time data. This necessitates advanced antenna systems capable of supporting high-frequency bands (such as X-band and Ka-band) for downlinking large volumes of data. Companies like GomSpace and CubeSatShop are actively developing deployable and steerable antenna solutions tailored for small satellite platforms, enabling more efficient data transmission and flexible mission profiles. The integration of phased array antennas, which allow electronic beam steering without mechanical movement, is gaining traction for its ability to enhance link reliability and support dynamic pointing requirements.

For IoT applications, nanosatellites serve as critical nodes in global connectivity networks, particularly in remote or underserved regions. The antenna systems for these missions prioritize omnidirectional coverage and low power consumption to maximize the number of devices that can be serviced per pass. Companies such as SWISSto12 are pioneering additive manufacturing techniques to produce lightweight, high-performance antennas optimized for IoT payloads. The trend toward multi-band and reconfigurable antennas is also evident, as operators seek to support a variety of IoT protocols and frequency allocations within a single platform.

In the communications domain, nanosatellite constellations are being deployed to provide low-latency, global coverage for broadband and narrowband services. The engineering challenge lies in balancing the constraints of limited surface area and power budgets with the need for high-gain, directional antennas. EnduroSat and Astrocast are notable for their modular antenna architectures, which allow for rapid integration and customization based on mission requirements. The adoption of inter-satellite links, leveraging compact directional antennas, is expected to increase, enabling more resilient and scalable network topologies.

Looking ahead to the next few years, the application spectrum for nanosatellite antenna systems is set to broaden further. The convergence of advanced materials, digital beamforming, and AI-driven antenna control will likely yield systems that are more adaptive, efficient, and capable of supporting emerging use cases such as autonomous maritime monitoring and real-time disaster response. As the market matures, collaboration between antenna manufacturers, satellite integrators, and end-users will be crucial in driving innovation and meeting the evolving demands of Earth observation, IoT, and communications from orbit.

Regulatory Landscape and Spectrum Allocation (itu.int, fcc.gov)

The regulatory landscape for nanosatellite antenna systems engineering is rapidly evolving as the proliferation of small satellites intensifies spectrum management challenges. In 2025, the International Telecommunication Union (International Telecommunication Union) remains the primary global authority overseeing spectrum allocation and orbital slot coordination for all satellite classes, including nanosatellites. The ITU’s Radio Regulations, updated at the World Radiocommunication Conference 2023 (WRC-23), introduced new provisions to streamline filings for non-geostationary (NGSO) small satellite networks, aiming to reduce regulatory bottlenecks and clarify requirements for frequency coordination and notification.

National regulators, such as the United States Federal Communications Commission (Federal Communications Commission), have also updated their frameworks to address the unique operational profiles of nanosatellites. The FCC’s streamlined licensing process for small satellites, first introduced in 2019, continues to be refined in 2025 to accommodate increasing launch rates and the growing diversity of missions. The FCC’s rules specify technical and operational requirements for antenna systems, including power flux density limits, out-of-band emissions, and interference mitigation protocols, particularly in the UHF, S-band, and X-band frequencies commonly used by nanosatellites.

Antenna system engineers must navigate these regulatory requirements from the earliest design stages. For instance, the ITU mandates that all nanosatellite operators submit advance publication information (API) and coordinate with existing users to prevent harmful interference. This process directly impacts antenna design, as engineers must ensure that their systems can operate within the assigned frequency bands and comply with emission masks and polarization requirements. The increasing use of deployable and steerable antennas in nanosatellites, which can dynamically adjust beam patterns and frequencies, adds complexity to regulatory compliance, necessitating robust simulation and documentation during the licensing process.

Looking ahead, the regulatory outlook for nanosatellite antenna systems is expected to become more nuanced. The ITU is considering further simplification of procedures for short-duration missions and constellations, while national authorities like the FCC are exploring spectrum sharing frameworks and dynamic allocation models to maximize spectrum efficiency. These developments will require antenna engineers to adopt more agile and adaptive design strategies, leveraging software-defined radios and reconfigurable antenna architectures to meet evolving regulatory and operational demands. Close collaboration between industry, regulators, and standards bodies will be essential to ensure that nanosatellite missions can scale sustainably without compromising spectrum integrity or safety.

Manufacturing Ecosystem: Supply Chain, Integration, and Testing

The manufacturing ecosystem for nanosatellite antenna systems is rapidly evolving in 2025, driven by the increasing demand for small satellite constellations and the need for high-performance, miniaturized communication solutions. The supply chain for these systems is characterized by a mix of established aerospace suppliers and a growing number of specialized startups, each contributing to the design, fabrication, and integration of advanced antenna technologies.

Key players in the supply chain include component manufacturers specializing in radio frequency (RF) materials, microelectromechanical systems (MEMS), and deployable structures. Companies such as ISISPACE Group and GomSpace are recognized for providing off-the-shelf and custom antenna solutions tailored for nanosatellite platforms. These firms offer a range of products, from simple monopole and dipole antennas to more complex patch and helical designs, supporting various frequency bands including UHF, S-band, and X-band.

Integration of antenna systems into nanosatellites requires close collaboration between antenna designers, satellite bus manufacturers, and systems integrators. The process involves not only mechanical and electrical integration but also electromagnetic compatibility (EMC) testing to ensure optimal performance in the constrained environment of a nanosatellite. Companies like Tyvak International (now part of Terran Orbital) and Northrop Grumman have developed streamlined integration workflows, leveraging modular architectures and standardized interfaces to accelerate assembly and reduce lead times.

Testing is a critical phase in the manufacturing ecosystem, encompassing both ground-based and in-orbit validation. Facilities equipped with anechoic chambers and near-field measurement systems are essential for characterizing antenna radiation patterns, gain, and polarization. Airbus Defence and Space and Lockheed Martin maintain advanced test facilities that support not only their own nanosatellite programs but also offer services to third-party developers. Environmental testing, including vibration, thermal cycling, and vacuum exposure, is conducted to ensure antenna reliability under launch and space conditions.

Looking ahead, the supply chain is expected to become more resilient and responsive, with increased adoption of additive manufacturing and advanced materials to enable rapid prototyping and customization. The integration of electronically steerable antennas and phased array technologies is anticipated to become more prevalent, driven by the need for higher data rates and flexible mission profiles. As the nanosatellite market continues to expand, collaboration between established aerospace firms and agile new entrants will be crucial in meeting the evolving demands of satellite operators and ensuring the reliability and performance of antenna systems in orbit.

Challenges: Power, Bandwidth, and Environmental Constraints

Nanosatellite antenna systems engineering in 2025 faces a complex set of challenges, primarily centered on power limitations, bandwidth constraints, and the harsh environmental conditions of space. As the demand for high-data-rate communications and real-time Earth observation grows, these challenges are becoming more acute, driving innovation and collaboration across the industry.

Power remains a critical bottleneck for nanosatellite antennas. The limited surface area available for solar panels on CubeSats and other nanosatellites restricts the energy budget, directly impacting the transmission power and, consequently, the achievable data rates. Leading manufacturers such as ISISPACE Group and GomSpace are actively developing ultra-low-power transceivers and deployable antenna systems to maximize efficiency within these constraints. Recent missions have demonstrated the use of high-efficiency, deployable antennas that can be stowed during launch and extended in orbit, optimizing both power usage and antenna gain.

Bandwidth allocation is another significant challenge. The proliferation of nanosatellites has led to increased competition for limited radio frequency spectrum, particularly in the UHF, S-band, and X-band ranges commonly used for small satellite communications. Regulatory bodies such as the International Telecommunication Union are working to manage spectrum congestion, but the rapid pace of satellite deployments is outstripping regulatory adaptation. Companies like EnduroSat are responding by developing software-defined radios (SDRs) and adaptive modulation schemes, allowing satellites to dynamically adjust their communication parameters to optimize bandwidth usage and mitigate interference.

Environmental constraints in low Earth orbit (LEO) further complicate antenna system design. Nanosatellites must withstand extreme temperature fluctuations, radiation, and the risk of micrometeoroid impacts, all while maintaining precise pointing and reliable deployment mechanisms. Materials innovation is a key area of focus, with firms such as Tyvak Nanosatellite Systems and Planet Labs PBC investing in robust, lightweight composites and advanced thermal management solutions. The trend toward modular, standardized antenna components is also gaining momentum, enabling faster integration and improved reliability across diverse mission profiles.

Looking ahead, the next few years are expected to see continued advancements in miniaturized, high-gain antenna technologies, as well as increased adoption of inter-satellite links to offload bandwidth and reduce reliance on ground stations. However, the fundamental challenges of power, bandwidth, and environmental resilience will remain central to nanosatellite antenna systems engineering, shaping both technological development and regulatory policy through 2025 and beyond.

Investment, Funding, and M&A Activity in Nanosatellite Antenna Systems

The nanosatellite sector, particularly in antenna systems engineering, is experiencing robust investment and consolidation as commercial and governmental demand for small satellite communications accelerates into 2025. Venture capital, strategic corporate investment, and government-backed funding are converging to support innovation in deployable, high-gain, and phased array antenna technologies tailored for nanosatellites.

Key players such as ISISPACE Group (Netherlands), a leading supplier of nanosatellite components and turnkey solutions, have attracted both public and private investment to expand their antenna product lines and manufacturing capabilities. Similarly, GomSpace (Denmark), recognized for its advanced nanosatellite platforms and communication subsystems, continues to secure funding through equity offerings and strategic partnerships, enabling R&D in miniaturized, high-performance antenna systems.

In the United States, Planet Labs PBC—a major operator of nanosatellite constellations—has invested in proprietary antenna technologies to enhance data downlink rates and global coverage. The company’s ongoing capital raises and public market presence (NYSE: PL) have provided resources for both internal development and targeted acquisitions of antenna technology startups.

Mergers and acquisitions are shaping the competitive landscape. For example, Terran Orbital Corporation has pursued a strategy of acquiring subsystem manufacturers, including those specializing in deployable antennas, to vertically integrate its supply chain and accelerate time-to-market for advanced nanosatellite communications solutions. This trend is mirrored by Satellogic, which has expanded its in-house engineering capabilities through acquisition and partnership, focusing on scalable antenna architectures for Earth observation missions.

Governmental and defense-related funding remains a significant driver. Agencies such as NASA and the European Space Agency (ESA) have awarded contracts and grants to companies like Tyvak International (a subsidiary of Terran Orbital) and GomSpace for the development of next-generation nanosatellite antennas supporting deep space and inter-satellite communications.

Looking ahead, the outlook for 2025 and beyond suggests continued growth in investment and M&A activity, as the demand for high-throughput, low-latency nanosatellite communications intensifies. The emergence of new entrants, alongside established players, is expected to drive further innovation in antenna miniaturization, beam steering, and multi-band operation, supported by a dynamic funding environment and increasing commercial adoption.

Future Outlook: Disruptive Technologies and Long-Term Opportunities

The future of nanosatellite antenna systems engineering is poised for significant transformation as disruptive technologies mature and new market opportunities emerge through 2025 and beyond. The rapid miniaturization of components, advances in materials science, and the integration of artificial intelligence (AI) are converging to redefine the capabilities and applications of nanosatellite antennas.

One of the most promising developments is the adoption of electronically steerable antennas (ESAs), such as phased array systems, which enable dynamic beam steering without mechanical movement. These antennas are becoming increasingly viable for nanosatellites due to ongoing reductions in power consumption and form factor. Companies like Kymeta Corporation and European Space Agency are actively developing and testing flat-panel and phased array antennas suitable for small satellite platforms, aiming to enhance data throughput and enable real-time reconfiguration for diverse mission profiles.

Material innovation is another key driver. The use of metamaterials and advanced composites is expected to yield antennas with higher efficiency, broader bandwidth, and improved radiation patterns, all within the strict mass and volume constraints of nanosatellites. Organizations such as CubeSatShop and GomSpace are already offering deployable and high-gain antenna solutions, and are investing in next-generation materials to further push the boundaries of performance.

The integration of AI and machine learning into antenna systems is anticipated to revolutionize in-orbit operations. Smart antennas capable of autonomously optimizing their orientation, frequency, and polarization in response to environmental conditions and mission requirements are under development. This trend is supported by the increasing onboard processing power available in nanosatellites, as seen in recent missions by Tyvak Nanosatellite Systems and Northrop Grumman, which are exploring adaptive communication architectures.

Looking ahead, the proliferation of large nanosatellite constellations for Earth observation, IoT, and global communications will drive demand for scalable, cost-effective, and high-performance antenna systems. The anticipated deployment of 5G and 6G non-terrestrial networks will further accelerate innovation, with industry leaders such as Airbus and Satellogic investing in research to ensure compatibility and interoperability with terrestrial infrastructure.

In summary, the next few years will see nanosatellite antenna systems engineering shaped by disruptive advances in electronic beamforming, materials, and intelligent control, opening new frontiers for commercial, scientific, and defense applications worldwide.

Sources & References

- ISISPACE Group

- GomSpace

- Tecnavia

- EnduroSat

- Space & Satellite Professionals International

- Planet Labs PBC

- GomSpace

- European Space Agency (ESA)

- International Telecommunication Union

- Northrop Grumman

- Airbus Defence and Space

- Lockheed Martin

- Terran Orbital Corporation

- Satellogic

- European Space Agency