Unlocking the Future of Brainwave Insights: Magnetoencephalography Signal Analysis Software Development in 2025 and Beyond. Explore Market Growth, Technological Breakthroughs, and Strategic Opportunities in a Rapidly Evolving Sector.

- Executive Summary: Key Findings and 2025 Highlights

- Market Overview: Defining the Magnetoencephalography Signal Analysis Software Sector

- Current Market Size and 2025–2030 Growth Forecast (CAGR: 11.2%)

- Competitive Landscape: Leading Players and Emerging Innovators

- Technological Advancements: AI, Cloud Integration, and Real-Time Analytics

- Regulatory Environment and Compliance Trends

- End-User Segmentation: Research, Clinical, and Commercial Applications

- Regional Analysis: North America, Europe, Asia-Pacific, and Emerging Markets

- Investment Trends and Funding Landscape

- Challenges and Barriers to Adoption

- Future Outlook: Disruptive Technologies and Market Opportunities Through 2030

- Strategic Recommendations for Stakeholders

- Sources & References

Executive Summary: Key Findings and 2025 Highlights

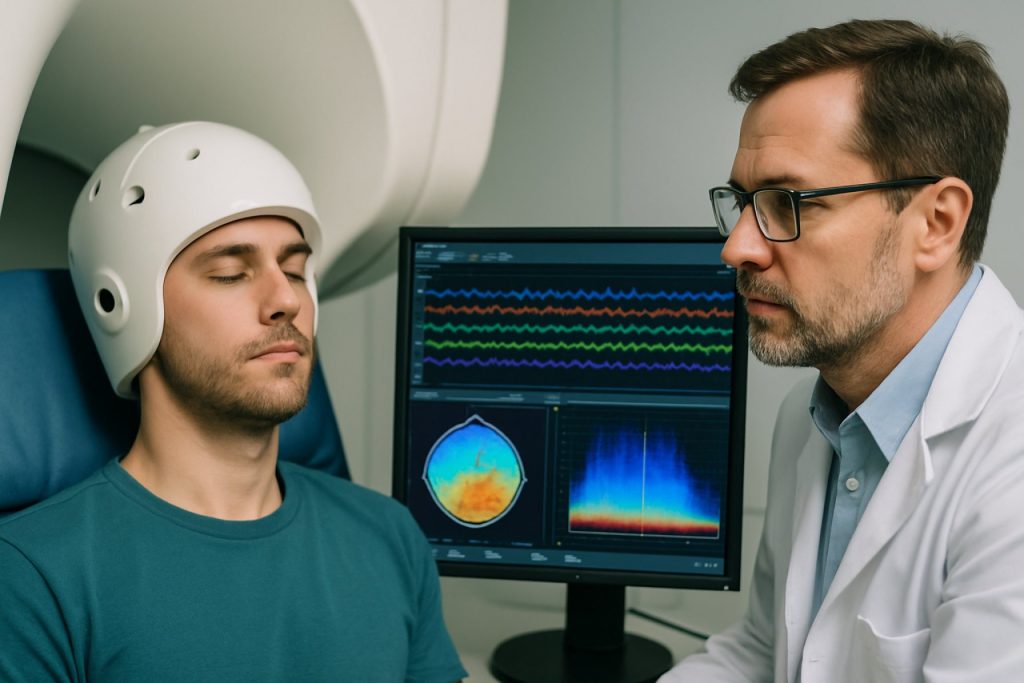

The landscape of magnetoencephalography (MEG) signal analysis software is rapidly evolving, driven by advances in neuroimaging technology, computational neuroscience, and the growing demand for non-invasive brain mapping solutions. In 2025, the development of MEG signal analysis software is characterized by several key trends and findings that are shaping both research and clinical applications.

A primary highlight is the integration of artificial intelligence (AI) and machine learning algorithms into MEG analysis pipelines. These technologies are enabling more accurate and automated detection of neural patterns, artifact removal, and source localization, significantly reducing manual intervention and analysis time. Leading neurotechnology companies and research institutions, such as Elekta AB and MEGIN Oy, are at the forefront of incorporating AI-driven modules into their software suites, enhancing both usability and diagnostic precision.

Another significant development is the move toward open-source and interoperable software platforms. Initiatives like MNE-Python and FieldTrip are fostering collaborative development and standardization, allowing researchers to customize analysis workflows and ensure reproducibility across studies. This trend is further supported by the adoption of standardized data formats, such as the Brain Imaging Data Structure (BIDS), which streamlines data sharing and multi-center collaborations.

Cloud-based processing and high-performance computing are also gaining traction, enabling the handling of large-scale MEG datasets and facilitating real-time analysis. Companies like Brain Products GmbH are investing in scalable infrastructure to support remote data processing and secure storage, addressing the growing need for accessibility and data security in clinical environments.

In summary, the 2025 MEG signal analysis software market is marked by the convergence of AI, open-source collaboration, and cloud computing. These advancements are accelerating the translation of MEG research into clinical practice, improving the accuracy of neurological diagnostics, and expanding the accessibility of advanced neuroimaging tools worldwide.

Market Overview: Defining the Magnetoencephalography Signal Analysis Software Sector

The magnetoencephalography (MEG) signal analysis software sector is a specialized segment within the broader neurotechnology and medical imaging software market. MEG is a non-invasive technique that measures the magnetic fields produced by neuronal activity in the brain, offering millisecond temporal resolution and high spatial accuracy. The development of MEG signal analysis software is crucial for translating raw MEG data into meaningful insights for clinical diagnostics, cognitive neuroscience research, and brain-computer interface applications.

In 2025, the MEG signal analysis software market is characterized by a combination of established neuroimaging software providers and emerging technology firms. Key players such as Elekta AB and MEGIN Oy (formerly Elekta Oy) continue to drive innovation by integrating advanced algorithms for source localization, artifact rejection, and connectivity analysis. These solutions are increasingly leveraging machine learning and artificial intelligence to enhance the accuracy and automation of MEG data interpretation.

The sector is also shaped by the growing adoption of open-source platforms and collaborative projects, such as MNE-Python, which provide researchers with flexible, customizable tools for MEG data processing. This trend supports interoperability and reproducibility in scientific research, while also lowering barriers to entry for new users and institutions.

Regulatory compliance and data security are significant considerations in the development and deployment of MEG signal analysis software, particularly as these tools are increasingly used in clinical environments. Developers must adhere to standards set by organizations such as the U.S. Food and Drug Administration (FDA) and the European Commission for medical device software.

Market growth is further propelled by the expanding clinical applications of MEG, including epilepsy surgery planning, functional brain mapping, and neurodevelopmental disorder assessment. As healthcare providers and research institutions invest in advanced neuroimaging infrastructure, demand for robust, user-friendly MEG signal analysis software is expected to rise. The sector’s evolution is also influenced by ongoing collaborations between academic institutions, healthcare providers, and industry leaders, fostering innovation and the translation of research breakthroughs into commercial solutions.

Current Market Size and 2025–2030 Growth Forecast (CAGR: 11.2%)

The global market for magnetoencephalography (MEG) signal analysis software is experiencing robust growth, driven by increasing adoption of MEG technology in neuroscience research, clinical diagnostics, and brain-computer interface development. As of 2025, the market size for MEG signal analysis software is estimated to be approximately USD 120 million, reflecting a steady rise in demand from academic institutions, hospitals, and research centers worldwide. This growth is underpinned by the expanding use of MEG for non-invasive mapping of brain activity, particularly in the diagnosis and treatment planning for neurological disorders such as epilepsy and brain tumors.

Key players in the MEG signal analysis software market include Elekta AB, which offers the Neuromag software suite, and MEGIN Oy, a pioneer in MEG technology. These companies, along with emerging software developers, are investing in advanced algorithms for artifact removal, source localization, and connectivity analysis, enhancing the clinical and research utility of MEG data. The integration of artificial intelligence and machine learning into MEG analysis platforms is also accelerating, enabling more accurate and automated interpretation of complex brain signals.

From 2025 to 2030, the MEG signal analysis software market is projected to grow at a compound annual growth rate (CAGR) of 11.2%. This expansion is fueled by several factors: increasing prevalence of neurological disorders, rising investments in brain research initiatives, and the growing availability of high-performance computing resources for large-scale data analysis. Additionally, collaborations between software developers and hardware manufacturers are streamlining the compatibility and interoperability of MEG systems, further broadening the market’s reach.

Geographically, North America and Europe are expected to maintain their dominance due to strong research infrastructure and funding, while Asia-Pacific is anticipated to witness the fastest growth, supported by expanding healthcare investments and the establishment of new neuroscience research centers. Regulatory support and standardization efforts by organizations such as the International Society for Magnetic Resonance in Medicine are also contributing to market maturation and user confidence.

In summary, the MEG signal analysis software market is on a trajectory of significant expansion, with technological innovation and cross-sector collaboration poised to drive adoption and unlock new applications in both clinical and research domains through 2030.

Competitive Landscape: Leading Players and Emerging Innovators

The competitive landscape of magnetoencephalography (MEG) signal analysis software development in 2025 is characterized by a dynamic interplay between established industry leaders and a growing cohort of innovative startups. The field is driven by the increasing demand for advanced neuroimaging tools in both clinical and research settings, with a focus on improving the accuracy, speed, and usability of MEG data interpretation.

Among the leading players, Elekta AB continues to maintain a strong presence with its Neuromag software suite, which is widely adopted in hospitals and research institutions for its robust preprocessing, source localization, and connectivity analysis capabilities. MEGIN Oy, a subsidiary of Elekta, also plays a pivotal role, offering integrated hardware-software solutions that streamline the MEG workflow from data acquisition to advanced analytics.

Academic and open-source initiatives remain influential, with the MNE-Python project standing out as a widely used, community-driven platform for MEG and EEG data analysis. Its modular architecture and active development community have made it a preferred choice for researchers seeking flexibility and transparency in their analytical pipelines. Similarly, FieldTrip, developed at Radboud University, continues to be a cornerstone for advanced signal processing and statistical analysis in the MEG community.

Emerging innovators are leveraging artificial intelligence and cloud computing to address longstanding challenges in MEG signal analysis. Startups such as Neuroelectrics are integrating machine learning algorithms to enhance artifact rejection and automate source reconstruction, while companies like Brain Products GmbH are developing cloud-based platforms that facilitate collaborative research and remote data processing.

Strategic partnerships between software developers, hardware manufacturers, and clinical institutions are accelerating the translation of novel algorithms into user-friendly applications. The trend toward interoperability and standardized data formats, championed by organizations such as the Human Brain Project, is further shaping the competitive landscape by enabling seamless integration of diverse analytical tools.

In summary, the MEG signal analysis software market in 2025 is marked by robust competition, rapid technological innovation, and a collaborative ethos that is driving the field toward greater accessibility, precision, and clinical relevance.

Technological Advancements: AI, Cloud Integration, and Real-Time Analytics

The development of magnetoencephalography (MEG) signal analysis software has accelerated rapidly in 2025, driven by the integration of artificial intelligence (AI), cloud computing, and real-time analytics. These technological advancements are transforming how researchers and clinicians process, interpret, and utilize MEG data, which is crucial for understanding brain function and diagnosing neurological disorders.

AI-powered algorithms, particularly those based on deep learning, are now routinely embedded in MEG analysis pipelines. These models excel at denoising raw MEG signals, identifying subtle patterns, and automating artifact rejection, which traditionally required significant manual intervention. For example, convolutional neural networks can distinguish between neural activity and external noise, improving the reliability of source localization and connectivity analyses. This automation not only enhances accuracy but also reduces the time required for data processing, making MEG more accessible for clinical applications.

Cloud integration has further revolutionized MEG signal analysis by enabling scalable, collaborative, and secure data processing. Leading MEG software platforms now offer cloud-based solutions that allow users to upload raw data, run complex analyses, and share results with collaborators worldwide. This approach eliminates the need for high-performance local hardware and facilitates compliance with data privacy regulations through robust encryption and access controls. Organizations such as Elekta AB and MEGIN Oy have introduced cloud-enabled MEG analysis suites, supporting multi-center studies and large-scale data aggregation.

Real-time analytics represent another significant leap forward. Modern MEG systems, paired with advanced software, can now process and visualize brain activity in near real-time. This capability is particularly valuable for intraoperative monitoring, neurofeedback, and brain-computer interface (BCI) research. Real-time feedback enables clinicians to make immediate decisions during surgical procedures and supports adaptive experimental paradigms in cognitive neuroscience. The integration of real-time analytics is supported by optimized data pipelines and low-latency cloud infrastructure, as seen in offerings from Elekta AB and MEGIN Oy.

In summary, the convergence of AI, cloud integration, and real-time analytics is reshaping MEG signal analysis software development in 2025. These advancements are enhancing the precision, scalability, and clinical utility of MEG, paving the way for broader adoption and new research frontiers.

Regulatory Environment and Compliance Trends

The regulatory environment for magnetoencephalography (MEG) signal analysis software is evolving rapidly as the technology becomes more integral to clinical diagnostics and neuroscience research. In 2025, developers face a landscape shaped by increasing scrutiny from regulatory bodies, heightened expectations for data security, and the growing influence of international standards. Regulatory agencies such as the U.S. Food and Drug Administration and the European Commission (under the Medical Device Regulation, MDR) classify MEG analysis software as a medical device when used for clinical purposes, subjecting it to rigorous premarket review and post-market surveillance requirements.

A key compliance trend is the emphasis on software as a medical device (SaMD) frameworks, which require developers to demonstrate robust clinical validation, risk management, and cybersecurity measures. The FDA’s Digital Health Center of Excellence and the International Medical Device Regulators Forum (IMDRF) have published guidance documents outlining expectations for SaMD, including lifecycle management, transparency in algorithm development, and real-world performance monitoring.

Interoperability and data privacy are also central to compliance. MEG software must often integrate with hospital information systems and electronic health records, necessitating adherence to standards such as HL7 and ISO/IEC 27001 for information security. In the European Union, the General Data Protection Regulation (GDPR) imposes strict requirements on the handling of patient data, influencing software architecture and data management practices.

Looking ahead, regulatory bodies are increasingly focusing on artificial intelligence and machine learning components within MEG analysis tools. The FDA and the European Commission are developing frameworks for the oversight of adaptive algorithms, requiring transparency, explainability, and continuous performance assessment. Developers must stay abreast of these evolving requirements to ensure compliance and maintain market access.

End-User Segmentation: Research, Clinical, and Commercial Applications

End-user segmentation is a critical consideration in the development of magnetoencephalography (MEG) signal analysis software, as the requirements and expectations of research, clinical, and commercial users differ significantly. Each segment drives unique software features, compliance standards, and integration needs, shaping the evolution of MEG analysis tools.

In the research sector, end-users are typically academic institutions, neuroscience laboratories, and research hospitals. These users prioritize flexibility, advanced analytical capabilities, and open-source compatibility. They often require customizable pipelines for preprocessing, source localization, and connectivity analysis, as well as support for scripting languages like Python and MATLAB. Leading research-focused software, such as those developed by Athinoula A. Martinos Center for Biomedical Imaging and MRC Cognition and Brain Sciences Unit, emphasize modularity and interoperability with other neuroimaging tools.

For clinical applications, the focus shifts to reliability, regulatory compliance, and user-friendly interfaces. Hospitals and medical centers require MEG analysis software that adheres to standards set by regulatory bodies such as the FDA and CE, ensuring patient safety and data integrity. Clinical users often need streamlined workflows for epilepsy localization, pre-surgical mapping, and integration with electronic health records. Companies like Elekta AB and Cortech Solutions, Inc. provide FDA-cleared MEG software platforms tailored for clinical diagnostics, emphasizing automation, reproducibility, and robust technical support.

The commercial segment encompasses companies developing brain-computer interfaces, neurotechnology startups, and pharmaceutical firms leveraging MEG for product development or cognitive assessment. These users demand scalable, secure, and often cloud-based solutions that can handle large datasets and integrate with proprietary hardware or analytics platforms. Commercial software providers, such as MEGIN Oy, focus on delivering turnkey solutions with APIs for integration, data privacy features, and support for real-time processing.

Understanding these distinct end-user needs is essential for MEG signal analysis software developers. Tailoring features, compliance, and support to each segment not only enhances user satisfaction but also drives innovation and adoption across the research, clinical, and commercial landscapes.

Regional Analysis: North America, Europe, Asia-Pacific, and Emerging Markets

The development of magnetoencephalography (MEG) signal analysis software is experiencing significant regional variation, shaped by research priorities, healthcare infrastructure, and investment in neurotechnology. In North America, particularly the United States and Canada, robust funding from agencies such as the National Institutes of Health and collaborations with leading academic centers have fostered a dynamic ecosystem for MEG software innovation. Companies and research institutions focus on advanced machine learning algorithms, real-time data processing, and integration with multimodal imaging, reflecting the region’s emphasis on translational neuroscience and clinical applications.

In Europe, the landscape is characterized by strong cross-border collaborations and adherence to stringent data privacy regulations. Initiatives supported by the European Commission and national research councils have led to the development of open-source MEG analysis platforms, such as those promoted by the Human Brain Project. European developers prioritize interoperability, reproducibility, and compliance with the General Data Protection Regulation (GDPR), which influences software architecture and data management strategies.

The Asia-Pacific region, led by Japan, China, and South Korea, is rapidly expanding its MEG capabilities. Government-backed initiatives, such as those from the Japan Science and Technology Agency and the National Medical Products Administration in China, are driving investment in both hardware and software. The focus here is on scalable, cost-effective solutions and the adaptation of MEG analysis tools for large-scale population studies, reflecting the region’s growing interest in brain health and neurodevelopmental research.

Emerging markets in Latin America, the Middle East, and parts of Eastern Europe are at an earlier stage of MEG software adoption. However, increasing collaborations with global research consortia and support from organizations like the World Health Organization are facilitating technology transfer and capacity building. These regions often prioritize affordable, user-friendly software solutions that can be integrated into resource-limited clinical and research settings.

Overall, regional differences in MEG signal analysis software development are shaped by local research agendas, regulatory environments, and access to funding, resulting in a diverse and evolving global market.

Investment Trends and Funding Landscape

The investment landscape for magnetoencephalography (MEG) signal analysis software development in 2025 is shaped by a convergence of technological innovation, growing clinical adoption, and increased interest from both public and private sectors. MEG, a non-invasive neuroimaging technique, requires sophisticated software for data acquisition, preprocessing, and advanced analytics, driving demand for robust, user-friendly solutions. In recent years, funding has flowed from a mix of government grants, venture capital, and strategic partnerships, reflecting the sector’s interdisciplinary nature.

Major research funding agencies, such as the National Institutes of Health and the European Commission, continue to support MEG software projects, particularly those with translational potential in neurology and psychiatry. These grants often target open-source tool development and integration with other neuroimaging modalities, fostering collaboration between academic institutions and industry. For example, the Human Brain Project has provided significant resources for the development of interoperable neuroinformatics platforms, including MEG analysis tools.

On the private side, venture capital investment is increasingly directed toward startups leveraging artificial intelligence and machine learning to enhance MEG data interpretation. Companies such as Cognionics, Inc. and MEGIN Oy have attracted funding rounds aimed at expanding their software capabilities and integrating cloud-based analytics. Strategic investments from established medical device manufacturers, including Siemens Healthineers and GE HealthCare, are also notable, as these firms seek to broaden their neuroimaging portfolios through partnerships or acquisitions.

The funding environment is further buoyed by the increasing recognition of MEG’s clinical value, particularly in pre-surgical mapping for epilepsy and brain tumor patients. This clinical momentum has encouraged hospital systems and research centers to allocate internal funds for software upgrades and custom tool development, often in collaboration with software vendors or academic spin-offs.

Looking ahead to 2025, the MEG signal analysis software sector is expected to see continued diversification of funding sources, with a growing emphasis on interoperability, regulatory compliance, and real-time analytics. The interplay between public research initiatives and private investment will likely accelerate innovation, supporting the translation of advanced MEG analytics from research settings into routine clinical practice.

Challenges and Barriers to Adoption

The development and adoption of magnetoencephalography (MEG) signal analysis software face several significant challenges and barriers, despite the technology’s promise for non-invasive brain mapping and clinical diagnostics. One of the primary obstacles is the complexity and variability of MEG data itself. MEG signals are highly sensitive to noise and artifacts, requiring sophisticated algorithms for preprocessing, source localization, and statistical analysis. Developing robust software that can handle these challenges across diverse datasets and hardware platforms remains a technical hurdle.

Interoperability is another major barrier. MEG systems are produced by different manufacturers, each with proprietary data formats and acquisition protocols. This lack of standardization complicates the development of universal analysis tools and often necessitates custom solutions for each system. Efforts by organizations such as the MEGIN and Elekta AB to provide software development kits and open data formats have helped, but full interoperability is still lacking.

Regulatory and clinical validation requirements also slow the adoption of new MEG analysis software. For clinical use, software must comply with stringent medical device regulations, such as those enforced by the U.S. Food and Drug Administration (FDA) and the European Commission. Achieving certification demands extensive testing, documentation, and often costly clinical trials, which can be prohibitive for smaller developers and research groups.

Another challenge is the steep learning curve associated with MEG data analysis. Advanced software tools often require specialized knowledge in signal processing, neuroanatomy, and statistics. This limits their accessibility to a broader user base, including clinicians and researchers without extensive technical backgrounds. Initiatives by academic consortia, such as the Human Connectome Project, to provide open-source tools and training resources are helping to address this gap, but widespread adoption remains a work in progress.

Finally, funding and resource constraints can impede both the development and implementation of MEG analysis software. High costs associated with MEG hardware, software licensing, and ongoing support can be prohibitive, particularly for smaller institutions and those in low-resource settings. Overcoming these barriers will require continued collaboration between industry, academia, and regulatory bodies to promote standardization, validation, and accessibility in MEG signal analysis software.

Future Outlook: Disruptive Technologies and Market Opportunities Through 2030

The future of magnetoencephalography (MEG) signal analysis software development is poised for significant transformation through 2030, driven by disruptive technologies and expanding market opportunities. As MEG systems become more accessible and advanced, the demand for sophisticated software capable of handling large-scale, high-resolution neural data is accelerating. Key technological trends shaping this landscape include the integration of artificial intelligence (AI) and machine learning (ML) algorithms, cloud-based processing, and real-time data analytics.

AI and ML are expected to revolutionize MEG signal analysis by enabling automated artifact detection, source localization, and pattern recognition in complex brain signals. These technologies can enhance the accuracy and speed of data interpretation, supporting both clinical diagnostics and neuroscience research. Leading manufacturers such as Elekta AB and Cortech Solutions, Inc. are already exploring AI-driven modules within their software suites, aiming to streamline workflows and reduce the expertise barrier for end-users.

Cloud computing is another disruptive force, offering scalable storage and computational resources for MEG data analysis. Cloud-based platforms facilitate collaborative research, remote diagnostics, and integration with other neuroimaging modalities. Organizations like Megin Oy are developing cloud-enabled solutions that allow users to process and share MEG datasets securely, fostering global research networks and multi-center studies.

The convergence of MEG with other neuroimaging techniques, such as MRI and EEG, is opening new market opportunities for multimodal analysis software. This integration enables more comprehensive brain mapping and supports personalized medicine approaches in neurology and psychiatry. Software developers are increasingly focusing on interoperability and standardized data formats, as promoted by industry bodies like the Organization for Human Brain Mapping.

By 2030, the MEG signal analysis software market is expected to benefit from regulatory advancements, increased investment in brain health, and the proliferation of portable MEG devices. These trends will likely lower adoption barriers in clinical and research settings, expanding the user base beyond specialized academic centers. Companies that prioritize user-friendly interfaces, robust data security, and continuous innovation will be well-positioned to capture emerging opportunities in this dynamic field.

Strategic Recommendations for Stakeholders

The development of magnetoencephalography (MEG) signal analysis software is a rapidly evolving field, driven by advances in neuroscience, machine learning, and hardware capabilities. For stakeholders—including software developers, research institutions, medical device manufacturers, and clinical end-users—strategic planning is essential to ensure competitiveness and relevance in 2025 and beyond.

- Prioritize Interoperability and Open Standards: Stakeholders should focus on developing software that adheres to open data formats and interfaces, such as the Brain Imaging Data Structure (BIDS) for MEG. This facilitates data sharing, reproducibility, and integration with other neuroimaging modalities. Collaboration with organizations like the Human Brain Project and National Institute of Mental Health can help align with emerging standards.

- Invest in Advanced Analytics and AI Integration: Incorporating machine learning and deep learning algorithms can enhance artifact removal, source localization, and pattern recognition in MEG data. Partnerships with AI research groups and leveraging open-source frameworks, such as those promoted by the MNE-Python community, can accelerate innovation.

- Enhance User Experience and Accessibility: User-friendly interfaces and comprehensive documentation are critical for adoption by clinicians and researchers. Stakeholders should conduct user-centered design studies and provide extensive training resources, as exemplified by Elekta AB and MEGIN Oy, leading MEG hardware and software providers.

- Ensure Regulatory Compliance and Data Security: As MEG applications expand into clinical diagnostics, compliance with medical device regulations (e.g., FDA, CE marking) and robust data privacy measures are paramount. Engaging with regulatory bodies and adopting best practices from organizations like the U.S. Food and Drug Administration will help streamline approval processes.

- Foster Multidisciplinary Collaboration: Successful MEG software development requires input from neuroscientists, engineers, clinicians, and data scientists. Stakeholders should establish consortia or participate in initiatives such as the Human Connectome Project to drive innovation and address complex challenges.

By implementing these strategic recommendations, stakeholders can position themselves at the forefront of MEG signal analysis software development, ensuring both scientific impact and commercial viability in 2025.

Sources & References

- Elekta AB

- MEGIN Oy

- MNE-Python

- FieldTrip

- Brain Products GmbH

- European Commission

- International Society for Magnetic Resonance in Medicine

- Neuroelectrics

- Human Brain Project

- International Medical Device Regulators Forum

- ISO/IEC 27001

- Athinoula A. Martinos Center for Biomedical Imaging

- MRC Cognition and Brain Sciences Unit

- Cortech Solutions, Inc.

- National Institutes of Health

- Japan Science and Technology Agency

- National Medical Products Administration

- World Health Organization

- Siemens Healthineers

- GE HealthCare

- Human Connectome Project

- Organization for Human Brain Mapping

- National Institute of Mental Health

- MNE-Python