Table of Contents

- Executive Summary: Key Findings & 2025 Highlights

- Market Size & Growth Forecast Through 2030

- Technology Overview: Principles of Lenticular Enamel Microscopy

- Major Industry Players & Recent Innovations

- Emerging Applications in Dentistry and Biomaterials

- Integration with Digital Dentistry and Imaging Platforms

- Key Regulatory and Certification Developments

- Investment Trends and Funding Landscape

- Competitive Landscape and Strategic Partnerships

- Future Outlook: Disruptive Trends and Strategic Recommendations

- Sources & References

Executive Summary: Key Findings & 2025 Highlights

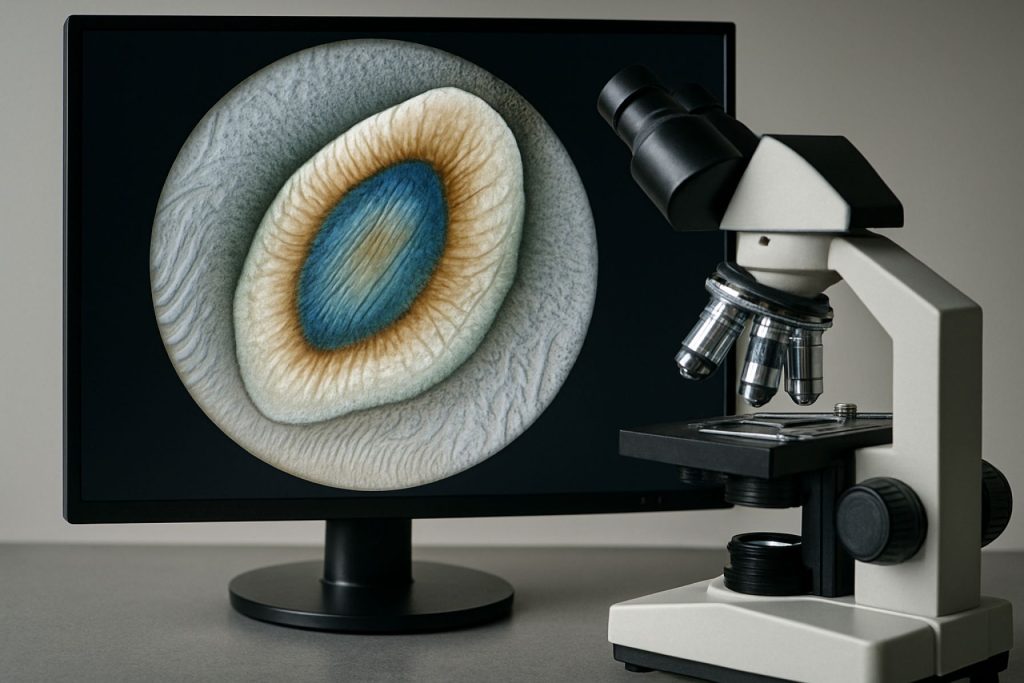

Lenticular enamel microscopy, a specialized technique for examining the microstructure of dental enamel, has rapidly advanced in both research and clinical applications as of 2025. This method leverages high-resolution imaging to analyze the lenticular (lens-shaped) structures within enamel, providing critical insights for dental diagnostics, biomaterials research, and evolutionary biology. Recent developments are propelled by innovations in microscopy hardware, enhanced imaging software, and the integration of artificial intelligence (AI) for image analysis.

- Technological Advancements: The adoption of next-generation scanning electron microscopes (SEMs) with sub-nanometer resolution has become increasingly widespread. Leading manufacturers such as JEOL Ltd. and Thermo Fisher Scientific have introduced new SEM models specifically optimized for dental materials, allowing for more precise visualization of lenticular formations and their distribution in enamel.

- AI-Powered Image Analysis: Automated pattern recognition and segmentation of enamel lenticules are now feasible through AI-driven software. Companies like Carl Zeiss AG have incorporated deep learning modules into their microscopes’ analysis suites, significantly reducing manual processing time and improving reproducibility in research outcomes.

- Clinical and Forensic Applications: Microscopy of lenticular enamel is increasingly used in dental pathology to distinguish between developmental anomalies and acquired defects. Furthermore, forensic laboratories—such as those equipped by Leica Microsystems—are utilizing this technique to enhance individual identification by enamel microstructure profiling, a trend expected to grow through 2025 and beyond.

- Standardization and Training: Recognized industry organizations, including the International Association for Dental Research (IADR), are initiating efforts to standardize protocols for lenticular enamel microscopy. This push aims to harmonize cross-laboratory data and facilitate global collaboration.

- Outlook for 2025–2027: The next few years are likely to see further miniaturization of microscopy platforms, increased cloud-based data sharing, and broader adoption in both academic and clinical settings. Ongoing partnerships between instrument manufacturers and dental research institutions signal a continued trend towards integrated, high-throughput analysis of enamel microstructures.

In summary, lenticular enamel microscopy is transitioning from a niche research tool to a mainstream analytical technique, underpinned by robust technology pipelines and growing interdisciplinary demand. Stakeholders can anticipate further breakthroughs in precision, scalability, and practical application as industry leaders and research organizations continue to invest in this field.

Market Size & Growth Forecast Through 2030

Lenticular enamel microscopy, a specialized imaging technique used to analyze the microstructure of dental enamel, is poised for significant growth through 2030 as advancements in dental research, materials science, and preventive diagnostics accelerate. As of 2025, the market for lenticular enamel microscopy remains niche but is experiencing a surge in adoption within academic research institutions, dental schools, and advanced clinical laboratories. This momentum is largely attributed to the growing demand for high-resolution characterization tools that support both fundamental tooth biology research and applied fields such as forensic odontology and biomimetic material development.

Leading microscopy manufacturers, such as Olympus Corporation and Carl Zeiss Microscopy, have expanded their product offerings to include platforms with enhanced optical sectioning and image analysis features tailored for hard tissue imaging, including enamel. These improvements facilitate the precise visualization of lenticular structures within enamel, which is crucial for understanding growth patterns, pathology, and evolutionary adaptations in both human and non-human specimens. The integration of artificial intelligence-driven image analysis—offered by companies like Leica Microsystems—is expected to further streamline data interpretation and accelerate throughput in research and clinical settings.

Market expansion is further supported by the increasing prevalence of dental caries and enamel defects globally, prompting investment in advanced diagnostic methodologies. National and international dental research organizations—including the American Dental Association—have highlighted the need for improved enamel assessment techniques, fostering collaborations with equipment manufacturers and research consortia to validate and standardize lenticular enamel microscopy protocols. In 2025, several multi-center studies are underway to evaluate the clinical utility of these methods for early detection of enamel pathologies and optimization of restorative strategies.

Looking toward 2030, the lenticular enamel microscopy market is anticipated to grow at a compound annual growth rate (CAGR) in the mid- to high-single digits, outpacing the broader dental microscopy segment. Expansion into emerging markets, increased funding for oral health research, and ongoing technological innovation—such as hybrid imaging modalities and portable microscopy units—are expected to drive further adoption. Industry leaders are also investing in training programs and application support, aiming to lower barriers to entry and facilitate widespread utilization in both academic and clinical environments.

In summary, the market for lenticular enamel microscopy is on track for robust growth through 2030, propelled by technological advancements, greater awareness of enamel health, and concerted efforts from manufacturers and research organizations to expand access to high-resolution enamel imaging solutions.

Technology Overview: Principles of Lenticular Enamel Microscopy

Lenticular Enamel Microscopy (LEM) is an advanced imaging technique designed to analyze the microstructural organization of dental enamel, leveraging the unique refractive and reflective properties of lenticular enamel prisms. The principle of LEM is grounded in the use of high-resolution, often confocal or multiphoton, microscopy systems combined with specialized contrast agents or polarized light to visualize the orientation and integrity of enamel rods at micron or submicron scales.

In 2025, the field is seeing notable developments in both instrumentation and methodology. Modern LEM setups commonly utilize laser scanning confocal microscopes equipped with polarization-sensitive detectors, enabling researchers to distinguish subtle differences in the orientation of apatite crystallites—information critical for understanding enamel biomechanics and pathology. For example, recent product lines from Leica Microsystems and Carl Zeiss Microscopy feature enhanced polarization modules and adaptive optics, specifically targeting the imaging of hard dental tissues.

Advances in sample preparation are also enabling higher fidelity imaging. Manufacturers such as Ted Pella, Inc. have introduced precision microtomes and resin embedding kits tailored to preserve enamel prism orientation during sectioning, a crucial step for accurate LEM analysis. Additionally, the deployment of proprietary contrast agents by suppliers like Thermo Fisher Scientific has improved the differentiation of enamel substructures under fluorescence or phase contrast conditions.

LEM’s capability to generate three-dimensional reconstructions is further enhanced by integration with computational imaging platforms. Companies such as Oxford Instruments are providing software suites that facilitate automated segmentation, quantitative analysis, and virtual rendering of enamel microarchitecture. These digital tools not only accelerate research workflows but also promote standardized data interpretation across laboratories.

The outlook for LEM through the remainder of the decade is promising, with expectations for integration with AI-assisted image analysis and increased adoption in both clinical and research settings. Industry leaders are investing in miniaturizing LEM components for chairside diagnostics and developing protocols for in vivo applications, which could revolutionize early detection of enamel defects and caries. As collaborations intensify between microscopy manufacturers and dental research institutions, the next few years are likely to yield further improvements in resolution, speed, and accessibility of LEM systems (Leica Microsystems).

Major Industry Players & Recent Innovations

Lenticular enamel microscopy, a specialized field within dental and material sciences, continues to see substantial innovation and involvement by key industry players as we move toward 2025. The technology, which focuses on imaging and analyzing the prism structures of dental enamel, is increasingly central in both academic research and applied dental diagnostics.

Among the forefront companies, Carl Zeiss Microscopy remains a leader, offering advanced electron and light microscopes widely adopted for enamel prism visualization. In 2023 and 2024, Zeiss expanded its GeminiSEM product line, enhancing surface-sensitive imaging—crucial for lenticular enamel structure analysis. Their collaborations with university dental faculties are driving methodological standards for the upcoming years.

Another major player, Olympus Life Science, has continued to innovate in the digital imaging space, integrating AI-powered analysis platforms into their microscopy solutions. Their 2024 launch of the OLYMPUS X Line objectives, designed for high-resolution imaging of mineralized tissues, has been adopted by research centers focusing on enamel microstructure, providing enhanced clarity and reproducibility.

Meanwhile, Leica Microsystems has maintained its role as a provider of modular microscopy systems. The company introduced its THUNDER Imager platform updates in late 2023, offering improved computational clearing to resolve fine enamel features in thick sections without sample degradation. This technology is being piloted by dental research institutes exploring the correlation between lenticular enamel morphology and caries resistance.

On the sample preparation front, Buehler and LECO Corporation have released new microtomy and sample polishing systems tailored for hard-tissue research. These systems, adopted by both academic and industry laboratories in 2024, enable more precise sectioning of enamel samples, which is essential for high-fidelity lenticular microscopy.

Looking ahead, the integration of AI-driven image analysis and high-throughput sample processing is expected to accelerate discovery in the field. Industry collaborations with dental material manufacturers and research consortia are likely to standardize lenticular enamel microscopy protocols by 2026, further propelling the field into routine clinical and quality assurance workflows.

Emerging Applications in Dentistry and Biomaterials

Lenticular enamel microscopy is gaining traction as a transformative technique in dental research and biomaterials development, particularly as we enter 2025. This method leverages advanced imaging to analyze the microstructure of tooth enamel, revealing detailed information about prism morphology, mineral density, and the presence of lenticular (lens-shaped) features that are critical to understanding tooth function and pathology. In recent years, the integration of high-resolution scanning electron microscopy (SEM) and focused ion beam (FIB) systems has allowed for unprecedented visualization of these structures in both natural and synthetic enamel analogues.

In 2024 and moving into 2025, several research centers and manufacturers are expanding the use of lenticular enamel microscopy to assess the performance of novel biomimetic dental materials. For example, developers of hydroxyapatite-based restoratives and coatings are utilizing these imaging techniques to closely match the hierarchical structure of native enamel, improving mechanical resilience and longevity. Companies such as JEOL Ltd. and Carl Zeiss AG have reported increased demand for their high-resolution SEM and FIB-SEM platforms from dental research laboratories and materials science departments.

- In 2023-2025, Thermo Fisher Scientific introduced new analytical capabilities in their Helios DualBeam systems, enabling more precise cross-sectional imaging of enamel and dentin interfaces. This is facilitating the development of next-generation bioactive composites that closely replicate natural enamel’s lenticular microstructure.

- Evident (formerly Olympus Life Science) is supporting dental schools and biomaterials research groups with upgraded confocal and electron microscopy tools, empowering studies on enamel remineralization and early caries detection by visualizing microstructural changes at the lenticular level.

Looking forward, the outlook for lenticular enamel microscopy in dentistry is highly promising. The increasing adoption of artificial intelligence (AI)-driven image analysis is expected to further enhance quantification of microstructural defects, leading to earlier diagnosis of enamel pathologies and more effective preventive strategies. Additionally, standardization efforts by organizations such as the International Organization for Standardization (ISO) in dental materials testing are likely to incorporate advanced lenticular microscopy protocols, ensuring consistent quality in restorative products.

In summary, as technology advances and interdisciplinary collaboration grows, lenticular enamel microscopy is poised to play a pivotal role in the evolution of dental diagnostics, restorative material innovation, and personalized oral healthcare over the next few years.

Integration with Digital Dentistry and Imaging Platforms

The integration of Lenticular Enamel Microscopy (LEM) with digital dentistry and advanced imaging platforms is expected to accelerate significantly in 2025 and the following years. LEM, which provides high-resolution visualization of enamel microstructure, is being increasingly recognized for its potential to enhance diagnostic precision, preventive care, and minimally invasive treatment planning in contemporary dental practice.

Recent collaborations between microscopy technology providers and dental imaging system manufacturers have laid the groundwork for seamless data exchange and analytical interoperability. Companies such as Carl Zeiss Meditec AG and Leica Microsystems are actively developing solutions that allow LEM-generated datasets to be directly integrated with digital patient records, chairside CAD/CAM design software, and 3D dental scanners. These efforts aim to enable clinicians to overlay LEM images with traditional radiographs, intraoral scans, and cone-beam computed tomography (CBCT) data, thus offering a holistic view of tooth morphology and pathology in real time.

In 2025, manufacturers such as Dentsply Sirona and Planmeca are expected to release updates to their digital workflow platforms, incorporating compatibility modules for accepting and analyzing LEM data. This will facilitate the use of enamel microstructure information in restorative planning, early caries detection, and personalized preventive protocols—potentially reducing the need for invasive diagnostic interventions.

Moreover, the adoption of open digital standards and secure data-sharing protocols championed by organizations like the Dental Industry Association is anticipated to streamline interoperability challenges. Efforts to integrate LEM outputs with artificial intelligence-driven diagnostic platforms are also underway, with companies such as DentalMonitoring exploring ways to enhance automated caries risk assessment and enamel defect detection.

- Key 2025 Outlook: Expect wider clinical trials and academic partnerships focused on validating LEM-enhanced digital workflows, along with regulatory submissions for software modules that enable secure storage and exchange of LEM data across different dental imaging systems.

- Challenges: Standardizing file formats, ensuring image quality consistency, and training clinicians to interpret and utilize lenticular enamel microscopy images effectively remain active areas of development.

Overall, the next few years should see LEM become a vital layer within digital dentistry ecosystems, driving improvements in diagnostic accuracy, patient engagement, and long-term oral health outcomes as integration with mainstream imaging platforms matures.

Key Regulatory and Certification Developments

Lenticular enamel microscopy (LEM) is poised to occupy an increasingly prominent role in dental and materials science, particularly as regulatory and certification frameworks adapt to new standards of precision and safety in dental diagnostics and biomaterials characterization. As of 2025, key regulatory agencies and industry standards bodies are recognizing the need to address the unique capabilities of LEM, particularly its application in tooth enamel analysis for forensic, anthropological, and clinical purposes.

In the European Union, the implementation of the Medical Device Regulation (MDR, Reg. 2017/745) continues to shape the certification landscape for diagnostic devices and laboratory equipment, including advanced microscopy platforms. Manufacturers incorporating LEM technology into diagnostic workflows are increasingly required to demonstrate conformity with rigorous safety, performance, and reproducibility standards, with oversight from notified bodies such as TÜV SÜD and DEKRA. The push for digitalization and traceability in dental diagnostics is further catalyzing the integration of automated LEM systems with compliant data management and image archiving solutions.

In the United States, the Food and Drug Administration (FDA) has maintained its focus on the 510(k) pathway for dental diagnostic devices, and as of 2025, several manufacturers are engaging in premarket notifications for next-generation LEM platforms. Emphasis is placed on evidence-based validation of enamel microstructure imaging and analysis, as well as robust cybersecurity and interoperability standards for digital imaging equipment. The American Dental Association (ADA) continues to update its standards for dental materials and diagnostic methodologies, providing guidance for the clinical acceptance of techniques such as LEM in caries detection and age estimation.

Globally, the International Organization for Standardization (ISO) is advancing updates to ISO 7491 (Dental materials—Determination of color stability) and ISO 22112 (Dentistry—Artificial teeth for dental prostheses), with working groups increasingly considering the precision offered by LEM in quantifying enamel features and material-tissue interactions. Manufacturers including Olympus Life Science and ZEISS Microscopy are collaborating with regulatory bodies to ensure that their LEM-enabled platforms meet evolving international standards for both research and clinical applications.

Looking ahead to the next few years, industry stakeholders anticipate further harmonization of LEM-specific protocols and certification requirements, particularly as advances in machine learning and automation enhance the accessibility and diagnostic power of lenticular enamel microscopy. The emergence of comprehensive regulatory guidelines will be crucial in supporting widespread clinical adoption and ensuring patient safety in the application of this cutting-edge technology.

Investment Trends and Funding Landscape

Investment in lenticular enamel microscopy has witnessed notable momentum entering 2025, driven by growing interest from both dental materials manufacturers and advanced microscopy solution providers. This sector, at the intersection of dental research and high-resolution imaging, is attracting capital as it promises new pathways for non-destructive enamel analysis, with implications for preventive dentistry, restorative materials, and oral health diagnostics.

Major dental equipment companies are increasing their focus on imaging technologies that can enhance understanding of enamel microstructure. In early 2025, Dentsply Sirona announced a strategic collaboration with a European microscopy startup to explore enhanced imaging protocols tailored to dental hard tissues, including lenticular enamel. This partnership includes joint funding for R&D and aims to accelerate the translation of advanced microscopy into clinical practice.

Meanwhile, established microscopy leaders such as Carl Zeiss AG have continued to expand their product lines relevant to the dental sciences. Zeiss’s recent product updates for their field emission scanning electron microscopes (FE-SEMs)—widely used in enamel research—have attracted institutional buyers from leading dental research centers, supported by targeted funding rounds and equipment grants.

Universities and specialized research institutes, including those affiliated with the American Dental Association, are increasingly securing federal and foundation grants to pursue lenticular enamel studies. Several grant announcements in late 2024 and early 2025 have specified funds for the acquisition of next-generation electron and confocal microscopes, signaling recognition of the technology’s potential impact.

Venture capital investment, while still in its early phases, is building, particularly around startups developing software and AI-powered analytics for enamel image interpretation. Companies such as Evident (formerly Olympus Life Science) have reported increased inquiries from venture-backed digital dentistry firms seeking to integrate their imaging platforms with automated enamel assessment modules.

Looking ahead, the funding landscape is expected to diversify, with more direct investments from dental device manufacturers and cross-sector collaborations involving imaging and healthtech firms. Public-private partnerships and government innovation incentives—especially in the US, EU, and Japan—are anticipated to further catalyze technology translation from laboratory to clinic by 2026.

Competitive Landscape and Strategic Partnerships

The competitive landscape for Lenticular Enamel Microscopy (LEM) in 2025 is characterized by a small but rapidly evolving cohort of companies and research institutions, each leveraging innovations in imaging hardware, software, and sample preparation. The field is primarily driven by the need for high-resolution, non-destructive analysis of dental enamel structures for applications in both biomedical research and clinical diagnostics.

Key players in the LEM sector include established electron microscopy manufacturers such as Thermo Fisher Scientific (FEI) and JEOL Ltd., who have integrated advanced lenticular imaging modules into their flagship scanning electron microscopes (SEMs) and focused ion beam (FIB) systems. These companies are actively collaborating with dental research institutions to tailor their platforms for enamel-specific imaging, offering proprietary detectors and software suites optimized for lenticular pattern analysis.

Strategic partnerships have become increasingly pivotal. In 2024, Carl Zeiss Microscopy entered a collaboration with the King’s College London Dental Institute to co-develop automated LEM workflows, integrating artificial intelligence (AI) for real-time enamel microstructure classification. This partnership aims to accelerate the translation of LEM from research to clinical practice, particularly in early-stage caries detection and forensic odontology.

Emerging technology companies, such as Oxford Instruments, are focusing on compact, benchtop systems that lower the entry barrier for dental clinics and academic settings. Their recent product launches emphasize ease-of-use, rapid sample throughput, and cloud-based data management, fostering new strategic alliances with dental equipment suppliers and laboratory networks.

Industry consortia and standards bodies, such as the American Dental Research Foundation and ISO/TC 106 Dentistry, are increasingly involved in standardizing LEM protocols and data formats. These collaborations are expected to underpin future interoperability and regulatory acceptance, encouraging broader adoption over the next few years.

Looking ahead, the competitive environment is likely to intensify as major microscopy players expand their LEM portfolios and new entrants pursue niche applications. Strategic partnerships—particularly those bridging clinical, academic, and industrial domains—will remain key to driving innovation, reducing costs, and accelerating the integration of Lenticular Enamel Microscopy into mainstream dental diagnostics and research workflows.

Future Outlook: Disruptive Trends and Strategic Recommendations

Lenticular enamel microscopy, a high-resolution technique for analyzing the microstructure of dental enamel, is poised for significant advancements and potential disruption in the dental and materials science sectors by 2025 and the ensuing years. This method, which leverages advanced imaging modalities—such as confocal laser scanning microscopy and atomic force microscopy—to resolve lenticular (lens-shaped) structures within enamel, is benefiting from rapid innovation in imaging hardware, data analytics, and sample preparation.

Key disruptive trends are driven by the integration of artificial intelligence (AI) and machine learning to automate image analysis and pattern recognition. Leading microscopy manufacturers, such as Carl Zeiss Microscopy and Olympus Life Science, are actively developing AI-powered imaging platforms that streamline the identification of microstructural features and anomalies. Such automation holds the promise of accelerating research timelines and improving reproducibility in enamel studies, facilitating broader adoption for both clinical diagnostics and biomaterials research.

On the instrumentation front, the miniaturization and increased accessibility of high-resolution microscopes are expected to democratize lenticular enamel microscopy. Companies like Leica Microsystems are emphasizing compact, user-friendly designs that can be deployed in diverse environments—from research laboratories to dental clinics. This shift may drive new applications, such as chairside enamel assessment and real-time monitoring of dental treatments, especially as imaging systems become more portable and affordable.

In parallel, the integration of correlative microscopy techniques—enabling simultaneous analysis with multiple imaging modalities—is gaining traction. For example, Bruker is advancing hybrid solutions that bridge atomic force microscopy with confocal imaging, yielding richer, multi-dimensional datasets. This trend is expected to enhance the understanding of lenticular enamel patterns and their implications for dental health, forensic science, and the development of biomimetic materials.

Strategically, stakeholders should invest in cross-disciplinary collaborations linking dental researchers, materials scientists, and technology developers to unlock new use cases. Continuing education initiatives and industry partnerships will be critical to ensure end-users are proficient in both the hardware and evolving AI-driven software environments. Furthermore, as regulatory frameworks around medical imaging evolve, close engagement with standards organizations—such as the International Organization for Standardization (ISO)—will be essential to ensure compliance and facilitate global adoption.

Looking ahead, lenticular enamel microscopy is poised to transition from a niche research tool to a mainstream technology with tangible clinical and industrial impact, provided stakeholders capitalize on these disruptive trends and invest in skills, standards, and scalable systems.

Sources & References

- JEOL Ltd.

- Thermo Fisher Scientific

- Carl Zeiss AG

- Leica Microsystems

- International Association for Dental Research (IADR)

- Olympus Corporation

- American Dental Association

- Ted Pella, Inc.

- Oxford Instruments

- Buehler

- LECO Corporation

- International Organization for Standardization (ISO)

- Dentsply Sirona

- Planmeca

- DEKRA

- Thermo Fisher Scientific (FEI)

- King’s College London Dental Institute

- Bruker