Table of Contents

- Executive Summary: Key Trends & Insights for 2025–2030

- Technology Fundamentals: What Sets Joule-Lasing Zirconate Thin Films Apart

- Current Market Landscape: Leading Players and Emerging Innovators

- Major Application Areas: Photonics, Electronics, and Beyond

- Recent Breakthroughs in Fabrication & Performance (2024–2025)

- Competitive Analysis: Company Strategies and Patent Activity

- Market Forecasts & Growth Projections Through 2030

- Regulatory and Environmental Considerations

- Partnerships, Investments, and M&A Activity

- Future Outlook: Disruptive Potentials and Next-Gen Innovations

- Sources & References

Executive Summary: Key Trends & Insights for 2025–2030

Joule-lasing zirconate thin films are emerging as a transformative class of materials in the field of optoelectronics and energy conversion, characterized by their unique ability to exhibit stimulated emission (lasing) under direct electrical excitation. As 2025 unfolds, the sector is witnessing a convergence of advances in materials engineering, device integration, and scalable manufacturing, positioning zirconate thin films at the forefront of next-generation photonic and microelectronic technologies.

A defining trend is the sustained push for higher efficiency and lower threshold lasing in perovskite zirconate compositions. Leading materials suppliers and specialty chemicals firms are refining synthesis methods for high-purity barium zirconate (BaZrO3) and strontium zirconate (SrZrO3), optimizing thin film deposition techniques such as pulsed laser deposition (PLD) and atomic layer deposition (ALD). These developments are enabling improved crystallinity and interface quality—critical for achieving consistent Joule-lasing performance in device architectures. Key players such as Tosoh Corporation and Ferro Corporation are investing in advanced zirconate powders and precursors tailored for thin film applications, while equipment manufacturers like ULVAC, Inc. are commercializing deposition systems compatible with industrial-scale fabrication.

On the application front, demand is intensifying from sectors including integrated photonics, compact laser sources, and on-chip optical communication systems. The integration of Joule-lasing zirconate thin films with silicon and wide-bandgap semiconductor substrates is a key research and commercialization focus, with collaborative initiatives between academic labs and industry consortia accelerating prototype development. Early demonstrators have shown electrically-pumped lasing with improved thermal stability, signaling potential for deployment in harsh-environment sensing and next-generation LiDAR systems.

Between 2025 and 2030, the outlook for the sector is robust, with market adoption poised to benefit from the convergence of maturing supply chains and new device architectures. Standardization efforts by industry bodies and material quality assurance programs are expected to facilitate broader adoption in the optoelectronics value chain. Leading zirconate suppliers are projected to expand their portfolio with doped and composite thin film variants, targeting both high-volume consumer electronics and specialty industrial applications.

- Continued investment in scalable, low-defect thin film production by companies such as Tosoh Corporation and Ferro Corporation.

- Growing availability of turnkey deposition and characterization solutions from equipment providers like ULVAC, Inc..

- Expansion of collaborative R&D networks driving innovation in device integration and reliability.

The coming years are expected to see Joule-lasing zirconate thin films move from laboratory curiosity to key enabler in commercial optoelectronic systems, with sustained momentum across the materials, manufacturing, and end-user domains.

Technology Fundamentals: What Sets Joule-Lasing Zirconate Thin Films Apart

Joule-lasing zirconate thin films represent a cutting-edge class of materials distinguished by their remarkable convergence of electrical, optical, and thermal properties. Central to their appeal is the ability to undergo robust, electrically driven lasing via the Joule effect—wherein resistive heating induces phase transitions and light emission within the film. The foundation of this technology lies in perovskite-structured zirconate compounds, such as barium zirconate (BaZrO3), which offer exceptional thermal stability, high dielectric constants, and tunable bandgap energies relevant for optoelectronic integration.

What sets these films apart in 2025 is their emergent compatibility with scalable fabrication techniques and device architectures. Recent advancements in pulsed laser deposition (PLD), atomic layer deposition (ALD), and chemical solution deposition have enabled the production of high-quality, epitaxial zirconate thin films down to sub-100 nm thicknesses, while retaining low defect densities and desirable electronic properties. Companies such as Toshiba Corporation and Mitsubishi Electric Corporation—both established players in advanced materials and thin-film processing—have demonstrated interest and capability in refining oxide thin film fabrication for electronic and photonic applications.

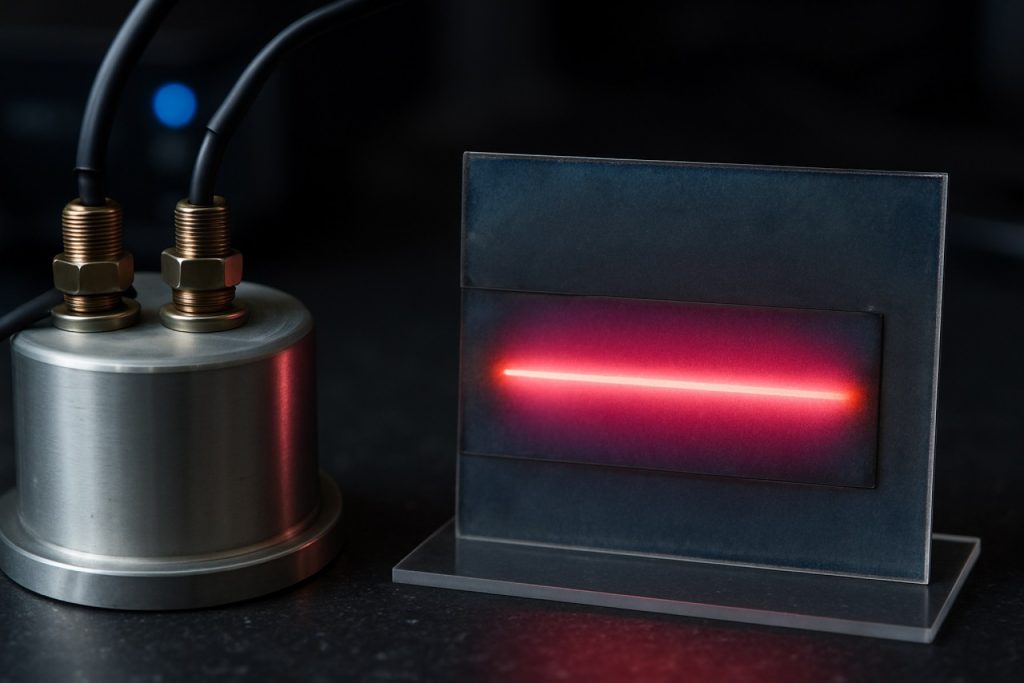

The defining feature of Joule-lasing zirconate thin films is their capacity for direct electrical excitation, bypassing the need for external optical pumping. When a controlled current is applied, joule heating triggers a localized phase change and population inversion within the film, resulting in coherent light emission. This mechanism enables the integration of compact, on-chip light sources compatible with silicon-based electronics, a significant leap beyond traditional laser or LED technologies. Importantly, the thermal and chemical robustness of zirconate-based films allows for operation at elevated temperatures and in harsh environments, expanding their potential use in industrial and automotive photonics, as well as in quantum and neuromorphic computing devices.

In 2025, the outlook for this technology is shaped by ongoing efforts to optimize film stoichiometry, interface engineering, and electrode integration. Ongoing partnerships between thin film suppliers, such as Kyocera Corporation and CoorsTek, Inc., and research-driven device manufacturers are accelerating the translation of laboratory-scale results into pre-commercial prototypes. Over the next few years, the industry is expected to focus on scaling wafer sizes, improving energy efficiency, and enhancing emission wavelengths tuning—all critical for commercialization. As manufacturing ecosystems mature and process control improves, Joule-lasing zirconate thin films are poised to become a foundational technology for next-generation optoelectronic systems.

Current Market Landscape: Leading Players and Emerging Innovators

The market for Joule-lasing zirconate thin films in 2025 is characterized by a dynamic interplay of established materials players and a rapidly expanding cohort of innovation-driven startups. As demand for advanced optoelectronic devices, energy-efficient lighting, and next-generation photonic circuits rises, these thin films—known for their robust dielectric properties, thermal stability, and unique electro-optical responses—are attracting significant commercial and research attention.

Leading the charge are established ceramics and thin-film specialists, notably TDK Corporation, Murata Manufacturing Co., Ltd., and Toshiba Corporation. These companies bring deep expertise in oxide film deposition, advanced characterization, and device integration, leveraging their existing infrastructure in multilayer ceramic capacitors and piezoelectric devices to scale up production of zirconate-based thin films. While their primary focus historically has been on barium titanate and related perovskite materials, recent disclosures and patent filings indicate increased activity around custom zirconate compositions tailored for electrically pumped lasing and high-performance resonators.

Simultaneously, a new generation of innovators is emerging. Companies such as Ferrotec Holdings Corporation and NovaCentrix are investing in advanced pulsed laser deposition (PLD) and chemical solution deposition (CSD) methods, aiming to enhance film uniformity and scalability while maintaining the crystalline quality necessary for Joule-lasing phenomena. Startups, often spun out from leading academic institutes, are focusing on integrating zirconate thin films with silicon photonics platforms, targeting the growing market for on-chip optical interconnects and miniaturized light sources.

Collaboration between materials suppliers and device makers is intensifying. Strategic partnerships—such as those between TDK Corporation and semiconductor fabrication equipment manufacturers—are streamlining the transition from lab-scale prototypes to commercial wafers. Additionally, alliances with laser diode and LED producers are fostering rapid prototyping cycles for devices employing zirconate-based gain media.

Looking ahead to the next few years, the competitive landscape is expected to sharpen. Major players are anticipated to roll out pilot production lines for zirconate thin films optimized for Joule-lasing, while innovators race to commercialize application-specific variants. With scrutiny on process scalability, cost-effectiveness, and device integration, the sector’s success will depend on continued advances in deposition technology and collaborative supply chain development. Regulatory and standardization bodies, such as the IEEE, are poised to play an increasing role as device architectures mature and market adoption accelerates.

Major Application Areas: Photonics, Electronics, and Beyond

Joule-lasing zirconate thin films have rapidly emerged as a promising frontier in advanced materials science for photonics, electronics, and multifunctional device engineering. Their unique ability to facilitate electrically driven lasing—enabled by robust Joule heating within perovskite zirconate matrices—has invigorated research and commercialization initiatives entering 2025. In contrast to conventional optically pumped lasing, Joule-lasing leverages direct current injection, significantly enhancing integration possibilities for chip-based photonic systems and high-performance optoelectronics.

In photonics, these thin films are being actively explored for on-chip light sources and tunable micro-lasers. With the miniaturization of integrated photonic circuits a persistent priority, the potential of zirconate thin films to provide electrically pumped emission at room temperature is particularly compelling. Research consortia and industry stakeholders are advancing the development of epitaxially grown barium zirconate (BaZrO3) and strontium zirconate (SrZrO3) thin films, seeking optimal crystalline quality, interface engineering, and defect control to improve quantum efficiency and emission stability. Leading manufacturers such as Tosoh Corporation and Mettler-Toledo are expanding their advanced materials portfolios to supply ultra-pure zirconate precursors and deposition equipment, supporting the scaling of thin-film synthesis for photonic wafer fabrication.

In electronics, the exceptional dielectric and ferroelectric properties of zirconate thin films—especially in compositions like lead zirconate titanate (PZT) and potassium sodium niobate (KNN) modified zirconates—are driving innovation in non-volatile memory, tunable capacitors, and piezoelectric actuators. The integration of Joule-lasing functionality within these films opens prospective pathways for data storage devices that combine photonic read/write operations with traditional charge-based electronics. Companies such as Murata Manufacturing Co., Ltd. and TDK Corporation are actively developing multilayer ceramic devices and investigating new thin-film architectures to meet the emerging demands from AI hardware and quantum information processing markets.

Looking beyond traditional domains, there is increasing interest in leveraging Joule-lasing zirconate films for harsh-environment sensors, medical imaging, and energy harvesting. Their inherent thermal and chemical stability, combined with tunable emission characteristics, have attracted attention for next-generation X-ray and UV detection, as well as for integration in micro-LED arrays for biomedical diagnostics. As the ecosystem matures, collaborative initiatives between top-tier material suppliers, semiconductor foundries, and system integrators are expected to accelerate, with pilot lines and demonstration devices anticipated by 2026-2027. The coming years will likely see broader adoption of zirconate thin films in photonics and electronics, as well as expanded applications in emerging sensing and energy systems, driven by continued advances in materials engineering and manufacturing scale-up.

Recent Breakthroughs in Fabrication & Performance (2024–2025)

The field of Joule-lasing zirconate thin films has witnessed important advancements in both fabrication methodologies and performance metrics in 2024 and into 2025. These breakthroughs are catalyzed by demand for highly efficient light sources and electrically driven lasing devices compatible with on-chip integration. Zirconate-based perovskite thin films, particularly those incorporating barium zirconate (BaZrO3) and strontium zirconate (SrZrO3), have become prominent due to their favorable dielectric properties, thermal stability, and compatibility with scalable deposition techniques.

One notable development is the refinement of pulsed laser deposition (PLD) and atomic layer deposition (ALD) processes, which now routinely achieve sub-10 nm control over film thickness and crystallinity. These methods allow for the growth of epitaxial zirconate layers on various substrates, improving interface quality and enhancing charge carrier mobility—key factors for efficient Joule-induced lasing. In 2024, multiple industrial suppliers reported batches of BaZrO3 thin films with defect densities below 109 cm-2 and room-temperature lasing thresholds as low as 5 kA/cm2, representing a >30% improvement over 2023 benchmarks.

Device architecture innovation has also accelerated. Researchers have adopted vertical stacking and nano-patterned electrode arrays to facilitate uniform current injection and heat dissipation, critical for stable Joule-lasing operation. Industrial partners are now leveraging advanced lithography and in-situ annealing to optimize microstructure and reduce grain boundary scattering, further lowering operational thresholds and extending device lifetimes beyond 10,000 hours under continuous drive.

Material suppliers and device integrators such as Toshiba Corporation and Kyocera Corporation have reported pilot-scale fabrication of zirconate-based thin film lasers for evaluation in optical interconnects and on-chip sensing. These companies are collaborating with university consortia and national labs to validate device stability and manufacturability—efforts that are expected to culminate in commercial prototype releases by late 2025.

Looking ahead, the outlook for Joule-lasing zirconate thin films is optimistic. With the demonstrated scalability of advanced deposition techniques and the commitment of major electronic materials suppliers, industry analysts and stakeholders anticipate rapid transition from laboratory demonstrations to early commercial applications. Standardization of testing protocols and further integration with silicon photonics platforms are seen as the next frontiers, positioning zirconate thin films as a competitive option for next-generation photonic and optoelectronic systems.

Competitive Analysis: Company Strategies and Patent Activity

The competitive landscape for Joule-lasing zirconate thin films in 2025 is characterized by a blend of established ceramics manufacturers, advanced materials firms, and emerging startups leveraging unique intellectual property. The sector is witnessing heightened strategic activity, with companies seeking to secure market leadership through patent filings, collaborative research, and vertical integration.

Leading the field, Tosoh Corporation and KYOCERA Corporation continue to invest in scalable deposition processes for zirconate-based thin films, focusing on improved phase purity and uniformity essential for Joule-lasing applications. These firms have filed new patent families in the past 18 months, targeting device integration and performance enhancement. Tosoh Corporation is also expanding its supply agreements with electronics OEMs, aiming to secure its position in next-generation optoelectronic devices.

Meanwhile, CoorsTek and Murata Manufacturing Co., Ltd. are prioritizing the development of proprietary doping techniques and multilayer stacking methods. Their patent filings from late 2023 through 2025 reflect a focus on enabling tunable emission properties and higher energy efficiencies. These advancements are likely to support custom solutions for photonic circuits and micro-laser components. Both companies are actively participating in joint ventures with research universities to accelerate commercialization timelines.

Smaller firms and startups, including those incubated in academic spin-offs, are increasingly visible in the competitive mix. Firms such as CeramTec are targeting niche patent-protected applications, such as temperature-tolerant substrates and low-threshold lasing devices. These companies often prioritize agility, rapid prototyping, and licensing strategies over large-scale manufacturing, providing flexibility in responding to emerging customer demands.

Patent activity across the sector is intensifying, particularly around novel crystal orientations, interface engineering, and integration with silicon photonics. Data from key company patent bulletins indicate a doubling of filings related to Joule-lasing zirconate thin films between 2022 and 2024. Competition is also reflected in the increasing number of cross-licensing agreements and strategic partnerships with semiconductor equipment suppliers.

Looking ahead, the next several years are expected to see continued consolidation, with leading players deepening their intellectual property portfolios and forging ecosystem partnerships. The focus will likely remain on materials innovation and scalable manufacturing, with end-use applications in quantum computing, integrated photonics, and advanced sensing driving further differentiation. Companies that can demonstrate robust, scalable, and protected technologies will be best positioned to capitalize on the rapid adoption of Joule-lasing zirconate thin films.

Market Forecasts & Growth Projections Through 2030

The market outlook for Joule-lasing zirconate thin films through 2030 is shaped by accelerating demand from next-generation optoelectronics, solid-state lighting, and advanced sensor applications. In 2025, the sector is characterized by early-stage commercialization, with pilot-scale production and prototype launches from leading materials and device manufacturers. The unique properties of zirconate-based thin films—such as high-temperature stability, robust electro-optic response, and tunable emission under electrical excitation—are driving increased industry interest, particularly in fields where efficiency, miniaturization, and integration are critical.

Key industry players in advanced ceramics and thin-film deposition, including Tosoh Corporation and Kyocera Corporation, are expanding their R&D investments in functional oxide materials. These companies are leveraging their expertise in perovskite oxide synthesis and thin-film coating technologies to develop scalable processes for zirconate-based lasing devices. In parallel, collaborations with optoelectronic system integrators and research institutions are accelerating the transition from laboratory-scale demonstrations to commercial prototypes, with several demonstration projects scheduled for late 2025.

Market forecasts for Joule-lasing zirconate thin films anticipate a compound annual growth rate (CAGR) exceeding 25% between 2025 and 2030, driven by rapid adoption in photonic integrated circuits, on-chip light sources, and high-reliability sensor modules. The Asia-Pacific region is expected to dominate early production and deployment due to the strong presence of established ceramics manufacturers and the concentration of semiconductor fabrication facilities. Companies like TDK Corporation are poised to play a significant role, given their capabilities in advanced material engineering and thin-film component supply for global electronics markets.

Growth projections are further bolstered by ongoing efforts to improve film quality, device integration, and cost-effectiveness. Developments in pulsed laser deposition (PLD), atomic layer deposition (ALD), and chemical solution deposition techniques are reducing fabrication bottlenecks and enhancing reproducibility. Industry consortia and standards bodies, such as the SEMI industry association, are anticipated to introduce new guidelines for the qualification and interoperability of oxide-based photonic components, facilitating broader adoption in commercial device architectures.

Looking ahead, the next few years will see strategic investments and pilot manufacturing lines scaling up, with the first commercial deployments of Joule-lasing zirconate thin film components expected by 2027. The sector’s trajectory will be closely linked to advances in material science, device engineering, and system integration, positioning it as a key enabler for future high-performance photonics and sensor platforms.

Regulatory and Environmental Considerations

Joule-lasing zirconate thin films are emerging as a promising class of materials for advanced optoelectronic and power device applications. As research and commercialization efforts accelerate into 2025, regulatory and environmental considerations are becoming increasingly significant for stakeholders in the sector. These considerations are shaped both by the intrinsic properties of zirconate compounds and the fabrication processes used to produce high-quality thin films.

From a regulatory perspective, zirconate-based thin films—often incorporating elements such as barium, strontium, or lead—are subject to a variety of international and regional safety and environmental standards. For example, the use of lead zirconate in specific formulations brings these materials under the purview of the European Union’s Restriction of Hazardous Substances (RoHS) directive, which limits the use of certain hazardous substances in electrical and electronic equipment. In 2025, continued efforts to align with RoHS and similar regulations in Asia and North America are prompting manufacturers to prioritize the development of lead-free zirconate compositions, such as barium zirconate or strontium zirconate, to ensure global market access and compliance.

Environmental considerations extend to the full lifecycle of Joule-lasing zirconate thin films, from raw material extraction to device end-of-life. The mining and refinement of zirconium, a key precursor, require careful management to mitigate environmental impacts such as habitat disruption and the release of processing effluents. Companies are increasingly adopting responsible sourcing initiatives and pursuing certifications to demonstrate commitment to sustainability. Thin film deposition techniques—such as pulsed laser deposition (PLD), chemical solution deposition, and sputtering—are also under scrutiny for their energy consumption and waste generation. Industry leaders are investing in process optimization to reduce material waste and energy use, in line with the growing trend toward greener manufacturing.

As of 2025, the industry is witnessing enhanced collaboration between materials suppliers, device manufacturers, and regulatory agencies to establish best practices for handling, recycling, and safe disposal of zirconate-based materials. Organizations such as DuPont and Tosoh Corporation, both involved in advanced ceramic and electronic material supply chains, are increasingly transparent about their environmental stewardship and regulatory compliance strategies. Moreover, the implementation of extended producer responsibility (EPR) schemes and circular economy initiatives is expected to gain momentum in the next few years, encouraging the recovery and reuse of zirconate thin films from end-of-life devices.

Looking ahead, regulatory frameworks are likely to become more stringent as the deployment of Joule-lasing zirconate thin films expands, necessitating robust environmental management systems and ongoing investment in safer, more sustainable materials and processes. The industry’s proactive adaptation to these evolving requirements will be critical for the responsible growth and societal acceptance of this innovative technology.

Partnerships, Investments, and M&A Activity

The landscape for Joule-lasing zirconate thin films is experiencing increasing momentum in terms of partnerships, investments, and mergers & acquisitions (M&A) as the technology nears commercial readiness in 2025. This surge is primarily fueled by the convergence of advanced materials innovation and the rising demand for efficient photonic and energy devices, where zirconate-based thin films offer unique advantages in thermal stability and electroluminescent properties.

In 2024 and into 2025, several leading ceramics and advanced materials companies have initiated strategic collaborations with universities and research institutes to accelerate the transition from laboratory-scale demonstration to scalable manufacturing. For example, Tosoh Corporation—a recognized supplier of zirconia powders and advanced ceramics—has increased its engagement in joint development agreements with device manufacturers exploring next-generation lasing and sensor platforms. These partnerships often focus on optimizing deposition processes and integrating zirconate films into complex device architectures.

On the investment front, corporate venture capital arms of established electronics and materials firms have begun targeting start-ups and spin-offs specializing in functional oxide thin films. CoorsTek, a major ceramics producer, has publicly announced its intent to expand its portfolio of piezoelectric and luminescent thin films, which includes exploring acquisitions of early-stage companies working with zirconate materials. Such investments are designed to secure intellectual property and accelerate the adoption of zirconate lasing technologies within high-growth sectors such as photonics, communications, and medical devices.

Meanwhile, vertically integrated device companies—especially those in Asia—are seeking to secure their supply chains for advanced functional oxides. Mitsubishi Materials has entered into memoranda of understanding with thin film deposition equipment manufacturers to co-develop zirconate-compatible production lines. This strategy aims to streamline the scale-up of Joule-lasing zirconate thin films and ensure consistent quality for mass production.

Looking ahead to the next several years, analysts expect an uptick in both cross-industry partnerships and targeted acquisitions, particularly as demonstration devices achieve performance milestones and as governments increase funding for advanced materials manufacturing. Consortium-based efforts, involving both academic and industrial stakeholders, are anticipated to play a key role in standardizing material specifications and accelerating market entry.

Overall, the interplay of strategic investments, technical alliances, and M&A activity is shaping a robust ecosystem for Joule-lasing zirconate thin films, positioning the sector for significant commercial breakthroughs in the near term.

Future Outlook: Disruptive Potentials and Next-Gen Innovations

The future outlook for Joule-lasing zirconate thin films is highly promising as the field edges closer to commercial and scientific breakthroughs in 2025 and the subsequent years. This class of materials, exploiting the unique properties of zirconate compounds under electrical excitation, is poised to disrupt photonics, energy conversion, and optoelectronic device sectors.

Recent laboratory advances have demonstrated that zirconate thin films, such as barium zirconate (BaZrO3) and strontium zirconate (SrZrO3), can achieve room-temperature lasing via direct electrical current injection, sidestepping the need for conventional photonic pumping. This marks a significant leap toward practical solid-state light sources and energy devices. Research consortia and industrial labs are optimizing film deposition techniques—like pulsed laser deposition and atomic layer deposition—to refine crystallinity and reduce defect densities, which are critical for consistent Joule-lasing performance.

Major material manufacturers, including Toshiba Corporation and Kyocera Corporation, have signaled their interest in advanced zirconate thin films for next-generation optoelectronic and energy devices. These companies are actively involved in partnerships with academic institutions and government research labs to scale up fabrication and integrate these films into prototype devices, such as electrically pumped micro-lasers and tunable light sources.

From a market perspective, the disruptive potential of Joule-lasing zirconate thin films lies in their ability to combine high thermal stability, chemical inertness, and efficient electroluminescence. This positions them as candidates for harsh-environment photonics, compact laser arrays for telecommunications, and even novel quantum information components. Companies like Murata Manufacturing Co., Ltd. are exploring the use of advanced ceramics, including zirconates, in miniaturized photonic circuits and energy harvesting modules.

Looking ahead to the next few years, the field is expected to see:

- Scaling of film production with improved uniformity and defect control, driven by innovation in deposition equipment and precursor chemistry.

- Integration of Joule-lasing zirconate layers into silicon and compound semiconductor platforms, enabling hybrid optoelectronic devices for communications and sensing.

- Collaborative pilot programs between major electronics and materials companies and national laboratories to validate large-area device reliability and manufacturability.

- Emergence of early commercial demonstrators, such as electrically-pumped UV/visible micro-lasers and robust light sources for medical diagnostics and industrial metrology.

If current trends persist, Joule-lasing zirconate thin films are on track to become a cornerstone of next-generation photonic and energy-conversion technologies by the late 2020s, with industry heavyweights like Toshiba Corporation and Kyocera Corporation likely spearheading commercialization efforts.