2025 Hexapod Robotics for Precision Micromanipulation Market Report: In-Depth Analysis of Growth Drivers, Technology Innovations, and Global Opportunities. Explore Key Trends, Forecasts, and Competitive Insights Shaping the Industry.

- Executive Summary & Market Overview

- Key Technology Trends in Hexapod Robotics for Micromanipulation

- Market Size, Segmentation, and Growth Forecasts (2025–2030)

- Competitive Landscape and Leading Players

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Emerging Applications and End-User Insights

- Challenges, Risks, and Barriers to Adoption

- Opportunities and Strategic Recommendations

- Future Outlook: Innovation Pathways and Market Evolution

- Sources & References

Executive Summary & Market Overview

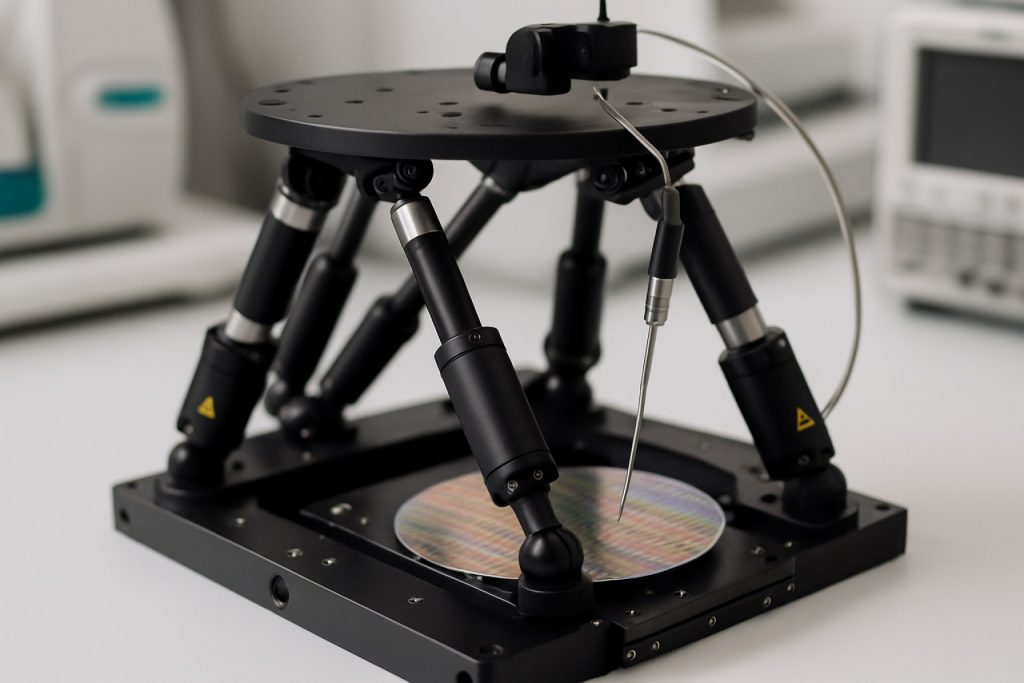

Hexapod robotics, characterized by their six-legged parallel kinematic architecture, have emerged as a transformative technology in the field of precision micromanipulation. These systems offer sub-micron accuracy, high repeatability, and multi-degree-of-freedom motion, making them indispensable in sectors such as semiconductor manufacturing, biomedical engineering, photonics, and micro-assembly. The global market for hexapod robotics dedicated to precision micromanipulation is projected to experience robust growth through 2025, driven by escalating demand for miniaturized components and the increasing complexity of microfabrication processes.

According to recent analyses, the hexapod robotics market is expected to register a compound annual growth rate (CAGR) exceeding 8% from 2023 to 2025, with the precision micromanipulation segment accounting for a significant share of this expansion. Key growth drivers include the proliferation of advanced manufacturing technologies, the push for automation in high-precision environments, and the integration of artificial intelligence for enhanced motion control. Notably, the semiconductor industry’s ongoing transition to smaller process nodes and the surge in photonics applications are catalyzing investments in high-precision robotic platforms.

Leading industry players such as Physik Instrumente (PI), Thorlabs, and Newport Corporation are at the forefront of innovation, offering hexapod systems tailored for applications requiring nanometer-level positioning and dynamic stability. These companies are focusing on expanding their product portfolios with modular, user-friendly solutions that integrate seamlessly with existing automation infrastructure. Additionally, collaborations between robotics manufacturers and research institutions are accelerating the development of application-specific hexapod platforms, particularly for life sciences and micro-optics.

Regionally, Asia-Pacific is anticipated to dominate the market by 2025, fueled by substantial investments in electronics manufacturing and research and development activities in countries such as China, Japan, and South Korea. North America and Europe are also witnessing steady adoption, supported by strong presence of high-tech industries and government initiatives promoting advanced manufacturing.

In summary, the hexapod robotics market for precision micromanipulation is poised for significant growth in 2025, underpinned by technological advancements, expanding application scope, and increasing demand for ultra-precise automation solutions. Market participants are expected to benefit from continued innovation and strategic partnerships, positioning hexapod robotics as a cornerstone technology in the era of micro- and nano-scale engineering.

Key Technology Trends in Hexapod Robotics for Micromanipulation

Hexapod robotics, characterized by their six-legged parallel kinematic architecture, are increasingly pivotal in precision micromanipulation applications across industries such as semiconductor manufacturing, biomedical engineering, and photonics. As of 2025, several key technology trends are shaping the evolution and adoption of hexapod systems for micromanipulation tasks that demand sub-micron accuracy and repeatability.

- Advanced Motion Control Algorithms: The integration of real-time adaptive control algorithms is enhancing the dynamic performance of hexapod platforms. These algorithms enable compensation for thermal drift, vibration, and non-linearities, resulting in improved trajectory accuracy and stability during delicate micromanipulation tasks. Companies like Physik Instrumente (PI) are at the forefront, offering controllers with embedded intelligence for high-precision applications.

- Miniaturization and Compact Design: There is a clear trend toward the miniaturization of hexapod systems, making them suitable for integration into confined environments such as electron microscopes and micro-assembly lines. Innovations in materials and actuator technologies, including piezoelectric and voice coil actuators, are enabling smaller footprints without compromising on load capacity or precision (Aerotech).

- Enhanced Sensor Integration: The adoption of high-resolution encoders, laser interferometers, and capacitive sensors is providing real-time feedback for closed-loop control, crucial for nanometer-level positioning. This sensor fusion is particularly important in applications like fiber alignment and micro-optics assembly, where even minute deviations can impact performance (Newport Corporation).

- Software and Digital Twin Capabilities: The use of digital twins and advanced simulation software is streamlining the design, calibration, and operation of hexapod systems. These tools allow for virtual prototyping, predictive maintenance, and process optimization, reducing downtime and accelerating deployment in high-precision environments (ABB).

- Integration with Automation Ecosystems: Hexapod robots are increasingly being designed for seamless integration with Industry 4.0 frameworks, including machine vision, AI-driven process control, and IoT connectivity. This interoperability is expanding their role in fully automated micro-manufacturing and inspection lines (Rockwell Automation).

These technology trends are collectively driving the adoption of hexapod robotics in precision micromanipulation, enabling new levels of accuracy, flexibility, and productivity in next-generation manufacturing and research settings.

Market Size, Segmentation, and Growth Forecasts (2025–2030)

The global market for hexapod robotics dedicated to precision micromanipulation is poised for significant expansion between 2025 and 2030, driven by advancements in automation, miniaturization, and demand from high-precision industries. In 2025, the market size is estimated to reach approximately USD 420 million, with a projected compound annual growth rate (CAGR) of 13.2% through 2030, potentially surpassing USD 780 million by the end of the forecast period. This robust growth is underpinned by increasing adoption in sectors such as semiconductor manufacturing, biomedical engineering, photonics, and micro-assembly, where sub-micron accuracy and multi-axis movement are critical.

Segmentation of the hexapod robotics market for precision micromanipulation can be analyzed across several dimensions:

- By Application: The largest share is held by the semiconductor and electronics industry, accounting for over 35% of the market in 2025, due to the need for wafer alignment, die bonding, and inspection tasks. Biomedical and life sciences applications, including microsurgery and cellular manipulation, represent the fastest-growing segment, with a CAGR exceeding 15% as per MarketsandMarkets.

- By End User: Research institutions and academic laboratories are significant consumers, but industrial users—particularly in precision manufacturing—are expected to drive the majority of revenue growth. The adoption rate among contract manufacturing organizations (CMOs) is also rising, as they seek to enhance throughput and quality in micro-assembly processes.

- By Geography: Asia-Pacific leads the market, with China, Japan, and South Korea investing heavily in advanced manufacturing infrastructure. North America and Europe follow, with strong demand from medical device and photonics sectors. According to IDTechEx, Asia-Pacific will account for nearly 45% of global revenues by 2030.

Growth drivers include the proliferation of micro-electromechanical systems (MEMS), the miniaturization of medical devices, and the increasing complexity of photonics components. Technological advancements, such as AI-driven motion control and improved parallel kinematics, are further enhancing the capabilities and appeal of hexapod systems. However, high initial costs and the need for specialized integration expertise may temper adoption in some regions and industries.

Overall, the outlook for hexapod robotics in precision micromanipulation is highly positive, with sustained investment in R&D and automation expected to fuel both market size and technological sophistication through 2030.

Competitive Landscape and Leading Players

The competitive landscape for hexapod robotics in precision micromanipulation is characterized by a mix of established automation giants and specialized robotics firms, each leveraging advanced kinematics and control algorithms to address the stringent demands of micro-assembly, semiconductor manufacturing, and biomedical research. As of 2025, the market is witnessing intensified competition driven by rapid technological advancements, miniaturization trends, and the growing need for sub-micron accuracy in industrial and research applications.

Key players dominating this segment include Physik Instrumente (PI), Thorlabs, and Newport Corporation. These companies have established strong reputations for delivering high-precision hexapod platforms with six degrees of freedom, catering to both OEMs and end-users in photonics, life sciences, and microelectronics. PI, for instance, continues to lead with its PIMikroMove software and proprietary parallel kinematics, offering nanometer-level repeatability and robust integration capabilities for automated production lines.

Emerging competitors such as Smart Systems Srl and Symétrie are gaining traction by focusing on modularity, user-friendly interfaces, and cost-effective solutions tailored for academic and R&D environments. These firms are differentiating themselves through open architecture designs and compatibility with a wide range of control systems, addressing the customization needs of research institutions and niche industrial users.

Strategic partnerships and acquisitions are shaping the competitive dynamics. For example, PI USA has expanded its market reach through collaborations with semiconductor equipment manufacturers, while Thorlabs has invested in vertically integrated production to ensure supply chain resilience and rapid product iteration. Additionally, Asian manufacturers, particularly from Japan and South Korea, are entering the market with competitively priced hexapod systems, intensifying price competition and pushing established players to innovate further.

- PI and Newport dominate high-end, industrial-grade hexapods for semiconductor and photonics applications.

- Thorlabs and Symétrie focus on research and laboratory-grade systems with flexible control options.

- Emerging Asian entrants are disrupting the market with cost-competitive offerings and localized support.

Overall, the 2025 market for hexapod robotics in precision micromanipulation is marked by technological differentiation, strategic alliances, and a growing emphasis on software-driven performance enhancements, as companies vie for leadership in this high-precision, innovation-driven sector.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global market for hexapod robotics in precision micromanipulation is experiencing differentiated growth across key regions: North America, Europe, Asia-Pacific, and the Rest of the World (RoW). Each region’s trajectory is shaped by its industrial base, research ecosystem, and investment in automation technologies.

North America remains a leading market, driven by robust demand from the semiconductor, medical device, and aerospace sectors. The United States, in particular, benefits from a concentration of advanced manufacturing and research institutions, fostering innovation in micromanipulation applications. Companies such as Physik Instrumente (PI) USA and Aerotech are prominent players, supplying high-precision hexapod systems for both industrial and academic use. The region’s focus on miniaturization and automation in life sciences and electronics is expected to sustain double-digit growth through 2025, according to Grand View Research.

Europe is characterized by a strong tradition in precision engineering and a well-established network of research collaborations. Germany, Switzerland, and France are at the forefront, with companies like Physik Instrumente (PI) and SmarAct leading innovation. The European Union’s funding for micro- and nanotechnology research, as well as its emphasis on Industry 4.0, is accelerating adoption in sectors such as photonics, optics, and medical robotics. The region is also seeing increased integration of hexapod platforms in academic research, supported by initiatives from organizations like CORDIS.

Asia-Pacific is the fastest-growing region, propelled by rapid industrialization and significant investments in electronics manufacturing, particularly in China, Japan, South Korea, and Taiwan. The expansion of semiconductor fabrication and display panel production is fueling demand for high-precision micromanipulation. Local players, alongside global suppliers, are expanding their presence, and government-backed initiatives in robotics and automation are further stimulating market growth. According to MarketsandMarkets, Asia-Pacific is projected to outpace other regions in CAGR through 2025.

Rest of the World (RoW) encompasses emerging markets in Latin America, the Middle East, and Africa. While adoption is currently limited by lower industrial automation rates and fewer research institutions, there is growing interest in medical and electronics applications. Strategic partnerships and technology transfers from established markets are expected to gradually increase regional uptake.

Emerging Applications and End-User Insights

Hexapod robotics, characterized by their six degrees of freedom and parallel kinematic architecture, are increasingly being adopted for precision micromanipulation across a range of emerging applications. In 2025, the demand for sub-micron accuracy and repeatability is driving the integration of hexapod systems in sectors such as semiconductor manufacturing, biomedical engineering, photonics, and micro-assembly.

In semiconductor fabrication, hexapod robots are utilized for wafer alignment, lithography, and inspection tasks, where their ability to perform complex, multi-axis movements with nanometer precision is critical. Leading manufacturers are leveraging these systems to enhance throughput and yield in advanced packaging and chiplet assembly processes. According to ASML Holding, the adoption of high-precision robotics, including hexapods, is a key enabler for next-generation EUV lithography and 3D integration.

The biomedical sector is another prominent end-user, with hexapod platforms supporting microsurgery, cell manipulation, and the handling of delicate biological samples. Their compact footprint and high stiffness make them ideal for integration into surgical robots and laboratory automation systems. For instance, Carl Zeiss Meditec has incorporated hexapod stages in advanced ophthalmic surgery equipment, enabling precise positioning and movement during minimally invasive procedures.

Photonics and optics industries are also capitalizing on hexapod robotics for the alignment of optical components, fiber arrays, and laser systems. The ability to automate multi-axis adjustments significantly reduces setup times and improves alignment accuracy, which is essential for the production of high-performance photonic devices. Physik Instrumente (PI), a leading provider of precision motion systems, reports a surge in demand for hexapod solutions in optical metrology and laser machining applications.

End-user insights reveal a growing preference for modular, software-integrated hexapod platforms that can be easily customized for specific micromanipulation tasks. Users prioritize features such as real-time feedback, intuitive programming interfaces, and compatibility with machine vision systems. The trend towards Industry 4.0 and smart manufacturing is further accelerating the adoption of networked hexapod systems, enabling remote monitoring and predictive maintenance.

Overall, the expanding scope of precision micromanipulation is positioning hexapod robotics as a cornerstone technology in high-value, innovation-driven industries, with end-users seeking solutions that deliver both flexibility and ultra-high precision.

Challenges, Risks, and Barriers to Adoption

The adoption of hexapod robotics for precision micromanipulation faces several significant challenges, risks, and barriers, despite the technology’s promise in fields such as semiconductor manufacturing, biomedical engineering, and micro-assembly. One of the primary challenges is the high cost of acquisition and integration. Hexapod systems, which offer six degrees of freedom and sub-micron accuracy, require advanced materials, precision engineering, and sophisticated control software, all of which contribute to elevated capital expenditures. This cost factor can be prohibitive for small and medium-sized enterprises (SMEs), limiting widespread adoption beyond large research institutions and multinational manufacturers (Physik Instrumente (PI) USA).

Another barrier is the complexity of system integration. Hexapod robots must be seamlessly incorporated into existing production lines or laboratory setups, which often involves custom interfaces, specialized training for operators, and compatibility with legacy equipment. The lack of standardized communication protocols and software interoperability further complicates integration, increasing both the time and cost required for deployment (IDTechEx).

Technical risks also persist, particularly regarding reliability and repeatability at the micro- and nano-scale. Even minor calibration errors or mechanical wear can lead to significant deviations in micromanipulation tasks, potentially resulting in product defects or compromised research outcomes. Ensuring long-term stability and minimizing drift in hexapod systems remains a technical hurdle, especially in high-throughput or continuous operation environments (MarketsandMarkets).

Cybersecurity and data integrity are emerging concerns as hexapod robotics become increasingly networked and integrated with Industry 4.0 frameworks. Unauthorized access or software vulnerabilities could disrupt precision operations or lead to intellectual property theft, particularly in sensitive sectors such as medical device manufacturing and semiconductor fabrication (Gartner).

Finally, regulatory and certification barriers can slow adoption, especially in medical and aerospace applications where compliance with stringent standards is mandatory. The lack of harmonized international standards for precision robotics further complicates global deployment and market entry (International Organization for Standardization (ISO)).

Opportunities and Strategic Recommendations

The market for hexapod robotics in precision micromanipulation is poised for significant growth in 2025, driven by advancements in miniaturization, automation, and the increasing demand for high-precision positioning across industries such as semiconductor manufacturing, biomedical engineering, and photonics. Key opportunities are emerging as manufacturers seek to enhance throughput, accuracy, and repeatability in processes that require sub-micron or nanometer-level manipulation.

One of the most promising opportunities lies in the semiconductor sector, where the ongoing transition to advanced node technologies and 3D packaging necessitates ultra-precise alignment and handling of wafers and components. Hexapod robots, with their six degrees of freedom and parallel kinematic design, offer superior flexibility and stability compared to traditional serial manipulators, making them ideal for tasks such as wafer bonding, die placement, and metrology. According to SEMI, the global semiconductor equipment market is expected to surpass $100 billion in 2025, with a growing share allocated to automation and precision robotics.

In biomedical applications, hexapod robotics are increasingly being adopted for microsurgery, cell manipulation, and micro-assembly of medical devices. The ability to perform complex, multi-axis movements with high repeatability is critical for these applications. The trend towards minimally invasive procedures and lab-on-chip technologies further amplifies the need for advanced micromanipulation solutions. Reports from MarketsandMarkets project the medical robotics market to grow at a CAGR of over 15% through 2025, with precision robotics as a key driver.

Strategically, companies should focus on integrating AI-driven control algorithms and real-time feedback systems to enhance the autonomy and adaptability of hexapod platforms. Partnerships with end-users in high-growth sectors—such as semiconductor fabs, research institutions, and medical device manufacturers—can accelerate product validation and adoption. Additionally, investing in modular, scalable designs will allow manufacturers to address a broader range of applications and price points.

- Expand R&D in AI-enhanced motion control and sensor integration.

- Develop application-specific hexapod solutions for semiconductor and biomedical markets.

- Forge strategic alliances with OEMs and research labs for co-development and pilot projects.

- Emphasize after-sales support and customization to build long-term client relationships.

By capitalizing on these opportunities and strategic imperatives, stakeholders can position themselves at the forefront of the rapidly evolving precision micromanipulation market in 2025.

Future Outlook: Innovation Pathways and Market Evolution

The future outlook for hexapod robotics in precision micromanipulation is marked by rapid innovation and expanding market opportunities, driven by advancements in miniaturization, control algorithms, and integration with emerging technologies. By 2025, the sector is expected to witness significant growth, propelled by increasing demand in semiconductor manufacturing, biomedical engineering, and photonics, where sub-micron accuracy and multi-axis flexibility are critical.

Key innovation pathways include the development of lighter, more compact hexapod platforms with enhanced payload-to-weight ratios, enabling deployment in space-constrained environments such as micro-assembly lines and surgical suites. The integration of AI-powered motion control and real-time feedback systems is anticipated to further improve precision, repeatability, and ease of programming, reducing the learning curve for operators and expanding accessibility to non-specialist users. Companies like Physik Instrumente (PI) and SMC Corporation are at the forefront, investing in adaptive control software and modular architectures that allow for rapid customization to specific application needs.

Market evolution is also shaped by the convergence of hexapod robotics with machine vision and advanced sensing technologies. This synergy is expected to enable closed-loop micromanipulation, where real-time imaging guides the robot’s movements at nanometer scales, crucial for applications such as optical fiber alignment and microelectromechanical systems (MEMS) assembly. According to MarketsandMarkets, the global robotics market is projected to grow at a CAGR of over 10% through 2025, with precision robotics representing a significant share of this expansion.

- Emerging Applications: The adoption of hexapod robots in minimally invasive surgery, microelectronics packaging, and quantum device fabrication is expected to accelerate, driven by the need for ultra-precise, multi-degree-of-freedom manipulation.

- Regional Trends: Asia-Pacific, particularly China, Japan, and South Korea, is poised to lead market growth due to robust investments in advanced manufacturing and R&D infrastructure, as highlighted by International Federation of Robotics (IFR) data.

- Sustainability and Cost Efficiency: Innovations aimed at reducing energy consumption and material waste, alongside modular, scalable designs, are likely to lower total cost of ownership and broaden adoption across industries.

In summary, the 2025 outlook for hexapod robotics in precision micromanipulation is defined by technological convergence, expanding application domains, and a strong trajectory of market growth, underpinned by ongoing R&D and cross-industry collaboration.

Sources & References

- Physik Instrumente (PI)

- Thorlabs

- Aerotech

- ABB

- Rockwell Automation

- MarketsandMarkets

- IDTechEx

- Symétrie

- PI USA

- Grand View Research

- Physik Instrumente (PI)

- SmarAct

- CORDIS

- ASML Holding

- Carl Zeiss Meditec

- Physik Instrumente (PI)

- International Organization for Standardization (ISO)

- International Federation of Robotics (IFR)