Flexible Substrate Electronics Industry Report 2025: Market Dynamics, Technology Innovations, and Strategic Forecasts Through 2030. Explore Key Growth Drivers, Regional Trends, and Competitive Insights.

- Executive Summary & Market Overview

- Key Technology Trends in Flexible Substrate Electronics

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Opportunities

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

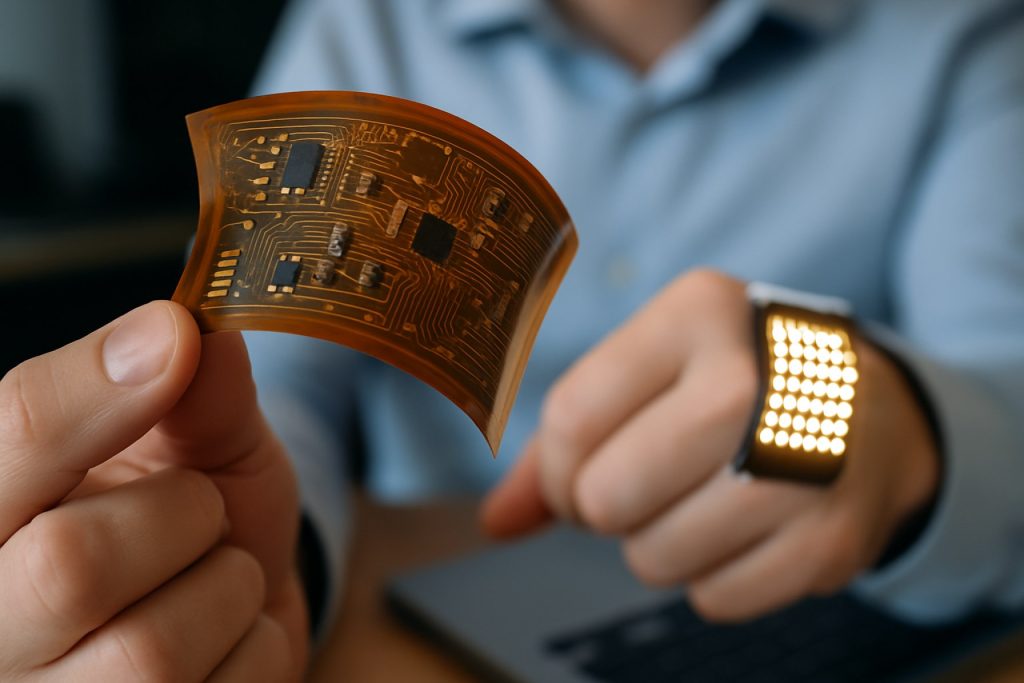

Flexible substrate electronics, also known as flexible electronics or flex circuits, refer to electronic devices built on flexible base materials such as plastic, metal foil, or flexible glass. This technology enables the creation of lightweight, bendable, and even stretchable electronic components, which are increasingly integral to next-generation applications in consumer electronics, healthcare, automotive, and industrial sectors. The global market for flexible substrate electronics is poised for robust growth in 2025, driven by escalating demand for wearable devices, foldable smartphones, advanced medical sensors, and flexible displays.

According to recent market analyses, the flexible electronics market is projected to reach a value exceeding USD 40 billion by 2025, with a compound annual growth rate (CAGR) of over 11% from 2020 to 2025. This growth is underpinned by rapid advancements in materials science, particularly in organic and inorganic semiconductors, and the increasing adoption of roll-to-roll manufacturing processes that enable high-volume, cost-effective production of flexible circuits. Key industry players such as Samsung Electronics, LG Electronics, and DuPont are investing heavily in R&D to enhance the performance, durability, and scalability of flexible substrates.

In 2025, the consumer electronics segment is expected to dominate the market, fueled by the proliferation of foldable smartphones, flexible OLED displays, and wearable health monitors. The healthcare sector is also witnessing significant adoption, with flexible biosensors and diagnostic devices enabling new paradigms in patient monitoring and personalized medicine. Automotive applications, including flexible lighting and in-cabin displays, are further expanding the market’s reach.

Geographically, Asia-Pacific remains the largest and fastest-growing region, accounting for a substantial share of global production and consumption. This is attributed to the presence of major electronics manufacturers, robust supply chains, and supportive government initiatives in countries like China, South Korea, and Japan. North America and Europe are also experiencing steady growth, driven by innovation hubs and increasing investments in flexible electronics research.

Despite the promising outlook, the market faces challenges such as high initial manufacturing costs, technical complexities in large-scale integration, and the need for improved material reliability. Nevertheless, ongoing technological advancements and strategic collaborations across the value chain are expected to mitigate these barriers, positioning flexible substrate electronics as a cornerstone of future electronic device innovation IDTechEx MarketsandMarkets.

Key Technology Trends in Flexible Substrate Electronics

Flexible substrate electronics, which involve the integration of electronic circuits onto bendable, stretchable, or foldable materials, are rapidly transforming the landscape of consumer electronics, healthcare, automotive, and industrial applications. As of 2025, several key technology trends are shaping the evolution and adoption of flexible substrate electronics.

- Advanced Materials Development: The shift from traditional rigid substrates to advanced flexible materials such as polyimide, polyethylene terephthalate (PET), and thermoplastic polyurethane (TPU) is accelerating. These materials offer improved mechanical flexibility, thermal stability, and chemical resistance, enabling more robust and reliable flexible devices. Notably, the use of organic and hybrid materials is expanding, supporting the development of ultra-thin, lightweight, and transparent electronic components (IDTechEx).

- Printing and Roll-to-Roll Manufacturing: Printing technologies, including inkjet, screen, and gravure printing, are being increasingly adopted for the mass production of flexible electronics. Roll-to-roll (R2R) processing, in particular, is enabling high-throughput, cost-effective manufacturing, which is critical for scaling up production and reducing unit costs. This trend is fostering the commercialization of flexible displays, sensors, and photovoltaic cells (Frost & Sullivan).

- Integration of Flexible and Stretchable Components: The integration of flexible batteries, sensors, and interconnects is advancing, allowing for the creation of fully flexible electronic systems. This is particularly significant in wearable technology and medical devices, where conformability and comfort are paramount. Innovations in stretchable conductors and encapsulation techniques are further enhancing device durability and performance (MarketsandMarkets).

- Emergence of Flexible Displays and Lighting: Flexible OLED and micro-LED displays are gaining traction in smartphones, wearables, and automotive dashboards. These displays offer superior design freedom, reduced weight, and improved durability compared to conventional rigid screens. Flexible lighting solutions, such as bendable OLED panels, are also being adopted in automotive and architectural applications (OLED-Info).

- Smart Packaging and IoT Integration: The incorporation of flexible electronics into smart packaging is enabling real-time tracking, authentication, and environmental sensing for logistics and retail. Additionally, the proliferation of the Internet of Things (IoT) is driving demand for flexible sensors and antennas that can be seamlessly embedded into a wide range of objects (Gartner).

These technology trends are collectively propelling the flexible substrate electronics market toward broader adoption and new application frontiers in 2025 and beyond.

Competitive Landscape and Leading Players

The competitive landscape of the flexible substrate electronics market in 2025 is characterized by a dynamic mix of established electronics giants, specialized material suppliers, and innovative startups. The sector is witnessing intensified competition as demand surges across applications such as flexible displays, wearable devices, medical sensors, and advanced packaging. Key players are leveraging proprietary technologies, strategic partnerships, and vertical integration to secure market share and drive innovation.

Leading the market are companies like Samsung Electronics and LG Display, both of which have made significant investments in flexible OLED and AMOLED display technologies. Their dominance is underpinned by robust R&D capabilities and large-scale manufacturing infrastructure, enabling them to supply flexible substrates for next-generation smartphones, tablets, and foldable devices. BOE Technology Group has also emerged as a formidable competitor, particularly in the Asia-Pacific region, with aggressive expansion in flexible display production and a growing portfolio of patents.

Material innovation is a critical differentiator in this market. DuPont and Kuraray are prominent suppliers of high-performance polyimide films and other advanced polymers, which are essential for the mechanical flexibility and thermal stability required in flexible electronics. These companies are investing in next-generation substrate materials to address challenges such as transparency, barrier properties, and process compatibility.

Startups and niche players are also shaping the competitive landscape by focusing on specialized applications and novel manufacturing techniques. For example, FlexEnable is pioneering organic electronics and flexible transistor arrays, targeting applications in automotive displays and smart surfaces. Meanwhile, Royole Corporation continues to push the boundaries of ultra-thin, flexible sensors and displays, often collaborating with consumer electronics brands to accelerate commercialization.

- Strategic alliances and joint ventures are increasingly common, as seen in partnerships between display manufacturers and material science companies to co-develop next-generation substrates.

- Intellectual property portfolios and patent filings are key competitive levers, with leading players aggressively protecting innovations in substrate composition and device integration.

- Regional dynamics are significant, with Asia-Pacific maintaining a leadership position in manufacturing capacity and innovation, while North America and Europe focus on high-value applications and R&D.

Overall, the flexible substrate electronics market in 2025 is marked by rapid technological evolution, with competition driven by material breakthroughs, manufacturing scale, and the ability to address emerging application segments.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The flexible substrate electronics market is poised for robust growth between 2025 and 2030, driven by expanding applications in consumer electronics, automotive, healthcare, and industrial sectors. According to projections by MarketsandMarkets, the global flexible electronics market—which includes flexible substrates such as polyimide, PET, PEN, and metal foils—is expected to register a compound annual growth rate (CAGR) of approximately 14% during this period. This growth is underpinned by increasing demand for lightweight, thin, and bendable electronic devices, as well as advancements in manufacturing processes that enable higher yields and lower costs.

Revenue forecasts indicate that the market size for flexible substrate electronics will reach around USD 40 billion by 2030, up from an estimated USD 18 billion in 2025. This surge is attributed to the proliferation of flexible displays, wearable devices, and flexible sensors, particularly in Asia-Pacific, which is anticipated to maintain the largest market share due to the presence of major electronics manufacturers and a robust supply chain ecosystem. IDTechEx highlights that the volume of flexible substrates shipped is expected to grow at a CAGR exceeding 12% through 2030, with polyimide and PET substrates dominating due to their favorable electrical and mechanical properties.

- Consumer Electronics: Flexible OLED displays, foldable smartphones, and wearable health monitors are key drivers, with unit shipments projected to double between 2025 and 2030.

- Automotive: Integration of flexible touch panels and lighting in vehicle interiors is expected to boost demand, especially as electric vehicles adopt more advanced human-machine interfaces.

- Healthcare: Flexible biosensors and diagnostic patches are forecasted to see rapid adoption, contributing significantly to volume growth.

Regionally, Grand View Research notes that Asia-Pacific will account for over 45% of global revenue by 2025, with China, South Korea, and Japan leading investments in R&D and manufacturing capacity. North America and Europe are also expected to witness steady growth, driven by innovation in medical and industrial applications.

In summary, the flexible substrate electronics market in 2025 is set for accelerated expansion, with strong CAGR, rising revenues, and increasing shipment volumes across multiple end-use industries, laying the foundation for continued innovation and market penetration through 2030.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global market for flexible substrate electronics is experiencing robust growth, with significant regional variations in adoption, innovation, and manufacturing capacity. In 2025, North America, Europe, Asia-Pacific, and the Rest of the World (RoW) each present distinct market dynamics shaped by local industry strengths, regulatory environments, and investment trends.

- North America: The North American market, led by the United States, is characterized by strong R&D activity and early adoption of advanced technologies. Major players in consumer electronics, medical devices, and automotive sectors are driving demand for flexible substrates, particularly in applications such as wearable devices and flexible displays. The presence of leading research institutions and a robust startup ecosystem further accelerates innovation. According to IDTechEx, North America remains a key hub for high-value, low-volume production, especially in medical and aerospace applications.

- Europe: Europe’s flexible substrate electronics market is propelled by stringent environmental regulations and a strong focus on sustainability. The region is witnessing increased investment in organic and printed electronics, with Germany, France, and the UK at the forefront. The automotive and industrial sectors are major end-users, leveraging flexible substrates for sensors and smart surfaces. The European Union’s funding initiatives, such as Horizon Europe, are fostering collaborative R&D projects, as highlighted by European Commission reports.

- Asia-Pacific: Asia-Pacific dominates global production, accounting for the largest market share in 2025. Countries like China, South Korea, and Japan are home to leading manufacturers of flexible displays, printed circuits, and photovoltaic cells. The region benefits from a well-established electronics manufacturing ecosystem, cost advantages, and strong government support for innovation. According to MarketsandMarkets, rapid growth in consumer electronics and the proliferation of IoT devices are key drivers in this region.

- Rest of World (RoW): The RoW segment, including Latin America, the Middle East, and Africa, is at an earlier stage of market development. Growth is primarily driven by increasing investments in telecommunications infrastructure and emerging interest in smart packaging and healthcare applications. However, limited local manufacturing capacity and reliance on imports from Asia-Pacific and Europe remain challenges, as noted by Fortune Business Insights.

Overall, while Asia-Pacific leads in manufacturing scale, North America and Europe are distinguished by innovation and high-value applications, with the Rest of the World showing gradual uptake as infrastructure and investment improve.

Future Outlook: Emerging Applications and Investment Opportunities

The future outlook for flexible substrate electronics in 2025 is marked by rapid expansion into emerging applications and a surge in investment opportunities. As the demand for lightweight, bendable, and durable electronic components intensifies, industries such as consumer electronics, healthcare, automotive, and energy are increasingly integrating flexible substrates into their product designs.

One of the most promising emerging applications is in the realm of wearable technology. Flexible substrates enable the development of ultra-thin, conformable sensors and displays that can be seamlessly integrated into clothing, medical patches, and fitness trackers. This is driving innovation in remote health monitoring and personalized medicine, with companies like Philips and GE Healthcare investing in flexible biosensors and smart patches for continuous patient monitoring.

In the automotive sector, flexible substrate electronics are being adopted for advanced driver-assistance systems (ADAS), interior lighting, and flexible displays. The ability to mold electronics to curved surfaces allows for more ergonomic and aesthetically pleasing designs, as seen in the latest concept vehicles from BMW and Toyota. Additionally, flexible solar panels based on these substrates are being explored for integration into vehicle exteriors, supporting the shift toward sustainable mobility.

Another significant area of growth is in flexible and large-area displays, including foldable smartphones, rollable televisions, and e-paper signage. Market leaders such as Samsung and LG Electronics are expanding their portfolios with new products that leverage the unique properties of flexible substrates, aiming to capture a larger share of the premium display market.

From an investment perspective, the global flexible electronics market is projected to reach $48.2 billion by 2025, with a compound annual growth rate (CAGR) of 11.0% from 2020 to 2025, according to MarketsandMarkets. Venture capital and corporate investments are flowing into startups focused on novel materials, such as organic semiconductors and printable conductive inks, as well as scalable manufacturing processes like roll-to-roll printing.

In summary, 2025 is poised to be a pivotal year for flexible substrate electronics, with breakthroughs in materials science and manufacturing unlocking new applications and attracting significant investment across multiple industries.

Challenges, Risks, and Strategic Opportunities

The flexible substrate electronics market in 2025 faces a complex landscape of challenges, risks, and strategic opportunities as it matures and expands into diverse applications such as wearables, flexible displays, medical devices, and IoT sensors. One of the primary challenges is the technical limitation associated with substrate materials. Flexible substrates, including polyimide, polyethylene terephthalate (PET), and polyethylene naphthalate (PEN), must balance flexibility, thermal stability, and electrical performance. Achieving this balance remains difficult, especially as device miniaturization and higher performance demands increase. Material inconsistencies and defects during large-scale manufacturing can lead to yield losses and reliability concerns, impacting cost-effectiveness and scalability.

Another significant risk is the high initial capital investment required for advanced manufacturing equipment and process development. The transition from rigid to flexible electronics often necessitates new production lines, specialized handling systems, and stringent quality control protocols. This can deter smaller players and slow down industry adoption, particularly in price-sensitive markets. Additionally, intellectual property (IP) risks are prominent, as the field is crowded with patents and proprietary technologies, leading to potential legal disputes and barriers to entry for new innovators.

Supply chain vulnerabilities also pose a risk, especially given the reliance on specialty materials and global suppliers. Disruptions—such as those experienced during the COVID-19 pandemic—can lead to delays and increased costs. Furthermore, environmental and regulatory pressures are mounting, with increasing scrutiny on the recyclability and toxicity of flexible substrates and associated electronic components. Compliance with evolving regulations, such as the EU’s RoHS and REACH directives, adds complexity and cost to product development and market entry.

Despite these challenges, strategic opportunities abound. The growing demand for lightweight, bendable, and wearable electronics is driving innovation and investment. Strategic partnerships between material suppliers, device manufacturers, and research institutions are accelerating the development of next-generation substrates with improved performance and sustainability profiles. Companies that can successfully integrate flexible electronics into high-growth sectors—such as healthcare monitoring, smart packaging, and automotive interiors—stand to gain significant competitive advantages. Furthermore, advances in roll-to-roll manufacturing and printing technologies are expected to reduce costs and enable mass production, opening new markets and applications.

In summary, while the flexible substrate electronics market in 2025 is fraught with technical, financial, and regulatory risks, it also presents substantial opportunities for companies that can navigate these challenges through innovation, collaboration, and strategic investment. For further insights, see reports from IDTechEx and MarketsandMarkets.

Sources & References

- LG Electronics

- DuPont

- IDTechEx

- MarketsandMarkets

- Frost & Sullivan

- OLED-Info

- LG Display

- BOE Technology Group

- Kuraray

- FlexEnable

- Grand View Research

- European Commission

- Fortune Business Insights

- Philips

- GE Healthcare

- Toyota