Electromagnetic Compatibility Testing for Medical Implants 2025: In-Depth Market Analysis, Technology Trends, and Future Growth Opportunities. Explore Key Drivers, Regional Insights, and Competitive Dynamics Shaping the Industry.

- Executive Summary & Market Overview

- Key Market Drivers and Restraints

- Technology Trends in EMC Testing for Medical Implants

- Competitive Landscape and Leading Players

- Growth Forecasts and Market Projections (2025–2030)

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Regulatory Environment and Compliance Standards

- Challenges and Opportunities in EMC Testing for Medical Implants

- Future Outlook: Innovations and Emerging Applications

- Sources & References

Executive Summary & Market Overview

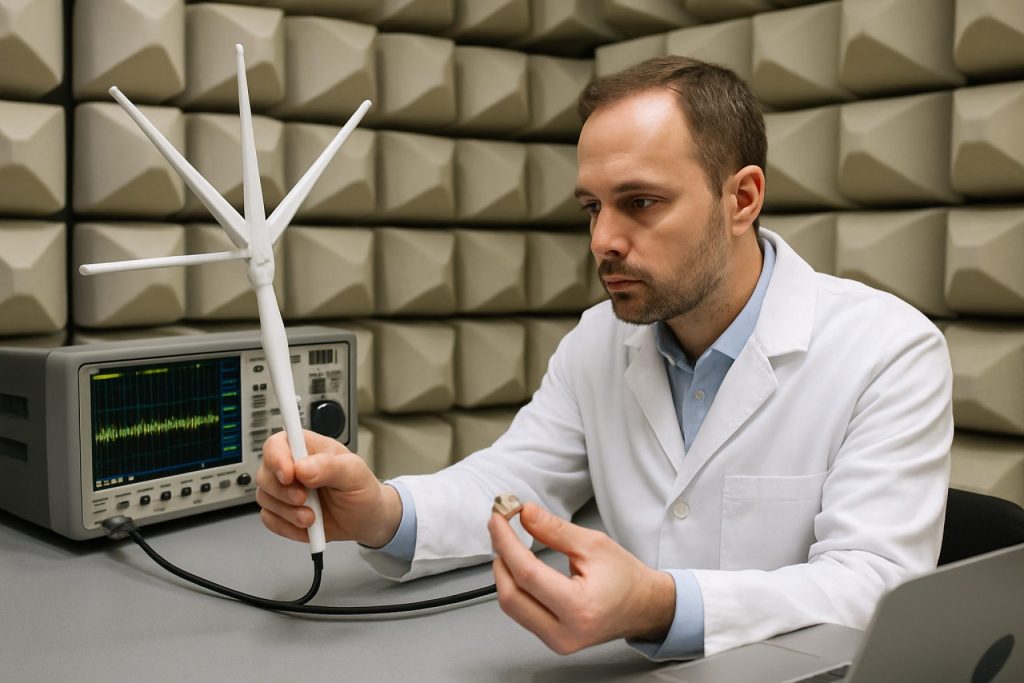

Electromagnetic Compatibility (EMC) testing for medical implants is a critical segment within the broader medical device testing market, ensuring that implantable devices such as pacemakers, neurostimulators, and cochlear implants function safely and effectively in environments with various electromagnetic disturbances. As of 2025, the global demand for EMC testing in this sector is driven by the proliferation of electronic medical implants, increasing regulatory scrutiny, and the rapid evolution of wireless technologies in healthcare settings.

Medical implants are increasingly exposed to complex electromagnetic environments due to the widespread adoption of wireless communication devices, hospital equipment, and consumer electronics. This has heightened the risk of electromagnetic interference (EMI), which can compromise device performance or patient safety. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Commission have established stringent EMC requirements for medical implants, mandating comprehensive pre-market and post-market testing to ensure compliance with international standards like IEC 60601-1-2 and ISO 14708.

According to recent market analyses, the global EMC testing market for medical devices—including implants—is projected to grow at a CAGR of 6-8% through 2025, with the medical implants segment representing a significant and expanding share of this growth. The increasing prevalence of chronic diseases, aging populations, and technological advancements in implantable devices are key factors fueling this trend. Major players in the EMC testing market, such as Intertek Group plc, SGS SA, and TÜV SÜD, have expanded their service offerings to address the unique challenges of EMC testing for active implantable medical devices (AIMDs).

- Market Drivers: Rising implant adoption rates, stricter regulatory frameworks, and the integration of wireless technologies in implants.

- Challenges: Evolving electromagnetic environments, the complexity of testing protocols, and the need for continuous compliance monitoring.

- Opportunities: Growth in emerging markets, advancements in simulation and testing technologies, and increased collaboration between manufacturers and testing laboratories.

In summary, EMC testing for medical implants is a rapidly evolving market segment, underpinned by regulatory imperatives and technological innovation. As the healthcare landscape becomes more interconnected and reliant on electronic implants, robust EMC testing will remain essential to patient safety and device reliability in 2025 and beyond.

Key Market Drivers and Restraints

Electromagnetic compatibility (EMC) testing for medical implants is increasingly critical as the healthcare sector integrates more electronic and wireless technologies. Several key drivers are propelling the growth of this market segment. First, the proliferation of implantable medical devices—such as pacemakers, neurostimulators, and insulin pumps—has heightened the need for rigorous EMC testing to ensure patient safety and device reliability. The growing prevalence of chronic diseases and an aging global population are further accelerating the adoption of such implants, thereby expanding the demand for EMC testing services.

Regulatory requirements are a primary driver. Authorities such as the U.S. Food and Drug Administration (FDA) and the European Commission have established stringent standards for EMC in medical devices, including the IEC 60601-1-2 and ISO 14708 series. Compliance with these standards is mandatory for market approval, compelling manufacturers to invest in advanced EMC testing. Additionally, the increasing complexity of hospital environments—characterized by dense concentrations of wireless and electronic equipment—necessitates robust EMC performance to prevent device malfunction or interference.

Technological advancements are also fueling market growth. The integration of wireless communication capabilities (e.g., Bluetooth, NFC) in implants introduces new EMC challenges, requiring more sophisticated testing protocols. The emergence of 5G and the Internet of Medical Things (IoMT) further complicate the electromagnetic environment, driving demand for specialized EMC testing solutions. Leading testing service providers, such as Intertek Group plc and SGS SA, are expanding their capabilities to address these evolving requirements.

However, the market faces notable restraints. The high cost and technical complexity of EMC testing for medical implants can be prohibitive, particularly for small and medium-sized manufacturers. The need for specialized equipment, skilled personnel, and compliance with multiple international standards increases operational expenses and time-to-market. Additionally, the rapid pace of technological change can outstrip the development of standardized testing protocols, creating regulatory uncertainty and potential delays in product approvals.

In summary, while regulatory mandates, technological innovation, and the expanding use of implantable devices are driving the EMC testing market for medical implants, high costs, technical challenges, and evolving standards remain significant barriers to broader adoption and market growth in 2025.

Technology Trends in EMC Testing for Medical Implants

Electromagnetic Compatibility (EMC) testing for medical implants is undergoing significant technological transformation in 2025, driven by the increasing complexity of implantable devices and the proliferation of wireless technologies in healthcare environments. EMC testing ensures that medical implants, such as pacemakers, neurostimulators, and insulin pumps, function reliably without electromagnetic interference (EMI) from external sources or other medical equipment. As the number of connected medical devices grows, so does the need for advanced EMC testing methodologies to safeguard patient safety and regulatory compliance.

One of the most notable trends is the integration of real-world simulation environments into EMC testing protocols. Traditional laboratory-based tests are being supplemented with advanced simulation tools that replicate the electromagnetic conditions found in hospitals, homes, and public spaces. This shift is supported by the adoption of digital twins and virtual prototyping, allowing manufacturers to predict and mitigate EMC issues earlier in the design process. According to Intertek Group plc, these innovations reduce time-to-market and improve the reliability of implantable devices.

Another key trend is the focus on testing for coexistence with wireless technologies, particularly as implants increasingly incorporate Bluetooth, NFC, and proprietary wireless protocols for data transmission and remote monitoring. The U.S. Food and Drug Administration (FDA) has updated its guidance to emphasize the importance of evaluating device performance in the presence of multiple wireless signals, reflecting the crowded radiofrequency (RF) spectrum in modern healthcare settings.

Automation and artificial intelligence (AI) are also reshaping EMC testing workflows. Automated test systems can execute complex test sequences, analyze large datasets, and identify subtle patterns of interference that might be missed by manual methods. AI-driven analytics are being used to optimize test coverage and predict potential EMC failures, as highlighted by TÜV SÜD. This not only enhances test accuracy but also streamlines compliance with international standards such as IEC 60601-1-2:2020.

Finally, regulatory harmonization is influencing technology trends in EMC testing. Global convergence of EMC standards is prompting manufacturers to adopt more robust and universally accepted testing platforms. Organizations like the International Electrotechnical Commission (IEC) are working to align requirements, facilitating smoother market access for innovative medical implants worldwide.

Competitive Landscape and Leading Players

The competitive landscape for electromagnetic compatibility (EMC) testing in the medical implants sector is characterized by a mix of global testing, inspection, and certification (TIC) giants, specialized medical device testing firms, and emerging regional players. As regulatory scrutiny intensifies and the complexity of implantable medical devices increases, the demand for advanced EMC testing services is rising, driving both consolidation and innovation in the market.

Leading players such as TÜV SÜD, SGS, and Intertek have established comprehensive EMC testing capabilities tailored to the unique requirements of active implantable medical devices (AIMDs) and other critical implants. These organizations leverage global laboratory networks, deep regulatory expertise, and advanced simulation tools to support manufacturers in meeting standards such as IEC 60601-1-2 and ISO 14708. Their ability to offer end-to-end services—from pre-compliance consulting to full certification—positions them as preferred partners for multinational medical device companies.

In addition to these TIC leaders, specialized firms like UL Solutions and BSI Group have carved out significant market share by focusing on the nuances of implantable device EMC, including wireless coexistence and susceptibility to emerging sources of electromagnetic interference (EMI). These companies often collaborate with device manufacturers early in the product development cycle, providing risk assessments and tailored test protocols that address both regulatory and clinical performance concerns.

Regional players, particularly in North America, Europe, and Asia-Pacific, are also gaining traction by offering localized expertise and faster turnaround times. For example, Eurofins Scientific has expanded its medical device testing portfolio through acquisitions and investments in state-of-the-art EMC laboratories, catering to the growing number of small and mid-sized implant manufacturers seeking cost-effective solutions.

Competitive differentiation in 2025 is increasingly driven by digitalization, with leading providers integrating data analytics, remote testing, and digital reporting platforms to enhance client experience and operational efficiency. Strategic partnerships with device OEMs, investments in next-generation test equipment, and proactive adaptation to evolving regulatory frameworks (such as the EU MDR and FDA guidance updates) are expected to further shape the competitive dynamics in the EMC testing market for medical implants.

Growth Forecasts and Market Projections (2025–2030)

The market for electromagnetic compatibility (EMC) testing of medical implants is poised for robust growth in 2025, driven by the increasing complexity of implantable devices and stringent regulatory requirements. As medical implants such as pacemakers, neurostimulators, and cochlear implants become more technologically advanced, ensuring their safe operation in environments saturated with electromagnetic interference (EMI) is critical. Regulatory bodies, including the U.S. Food and Drug Administration (FDA) and the European Commission, are enforcing rigorous EMC standards, compelling manufacturers to invest in comprehensive testing protocols.

According to recent market analyses, the global EMC testing market for medical devices is expected to reach a valuation of approximately USD 1.2 billion in 2025, with medical implants representing a significant and growing segment of this market. The compound annual growth rate (CAGR) for EMC testing in the medical implant sector is projected to exceed 7% from 2025 through 2030, outpacing the broader medical device testing market. This acceleration is attributed to the proliferation of wireless-enabled implants and the adoption of new communication protocols, which increase susceptibility to EMI and necessitate more sophisticated testing methodologies (Grand View Research).

Regionally, North America and Europe are expected to maintain their dominance in 2025, accounting for over 60% of the global market share. This is largely due to the presence of leading medical device manufacturers, advanced healthcare infrastructure, and proactive regulatory frameworks. However, the Asia-Pacific region is anticipated to witness the fastest growth, fueled by expanding healthcare investments, rising adoption of implantable devices, and increasing awareness of EMC compliance requirements (MarketsandMarkets).

- Key drivers in 2025 include the integration of 5G and IoT technologies in medical implants, which introduce new EMC challenges.

- Outsourcing of EMC testing to specialized laboratories is expected to rise, as manufacturers seek to accelerate time-to-market and ensure compliance with evolving standards.

- Investments in advanced simulation and testing equipment are projected to increase, supporting more accurate and efficient EMC assessments.

In summary, 2025 marks a pivotal year for the EMC testing market for medical implants, with growth underpinned by technological innovation, regulatory rigor, and expanding global demand for safe, reliable implantable medical devices.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global market for electromagnetic compatibility (EMC) testing of medical implants is characterized by distinct regional dynamics, shaped by regulatory frameworks, technological advancements, and healthcare infrastructure. In 2025, North America, Europe, Asia-Pacific, and the Rest of the World (RoW) each present unique opportunities and challenges for EMC testing providers and medical device manufacturers.

- North America: The United States and Canada lead the region, driven by stringent regulatory requirements from the U.S. Food and Drug Administration (FDA) and Health Canada. The FDA’s rigorous premarket approval process for implantable devices mandates comprehensive EMC testing, fostering a mature and technologically advanced testing ecosystem. The presence of major medical device manufacturers and specialized testing laboratories further consolidates North America’s dominance. The region is also witnessing increased investment in wireless-enabled implants, necessitating advanced EMC protocols.

- Europe: The European market is shaped by the European Union Medical Device Regulation (EU MDR) and harmonized standards such as EN 60601-1-2. Countries like Germany, France, and the UK are at the forefront, supported by robust healthcare systems and a strong emphasis on patient safety. The region’s focus on cross-border standardization and the presence of leading notified bodies and testing organizations, such as TÜV Rheinland and SGS, drive market growth. However, the complexity of regulatory updates and Brexit-related uncertainties may pose challenges.

- Asia-Pacific: Rapidly expanding healthcare infrastructure and increasing adoption of advanced medical implants are propelling demand for EMC testing in countries like China, Japan, South Korea, and India. Regulatory agencies such as China’s NMPA and Japan’s PMDA are tightening compliance requirements, aligning more closely with international standards. The region is also benefiting from the growth of local testing providers and government initiatives to boost medical device innovation, though disparities in regulatory enforcement persist.

- Rest of World (RoW): This segment, encompassing Latin America, the Middle East, and Africa, is experiencing gradual growth. While regulatory frameworks are less mature, increasing healthcare investments and the entry of multinational device manufacturers are driving demand for EMC testing. Countries like Brazil and South Africa are emerging as focal points, with local agencies such as ANVISA strengthening oversight.

Overall, regional variations in regulatory rigor, healthcare investment, and technological adoption will continue to shape the EMC testing landscape for medical implants in 2025, with North America and Europe maintaining leadership, and Asia-Pacific emerging as a high-growth market.

Regulatory Environment and Compliance Standards

The regulatory environment for electromagnetic compatibility (EMC) testing of medical implants in 2025 is shaped by increasingly stringent global standards and evolving compliance frameworks. Medical implants, such as pacemakers, neurostimulators, and cochlear implants, must demonstrate robust immunity to electromagnetic interference (EMI) to ensure patient safety and device efficacy. Regulatory bodies, including the U.S. Food and Drug Administration (FDA), the European Commission, and the Japanese Ministry of Health, Labour and Welfare (MHLW), mandate rigorous EMC testing as part of the premarket approval process.

In the United States, the FDA enforces compliance with standards such as IEC 60601-1-2 and ISO 14708-1, which specify EMC requirements for active implantable medical devices. The FDA’s guidance emphasizes risk-based approaches, requiring manufacturers to assess the likelihood and consequences of EMI in real-world environments, including exposure to wireless communication devices and magnetic resonance imaging (MRI) systems. The FDA’s Center for Devices and Radiological Health (CDRH) regularly updates its recommendations to reflect emerging technologies and new sources of electromagnetic fields (FDA Medical Devices).

In the European Union, the Medical Device Regulation (MDR 2017/745) and harmonized standards such as EN 45502-2-1 for cardiac pacemakers and EN 45502-2-2 for implantable defibrillators set the baseline for EMC testing. The European Commission requires conformity assessment procedures, including third-party testing and technical documentation, to demonstrate compliance. Notified Bodies play a critical role in verifying that EMC testing protocols align with the latest harmonized standards and that risk management processes are robust.

- Manufacturers must document EMC test plans, results, and risk assessments as part of their technical files.

- Post-market surveillance is increasingly emphasized, with requirements to monitor and report EMC-related adverse events.

- Global harmonization efforts, such as those led by the International Medical Device Regulators Forum (IMDRF), are streamlining compliance pathways for multinational manufacturers.

As wireless technologies proliferate and the electromagnetic environment becomes more complex, regulatory agencies are expected to further tighten EMC requirements for medical implants in 2025. This trend underscores the need for continuous investment in advanced EMC testing methodologies and proactive compliance strategies.

Challenges and Opportunities in EMC Testing for Medical Implants

Electromagnetic Compatibility (EMC) testing for medical implants is a critical process that ensures these devices function safely and effectively in environments saturated with electromagnetic (EM) signals. As the healthcare sector accelerates its adoption of connected and miniaturized implantable devices, the complexity of EMC testing is increasing, presenting both significant challenges and emerging opportunities for manufacturers and testing laboratories in 2025.

Challenges:

- Increasing EM Environment Complexity: The proliferation of wireless technologies, such as 5G, Wi-Fi 6, and Bluetooth Low Energy, has intensified the electromagnetic environment in hospitals and homes. Medical implants must now be tested against a broader spectrum of frequencies and signal types, complicating test protocols and increasing the risk of interference-induced malfunctions (U.S. Food and Drug Administration).

- Miniaturization and Integration: As implants become smaller and more complex, integrating multiple functionalities (e.g., sensing, wireless communication, and stimulation), their susceptibility to EM interference rises. This necessitates more sensitive and precise EMC testing methodologies, which can be technically demanding and costly (Intertek Group plc).

- Regulatory Evolution: Regulatory bodies are updating EMC standards to reflect new risks, requiring manufacturers to adapt quickly. For example, the IEC 60601-1-2 standard has been revised to address emerging wireless threats, increasing the compliance burden for device makers (International Electrotechnical Commission).

Opportunities:

- Advanced Simulation and Modeling: The adoption of digital twins and advanced simulation tools allows for early-stage EMC risk assessment, reducing the need for costly physical prototypes and accelerating time-to-market (ANSYS, Inc.).

- Growth in Specialized Testing Services: The complexity of EMC requirements is driving demand for third-party laboratories with expertise in medical implant testing, creating new business opportunities for service providers (TÜV SÜD AG).

- Innovation in Shielding and Filtering: Advances in materials science are enabling the development of more effective EM shielding and filtering solutions, which can be integrated into implants to enhance their immunity to interference (3M Company).

In summary, while EMC testing for medical implants in 2025 faces mounting technical and regulatory challenges, it also presents significant opportunities for innovation, collaboration, and market growth as the industry adapts to an increasingly connected healthcare landscape.

Future Outlook: Innovations and Emerging Applications

The future outlook for electromagnetic compatibility (EMC) testing in medical implants is shaped by rapid technological advancements, evolving regulatory frameworks, and the increasing complexity of implantable devices. As the global market for medical implants continues to expand—driven by aging populations and the prevalence of chronic diseases—ensuring robust EMC is becoming more critical than ever. In 2025, several innovations and emerging applications are poised to redefine the landscape of EMC testing for these life-sustaining devices.

One of the most significant trends is the integration of wireless communication technologies, such as Bluetooth Low Energy (BLE) and near-field communication (NFC), into medical implants. These features enable remote monitoring and data transmission but also introduce new vectors for electromagnetic interference (EMI). As a result, EMC testing protocols are evolving to address the unique challenges posed by these wireless-enabled devices. Advanced simulation tools and real-time monitoring systems are being developed to assess device performance in increasingly complex electromagnetic environments, including those found in smart hospitals and homes equipped with Internet of Things (IoT) devices (International Electrotechnical Commission).

Artificial intelligence (AI) and machine learning are also emerging as transformative tools in EMC testing. By analyzing vast datasets from previous tests and real-world device usage, AI-driven platforms can predict potential EMC issues and optimize test parameters, reducing time-to-market and improving patient safety (U.S. Food and Drug Administration). Additionally, the adoption of digital twins—virtual replicas of physical implants—enables continuous, in-silico EMC assessment throughout the device lifecycle, from design to post-market surveillance.

Regulatory bodies are responding to these technological shifts by updating standards and guidance documents. For example, the International Electrotechnical Commission and International Organization for Standardization are collaborating on harmonized EMC requirements for active implantable medical devices, with a focus on emerging wireless technologies and interoperability. The U.S. Food and Drug Administration is also piloting new approaches for premarket EMC evaluation, including scenario-based testing and risk-based frameworks.

Looking ahead, the convergence of miniaturization, wireless connectivity, and AI-driven diagnostics will continue to push the boundaries of EMC testing. Innovations such as implantable biosensors, closed-loop neuromodulation systems, and networked implant ecosystems will require even more sophisticated EMC assessment methodologies. As these trends accelerate, collaboration between manufacturers, regulators, and testing laboratories will be essential to ensure the safety and reliability of next-generation medical implants.

Sources & References

- European Commission

- Intertek Group plc

- SGS SA

- UL Solutions

- BSI Group

- Grand View Research

- MarketsandMarkets

- Health Canada

- TÜV Rheinland

- Japan’s PMDA

- Japanese Ministry of Health, Labour and Welfare (MHLW)

- International Medical Device Regulators Forum (IMDRF)

- International Organization for Standardization