- Bitcoin’s psychological milestone above $105,000 has renewed interest in the overall crypto market, but emerging opportunities are surfacing beyond the spotlight.

- Cardano continues to stand out in DeFi for its secure, energy-efficient blockchain and reliable proof-of-stake consensus, attracting long-term investors.

- Mutuum Finance is rapidly gaining traction during its presale, with unique DeFi features like peer-to-peer lending and automated liquidity pools powered by smart contracts.

- Innovative data compression in Mutuum reduces transaction costs and accelerates settlements, improving scalability and user experience.

- Staking rewards in Mutuum come from ecosystem fees reinvested into token purchases, fostering a sustainable and community-driven growth model.

- The next big crypto success could come from platforms that prioritize both technological innovation and broad financial inclusion.

Cracking through the psychological barrier of $105,000 this May, Bitcoin once again stole the headlines. But savvy investors notice where attention lingers and where opportunity quietly blossoms. This late spring, fresh excitement circles two crypto contenders: the seasoned Cardano and an audacious upstart—Mutuum Finance.

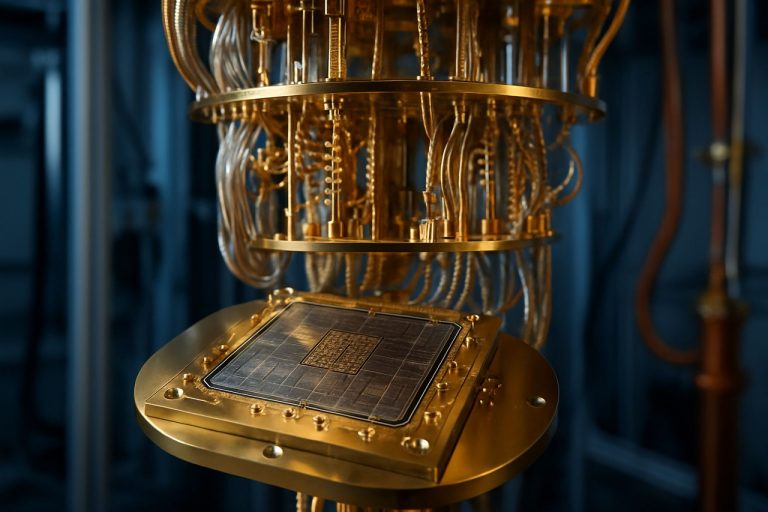

Cardano, a familiar stalwart in the decentralized finance (DeFi) sphere, continues to build on its secure, energy-efficient foundation, drawing investors who value both proven technology and a steady pace. Cardano’s unique Ouroboros consensus—a peer-reviewed proof-of-stake protocol—cements its reputation as a steadfast blockchain platform for decentralized apps and smart contracts. With a sprawling global community and high-profile partnerships, ADA consistently demonstrates resilience in the ever-shifting crypto landscape.

Where Cardano’s roots run deep, Mutuum Finance bursts forth with the vigor of a new era. Still in its presale phase, this DeFi project has already raised more than $9 million from thousands of investors, hinting at the sort of grassroots momentum that can turn a startup into a juggernaut. The token’s modest current price—mere cents apiece—intensifies the allure, fanning hopes of early-bird gains for buyers betting on an explosive ascent.

So, what truly sets Mutuum Finance apart in a field crowded with innovation?

Imagine a financial system where lending operates without gatekeepers. Two distinct gears drive Mutuum’s machine: a peer-to-peer mechanism that allows lenders to negotiate directly with borrowers—even dabbling in volatile meme coins for those who savor risk—and a peer-to-contract pool, letting users deposit assets en masse to supply liquidity, governed not by whim but by self-executing smart contracts. Interest rates ebb and flow with market forces, sparking more deposits when demand spikes and protecting borrowers from runaway rates.

As liquidity pools grow, lenders receive special tokens tracking both their principal and the interest it accrues—tokens that can be used as collateral elsewhere, generating a chain reaction of passive income and leveraging possibilities. The potential compounding effect echoes through the project, rewarding proactive participants rather than sidelined spectators.

Mutuum Finance isn’t blind to the fundamental challenges hindering DeFi’s mainstream adoption. High transaction costs and sluggish speeds, especially on layer 2 chains, have soured many decentralized dreams. Here, Mutuum compresses transaction data into byte-encoded strings, a seemingly small tweak with enormous implications—it means lower costs, faster settlements, and seamless scaling as new users flood in.

A defining twist awaits stakers, too. Mutuum commits to rich incentives, plowing ecosystem fees back into the purchase of its own tokens—and distributing these to its loyal community. This feedback loop echoes the logic of blue-chip dividend stocks: the more the platform is used, the greater the rewards for early believers.

If the Rules of Technological Revolutions are to be believed, mass adoption rides on one thing: innovation that lowers friction and opens the gates a little wider. Cardano and Mutuum strive in different ways to embody this ethos—one fortified by academic rigor and stability, the other propelled by radical automation and communal gains.

The fierce rallying of so many of 2025’s top coins has reawakened dreams last seen at the peak of the 2021 bull market. Yet, for those who survey the entire field, it’s clear that the next champion might emerge not from the old guard, but from a nimble, disruptive force—one that fuses bold technical leaps with community-driven growth.

Main takeaway: Crypto’s future won’t be built on hype alone. It will be earned by those platforms that deliver both innovation and opportunity, empowering anyone with vision—and a bit of courage—to shape tomorrow’s financial landscape.

Discover more about transformative crypto projects and trends at Coindesk and Binance.

The Crypto Titans Clash: Why Cardano’s Stability and Mutuum Finance’s Innovation Are Set to Shake Up the 2025 Market

Crypto headlines say Bitcoin is breaking psychological barriers, but beneath the surface, two contenders—Cardano and Mutuum Finance—are quietly preparing to shape the future of decentralized finance (DeFi). If you’re deciding where to put your money or simply want to understand what drives the next wave of crypto, here’s what the mainstream coverage missed and what you need to know.

—

Cardano vs. Mutuum Finance: Key Facts, Features & Expert Analysis

1. Cardano: A Peer-Reviewed Pillar of DeFi

Features & Specs

– Consensus: Ouroboros proof-of-stake, renowned for security and energy efficiency ([source](https://www.cardano.org)).

– Major Partnerships: Collaborations with academic institutions and governments (e.g., Ethiopia’s Ministry of Education partnership for student ID solutions).

– Smart Contracts: Supports Plutus and Marlowe, enabling advanced DApps and financial instruments.

– Tokenomics: ADA’s capped supply of 45 billion tokens promotes scarcity relative to inflationary coins.

Security & Sustainability

– Cardano’s PoS model uses orders of magnitude less energy than proof-of-work coins like Bitcoin.

– Community-led development via Project Catalyst ensures decentralization and accountability.

Market Trends

– Cardano consistently ranks in the top 10 cryptos by market cap, indicating institutional and retail trust.

– Recent upgrades (e.g., the Vasil hard fork) drive interoperability and throughput enhancements.

How-To: Get Started With Cardano

1. Install a non-custodial wallet (e.g., Daedalus or Yoroi).

2. Purchase ADA from reputable exchanges.

3. Delegate your tokens to a stake pool for passive income—no technical knowledge required.

Pros & Cons

– Pros: Robust, audited security; low energy usage; transparent roadmap.

– Cons: Sometimes criticized for slow rollout of features and conservative development.

2. Mutuum Finance: DeFi’s High-Growth Newcomer

What Makes Mutuum Unique?

– Dual Lending: Peer-to-peer for negotiation flexibility, plus peer-to-contract pools governed by smart contracts to optimize liquidity and rates.

– Composable Collateral: Interest-bearing tokens can be used elsewhere for further leveraging or liquidity farming.

– Byte-Encoded Transactions: This technical advance compresses transaction data, substantially lowering costs and increasing network speed—key for mass user adoption.

Presale Momentum & Tokenomics

– Raised over $9 million during presale, indicating significant early investor endorsement.

– Tokens available at only cents apiece, benefiting early participants with high upside potential.

Earning Potential & Staking Life Hacks

– Staking Rewards: Platform uses ecosystem fees to buy back and redistribute tokens.

– Hack: Early adopters can compound rewards not just by staking, but by using interest tokens as leverage elsewhere—creating “stacked passive income streams.”

Security & Limitations

– Smart contract code has been audited by third parties; however, as with any new protocol, unforeseen vulnerabilities can exist ([source](https://www.binance.com)).

– Early-stage: Higher upside but also greater risk compared to blue-chip coins due to nascent network effects and potential for exploits.

Real-World Use Cases

– Democratized lending for users in regions with limited banking infrastructure.

– Collateralized loans against volatile cryptocurrencies or NFTs.

– Institutional DeFi adoption (pending regulatory clarity).

3. Pressing Questions Answered

Q: Will Mutuum Finance disrupt traditional DeFi, or is it just hype?

A: Its compressed transaction model and feedback-loop staking create a more sustainable incentive model. If adoption continues post-launch, it could challenge established DEX and lending protocols. But as with any new player, do your due diligence.

Q: How does Cardano’s eco-friendliness compare to other blockchains?

A: Cardano consumes around 6 GWh per year, drastically lower than Bitcoin (120 TWh) and Ethereum pre-transition. This makes it suitable for ESG-focused investors.

Q: Can I use both platforms for risk management?

A: Yes. Diversify by holding ADA for stability and staking rewards, and allocate a smaller, higher-risk tranche to Mutuum’s presale for growth exposure. This hedges returns and volatility.

—

Reviews, Comparisons & Market Outlook

Comparing Cardano and Mutuum

– Cardano: Best for those seeking proven, future-proofed infrastructure and consistent returns.

– Mutuum: Appeals to early adopter risk-takers aiming for outsized gains and exposure to protocol-level innovations.

Market Predictions

– If Mutuum successfully scales and launches secondary markets for its interest tokens, analysts expect price appreciation similar to early Compound or Aave tokens.

– Cardano is positioned to benefit as more institutional players and dApps migrate to secure, scalable blockchains post-2024.

Industry Trends

– Rise of “DeFi 2.0” focused on composability, sustainable incentives, and lower fees.

– Regulatory scrutiny is increasing, especially in lending—platforms transparent about code and governance will outlast rivals.

—

Actionable Quick Tips

– Start small with new tokens—test Mutuum’s peer-to-peer feature with minimal funds to understand risk.

– For stable DeFi returns, stake ADA in a reputable pool.

– Track both projects on reputable sources like Coindesk and Binance for real-time updates.

—

Final Recommendation

Crypto fortunes favor the informed and prepared. Cardano’s steady hand and Mutuum’s radical tools are both poised for 2025, but differ in risk and return. Maximize exposure by diversifying, always using wallets and protocols with strong security reputations. Finally, stay updated—DeFi evolves fast, and so should your strategy.

—

Want cutting-edge news and guides? Bookmark Coindesk and Binance for trusted updates on all things crypto.