Bulk Ultrafast Laser Micromachining Industry Report 2025: Market Dynamics, Technology Innovations, and Strategic Forecasts to 2030

- Executive Summary and Market Overview

- Key Technology Trends in Bulk Ultrafast Laser Micromachining

- Competitive Landscape and Leading Players

- Market Growth Forecasts and Revenue Projections (2025–2030)

- Regional Analysis: Key Markets and Emerging Opportunities

- Challenges, Risks, and Market Entry Barriers

- Opportunities and Strategic Recommendations

- Future Outlook: Innovations and Long-Term Market Potential

- Sources & References

Executive Summary and Market Overview

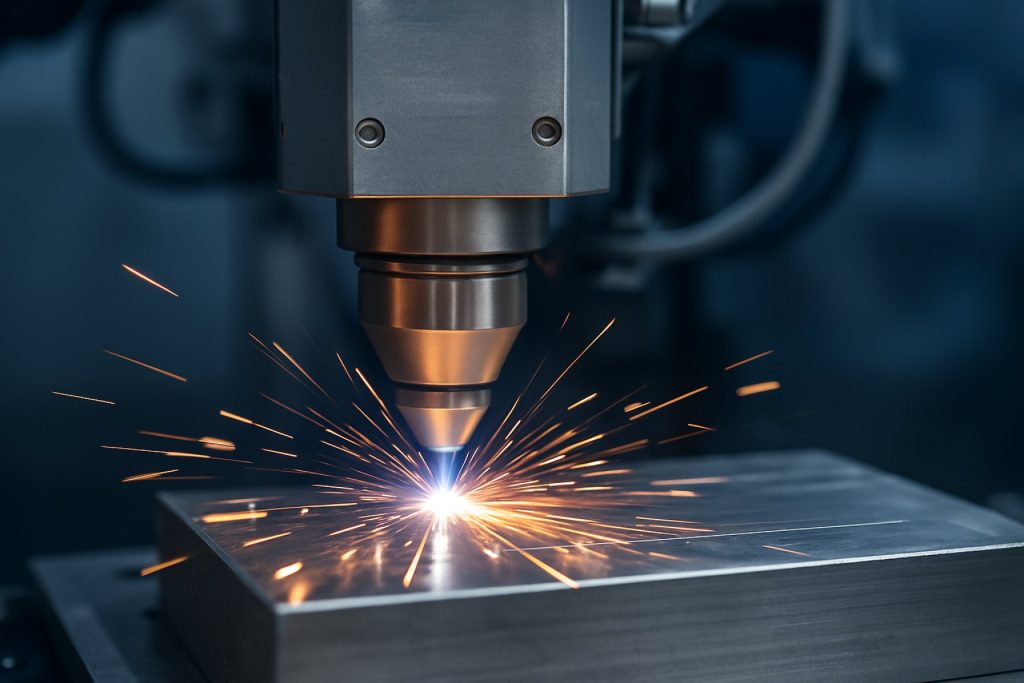

Bulk ultrafast laser micromachining refers to the use of ultrashort laser pulses—typically in the femtosecond to picosecond range—to process materials with high precision and minimal thermal damage. This technology enables the fabrication of intricate three-dimensional structures within transparent materials, as well as high-quality surface and sub-surface modifications in metals, semiconductors, and polymers. The process is widely adopted in industries such as electronics, medical devices, automotive, and photonics, where demand for miniaturization and complex geometries is accelerating.

The global market for bulk ultrafast laser micromachining is poised for robust growth in 2025, driven by advancements in laser source technology, increasing automation, and expanding application areas. According to MarketsandMarkets, the ultrafast laser market is projected to reach USD 3.5 billion by 2025, with micromachining representing a significant and rapidly expanding segment. The adoption of femtosecond and picosecond lasers is particularly strong in the semiconductor and electronics sectors, where they are used for wafer dicing, via drilling, and OLED patterning.

Key market drivers include the growing need for precision manufacturing in the medical device industry—such as stent and microfluidic device fabrication—and the push for higher throughput and yield in electronics manufacturing. The automotive sector is also leveraging ultrafast laser micromachining for lightweighting and the production of advanced sensor components. Geographically, Asia-Pacific leads the market, fueled by the concentration of electronics manufacturing hubs in China, Japan, and South Korea, as noted by Laser Focus World.

- Technological innovations, such as higher average power lasers and advanced beam delivery systems, are reducing processing times and expanding the range of machinable materials.

- Integration with Industry 4.0 and smart manufacturing platforms is enhancing process monitoring and quality control.

- Challenges remain in terms of high capital costs and the need for skilled operators, but ongoing R&D and automation are mitigating these barriers.

In summary, the bulk ultrafast laser micromachining market in 2025 is characterized by rapid technological progress, expanding end-use applications, and strong regional growth in Asia-Pacific. The sector is expected to maintain a high growth trajectory as industries continue to demand greater precision, efficiency, and material versatility.

Key Technology Trends in Bulk Ultrafast Laser Micromachining

Bulk ultrafast laser micromachining is experiencing rapid technological evolution, driven by the demand for higher precision, throughput, and versatility in manufacturing sectors such as electronics, photonics, and medical devices. As of 2025, several key technology trends are shaping the landscape of this market.

- Higher Average Power and Pulse Energy: The latest ultrafast laser systems are delivering higher average powers (exceeding 100 W) and pulse energies, enabling faster material removal rates and deeper penetration in bulk materials. This is particularly significant for applications in glass cutting, wafer dicing, and 3D microstructuring. Companies like TRUMPF and Coherent are at the forefront, introducing femtosecond lasers with improved beam quality and stability.

- Pulse Shaping and Burst Modes: Advanced pulse shaping and burst mode operation are becoming standard features, allowing for tailored energy delivery and reduced thermal effects. This results in cleaner cuts, minimized microcracks, and enhanced surface quality, which are critical for high-value components in the semiconductor and medical industries (Laser Focus World).

- Integration with Automation and AI: The integration of ultrafast lasers with automated handling systems and AI-driven process monitoring is improving yield and consistency. Real-time feedback and adaptive control systems are enabling closed-loop manufacturing, reducing defects and downtime (MarketsandMarkets).

- Multi-Beam and Parallel Processing: Multi-beam technology, where a single laser source is split into multiple beams, is gaining traction for high-throughput applications. This approach significantly increases processing speed, making ultrafast laser micromachining more viable for mass production (Photonics Media).

- Expansion into New Materials: Innovations in wavelength tunability and pulse duration are enabling the processing of a broader range of materials, including transparent ceramics, advanced polymers, and composite substrates. This is expanding the addressable market for bulk ultrafast laser micromachining (Laserfair).

These trends are collectively driving the adoption of bulk ultrafast laser micromachining in both established and emerging industries, positioning it as a cornerstone technology for next-generation manufacturing in 2025 and beyond.

Competitive Landscape and Leading Players

The competitive landscape of the bulk ultrafast laser micromachining market in 2025 is characterized by a mix of established photonics giants, specialized laser manufacturers, and innovative startups. The sector is driven by rapid advancements in femtosecond and picosecond laser technologies, as well as increasing demand from industries such as semiconductor manufacturing, medical device fabrication, and precision engineering.

Key players dominating the market include TRUMPF Group, Coherent Corp., and Spectra-Physics (MKS Instruments). These companies leverage extensive R&D capabilities and global distribution networks to maintain their leadership. TRUMPF Group continues to expand its ultrafast laser portfolio, focusing on high-repetition-rate systems for industrial-scale micromachining. Coherent Corp. has strengthened its position through strategic acquisitions and the development of turnkey solutions tailored for electronics and medical applications.

Emerging players such as Light Conversion and Amplitude Laser are gaining traction by offering highly customizable femtosecond laser systems, targeting niche applications like 3D glass structuring and advanced microfluidics. These companies often collaborate with research institutions to accelerate innovation and address evolving customer requirements.

Asian manufacturers, notably IPG Photonics and Lumentum Holdings, are increasing their market share by providing cost-competitive solutions and expanding their presence in the fast-growing electronics and display manufacturing sectors in China, South Korea, and Japan. Their focus on scalability and integration with automated production lines is a key differentiator in high-volume markets.

Strategic partnerships, mergers, and acquisitions are shaping the competitive dynamics. For example, Coherent Corp.’s acquisition of Rofin-Sinar has broadened its technology base and customer reach. Meanwhile, collaborations between laser manufacturers and system integrators are enabling the delivery of complete micromachining workstations, reducing time-to-market for end users.

Overall, the 2025 market is marked by intense competition, rapid technological innovation, and a strong emphasis on application-specific solutions. Companies that can offer high-precision, reliable, and scalable ultrafast laser micromachining systems are best positioned to capture growth in this evolving landscape.

Market Growth Forecasts and Revenue Projections (2025–2030)

The bulk ultrafast laser micromachining market is poised for robust growth in 2025, driven by increasing demand for high-precision manufacturing across sectors such as electronics, medical devices, and automotive. According to recent industry analyses, the global market size for ultrafast laser micromachining is projected to reach approximately USD 1.2 billion in 2025, reflecting a compound annual growth rate (CAGR) of around 12% from 2023 levels MarketsandMarkets. This growth is underpinned by the expanding adoption of femtosecond and picosecond laser systems for bulk material processing, which offer superior precision and minimal thermal damage compared to traditional techniques.

Key revenue drivers in 2025 include the proliferation of advanced consumer electronics, where ultrafast lasers are essential for micromachining brittle materials such as glass and ceramics used in displays and sensors. The medical device sector is also a significant contributor, with manufacturers leveraging ultrafast laser micromachining for stent fabrication, microfluidic devices, and implantable components Laser Focus World. Additionally, the automotive industry’s shift toward electric vehicles is spurring demand for precise micromachining of battery components and lightweight materials.

Regionally, Asia-Pacific is expected to dominate market revenues in 2025, accounting for over 40% of global sales, fueled by the concentration of electronics manufacturing hubs in China, Japan, and South Korea Grand View Research. North America and Europe will also see steady growth, supported by ongoing investments in medical technology and automotive innovation.

- Market Leaders: Major players such as TRUMPF Group, Coherent Corp., and Amplitude Laser are expected to maintain strong market positions through continued R&D and strategic partnerships.

- Emerging Trends: The integration of AI-driven process control and automation in micromachining systems is anticipated to further enhance throughput and yield, supporting higher revenue growth in 2025.

Overall, 2025 will mark a pivotal year for bulk ultrafast laser micromachining, with revenue projections reflecting both technological advancements and expanding end-use applications across key industries.

Regional Analysis: Key Markets and Emerging Opportunities

The regional landscape for bulk ultrafast laser micromachining in 2025 is shaped by a combination of established industrial bases, government initiatives, and the rapid adoption of advanced manufacturing technologies. Key markets include North America, Europe, and Asia-Pacific, each exhibiting distinct growth drivers and emerging opportunities.

North America remains a leading market, propelled by robust investments in aerospace, medical devices, and semiconductor manufacturing. The United States, in particular, benefits from a strong R&D ecosystem and the presence of major players such as Coherent and IPG Photonics. The region’s focus on precision manufacturing and miniaturization in electronics continues to drive demand for ultrafast laser micromachining solutions. Additionally, government funding for advanced manufacturing and defense applications further supports market expansion.

Europe is characterized by a high concentration of automotive and industrial equipment manufacturers, especially in Germany, France, and Switzerland. The region’s emphasis on Industry 4.0 and digitalization has accelerated the adoption of ultrafast laser micromachining for high-precision component fabrication. Companies such as TRUMPF and Amplitude Laser are at the forefront, leveraging strong collaborations with research institutions. The European Union’s funding for photonics and microfabrication research, through programs like Horizon Europe, is expected to create new opportunities for market entrants and technology innovators.

- Germany: Dominates the European market due to its advanced manufacturing sector and export-oriented economy.

- France & Switzerland: Notable for their contributions to medical device and watchmaking industries, both of which require high-precision micromachining.

Asia-Pacific is the fastest-growing region, led by China, Japan, and South Korea. The expansion of consumer electronics, automotive, and semiconductor industries is fueling demand for ultrafast laser micromachining. China’s government-backed initiatives to localize high-end manufacturing and the presence of domestic players such as Han’s Laser are accelerating technology adoption. Japan’s established electronics sector and South Korea’s focus on semiconductor innovation further contribute to regional growth.

Emerging opportunities are also evident in Southeast Asia and India, where increasing foreign direct investment and the rise of local manufacturing hubs are expected to drive future demand for bulk ultrafast laser micromachining solutions.

Challenges, Risks, and Market Entry Barriers

The bulk ultrafast laser micromachining market in 2025 faces a complex landscape of challenges, risks, and entry barriers that shape its competitive dynamics and growth trajectory. One of the primary challenges is the high capital expenditure required for advanced ultrafast laser systems. These systems, often incorporating femtosecond or picosecond lasers, demand significant investment not only in the laser sources themselves but also in precision motion control, environmental controls, and safety infrastructure. This financial barrier limits market entry primarily to established players or well-funded startups, restricting broader participation and innovation.

Technical complexity is another significant hurdle. Achieving consistent, high-precision results in bulk micromachining requires deep expertise in laser-material interactions, process optimization, and system integration. The need for highly skilled personnel—ranging from photonics engineers to application specialists—creates a talent bottleneck, especially as demand for such expertise outpaces supply. Additionally, the rapid pace of technological advancement means that companies must continuously invest in R&D to remain competitive, further raising the stakes for new entrants.

Intellectual property (IP) protection and regulatory compliance also pose risks. The field is characterized by a dense landscape of patents covering laser architectures, beam delivery systems, and process methodologies. Navigating this IP environment can be costly and time-consuming, with the risk of litigation acting as a deterrent to new market participants. Furthermore, compliance with international safety and quality standards—such as ISO 13485 for medical device manufacturing or ISO 9001 for general quality management—adds another layer of complexity and cost, particularly for companies targeting regulated industries like medical devices or aerospace.

- Supply Chain Vulnerabilities: The market is sensitive to disruptions in the supply of critical components such as laser diodes, precision optics, and motion systems. Geopolitical tensions and global semiconductor shortages have highlighted these vulnerabilities, impacting lead times and pricing (Lumentum Holdings Inc.).

- Customer Adoption Risks: End-users in industries such as electronics, automotive, and medical devices may be hesitant to adopt ultrafast laser micromachining due to concerns over process reliability, integration complexity, and return on investment (TRUMPF Group).

- Competitive Pressure: Established players with vertically integrated capabilities and global service networks, such as Coherent Corp. and Amplitude Laser, create high competitive barriers for new entrants.

In summary, while the bulk ultrafast laser micromachining market offers significant growth potential, it is characterized by high entry barriers, technical and regulatory risks, and a competitive environment dominated by a few key players. Overcoming these challenges requires substantial investment, technical expertise, and strategic partnerships.

Opportunities and Strategic Recommendations

The bulk ultrafast laser micromachining market in 2025 is poised for significant growth, driven by advancements in laser technology, increasing demand for precision manufacturing, and the expansion of applications across industries such as electronics, medical devices, and automotive. Several key opportunities and strategic recommendations can be identified for stakeholders aiming to capitalize on this evolving landscape.

- Expansion into High-Growth Sectors: The electronics and semiconductor industries are expected to remain primary drivers, with ultrafast laser micromachining enabling the fabrication of microelectronic components, flexible circuits, and advanced packaging. Companies should target partnerships with leading electronics manufacturers and invest in R&D to address the miniaturization and complexity requirements of next-generation devices (Laser Focus World).

- Medical Device Innovation: The medical sector presents robust opportunities, particularly in the production of microfluidic devices, stents, and implantable sensors. Strategic collaborations with medical device OEMs and compliance with stringent regulatory standards will be crucial for market penetration (MarketsandMarkets).

- Geographic Diversification: Asia-Pacific, especially China, Japan, and South Korea, is projected to witness the fastest growth due to expanding manufacturing bases and government initiatives supporting advanced manufacturing. Establishing local partnerships and service centers in these regions can enhance market access and customer support (Grand View Research).

- Process Automation and Digital Integration: Integrating ultrafast laser systems with Industry 4.0 technologies—such as real-time monitoring, AI-driven process optimization, and digital twins—can deliver higher throughput, reduced downtime, and improved quality assurance. Investment in software development and system integration capabilities is recommended (Photonics Media).

- Sustainability and Green Manufacturing: As environmental regulations tighten, promoting the energy efficiency and minimal waste generation of ultrafast laser micromachining can be a differentiator. Companies should highlight these benefits in their value proposition and pursue certifications that validate their sustainability claims (Laserfair).

In summary, stakeholders should focus on sector-specific innovation, geographic expansion, digital transformation, and sustainability to maximize their competitive advantage in the bulk ultrafast laser micromachining market in 2025.

Future Outlook: Innovations and Long-Term Market Potential

The future outlook for bulk ultrafast laser micromachining is marked by rapid innovation and expanding long-term market potential, driven by advancements in laser technology, automation, and the growing demand for precision manufacturing across multiple industries. By 2025, the market is expected to benefit from several key trends that will shape its trajectory.

One of the most significant innovations is the development of higher-power, more efficient ultrafast lasers, including femtosecond and picosecond systems. These lasers enable faster processing speeds, greater material versatility, and improved feature resolution, making them increasingly attractive for applications in microelectronics, medical device fabrication, and photonics. The integration of ultrafast lasers with advanced motion control and real-time monitoring systems is further enhancing throughput and process reliability, reducing operational costs and enabling mass production of complex microstructures TRUMPF.

Automation and artificial intelligence (AI) are poised to play a transformative role in the sector. AI-driven process optimization and machine learning algorithms are being deployed to fine-tune laser parameters in real time, ensuring consistent quality and minimizing waste. This is particularly relevant for high-value sectors such as semiconductor manufacturing and medical device production, where precision and repeatability are paramount MarketsandMarkets.

From a market perspective, the global ultrafast laser market is projected to grow at a CAGR of over 15% through 2025, with bulk micromachining representing a significant share of this expansion. The Asia-Pacific region, led by China, Japan, and South Korea, is expected to be a major growth driver due to robust investments in electronics and automotive manufacturing Grand View Research.

- Emerging applications in quantum technology, microfluidics, and bioengineering are opening new avenues for bulk ultrafast laser micromachining.

- Collaborations between laser manufacturers and end-users are accelerating the development of application-specific solutions.

- Environmental sustainability is gaining importance, with innovations focused on energy efficiency and reduced material waste.

In summary, by 2025, bulk ultrafast laser micromachining is set to benefit from technological breakthroughs, increased automation, and expanding application fields, positioning it as a cornerstone technology for next-generation manufacturing.

Sources & References

- MarketsandMarkets

- Laser Focus World

- TRUMPF

- Coherent

- Laserfair

- Amplitude Laser

- IPG Photonics

- Lumentum Holdings

- Grand View Research

- Han’s Laser