Biohybrid Biorobotics Industry Report 2025: Market Dynamics, Technology Breakthroughs, and Strategic Forecasts. Explore Key Growth Drivers, Regional Trends, and Competitive Insights Shaping the Next 5 Years.

- Executive Summary & Market Overview

- Key Technology Trends in Biohybrid Biorobotics

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

Biohybrid biorobotics is an emerging interdisciplinary field that integrates living biological components—such as cells, tissues, or even entire organisms—with synthetic robotic systems to create machines capable of advanced, adaptive behaviors. This fusion leverages the unique capabilities of biological materials, such as self-healing, energy efficiency, and environmental responsiveness, to overcome the limitations of traditional robotics. As of 2025, the global biohybrid biorobotics market is experiencing rapid growth, driven by advances in tissue engineering, synthetic biology, and microfabrication technologies.

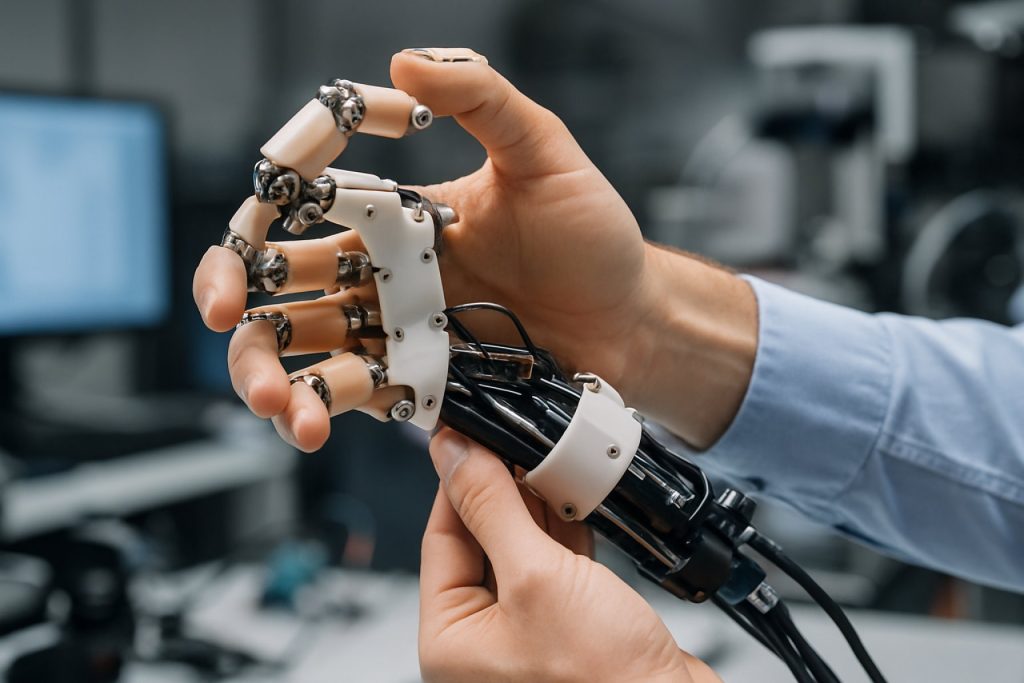

The market is characterized by a surge in research and development activities, with significant investments from both public and private sectors. Key application areas include medical devices (such as soft actuators for minimally invasive surgery), environmental monitoring, drug delivery systems, and next-generation prosthetics. According to Grand View Research, the broader biomedical robotics market is projected to reach USD 19.3 billion by 2028, with biohybrid systems representing a fast-growing segment due to their potential for personalized and adaptive solutions.

Leading academic institutions and research organizations, such as Harvard University and Massachusetts Institute of Technology (MIT), are at the forefront of innovation, developing biohybrid robots powered by muscle cells or engineered tissues. Startups and established companies are also entering the space, with notable examples including Cyborgbotics and Soft Robotics Inc., which are exploring commercial applications ranging from soft grippers to bio-actuated micro-robots.

- Market Drivers: The demand for more adaptable, efficient, and biocompatible robotic systems in healthcare and environmental sectors is a primary growth driver. Advances in 3D bioprinting and microfluidics are enabling the scalable production of biohybrid components.

- Challenges: Technical hurdles include the integration of living tissues with synthetic materials, long-term viability of biological components, and regulatory uncertainties regarding safety and ethical considerations.

- Regional Insights: North America and Europe lead in R&D and commercialization, while Asia-Pacific is rapidly increasing its investment, particularly in biomedical and agricultural applications.

In summary, biohybrid biorobotics is poised for significant expansion in 2025, with multidisciplinary collaboration and technological breakthroughs accelerating its transition from laboratory prototypes to real-world applications.

Key Technology Trends in Biohybrid Biorobotics

Biohybrid biorobotics, the interdisciplinary field combining biological tissues with synthetic robotic systems, is experiencing rapid technological evolution as it moves toward practical applications in medicine, environmental monitoring, and soft robotics. In 2025, several key technology trends are shaping the trajectory of this sector, driven by advances in materials science, tissue engineering, and artificial intelligence.

- Integration of Living Cells and Synthetic Materials: The development of robust interfaces between living cells (such as muscle or nerve cells) and synthetic scaffolds is a central trend. Innovations in hydrogel matrices and biocompatible polymers are enabling more stable and functional integration, allowing for the creation of actuators and sensors that mimic natural muscle movement and responsiveness. Research from institutions like Nature highlights breakthroughs in engineered muscle tissues powering soft robotic devices.

- Advancements in Microfabrication and 3D Bioprinting: Precision microfabrication and 3D bioprinting technologies are allowing for the construction of complex, multi-material biohybrid structures at micro- and nano-scales. This enables the design of biorobots with intricate architectures, such as vascularized tissues or neuron-integrated circuits, which are essential for advanced functionalities. Companies like CELLINK are at the forefront of commercializing bioprinting platforms for biohybrid applications.

- AI-Driven Control and Learning: Artificial intelligence and machine learning algorithms are increasingly being used to control biohybrid systems, enabling adaptive behaviors and real-time learning from environmental feedback. This trend is particularly significant for autonomous biorobots intended for dynamic environments, as seen in research collaborations reported by IEEE.

- Energy Harvesting and Wireless Power: Powering biohybrid robots remains a challenge, but recent advances in wireless energy transfer and bio-compatible energy harvesting (such as glucose fuel cells) are extending operational lifespans and enabling untethered operation. Startups and research groups, including those highlighted by Nature Nanotechnology, are demonstrating proof-of-concept devices that operate autonomously for extended periods.

- Ethical and Regulatory Frameworks: As biohybrid biorobotics approaches clinical and commercial deployment, there is a growing emphasis on developing ethical guidelines and regulatory standards. Organizations such as the U.S. Food and Drug Administration (FDA) are beginning to address the unique challenges posed by these hybrid systems.

These trends collectively indicate a maturing field, with 2025 poised to see increased commercialization, interdisciplinary collaboration, and the emergence of new application domains for biohybrid biorobotics.

Competitive Landscape and Leading Players

The competitive landscape of the biohybrid biorobotics market in 2025 is characterized by a dynamic mix of established robotics firms, biotechnology innovators, and academic spin-offs, all vying for leadership in this rapidly evolving field. Biohybrid biorobotics, which integrates living biological components with synthetic robotic systems, is still in its nascent commercialization phase, but the sector is witnessing increased investment and strategic partnerships.

Key players in the market include Harvard University and its Wyss Institute, which have pioneered soft robotic actuators powered by living muscle tissue, and Stanford University, known for its research in biohybrid locomotion and neural integration. These academic institutions often collaborate with industry partners to accelerate technology transfer and commercialization.

Among commercial entities, SoftBank Robotics and Boston Robotics are exploring biohybrid approaches to enhance adaptability and energy efficiency in their robotic platforms. Meanwhile, biotechnology companies such as Organovo Holdings, Inc. are leveraging their expertise in tissue engineering to develop living components for integration into robotic systems.

Startups are also playing a pivotal role. Companies like Cyfuse Biomedical and Emulate, Inc. are developing proprietary bioprinting and organ-on-chip technologies that can be adapted for biohybrid robotic applications. These firms are attracting venture capital and forming alliances with larger robotics and medical device companies to scale their innovations.

The competitive environment is further shaped by government and defense agencies, such as the Defense Advanced Research Projects Agency (DARPA), which funds projects at the intersection of biology and robotics for applications in search and rescue, environmental monitoring, and medical devices.

- Academic-industry partnerships are crucial for bridging the gap between research and market-ready products.

- Intellectual property portfolios and proprietary biomanufacturing techniques are key differentiators among leading players.

- Geographically, North America and East Asia are the primary hubs for innovation and commercialization, driven by robust funding and research ecosystems.

As the field matures, the competitive landscape is expected to consolidate, with mergers, acquisitions, and strategic collaborations shaping the trajectory of biohybrid biorobotics through 2025 and beyond.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The biohybrid biorobotics market is poised for significant expansion between 2025 and 2030, driven by rapid advancements in biomaterials, tissue engineering, and robotics integration. According to projections from MarketsandMarkets, the global biohybrid biorobotics sector is expected to register a compound annual growth rate (CAGR) of approximately 18–22% during this period. This robust growth is attributed to increasing investments in medical robotics, the rising demand for soft robotics in minimally invasive surgery, and the expanding application of living-tissue-based actuators in research and industry.

Revenue forecasts indicate that the market, valued at an estimated USD 1.2 billion in 2025, could surpass USD 3.2 billion by 2030. This surge is underpinned by the commercialization of biohybrid devices for drug delivery, prosthetics, and micro-manipulation, as well as the growing adoption of biohybrid robots in academic and industrial research settings. Grand View Research highlights that North America and Europe will remain the leading revenue contributors, owing to strong R&D ecosystems and supportive regulatory frameworks, while Asia-Pacific is expected to witness the fastest CAGR due to increased government funding and emerging biotech hubs.

In terms of volume, the number of biohybrid biorobotic units deployed globally is projected to grow from approximately 8,000 units in 2025 to over 25,000 units by 2030. This volume growth is particularly notable in the healthcare sector, where biohybrid robots are increasingly used for tissue engineering, organ-on-chip systems, and rehabilitation devices. Fortune Business Insights reports that the integration of living cells with synthetic frameworks is enabling new classes of soft robots with enhanced adaptability and functionality, further accelerating market adoption.

- CAGR (2025–2030): 18–22%

- Revenue (2025): USD 1.2 billion

- Revenue (2030): USD 3.2 billion+

- Volume (2025): ~8,000 units

- Volume (2030): 25,000+ units

Overall, the 2025–2030 period is expected to be transformative for biohybrid biorobotics, with strong growth in both revenue and deployment volumes, driven by technological innovation and expanding application domains.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The regional landscape of the biohybrid biorobotics market in 2025 is shaped by varying levels of research investment, regulatory environments, and industrial adoption across North America, Europe, Asia-Pacific, and the Rest of the World. Each region demonstrates unique drivers and challenges influencing the pace and direction of market growth.

- North America: North America, led by the United States, remains at the forefront of biohybrid biorobotics innovation. The region benefits from robust funding for advanced robotics and biotechnology research, with institutions such as National Institutes of Health and National Science Foundation supporting interdisciplinary projects. The presence of leading universities and startups, coupled with a favorable intellectual property regime, accelerates commercialization. In 2025, North America is expected to account for the largest market share, driven by applications in healthcare, soft robotics, and defense sectors.

- Europe: Europe is characterized by strong academic collaboration and public-private partnerships, particularly in countries like Germany, the UK, and the Netherlands. The European Commission has prioritized funding for biohybrid systems under its Horizon Europe program, fostering cross-border research. Regulatory harmonization efforts and a focus on ethical frameworks are shaping the adoption of biohybrid biorobotics in medical and industrial applications. The region is projected to see steady growth, with emphasis on sustainable and human-centric robotics.

- Asia-Pacific: The Asia-Pacific region is witnessing rapid expansion, fueled by significant investments from countries such as Japan, China, and South Korea. Government initiatives, such as Japan’s Ministry of Economy, Trade and Industry robotics strategy and China’s Ministry of Science and Technology funding, are propelling research and industrial deployment. The region’s large manufacturing base and growing healthcare needs are catalyzing demand for biohybrid biorobotics, particularly in rehabilitation and assistive devices.

- Rest of World: In other regions, including Latin America, the Middle East, and Africa, adoption remains nascent but is gradually increasing. Localized research initiatives and international collaborations are beginning to emerge, though limited funding and infrastructure pose challenges. However, pilot projects in agriculture and environmental monitoring are laying the groundwork for future market entry.

Overall, the global biohybrid biorobotics market in 2025 is marked by regional disparities in maturity and adoption, with North America and Asia-Pacific leading in innovation and deployment, while Europe emphasizes regulatory and ethical integration, and the Rest of the World explores niche applications.

Future Outlook: Emerging Applications and Investment Hotspots

Looking ahead to 2025, the field of biohybrid biorobotics is poised for significant expansion, driven by advances in tissue engineering, soft robotics, and synthetic biology. Biohybrid biorobots—systems that integrate living biological tissues with artificial components—are expected to move beyond laboratory prototypes toward real-world applications, particularly in healthcare, environmental monitoring, and precision agriculture.

One of the most promising emerging applications is in the development of next-generation medical devices. Biohybrid actuators and sensors, which leverage living muscle cells or neurons, are being explored for use in minimally invasive surgical tools and implantable devices that can adapt to the body’s environment. For example, research funded by the National Institutes of Health is advancing biohybrid micro-robots capable of targeted drug delivery and tissue repair, with several preclinical trials anticipated in 2025.

Environmental monitoring is another hotspot, with biohybrid robots designed to mimic aquatic organisms for pollution detection and ecosystem assessment. These devices, often powered by living cells, offer enhanced sensitivity and adaptability compared to traditional sensors. The Defense Advanced Research Projects Agency (DARPA) has invested in projects that deploy biohybrid fish and jellyfish robots for underwater surveillance and environmental data collection, with pilot deployments expected to scale in 2025.

In agriculture, biohybrid biorobots are being developed to perform delicate tasks such as pollination, pest control, and crop monitoring. Startups and research consortia, supported by organizations like the European Commission, are piloting biohybrid drones and soft robots that can interact safely with plants and animals, addressing labor shortages and sustainability challenges in the sector.

From an investment perspective, venture capital and government funding are increasingly targeting biohybrid biorobotics startups and collaborative research initiatives. According to CB Insights, global investment in biohybrid robotics exceeded $400 million in 2023, with a projected annual growth rate of 18% through 2025. Key investment hotspots include North America, Western Europe, and East Asia, where robust biotech and robotics ecosystems support rapid commercialization.

Overall, 2025 is expected to mark a pivotal year for biohybrid biorobotics, as emerging applications transition from proof-of-concept to early-stage deployment, attracting both strategic and financial investors eager to capitalize on the convergence of biology and robotics.

Challenges, Risks, and Strategic Opportunities

Biohybrid biorobotics, which integrates living biological components with synthetic robotic systems, faces a unique set of challenges and risks as it moves toward broader commercialization and real-world deployment in 2025. One of the primary technical challenges is the reliable integration of living tissues—such as muscle cells or neurons—with artificial materials. Achieving stable, long-term interfaces without immune rejection or degradation remains a significant hurdle, as highlighted by research from the Nature Reviews Materials. Additionally, maintaining the viability and functionality of biological components outside their native environments requires advanced bioreactor systems and precise environmental controls, which can increase complexity and cost.

Regulatory uncertainty is another major risk. Biohybrid biorobots often fall into a gray area between medical devices, biologics, and robotics, making it unclear which regulatory pathways apply. This ambiguity can delay product development and market entry, as noted by the U.S. Food and Drug Administration in its guidance on combination products. Ethical concerns also loom large, particularly regarding the use of animal or human-derived tissues, raising questions about consent, animal welfare, and potential misuse.

From a market perspective, scalability and reproducibility are persistent challenges. Producing biohybrid systems at commercial scale while ensuring consistent quality and performance is difficult, especially given the variability inherent in biological materials. This can limit the ability of companies to meet demand or achieve cost efficiencies, as reported by IDTechEx.

Despite these challenges, strategic opportunities abound. Advances in stem cell engineering, 3D bioprinting, and microfluidics are enabling more robust and customizable biohybrid constructs. Collaborations between academic institutions, biotech firms, and robotics companies are accelerating innovation and de-risking early-stage development. For example, partnerships like those fostered by the Defense Advanced Research Projects Agency (DARPA) are driving breakthroughs in soft robotics and biohybrid actuation.

- Emerging applications in soft robotics, medical devices, and environmental sensing offer new revenue streams.

- Early-mover advantage exists for companies that can navigate regulatory pathways and establish robust supply chains.

- Strategic investment in intellectual property and cross-disciplinary talent is critical for long-term competitiveness.

In summary, while biohybrid biorobotics faces significant technical, regulatory, and ethical risks, the sector is poised for growth as enabling technologies mature and strategic partnerships proliferate.

Sources & References

- Grand View Research

- Harvard University

- Massachusetts Institute of Technology (MIT)

- Soft Robotics Inc.

- Nature

- CELLINK

- IEEE

- Stanford University

- SoftBank Robotics

- Organovo Holdings, Inc.

- Cyfuse Biomedical

- Emulate, Inc.

- Defense Advanced Research Projects Agency (DARPA)

- MarketsandMarkets

- Fortune Business Insights

- National Institutes of Health

- National Science Foundation

- European Commission

- Ministry of Science and Technology

- IDTechEx