Avalanche Photodiode Manufacturing Industry Report 2025: In-Depth Analysis of Market Dynamics, Technology Innovations, and Global Growth Prospects

- Executive Summary & Market Overview

- Key Technology Trends in Avalanche Photodiode Manufacturing

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Opportunities

- Challenges, Risks, and Strategic Opportunities for Stakeholders

- Sources & References

Executive Summary & Market Overview

The avalanche photodiode (APD) manufacturing market is poised for significant growth in 2025, driven by expanding applications in telecommunications, medical imaging, industrial automation, and automotive LiDAR systems. Avalanche photodiodes are highly sensitive semiconductor devices that amplify weak optical signals, making them essential in high-speed and low-light detection environments. The global APD market is expected to reach a valuation of approximately USD 250 million by 2025, with a compound annual growth rate (CAGR) of around 7% from 2022 to 2025, according to MarketsandMarkets.

Key drivers for this growth include the rapid deployment of 5G networks, which require high-performance photodetectors for optical communication infrastructure, and the increasing adoption of advanced driver-assistance systems (ADAS) and autonomous vehicles, where APDs are integral to LiDAR sensors. Additionally, the medical sector’s demand for precise imaging technologies, such as positron emission tomography (PET), is fueling further innovation and investment in APD manufacturing.

Asia-Pacific remains the dominant region in APD manufacturing, led by countries such as China, Japan, and South Korea, due to their robust electronics and semiconductor industries. North America and Europe are also significant markets, particularly in the context of research, defense, and healthcare applications. Leading manufacturers, including Hamamatsu Photonics, First Sensor AG (now part of TE Connectivity), and Lumentum Holdings Inc., are investing in advanced fabrication techniques to improve device performance, reliability, and cost-effectiveness.

- Technological Trends: The market is witnessing a shift toward silicon-based APDs for cost-sensitive applications and InGaAs-based APDs for high-speed, long-wavelength detection, particularly in fiber-optic communications.

- Supply Chain Dynamics: The industry faces challenges related to the sourcing of high-purity semiconductor materials and the need for precision manufacturing equipment, which can impact lead times and pricing.

- Competitive Landscape: Strategic collaborations, mergers, and acquisitions are shaping the competitive environment, with companies seeking to expand their product portfolios and global reach.

In summary, the avalanche photodiode manufacturing market in 2025 is characterized by robust demand across multiple high-growth sectors, ongoing technological advancements, and a dynamic competitive landscape, positioning it as a critical segment within the broader optoelectronics industry.

Key Technology Trends in Avalanche Photodiode Manufacturing

In 2025, avalanche photodiode (APD) manufacturing is witnessing significant technological advancements driven by the demands of high-speed optical communication, LiDAR, and advanced imaging systems. Key trends shaping the industry include the integration of new semiconductor materials, miniaturization, and the adoption of advanced fabrication techniques to enhance device performance and scalability.

One of the most notable trends is the shift from traditional silicon-based APDs to those utilizing compound semiconductors such as indium gallium arsenide (InGaAs) and germanium. These materials offer superior sensitivity in the near-infrared spectrum, which is critical for applications in fiber-optic communications and automotive LiDAR. Manufacturers are increasingly investing in heterojunction structures and multi-layer epitaxial growth to achieve higher quantum efficiency and lower noise characteristics, as reported by MarketsandMarkets.

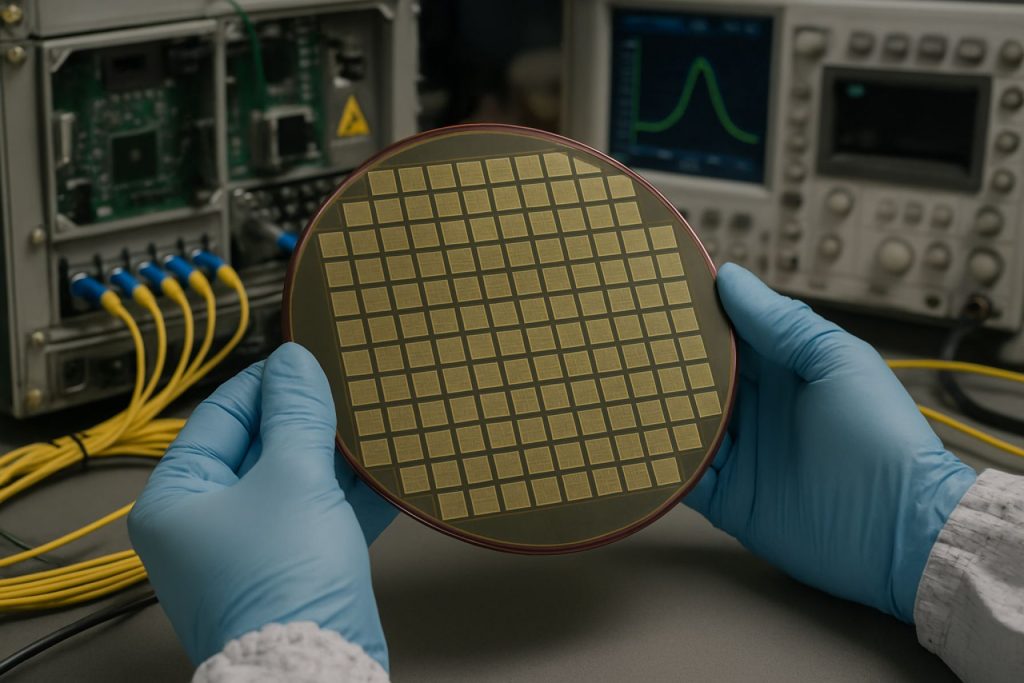

Another key trend is the miniaturization and integration of APDs into photonic integrated circuits (PICs). This approach enables the development of compact, high-density sensor arrays suitable for next-generation 3D imaging and high-speed data transmission. The use of wafer-level packaging and advanced lithography techniques is facilitating the mass production of APDs with consistent performance and reduced manufacturing costs, as highlighted by Yole Group.

Automation and process control are also becoming increasingly important in APD manufacturing. The adoption of machine learning algorithms for real-time monitoring and defect detection during fabrication is improving yield rates and device reliability. This trend is particularly relevant as manufacturers scale up production to meet the growing demand from telecommunications and automotive sectors, according to IDC.

Finally, sustainability and supply chain resilience are emerging as critical considerations. Manufacturers are exploring eco-friendly materials and energy-efficient processes to reduce the environmental impact of APD production. Additionally, efforts to localize supply chains and diversify sourcing of critical raw materials are being prioritized to mitigate risks associated with geopolitical tensions and global disruptions, as noted by Gartner.

Competitive Landscape and Leading Players

The competitive landscape of avalanche photodiode (APD) manufacturing in 2025 is characterized by a mix of established photonics giants and specialized semiconductor firms, each leveraging advanced fabrication techniques and proprietary technologies to capture market share. The sector is marked by high barriers to entry due to the technical complexity of APD design, stringent quality requirements, and the need for significant capital investment in cleanroom facilities and testing equipment.

Key players dominating the APD market include Hamamatsu Photonics, First Sensor AG (now part of TE Connectivity), Lumentum Holdings Inc., and onsemi. These companies have established robust supply chains and maintain strong relationships with end-users in telecommunications, medical imaging, and industrial automation. Their competitive advantage is often rooted in proprietary semiconductor processing, vertical integration, and the ability to deliver high-performance APDs with low noise and high gain characteristics.

In recent years, the market has also seen the emergence of innovative players such as Excelitas Technologies and Laser Components, which focus on niche applications and custom solutions. These firms differentiate themselves through agility in product development and the ability to tailor APD modules for specific wavelength ranges or integration into compact optoelectronic systems.

Strategic partnerships and mergers have further shaped the competitive landscape. For example, the acquisition of First Sensor by TE Connectivity has enabled broader market access and enhanced R&D capabilities, while collaborations between APD manufacturers and system integrators have accelerated the adoption of APDs in emerging fields such as LiDAR and quantum communications.

- Hamamatsu Photonics: Market leader with a comprehensive APD portfolio and global distribution network.

- First Sensor AG (TE Connectivity): Strong in automotive and industrial applications, leveraging TE’s global reach.

- Lumentum Holdings Inc.: Focused on telecom and datacom, with advanced InGaAs APD technology.

- onsemi: Major supplier for high-volume, cost-sensitive markets.

- Excelitas Technologies and Laser Components: Specialists in custom and high-sensitivity APDs.

Overall, the APD manufacturing sector in 2025 is defined by technological innovation, strategic consolidation, and a focus on application-specific performance, with leading players investing heavily in R&D to maintain their competitive edge.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The avalanche photodiode (APD) manufacturing market is poised for robust growth between 2025 and 2030, driven by escalating demand in telecommunications, medical imaging, and industrial automation. According to recent projections, the global APD market is expected to register a compound annual growth rate (CAGR) of approximately 7.5% during this period, with total market revenue anticipated to reach USD 1.2 billion by 2030, up from an estimated USD 780 million in 2025 MarketsandMarkets.

Volume-wise, the number of APD units shipped is forecasted to grow in tandem with revenue, reflecting both increased adoption and technological advancements that enable broader application. By 2030, annual shipments are projected to surpass 25 million units, compared to approximately 15 million units in 2025. This growth is underpinned by the proliferation of high-speed optical communication networks, where APDs are critical for signal detection and amplification, as well as the expansion of LiDAR systems in automotive and industrial sectors Global Market Insights.

Regionally, Asia-Pacific is expected to maintain its dominance in APD manufacturing, accounting for over 45% of global revenue by 2030. This is attributed to the concentration of key manufacturers and the rapid expansion of 5G infrastructure and fiber-optic networks in countries such as China, Japan, and South Korea. North America and Europe are also projected to experience steady growth, fueled by investments in medical imaging technologies and defense applications Fortune Business Insights.

- CAGR (2025–2030): ~7.5%

- Revenue (2030): USD 1.2 billion

- Volume (2030): 25+ million units

- Key Growth Drivers: Optical communications, LiDAR, medical imaging, industrial automation

- Leading Region: Asia-Pacific

Overall, the APD manufacturing sector is set for significant expansion through 2030, propelled by technological innovation and the growing need for high-performance photodetection across multiple industries.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global avalanche photodiode (APD) manufacturing market demonstrates distinct regional dynamics, shaped by technological innovation, end-user demand, and supply chain capabilities. In 2025, North America, Europe, Asia-Pacific, and the Rest of World (RoW) regions each contribute uniquely to the sector’s growth trajectory.

North America remains a leader in APD innovation, driven by robust investments in telecommunications, defense, and medical imaging. The presence of major industry players and research institutions fosters continuous advancements in APD performance and integration. The U.S. market, in particular, benefits from government-backed R&D and a strong focus on next-generation optical networks, supporting both domestic manufacturing and export opportunities. According to MarketsandMarkets, North America’s share is bolstered by early adoption of 5G and LiDAR technologies, with the region expected to maintain steady growth through 2025.

Europe is characterized by a focus on high-reliability APDs for automotive, aerospace, and industrial automation applications. The region’s stringent regulatory standards and emphasis on quality have led to the development of advanced manufacturing processes. Germany, France, and the UK are at the forefront, leveraging strong automotive and photonics sectors. The European Union’s initiatives to strengthen semiconductor supply chains and reduce reliance on imports further support local APD manufacturing, as highlighted by European Commission policy updates.

Asia-Pacific is the fastest-growing region, propelled by large-scale investments in telecommunications infrastructure, consumer electronics, and industrial automation. China, Japan, and South Korea dominate APD production, benefiting from cost-effective manufacturing, government incentives, and a rapidly expanding domestic market. The region’s manufacturers are increasingly moving up the value chain, focusing on high-sensitivity and low-noise APDs for emerging applications such as quantum communications and advanced medical diagnostics. Global Information, Inc. reports that Asia-Pacific is set to outpace other regions in both volume and revenue growth by 2025.

Rest of World (RoW) markets, including Latin America, the Middle East, and Africa, are in the early stages of APD adoption. Growth is primarily driven by infrastructure modernization and increasing demand for fiber-optic networks. While manufacturing capabilities remain limited, partnerships with established players from other regions are facilitating technology transfer and local assembly initiatives, as noted by International Data Corporation (IDC).

Future Outlook: Emerging Applications and Investment Opportunities

The future outlook for avalanche photodiode (APD) manufacturing in 2025 is shaped by a convergence of technological advancements, expanding application domains, and increasing investment activity. As demand for high-speed, high-sensitivity photodetectors intensifies, APDs are poised to play a pivotal role in next-generation optical communication, automotive LiDAR, quantum sensing, and medical imaging systems.

Emerging applications are particularly prominent in the automotive sector, where APDs are integral to advanced driver-assistance systems (ADAS) and autonomous vehicle LiDAR. The need for precise distance measurement and object detection is driving automakers and Tier 1 suppliers to invest in APD-based solutions, with the global automotive LiDAR market projected to grow at a CAGR of over 20% through 2025, according to MarketsandMarkets. Similarly, the proliferation of 5G and data center infrastructure is fueling demand for APDs in high-speed optical receivers, as highlighted by OODA Loop.

In the medical sector, APDs are increasingly used in positron emission tomography (PET) scanners and other imaging modalities, where their high gain and fast response times enable improved image resolution. The global medical imaging market, valued at over $30 billion in 2023, is expected to see robust growth, with APD manufacturers such as Hamamatsu Photonics and First Sensor AG expanding their product portfolios to address these needs.

On the investment front, venture capital and corporate funding are flowing into APD manufacturing startups and established players alike. Strategic partnerships between semiconductor foundries and photonics companies are accelerating the development of silicon-based APDs, which promise lower costs and easier integration with existing CMOS processes. For instance, onsemi and Lumentum Holdings have announced initiatives to scale up APD production for telecom and automotive applications.

- Expansion into quantum communication and sensing, where APDs are critical for single-photon detection, is expected to open new high-value markets.

- Government funding for photonics research, particularly in the US, EU, and China, is supporting innovation in APD materials and device architectures.

- Supply chain investments are focusing on improving wafer yields and reducing defect rates, which remain key challenges for APD manufacturing scalability.

Overall, 2025 is set to be a transformative year for APD manufacturing, with emerging applications and robust investment activity driving both technological progress and market expansion.

Challenges, Risks, and Strategic Opportunities for Stakeholders

The manufacturing of avalanche photodiodes (APDs) in 2025 faces a complex landscape of challenges, risks, and strategic opportunities for stakeholders across the value chain. As demand for high-speed optical communication, LiDAR, and advanced imaging systems grows, manufacturers must navigate technical, economic, and geopolitical hurdles while capitalizing on emerging market trends.

Challenges and Risks

- Supply Chain Vulnerabilities: The APD manufacturing process relies on high-purity semiconductor materials such as silicon and indium gallium arsenide (InGaAs). Disruptions in the global supply of these materials, exacerbated by geopolitical tensions and export restrictions, pose significant risks to production continuity and cost stability. According to SEMI, ongoing semiconductor shortages and logistics bottlenecks continue to impact photonics component suppliers in 2025.

- Technological Complexity: Achieving high gain, low noise, and uniformity in APDs requires advanced fabrication techniques and stringent quality control. The push for miniaturization and integration with photonic integrated circuits (PICs) further complicates manufacturing, increasing capital expenditure and the need for specialized expertise. Yole Group highlights that yield losses and process variability remain key pain points, especially for next-generation APDs targeting automotive and quantum applications.

- Regulatory and Environmental Pressures: Stricter environmental regulations on hazardous substances and energy consumption in manufacturing facilities are driving up compliance costs. Stakeholders must invest in greener processes and materials to meet evolving standards, as noted by International Energy Agency (IEA) reports on sustainable electronics manufacturing.

Strategic Opportunities

- Vertical Integration and Localization: To mitigate supply chain risks, leading players are pursuing vertical integration and regionalizing production. This strategy not only secures material access but also enhances control over quality and intellectual property, as seen in recent moves by Hamamatsu Photonics and First Sensor AG.

- Innovation in Materials and Processes: The adoption of novel materials (e.g., germanium-on-silicon) and advanced wafer-level packaging offers pathways to improved performance and cost efficiency. Collaborative R&D, often supported by government initiatives, is accelerating breakthroughs in APD design and manufacturability, according to European Photonics Industry Consortium (EPIC).

- Expanding End-Use Applications: The proliferation of 5G, autonomous vehicles, and quantum communication is expanding the addressable market for APDs. Stakeholders who align their product portfolios with these high-growth sectors stand to benefit from robust demand and premium pricing opportunities, as projected by MarketsandMarkets.

Sources & References

- MarketsandMarkets

- Hamamatsu Photonics

- First Sensor AG

- Lumentum Holdings Inc.

- IDC

- Laser Components

- Global Market Insights

- Fortune Business Insights

- European Commission

- Global Information, Inc.

- International Energy Agency (IEA)