2025 Additive Manufacturing for Jet Engine Design Market Report: Unveiling Growth Drivers, Key Players, and Future Opportunities. Explore In-Depth Analysis of Technology Trends, Regional Dynamics, and Forecasts Through 2030.

- Executive Summary & Market Overview

- Key Technology Trends in Additive Manufacturing for Jet Engines

- Competitive Landscape and Leading Market Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Projections

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Challenges, Risks, and Opportunities in Jet Engine Additive Manufacturing

- Future Outlook: Innovations, Investments, and Strategic Recommendations

- Sources & References

Executive Summary & Market Overview

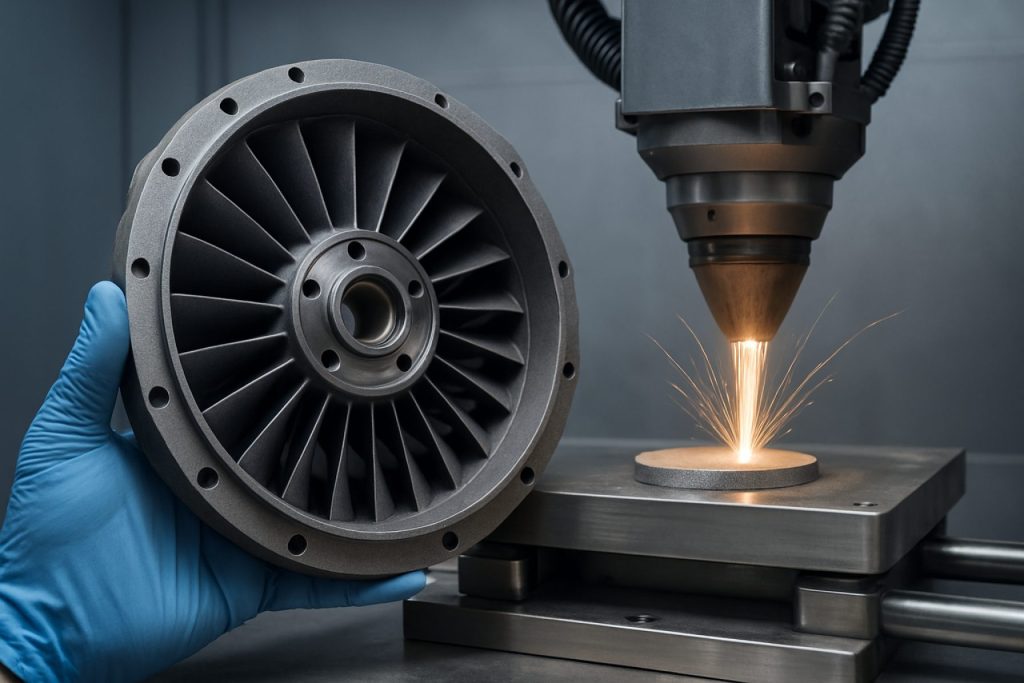

Additive manufacturing (AM), commonly known as 3D printing, is revolutionizing jet engine design by enabling the production of complex, lightweight, and highly efficient components that were previously impossible or uneconomical to manufacture using traditional methods. In 2025, the global market for additive manufacturing in jet engine design is experiencing robust growth, driven by the aerospace industry’s demand for fuel efficiency, reduced emissions, and rapid prototyping capabilities.

The adoption of AM technologies—such as selective laser melting (SLM), electron beam melting (EBM), and direct metal laser sintering (DMLS)—has allowed leading aerospace manufacturers to redesign critical engine parts, including fuel nozzles, turbine blades, and combustor liners. These components benefit from weight reduction, improved cooling channels, and consolidated assemblies, which translate into lower operating costs and enhanced engine performance. For instance, GE Aerospace has successfully implemented AM to produce fuel nozzles for its LEAP engines, achieving a 25% weight reduction and a fivefold increase in durability compared to conventionally manufactured parts.

According to a 2024 report by SmarTech Analysis, the aerospace sector accounted for over 30% of the $18 billion global additive manufacturing market in 2023, with jet engine applications representing a significant and fast-growing segment. The report projects a compound annual growth rate (CAGR) of 18% for AM in aerospace propulsion systems through 2028, fueled by ongoing investments from major OEMs and tier-one suppliers.

Regulatory acceptance of AM-produced engine parts is also advancing, with organizations such as the Federal Aviation Administration (FAA) and European Union Aviation Safety Agency (EASA) issuing updated guidelines for certification and quality assurance. This regulatory progress is accelerating the commercialization of AM components in both commercial and military aviation.

Key market players—including Rolls-Royce, Safran, and Pratt & Whitney—are expanding their AM capabilities through strategic partnerships, in-house production, and investments in digital design tools. As a result, the additive manufacturing market for jet engine design in 2025 is characterized by rapid innovation, increasing adoption, and a clear trajectory toward mainstream integration in next-generation propulsion systems.

Key Technology Trends in Additive Manufacturing for Jet Engines

Additive manufacturing (AM), commonly known as 3D printing, is rapidly transforming jet engine design by enabling unprecedented levels of complexity, customization, and performance optimization. In 2025, several key technology trends are shaping the integration of AM into jet engine development, with leading aerospace companies and research institutions driving innovation.

- Advanced Materials and Alloys: The development and qualification of high-performance materials, such as nickel-based superalloys and ceramic matrix composites, are expanding the capabilities of AM for jet engine components. These materials offer superior heat resistance and mechanical strength, essential for turbine blades and combustor parts. Companies like GE Aerospace and Rolls-Royce are investing heavily in material science to unlock new design possibilities.

- Design for Additive Manufacturing (DfAM): Engineers are leveraging DfAM principles to create intricate geometries, such as lattice structures and internal cooling channels, that are impossible or prohibitively expensive to produce with traditional methods. This approach not only reduces weight but also enhances thermal management and fuel efficiency. Safran and Pratt & Whitney have reported significant performance gains in next-generation engine prototypes using DfAM.

- Integrated Digital Thread: The adoption of digital twins and end-to-end digital workflows is streamlining the design-to-production process. Real-time simulation, process monitoring, and quality assurance are now integrated into AM platforms, reducing lead times and improving traceability. Siemens and Ansys are at the forefront of providing digital solutions tailored for aerospace AM applications.

- Scalability and Certification: As AM moves from prototyping to full-scale production, the focus is on process repeatability, part certification, and supply chain integration. Regulatory bodies such as the Federal Aviation Administration (FAA) are collaborating with industry leaders to establish standards for AM-produced engine parts, accelerating their adoption in commercial and military aviation.

These trends are converging to make additive manufacturing a cornerstone of jet engine innovation, enabling lighter, more efficient, and more reliable propulsion systems for the next generation of aircraft. The ongoing collaboration between OEMs, material suppliers, and regulatory agencies is expected to further accelerate the adoption of AM in jet engine design through 2025 and beyond.

Competitive Landscape and Leading Market Players

The competitive landscape for additive manufacturing (AM) in jet engine design is characterized by a dynamic mix of established aerospace giants, specialized AM technology providers, and innovative startups. As of 2025, the sector is witnessing intensified collaboration and investment, driven by the need for lighter, more efficient, and cost-effective jet engine components.

Leading Market Players

- GE Additive: A subsidiary of General Electric, GE Additive remains a dominant force, leveraging its expertise in both AM technology and jet engine manufacturing. The company’s LEAP engine, developed in partnership with CFM International, features 3D-printed fuel nozzles, setting industry benchmarks for performance and efficiency.

- Rolls-Royce: Rolls-Royce continues to expand its AM capabilities, focusing on complex engine parts such as combustor tiles and turbine blades. The company’s investment in large-scale AM facilities and partnerships with research institutions underscores its commitment to integrating AM across its engine portfolio.

- Safran: Safran, through its subsidiary Safran Additive Manufacturing, is advancing the use of AM for both prototyping and serial production of engine components. The company collaborates closely with OEMs and research centers to accelerate the industrialization of AM processes.

- Siemens: Siemens is a key player in the development of AM software and hardware solutions, supporting the aerospace sector with digital twin technology and advanced simulation tools for jet engine design optimization.

- Stratasys and 3D Systems: These AM technology providers supply high-performance printers and materials tailored for aerospace applications, enabling rapid prototyping and low-volume production of engine parts.

Market competition is further fueled by strategic alliances, such as the partnership between Airbus and Materialise, and the entry of new players focusing on metal AM technologies. The competitive environment is expected to intensify as certification standards evolve and the demand for sustainable, high-performance engines grows. According to SmarTech Analysis, the aerospace AM market is projected to surpass $5 billion by 2025, with jet engine applications representing a significant share of this growth.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Projections

The additive manufacturing (AM) market for jet engine design is poised for robust growth between 2025 and 2030, driven by increasing adoption in aerospace for both commercial and military applications. According to projections by Grand View Research, the global additive manufacturing market is expected to register a compound annual growth rate (CAGR) of approximately 20% during this period, with the aerospace sector—particularly jet engine components—being a primary contributor.

Revenue from additive manufacturing in jet engine design is forecasted to reach $2.8 billion by 2030, up from an estimated $1.1 billion in 2025. This surge is attributed to the increasing demand for lightweight, fuel-efficient engines and the ability of AM to produce complex geometries that are otherwise unachievable with traditional manufacturing methods. SME reports that leading engine manufacturers are scaling up investments in AM technologies, with a focus on critical components such as fuel nozzles, turbine blades, and heat exchangers.

In terms of volume, the number of jet engine parts produced using additive manufacturing is projected to grow at a CAGR of 18% from 2025 to 2030. IDTechEx estimates that by 2030, over 500,000 jet engine components annually will be manufactured using AM processes, compared to approximately 180,000 in 2025. This growth is underpinned by the increasing certification of AM parts for flight, as well as the expansion of digital inventory and on-demand production models.

- CAGR (2025–2030): ~20% for revenue, ~18% for volume

- Revenue Projection (2030): $2.8 billion

- Volume Projection (2030): 500,000+ jet engine components annually

Key market drivers include ongoing advancements in metal AM technologies, such as laser powder bed fusion and electron beam melting, and the growing emphasis on sustainability and supply chain resilience. As OEMs and tier-one suppliers continue to validate and certify AM parts, the market is expected to experience accelerated adoption, particularly in the production of high-value, mission-critical jet engine components.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The regional landscape for additive manufacturing (AM) in jet engine design is evolving rapidly, with North America, Europe, Asia-Pacific, and the Rest of the World (RoW) each exhibiting distinct growth drivers and adoption patterns in 2025.

North America remains the global leader, propelled by robust investments from major aerospace OEMs and defense agencies. The United States, in particular, benefits from the presence of industry giants such as GE Aerospace and RTX Corporation (formerly Raytheon Technologies), both of which have integrated AM into jet engine component production and prototyping. The U.S. Air Force and NASA continue to fund research and pilot programs, accelerating the transition from R&D to serial production. According to SME, North American aerospace AM revenues are projected to grow at a CAGR exceeding 15% through 2025, driven by demand for lightweight, fuel-efficient engine parts.

Europe is characterized by strong regulatory support and collaborative innovation. The region’s aerospace sector, led by Rolls-Royce, Safran, and Airbus, has embraced AM for both civil and military jet engines. The European Union’s Horizon Europe program and national initiatives in Germany and France are fostering public-private partnerships to advance AM technologies. According to Smart Europe, the region is focusing on standardization and certification, which is expected to accelerate the adoption of AM in critical engine components by 2025.

- Asia-Pacific is emerging as a high-growth market, with China and Japan at the forefront. Chinese aerospace firms, such as AVIC, are investing heavily in AM to localize jet engine production and reduce reliance on imports. Japan’s Mitsubishi Heavy Industries is leveraging AM for rapid prototyping and small-batch production. The region’s growth is supported by government funding and a burgeoning domestic aviation market, as noted by CAPA – Centre for Aviation.

- Rest of World (RoW) includes the Middle East, Latin America, and Africa, where adoption is nascent but growing. The Middle East, led by the UAE’s Strata Manufacturing, is investing in AM as part of broader aerospace diversification strategies. However, limited technical expertise and supply chain constraints remain challenges for widespread adoption in these regions.

Overall, while North America and Europe are expected to maintain their leadership in 2025, Asia-Pacific’s rapid expansion and RoW’s gradual entry signal a more globally distributed AM ecosystem for jet engine design in the coming years.

Challenges, Risks, and Opportunities in Jet Engine Additive Manufacturing

Additive manufacturing (AM), commonly known as 3D printing, is transforming jet engine design by enabling the production of complex geometries, reducing part counts, and facilitating rapid prototyping. However, the adoption of AM in jet engine manufacturing presents a unique set of challenges, risks, and opportunities as the industry moves into 2025.

Challenges and Risks

- Material Qualification and Certification: Jet engines operate under extreme conditions, demanding rigorous material performance. The qualification of AM-produced alloys, especially for critical components like turbine blades, remains a significant hurdle. Regulatory bodies such as the Federal Aviation Administration and European Union Aviation Safety Agency require extensive testing and documentation, which can slow down adoption.

- Process Repeatability and Quality Assurance: Ensuring consistent quality across batches is a persistent challenge. Variability in powder quality, machine calibration, and post-processing can lead to defects or performance inconsistencies, raising concerns for safety-critical applications (GE Aerospace).

- Cost and Scalability: While AM can reduce waste and tooling costs, the high price of metal powders and slow build rates can limit cost-effectiveness for large-scale production. Scaling up from prototyping to full-rate manufacturing remains a complex task (Roland Berger).

- Intellectual Property (IP) and Cybersecurity: The digital nature of AM design files increases the risk of IP theft and cyberattacks, necessitating robust data protection strategies (National Institute of Standards and Technology).

Opportunities

- Design Innovation: AM enables the creation of lightweight, integrated structures that were previously impossible or uneconomical to manufacture. This can lead to improved fuel efficiency and reduced emissions (Safran).

- Supply Chain Resilience: On-demand production and localized manufacturing can reduce lead times and inventory costs, making the supply chain more agile and responsive to disruptions (PwC).

- Lifecycle Support: AM offers potential for rapid repair and replacement of parts, extending engine life and reducing maintenance downtime (Rolls-Royce).

As the jet engine sector continues to invest in additive manufacturing, overcoming these challenges will be critical to unlocking the full potential of AM-driven innovation in 2025 and beyond.

Future Outlook: Innovations, Investments, and Strategic Recommendations

The future outlook for additive manufacturing (AM) in jet engine design is marked by rapid innovation, increased investment, and evolving strategic priorities as the aerospace sector seeks to enhance performance, sustainability, and supply chain resilience. By 2025, the integration of AM technologies—such as selective laser melting (SLM), electron beam melting (EBM), and binder jetting—into jet engine production is expected to accelerate, driven by both technological advancements and shifting market demands.

Key innovations are anticipated in the development of high-temperature alloys and ceramic matrix composites specifically tailored for AM processes. These materials enable the production of lighter, more heat-resistant engine components, directly contributing to improved fuel efficiency and reduced emissions. Companies like GE Additive and Rolls-Royce are at the forefront, investing in proprietary AM techniques to manufacture complex parts such as fuel nozzles, turbine blades, and heat exchangers that were previously impossible or uneconomical to produce using traditional methods.

Investment trends indicate a robust pipeline of funding from both private and public sectors. According to SmarTech Analysis, the aerospace AM market is projected to surpass $5 billion by 2025, with jet engine applications representing a significant share. Strategic partnerships between OEMs, material suppliers, and digital solution providers are proliferating, as seen in collaborations like Safran’s alliances with AM startups and research institutions to accelerate certification and industrialization of 3D-printed engine parts.

Looking ahead, several strategic recommendations emerge for stakeholders:

- Accelerate R&D in AM-specific superalloys and process monitoring to ensure repeatability and certification compliance.

- Invest in digital twin and simulation technologies to optimize part design and predict in-service performance, reducing costly prototyping cycles.

- Expand workforce training programs to address the skills gap in AM design, quality assurance, and post-processing.

- Foster open innovation ecosystems by partnering with universities, startups, and regulatory bodies to streamline qualification pathways.

In summary, by 2025, additive manufacturing is poised to become a cornerstone of jet engine innovation, with sustained investments and strategic collaborations driving the next wave of efficiency, sustainability, and competitive differentiation in the aerospace industry.

Sources & References

- GE Aerospace

- SmarTech Analysis

- European Union Aviation Safety Agency (EASA)

- Rolls-Royce

- Siemens

- CFM International

- Stratasys

- 3D Systems

- Airbus

- Materialise

- Grand View Research

- SME

- IDTechEx

- RTX Corporation

- AVIC

- Mitsubishi Heavy Industries

- Strata Manufacturing

- GE Aerospace

- Roland Berger

- National Institute of Standards and Technology

- PwC