Table of Contents

- Executive Summary: The 2025 Index-Junction Microchip Fabrication Landscape

- Key Market Drivers and Restraints in Microchip Fabrication

- Cutting-Edge Fabrication Technologies Shaping 2025 and Beyond

- Index-Junction’s Market Size Forecasts (2025–2030)

- Major Industry Players and Strategic Partnerships

- Raw Materials, Supply Chains, and Sustainability Initiatives

- Regulatory Environment and Industry Standards (2025 Update)

- Emerging Applications: AI, IoT, and Beyond

- Investment Trends and Funding in Microchip Fabrication

- Future Outlook: Opportunities, Risks, and Scenario Analysis

- Sources & References

Executive Summary: The 2025 Index-Junction Microchip Fabrication Landscape

The global landscape of index-junction microchip fabrication is undergoing significant transformation in 2025, shaped by rapid technological advancements, strategic investments, and evolving market demands. Index-junction microchips, known for their high-density interconnects and advanced logic capabilities, are pivotal in enabling next-generation computing, AI acceleration, and high-bandwidth memory integration. The sector is marked by intense competition among leading foundries and an increasing emphasis on process node miniaturization and heterogeneous integration.

Industry frontrunners such as TSMC and Samsung Electronics have accelerated their development and deployment of sub-3nm process technologies, integrating index-junction architectures to improve power efficiency and performance. In early 2025, TSMC commenced risk production of its 2nm node, leveraging new index-junction optimizations for enhanced transistor density and improved scaling, targeting both consumer and HPC applications. Intel Corporation is simultaneously pushing its Intel 18A process, incorporating index-junction innovations to advance its IDM 2.0 strategy and meet the surging demand for AI-optimized chips.

The adoption of advanced packaging technologies, such as 3D stacking and chiplet integration, is closely intertwined with index-junction fabrication. AMD and NVIDIA are actively collaborating with foundries to incorporate index-junction logic into their next-generation GPUs and data center accelerators, aiming for unprecedented compute density and energy efficiency. Additionally, Apple Inc. continues to invest in custom silicon, utilizing index-junction enhancements in its M-series processors to push the envelope in mobile and desktop computing.

Looking ahead, the next few years are expected to witness further miniaturization, with industry roadmaps targeting 1.4nm and beyond, and increasing deployment of EUV lithography and novel materials to enable finer index-junction structures. Supply chain resilience remains a critical focus, with manufacturers investing in geographic diversification and strategic partnerships to mitigate risks associated with geopolitical tensions and resource constraints. The outlook for index-junction microchip fabrication is robust, with ongoing breakthroughs poised to support the exponential growth of AI, edge computing, and high-performance networking—cementing its role as a cornerstone of technological progress through 2025 and beyond.

Key Market Drivers and Restraints in Microchip Fabrication

Index-junction microchip fabrication, a specialized domain in semiconductor manufacturing, is increasingly influenced by the convergence of advanced materials, process innovation, and escalating demand across sectors such as telecommunications, automotive, and AI-driven devices. As of 2025, the primary market drivers are rooted in the ongoing miniaturization of devices, the proliferation of Internet of Things (IoT) applications, and the urgent need for higher-performance, energy-efficient chips.

- Technological Advancements: The relentless pursuit of Moore’s Law continues to push manufacturers toward more sophisticated fabrication methods. Index-junction architectures, which optimize electrical junctions at the micro- and nanoscale, are proving essential for achieving the low leakage currents and high-speed switching required in next-generation logic and memory chips. Companies like Intel and TSMC have announced roadmaps incorporating junction engineering and novel index-based designs to sustain performance improvements below the 5nm node.

- Demand from Key Verticals: The surge in AI workloads and data-center operations is accelerating demand for microchips with advanced junction properties that support high performance and low latency. The automotive sector, especially with the growth of electric and autonomous vehicles, is prioritizing highly reliable index-junction chips to meet stringent safety and power efficiency standards, as highlighted by NXP Semiconductors and Infineon Technologies.

- Material and Equipment Innovations: The adoption of new materials (such as high-mobility channel materials and advanced dielectrics) is critical for index-junction fabrication. Equipment manufacturers like ASML are driving process advancements with EUV lithography systems, enabling finer feature sizes and more precise junction engineering.

- Restraints – Cost and Complexity: Despite these advances, the market faces significant restraints. The capital expenditure required for new fabrication plants and equipment is immense, with leading-edge facilities costing upwards of $20 billion each. Process complexity and yield challenges rise sharply as junction geometries shrink, making it difficult for all but the largest players to compete. Samsung Electronics and GlobalFoundries have noted the need for strategic partnerships and government incentives to manage these risks.

Looking ahead, the index-junction microchip fabrication market will be shaped by continued investment in R&D, increasing collaboration across the supply chain, and further integration of AI-driven process control. Regulatory support and public-private investments are expected to mitigate some cost barriers, particularly in the U.S., Europe, and East Asia, sustaining innovation momentum through the remainder of the decade.

Cutting-Edge Fabrication Technologies Shaping 2025 and Beyond

Index-junction microchip fabrication is entering a pivotal era in 2025, as the semiconductor industry seeks new architectures to push the limits of miniaturization, power efficiency, and device functionality. Index-junctions, which leverage engineered refractive index profiles at material interfaces, are vital for enabling photonic and optoelectronic integration at the micro- and nanoscale. In 2025, leading semiconductor manufacturers and equipment suppliers are advancing fabrication technologies that allow precise control of these junctions, responding to the demand for faster data processing and lower energy consumption in applications ranging from data centers to quantum computing.

Recent developments center on atomic layer deposition (ALD) and advanced lithography techniques. ALD is being refined to deposit ultrathin films with nanometer-scale accuracy, essential for creating sharp refractive index transitions. Companies such as ASM International are enhancing ALD systems for better uniformity and throughput, allowing for scalable production of complex index-junction structures. Meanwhile, ASML’s extreme ultraviolet (EUV) lithography machines are now capable of defining features below 5 nm, a critical threshold for next-generation index-based devices.

Material innovation is another area of rapid progress. Silicon photonics foundries like IMEC are pioneering the integration of new materials—such as silicon nitride, germanium, and III-V compounds—into CMOS-compatible processes, enabling finer tuning of index contrasts while maintaining mass manufacturability. This is especially important for heterogeneous integration, where combining different material systems at the chip level unlocks new device performance metrics.

In parallel, equipment makers are delivering advanced metrology and inspection solutions to ensure process reliability at the atomic scale. KLA Corporation is developing in-line metrology tools that can characterize refractive index profiles and junction sharpness in real time, addressing critical yield and performance challenges as feature sizes shrink.

- Mass production of photonic and optoelectronic chips with engineered index-junctions is expected to accelerate in 2025–2027, driven by demand from AI, high-speed communications, and quantum technology sectors.

- The industry outlook points to further convergence of photonics and electronics, with foundries and equipment suppliers expanding their portfolios to support index-junction-based device fabrication.

- Strategic collaborations between leading research institutes and commercial fabs are anticipated to fast-track the commercialization of novel index-junction architectures, shortening the time from lab-scale innovation to volume manufacturing.

Overall, the coming years will see index-junction microchip fabrication move from a niche capability towards a mainstream enabler of high-performance, energy-efficient computing and communications hardware.

Index-Junction’s Market Size Forecasts (2025–2030)

The global market for index-junction microchip fabrication is poised for significant growth between 2025 and 2030, driven by escalating demand for high-performance semiconductor devices in AI, 5G, automotive, and advanced computing sectors. Index-junction technology, which optimizes the interface and junction properties within microchips, is increasingly being integrated into next-generation nodes by leading foundries and integrated device manufacturers (IDMs).

In 2025, adoption is expected to accelerate as major semiconductor manufacturers—such as Taiwan Semiconductor Manufacturing Company (TSMC) and Intel Corporation—expand their advanced process nodes (e.g., 3nm and beyond), where index-junction architectures help manage parasitic losses and enhance device scaling. TSMC has announced plans to invest tens of billions of dollars into expanding their advanced process capacity through 2027, targeting applications that benefit from sophisticated junction technologies (TSMC). Similarly, Intel’s roadmap for its Angstrom-era nodes includes device architectures that are highly likely to incorporate index-junction optimizations to address power and performance bottlenecks (Intel Corporation).

By 2026–2027, industry leaders such as Samsung Electronics and GLOBALFOUNDRIES are set to commercialize fabrication techniques leveraging index-junction innovations for both logic and memory products, targeting high-growth segments like automotive electronics and data centers. This is underscored by their ongoing investments in EUV lithography and advanced transistor architectures, which benefit from precise control at the junction level (Samsung Electronics).

Forecasts through 2030 indicate that the index-junction microchip fabrication market could achieve a compound annual growth rate (CAGR) in the high single- to low double-digit range, as more manufacturers adopt this technology to meet stringent energy efficiency and computational performance requirements. Regional expansion is expected, especially in the U.S., South Korea, and Taiwan, where government incentives for domestic semiconductor production are further stimulating investment and capacity builds (TSMC; Intel Corporation).

Overall, the outlook for index-junction microchip fabrication between 2025 and 2030 is robust, with the technology set to play a pivotal role in enabling next-generation semiconductor products across multiple high-value domains.

Major Industry Players and Strategic Partnerships

The landscape of index-junction microchip fabrication is undergoing significant transformation as major industry players intensify efforts to advance process technologies, scale up production, and form strategic partnerships. In 2025, leading semiconductor foundries and integrated device manufacturers (IDMs) are leveraging their expertise to address the increasing complexity and shrinking node requirements of index-junction architectures, which are critical for high-performance computing, advanced sensing, and next-generation communication devices.

Key companies such as Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung Electronics are at the forefront, investing in new fabrication lines and integrating index-junction processes into their advanced nodes. TSMC, for example, continues to expand its capacity for 3nm and 2nm technologies, which facilitate the dense integration demanded by index-junction microchips. Samsung’s commitment to gate-all-around (GAA) transistor technology is also pertinent, as this innovation supports enhanced junction control and scaling necessary for index-junction applications.

Collaborations are accelerating innovation and commercialization. In 2024 and early 2025, Intel Corporation deepened its collaboration with research centers and ecosystem partners, focusing on novel junction formation and metrology to enhance device reliability at advanced nodes. Partnerships between foundries and materials suppliers—such as ASML for extreme ultraviolet (EUV) lithography and DuPont for advanced photoresists—ensure that each step in index-junction fabrication achieves the required precision and yield.

- TSMC is rolling out new process nodes tailored for high-density junction integration, supporting clients in AI, edge computing, and automotive sectors.

- Samsung is advancing nanosheet and GAA technologies, which are crucial for reliable index-junction formation at sub-3nm geometries.

- Intel is emphasizing ecosystem partnerships—recently announcing joint R&D initiatives with academic institutions and tool providers to refine junction engineering for its RibbonFET architecture.

- ASML and DuPont are providing essential lithography and materials innovations, collaborating closely with chipmakers for next-generation junction patterning and etching solutions.

Looking ahead, the competitive landscape is expected to see more cross-border joint ventures and supply chain integrations, particularly as geopolitical factors and regional incentives shape the semiconductor ecosystem. The focus on index-junction microchip fabrication will remain central as the industry targets sub-2nm production and explores new materials and device architectures, with global leaders strengthening strategic alliances to maintain technology leadership and resilience.

Raw Materials, Supply Chains, and Sustainability Initiatives

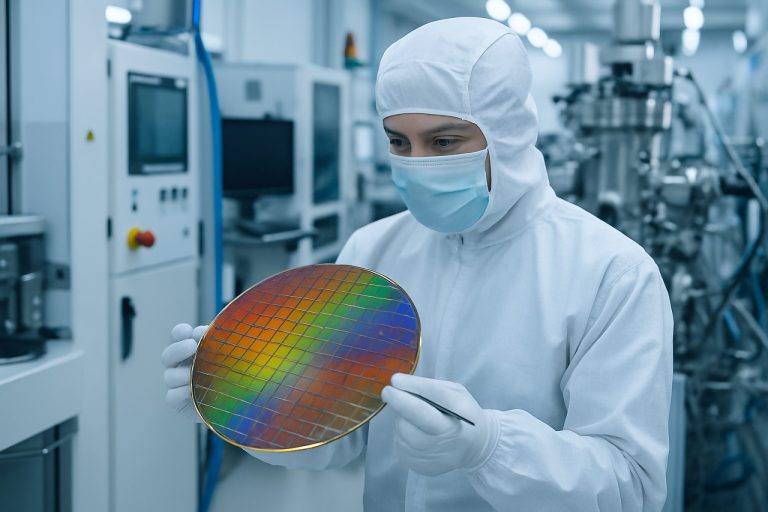

Index-junction microchip fabrication, a subset of advanced semiconductor manufacturing, relies heavily on the consistent supply of ultra-high-purity raw materials such as silicon wafers, specialty photoresists, and rare dopants. In 2025, the sector continues to be influenced by ongoing global efforts to secure and diversify supply chains amidst geopolitical pressures and emerging sustainability mandates.

Silicon remains the foundational material, with leading wafer producers like Siltronic AG and SUMCO Corporation reporting investments in new capacity and recycling initiatives to mitigate shortages and environmental impact. These companies are also pursuing energy efficiency improvements in crystal growth and wafer slicing processes, responding to both regulatory requirements and customer sustainability demands.

Supply chain resilience is a dominant theme as manufacturers seek alternatives to single-source suppliers for critical chemicals and gases. Entegris and Air Liquide are expanding regional production hubs and implementing blockchain-based material tracking to enhance transparency and traceability, crucial for both compliance and risk management. In parallel, strategic partnerships are forming between chipmakers and raw material suppliers to co-develop greener process chemistries and closed-loop recycling for solvents and etchants.

Rare earth elements and specialty metals used in index-junction doping, such as gallium and indium, remain vulnerable to supply chain disruptions. In response, organizations like Umicore are expanding recycling of end-of-life electronic devices and industrial scrap to recover these metals, while KYOCERA Corporation is developing alternative material formulations to reduce dependence on high-risk elements.

Sustainability initiatives are accelerating, driven by both voluntary commitments and regulatory frameworks. The Semiconductor Industry Association is coordinating industry-wide efforts to standardize carbon accounting, improve water usage efficiency, and reduce waste in fabrication plants. Major foundries such as TSMC are targeting net-zero emissions for their operations by 2050, with interim milestones over the next five years that include increased use of renewable energy and advanced wastewater treatment technologies.

Looking ahead, the convergence of digital traceability, circular economy initiatives, and regionalization of supply chains is expected to shape the raw materials landscape for index-junction microchip fabrication. Collaboration across the ecosystem will be essential to balance innovation, reliability, and environmental stewardship by 2030 and beyond.

Regulatory Environment and Industry Standards (2025 Update)

The regulatory environment and industry standards for index-junction microchip fabrication are undergoing significant evolution in 2025, reflecting both technological advances and geopolitical dynamics. As index-junction architectures gain traction for their potential in performance scaling and energy efficiency, regulatory bodies and standard-setting organizations are intensifying their focus on process uniformity, material safety, and cross-border compliance.

The SEMI organization remains central in setting global technical standards for semiconductor manufacturing equipment and materials, including those relevant to novel junction architectures. SEMI’s latest updates in 2025 include new guidelines for critical dimension control in index-junction layers and advanced traceability protocols for wafer-level processes, aiming to minimize variation and ensure interoperability across fabs worldwide.

The International Electrotechnical Commission (IEC) has also published revised standards (IEC 62256 series) covering the electrical and physical testing of advanced junction microchips, emphasizing reliability and safety. These updated standards now specifically address the unique failure mechanisms and reliability metrics associated with index-junction designs, with input from leading industry players.

On the regulatory front, the U.S. Environmental Protection Agency (EPA) and the European Commission are tightening restrictions on per- and polyfluoroalkyl substances (PFAS) and other specialty chemicals used in advanced photolithography and etching steps critical to index-junction fabrication. This is prompting manufacturers to accelerate adoption of greener chemistries and closed-loop process controls.

Export controls and supply chain transparency are also in sharp focus. The U.S. Department of Commerce Bureau of Industry and Security (BIS) has updated its export administration regulations in 2025 to include certain equipment and precursor materials used in index-junction fabrication, in response to global competitiveness and security concerns.

Industry alliances such as the CHIPS Alliance are facilitating pre-competitive collaboration on open-process standards and best practices, fostering alignment across the supply chain. Meanwhile, major foundries like TSMC and Intel are proactively publishing sustainability and compliance roadmaps that address both regulatory mandates and voluntary ESG goals.

Looking ahead, the industry anticipates further harmonization of standards to support global supply chain resilience, as well as ongoing regulatory scrutiny of environmental and security aspects. Stakeholders must remain agile, integrating new standards and compliance measures as index-junction microchip fabrication becomes a core pillar of next-generation semiconductor innovation.

Emerging Applications: AI, IoT, and Beyond

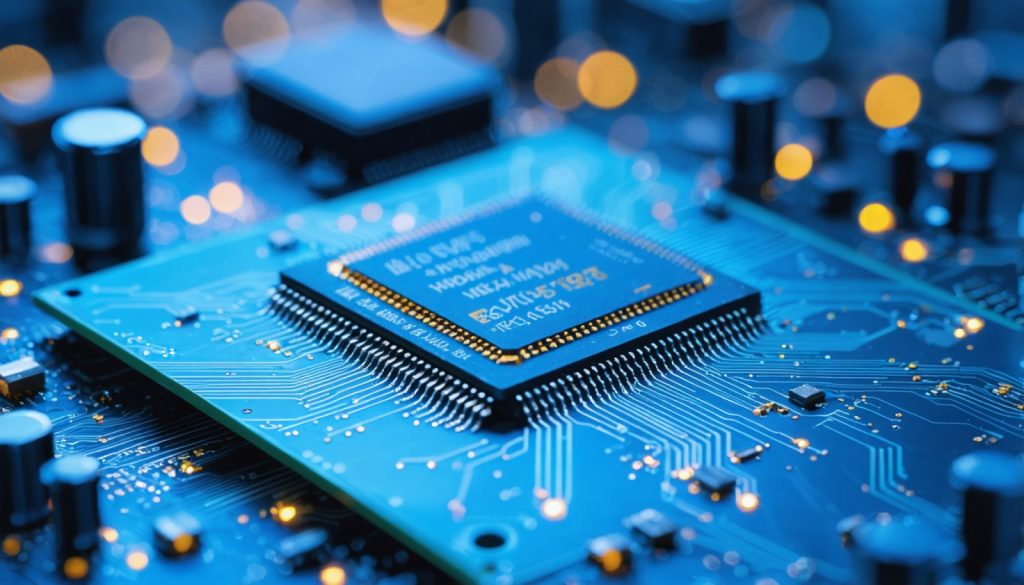

The rapid evolution of artificial intelligence (AI) and the Internet of Things (IoT) is propelling demand for advanced microchip fabrication techniques, with index-junction architectures gaining prominence for their unique electrical and optical properties. In 2025, leading semiconductor manufacturers are integrating index-junction microchip designs to address the growing need for high-speed data processing and ultra-low power consumption in edge AI and IoT devices. For instance, Intel Corporation has publicly detailed its roadmap to support AI-enabled edge computing through heterogenous integration, which includes the development of novel junction-based devices for improved performance and energy efficiency in their upcoming chipsets.

Index-junction microchips exploit engineered interfaces between materials with differing refractive indices or electronic band structures, enabling more efficient charge carrier separation and enhanced photonic interactions. These features are especially valuable for AI accelerators and sensor nodes in IoT networks, where dense integration and rapid, low-latency data movement are critical. Taiwan Semiconductor Manufacturing Company (TSMC) has recently announced advanced process nodes that facilitate the fabrication of such complex junctions, supporting the miniaturization and functional diversification required by next-generation AI and IoT applications.

In parallel, the push for edge inferencing—processing AI workloads on devices rather than in the cloud—has led to collaborations between microchip fabricators and AI technology firms. Samsung Electronics highlights its ongoing work in integrating novel junction-based device architectures into its Exynos processors, targeting embedded vision and sensor fusion tasks in IoT and autonomous systems. Similarly, Infineon Technologies is leveraging index-junction fabrication to develop energy-efficient microcontrollers and power management ICs, which are crucial for battery-powered IoT endpoints.

Looking forward to the next few years, the convergence of AI, IoT, and advanced chipmaking is expected to further accelerate index-junction adoption. Industry roadmaps from organizations such as Semiconductor Industry Association emphasize the importance of continued innovation in junction engineering to maintain pace with Moore’s Law alternatives and to address the specialized requirements of machine learning at the edge, ubiquitous sensing, and secure, low-power connectivity.

Overall, as AI and IoT applications proliferate across automotive, healthcare, manufacturing, and smart infrastructure, index-junction microchip fabrication stands at the forefront of enabling the performance, integration, and efficiency gains that these domains demand through 2025 and beyond.

Investment Trends and Funding in Microchip Fabrication

The landscape of investment and funding in index-junction microchip fabrication is rapidly evolving in 2025, shaped by the demand for advanced semiconductors in applications such as artificial intelligence, automotive electronics, and next-generation communications. Major semiconductor manufacturers and government initiatives are driving substantial capital towards fabrication facilities (fabs) specializing in novel architectures like index-junction microchips, which promise enhanced electrical performance and energy efficiency.

In the current year, several leading companies have announced multi-billion-dollar investments to expand or construct state-of-the-art fabs. For instance, Intel Corporation has committed over $20 billion for new and upgraded fabs in the United States and Europe, citing the need to support cutting-edge process technologies and respond to growing demand for advanced chips. While Intel’s core focus remains on mainstream logic and memory, its investment strategy explicitly includes R&D into innovative device structures such as junction-based logic transistors and heterogeneous integration.

Similarly, Taiwan Semiconductor Manufacturing Company (TSMC) has allocated close to $32 billion for capital expenditures in 2025, with a portion dedicated to R&D in emerging device architectures, including those relevant to index-junction technologies. TSMC’s roadmap highlights the integration of new materials and junction engineering in their upcoming sub-2nm process nodes, reflecting the industry’s shift toward more complex and efficient microchip designs.

On the public funding front, government initiatives in the U.S., Europe, and Asia are bolstering private investment. The CHIPS Act in the United States, for example, is disbursing billions in grants and incentives to support domestic fabrication of advanced semiconductors, specifically targeting projects that incorporate innovative device structures and manufacturing techniques (National Institute of Standards and Technology). In Europe, similar funding mechanisms under the EU Chips Act are being deployed to support companies investing in next-generation fabrication, with a focus on sovereignty and supply chain resilience (European Commission).

In the next few years, the outlook is for continued robust funding, with the expectation that both private and public sectors will increasingly prioritize research and commercialization of index-junction microchip technologies. This trend is likely to accelerate as device scaling approaches physical limits and the industry seeks new paradigms for performance and efficiency. As a result, stakeholders can anticipate a steady flow of capital into fabs and R&D centers dedicated to this segment, laying the groundwork for commercial deployment of index-junction microchips by late this decade.

Future Outlook: Opportunities, Risks, and Scenario Analysis

The future outlook for index-junction microchip fabrication in 2025 and the coming years is shaped by accelerating demand for high-performance, energy-efficient semiconductor devices, as well as ongoing advances in materials science and manufacturing precision. Industry leaders and research consortia are investing heavily to overcome current scalability and yield limitations, aiming to unlock new opportunities in artificial intelligence, 5G/6G communications, edge computing, and advanced sensing.

One of the most significant opportunities lies in the integration of novel materials—such as wide-bandgap semiconductors and two-dimensional (2D) materials—into index-junction architectures. Companies like Intel and TSMC are developing next-generation process nodes that may leverage such material innovations for sub-2-nanometer fabrication, potentially enabling index-junction devices with unprecedented switching speeds and lower power consumption. The SEMI industry group projects continued growth in global fab investments, with leading players expanding capacity for advanced nodes through 2027.

However, several technical and economic risks persist. The complexity of fabricating index-junction microchips—requiring atomic-level control over material deposition and junction formation—raises concerns about yield, reproducibility, and cost. Equipment manufacturers like ASML are racing to refine extreme ultraviolet (EUV) lithography and atomic layer deposition (ALD) tools, essential for reliable index-junction patterning at scale. Supply chain vulnerabilities, particularly for specialty gases, photomasks, and ultrapure materials, also pose potential bottlenecks, as highlighted by Applied Materials.

Scenario analysis suggests a likely baseline in which index-junction fabrication becomes mainstream in specialized high-value applications—such as data center accelerators and quantum computing interfaces—by 2027, with broader adoption in consumer electronics following improved cost structures and process maturity. An optimistic scenario would see rapid breakthroughs in automated process control and material engineering, accelerating volume manufacturing and expanding use cases. Conversely, a pessimistic scenario, driven by persistent technical hurdles or geopolitical disruptions in the semiconductor supply chain, could delay mass adoption and limit market impact to niche sectors.

Overall, 2025 marks a pivotal period for index-junction microchip fabrication, with industry momentum and investment likely to yield significant advances. Successful navigation of technical and supply chain risks will determine the pace at which these devices transform the broader electronics landscape.

Sources & References

- NVIDIA

- Apple Inc.

- NXP Semiconductors

- Infineon Technologies

- ASML

- ASM International

- IMEC

- KLA Corporation

- Samsung Electronics

- DuPont

- Siltronic AG

- SUMCO Corporation

- Entegris

- Air Liquide

- Umicore

- European Commission

- U.S. Department of Commerce Bureau of Industry and Security (BIS)

- CHIPS Alliance

- Semiconductor Industry Association

- National Institute of Standards and Technology