Table of Contents

- Executive Summary: Key Highlights & Market Drivers

- Global Market Forecast 2025–2029: Revenue, Volume, and Growth Hotspots

- Emerging Technologies: Sensor Advances, AI Integration, and New Materials

- Competitive Landscape: Leading Manufacturers and New Entrants (e.g., geometrics.com, marine.magnetics.com)

- Applications in Marine Research, Defense, and Resource Exploration

- Regional Analysis: North America, Europe, Asia-Pacific, and Beyond

- Supply Chain Trends and Manufacturing Innovations

- Regulatory and Environmental Considerations (e.g., imo.org)

- Customer Demand Shifts and End-User Insights

- Future Outlook: Disruptive Trends, Investment Opportunities, and Strategic Recommendations

- Sources & References

Executive Summary: Key Highlights & Market Drivers

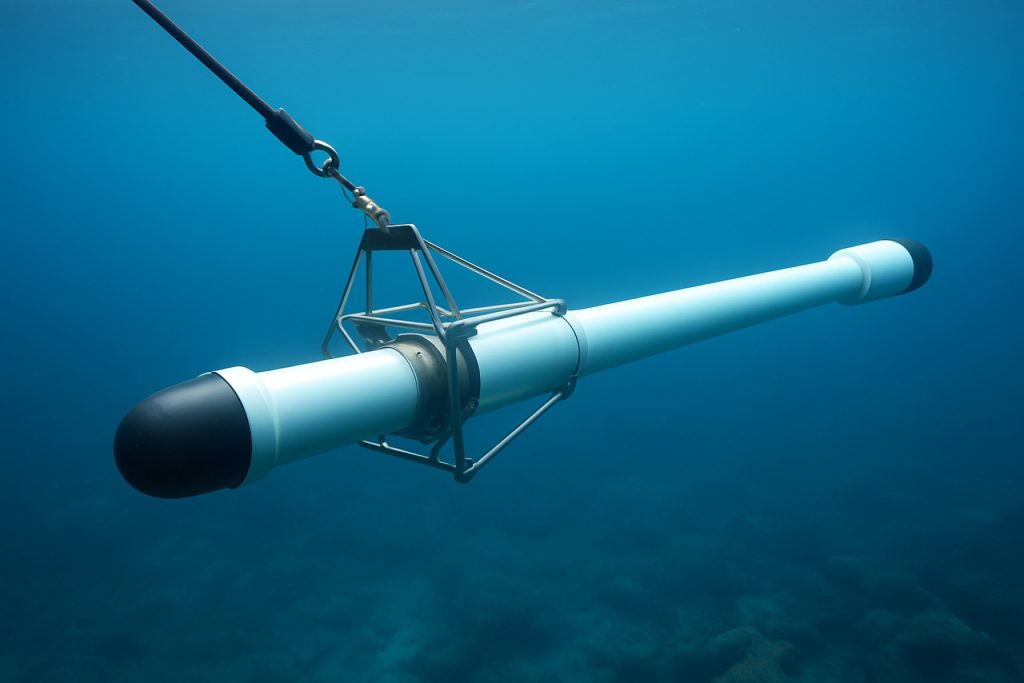

The global market for towed underwater magnetometer manufacturing is experiencing robust activity in 2025, driven by surging demand from marine geophysical surveys, defense applications, and offshore renewable energy projects. These specialized sensors, essential for detecting magnetic anomalies beneath the seabed, are being prioritized by governments and private sector entities seeking enhanced capabilities in underwater mapping, unexploded ordnance (UXO) detection, and resource exploration.

Key industry players such as Geometrix Technology, Seamap, and MIND Technology are investing in next-generation magnetometer designs that offer improved sensitivity, greater tow depth, and enhanced resistance to environmental noise. In 2025, manufacturers are also responding to growing end-user requirements for modularity and data integration, enabling seamless connection with side-scan sonar and sub-bottom profiler systems.

The defense sector remains a significant market driver, with navies and security agencies increasing procurement of towed magnetometers for mine countermeasure operations and underwater surveillance. For instance, L3Harris continues to supply advanced magnetometer solutions for both commercial and military customers, reflecting a steady pipeline of contracts through 2025 and beyond.

Offshore wind development and subsea cable projects are further expanding the commercial base for these instruments. As the offshore renewable energy sector accelerates globally, there is heightened demand for accurate seabed mapping to ensure safe installation and operation of wind turbines and power cables. Companies such as Geometrics have reported increased orders from marine survey contractors supporting these large-scale infrastructure initiatives.

On the manufacturing front, advances in high-temperature superconducting sensors and digital electronics are allowing for higher-resolution data capture and reduced maintenance costs. Producers are also investing in environmentally robust packaging and hydrodynamic towfish designs to enable longer survey missions in challenging ocean conditions.

Outlook for 2025 and the next few years remains strong, with the intersection of blue economy investments, maritime security concerns, and growing sophistication of underwater robotics fueling a steady rise in demand for towed magnetometer systems. Manufacturers are poised to benefit from technological upgrades, new geographic markets, and the integration of AI-driven data analytics for real-time anomaly detection and mapping.

Global Market Forecast 2025–2029: Revenue, Volume, and Growth Hotspots

The global market for towed underwater magnetometer manufacturing is poised for steady expansion in the 2025–2029 period, driven by escalating demand across marine geophysical survey, defense, and offshore resource exploration sectors. The proliferation of offshore wind farm projects and increased activity in subsea mineral exploration are fueling a surge in survey requirements, directly impacting demand for advanced towed magnetometer systems. Key manufacturers such as GEOMAR Helmholtz Centre for Ocean Research Kiel and Geo Marine Survey Systems are scaling up production to address these expanding needs.

Revenue growth is expected to surpass 6–7% CAGR from 2025 to 2029, with overall market value projected to exceed several hundred million USD by the end of the period. Volume output is anticipated to increase as manufacturers introduce modular, scalable solutions to cater to a broader range of vessel classes and survey types. Notably, Marine Magnetics Corp. has recently expanded its product line with higher-sensitivity, deep-tow magnetometers, positioning itself to capture a share of new contracts in Asia-Pacific and Europe.

Growth hotspots are emerging in regions with substantial offshore infrastructure investment. The Asia-Pacific market, led by China, Japan, and South Korea, is accelerating adoption due to expanding offshore wind and subsea cable projects. European activity is also robust, with the North Sea and Baltic regions investing heavily in subsea surveys for both renewable energy and defense applications. Fugro has reported increased procurement of towed magnetometers for integrated geophysical survey fleets to meet North Sea wind farm development timelines.

Technological innovation will underpin growth as manufacturers integrate AI-driven data analytics and real-time transmission into new systems, enabling faster interpretation and more efficient operations. Companies like Geo Marine Survey Systems are actively developing platforms with enhanced data fidelity and autonomous towing support. These advancements are expected to lower operational costs and expand the addressable market to include smaller survey operators.

In summary, the outlook for towed underwater magnetometer manufacturing from 2025 to 2029 is robust, with revenue and unit shipments set to rise in tandem with global offshore infrastructure development. Regional growth hotspots and ongoing technology evolution will shape competitive dynamics and open new opportunities for agile manufacturers.

Emerging Technologies: Sensor Advances, AI Integration, and New Materials

The manufacturing landscape for towed underwater magnetometers is experiencing a surge in technological innovation as we enter 2025, driven by demands for greater sensitivity, robust data processing, and deployment versatility across marine geophysics, defense, and environmental monitoring. Key advances are occurring in three interconnected domains: sensor design, artificial intelligence (AI) integration, and the application of novel materials.

Sensor technologies are rapidly evolving, with manufacturers prioritizing increased sensitivity and noise reduction. Modern fluxgate and optically pumped magnetometers—such as those supplied by Geometrics and Marine Magnetics—now feature triaxial configurations and adaptive filtering, improving signal fidelity in complex subsea environments. In 2025, zero-drift sensors and high-sampling-rate digital acquisition systems are becoming standard, enabling operators to detect subtle magnetic anomalies with enhanced spatial accuracy.

AI and machine learning are playing a transformative role in both instrument firmware and post-acquisition data analysis. Companies like SBG Systems are embedding real-time anomaly detection and automated noise classification directly into onboard software, streamlining survey operations and reducing requirements for highly specialized operators. Furthermore, adaptive path-planning algorithms—often cloud-connected—are being trialed to optimize survey efficiency by dynamically adjusting to environmental conditions and preliminary findings during missions.

Material science is also propelling innovations in the manufacture of towed magnetometers. Lightweight, corrosion-resistant composites and pressure-tolerant polymers are increasingly replacing legacy metal housings, as seen in products by Marine Magnetics. These materials not only extend operational lifespans in deepwater and polar conditions but also facilitate the integration of modular sensor arrays, allowing rapid customization for diverse missions without significant re-engineering.

Looking ahead over the next few years, industry outlook is shaped by the convergence of these advances. The proliferation of autonomous and remotely operated vehicles is prompting manufacturers to prioritize miniaturization and power efficiency, enabling longer deployments and broader geographic reach. Environmental monitoring mandates, especially in offshore wind and subsea cable projects, are anticipated to further boost demand for high-resolution, AI-enabled magnetometry solutions. As R&D efforts continue to focus on even more sensitive quantum sensors and edge-computing capabilities, the sector is poised for sustained growth and increased operational sophistication through at least 2028.

Competitive Landscape: Leading Manufacturers and New Entrants (e.g., geometrics.com, marine.magnetics.com)

The competitive landscape for towed underwater magnetometer manufacturing in 2025 is characterized by a blend of established leaders and emerging entrants, reflecting both technological advancement and expanding application areas. Geometrics, Inc. continues to be a dominant force, leveraging its long-standing expertise in magnetic sensing and survey equipment. Their G-882 Marine Magnetometer remains a benchmark for high-sensitivity, low-drag solutions, widely adopted for hydrographic, archaeological, and defense applications. Geometrics’ commitment to innovation is evident in ongoing product updates, including improved digital interfaces and integration with modern positioning systems.

Another major player, Marine Magnetics Corp., stands out for its focus on ultra-high sensitivity and low power consumption. Their SeaSPY and Explorer series have seen continual refinement, with a strong emphasis on reliability in harsh marine environments and seamless towing configurations. In recent years, Marine Magnetics has invested in modular systems and user-friendly software, catering to both large-scale geophysical surveys and niche scientific research.

- Mid-sized manufacturers such as Scintrex Limited are maintaining relevance by targeting specialized market segments, for instance, dual-sensor or gradiometer configurations for UXO detection and pipeline surveys. Scintrex is also developing lighter, more compact magnetometers to support deployment from smaller survey vessels and autonomous platforms.

- Significant activity among new entrants is observed in Asia and Europe. Companies like SBG Systems are integrating advanced inertial navigation with magnetometer technology, aiming to deliver all-in-one towing solutions for improved survey efficiency. These new players are leveraging recent advances in sensor miniaturization and AI-based noise reduction to compete with well-established brands.

- Collaborations between manufacturers and academic research institutions are increasingly common, as seen in joint projects for deep-sea mineral exploration and environmental monitoring. This trend is likely to accelerate as new applications—such as offshore wind farm site assessment and microplastic detection—emerge.

Looking ahead, the outlook for the sector suggests increased competition driven by demand for higher sensitivity, better data integration, and adaptability to autonomous and unmanned survey vessels. Established manufacturers are expected to invest further in R&D, while new entrants bring disruptive innovation, particularly in software analytics and multi-sensor integration. The market will likely see both consolidation and diversification as global infrastructure and environmental monitoring needs grow.

Applications in Marine Research, Defense, and Resource Exploration

Towed underwater magnetometers are playing an increasingly pivotal role in several sectors, notably marine research, defense, and resource exploration, with recent manufacturing trends reflecting evolving industry requirements. As of 2025, advancements in sensor sensitivity, miniaturization, and integration with sophisticated data acquisition systems are broadening the application spectrum of these instruments.

In marine research, towed magnetometers are essential for geological mapping, studying seafloor spreading, and locating submerged volcanic structures. Manufacturers such as Geometrics, Inc. and Marine Magnetics Corp. have reported a notable uptick in orders from oceanographic institutes and universities, driven by climate-related research and increased funding for ocean sciences. Enhanced manufacturing processes now support production of ruggedized, high-resolution models capable of withstanding extended surveys in harsh oceanographic conditions.

The defense sector remains a primary driver of demand for advanced towed underwater magnetometers. Navies and defense agencies utilize these instruments for mine countermeasure operations, detection of unexploded ordnance, and submarine tracking. Companies such as Lockheed Martin are integrating towed magnetometers into unmanned underwater vehicles (UUVs) and minehunting systems, requiring manufacturers to focus on compatibility, reduced drag, and low magnetic signature designs. In 2025, ongoing naval modernization programs in the US, Europe, and Asia-Pacific are expected to further stimulate specialized manufacturing, with bespoke models tailored to specific military requirements.

- Resource exploration also heavily relies on these tools for hydrocarbon and mineral prospecting. Offshore oil and gas operators and marine mining companies deploy towed magnetometers to map anomalies associated with ferrous deposits and to distinguish economic targets from geological noise. Fugro has expanded its fleet of survey vessels equipped with next-generation magnetometer arrays, and manufacturers are responding with modular, scalable systems that can be integrated into autonomous surface and underwater vehicles.

Looking ahead, the outlook for towed underwater magnetometer manufacturing remains robust through the next few years. Continued miniaturization, power efficiency improvements, and seamless integration with real-time data analytics platforms are likely to set the pace for product development. Partnerships between manufacturers and end-users will remain critical for customizing instrument specifications, as demand diversifies across environmental monitoring, critical mineral exploration, and maritime security operations.

Regional Analysis: North America, Europe, Asia-Pacific, and Beyond

The global landscape for towed underwater magnetometer manufacturing is experiencing significant shifts as technological advancements and regional market demands evolve. In 2025 and the following years, three major regions—North America, Europe, and Asia-Pacific—are at the forefront of industry development, each exhibiting unique strengths and strategic priorities.

- North America: The United States continues to lead in the design and production of advanced towed magnetometer systems, driven by sustained investments in marine geophysical research, defense, and offshore energy exploration. Manufacturers such as GeoMarine Survey Systems and MIND Technology are expanding production capacity and integrating next-generation sensor technologies to improve sensitivity and data accuracy. The U.S. Navy and commercial marine surveyors remain key customers, ensuring a robust domestic market. The region also witnesses extensive collaboration with Canadian firms, notably as Canada increases hydrographic and mineral exploration across the Arctic and Atlantic coasts.

- Europe: European manufacturers are emphasizing environmental compliance and modular system design, responding to regulations and diverse operating environments from the North Sea to the Mediterranean. Companies like Sea Technology Ltd in the UK and Marine Technology AS in Norway are advancing magnetometer platforms suitable for offshore wind farm site surveys, UXO detection, and maritime archaeology. The European Union’s Blue Economy policies, which encourage sustainable marine technology, are expected to further stimulate R&D and cross-border manufacturing partnerships through 2025 and beyond.

- Asia-Pacific: Rapid expansion in offshore infrastructure and defense spending characterizes the Asia-Pacific market. Japanese firms such as TOKYO KEIKI INC. and Australian companies like Geometrics Oceania (a regional branch of U.S.-based Geometrics) are scaling up production and localizing assembly lines to meet rising demand from China, South Korea, and Southeast Asia. This region is expected to see the fastest growth, propelled by large-scale marine resource mapping, port construction, and naval modernization initiatives.

- Beyond: While other regions—including Latin America and the Middle East—currently have limited indigenous manufacturing, they are increasingly importing towed magnetometer systems for oil exploration and maritime security, often sourcing from established North American, European, or Asian suppliers. As these markets mature, local assembly and service centers may emerge to support regional fleets and reduce lead times.

Overall, the towed underwater magnetometer manufacturing sector is poised for steady growth, with regional hubs driving innovation and addressing specific market requirements through 2025 and the near future.

Supply Chain Trends and Manufacturing Innovations

The manufacturing landscape for towed underwater magnetometers is experiencing notable transformation in 2025, driven by advancements in sensor technology, evolving supply chain strategies, and increased demand from both defense and commercial sectors. Key manufacturers are optimizing production processes to address challenges such as component scarcity, geopolitical supply risks, and the necessity for robust, high-precision instrumentation.

A significant trend is the adoption of modular design in magnetometer systems. Leading companies like GEOMAR Helmholtz Centre for Ocean Research Kiel and Geo Marine Survey Systems have integrated modularity into their towed magnetometers, allowing for easier upgrades and faster maintenance. This approach not only shortens lead times but also enables customization for specialized marine survey missions.

Supply chain resilience is another focal point, especially with ongoing global semiconductor shortages and material sourcing uncertainties. Manufacturers are increasingly investing in vertical integration and establishing strategic partnerships with electronics suppliers to secure critical components such as fluxgate sensors and high-precision navigation units. For example, Teledyne Marine has expanded its in-house capabilities to reduce dependency on external suppliers, ensuring continuity in production and quicker response to market demands.

Automation and digitalization are being rapidly adopted in manufacturing facilities. The use of advanced robotics and smart assembly lines has led to improved consistency and throughput. Marine Magnetics has reported significant reductions in production cycle times by integrating automated calibration and testing systems, enhancing both product quality and scalability.

Environmental sustainability is also shaping supply chain decisions. Companies are increasingly sourcing recyclable materials for housings and developing energy-efficient electronics to minimize the environmental impact of their products. This aligns with stricter environmental regulations and growing customer expectations in the marine technology sector.

Looking ahead, the outlook for towed underwater magnetometer manufacturing remains robust. As offshore wind, submarine cable installation, and defense sectors continue to expand, demand for high-performance magnetometers is predicted to grow. Manufacturers are expected to further invest in research and development, focusing on miniaturization, increased sensitivity, and enhanced integration with autonomous platforms. Continuous innovation in both supply chain management and production technology will be critical to maintaining competitiveness in this evolving market.

Regulatory and Environmental Considerations (e.g., imo.org)

The manufacturing of towed underwater magnetometers in 2025 is shaped by an evolving regulatory and environmental framework, reflecting increasing global attention to marine ecosystem protection and sustainable ocean technology deployment. At the international level, the International Maritime Organization (IMO) continues to enforce and update conventions that impact the design, materials, and operational protocols of marine scientific equipment, including towed magnetometers. The IMO’s International Convention for the Control and Management of Ships’ Ballast Water and Sediments and the International Convention for the Prevention of Pollution from Ships (MARPOL) both contribute to stricter guidelines on equipment that may interact with the marine environment, encouraging manufacturers to minimize potential ecological disturbances caused by towing devices through sensitive habitats.

Manufacturers are responding by incorporating environmentally benign materials and designing streamlined tow bodies that reduce drag, noise, and seabed disturbance. Companies such as Geomarine Dynamics and Teledyne Marine are emphasizing compliance with such international regulations by adopting recyclable composites, low-toxicity lubricants, and advanced hydrodynamic shapes in their latest product lines. Additionally, the push toward electrification and the reduction of hazardous substances aligns with the IMO’s environmental protection objectives, influencing the selection of batteries, cabling, and electronics used in magnetometer systems.

National maritime authorities are also tightening certification requirements for scientific gear deployed in exclusive economic zones (EEZs). In 2025, manufacturers must increasingly demonstrate Environmental Impact Assessments (EIAs) and obtain permits for equipment likely to be used in sensitive or protected areas. This has driven investment in R&D for non-invasive deployment methods, such as remotely operated winches and real-time monitoring systems, to limit the potential for accidental seabed contact or wildlife disturbance. For example, Marine Magnetics Corporation highlights their systems’ low environmental footprint and compliance with both national and international standards as part of their commitment to sustainable ocean technology.

Looking ahead, the regulatory landscape is expected to become more stringent as new marine protected areas are established and international agreements on deep-sea mining and biodiversity come into force. Manufacturers are proactively engaging with regulatory bodies and industry consortia to anticipate future requirements, ensuring that their design, manufacturing, and documentation processes will meet the evolving standards. This collaborative approach is expected to accelerate the adoption of best practices, supporting both the industry’s growth and the protection of marine environments worldwide.

Customer Demand Shifts and End-User Insights

In 2025, customer demand for towed underwater magnetometer systems is evolving rapidly, driven by shifting priorities in defense, marine exploration, and infrastructure development. Defense agencies remain key end-users, seeking advanced magnetometers for mine countermeasures, unexploded ordnance detection, and anti-submarine warfare. This has resulted in increased procurement of high-sensitivity arrays and modular towfish designs that can be rapidly deployed from a range of naval platforms. For instance, L3Harris has reported continued interest from navies in its MAG-2 and MAG-3 systems, which offer enhanced detection ranges and improved data fidelity suitable for modern naval missions.

In the civil sector, offshore wind farm development and subsea cable installation are accelerating demand for towed magnetometer solutions that can offer geophysical mapping and ferrous object detection with high reliability. End-users in this segment are increasingly requesting magnetometers with real-time data transmission capabilities, integration with GNSS, and compatibility with autonomous surface vessels. Manufacturers such as Geomarine Survey Systems and Marine Magnetics Corporation have responded by incorporating advanced telemetry and user-friendly software into their products, enabling operators to reduce survey times and improve operational efficiency.

Another notable trend is the growing interest from research institutions and environmental agencies. These users prioritize high-resolution data for mapping geomagnetic anomalies and archaeological sites, often requiring custom sensor arrays and robust post-processing support. Feedback from organizations such as Woods Hole Oceanographic Institution indicates a preference for modular platforms that can be tailored to specific scientific objectives and deployed from smaller research vessels.

- Defence clients are demanding greater automation, enhanced sensitivity, and cross-platform interoperability to support multi-domain operations.

- Civil and commercial stakeholders are prioritizing ease of integration with survey equipment and autonomous systems, alongside robust technical support.

- Academic and research end-users emphasize adaptability, high data fidelity, and open data formats for seamless analysis and collaboration.

Looking ahead, manufacturers are expected to focus on further miniaturization, increased sensor fusion capabilities, and greater compatibility with autonomous and remotely operated vehicles. The sector is also witnessing a shift towards subscription-based service models, where end-users lease equipment bundled with analytics and support—an approach being piloted by companies such as Marine Magnetics Corporation. As regulatory scrutiny on subsea infrastructure projects tightens, demand for comprehensive, high-precision towed magnetometer solutions is anticipated to rise through 2026 and beyond.

Future Outlook: Disruptive Trends, Investment Opportunities, and Strategic Recommendations

The manufacturing landscape for towed underwater magnetometers is poised for significant evolution through 2025 and the ensuing years, driven by technological innovation, increased demand for subsea exploration, and new investment flows. The development of compact, high-sensitivity fluxgate and optically pumped magnetometers remains a cornerstone, with manufacturers focusing on improving sensor performance, noise reduction, and durability at greater depths. Key players like GEOMAR Helmholtz Centre for Ocean Research Kiel and Sea-Bird Scientific have recently emphasized integration of multi-parameter sensor arrays, allowing for simultaneous collection of magnetic, conductivity, and temperature data, streamlining offshore survey operations.

A disruptive trend reshaping the sector is the adoption of autonomous and remotely operated towing platforms. Manufacturers such as GEOMAR Helmholtz Centre for Ocean Research Kiel and MIND Technology are investing in compact, power-efficient magnetometers tailored for deployment on autonomous underwater vehicles (AUVs) and remotely operated vehicles (ROVs). This shift addresses growing demand from marine mineral prospecting, pipeline inspection, and unexploded ordnance detection, all sectors expected to experience heightened activity due to expanding offshore energy projects and environmental monitoring mandates.

Investment opportunities in 2025 and beyond are likely to cluster around advanced materials—such as non-magnetic composites for housings and enhanced shielding—as well as digital signal processing and edge-computing capabilities for real-time anomaly detection. Companies such as MIND Technology and Geomatrix Earth Science Ltd are also exploring partnerships with defense and research organizations to develop next-generation magnetometer arrays with improved vector resolution, targeting both commercial and governmental applications.

Strategically, established manufacturers are recommended to prioritize modularity and interoperability, ensuring that new magnetometer systems can seamlessly interface with a wide range of underwater platforms and data management systems. Building alliances with AUV/ROV manufacturers and marine survey service providers can further expand market reach. Additionally, securing supply chains for rare-earth materials and investing in in-house calibration facilities will be critical to mitigating risks associated with geopolitical uncertainties and tightening export controls on sensitive technologies.

In summary, through 2025 and the following years, the towed underwater magnetometer manufacturing sector is set for transformative growth, propelled by advances in sensor technology, the proliferation of autonomous platforms, and expanding application domains. Firms that leverage these disruptive trends, invest in R&D, and foster strategic collaborations will be well positioned to capitalize on emerging global opportunities.

Sources & References

- Geometrix Technology

- MIND Technology

- L3Harris

- GEOMAR Helmholtz Centre for Ocean Research Kiel

- Geo Marine Survey Systems

- Fugro

- SBG Systems

- Geometrics, Inc.

- Marine Magnetics Corp.

- Scintrex Limited

- Marine Magnetics Corp.

- Lockheed Martin

- TOKYO KEIKI INC.

- Teledyne Marine

- International Maritime Organization (IMO)

- Marine Magnetics Corporation

- Sea-Bird Scientific

- Geomatrix Earth Science Ltd