2025 Fluoropolymer-Based Fuel Cell Membranes Market Report: Growth Drivers, Technology Innovations, and Strategic Insights for the Next 5 Years

- Executive Summary & Market Overview

- Key Technology Trends in Fluoropolymer-Based Fuel Cell Membranes

- Competitive Landscape and Leading Players

- Market Growth Forecasts and CAGR Analysis (2025–2030)

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Opportunities

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

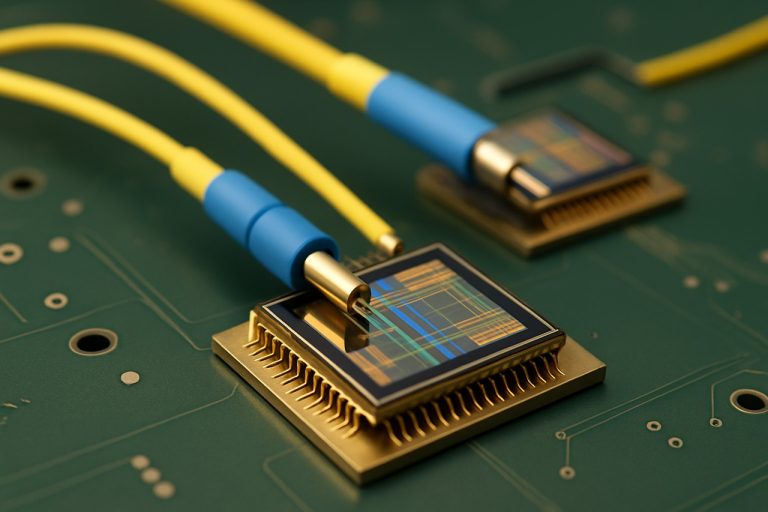

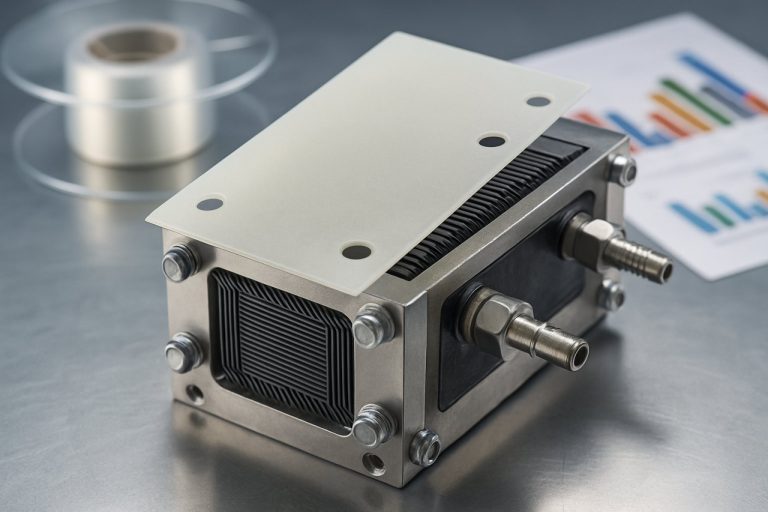

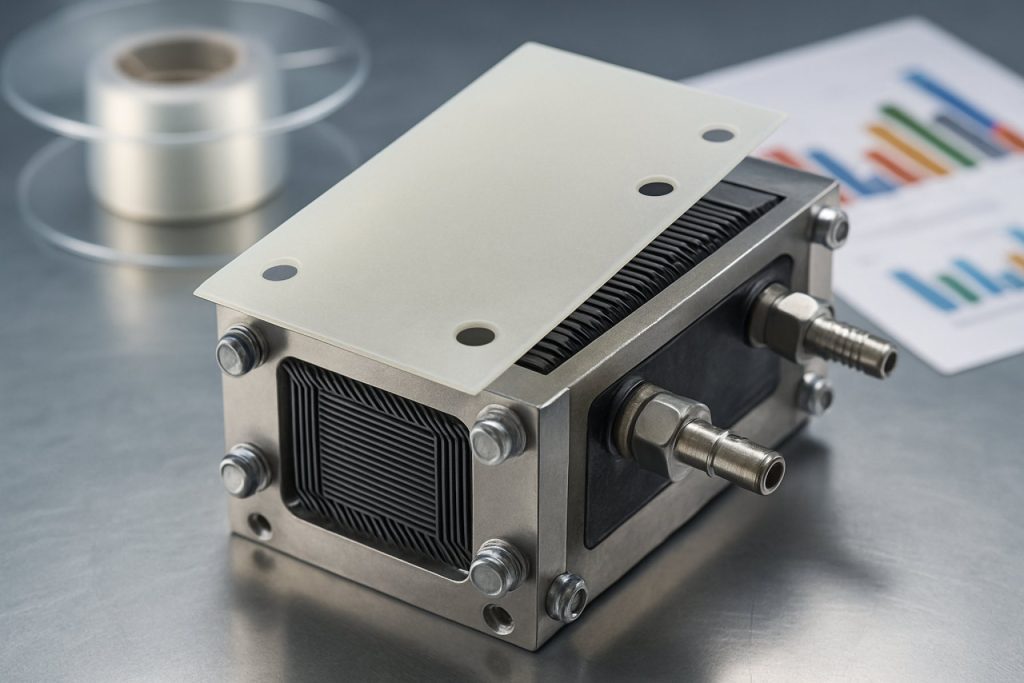

Fluoropolymer-based fuel cell membranes represent a critical component in the advancement of fuel cell technologies, particularly for proton exchange membrane fuel cells (PEMFCs) used in automotive, stationary, and portable power applications. These membranes, primarily composed of perfluorosulfonic acid (PFSA) polymers such as Nafion, are valued for their exceptional chemical stability, proton conductivity, and mechanical strength under a wide range of operating conditions. As the global push for decarbonization intensifies, the demand for high-performance fuel cell membranes is accelerating, positioning fluoropolymer-based solutions at the forefront of innovation.

The global market for fluoropolymer-based fuel cell membranes is projected to experience robust growth through 2025, driven by increasing investments in hydrogen infrastructure, government incentives for clean energy adoption, and the automotive sector’s transition toward zero-emission vehicles. According to MarketsandMarkets, the broader fluoropolymer market is expected to reach USD 9.6 billion by 2025, with fuel cell applications representing a significant and rapidly expanding segment. Key industry players such as The Chemours Company, Solvay, and 3M are actively investing in R&D to enhance membrane performance, durability, and cost-effectiveness.

- Automotive: The adoption of fuel cell electric vehicles (FCEVs) by major automakers, including Toyota and Hyundai, is a primary driver for membrane demand. These companies rely on advanced fluoropolymer membranes to ensure reliability and efficiency in commercial FCEV models.

- Stationary Power: Utilities and industrial users are deploying PEMFCs for backup and distributed power generation, leveraging the long service life and high performance of fluoropolymer-based membranes.

- Regional Trends: Asia-Pacific leads the market, with strong government support in Japan, South Korea, and China for hydrogen fuel cell infrastructure, while Europe and North America are rapidly scaling up investments.

Despite their advantages, fluoropolymer-based membranes face challenges related to cost and recycling. However, ongoing innovation and economies of scale are expected to improve their competitiveness. As the hydrogen economy matures, these membranes will remain pivotal in enabling the widespread adoption of clean fuel cell technologies.

Key Technology Trends in Fluoropolymer-Based Fuel Cell Membranes

Fluoropolymer-based fuel cell membranes are at the forefront of innovation in the hydrogen economy, serving as critical components in proton exchange membrane fuel cells (PEMFCs) due to their exceptional chemical stability, proton conductivity, and mechanical strength. As the market for fuel cells expands—driven by decarbonization efforts in transportation, stationary power, and portable applications—several key technology trends are shaping the development and commercialization of these membranes in 2025.

- Advanced Composite Structures: Leading manufacturers are integrating inorganic fillers, such as silica, titania, and graphene oxide, into fluoropolymer matrices to enhance mechanical durability and water retention at elevated temperatures. These hybrid membranes address the traditional limitations of perfluorosulfonic acid (PFSA) membranes, such as DuPont’s Nafion, by improving performance under low-humidity and high-temperature conditions.

- Cost Reduction and Process Innovation: The high cost of fluoropolymer membranes remains a barrier to mass adoption. In 2025, process innovations—such as roll-to-roll manufacturing, solvent-free casting, and recycling of off-spec materials—are being implemented to reduce production costs and environmental impact. Companies like W. L. Gore & Associates are investing in scalable manufacturing technologies to meet growing demand.

- Enhanced Durability and Lifetime: Research is focused on increasing membrane lifetimes to over 20,000 hours for automotive applications. This is achieved through chemical stabilization of the polymer backbone, incorporation of radical scavengers, and crosslinking strategies. For example, 3M has developed reinforced ionomer membranes with improved resistance to chemical degradation.

- Next-Generation Ionomers: The development of short-side-chain (SSC) and ultra-low equivalent weight (EW) ionomers is enabling higher proton conductivity and lower gas crossover. These materials, pioneered by companies such as Solvay, are tailored for high-power density and long-term stability.

- Sustainability and Recycling: Environmental considerations are driving the adoption of greener chemistries and closed-loop recycling systems for fluoropolymer membranes. Industry initiatives, such as those led by Chemours, focus on reducing fluorinated emissions and reclaiming valuable materials from end-of-life membranes.

These technology trends are positioning fluoropolymer-based fuel cell membranes as a linchpin in the global transition to clean hydrogen energy, with ongoing R&D and industrial collaboration expected to accelerate market growth through 2025 and beyond.

Competitive Landscape and Leading Players

The competitive landscape for fluoropolymer-based fuel cell membranes in 2025 is characterized by a mix of established chemical giants and specialized membrane technology firms, all vying for market share in a sector driven by the accelerating adoption of hydrogen fuel cells in transportation, stationary power, and portable applications. The market is highly consolidated, with a few key players dominating global supply, leveraging their extensive R&D capabilities, proprietary technologies, and integrated supply chains.

Leading Players

- The Chemours Company remains a global leader, primarily through its Nafion™ brand of perfluorosulfonic acid (PFSA) membranes. Chemours continues to invest in capacity expansion and product innovation, focusing on improving membrane durability and proton conductivity to meet the evolving demands of automotive and industrial fuel cell applications.

- Solvay S.A. is another major player, offering its Aquivion® range of short-side-chain PFSA membranes. Solvay differentiates itself through advanced membrane chemistries that provide enhanced chemical stability and operational lifetimes, targeting both PEM fuel cells and electrolyzer markets.

- 3M Company maintains a significant presence, with its ion exchange membrane technologies widely adopted in automotive fuel cell stacks. 3M’s focus on cost reduction and scalable manufacturing processes has enabled it to supply high-performance membranes to leading OEMs and system integrators.

- W. L. Gore & Associates, Inc. is renowned for its GORE-SELECT® membranes, which are recognized for their thinness, high power density, and mechanical robustness. Gore’s partnerships with automotive manufacturers and fuel cell system developers have solidified its position in the high-performance segment.

- Toray Industries, Inc. and Asahi Kasei Corporation are prominent in the Asia-Pacific region, leveraging their expertise in fluoropolymer chemistry and large-scale production to serve both domestic and international markets.

The competitive dynamics are further shaped by ongoing collaborations, joint ventures, and licensing agreements, as companies seek to accelerate innovation and secure long-term supply contracts with automotive and energy sector clients. The entry of new players remains challenging due to high capital requirements, stringent quality standards, and the need for proven long-term membrane durability. As the fuel cell market matures, leading fluoropolymer membrane suppliers are expected to intensify their focus on cost optimization, sustainability, and next-generation material development to maintain their competitive edge.

Market Growth Forecasts and CAGR Analysis (2025–2030)

The global market for fluoropolymer-based fuel cell membranes is poised for robust growth between 2025 and 2030, driven by accelerating adoption of fuel cell technologies in transportation, stationary power, and portable applications. According to projections by MarketsandMarkets, the overall fluoropolymer market is expected to witness a compound annual growth rate (CAGR) of approximately 6–7% during this period, with the fuel cell membrane segment outpacing the broader market due to its critical role in proton exchange membrane (PEM) fuel cells.

Specifically, the fluoropolymer-based fuel cell membrane market is forecasted to achieve a CAGR of 8–10% from 2025 to 2030, as reported by Grand View Research. This growth is underpinned by increasing investments in hydrogen infrastructure, government incentives for clean energy, and the automotive industry’s shift toward zero-emission vehicles. The Asia-Pacific region, led by China, Japan, and South Korea, is expected to dominate market expansion, supported by aggressive national hydrogen strategies and large-scale deployment of fuel cell electric vehicles (FCEVs).

Key industry players such as The Chemours Company and Solvay S.A. are investing in R&D to enhance membrane durability, conductivity, and cost-effectiveness, which is anticipated to further accelerate market penetration. The automotive sector, particularly commercial vehicles and buses, is projected to be the fastest-growing application segment, with several OEMs announcing plans for mass production of FCEVs by 2025–2027 (U.S. Department of Energy).

- 2025 Market Size: Estimated at USD 650–700 million for fluoropolymer-based fuel cell membranes globally.

- 2030 Projection: Expected to surpass USD 1.1–1.2 billion, reflecting strong CAGR and expanding end-use applications.

- Regional Leaders: Asia-Pacific (45–50% market share), followed by Europe and North America.

In summary, the period from 2025 to 2030 is set to witness significant expansion in the fluoropolymer-based fuel cell membrane market, with technological advancements, policy support, and growing demand for clean mobility acting as primary growth catalysts.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global market for fluoropolymer-based fuel cell membranes is witnessing dynamic regional trends, with North America, Europe, Asia-Pacific, and the Rest of the World (RoW) each exhibiting distinct growth drivers and challenges in 2025.

North America remains a leading region, propelled by robust investments in clean energy infrastructure and strong government incentives for hydrogen and fuel cell technologies. The United States, in particular, is home to major industry players and research institutions, fostering innovation in membrane technology. The region’s automotive and stationary power sectors are key adopters, with companies like 3M and Chemours advancing high-performance fluoropolymer membranes. The U.S. Department of Energy’s continued funding for hydrogen initiatives further accelerates market growth (U.S. Department of Energy).

Europe is characterized by stringent emission regulations and ambitious decarbonization targets, driving demand for fuel cell vehicles and stationary applications. The European Union’s “Fit for 55” package and the Hydrogen Strategy are catalyzing investments in fuel cell infrastructure. Germany, France, and the UK are at the forefront, with companies such as Solvay and Arkema leading membrane development. The region’s focus on green hydrogen and public-private partnerships is expected to sustain double-digit market growth through 2025 (Fuel Cells and Hydrogen Joint Undertaking).

Asia-Pacific is the fastest-growing market, driven by aggressive government policies in Japan, South Korea, and China to promote hydrogen as a clean energy vector. Japan’s “Basic Hydrogen Strategy” and South Korea’s “Hydrogen Economy Roadmap” are spurring large-scale adoption of fuel cell vehicles and power generation systems. Major automakers like Toyota and Hyundai are integrating advanced fluoropolymer membranes into their fuel cell electric vehicles. China’s focus on reducing urban air pollution and its investments in hydrogen refueling infrastructure further boost regional demand (International Energy Agency).

- Rest of World (RoW): While adoption is slower, countries in the Middle East and Latin America are exploring fuel cell applications for distributed power and transportation, supported by pilot projects and international collaborations (U.S. Department of Energy Hydrogen Program).

Overall, regional market dynamics in 2025 reflect a convergence of policy support, industrial innovation, and strategic investments, positioning fluoropolymer-based fuel cell membranes as a critical enabler of the global hydrogen economy.

Future Outlook: Emerging Applications and Investment Opportunities

The future outlook for fluoropolymer-based fuel cell membranes in 2025 is marked by a convergence of technological innovation, expanding application domains, and robust investment activity. As the global push for decarbonization intensifies, fuel cells—particularly proton exchange membrane fuel cells (PEMFCs)—are gaining traction in transportation, stationary power, and portable energy sectors. Fluoropolymer membranes, such as those based on perfluorosulfonic acid (PFSA), remain the industry standard due to their superior chemical stability, proton conductivity, and durability under harsh operating conditions.

Emerging applications are set to drive demand for advanced fluoropolymer membranes. The automotive sector, led by major OEMs and supported by government incentives, is accelerating the deployment of fuel cell electric vehicles (FCEVs). Notably, countries like Japan, South Korea, and Germany are investing heavily in hydrogen infrastructure, creating a fertile environment for membrane innovation and adoption International Energy Agency. Beyond mobility, stationary fuel cell systems for backup power and grid stabilization are gaining momentum, especially in regions with ambitious renewable energy targets. The rise of distributed energy resources and microgrids further amplifies the need for reliable, high-performance membranes.

On the technology front, R&D is focused on enhancing membrane longevity, reducing costs, and improving performance at higher temperatures and lower humidity. Companies are exploring composite and reinforced fluoropolymer membranes, as well as hybrid structures that combine the best attributes of PFSA with alternative ionomers. These innovations aim to address the limitations of current materials, such as degradation under cycling and high cost, thereby broadening the commercial viability of fuel cell systems 3M Company.

- Venture capital and corporate investments in fuel cell technology startups are rising, with a focus on membrane materials and manufacturing scale-up Bloomberg.

- Strategic partnerships between membrane producers and automotive or energy companies are accelerating commercialization and market entry.

- Government funding programs, such as the U.S. Department of Energy’s Hydrogen Shot, are catalyzing research and pilot projects for next-generation fluoropolymer membranes U.S. Department of Energy.

In summary, 2025 is poised to be a pivotal year for fluoropolymer-based fuel cell membranes, with emerging applications and investment opportunities shaping a dynamic and rapidly evolving market landscape.

Challenges, Risks, and Strategic Opportunities

Fluoropolymer-based fuel cell membranes, particularly those utilizing perfluorosulfonic acid (PFSA) chemistries such as Nafion, are central to the performance and durability of proton exchange membrane fuel cells (PEMFCs). However, the market in 2025 faces a complex landscape of challenges, risks, and strategic opportunities that will shape its trajectory.

Challenges and Risks

- Cost Pressures: Fluoropolymer membranes are significantly more expensive than hydrocarbon-based alternatives, primarily due to the high cost of raw materials and complex manufacturing processes. This cost premium remains a barrier to large-scale adoption, especially in price-sensitive automotive and stationary power markets (MarketsandMarkets).

- Supply Chain Vulnerabilities: The fluoropolymer supply chain is highly concentrated, with a few major players controlling the production of key monomers and resins. Disruptions—such as regulatory actions on PFAS (per- and polyfluoroalkyl substances) or geopolitical tensions—could impact availability and pricing (Chemours).

- Environmental and Regulatory Risks: Growing scrutiny of PFAS compounds, which include many fluoropolymers, poses regulatory risks. The European Union and U.S. EPA are considering stricter controls, which could increase compliance costs or restrict certain chemistries (European Chemicals Agency).

- Performance Limitations: While fluoropolymer membranes offer excellent chemical stability and proton conductivity, they can suffer from dehydration at high temperatures and reduced performance under low humidity, limiting their use in some next-generation fuel cell applications (Ballard Power Systems).

Strategic Opportunities

- Advanced Material Innovation: Ongoing R&D into reinforced and composite fluoropolymer membranes aims to improve durability, reduce thickness, and enhance water retention, opening new application segments such as heavy-duty transport and high-temperature PEMFCs (Dow).

- Recycling and Circular Economy: Developing recycling processes for end-of-life membranes and production scrap could mitigate environmental concerns and reduce raw material costs, aligning with global sustainability trends (Solvay).

- Strategic Partnerships: Collaborations between membrane producers, automakers, and energy companies are accelerating the commercialization of next-generation fuel cell systems, leveraging shared expertise and de-risking investment (Toyota Motor Corporation).

In summary, while fluoropolymer-based fuel cell membranes face significant headwinds in 2025, targeted innovation and strategic collaboration present clear pathways to overcoming these challenges and capturing emerging market opportunities.

Sources & References

- MarketsandMarkets

- Toyota

- Hyundai

- DuPont’s Nafion

- W. L. Gore & Associates

- Asahi Kasei Corporation

- Grand View Research

- U.S. Department of Energy

- Arkema

- International Energy Agency

- European Chemicals Agency

- Ballard Power Systems