Silicon Photonic Interconnects Market Report 2025: In-Depth Analysis of Growth Drivers, Technology Innovations, and Global Opportunities

- Executive Summary & Market Overview

- Key Technology Trends in Silicon Photonic Interconnects

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

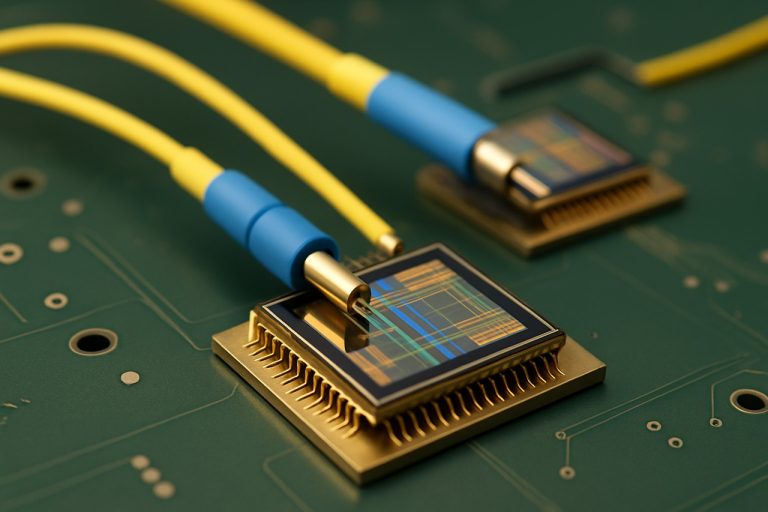

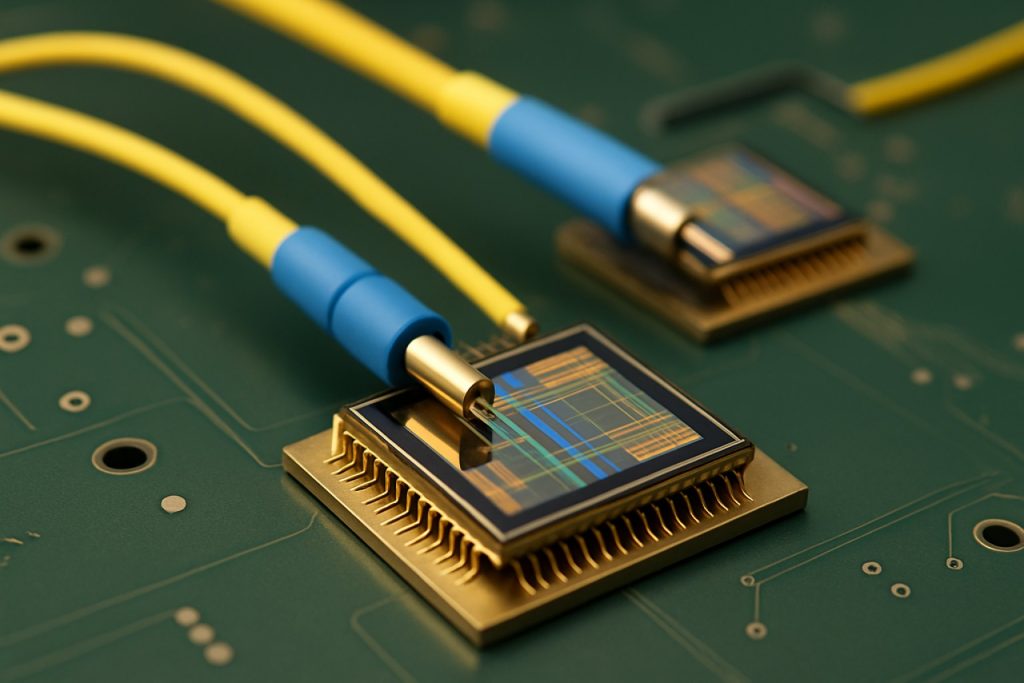

Silicon photonic interconnects are advanced optical communication technologies that leverage silicon-based photonic devices to transmit data at high speeds with low power consumption. These interconnects are increasingly critical in data centers, high-performance computing (HPC), and emerging AI workloads, where traditional copper-based connections face limitations in bandwidth, latency, and energy efficiency. The market for silicon photonic interconnects is poised for robust growth in 2025, driven by escalating data traffic, the proliferation of cloud services, and the need for scalable, energy-efficient infrastructure.

According to MarketsandMarkets, the global silicon photonics market is projected to reach USD 4.6 billion by 2025, growing at a CAGR of over 23% from 2020. This surge is underpinned by rapid adoption in data centers, where hyperscale operators such as Microsoft and Google are deploying silicon photonic solutions to meet the demands of AI and machine learning workloads. The technology’s ability to deliver high bandwidth (100G, 400G, and beyond) with lower power consumption compared to traditional electrical interconnects is a key differentiator.

Major industry players, including Intel, Cisco, and Rockley Photonics, are investing heavily in R&D to advance silicon photonic integration, reduce costs, and expand product portfolios. The ecosystem is also witnessing increased collaboration between component manufacturers, foundries, and system integrators to accelerate commercialization and standardization efforts.

- Data Center Demand: The exponential growth in cloud computing and AI is driving the need for faster, more efficient interconnects, positioning silicon photonics as a foundational technology for next-generation data centers.

- Technological Advancements: Innovations in packaging, integration, and manufacturing are reducing costs and improving performance, making silicon photonic interconnects more accessible for a broader range of applications.

- Regional Trends: North America leads in adoption, but significant investments are also observed in Europe and Asia-Pacific, particularly in China and Japan, where government initiatives support photonics research and commercialization (IDC).

In summary, the silicon photonic interconnects market in 2025 is characterized by rapid technological progress, strong end-user demand, and a dynamic competitive landscape, setting the stage for continued expansion and innovation.

Key Technology Trends in Silicon Photonic Interconnects

Silicon photonic interconnects are rapidly transforming data transmission within data centers, high-performance computing (HPC), and telecommunications infrastructure. As the demand for higher bandwidth, lower latency, and energy-efficient data transfer intensifies, several key technology trends are shaping the silicon photonic interconnect landscape in 2025.

- Co-Packaged Optics (CPO): The integration of optical engines directly with switch ASICs is gaining momentum, reducing electrical signal losses and power consumption. Major industry players are advancing CPO solutions to address the limitations of traditional pluggable optics, with Intel Corporation and Broadcom Inc. leading initiatives to commercialize CPO for next-generation data center switches.

- Advanced Modulation Formats: To achieve higher data rates, silicon photonic interconnects are adopting advanced modulation schemes such as PAM4 (Pulse Amplitude Modulation with 4 levels) and coherent modulation. These formats enable transmission speeds of 400G, 800G, and beyond, as highlighted in Credo Technology Group’s recent product launches.

- Integration of Lasers on Silicon: A significant trend is the monolithic or heterogeneous integration of laser sources onto silicon photonic chips. This reduces packaging complexity and cost, while improving performance. imec and Ayar Labs have demonstrated breakthroughs in integrating III-V lasers with silicon, paving the way for fully integrated optical transceivers.

- Wavelength Division Multiplexing (WDM): The adoption of WDM in silicon photonics allows multiple data channels to be transmitted simultaneously over a single fiber, significantly increasing bandwidth density. Cisco Systems, Inc. and Inphi Corporation (now part of Marvell Technology) are actively developing WDM-enabled silicon photonic solutions for hyperscale data centers.

- Standardization and Interoperability: Industry consortia such as the Optical Internetworking Forum (OIF) and Co-Packaged Optics Collaboration are driving standards for silicon photonic interconnects, ensuring multi-vendor interoperability and accelerating market adoption.

These technology trends are expected to drive the silicon photonic interconnect market toward multi-terabit data rates, reduced power consumption, and scalable architectures, positioning silicon photonics as a foundational technology for next-generation digital infrastructure in 2025 and beyond.

Competitive Landscape and Leading Players

The competitive landscape for silicon photonic interconnects in 2025 is characterized by a dynamic mix of established semiconductor giants, specialized photonics firms, and emerging startups, all vying for leadership in a market driven by the exponential growth of data centers, high-performance computing (HPC), and artificial intelligence (AI) workloads. The sector is witnessing rapid innovation, with companies focusing on increasing bandwidth, reducing power consumption, and improving integration with existing CMOS processes.

Key players dominating the silicon photonic interconnects market include Intel Corporation, which has been a pioneer in commercializing silicon photonics for data center applications. Intel’s optical transceivers and co-packaged optics solutions are widely adopted by hyperscale cloud providers, giving the company a significant market share. Cisco Systems, Inc. is another major contender, leveraging its acquisitions of photonics startups and its expertise in networking hardware to deliver advanced optical interconnect solutions.

Other notable leaders include Rockley Photonics, which focuses on high-density optical interconnects for both data communications and emerging applications in healthcare, and Ayar Labs, a startup that has gained traction with its monolithic integration of photonics and electronics, enabling ultra-low latency and high-bandwidth chip-to-chip communication. Inphi Corporation (now part of Marvell Technology, Inc.) is also a significant player, offering high-speed optical interconnects that are integral to next-generation data center architectures.

The competitive environment is further intensified by the entry of traditional optical component manufacturers such as Lumentum Holdings Inc. and Coherent Corp. (formerly II-VI Incorporated), both of which are investing heavily in silicon photonics R&D to capture a share of the growing demand for scalable, energy-efficient interconnects.

- Strategic partnerships and acquisitions are common, as seen in Marvell Technology, Inc.’s acquisition of Inphi and Cisco Systems, Inc.’s ongoing investments in photonics startups.

- Startups such as Lightmatter and DustPhotonics are pushing the envelope with novel architectures and integration techniques.

- Geographically, North America and parts of Asia-Pacific, particularly China, are hotbeds of innovation and investment, with government and private sector support accelerating commercialization.

Overall, the 2025 silicon photonic interconnects market is marked by intense competition, rapid technological advancement, and a clear trend toward ecosystem consolidation as players seek to secure their positions in the evolving data infrastructure landscape.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The silicon photonic interconnects market is poised for robust growth between 2025 and 2030, driven by escalating demand for high-speed data transmission in data centers, telecommunications, and high-performance computing. According to projections by MarketsandMarkets, the global silicon photonics market is expected to register a compound annual growth rate (CAGR) of approximately 23% during this period, with interconnects representing a significant share of this expansion.

Revenue forecasts indicate that the silicon photonic interconnects segment will see its market value rise from an estimated $1.2 billion in 2025 to over $3.3 billion by 2030. This surge is attributed to the increasing adoption of optical transceivers and switches in hyperscale data centers, as well as the integration of silicon photonics in next-generation server and storage architectures. International Data Corporation (IDC) highlights that the proliferation of artificial intelligence (AI) workloads and cloud computing is accelerating the need for low-latency, high-bandwidth interconnect solutions, further fueling market growth.

In terms of volume, the shipment of silicon photonic interconnect modules is projected to grow at a CAGR exceeding 25% from 2025 to 2030. Omdia reports that annual unit shipments could surpass 10 million by 2030, reflecting widespread deployment in both enterprise and hyperscale environments. The transition from copper-based to optical interconnects is expected to intensify, particularly as data rates move beyond 400 Gbps and approach 800 Gbps and 1.6 Tbps, where silicon photonics offers clear advantages in power efficiency and signal integrity.

- CAGR (2025–2030): ~23% for revenue, >25% for unit shipments

- Revenue (2025): ~$1.2 billion

- Revenue (2030): >$3.3 billion

- Volume (2030): >10 million units annually

Overall, the market outlook for silicon photonic interconnects from 2025 to 2030 is highly optimistic, underpinned by technological advancements, cost reductions, and the relentless growth of data-centric applications. Strategic investments by leading players such as Intel Corporation and Cisco Systems, Inc. are expected to further accelerate innovation and adoption across key verticals.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global silicon photonic interconnects market is poised for significant growth in 2025, with regional dynamics shaped by technological adoption, investment patterns, and end-user demand. The following analysis examines the market landscape across North America, Europe, Asia-Pacific, and the Rest of the World, highlighting key trends and drivers in each region.

- North America: North America remains the leading region for silicon photonic interconnects, driven by robust investments in data centers, cloud computing, and artificial intelligence infrastructure. The presence of major technology companies and research institutions, particularly in the United States, accelerates innovation and commercialization. According to Intel Corporation and Cisco Systems, Inc., the demand for high-speed, energy-efficient interconnects is surging as hyperscale data centers expand. The region also benefits from strong government support for photonics R&D, as evidenced by initiatives from the National Science Foundation.

- Europe: Europe is witnessing steady growth, underpinned by strategic investments in digital infrastructure and a focus on energy efficiency. The European Union’s digital agenda and funding from programs such as Digital Europe Programme are fostering the adoption of silicon photonics in telecommunications and high-performance computing. Leading research centers and companies, including STMicroelectronics and imec, are advancing photonic integration technologies, positioning Europe as a key innovator in the market.

- Asia-Pacific: The Asia-Pacific region is expected to register the fastest growth rate in 2025, fueled by rapid digital transformation, 5G rollout, and the proliferation of cloud services. Countries such as China, Japan, and South Korea are investing heavily in next-generation data centers and optical networks. According to Huawei Technologies Co., Ltd. and NEC Corporation, regional demand is further bolstered by government-backed initiatives to localize semiconductor and photonics manufacturing.

- Rest of World: While still emerging, markets in Latin America, the Middle East, and Africa are beginning to adopt silicon photonic interconnects, primarily in metropolitan data centers and telecom upgrades. Growth is constrained by limited infrastructure and investment, but international partnerships and technology transfers are expected to gradually increase adoption rates, as noted by International Data Corporation (IDC).

Overall, regional disparities in infrastructure, investment, and policy support will continue to shape the competitive landscape of silicon photonic interconnects in 2025, with North America and Asia-Pacific leading in both innovation and market share.

Future Outlook: Emerging Applications and Investment Hotspots

Looking ahead to 2025, silicon photonic interconnects are poised to play a transformative role in data center architectures, high-performance computing (HPC), and emerging AI workloads. The convergence of exponential data growth, energy efficiency imperatives, and the limitations of traditional copper-based interconnects is accelerating the adoption of silicon photonics for both intra- and inter-chip communication.

One of the most promising emerging applications is in AI and machine learning clusters, where the need for ultra-high bandwidth and low latency is critical. Major cloud service providers and hyperscale data centers are investing in silicon photonic solutions to address bottlenecks in server-to-server and rack-to-rack communication. For instance, Intel and NVIDIA are actively developing silicon photonic transceivers and switches tailored for AI-centric data center topologies.

Another hotspot is the integration of silicon photonics with advanced packaging technologies, such as co-packaged optics (CPO). This approach brings optical interconnects closer to the processor, reducing power consumption and enabling higher data rates. Industry leaders like Cisco and Broadcom are piloting CPO solutions, with commercial deployments expected to ramp up in 2025 and beyond.

Telecommunications is also a key sector, with 5G and future 6G networks demanding scalable, low-latency optical links. Silicon photonic interconnects are being explored for fronthaul and backhaul applications, as well as for enabling disaggregated network architectures. Analysys Mason projects that the telecom optical components market, including silicon photonics, will see double-digit growth through 2025, driven by these trends.

On the investment front, venture capital and corporate funding are flowing into startups and scale-ups focused on silicon photonic design, manufacturing, and packaging. According to PitchBook, 2023 and 2024 saw record funding rounds for companies such as Ayar Labs and Rockley Photonics, signaling strong investor confidence in the sector’s near-term growth potential.

In summary, 2025 will see silicon photonic interconnects move from niche deployments to mainstream adoption across data centers, telecom, and AI infrastructure, with co-packaged optics and AI-driven applications representing the most dynamic investment and innovation hotspots.

Challenges, Risks, and Strategic Opportunities

Silicon photonic interconnects are poised to revolutionize data transmission in high-performance computing, data centers, and telecommunications by enabling faster, more energy-efficient communication. However, the sector faces several challenges and risks that could impact its growth trajectory in 2025, while also presenting strategic opportunities for industry players.

Challenges and Risks

- Manufacturing Complexity and Yield: Integrating photonic components with existing CMOS processes remains technically challenging. Achieving high yields for complex photonic integrated circuits (PICs) is difficult, leading to higher production costs and potential supply constraints. This is particularly relevant as demand for advanced interconnects accelerates in AI and cloud infrastructure (Intel).

- Standardization and Interoperability: The lack of universally accepted standards for silicon photonic interconnects hinders widespread adoption. Interoperability issues between products from different vendors can slow deployment in multi-vendor environments, a critical concern for hyperscale data centers (Optical Internetworking Forum).

- Thermal Management: As data rates increase, managing heat dissipation in densely packed photonic circuits becomes more challenging. Ineffective thermal management can degrade performance and reliability, necessitating new materials and packaging solutions (Synopsys).

- Capital Intensity: Significant upfront investment is required for R&D, fabrication facilities, and testing infrastructure. This can be a barrier for new entrants and smaller firms, potentially slowing innovation (McKinsey & Company).

Strategic Opportunities

- AI and High-Performance Computing: The exponential growth in AI workloads and high-performance computing is driving demand for low-latency, high-bandwidth interconnects. Companies that can deliver scalable, energy-efficient silicon photonic solutions stand to capture significant market share (International Data Corporation (IDC)).

- Co-Packaged Optics: Integrating photonics directly with switch ASICs (co-packaged optics) is emerging as a key trend, promising to overcome bandwidth bottlenecks in next-generation data centers. Early movers in this space can establish strong partnerships with leading cloud providers (Cisco).

- Vertical Integration: Strategic acquisitions and partnerships across the value chain—from chip design to packaging—can help companies control quality, reduce costs, and accelerate time-to-market (AMD).

- Standardization Leadership: Active participation in industry consortia to shape standards can position companies as technology leaders and facilitate broader ecosystem adoption (IEEE).

In summary, while silicon photonic interconnects face technical and market risks in 2025, companies that address these challenges and capitalize on strategic opportunities are well-positioned for growth in a rapidly evolving digital infrastructure landscape.

Sources & References

- MarketsandMarkets

- Microsoft

- Cisco

- Rockley Photonics

- IDC

- Broadcom Inc.

- Credo Technology Group

- imec

- Ayar Labs

- Inphi Corporation

- Optical Internetworking Forum (OIF)

- Marvell Technology, Inc.

- Lumentum Holdings Inc.

- DustPhotonics

- Omdia

- National Science Foundation

- Digital Europe Programme

- STMicroelectronics

- Huawei Technologies Co., Ltd.

- NEC Corporation

- NVIDIA

- Analysys Mason

- Optical Internetworking Forum

- Synopsys

- McKinsey & Company

- IEEE