Electroreduction Catalysis for CO₂ Conversion Market Report 2025: In-Depth Analysis of Growth Drivers, Technology Innovations, and Global Opportunities

- Executive Summary & Market Overview

- Key Technology Trends in Electroreduction Catalysis

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Challenges, Risks, and Barriers to Adoption

- Opportunities and Strategic Recommendations

- Future Outlook: Emerging Applications and Investment Hotspots

- Sources & References

Executive Summary & Market Overview

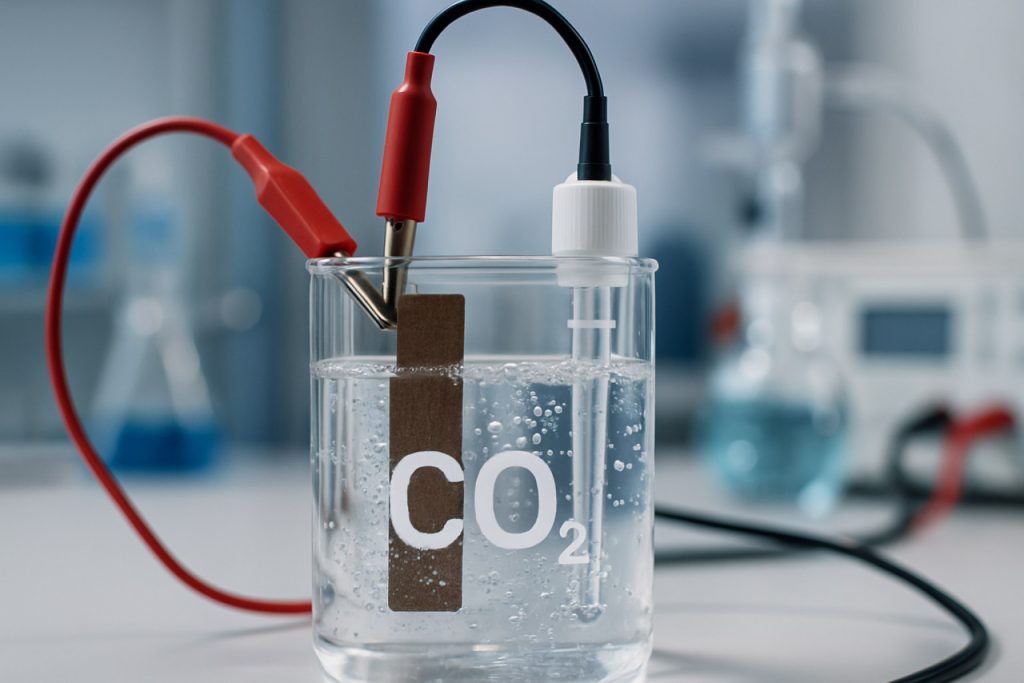

Electroreduction catalysis for CO₂ conversion represents a rapidly advancing field at the intersection of sustainable chemistry, energy transition, and climate mitigation. This technology leverages electrocatalysts to convert carbon dioxide (CO₂) into value-added chemicals and fuels—such as carbon monoxide, formic acid, methanol, and hydrocarbons—using renewable electricity. The process not only offers a pathway to reduce greenhouse gas emissions but also enables the circular utilization of CO₂, aligning with global decarbonization goals.

As of 2025, the global market for CO₂ electroreduction catalysis is experiencing robust growth, driven by increasing regulatory pressure to curb emissions, rising investments in carbon capture and utilization (CCU) technologies, and the expanding availability of low-cost renewable energy. According to International Energy Agency, the deployment of CCU technologies is expected to accelerate, with electrochemical conversion methods gaining traction due to their modularity and compatibility with intermittent renewable power sources.

Key industry players—including Twelve, Opus 12, and Carbon Clean—are scaling up pilot and demonstration projects, targeting commercial applications in chemicals, fuels, and materials. The market is also witnessing significant R&D investments from both public and private sectors, with the ARPA-E and the European Commission Directorate-General for Climate Action funding breakthrough research in catalyst design and process integration.

Market analysts project that the global CO₂ utilization market, including electroreduction, could surpass $10 billion by 2030, with a compound annual growth rate (CAGR) exceeding 15% from 2023 to 2030, as reported by MarketsandMarkets. The Asia-Pacific region is emerging as a key growth hub, propelled by ambitious net-zero targets in China, Japan, and South Korea, as well as strong government support for green hydrogen and power-to-X initiatives.

- Electroreduction catalysis is positioned as a critical enabler for sustainable chemical manufacturing and synthetic fuel production.

- Technological advancements in catalyst efficiency, selectivity, and durability are pivotal for commercial viability.

- Policy incentives, carbon pricing, and corporate sustainability commitments are accelerating market adoption.

In summary, electroreduction catalysis for CO₂ conversion is transitioning from laboratory innovation to early-stage commercialization, with 2025 marking a pivotal year for scaling and market entry. The sector’s trajectory will be shaped by continued technological breakthroughs, supportive policy frameworks, and the integration of renewable energy systems.

Key Technology Trends in Electroreduction Catalysis

Electroreduction catalysis for CO₂ conversion is experiencing rapid technological evolution, driven by the urgent need for carbon-neutral processes and the global push toward decarbonization. In 2025, several key technology trends are shaping the landscape of this sector, with a focus on improving catalyst efficiency, selectivity, scalability, and integration with renewable energy sources.

- Advanced Catalyst Materials: The development of novel catalyst materials, such as single-atom catalysts, bimetallic alloys, and nanostructured surfaces, is significantly enhancing the selectivity and activity of CO₂ electroreduction. For instance, copper-based catalysts remain at the forefront due to their unique ability to produce multi-carbon products, while emerging materials like metal–organic frameworks (MOFs) and doped carbon-based catalysts are showing promise for higher efficiency and product specificity (Nature Energy).

- Product Selectivity and Multi-Carbon Products: A major trend is the shift from simple products (e.g., CO, formate) to more valuable multi-carbon chemicals such as ethylene, ethanol, and propanol. Innovations in catalyst design and reaction environment engineering are enabling higher selectivity toward these complex molecules, which are critical for industrial applications (Nano Energy).

- Integration with Renewable Energy: The coupling of CO₂ electroreduction systems with intermittent renewable energy sources (solar, wind) is gaining traction. This integration is essential for achieving net-zero emissions and is driving the development of flexible, modular electrolyzer systems that can operate efficiently under variable power inputs (International Energy Agency).

- Scale-Up and System Engineering: Moving from laboratory-scale demonstrations to pilot and commercial-scale systems is a critical focus. Advances in reactor design, membrane technology, and process intensification are addressing challenges related to mass transport, product separation, and system durability (U.S. Department of Energy).

- Digitalization and AI-Driven Optimization: The application of machine learning and artificial intelligence is accelerating catalyst discovery and process optimization. Data-driven approaches are enabling rapid screening of catalyst candidates and real-time process control, reducing development timelines (Nano Energy).

These trends collectively indicate a maturing field, with significant investments from both public and private sectors aiming to commercialize CO₂ electroreduction technologies and integrate them into the broader carbon management ecosystem.

Competitive Landscape and Leading Players

The competitive landscape for electroreduction catalysis in CO₂ conversion is rapidly evolving, driven by the urgent need for scalable carbon capture and utilization (CCU) solutions. As of 2025, the sector is characterized by a mix of established chemical companies, innovative startups, and academic spin-offs, all vying to commercialize efficient, selective, and durable catalysts for the electrochemical reduction of CO₂ into value-added chemicals and fuels.

Leading players include BASF and Siemens Energy, both of which have invested heavily in R&D partnerships and pilot projects targeting CO₂ electroreduction. BASF, for instance, has collaborated with research institutions to develop copper-based and molecular catalysts that demonstrate improved selectivity for ethylene and ethanol production. Siemens Energy, meanwhile, is advancing integrated electrolyzer systems that incorporate proprietary catalyst technologies for industrial-scale deployment.

Among startups, Opus 12 (now known as Twelve) has emerged as a frontrunner, leveraging proprietary polymer electrolyte membrane (PEM) electrolyzers and custom catalyst formulations to convert CO₂ into syngas, methane, and other hydrocarbons. The company’s partnerships with major corporations, such as Airbus and Shell, underscore its commercial traction and the growing interest in sustainable aviation fuels and chemicals derived from captured CO₂.

Academic spin-offs such as Avantium and OxCCU are also making significant strides. Avantium’s focus on formic acid and oxalic acid production via electroreduction has attracted investment from the specialty chemicals sector, while OxCCU is developing catalysts for direct conversion of CO₂ to jet fuel precursors, supported by grants from the UK government and partnerships with energy majors.

- Key competitive factors include catalyst selectivity, energy efficiency, operational stability, and scalability.

- Intellectual property portfolios and strategic alliances with industrial partners are critical for market positioning.

- Government funding and regulatory incentives in the EU, US, and Asia-Pacific are accelerating technology demonstration and early commercialization.

Overall, the competitive landscape in 2025 is marked by rapid innovation, cross-sector collaboration, and a race to achieve cost parity with conventional chemical processes, positioning electroreduction catalysis as a pivotal technology in the global decarbonization effort.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The market for electroreduction catalysis in CO₂ conversion is poised for robust expansion between 2025 and 2030, driven by escalating global efforts to decarbonize industrial processes and the increasing adoption of sustainable chemical manufacturing. According to projections from MarketsandMarkets, the global CO₂ electrolysis market—which includes electroreduction catalysis technologies—is expected to register a compound annual growth rate (CAGR) exceeding 35% during this period. This surge is attributed to both technological advancements in catalyst efficiency and the scaling up of pilot projects to commercial operations.

Revenue forecasts indicate that the market could surpass USD 1.2 billion by 2030, up from an estimated USD 220 million in 2025. This growth is underpinned by significant investments from both public and private sectors, particularly in regions such as Europe, North America, and East Asia, where policy incentives and carbon pricing mechanisms are accelerating the deployment of CO₂ conversion technologies. For instance, the European Union’s Green Deal and the U.S. Department of Energy’s funding initiatives are catalyzing the commercialization of electroreduction platforms (European Commission; U.S. Department of Energy).

In terms of volume, the market is projected to witness a substantial increase in the deployment of electroreduction reactors and catalyst units. By 2030, annual installed capacity for CO₂ electroreduction is expected to reach over 1.5 million metric tons of CO₂ processed, compared to less than 200,000 metric tons in 2025 (International Energy Agency). This volume growth is closely linked to the scaling of demonstration plants and the integration of electroreduction systems into existing industrial CO₂ streams, particularly in sectors such as chemicals, fuels, and materials manufacturing.

- CAGR (2025–2030): 35%+

- Revenue (2030): USD 1.2 billion+

- Volume (2030): 1.5 million+ metric tons CO₂ processed annually

Overall, the market outlook for electroreduction catalysis in CO₂ conversion is highly optimistic, with strong momentum expected as technology matures and regulatory frameworks continue to favor low-carbon solutions.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The regional market landscape for electroreduction catalysis in CO₂ conversion is evolving rapidly, driven by policy initiatives, industrial decarbonization goals, and technological advancements. In 2025, North America, Europe, Asia-Pacific, and the Rest of the World (RoW) each present distinct opportunities and challenges for the adoption and commercialization of electroreduction catalysis technologies.

- North America: The United States and Canada are at the forefront of research and pilot-scale deployment, supported by robust funding from government agencies such as the U.S. Department of Energy and private sector investments. The region benefits from a mature renewable energy infrastructure, which is critical for powering electrochemical CO₂ conversion processes sustainably. Key players, including 3M and ExxonMobil, are actively exploring partnerships and demonstration projects. The North American market is expected to see steady growth, particularly in sectors such as chemicals and fuels, where low-carbon alternatives are in high demand.

- Europe: Europe leads in regulatory support and ambitious climate targets, with the European Commission driving initiatives like the European Green Deal. Countries such as Germany, the Netherlands, and Denmark are investing in large-scale pilot plants and cross-sector collaborations. The presence of established chemical industries and a strong focus on circular economy principles further accelerate market adoption. Companies like BASF and Siemens Energy are prominent in advancing electroreduction catalysis technologies. The European market is projected to experience the fastest growth rate through 2025, underpinned by policy-driven demand and innovation funding.

- Asia-Pacific: The Asia-Pacific region, led by China, Japan, and South Korea, is witnessing rapid scaling of CO₂ conversion technologies, supported by government incentives and industrial decarbonization mandates. China, in particular, is investing heavily in R&D and pilot projects, with companies like Sinopec and State Grid Corporation of China exploring integration with renewable energy assets. Japan’s focus on hydrogen and synthetic fuels also drives interest in electroreduction catalysis. The region’s market growth is characterized by large-scale demonstration projects and increasing commercialization efforts.

- Rest of World: While adoption in Latin America, the Middle East, and Africa remains nascent, there is growing interest in leveraging abundant renewable resources for CO₂ conversion. Pilot initiatives in countries like the UAE and Brazil are emerging, often in partnership with international technology providers. Market growth in these regions is expected to accelerate post-2025 as technology costs decline and climate policies strengthen.

Challenges, Risks, and Barriers to Adoption

The adoption of electroreduction catalysis for CO₂ conversion faces several significant challenges, risks, and barriers that could impede its widespread commercialization by 2025. Despite promising laboratory results, scaling up these technologies to industrial levels remains a complex endeavor.

- Catalyst Performance and Stability: One of the primary technical challenges is the development of catalysts that are both highly selective and stable over prolonged operational periods. Many current catalysts suffer from deactivation, low selectivity for desired products, or require rare and expensive materials, which increases costs and limits scalability. According to National Renewable Energy Laboratory, achieving long-term stability and high faradaic efficiency is essential for commercial viability.

- Energy Efficiency and Integration: Electroreduction processes are energy-intensive, and their overall carbon footprint depends heavily on the source of electricity. If powered by fossil-based grids, the environmental benefits are diminished. Integrating these systems with renewable energy sources is critical but presents logistical and economic challenges, as highlighted by International Energy Agency.

- Product Separation and Purification: The electrochemical reduction of CO₂ often produces a mixture of products (e.g., CO, formic acid, hydrocarbons), necessitating complex downstream separation and purification steps. These processes add to operational costs and can reduce overall process efficiency, as noted by IEA CCUS in Clean Energy Transitions.

- Economic Competitiveness: The cost of CO₂-derived chemicals and fuels via electroreduction is currently higher than those produced from conventional fossil-based processes. Market adoption is hindered by the lack of carbon pricing mechanisms or policy incentives that could bridge this cost gap, as reported by IEA Technology Roadmap: Carbon Capture and Storage.

- Infrastructure and Regulatory Barriers: Widespread deployment requires new infrastructure for CO₂ capture, transport, and storage, as well as regulatory frameworks to ensure safety and environmental compliance. The absence of clear standards and permitting processes can delay project development, according to Global CCS Institute.

Addressing these challenges will require coordinated efforts in research, policy, and industry collaboration to unlock the full potential of electroreduction catalysis for CO₂ conversion.

Opportunities and Strategic Recommendations

The electroreduction catalysis market for CO₂ conversion is poised for significant growth in 2025, driven by intensifying global decarbonization mandates and the rapid advancement of renewable energy integration. As industries and governments seek scalable solutions to reduce atmospheric CO₂, electrochemical conversion technologies are emerging as a promising pathway to produce value-added chemicals and fuels, such as ethylene, methanol, and formic acid, from captured CO₂. This section outlines key opportunities and strategic recommendations for stakeholders aiming to capitalize on this evolving market.

- Integration with Renewable Energy: The intermittency of solar and wind power creates a unique opportunity for electroreduction systems to act as flexible, grid-balancing loads. Companies should prioritize partnerships with renewable energy providers to develop integrated CO₂-to-chemicals plants, leveraging low-cost, surplus electricity for high-efficiency conversion processes (International Energy Agency).

- Advancement in Catalyst Design: There is a growing demand for catalysts that offer high selectivity, stability, and low overpotentials. Investment in R&D for novel materials—such as single-atom catalysts, bimetallic alloys, and nanostructured surfaces—can yield significant competitive advantages. Collaborations with academic institutions and research consortia can accelerate breakthroughs (National Renewable Energy Laboratory).

- Scale-Up and Modularization: The transition from laboratory to commercial scale remains a challenge. Companies should focus on modular reactor designs that allow for incremental scaling and easier integration into existing industrial infrastructure. Strategic alliances with engineering firms and pilot project deployments will be critical for de-risking scale-up (International Energy Agency).

- Policy and Carbon Markets: The evolving landscape of carbon pricing and regulatory incentives presents a window for early movers. Engaging with policymakers to shape supportive frameworks—such as tax credits, feed-in tariffs, and low-carbon product standards—can enhance project economics and market adoption (World Bank).

- End-Use Market Development: Targeting sectors with high demand for green chemicals and fuels, such as plastics, aviation, and specialty chemicals, will be essential. Building offtake agreements and certification schemes for CO₂-derived products can help secure long-term revenue streams (International Energy Agency).

In summary, stakeholders should adopt a multi-pronged strategy—combining technology innovation, cross-sector partnerships, and proactive policy engagement—to unlock the full market potential of electroreduction catalysis for CO₂ conversion in 2025 and beyond.

Future Outlook: Emerging Applications and Investment Hotspots

The future outlook for electroreduction catalysis in CO₂ conversion is marked by rapid technological advancements, expanding application domains, and intensifying investment activity. As the urgency to decarbonize industrial processes and achieve net-zero targets accelerates, electrochemical CO₂ reduction (CO₂RR) is emerging as a pivotal technology for transforming captured carbon dioxide into value-added chemicals and fuels using renewable electricity.

Emerging applications are diversifying beyond traditional syngas and formic acid production. Notably, the synthesis of multi-carbon products such as ethylene, ethanol, and propanol is gaining traction, driven by advances in catalyst design—particularly with copper-based and single-atom catalysts. These products are integral to the chemical and plastics industries, offering a sustainable alternative to fossil-derived feedstocks. Additionally, the integration of CO₂RR with green hydrogen production and renewable energy sources is being piloted in power-to-X projects, enabling the storage of intermittent renewable energy in chemical bonds and supporting grid stability (International Energy Agency).

Geographically, investment hotspots are emerging in regions with strong policy support and abundant renewable resources. Europe, led by Germany and the Netherlands, is at the forefront, with large-scale demonstration projects and public-private partnerships. North America, particularly the United States, is witnessing increased venture capital and government funding, exemplified by initiatives under the Department of Energy’s ARPA-E program and the Inflation Reduction Act’s incentives for carbon management technologies (U.S. Department of Energy). In Asia, China, Japan, and South Korea are scaling up pilot plants and investing in domestic catalyst manufacturing capabilities (International Energy Agency).

- Industrial Integration: Companies are exploring the integration of CO₂RR units with existing industrial emitters, such as cement and steel plants, to create circular carbon economies.

- Materials Innovation: Startups and research consortia are focusing on novel catalyst materials—such as bimetallic alloys and nanostructured electrodes—to improve selectivity, efficiency, and durability.

- Scale-up and Commercialization: Pilot-to-commercial scale projects are expected to multiply by 2025, with several companies targeting gigawatt-scale installations by 2030 (BloombergNEF).

Overall, the convergence of policy incentives, technological breakthroughs, and market demand is positioning electroreduction catalysis for CO₂ conversion as a cornerstone of the emerging carbon management industry, with significant growth anticipated through 2025 and beyond.

Sources & References

- International Energy Agency

- Twelve

- Carbon Clean

- ARPA-E

- European Commission Directorate-General for Climate Action

- MarketsandMarkets

- Nature Energy

- BASF

- Siemens Energy

- Airbus

- Shell

- OxCCU

- ExxonMobil

- National Renewable Energy Laboratory

- Global CCS Institute

- World Bank

- BloombergNEF