Extreme Ultraviolet Lithography Equipment Manufacturing Market Report 2025: In-Depth Analysis of Growth Drivers, Technology Shifts, and Global Opportunities

- Executive Summary and Market Overview

- Key Technology Trends in EUV Lithography Equipment

- Competitive Landscape and Leading Manufacturers

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Innovation, Investment, and Market Expansion

- Challenges and Opportunities: Supply Chain, Cost, and Regulatory Factors

- Sources & References

Executive Summary and Market Overview

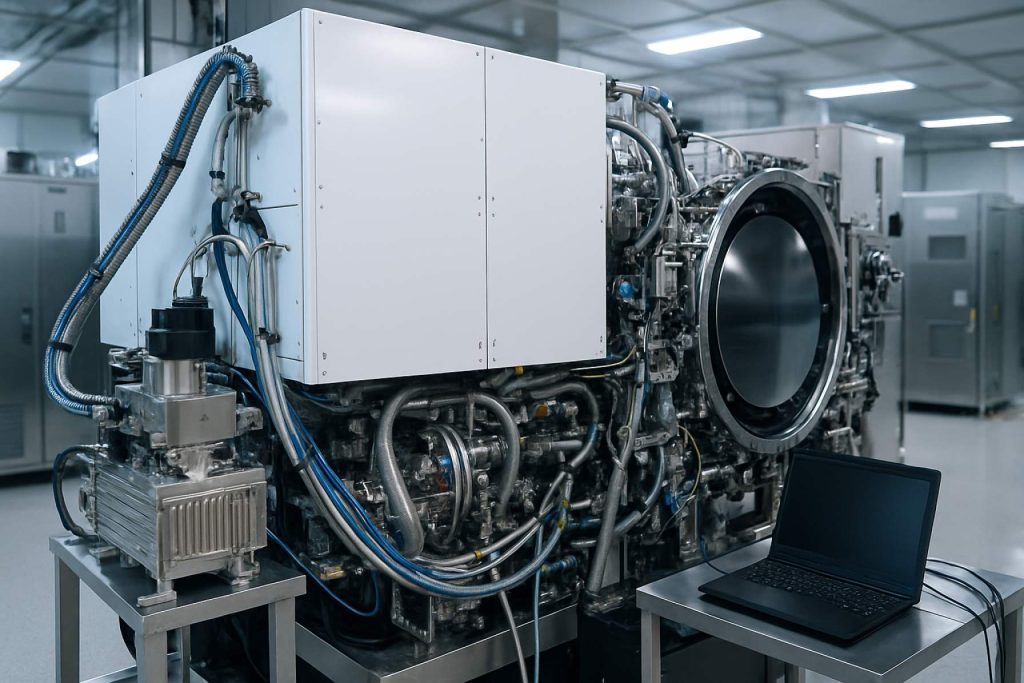

Extreme Ultraviolet (EUV) Lithography Equipment Manufacturing represents a critical segment within the semiconductor fabrication industry, enabling the production of advanced integrated circuits at sub-7nm process nodes. EUV lithography utilizes light with a wavelength of 13.5 nanometers, allowing for finer patterning on silicon wafers compared to traditional deep ultraviolet (DUV) methods. This technology is essential for meeting the escalating demand for higher performance and energy-efficient chips in applications such as artificial intelligence, 5G, and high-performance computing.

As of 2025, the global EUV lithography equipment market is characterized by high entry barriers, significant capital investment, and a concentrated competitive landscape. ASML Holding NV remains the dominant supplier, holding a near-monopoly due to its technological leadership and exclusive partnerships with key component providers. The market’s value is projected to surpass USD 20 billion by 2025, driven by aggressive capacity expansions from leading foundries such as Taiwan Semiconductor Manufacturing Company (TSMC), Samsung Electronics, and Intel Corporation as they transition to 3nm and 2nm nodes (Gartner).

Key market drivers include:

- Escalating demand for advanced chips in AI, automotive, and IoT sectors.

- Continued scaling of semiconductor devices, necessitating finer lithographic resolution.

- Government incentives and strategic investments in domestic semiconductor manufacturing, particularly in the US, EU, and East Asia (Semiconductor Industry Association).

However, the market faces challenges such as supply chain constraints for critical components (e.g., high-precision optics, light sources), the complexity of EUV system integration, and the need for highly skilled technical talent. The average selling price of an EUV scanner exceeds USD 150 million, reflecting the sophistication and cost intensity of the technology (SEMI).

In summary, the EUV lithography equipment manufacturing market in 2025 is poised for robust growth, underpinned by technological innovation, strategic investments, and the relentless pursuit of Moore’s Law. The sector’s trajectory will be shaped by ongoing R&D, supply chain resilience, and the pace of adoption among leading-edge chipmakers.

Key Technology Trends in EUV Lithography Equipment

Extreme Ultraviolet (EUV) lithography equipment manufacturing is undergoing rapid technological evolution as the semiconductor industry pushes toward sub-5nm and even 2nm process nodes. In 2025, several key technology trends are shaping the landscape of EUV lithography equipment, driven by the demand for higher resolution, improved throughput, and greater reliability.

- High-NA EUV Systems: The transition from conventional 0.33 numerical aperture (NA) EUV systems to high-NA (0.55 NA) platforms is a pivotal trend. High-NA EUV tools, such as those developed by ASML Holding, enable finer patterning and improved process windows, essential for advanced logic and memory devices. These systems require new optical designs, larger mirrors, and enhanced resist materials to fully leverage their resolution capabilities.

- Source Power Scaling: Increasing the power of EUV light sources is critical for boosting wafer throughput. In 2025, manufacturers are deploying EUV sources exceeding 500W, a significant leap from earlier generations. This advancement, led by Cymer (a subsidiary of ASML), addresses the industry’s need for higher productivity while maintaining stable operation and minimizing downtime.

- Mask Defect Mitigation and Pellicle Development: As EUV wavelengths are highly sensitive to mask defects, the industry is investing in advanced mask inspection and repair technologies. The development of robust EUV pellicles—protective membranes that shield masks from contamination—remains a focus, with companies like Shin-Etsu Chemical and Mitsui Chemicals making significant progress in pellicle durability and transmission efficiency.

- Resist Material Innovation: The push for smaller nodes necessitates new photoresist chemistries with higher sensitivity and lower line edge roughness. Collaborative efforts between equipment makers and material suppliers, such as Tokyo Ohka Kogyo and JSR Corporation, are accelerating the commercialization of next-generation EUV resists.

- In-Line Metrology and Process Control: Real-time metrology and advanced process control systems are being integrated into EUV lithography tools to ensure pattern fidelity and yield. Companies like KLA Corporation are at the forefront, providing solutions that enable rapid defect detection and correction during manufacturing.

These technology trends are collectively enabling the semiconductor industry to meet the stringent requirements of next-generation devices, reinforcing EUV lithography’s central role in advanced chip manufacturing through 2025 and beyond.

Competitive Landscape and Leading Manufacturers

The competitive landscape of the extreme ultraviolet (EUV) lithography equipment market in 2025 is characterized by high entry barriers, significant technological complexity, and a concentrated supplier base. The market is dominated by a handful of players, with ASML Holding NV standing as the undisputed global leader. ASML is currently the only company capable of manufacturing and supplying commercial EUV lithography systems, a position it has solidified through decades of R&D investment and strategic partnerships with key semiconductor manufacturers such as TSMC, Samsung Electronics, and Intel Corporation.

ASML’s EUV systems, particularly the Twinscan NXE and EXE series, are critical for the production of advanced semiconductor nodes at 5nm and below. The company’s technological moat is reinforced by its proprietary light source technology, precision optics (developed in collaboration with Carl Zeiss AG), and a robust global service network. In 2024, ASML reported record revenues from EUV system sales, with demand outstripping supply due to the ongoing transition to sub-5nm process technologies and the ramp-up of high-performance computing and AI chip production ASML Annual Report.

While ASML dominates the market, several other companies play crucial roles in the EUV ecosystem. Canon Inc. and Nikon Corporation are established lithography equipment manufacturers, but their focus remains on deep ultraviolet (DUV) systems. Both have announced R&D efforts in EUV, but as of 2025, neither has achieved commercial deployment. Component suppliers such as Cymer (a subsidiary of ASML) provide EUV light sources, while TRUMPF Group supplies high-power lasers essential for EUV generation.

The high cost, technical challenges, and intellectual property barriers have limited new entrants. However, China is investing heavily in domestic EUV R&D, with entities like SMIC and the Institute of Microelectronics of the Chinese Academy of Sciences pursuing indigenous solutions, though commercial viability is not expected before 2027 SEMI.

In summary, the 2025 EUV lithography equipment market is highly consolidated, with ASML as the sole commercial supplier and a supporting cast of specialized component manufacturers. The competitive landscape is shaped by technological leadership, strategic alliances, and the race for next-generation semiconductor manufacturing capabilities.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The global extreme ultraviolet (EUV) lithography equipment manufacturing market is poised for robust growth between 2025 and 2030, driven by escalating demand for advanced semiconductor devices and the ongoing transition to sub-7nm process nodes. According to projections by Gartner, the semiconductor industry’s overall revenue is expected to rebound strongly, which will directly benefit the EUV equipment segment due to its critical role in next-generation chip fabrication.

Market research from MarketsandMarkets estimates that the EUV lithography equipment market will register a compound annual growth rate (CAGR) of approximately 20% from 2025 to 2030. This growth is underpinned by aggressive capital expenditures from leading foundries and integrated device manufacturers (IDMs) such as TSMC, Samsung Electronics, and Intel, all of which are scaling up EUV capacity to meet the surging demand for high-performance computing, artificial intelligence, and 5G applications.

In terms of revenue, the EUV lithography equipment market is projected to surpass $25 billion by 2030, up from an estimated $10 billion in 2025, as reported by IDC. Volume shipments of EUV scanners are also expected to increase significantly, with annual unit sales forecasted to double over the forecast period. The market remains highly consolidated, with ASML Holding maintaining a near-monopoly as the sole supplier of commercial EUV lithography systems. ASML’s order backlog and planned capacity expansions signal continued momentum, with the company targeting delivery of over 100 EUV systems annually by 2030.

- Key growth drivers include the proliferation of advanced logic and memory chips, rising investments in semiconductor manufacturing infrastructure, and the push for technological sovereignty in major economies.

- Potential headwinds include supply chain constraints, high system costs, and geopolitical tensions affecting cross-border technology transfers.

Overall, the 2025–2030 period is expected to be transformative for EUV lithography equipment manufacturing, with sustained double-digit growth rates, expanding revenue pools, and increasing shipment volumes reflecting the technology’s centrality to the future of semiconductor innovation.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global market for extreme ultraviolet (EUV) lithography equipment is characterized by significant regional disparities in manufacturing capabilities, adoption rates, and strategic investments. In 2025, North America, Europe, Asia-Pacific, and the Rest of World (RoW) regions each play distinct roles in the EUV lithography value chain, shaped by their respective semiconductor industries, government policies, and supply chain dynamics.

- North America: The United States remains a pivotal player in the EUV lithography ecosystem, primarily through its dominance in semiconductor design and critical component supply. While the U.S. does not manufacture complete EUV systems, it is home to leading suppliers of photomasks, light sources, and software essential for EUV operations. Strategic government initiatives, such as the CHIPS and Science Act, are expected to bolster domestic semiconductor manufacturing and indirectly stimulate demand for EUV equipment in 2025. However, the region remains reliant on European and Asian partners for full-system integration and deployment (Semiconductor Industry Association).

- Europe: Europe, led by the Netherlands-based ASML Holding, is the undisputed global leader in EUV lithography equipment manufacturing. ASML is the sole supplier of commercial EUV systems, with its advanced manufacturing facilities and R&D centers concentrated in the region. European governments continue to support ASML and its supply chain through research funding and export controls, ensuring technological leadership and supply security. In 2025, Europe’s focus remains on scaling production to meet surging global demand, particularly from Asia-Pacific foundries (ASML Q4 2023 Financial Results).

- Asia-Pacific: The Asia-Pacific region, especially Taiwan, South Korea, and China, is the largest consumer of EUV lithography equipment, driven by aggressive investments from foundries such as TSMC and Samsung Electronics. These companies are at the forefront of advanced node production, necessitating continuous EUV adoption. In 2025, regional governments are intensifying efforts to localize supply chains and reduce dependency on foreign technology, but EUV system manufacturing remains out of reach due to technological and IP barriers (SEMI).

- Rest of World: Other regions, including the Middle East and Latin America, have minimal direct involvement in EUV lithography equipment manufacturing. Their participation is largely limited to supporting roles in raw material supply or as emerging markets for semiconductor consumption. In 2025, no significant EUV manufacturing initiatives are expected from these regions (Gartner).

Overall, the EUV lithography equipment manufacturing landscape in 2025 is defined by European technological leadership, North American component innovation, and Asia-Pacific’s dominant consumption and integration, with the rest of the world playing a peripheral role.

Future Outlook: Innovation, Investment, and Market Expansion

The future outlook for extreme ultraviolet (EUV) lithography equipment manufacturing in 2025 is characterized by robust innovation, significant investment, and aggressive market expansion. As the semiconductor industry pushes toward sub-5nm and even 2nm process nodes, EUV lithography remains the critical enabler for advanced chip production. Leading manufacturers are intensifying R&D efforts to enhance EUV system throughput, improve source power, and reduce stochastic defects, all of which are essential for scaling to next-generation nodes.

Innovation is expected to accelerate, with companies like ASML Holding—the sole supplier of high-volume EUV scanners—projecting the introduction of High-NA (numerical aperture) EUV systems in 2025. These systems promise higher resolution and productivity, supporting the industry’s roadmap for denser and more energy-efficient chips. Intel, TSMC, and Samsung Electronics are all investing heavily in EUV-enabled fabs, with capital expenditures in the tens of billions of dollars, underscoring the technology’s centrality to future semiconductor manufacturing.

- Investment: According to SEMI, global fab equipment spending is forecast to surpass $100 billion in 2025, with a significant portion allocated to EUV tools and infrastructure. Gartner projects that EUV equipment revenues will grow at a double-digit CAGR through 2025, driven by both logic and memory segments.

- Market Expansion: The adoption of EUV is expanding beyond leading-edge foundries to include memory manufacturers and, increasingly, advanced packaging applications. TechInsights notes that the number of fabs equipped with EUV tools is expected to double by 2025, with new entrants in China and other regions seeking to localize advanced semiconductor production.

- Supply Chain and Geopolitics: The EUV equipment market remains highly concentrated, with ASML Holding as the dominant supplier. However, ongoing geopolitical tensions and export controls are prompting efforts to diversify supply chains and develop indigenous EUV capabilities, particularly in China and the U.S.

In summary, 2025 will see EUV lithography equipment manufacturing at the forefront of semiconductor innovation, with escalating investments, expanding market adoption, and a dynamic competitive landscape shaped by both technological and geopolitical forces.

Challenges and Opportunities: Supply Chain, Cost, and Regulatory Factors

The manufacturing of Extreme Ultraviolet (EUV) lithography equipment in 2025 faces a complex landscape shaped by supply chain vulnerabilities, escalating costs, and evolving regulatory frameworks. EUV systems, essential for producing advanced semiconductor nodes below 7nm, are among the most intricate machines ever built, with each unit comprising over 100,000 components sourced globally. This complexity exposes manufacturers to significant supply chain risks, particularly in the wake of ongoing geopolitical tensions and post-pandemic disruptions. For instance, ASML Holding NV, the sole supplier of EUV lithography machines, has reported persistent challenges in securing critical components such as high-precision optics and specialized light sources, often sourced from a limited pool of suppliers.

Cost remains a formidable barrier. The average price of an EUV system surpassed $200 million in 2024, and further increases are anticipated due to inflationary pressures on raw materials and the need for continuous R&D investment. The capital intensity of EUV manufacturing is compounded by the requirement for ultra-clean environments and highly skilled labor, both of which are in short supply. According to SEMI, the global semiconductor equipment market is expected to grow by 8% in 2025, but EUV’s share of capital expenditure will rise disproportionately, straining the budgets of even the largest foundries.

Regulatory factors are also reshaping the industry. Export controls imposed by the United States and the European Union on advanced lithography equipment, particularly targeting sales to China, have introduced new compliance burdens and market uncertainties. U.S. Bureau of Industry and Security regulations now require extensive end-user verification and licensing, slowing delivery timelines and complicating after-sales support. These restrictions have forced manufacturers to diversify their customer base and invest in compliance infrastructure, while also spurring efforts by affected countries to develop indigenous alternatives.

Despite these challenges, opportunities abound. The insatiable demand for high-performance computing, AI accelerators, and next-generation memory chips is driving foundries to accelerate EUV adoption. Strategic partnerships between equipment makers, material suppliers, and chip manufacturers are emerging to mitigate supply chain risks and share R&D costs. Furthermore, government incentives in the U.S., EU, and Asia—such as those under the CHIPS Act—are expected to bolster domestic manufacturing capabilities and foster innovation in EUV technology throughout 2025.

Sources & References

- ASML Holding NV

- Semiconductor Industry Association

- Shin-Etsu Chemical

- Tokyo Ohka Kogyo

- JSR Corporation

- KLA Corporation

- Carl Zeiss AG

- Canon Inc.

- Nikon Corporation

- TRUMPF Group

- SMIC

- MarketsandMarkets

- IDC

- TechInsights

- U.S. Bureau of Industry and Security