Semiconductor Lithography Metrology Market Report 2025: In-Depth Analysis of Technology Advancements, Market Dynamics, and Global Growth Projections. Explore Key Trends, Competitive Strategies, and Future Opportunities Shaping the Industry.

- Executive Summary & Market Overview

- Key Technology Trends in Lithography Metrology

- Competitive Landscape and Leading Players

- Market Size, Growth Forecasts & CAGR Analysis (2025–2030)

- Regional Market Analysis: North America, Europe, Asia-Pacific & Rest of World

- Challenges, Risks, and Emerging Opportunities

- Future Outlook: Innovation, Investment, and Strategic Recommendations

- Sources & References

Executive Summary & Market Overview

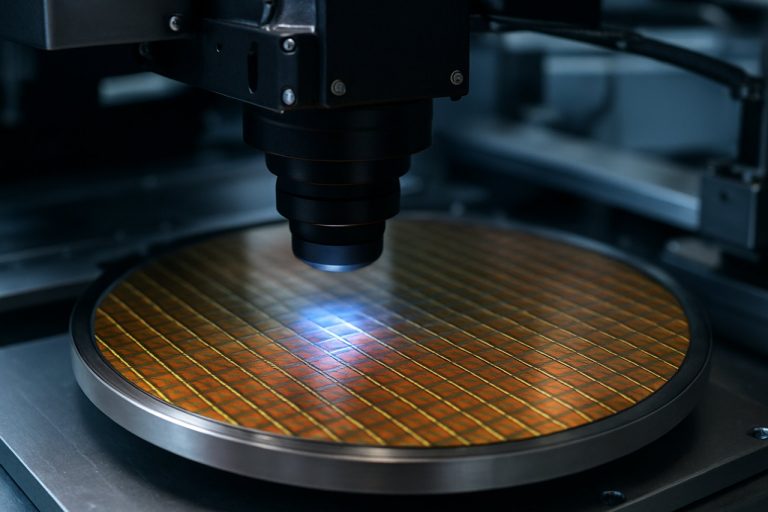

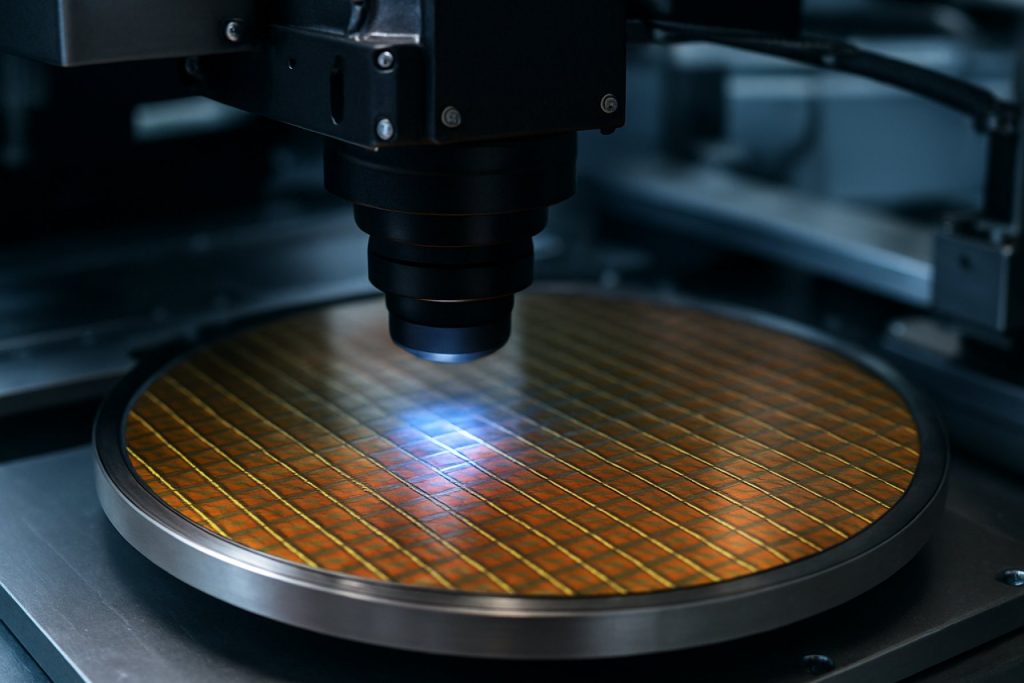

The semiconductor lithography metrology market is a critical segment within the broader semiconductor manufacturing industry, providing the measurement and inspection solutions necessary to ensure the accuracy and yield of advanced integrated circuits. Lithography metrology encompasses a range of technologies and tools used to measure critical dimensions (CD), overlay, and pattern fidelity during and after the photolithography process. As semiconductor device geometries continue to shrink, with leading-edge nodes moving to 3nm and below, the demand for highly precise and reliable metrology solutions has intensified.

In 2025, the global semiconductor lithography metrology market is projected to experience robust growth, driven by the ongoing transition to advanced process nodes, the proliferation of artificial intelligence (AI), 5G, and high-performance computing (HPC) applications. According to SEMI, the overall semiconductor equipment market is expected to surpass $100 billion, with metrology and inspection tools representing a significant and growing share. The increasing complexity of multi-patterning, extreme ultraviolet (EUV) lithography, and 3D device architectures has made advanced metrology indispensable for process control and yield enhancement.

Key players in the lithography metrology market include ASML Holding, KLA Corporation, Hitachi High-Tech Corporation, and Onto Innovation. These companies are investing heavily in R&D to develop next-generation metrology platforms capable of addressing the stringent requirements of sub-5nm manufacturing. Innovations such as optical scatterometry, critical dimension scanning electron microscopy (CD-SEM), and in-line overlay metrology are being rapidly adopted by leading foundries and integrated device manufacturers (IDMs).

Geographically, Asia-Pacific remains the dominant region, led by significant investments in semiconductor fabrication facilities in Taiwan, South Korea, and China. The region’s leadership is reinforced by the presence of major chipmakers and government-backed initiatives to bolster domestic semiconductor capabilities. North America and Europe also maintain strong positions, supported by advanced R&D ecosystems and strategic investments in next-generation lithography and metrology technologies.

In summary, the semiconductor lithography metrology market in 2025 is characterized by technological innovation, increasing capital expenditure by chipmakers, and a heightened focus on process control to enable the continued scaling of semiconductor devices. The market’s trajectory is closely tied to the evolution of lithography techniques and the relentless pursuit of higher performance, lower power, and greater integration in semiconductor products.

Key Technology Trends in Lithography Metrology

Semiconductor lithography metrology is undergoing rapid transformation in 2025, driven by the relentless push toward smaller process nodes, advanced packaging, and heterogeneous integration. As device geometries approach the sub-3nm scale, traditional metrology techniques face significant challenges in accuracy, throughput, and non-destructive measurement. The following key technology trends are shaping the landscape:

- Optical and Hybrid Metrology Advancements: Optical metrology remains foundational, but its limitations at advanced nodes have spurred the integration of hybrid approaches. Techniques such as scatterometry, ellipsometry, and critical dimension scanning electron microscopy (CD-SEM) are increasingly combined to enhance measurement precision and process control. Hybrid metrology leverages the strengths of each method, providing richer datasets for machine learning-driven analytics (KLA Corporation).

- Increased Adoption of Machine Learning and AI: Artificial intelligence and machine learning algorithms are now integral to metrology data analysis. These tools enable real-time defect detection, predictive maintenance, and process optimization, significantly reducing cycle times and improving yield. AI-driven solutions are particularly valuable for analyzing the massive datasets generated by advanced metrology tools (Applied Materials).

- In-Line and In-Situ Metrology: The demand for higher throughput and reduced process variability is accelerating the shift toward in-line and in-situ metrology. These systems provide immediate feedback during wafer processing, enabling dynamic process adjustments and minimizing costly rework. In-situ metrology is especially critical for EUV lithography, where process windows are extremely tight (ASML Holding).

- Metrology for Advanced Packaging: As advanced packaging technologies such as 2.5D and 3D integration gain traction, metrology solutions are evolving to address new challenges in overlay, bump height, and interconnect inspection. Non-destructive, high-resolution techniques are essential for ensuring reliability and performance in these complex architectures (TechInsights).

- Emergence of X-ray and Electron-Based Techniques: To overcome the limitations of optical methods at the atomic scale, X-ray and electron-based metrology tools are being adopted for critical dimension and material characterization. These techniques offer unparalleled resolution and are increasingly important for process control at the leading edge (Carl Zeiss AG).

Collectively, these trends underscore the pivotal role of innovation in semiconductor lithography metrology as the industry advances toward ever-smaller nodes and more complex device architectures in 2025.

Competitive Landscape and Leading Players

The competitive landscape of the semiconductor lithography metrology market in 2025 is characterized by a concentrated group of global players, each leveraging advanced technologies to address the increasing complexity of semiconductor manufacturing. The market is primarily dominated by a handful of established companies, with ASML Holding, KLA Corporation, and Hitachi High-Tech Corporation leading the field. These companies have maintained their positions through continuous innovation, strategic partnerships, and significant investments in R&D.

ASML, renowned for its lithography systems, has expanded its metrology portfolio to complement its EUV (Extreme Ultraviolet) lithography solutions, offering integrated metrology modules that enhance process control and yield. KLA Corporation remains a dominant force, providing a comprehensive suite of metrology and inspection tools, including advanced overlay metrology and critical dimension (CD) measurement systems. KLA’s focus on AI-driven analytics and in-line process control has further solidified its market leadership. Hitachi High-Tech, meanwhile, is recognized for its high-resolution CD-SEM (Critical Dimension Scanning Electron Microscope) systems, which are widely adopted for sub-5nm node manufacturing.

Other notable players include Onto Innovation (formerly Nanometrics and Rudolph Technologies), which specializes in optical metrology and inspection solutions, and Carl Zeiss SMT, a key supplier of optical components and metrology systems for advanced lithography. Nikon Corporation and Canon Inc. also maintain a presence, particularly in overlay metrology and alignment systems, though their market share is more pronounced in legacy nodes and specific regional markets.

- ASML Holding: Integrated metrology for EUV and DUV lithography

- KLA Corporation: Broad metrology portfolio, AI-driven analytics

- Hitachi High-Tech Corporation: CD-SEM leadership for advanced nodes

- Onto Innovation: Optical metrology and inspection

- Carl Zeiss SMT: Optical metrology and components

- Nikon Corporation and Canon Inc.: Overlay and alignment metrology

The competitive dynamics are further shaped by the rapid pace of technological change, with leading players racing to support sub-3nm and future nodes. Strategic collaborations between equipment vendors and semiconductor foundries, such as those between ASML and major chipmakers, are increasingly common to accelerate innovation and address the stringent requirements of next-generation devices. As a result, barriers to entry remain high, and the market is expected to remain consolidated among these key players through 2025.

Market Size, Growth Forecasts & CAGR Analysis (2025–2030)

The global semiconductor lithography metrology market is poised for robust growth between 2025 and 2030, driven by escalating demand for advanced semiconductor devices, the proliferation of AI and IoT applications, and the ongoing transition to sub-5nm process nodes. According to recent industry analyses, the market size for semiconductor lithography metrology is projected to reach approximately USD 2.8 billion by 2025, with expectations to surpass USD 4.5 billion by 2030. This reflects a compound annual growth rate (CAGR) of around 9.8% during the forecast period MarketsandMarkets.

Key growth drivers include the increasing complexity of semiconductor manufacturing, which necessitates precise metrology solutions for critical dimension (CD) measurement, overlay control, and defect inspection. The adoption of extreme ultraviolet (EUV) lithography in high-volume manufacturing is further amplifying the need for advanced metrology tools capable of handling tighter process tolerances and smaller feature sizes SEMI. Additionally, the expansion of foundry capacities in Asia-Pacific, particularly in Taiwan, South Korea, and China, is expected to contribute significantly to market growth, as these regions continue to invest heavily in next-generation semiconductor fabs Gartner.

- By Technology: Optical metrology remains the dominant segment, but e-beam and hybrid metrology solutions are gaining traction due to their superior resolution and accuracy for advanced nodes.

- By Application: Logic and memory device manufacturers are the primary adopters, with demand intensifying as chipmakers push toward 3nm and beyond.

- By Region: Asia-Pacific leads the market, accounting for over 60% of global revenue, followed by North America and Europe.

Looking ahead, the market is expected to benefit from ongoing R&D investments, the integration of AI-driven analytics in metrology systems, and the emergence of new materials and device architectures. However, challenges such as high equipment costs and technical barriers to scaling metrology for next-generation nodes may temper the pace of growth. Overall, the semiconductor lithography metrology market is set for sustained expansion, underpinned by the relentless drive for miniaturization and yield enhancement in semiconductor manufacturing TECHCET.

Regional Market Analysis: North America, Europe, Asia-Pacific & Rest of World

The semiconductor lithography metrology market is poised for differentiated growth across key regions in 2025, driven by varying levels of semiconductor manufacturing investment, technological adoption, and government initiatives.

- North America: The region, led by the United States, remains a global hub for advanced semiconductor R&D and manufacturing. The ongoing implementation of the CHIPS and Science Act is catalyzing significant capital inflows into domestic fabs, with major players such as Intel and TSMC (Arizona) expanding their U.S. presence. This surge in advanced node production is fueling demand for state-of-the-art metrology solutions, particularly for EUV and DUV lithography processes. The region’s focus on leading-edge nodes (5nm and below) necessitates high-precision metrology tools, supporting robust market growth.

- Europe: Europe’s semiconductor strategy, underpinned by the European Chips Act, is driving investments in both mature and advanced node manufacturing. Key countries such as Germany, France, and the Netherlands are home to major equipment suppliers like ASML, which dominates the global lithography market. European fabs are increasingly adopting advanced metrology systems to support automotive, industrial, and IoT chip production. The region’s emphasis on supply chain resilience and technological sovereignty is expected to sustain steady demand for metrology equipment in 2025.

- Asia-Pacific: Asia-Pacific remains the largest and fastest-growing market for semiconductor lithography metrology, accounting for over 60% of global semiconductor fabrication capacity according to SEMI. Countries such as Taiwan, South Korea, China, and Japan are aggressively investing in new fabs and process technology upgrades. Leading foundries like TSMC and Samsung Electronics are at the forefront of sub-5nm and 3nm production, driving demand for next-generation metrology tools. China’s push for semiconductor self-sufficiency is also spurring domestic metrology equipment development and adoption.

- Rest of World: While smaller in scale, regions such as the Middle East and Latin America are witnessing nascent investments in semiconductor manufacturing, often focused on packaging and assembly. These markets are gradually adopting basic metrology solutions, with potential for future growth as local ecosystems mature.

Overall, regional dynamics in 2025 will be shaped by government policy, supply chain strategies, and the race for technological leadership, with Asia-Pacific and North America leading in advanced metrology adoption, and Europe focusing on strategic autonomy and supply chain resilience.

Challenges, Risks, and Emerging Opportunities

The semiconductor lithography metrology market in 2025 faces a complex landscape of challenges, risks, and emerging opportunities as the industry pushes toward ever-smaller process nodes and higher device complexity. One of the primary challenges is the escalating technical difficulty of measuring and controlling critical dimensions (CD) at sub-5nm and even sub-3nm nodes. As feature sizes shrink, traditional optical metrology techniques approach their physical limits, necessitating the adoption of advanced solutions such as scatterometry, critical dimension scanning electron microscopy (CD-SEM), and hybrid metrology approaches. This transition increases both capital expenditure and operational complexity for semiconductor manufacturers, as highlighted by ASML and KLA Corporation.

Another significant risk is the supply chain vulnerability for high-precision metrology equipment and components. The global semiconductor supply chain disruptions experienced in recent years have underscored the importance of resilient sourcing strategies and the potential for delays in equipment delivery, which can impact fab ramp-up schedules and yield optimization. Additionally, the rapid pace of innovation in device architectures—such as gate-all-around (GAA) transistors and 3D NAND—demands new metrology solutions capable of characterizing complex 3D structures, as noted by Semiconductor Industry Association.

- Data Management and AI Integration: The explosion of metrology data generated by advanced nodes presents both a challenge and an opportunity. Efficient data management and the integration of artificial intelligence (AI) and machine learning (ML) for real-time process control are becoming essential. Companies investing in AI-driven metrology analytics, such as Hitachi High-Tech, are poised to gain a competitive edge.

- Cost Pressures: The high cost of next-generation metrology tools is a persistent risk, particularly for smaller foundries and integrated device manufacturers (IDMs). This may drive industry consolidation or increased reliance on equipment leasing and as-a-service business models.

- Emerging Opportunities: The transition to advanced packaging, including chiplets and heterogeneous integration, is creating new demand for metrology solutions tailored to wafer-level and die-level inspection. Furthermore, the growth of automotive, AI, and IoT markets is expanding the application scope for semiconductor metrology, as reported by Gartner.

In summary, while the semiconductor lithography metrology sector in 2025 is challenged by technical, financial, and supply chain risks, it is also positioned for growth through innovation in AI, advanced packaging, and new device architectures.

Future Outlook: Innovation, Investment, and Strategic Recommendations

The future outlook for semiconductor lithography metrology in 2025 is shaped by rapid innovation, robust investment, and evolving strategic imperatives. As the semiconductor industry pushes toward sub-3nm process nodes, the demand for advanced metrology solutions is intensifying. Key players are accelerating R&D to address the challenges of shrinking feature sizes, complex 3D structures, and the integration of new materials.

Innovation is expected to center on the development of high-resolution, non-destructive metrology tools capable of providing real-time feedback during the lithography process. Technologies such as hybrid metrology—combining optical and e-beam techniques—are gaining traction for their ability to deliver comprehensive data on critical dimensions and overlay accuracy. The integration of artificial intelligence and machine learning into metrology systems is also anticipated to enhance defect detection and process control, reducing cycle times and improving yield. Companies like ASML and KLA Corporation are at the forefront, investing heavily in next-generation metrology platforms tailored for extreme ultraviolet (EUV) lithography and advanced packaging applications.

Investment trends indicate a sustained influx of capital into metrology R&D, driven by both established semiconductor manufacturers and emerging foundries. According to SEMI, global semiconductor equipment spending is projected to reach new highs in 2025, with a significant portion allocated to metrology and inspection tools. Strategic partnerships between equipment vendors and chipmakers are becoming more common, aiming to co-develop customized solutions that address specific process challenges.

Strategic recommendations for stakeholders in 2025 include:

- Prioritizing the adoption of AI-driven metrology platforms to enhance process control and predictive maintenance.

- Investing in hybrid and multi-modal metrology solutions to address the increasing complexity of device architectures.

- Fostering collaborations between equipment suppliers, foundries, and research institutions to accelerate innovation cycles.

- Expanding metrology capabilities to support advanced packaging and heterogeneous integration, which are critical for next-generation applications such as AI, 5G, and automotive electronics.

In summary, the semiconductor lithography metrology market in 2025 will be defined by technological breakthroughs, strategic investments, and collaborative innovation, all aimed at enabling the continued scaling and diversification of semiconductor devices.

Sources & References

- ASML Holding

- KLA Corporation

- Hitachi High-Tech Corporation

- Onto Innovation

- TechInsights

- Carl Zeiss AG

- Nikon Corporation

- Canon Inc.

- MarketsandMarkets

- TECHCET

- European Chips Act

- Semiconductor Industry Association