2025 Embedded Systems Design for Medical Devices: Market Dynamics, Technology Innovations, and Strategic Forecasts. Explore Key Trends, Growth Drivers, and Competitive Insights Shaping the Next Five Years.

- Executive Summary & Market Overview

- Key Technology Trends in Embedded Systems for Medical Devices

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

Embedded systems design for medical devices refers to the integration of specialized computing hardware and software within medical equipment to perform dedicated functions, such as monitoring, diagnostics, and therapeutic interventions. These systems are critical for ensuring device reliability, patient safety, and regulatory compliance. The global market for embedded systems in medical devices is experiencing robust growth, driven by technological advancements, increasing healthcare digitization, and rising demand for portable and connected medical solutions.

According to MarketsandMarkets, the global embedded systems market is projected to reach USD 137.5 billion by 2027, with the medical devices segment representing a significant and expanding share. The proliferation of Internet of Things (IoT) technologies, artificial intelligence (AI), and edge computing is accelerating the adoption of sophisticated embedded solutions in medical devices, ranging from wearable monitors to complex imaging systems.

Key drivers in 2025 include:

- Regulatory Evolution: Stricter standards from agencies such as the U.S. Food and Drug Administration (FDA) and the European Commission are compelling manufacturers to adopt advanced embedded designs that ensure cybersecurity, interoperability, and real-time data processing.

- Miniaturization and Power Efficiency: Advances in semiconductor technology are enabling the development of smaller, more energy-efficient embedded systems, crucial for portable and implantable medical devices.

- Connectivity and Data Integration: The demand for remote patient monitoring and telemedicine is driving the integration of wireless communication protocols and cloud connectivity within embedded platforms.

Major industry players such as Medtronic, GE HealthCare, and Philips are investing heavily in R&D to develop next-generation embedded solutions that enhance device intelligence and patient outcomes. Startups and technology providers, including Arm and STMicroelectronics, are also shaping the competitive landscape by offering specialized microcontrollers and software platforms tailored for medical applications.

In summary, the embedded systems design market for medical devices in 2025 is characterized by rapid innovation, regulatory complexity, and a strong focus on connectivity and patient-centric solutions. The sector is poised for continued expansion as healthcare providers and manufacturers prioritize smarter, safer, and more efficient medical technologies.

Key Technology Trends in Embedded Systems for Medical Devices

Embedded systems design for medical devices in 2025 is characterized by rapid innovation, driven by the convergence of advanced hardware, software, and connectivity solutions. The focus is on creating highly reliable, energy-efficient, and secure platforms that can support the increasing complexity and regulatory demands of modern healthcare applications.

One of the most significant trends is the integration of artificial intelligence (AI) and machine learning (ML) capabilities directly into embedded systems. This enables real-time data analysis and decision-making at the edge, reducing latency and reliance on cloud infrastructure. For example, AI-powered embedded systems are being used in portable diagnostic devices and wearable monitors to provide immediate feedback and early detection of anomalies, enhancing patient outcomes and operational efficiency (Frost & Sullivan).

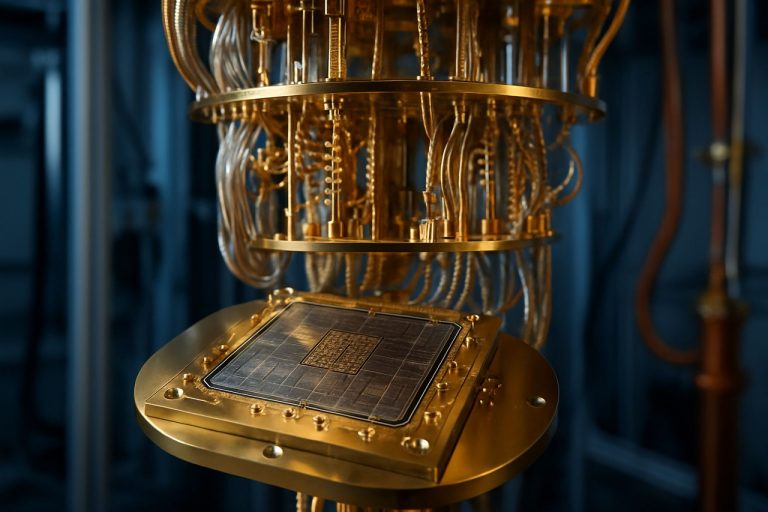

Another key trend is the adoption of advanced microcontrollers and system-on-chip (SoC) architectures that offer higher processing power, lower energy consumption, and enhanced security features. These components are essential for supporting the growing demand for miniaturized, battery-operated medical devices such as insulin pumps, implantable cardiac monitors, and smart inhalers (STMicroelectronics). The use of multicore processors and hardware accelerators is also becoming more prevalent, enabling complex signal processing and imaging tasks within compact form factors.

Connectivity is a central pillar of embedded systems design in 2025, with widespread implementation of wireless protocols such as Bluetooth Low Energy (BLE), Wi-Fi 6, and emerging 5G standards. These technologies facilitate seamless data exchange between medical devices, hospital information systems, and cloud platforms, supporting telemedicine, remote monitoring, and interoperability initiatives (Qualcomm). Designers are also prioritizing cybersecurity, incorporating hardware-based encryption, secure boot, and real-time threat detection to comply with stringent regulatory requirements like the FDA’s premarket cybersecurity guidance (U.S. Food and Drug Administration).

Finally, the adoption of model-based design and digital twin technologies is streamlining the development and validation of embedded systems. These approaches enable virtual prototyping, risk assessment, and compliance testing, reducing time-to-market and improving product reliability (Siemens). As the medical device landscape evolves, embedded systems design will continue to play a pivotal role in enabling smarter, safer, and more connected healthcare solutions.

Competitive Landscape and Leading Players

The competitive landscape for embedded systems design in medical devices is characterized by a mix of established technology conglomerates, specialized engineering firms, and innovative startups. As of 2025, the market is driven by the increasing integration of advanced microcontrollers, real-time operating systems, and connectivity solutions to enable smarter, safer, and more efficient medical devices. The demand for compliance with stringent regulatory standards, such as FDA and EU MDR, further intensifies competition, as companies must demonstrate both technical excellence and robust quality management systems.

Leading players in this sector include STMicroelectronics, Texas Instruments, and NXP Semiconductors, all of which provide a broad portfolio of microcontrollers and embedded processors tailored for medical applications. These companies invest heavily in R&D to support features such as ultra-low power consumption, wireless connectivity (Bluetooth Low Energy, Wi-Fi), and enhanced security, which are critical for portable and connected medical devices.

On the software and design services front, firms like Siemens EDA (Mentor Graphics) and Synopsys offer comprehensive embedded development platforms, simulation tools, and IP cores that accelerate time-to-market while ensuring compliance with medical safety standards (e.g., IEC 62304). These platforms are increasingly incorporating AI and machine learning capabilities to support next-generation diagnostic and monitoring devices.

Emerging players and niche specialists, such as Analog Devices and Microchip Technology, focus on sensor integration, signal processing, and power management solutions, which are essential for wearable and implantable medical devices. Their expertise in miniaturization and energy efficiency is particularly valued as the industry shifts toward patient-centric, remote monitoring solutions.

Strategic partnerships and acquisitions are common, as larger firms seek to enhance their embedded software capabilities or expand into new medical device segments. For example, Arm collaborates with both hardware and software vendors to provide secure, scalable embedded platforms for medical IoT devices. The competitive landscape is further shaped by the entry of cloud and connectivity providers, such as Google Cloud, which offer secure data management and analytics services tailored for medical device manufacturers.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The embedded systems design market for medical devices is poised for robust growth between 2025 and 2030, driven by the increasing integration of advanced electronics in healthcare equipment, the proliferation of connected medical devices, and the rising demand for personalized and remote patient care. According to projections by MarketsandMarkets, the global embedded systems market is expected to achieve a compound annual growth rate (CAGR) of approximately 6.5% during this period, with the medical devices segment representing a significant and expanding share.

Revenue from embedded systems design specifically for medical devices is forecasted to surpass USD 25 billion by 2030, up from an estimated USD 16 billion in 2025. This growth is underpinned by the increasing adoption of embedded solutions in diagnostic imaging, patient monitoring, implantable devices, and portable medical equipment. The surge in demand for real-time data processing, enhanced device connectivity, and compliance with stringent regulatory standards is compelling medical device manufacturers to invest heavily in sophisticated embedded architectures.

Volume analysis indicates a parallel rise in the number of embedded systems shipped for medical applications. Data from Fortune Business Insights suggests that annual shipments of embedded modules and boards for medical devices will grow at a CAGR of over 7% through 2030. This increase is particularly notable in regions with rapidly expanding healthcare infrastructure, such as Asia-Pacific and Latin America, where the adoption of digital health technologies is accelerating.

- Key Growth Drivers: The proliferation of wearable health monitors, the expansion of telemedicine, and the integration of artificial intelligence (AI) and machine learning (ML) into medical devices are major contributors to market expansion.

- Regional Trends: North America and Europe will continue to lead in revenue, but Asia-Pacific is expected to exhibit the fastest growth rate due to government initiatives and rising healthcare investments.

- Segment Insights: Embedded systems for patient monitoring and diagnostic imaging devices are projected to account for the largest revenue shares, while implantable device segments will see the highest CAGR due to technological advancements and miniaturization.

Overall, the 2025–2030 period will see embedded systems design for medical devices transition from traditional hardware-centric solutions to more software-driven, connected, and intelligent platforms, reflecting the broader digital transformation in healthcare technology.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global market for embedded systems design in medical devices is experiencing robust growth, with regional dynamics shaped by regulatory environments, healthcare infrastructure, and innovation ecosystems. In 2025, North America, Europe, Asia-Pacific, and the Rest of the World (RoW) each present distinct opportunities and challenges for stakeholders in this sector.

- North America: The United States and Canada continue to lead in embedded systems design for medical devices, driven by advanced healthcare infrastructure, significant R&D investments, and a strong presence of leading medical device manufacturers. The region benefits from a favorable regulatory framework, with the U.S. Food and Drug Administration (FDA) streamlining approval processes for digital health and embedded technologies. The adoption of AI-powered diagnostics, remote patient monitoring, and connected medical devices is accelerating, supported by initiatives such as the National Institutes of Health (NIH)’s funding for digital health innovation.

- Europe: Europe’s market is characterized by stringent regulatory standards under the Medical Device Regulation (MDR), which has prompted manufacturers to invest in robust embedded system designs that ensure safety and cybersecurity. Germany, the UK, and France are leading adopters, with a focus on interoperability and compliance. The European Union’s emphasis on data privacy (GDPR) also influences embedded software architecture, driving demand for secure, compliant solutions.

- Asia-Pacific: The Asia-Pacific region is witnessing the fastest growth, propelled by expanding healthcare access, rising chronic disease prevalence, and government initiatives to modernize medical infrastructure. Countries like China, Japan, and South Korea are investing heavily in smart hospitals and telemedicine, creating demand for advanced embedded systems. According to Mordor Intelligence, the region’s embedded systems market is expected to outpace global averages, with local players and multinational corporations increasing R&D footprints.

- Rest of World (RoW): In Latin America, the Middle East, and Africa, adoption is slower but rising, driven by efforts to improve healthcare delivery and digital infrastructure. Multinational companies are partnering with local firms to introduce cost-effective, ruggedized embedded solutions suitable for resource-constrained settings. The World Health Organization’s (WHO) digital health initiatives are also fostering market entry and technology transfer in these regions.

Overall, regional market dynamics in 2025 reflect a convergence of regulatory, technological, and demographic factors, with North America and Europe focusing on compliance and innovation, Asia-Pacific on rapid expansion, and RoW on accessibility and adaptation.

Future Outlook: Emerging Applications and Investment Hotspots

Looking ahead to 2025, the future of embedded systems design for medical devices is shaped by rapid technological advancements, evolving regulatory landscapes, and shifting investment priorities. The integration of artificial intelligence (AI), machine learning (ML), and Internet of Things (IoT) capabilities into embedded platforms is enabling a new generation of smart, connected medical devices. These innovations are driving growth in areas such as remote patient monitoring, wearable health technologies, and implantable devices, all of which require sophisticated embedded systems for real-time data processing, security, and connectivity.

Emerging applications are particularly prominent in chronic disease management, where embedded systems facilitate continuous monitoring and personalized therapy. For example, next-generation insulin pumps and cardiac monitors leverage embedded AI algorithms to adapt treatment in real time, improving patient outcomes and reducing healthcare costs. The demand for point-of-care diagnostics is also accelerating, with compact, embedded-enabled devices delivering rapid results outside traditional clinical settings. This trend is supported by the increasing adoption of telemedicine and home healthcare, both of which rely on robust, secure embedded platforms for data transmission and device interoperability.

From an investment perspective, hotspots are emerging in both established and nascent markets. North America and Europe continue to attract significant capital due to their mature regulatory frameworks and high healthcare spending. However, Asia-Pacific is rapidly gaining traction, driven by expanding healthcare infrastructure, rising chronic disease prevalence, and supportive government initiatives. According to Frost & Sullivan, the global market for embedded medical devices is projected to grow at a CAGR of over 8% through 2025, with Asia-Pacific outpacing other regions in terms of growth rate.

Venture capital and strategic investments are increasingly targeting startups and scale-ups focused on AI-powered diagnostics, cybersecurity for medical devices, and low-power embedded platforms. Notable deals in 2024 included funding rounds for companies developing next-generation wearable biosensors and secure embedded firmware for connected devices, as reported by CB Insights. Additionally, partnerships between medtech firms and semiconductor manufacturers are accelerating the development of application-specific integrated circuits (ASICs) tailored for medical use, as highlighted by Gartner.

In summary, the future outlook for embedded systems design in medical devices is characterized by technological convergence, expanding application domains, and dynamic investment flows. Stakeholders who prioritize innovation, regulatory compliance, and cybersecurity will be best positioned to capitalize on these emerging opportunities in 2025 and beyond.

Challenges, Risks, and Strategic Opportunities

Embedded systems design for medical devices in 2025 faces a complex landscape of challenges, risks, and strategic opportunities, shaped by rapid technological advancements, stringent regulatory requirements, and evolving market demands. The integration of embedded systems into medical devices is critical for enabling real-time data processing, connectivity, and advanced diagnostics, but it also introduces multifaceted risks and necessitates robust strategic planning.

One of the primary challenges is ensuring compliance with increasingly rigorous regulatory standards. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Commission have tightened requirements for software validation, cybersecurity, and post-market surveillance. The introduction of the EU Medical Device Regulation (MDR) and the FDA’s evolving guidance on software as a medical device (SaMD) demand that embedded systems be designed with traceability, risk management, and documentation at their core. Non-compliance can result in costly delays, recalls, or market access barriers.

Cybersecurity risks are escalating as medical devices become more connected. The proliferation of Internet of Medical Things (IoMT) devices increases the attack surface, making embedded systems vulnerable to data breaches and ransomware. According to IBM, the average cost of a healthcare data breach reached $10.93 million in 2023, underscoring the financial and reputational risks for device manufacturers. Embedded system designers must implement robust encryption, secure boot processes, and regular software updates to mitigate these threats.

Another significant challenge is managing the complexity of integrating advanced features such as artificial intelligence (AI), wireless connectivity, and interoperability with electronic health records (EHRs). These features require high-performance, low-power embedded platforms and sophisticated software architectures. The shortage of skilled engineers with expertise in both embedded systems and medical device regulations further exacerbates development timelines and costs, as highlighted by Frost & Sullivan.

- Strategic Opportunities: Companies that invest in modular, upgradable embedded platforms can accelerate time-to-market and adapt to regulatory changes more efficiently.

- Leveraging AI and edge computing within embedded systems enables real-time diagnostics and personalized medicine, creating new revenue streams and competitive differentiation.

- Collaborating with cybersecurity firms and regulatory consultants can streamline compliance and risk management, as recommended by Deloitte.

In summary, while embedded systems design for medical devices in 2025 is fraught with regulatory, technical, and security challenges, it also presents significant opportunities for innovation and market leadership for those who can navigate the evolving landscape effectively.

Sources & References

- MarketsandMarkets

- European Commission

- Medtronic

- GE HealthCare

- Philips

- Arm

- STMicroelectronics

- Frost & Sullivan

- Qualcomm

- Siemens

- Texas Instruments

- NXP Semiconductors

- Siemens EDA (Mentor Graphics)

- Synopsys

- Google Cloud

- Fortune Business Insights

- National Institutes of Health (NIH)

- Mordor Intelligence

- WHO

- IBM

- Deloitte