Superconducting Quantum Processors Market Report 2025: In-Depth Analysis of Growth Drivers, Technology Innovations, and Competitive Dynamics. Explore Market Size, Regional Trends, and Future Opportunities Shaping the Quantum Computing Landscape.

- Executive Summary and Market Overview

- Key Technology Trends in Superconducting Quantum Processors

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Adoption Rates

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Challenges, Risks, and Emerging Opportunities

- Future Outlook: Strategic Recommendations and Investment Insights

- Sources & References

Executive Summary and Market Overview

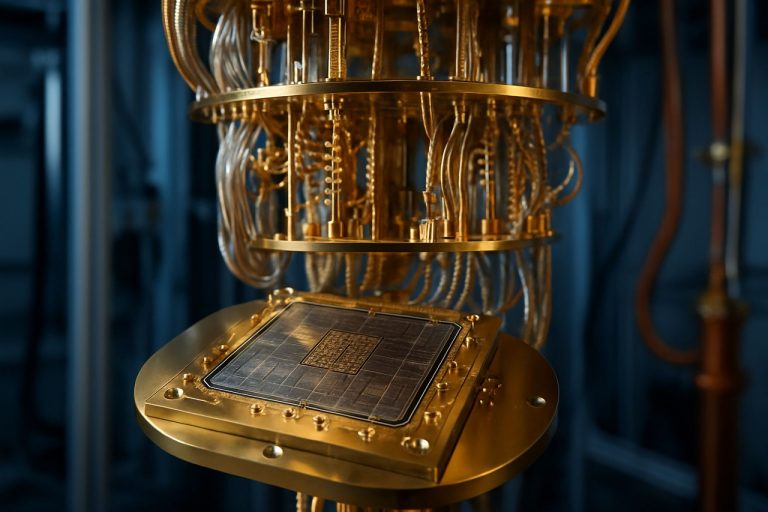

Superconducting quantum processors represent a leading architecture in the rapidly evolving quantum computing market. These processors leverage superconducting circuits, typically fabricated from materials such as niobium or aluminum, cooled to cryogenic temperatures to achieve quantum coherence and enable the manipulation of quantum bits (qubits). As of 2025, superconducting quantum processors are at the forefront of commercial and research-driven quantum computing initiatives, with major technology companies and startups investing heavily in their development and deployment.

The global quantum computing market is projected to reach a value of USD 2.5 billion by 2025, with superconducting quantum processors accounting for a significant share due to their scalability, relatively mature fabrication techniques, and demonstrated performance in multi-qubit systems (International Data Corporation (IDC)). Key industry players such as IBM, Google, and Rigetti Computing have made substantial advancements, with IBM’s roadmap targeting 1,000+ qubit systems and Google’s Sycamore processor achieving quantum supremacy milestones.

Market growth is driven by increasing demand for high-performance computing in sectors such as pharmaceuticals, materials science, finance, and logistics, where quantum processors promise exponential speedups for specific computational tasks. Superconducting quantum processors are particularly attractive due to their compatibility with existing semiconductor manufacturing infrastructure and their demonstrated ability to execute complex quantum algorithms with relatively low error rates (McKinsey & Company).

- Technological Advancements: Ongoing improvements in qubit coherence times, error correction, and cryogenic engineering are enhancing processor reliability and scalability.

- Commercialization: Cloud-based quantum computing services, such as IBM Quantum and Google Quantum AI, are democratizing access to superconducting quantum processors for enterprises and researchers.

- Investment and Collaboration: Strategic partnerships between technology firms, academic institutions, and government agencies are accelerating innovation and ecosystem development (Boston Consulting Group).

In summary, superconducting quantum processors are poised to remain a dominant force in the quantum computing landscape through 2025, underpinned by robust R&D, expanding commercial applications, and a supportive investment climate.

Key Technology Trends in Superconducting Quantum Processors

Superconducting quantum processors are at the forefront of quantum computing innovation, leveraging superconducting circuits to create and manipulate quantum bits (qubits) with high fidelity and scalability. As of 2025, several key technology trends are shaping the evolution and commercialization of these processors.

- Qubit Coherence and Error Rates: Enhancing qubit coherence times and reducing error rates remain top priorities. Recent advances in materials science and fabrication techniques have led to significant improvements, with leading players such as IBM and Rigetti Computing reporting coherence times exceeding 300 microseconds and gate fidelities above 99.9%. These improvements are critical for scaling up quantum processors and enabling practical quantum error correction.

- Qubit Connectivity and Architecture: The trend toward modular and highly connected architectures is accelerating. Companies like Google Quantum AI are exploring 2D and 3D lattice structures to enhance qubit interconnectivity, which is essential for complex quantum algorithms and error correction schemes. Innovations in chip packaging and interposer technologies are also facilitating denser qubit layouts.

- Scalability and Integration: Scaling up the number of qubits while maintaining performance is a central challenge. In 2025, IBM and Rigetti Computing have announced roadmaps targeting processors with 1,000+ qubits, leveraging advances in cryogenic control electronics and wafer-scale integration. These efforts are supported by improved fabrication yields and automated calibration techniques.

- Quantum Error Correction: Implementing practical quantum error correction is a major milestone. Research groups and industry leaders are demonstrating logical qubits and small-scale error-corrected circuits, with IBM and Google Quantum AI publishing results on surface code implementations and real-time error tracking.

- Software and Control Stack: The development of advanced software stacks and control systems is enabling more efficient programming, calibration, and error mitigation. Open-source frameworks such as Qiskit and Cirq are being widely adopted, supporting rapid prototyping and benchmarking of quantum algorithms on superconducting hardware.

These technology trends are collectively driving the superconducting quantum processor market toward greater performance, reliability, and commercial viability, positioning it as a leading platform in the race for quantum advantage.

Competitive Landscape and Leading Players

The competitive landscape for superconducting quantum processors in 2025 is characterized by intense innovation and strategic investments from both established technology giants and specialized quantum computing startups. The market is primarily dominated by a handful of key players, each leveraging proprietary technologies and forging partnerships to accelerate the commercialization of quantum computing.

Among the leaders, IBM continues to set benchmarks with its roadmap for scaling up superconducting qubit counts and improving quantum volume. IBM’s Eagle and Osprey processors, featuring 127 and 433 qubits respectively, have positioned the company at the forefront of hardware development, with plans to introduce even larger-scale processors in 2025. Google Quantum AI remains a formidable competitor, having achieved quantum supremacy in 2019 and now focusing on error correction and scaling through its Sycamore architecture. Google’s ongoing research into logical qubits and fault-tolerant systems is expected to yield significant advancements in the coming year.

Rigetti Computing is another prominent player, offering cloud-accessible superconducting quantum processors and targeting enterprise adoption through hybrid quantum-classical solutions. Rigetti’s Aspen series processors, with up to 80 qubits, are being integrated into commercial workflows, particularly in finance and logistics. Oxford Quantum Circuits (OQC) is gaining traction in Europe, focusing on modular superconducting architectures and expanding its quantum computing-as-a-service (QCaaS) offerings.

In Asia, Baidu and Alibaba Cloud are investing heavily in superconducting quantum research, with Baidu unveiling its 36-qubit processor and Alibaba collaborating with academic institutions to accelerate hardware development. These efforts are supported by significant government funding and national quantum initiatives.

The competitive landscape is further shaped by collaborations between hardware providers and cloud platforms, such as Microsoft Azure Quantum and Amazon Braket, which offer access to multiple superconducting quantum processors via the cloud. This ecosystem approach is lowering barriers to entry and fostering a vibrant developer community.

Overall, the superconducting quantum processor market in 2025 is defined by rapid technological progress, strategic alliances, and a race to achieve practical quantum advantage. The leading players are distinguished by their ability to scale qubit numbers, reduce error rates, and deliver accessible quantum computing solutions to a growing base of enterprise and research users.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Adoption Rates

The market for superconducting quantum processors is poised for robust growth between 2025 and 2030, driven by accelerating investments in quantum computing research, increasing commercialization efforts, and expanding use cases across industries. According to projections by International Data Corporation (IDC), the global quantum computing market is expected to achieve a compound annual growth rate (CAGR) of over 48% during this period, with superconducting quantum processors representing a significant share due to their technological maturity and adoption by leading vendors.

Revenue forecasts indicate that the superconducting quantum processor segment could generate upwards of $2.5 billion in annual revenues by 2030, up from an estimated $350 million in 2025. This surge is attributed to the scaling of quantum hardware by key players such as IBM, Google Quantum AI, and Rigetti Computing, all of whom are actively expanding their superconducting qubit platforms and cloud-based quantum services.

Adoption rates are expected to accelerate as quantum computing moves from experimental to early commercial deployment. By 2027, it is anticipated that over 60% of Fortune 500 companies in sectors such as pharmaceuticals, finance, and logistics will have initiated pilot projects or partnerships involving superconducting quantum processors, according to Gartner. This adoption is further supported by government initiatives and funding programs in the US, EU, and China, which are accelerating the development and deployment of superconducting quantum technologies.

- CAGR (2025–2030): Estimated at 48–52% for superconducting quantum processors.

- Revenue (2030): Projected to exceed $2.5 billion globally.

- Adoption Rates: Over 60% of major enterprises expected to engage in quantum pilot projects by 2027.

Overall, the period from 2025 to 2030 is expected to mark a transition from research-driven development to broader commercial adoption, positioning superconducting quantum processors as a cornerstone of the emerging quantum computing industry.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The regional landscape for superconducting quantum processors in 2025 is shaped by varying levels of investment, research infrastructure, and commercialization efforts across North America, Europe, Asia-Pacific, and the Rest of the World. Each region demonstrates unique strengths and challenges in the race to develop scalable quantum computing technologies.

- North America: North America, particularly the United States, remains the global leader in superconducting quantum processor development. Major technology companies such as IBM and Google are at the forefront, with significant investments in R&D and robust collaborations with academic institutions. The U.S. government’s National Quantum Initiative Act continues to drive funding and public-private partnerships, fostering a vibrant ecosystem for startups and established players alike. Canada also contributes through institutions like the Perimeter Institute and companies such as D-Wave Systems, focusing on both hardware and software innovation.

- Europe: Europe is characterized by strong public funding and cross-border collaboration, exemplified by the Quantum Flagship program, which allocates over €1 billion to quantum technologies. Countries like Germany, the Netherlands, and France are home to leading research centers and startups, including Oxford Quantum Circuits and Institut de Ciències Fotòniques. European efforts emphasize open innovation and standardization, with a focus on building a competitive supply chain for superconducting components.

- Asia-Pacific: The Asia-Pacific region, led by China and Japan, is rapidly increasing its presence in superconducting quantum processor research. China’s Chinese Academy of Sciences and companies like Baidu and Alibaba are making significant strides, supported by substantial government funding and national strategies. Japan’s RIKEN and NTT are also advancing quantum processor capabilities, often in collaboration with global partners. The region’s focus is on both fundamental research and the commercialization of quantum computing services.

- Rest of World: While the Rest of the World lags behind the three leading regions, there is growing interest in quantum technologies in countries such as Australia, Israel, and Russia. Australia’s University of Sydney and Israel’s Weizmann Institute of Science are notable contributors, often leveraging international partnerships to access advanced fabrication and measurement infrastructure.

Overall, the global superconducting quantum processor market in 2025 is marked by intense competition, strategic alliances, and a clear divide between regions with established quantum ecosystems and those in the early stages of development. Regional policies, talent pools, and access to capital will continue to shape the pace and direction of innovation in this sector.

Challenges, Risks, and Emerging Opportunities

Superconducting quantum processors are at the forefront of quantum computing innovation, but their path to widespread adoption in 2025 is marked by significant challenges, risks, and emerging opportunities. One of the primary technical challenges is maintaining quantum coherence. Superconducting qubits are highly sensitive to environmental noise and material defects, which can lead to decoherence and limit the fidelity of quantum operations. Despite advances in error correction and materials engineering, achieving error rates low enough for practical, large-scale quantum computation remains a formidable hurdle IBM.

Scalability is another critical issue. While companies have demonstrated processors with dozens of qubits, scaling to the thousands or millions required for fault-tolerant quantum computing introduces complex engineering problems, such as crosstalk between qubits, increased cooling requirements, and intricate control electronics Rigetti Computing. The need for ultra-low temperatures, typically achieved with dilution refrigerators, adds to the cost and complexity, limiting accessibility for many potential users.

From a market perspective, the risk of technological obsolescence is significant. Competing quantum technologies, such as trapped ions or photonic qubits, may overcome their own limitations and leapfrog superconducting approaches. This uncertainty complicates investment decisions and long-term planning for both vendors and end-users Boston Consulting Group.

Despite these challenges, several emerging opportunities are shaping the landscape. The growing ecosystem of quantum software and hybrid quantum-classical algorithms is enabling early commercial applications in optimization, machine learning, and materials science, even with today’s noisy intermediate-scale quantum (NISQ) devices Zapata Computing. Strategic partnerships between hardware providers, cloud platforms, and industry end-users are accelerating the development of tailored quantum solutions and expanding market reach Google Cloud.

Furthermore, government funding and international collaboration are fueling research and infrastructure development, particularly in the US, Europe, and China National Science Foundation. As quantum hardware matures, new business models—such as quantum computing as a service (QCaaS)—are lowering barriers to entry and creating opportunities for startups and established players alike.

Future Outlook: Strategic Recommendations and Investment Insights

The future outlook for superconducting quantum processors in 2025 is shaped by rapid technological advancements, intensifying competition, and evolving investment landscapes. As leading technology firms and research institutions accelerate their efforts, the sector is poised for significant breakthroughs in scalability, error correction, and commercial viability.

Strategic Recommendations:

- Prioritize Scalable Architectures: Companies should focus on developing modular and scalable superconducting qubit architectures. This approach addresses the current bottleneck of limited qubit counts and paves the way for practical quantum advantage. Collaborations with academic institutions and consortia, such as those led by IBM and Google, can accelerate progress in this area.

- Invest in Error Mitigation and Correction: Error rates remain a critical challenge. Strategic investments in quantum error correction research, including partnerships with startups and academic labs, will be essential for achieving fault-tolerant quantum computing. Companies like Rigetti Computing and Quantinuum are actively pursuing these solutions.

- Expand Ecosystem Partnerships: Building a robust ecosystem—including software, hardware, and cloud integration—will be key to unlocking commercial applications. Strategic alliances with cloud providers such as Google Cloud and Microsoft Azure Quantum can provide access to broader user bases and accelerate adoption.

- Monitor Regulatory and Standardization Efforts: As quantum technologies mature, regulatory frameworks and industry standards will become increasingly important. Active participation in standardization bodies and policy discussions will help companies anticipate compliance requirements and shape favorable market conditions.

Investment Insights:

- Venture Capital and Corporate Investment: The sector continues to attract robust venture capital and corporate funding, with global quantum computing investments surpassing $2.35 billion in 2023, according to Boston Consulting Group. Investors should target firms with clear roadmaps for scaling qubit numbers and reducing error rates.

- Public-Private Partnerships: Governments worldwide are increasing funding for quantum research, creating opportunities for public-private partnerships. Notable initiatives include the U.S. National Quantum Initiative and the EU’s Quantum Flagship program (Quantum Flagship).

- Long-Term Horizon: Given the nascent stage of commercial quantum computing, investors should adopt a long-term perspective, focusing on companies with strong intellectual property portfolios and demonstrated progress toward practical quantum advantage.

In summary, 2025 will be a pivotal year for superconducting quantum processors, with strategic investments and partnerships likely to determine the sector’s leaders as the technology approaches commercial readiness.

Sources & References

- International Data Corporation (IDC)

- IBM

- Rigetti Computing

- McKinsey & Company

- IBM Quantum

- Google Quantum AI

- Qiskit

- Cirq

- Oxford Quantum Circuits

- Baidu

- Alibaba Cloud

- Amazon Braket

- Perimeter Institute

- Quantum Flagship

- Chinese Academy of Sciences

- Alibaba

- RIKEN

- University of Sydney

- Weizmann Institute of Science

- Google Cloud

- National Science Foundation

- Quantinuum