Quantum Photonic Hardware Market Report 2025: In-Depth Analysis of Growth Drivers, Technology Innovations, and Global Opportunities. Explore Key Trends, Forecasts, and Competitive Dynamics Shaping the Next 5 Years.

- Executive Summary & Market Overview

- Key Technology Trends in Quantum Photonic Hardware

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

Quantum photonic hardware refers to the physical systems and devices that leverage the quantum properties of photons—such as superposition and entanglement—to perform computation, communication, and sensing tasks. Unlike traditional quantum computing platforms that use trapped ions or superconducting circuits, quantum photonics utilizes light particles, offering advantages in scalability, room-temperature operation, and integration with existing fiber-optic infrastructure.

As of 2025, the quantum photonic hardware market is experiencing rapid growth, driven by increasing investments from both public and private sectors, as well as significant technological breakthroughs. The global quantum computing market, which includes photonic hardware, is projected to reach $7.6 billion by 2027, with photonics expected to capture a growing share due to its potential for high-speed, low-error quantum information processing (International Data Corporation (IDC)).

Key players in the quantum photonic hardware space include PsiQuantum, Xanadu, and ORCA Computing, all of which have secured substantial funding rounds and partnerships with major technology firms and research institutions. These companies are developing photonic quantum processors, integrated photonic chips, and supporting hardware for quantum networks. For example, PsiQuantum is working towards building a fault-tolerant, million-qubit quantum computer using silicon photonics, while Xanadu has launched the first publicly available photonic quantum cloud platform (Xanadu).

The market is also witnessing increased collaboration between hardware developers and end-users in sectors such as finance, pharmaceuticals, and logistics, who are exploring quantum photonic solutions for optimization, simulation, and secure communications. Governments in North America, Europe, and Asia-Pacific are providing significant funding and policy support, recognizing the strategic importance of quantum technologies (European Parliament).

Despite the promise, the sector faces challenges related to scaling up qubit numbers, reducing photon loss, and integrating photonic components with classical electronics. However, ongoing advances in integrated photonics, single-photon sources, and error correction are expected to accelerate commercialization and adoption in the coming years.

Key Technology Trends in Quantum Photonic Hardware

Quantum photonic hardware is rapidly evolving, driven by the need for scalable, stable, and high-fidelity quantum systems. In 2025, several key technology trends are shaping the landscape of quantum photonics, with significant implications for quantum computing, secure communications, and advanced sensing applications.

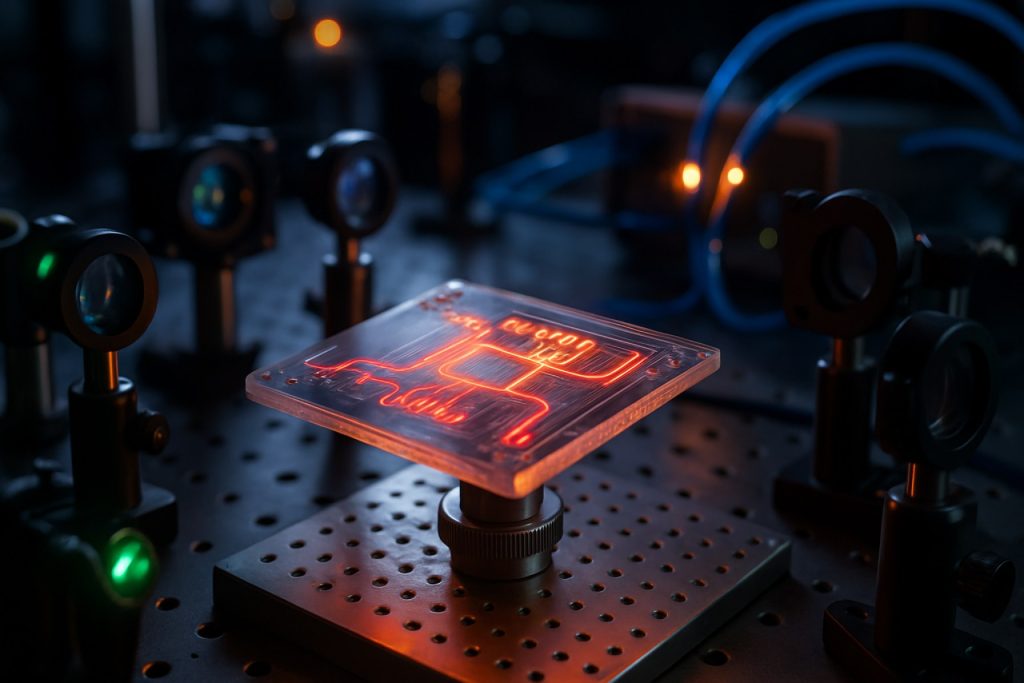

- Integrated Photonic Circuits: The miniaturization and integration of photonic components onto single chips is a major trend. Companies and research institutions are leveraging silicon photonics and other material platforms to fabricate complex quantum circuits with high component density. This integration reduces optical losses, enhances stability, and enables mass production. Notably, Paul Scherrer Institute and Imperial College London have demonstrated scalable photonic chips capable of manipulating multiple qubits.

- On-Demand Single-Photon Sources: The development of deterministic single-photon sources is critical for reliable quantum operations. Advances in quantum dot emitters, color centers in diamond, and nonlinear optical processes are enabling sources with higher purity, indistinguishability, and efficiency. Xanadu and PsiQuantum are at the forefront, integrating these sources into their photonic quantum processors.

- Low-Loss and High-Efficiency Components: Reducing optical losses in waveguides, couplers, and detectors is essential for scaling up quantum photonic systems. Innovations in fabrication techniques and materials, such as silicon nitride and lithium niobate, are yielding components with record-low losses. Ligentec and Cornell University have reported significant progress in this area.

- Advanced Quantum Detectors: Superconducting nanowire single-photon detectors (SNSPDs) and transition-edge sensors (TES) are being refined for higher detection efficiency, lower dark counts, and faster response times. These detectors are crucial for error correction and high-fidelity quantum measurements. ID Quantique and National Institute of Standards and Technology (NIST) are leading providers of advanced quantum photonic detection technologies.

- Hybrid Quantum Systems: There is growing interest in hybridizing photonic hardware with other quantum platforms, such as superconducting qubits and trapped ions, to leverage the strengths of each. This approach aims to create more versatile and robust quantum architectures, as explored by IBM Quantum and Rigetti Computing.

These trends underscore the dynamic progress in quantum photonic hardware, with 2025 poised to see further breakthroughs in integration, performance, and scalability, accelerating the commercialization of quantum technologies.

Competitive Landscape and Leading Players

The competitive landscape for quantum photonic hardware in 2025 is characterized by rapid innovation, strategic partnerships, and a growing influx of investment from both established technology giants and specialized startups. The market is driven by the pursuit of scalable, fault-tolerant quantum computing and secure quantum communication, with photonic approaches gaining traction due to their potential for room-temperature operation, high-speed data transmission, and integration with existing fiber-optic infrastructure.

Leading players in this space include PsiQuantum, which is developing a silicon photonics-based quantum computer aiming for one million qubits, leveraging partnerships with foundries such as GlobalFoundries for scalable manufacturing. Xanadu is another prominent contender, focusing on photonic quantum processors and offering cloud-based access to its Borealis system, which demonstrated quantum computational advantage in 2022. Quantinuum, formed from the merger of Honeywell Quantum Solutions and Cambridge Quantum, is also investing in photonic hardware, particularly for quantum networking and encryption.

European players are making significant strides as well. QuiX Quantum in the Netherlands specializes in photonic quantum processors based on integrated waveguide technology, targeting both computing and simulation applications. ORCA Computing in the UK is developing modular photonic quantum systems designed for integration with existing data center infrastructure, emphasizing compatibility and scalability.

Major technology corporations are entering the field through research initiatives and acquisitions. IBM and Intel are exploring photonic interconnects to link superconducting or silicon spin qubit processors, while Toshiba is advancing quantum key distribution (QKD) systems using photonic hardware for secure communications.

- PsiQuantum: Silicon photonics, large-scale quantum computing

- Xanadu: Photonic quantum processors, cloud access

- Quantinuum: Quantum networking, encryption

- QuiX Quantum: Integrated photonic processors

- ORCA Computing: Modular photonic systems

- IBM, Intel, Toshiba: Research and commercialization of photonic quantum technologies

The competitive landscape is expected to intensify as photonic hardware matures, with cross-industry collaborations and government-backed initiatives accelerating commercialization and standardization efforts in 2025.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The quantum photonic hardware market is poised for robust growth between 2025 and 2030, driven by accelerating investments in quantum computing, secure communications, and advanced sensing technologies. According to projections from International Data Corporation (IDC), the global quantum hardware market—including photonic platforms—is expected to achieve a compound annual growth rate (CAGR) of approximately 35% during this period. This surge is underpinned by increasing commercialization efforts and the maturation of photonic integration technologies.

Revenue forecasts indicate that the quantum photonic hardware segment will expand from an estimated $350 million in 2025 to over $1.5 billion by 2030. This growth is attributed to the rising adoption of photonic quantum processors, which offer advantages in scalability and error rates compared to superconducting and trapped-ion alternatives. Notably, companies such as PsiQuantum and Xanadu are expected to drive significant market share, leveraging their advancements in silicon photonics and continuous-variable quantum computing, respectively.

Volume analysis suggests a marked increase in the deployment of photonic quantum chips and modules. Industry estimates from Gartner predict that annual shipments of quantum photonic processors will grow from fewer than 1,000 units in 2025 to over 10,000 units by 2030, as research institutions, cloud providers, and enterprises ramp up pilot projects and early-stage commercial deployments.

- CAGR (2025–2030): ~35%

- Revenue (2025): $350 million

- Revenue (2030): $1.5 billion+

- Volume (2025): <1,000 units

- Volume (2030): 10,000+ units

Key growth drivers include the demand for quantum advantage in machine learning and cryptography, government funding initiatives, and the integration of photonic hardware into cloud-based quantum services. The market is also expected to benefit from ongoing collaborations between hardware startups and established semiconductor manufacturers, which are accelerating the path to scalable, fault-tolerant quantum systems.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global quantum photonic hardware market is experiencing significant regional differentiation, with North America, Europe, Asia-Pacific, and the Rest of the World (RoW) each exhibiting unique growth drivers and challenges in 2025.

North America remains the leading region, driven by robust investments from both government and private sectors. The United States, in particular, benefits from strong R&D funding, a mature photonics ecosystem, and the presence of key players such as IBM, Northrop Grumman, and Xanadu. The U.S. National Quantum Initiative Act continues to channel resources into quantum hardware development, fostering collaborations between academia and industry. Canada is also emerging as a hub, with companies like Xanadu advancing photonic quantum computing platforms. North America’s market is further propelled by early adoption in sectors such as defense, finance, and telecommunications.

Europe is characterized by strong public funding and cross-border collaborations. The European Union’s Quantum Flagship program, with a budget exceeding €1 billion, supports a range of photonic quantum hardware projects. Countries like Germany, the UK, and the Netherlands are at the forefront, with institutions such as QuTech and PSI leading research. European companies, including Rigetti Computing (with a UK presence) and PsiQuantum, are making notable advances. The region’s focus on standardization and interoperability is expected to accelerate commercialization in 2025.

- Asia-Pacific is rapidly catching up, led by China, Japan, and Australia. China’s government-backed initiatives and investments in quantum technology, including photonic hardware, are substantial, with entities like Origin Quantum and BAAI making significant strides. Japan’s NTT and Australia’s University of Sydney are also prominent contributors. The region benefits from a strong semiconductor manufacturing base, which supports scalable photonic hardware production.

- Rest of World (RoW) includes emerging markets in the Middle East, Latin America, and Africa. While these regions currently have limited direct involvement in quantum photonic hardware development, increasing interest in quantum technologies and international collaborations are expected to foster gradual market entry and growth.

In summary, while North America and Europe currently dominate the quantum photonic hardware landscape, Asia-Pacific is poised for rapid expansion, and RoW regions are beginning to lay the groundwork for future participation. Regional dynamics in 2025 will be shaped by funding, talent, and the ability to translate research into scalable commercial solutions.

Future Outlook: Emerging Applications and Investment Hotspots

Quantum photonic hardware is poised for significant advancements in 2025, driven by both technological breakthroughs and a surge in investment targeting emerging applications. As quantum computing and communication move from theoretical promise to practical deployment, photonic approaches—leveraging photons as quantum information carriers—are gaining traction due to their inherent advantages in speed, scalability, and room-temperature operation.

One of the most promising emerging applications is quantum networking, where photonic hardware enables secure quantum key distribution (QKD) and the development of quantum internet infrastructure. Major telecom operators and technology firms are piloting metropolitan-scale QKD networks, with countries like China and the EU investing heavily in national quantum communication backbones (ID Quantique; European Quantum Communication Infrastructure). In 2025, further expansion of these networks is expected, with photonic hardware at the core of trusted node and entanglement distribution systems.

Another hotspot is photonic quantum computing, where companies are racing to build scalable, fault-tolerant processors. Startups such as PsiQuantum and Xanadu are attracting substantial venture capital and government grants to develop silicon photonic chips capable of supporting millions of qubits. The anticipated commercialization of photonic quantum processors for specialized tasks—such as quantum simulation in chemistry and materials science—could begin as early as 2025, according to recent industry roadmaps (Boston Consulting Group).

In addition, quantum sensing and imaging are emerging as lucrative application areas. Photonic quantum sensors promise ultra-high precision in fields ranging from medical diagnostics to navigation and environmental monitoring. The defense and aerospace sectors, in particular, are increasing investments in quantum-enhanced lidar and radar systems, with pilot deployments expected in 2025 (DARPA).

Investment hotspots are shifting toward integrated photonic platforms, which combine quantum sources, detectors, and circuits on a single chip. This integration is critical for mass manufacturability and cost reduction. Leading semiconductor foundries and photonics companies are forming strategic partnerships with quantum startups to accelerate commercialization (GlobalFoundries; Lumentum).

Overall, 2025 is set to be a pivotal year for quantum photonic hardware, with rapid progress in networking, computing, and sensing applications, and a dynamic investment landscape focused on scalable, integrated solutions.

Challenges, Risks, and Strategic Opportunities

Quantum photonic hardware, which leverages photons as quantum information carriers, is at the forefront of next-generation quantum computing and communication systems. However, the sector faces a complex landscape of challenges and risks, even as it presents significant strategic opportunities for stakeholders in 2025.

One of the primary challenges is scalability. While photonic qubits offer advantages such as low decoherence and room-temperature operation, integrating large numbers of photonic components on a single chip remains technically demanding. Issues such as photon loss, imperfect sources, and limited on-chip integration of active elements hinder the realization of large-scale, fault-tolerant quantum processors. According to Oxford Quantum Circuits, overcoming these integration hurdles is essential for commercial viability.

Manufacturing risks are also significant. Quantum photonic devices require ultra-precise fabrication techniques, often at the nanometer scale, to ensure consistent performance. Variability in fabrication can lead to device inconsistencies, impacting yield and increasing costs. The need for specialized materials, such as silicon photonics or indium phosphide, further complicates supply chains and raises barriers to entry, as noted by PsiQuantum.

Another risk is the evolving standards and interoperability. The lack of universally accepted protocols for quantum photonic systems creates uncertainty for developers and end-users. This fragmentation can slow adoption and complicate integration with existing quantum and classical infrastructure, as highlighted by ID Quantique.

Despite these challenges, strategic opportunities abound. The global push for quantum-secure communications, especially in sectors like finance and defense, is driving demand for quantum photonic hardware. Photonic approaches are also well-suited for quantum networking, where the ability to transmit quantum information over long distances is crucial. According to McKinsey & Company, companies that can demonstrate scalable, reliable photonic quantum hardware stand to capture significant market share as quantum networks and cloud-based quantum computing services mature.

- Scalability and integration remain technical bottlenecks.

- Manufacturing precision and supply chain complexity increase risk.

- Lack of standards slows ecosystem development.

- Opportunities exist in quantum networking and secure communications.

Sources & References

- International Data Corporation (IDC)

- Xanadu

- European Parliament

- Paul Scherrer Institute

- Imperial College London

- Ligentec

- Cornell University

- ID Quantique

- National Institute of Standards and Technology (NIST)

- IBM Quantum

- Rigetti Computing

- Quantinuum

- QuiX Quantum

- Toshiba

- Northrop Grumman

- University of Sydney

- DARPA

- Lumentum

- Oxford Quantum Circuits

- McKinsey & Company