2025 Renewable Ocean Wave Energy Conversion Systems Market Report: In-Depth Analysis of Growth Drivers, Technology Advances, and Global Opportunities Through 2030

- Executive Summary & Market Overview

- Key Technology Trends in Ocean Wave Energy Conversion

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Challenges, Risks, and Barriers to Adoption

- Opportunities and Strategic Recommendations

- Future Outlook: Innovation, Policy, and Market Expansion

- Sources & References

Executive Summary & Market Overview

The global market for Renewable Ocean Wave Energy Conversion Systems (OWECS) is poised for significant growth in 2025, driven by increasing demand for sustainable energy solutions and supportive government policies targeting decarbonization. OWECS harness the kinetic and potential energy of ocean waves to generate electricity, offering a promising complement to established renewables like wind and solar. As of 2025, the sector remains in a pre-commercial phase, but pilot projects and demonstration plants are scaling up, particularly in Europe, North America, and Asia-Pacific.

According to International Energy Agency (IEA) data, global installed capacity for wave energy remains below 1 GW, but the pipeline of announced projects exceeds 3 GW, reflecting accelerating investment and technological maturation. The European Union continues to lead, with the Ocean Energy Europe reporting over €1 billion in cumulative investment and a robust policy framework under the EU Green Deal. The United Kingdom, Portugal, and Spain are notable hotspots, with government-backed test sites and feed-in tariffs supporting deployment.

In North America, the U.S. Department of Energy’s Water Power Technologies Office is funding multiple demonstration projects, while Canada’s Atlantic provinces are piloting grid-connected wave energy devices. The Asia-Pacific region, led by Australia and China, is also expanding its wave energy initiatives, with the Australian Renewable Energy Agency (ARENA) supporting several commercial-scale trials.

Market drivers in 2025 include rising electricity demand in coastal regions, the need for grid stability, and the unique advantage of wave energy’s high predictability compared to wind and solar. However, challenges persist: high capital costs, technology standardization, and environmental permitting remain barriers to large-scale commercialization. Nevertheless, the sector is attracting increased venture capital and strategic partnerships, as evidenced by collaborations between technology developers and major utilities such as EDF and Siemens Energy.

Looking ahead, the OWECS market is expected to achieve a compound annual growth rate (CAGR) of 10-15% through 2030, contingent on continued policy support and successful demonstration of cost reductions. As the world intensifies its transition to net-zero, ocean wave energy is positioned to play a vital role in the diversified renewable energy mix of the future.

Key Technology Trends in Ocean Wave Energy Conversion

Renewable ocean wave energy conversion systems are rapidly evolving, driven by technological innovation and the urgent need for sustainable energy sources. As of 2025, several key technology trends are shaping the development and deployment of these systems, aiming to enhance efficiency, reliability, and commercial viability.

- Advanced Materials and Durability: The harsh marine environment poses significant challenges for wave energy devices. Recent advancements focus on corrosion-resistant composites, self-healing coatings, and lightweight structural materials. These innovations extend device lifespans and reduce maintenance costs, as highlighted by International Energy Agency reports.

- Modular and Scalable Designs: Developers are increasingly adopting modular architectures, allowing for easier scaling and flexible deployment. Modular systems can be tailored to site-specific wave conditions and facilitate phased investments, as seen in projects supported by Ocean Energy Europe.

- Direct Drive and Power Take-Off (PTO) Innovations: Traditional hydraulic PTO systems are being replaced by direct-drive linear generators and advanced electromechanical converters. These technologies improve energy conversion efficiency and reduce mechanical complexity, as documented by National Renewable Energy Laboratory.

- Digitalization and Smart Monitoring: Integration of IoT sensors, real-time data analytics, and AI-driven predictive maintenance is becoming standard. These digital tools optimize performance, enable remote monitoring, and minimize downtime, as emphasized by DNV.

- Hybrid and Multi-Use Platforms: There is a growing trend toward combining wave energy converters with other marine renewables, such as offshore wind or solar, on shared platforms. This approach maximizes infrastructure utilization and grid stability, as explored by European Energy Innovation.

- Grid Integration and Energy Storage: Enhanced grid connection solutions and the integration of battery or hydrogen storage are being piloted to address the intermittency of wave energy. These efforts are supported by initiatives from Ocean Energy Systems (OES).

Collectively, these trends are accelerating the commercialization of renewable ocean wave energy conversion systems, positioning them as a vital component of the global clean energy transition in 2025 and beyond.

Competitive Landscape and Leading Players

The competitive landscape for renewable ocean wave energy conversion systems in 2025 is characterized by a mix of established energy conglomerates, specialized technology developers, and emerging startups, all vying for a share in a market projected to grow significantly as global decarbonization efforts intensify. The sector remains highly innovative, with companies focusing on improving conversion efficiency, survivability in harsh marine environments, and reducing levelized cost of energy (LCOE).

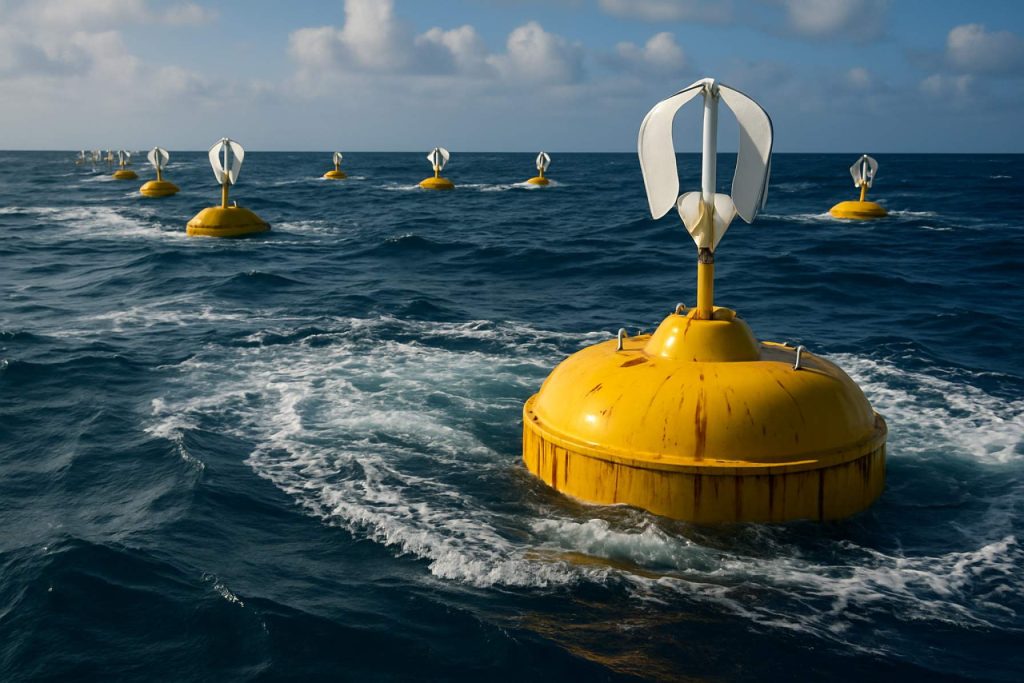

Leading players include Pelamis Wave Power, a pioneer in wave energy converters, which, despite past financial challenges, continues to influence technology development through its intellectual property and engineering expertise. Ocean Power Technologies (OPT) is another key player, with its PowerBuoy systems deployed in pilot projects across the US and Europe, targeting both grid-connected and off-grid applications. AW-Energy, based in Finland, has commercialized the WaveRoller device, which has undergone extensive sea trials and is now being integrated into hybrid renewable energy projects.

In the UK, Wave Energy Scotland acts as a government-backed innovation hub, funding and supporting a range of technology developers, including Mocean Energy and CorPower Ocean. These companies are advancing next-generation point absorber and oscillating water column technologies, with several demonstration projects scheduled for 2025. Seabased, headquartered in Sweden, is also notable for its modular wave energy parks, which are being piloted in the Atlantic and Indian Oceans.

Strategic partnerships and joint ventures are increasingly common, as seen in collaborations between ENGIE and SIMEC Atlantis Energy to integrate wave energy into broader marine renewables portfolios. Additionally, oil and gas majors such as Shell and TotalEnergies are investing in wave energy startups, seeking to diversify their renewable energy assets.

Despite the sector’s promise, challenges remain, including high capital costs, regulatory hurdles, and the need for robust grid integration. However, with increasing government support and private investment, the competitive landscape in 2025 is expected to see further consolidation and the emergence of commercially viable wave energy projects, particularly in Europe, North America, and Asia-Pacific International Energy Agency.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The global market for renewable ocean wave energy conversion systems is poised for significant expansion between 2025 and 2030, driven by increasing investments in clean energy, supportive government policies, and technological advancements. According to projections by Allied Market Research, the ocean energy market—which includes wave, tidal, and other marine energy sources—is expected to grow at a compound annual growth rate (CAGR) of approximately 23% during this period. Specifically, the wave energy segment is anticipated to outpace other marine energy types due to its vast untapped potential and ongoing pilot projects transitioning to commercial deployment.

Revenue forecasts indicate that the global wave energy market could surpass $1.5 billion by 2030, up from an estimated $350 million in 2025. This surge is attributed to the scaling up of demonstration projects in Europe, North America, and Asia-Pacific, as well as the entry of new market players and increased funding from both public and private sectors. For instance, the European Union’s continued support through the Horizon Europe program and national initiatives in the UK and Portugal are expected to catalyze market growth in the region, which currently leads in installed capacity and project pipeline (Ocean Energy Europe).

In terms of volume, the installed capacity of wave energy conversion systems is projected to grow from less than 100 MW in 2025 to over 500 MW by 2030, according to estimates from International Energy Agency (IEA). This fivefold increase reflects both the maturation of core technologies—such as oscillating water columns, point absorbers, and overtopping devices—and the expansion of grid-connected pilot arrays. The Asia-Pacific region, particularly China and Australia, is expected to contribute significantly to this capacity growth, supported by favorable regulatory frameworks and coastal resource availability.

- CAGR (2025–2030): ~23% for wave energy segment

- Revenue (2030): Projected to exceed $1.5 billion globally

- Installed Capacity (2030): Expected to reach 500+ MW

Overall, the 2025–2030 period is set to mark a pivotal phase for renewable ocean wave energy conversion systems, with robust growth in both revenue and installed capacity, underpinned by policy support, technological progress, and increasing commercial viability.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global market for renewable ocean wave energy conversion systems is experiencing varied growth trajectories across regions, shaped by policy frameworks, technological maturity, and investment climates. In 2025, North America, Europe, Asia-Pacific, and the Rest of the World each present distinct opportunities and challenges for the deployment and commercialization of wave energy technologies.

North America remains a promising market, particularly driven by the United States and Canada. The U.S. Department of Energy continues to fund pilot projects and research initiatives, with a focus on integrating wave energy into coastal microgrids and supporting blue economy applications. However, large-scale commercial deployment is still limited by regulatory hurdles and the need for further cost reductions. Canada, with its extensive coastline and supportive provincial policies, is advancing demonstration projects, especially in British Columbia and Nova Scotia (National Renewable Energy Laboratory).

Europe leads the global market in terms of installed capacity and policy support. The European Union’s Green Deal and the Horizon Europe program have catalyzed significant investments in wave energy R&D. The United Kingdom, Portugal, and Spain are at the forefront, hosting several grid-connected wave farms and test sites. The European Marine Energy Centre (EMEC) in Scotland remains a hub for technology validation and commercialization. The region’s ambitious renewable energy targets and established supply chains are expected to drive continued growth through 2025 (Ocean Energy Europe).

- Asia-Pacific is emerging as a high-growth region, led by Australia, China, and Japan. Australia’s Wave Energy Research Centre and government-backed funding are accelerating technology trials, particularly along the southern and western coasts. China is investing in indigenous wave energy prototypes and pilot plants as part of its broader renewable energy expansion. Japan, with its focus on disaster resilience and energy diversification, is supporting wave energy as a complement to offshore wind and solar (International Energy Agency).

- Rest of the World includes regions such as Latin America and Africa, where market activity is nascent but growing. Countries like Chile and South Africa are exploring wave energy potential, often in partnership with European technology providers. These markets are expected to benefit from technology transfer and international funding mechanisms in the coming years (World Bank).

Overall, while Europe maintains its leadership, North America and Asia-Pacific are rapidly scaling up, and the Rest of the World is beginning to tap into its vast ocean energy resources. Regional policy support, technology readiness, and investment flows will continue to shape the competitive landscape for wave energy conversion systems in 2025.

Challenges, Risks, and Barriers to Adoption

The adoption of renewable ocean wave energy conversion systems faces a complex array of challenges, risks, and barriers that continue to hinder large-scale deployment as of 2025. Despite significant technological advancements, several critical issues remain unresolved, impacting both the pace and scale of commercialization.

- Technical and Engineering Challenges: Wave energy devices must withstand harsh marine environments characterized by corrosion, biofouling, and extreme weather events. The reliability and durability of components are ongoing concerns, with maintenance costs often exceeding initial projections. The diversity of wave conditions across potential deployment sites further complicates the standardization of device designs, leading to increased R&D costs and slower technology maturation (International Energy Agency).

- Economic Barriers: The levelized cost of energy (LCOE) for wave energy remains significantly higher than for more mature renewables such as wind and solar. High upfront capital expenditures, coupled with uncertain long-term operational costs, deter private investment. Limited access to financing and the absence of robust revenue support mechanisms further constrain project development (International Renewable Energy Agency).

- Regulatory and Permitting Hurdles: The permitting process for wave energy projects is often lengthy and complex, involving multiple regulatory agencies and stakeholders. Environmental impact assessments are required to address concerns about marine ecosystems, fisheries, and coastal communities. The lack of clear, harmonized regulatory frameworks in many jurisdictions creates uncertainty and delays (Organisation for Economic Co-operation and Development).

- Grid Integration and Infrastructure: Many promising wave energy sites are located far from existing grid infrastructure, necessitating significant investment in subsea cables and onshore grid upgrades. The intermittent and variable nature of wave energy also poses challenges for grid stability and integration, especially in regions with limited energy storage capacity (Enerdata).

- Market and Public Acceptance: Public awareness of wave energy remains low compared to other renewables. Concerns about visual impacts, navigation hazards, and potential effects on tourism and local economies can lead to opposition from coastal communities and stakeholders (European Energy Innovation).

Addressing these multifaceted challenges will require coordinated efforts across technology development, policy support, and stakeholder engagement to unlock the full potential of ocean wave energy conversion systems.

Opportunities and Strategic Recommendations

The global market for renewable ocean wave energy conversion systems is poised for significant growth in 2025, driven by increasing demand for clean energy, supportive government policies, and technological advancements. Several key opportunities and strategic recommendations can be identified for stakeholders aiming to capitalize on this evolving sector.

- Geographic Expansion: Coastal regions with high wave energy potential, such as the United Kingdom, Portugal, Australia, and parts of Southeast Asia, present lucrative opportunities for deployment. Companies should prioritize market entry or expansion in these regions, leveraging local partnerships and government incentives. For instance, the UK Department for Energy Security and Net Zero has announced dedicated funding for marine energy projects, making the UK a strategic hub for wave energy innovation.

- Technology Differentiation: Advancements in device efficiency, durability, and grid integration are critical. Firms investing in robust, low-maintenance systems and hybrid solutions (combining wave with wind or solar) can gain a competitive edge. Collaborations with research institutions, such as the National Renewable Energy Laboratory, can accelerate innovation and reduce time-to-market.

- Policy and Regulatory Engagement: Proactive engagement with policymakers to shape favorable regulatory frameworks and secure long-term power purchase agreements (PPAs) is essential. The International Energy Agency highlights that clear permitting processes and grid access policies are pivotal for scaling up wave energy projects.

- Cost Reduction Strategies: Scaling up manufacturing, standardizing components, and optimizing installation and maintenance logistics can drive down levelized cost of energy (LCOE). Strategic alliances with offshore wind and oil & gas service providers can leverage existing infrastructure and expertise, as demonstrated by projects supported by Equinor and Shell.

- Environmental and Social Acceptance: Transparent stakeholder engagement and rigorous environmental impact assessments are crucial for project approval and long-term viability. Partnerships with organizations like the World Wildlife Fund can enhance community trust and project sustainability.

In summary, the 2025 landscape for ocean wave energy conversion systems offers robust opportunities for growth. Strategic focus on technology, policy, cost, and stakeholder engagement will be key to unlocking the sector’s full potential and accelerating the global transition to renewable energy.

Future Outlook: Innovation, Policy, and Market Expansion

The future outlook for renewable ocean wave energy conversion systems in 2025 is shaped by a confluence of technological innovation, evolving policy frameworks, and expanding market opportunities. As global decarbonization targets intensify, wave energy is increasingly recognized as a critical component of the renewable energy mix, offering predictable and consistent power generation compared to other intermittent sources.

On the innovation front, 2025 is expected to see significant advancements in device efficiency, survivability, and cost reduction. Developers are leveraging advanced materials, real-time monitoring, and digital twin technologies to enhance the durability and performance of wave energy converters (WECs). Notably, modular and scalable designs are gaining traction, enabling easier deployment and maintenance in diverse marine environments. Companies such as OceanEnergy and CorPower Ocean are piloting next-generation WECs with improved energy capture and grid integration capabilities.

Policy support remains pivotal in accelerating commercialization. In 2025, several governments are expected to expand feed-in tariffs, grant programs, and streamlined permitting processes for marine renewables. The European Union’s “Blue Economy” strategy and the U.S. Department of Energy’s Water Power Technologies Office are actively funding demonstration projects and research initiatives to de-risk investments and foster public-private partnerships (European Commission, U.S. Department of Energy). These policy measures are expected to catalyze further private sector engagement and cross-border collaborations.

- Market Expansion: The global wave energy market is projected to grow at a CAGR exceeding 20% through 2030, with Europe and Asia-Pacific leading deployments (MarketsandMarkets). Coastal nations with high wave resource potential, such as the UK, Portugal, Australia, and Japan, are scaling up pilot arrays and pre-commercial projects.

- Integration with Other Renewables: Hybrid projects combining wave, wind, and solar are emerging, optimizing grid stability and maximizing marine spatial use (International Energy Agency).

- Challenges: Despite progress, challenges remain in reducing levelized cost of energy (LCOE), securing long-term financing, and addressing environmental concerns. Continued R&D and supportive regulatory environments will be crucial for mainstream adoption.

In summary, 2025 is poised to be a pivotal year for renewable ocean wave energy conversion systems, marked by technological breakthroughs, robust policy backing, and expanding commercial opportunities that collectively advance the sector toward large-scale deployment.

Sources & References

- International Energy Agency

- Ocean Energy Europe

- Australian Renewable Energy Agency

- Siemens Energy

- National Renewable Energy Laboratory

- DNV

- European Energy Innovation

- Pelamis Wave Power

- Ocean Power Technologies

- Wave Energy Scotland

- Mocean Energy

- Shell

- TotalEnergies

- Allied Market Research

- World Bank

- Enerdata

- UK Department for Energy Security and Net Zero

- Equinor

- European Commission

- MarketsandMarkets