Fiber Bragg-Based Biosensing Technologies Market Report 2025: In-Depth Analysis of Growth Drivers, Innovations, and Global Opportunities. Explore Market Size, Key Players, and Strategic Forecasts for the Next 5 Years.

- Executive Summary & Market Overview

- Key Technology Trends in Fiber Bragg-Based Biosensing

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Challenges, Risks, and Emerging Opportunities

- Future Outlook: Strategic Recommendations and Innovation Pathways

- Sources & References

Executive Summary & Market Overview

Fiber Bragg-based biosensing technologies represent a rapidly advancing segment within the optical biosensor market, leveraging the unique properties of Fiber Bragg Gratings (FBGs) for highly sensitive, real-time detection of biological and chemical analytes. FBGs are periodic variations inscribed in the core of optical fibers, which reflect specific wavelengths of light in response to changes in temperature, strain, or refractive index—making them ideal for biosensing applications. In 2025, the global market for fiber Bragg-based biosensors is poised for robust growth, driven by increasing demand for point-of-care diagnostics, environmental monitoring, and biomedical research.

According to recent market analyses, the fiber optic biosensor market is projected to reach USD 2.1 billion by 2025, with FBG-based solutions accounting for a significant share due to their multiplexing capability, immunity to electromagnetic interference, and miniaturized form factor MarketsandMarkets. The healthcare sector remains the primary end-user, utilizing FBG biosensors for early disease detection, continuous patient monitoring, and advanced therapeutic research. Additionally, environmental agencies are increasingly adopting these technologies for real-time detection of pollutants and pathogens in water and air, capitalizing on the sensors’ high sensitivity and rapid response times Grand View Research.

Key industry players are investing in the development of next-generation FBG biosensors with enhanced specificity, multiplexing, and integration with microfluidic platforms. This innovation is supported by collaborative efforts between academic institutions and commercial entities, aiming to address challenges such as sensor functionalization, stability, and mass production Optica (formerly OSA). The Asia-Pacific region is expected to witness the fastest growth, fueled by expanding healthcare infrastructure, government initiatives, and increased R&D spending in countries like China, Japan, and South Korea Fortune Business Insights.

- Market drivers: Rising prevalence of chronic diseases, demand for rapid diagnostics, and technological advancements in fiber optics.

- Challenges: Sensor calibration, long-term stability, and regulatory hurdles for clinical adoption.

- Opportunities: Integration with IoT devices, wearable health monitors, and smart environmental sensing networks.

In summary, fiber Bragg-based biosensing technologies are set to play a pivotal role in the evolution of biosensors, offering unparalleled sensitivity, versatility, and integration potential across diverse application domains in 2025 and beyond.

Key Technology Trends in Fiber Bragg-Based Biosensing

Fiber Bragg-based biosensing technologies are at the forefront of next-generation optical biosensors, leveraging the unique properties of Fiber Bragg Gratings (FBGs) to enable highly sensitive, real-time detection of biological analytes. In 2025, several key technology trends are shaping the evolution and adoption of these biosensors across healthcare, environmental monitoring, and industrial applications.

- Miniaturization and Multiplexing: Advances in microfabrication and photonic integration are enabling the development of ultra-compact FBG biosensors. These miniaturized devices can be embedded into wearable platforms or minimally invasive probes, supporting simultaneous detection of multiple biomarkers through wavelength-division multiplexing. This trend is particularly significant for point-of-care diagnostics and continuous health monitoring, as highlighted by Carl Zeiss AG and recent academic research.

- Functionalization and Selectivity: Surface modification techniques, such as the immobilization of antibodies, aptamers, or molecularly imprinted polymers on the FBG surface, are enhancing the selectivity and specificity of biosensors. This enables the detection of low-abundance analytes in complex biological matrices, a critical requirement for early disease diagnosis and environmental biosurveillance, as reported by Thermo Fisher Scientific Inc..

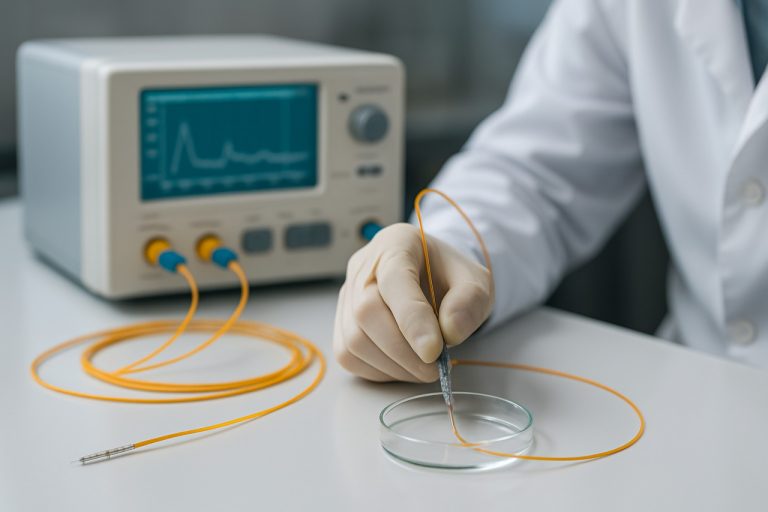

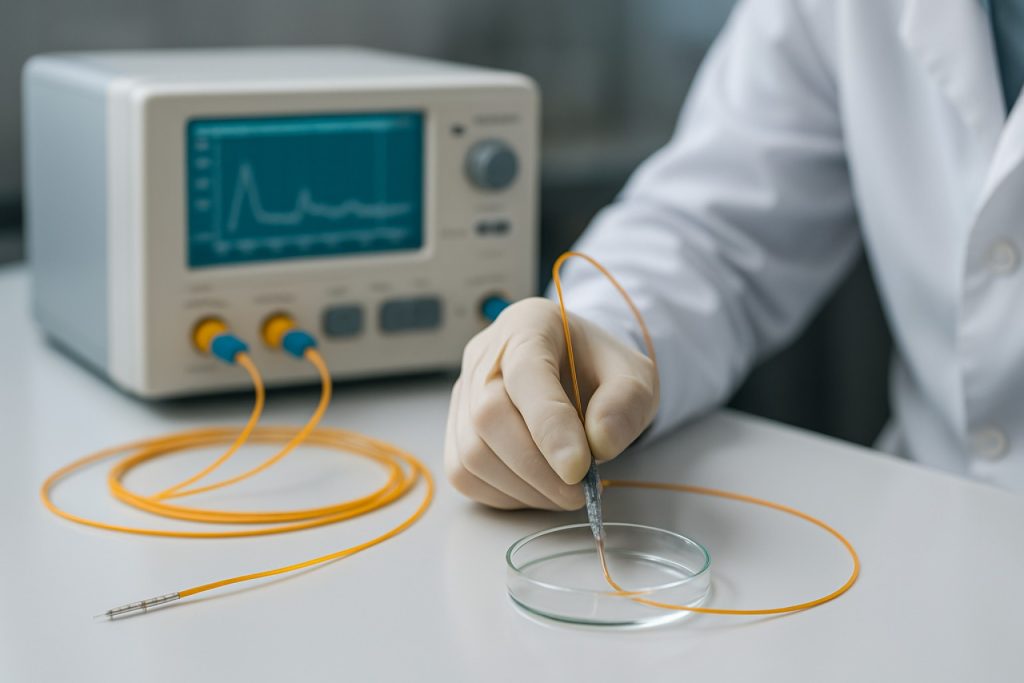

- Integration with Microfluidics: The convergence of FBG biosensors with microfluidic platforms is facilitating automated sample handling, reduced reagent consumption, and improved assay reproducibility. This integration supports the development of lab-on-fiber systems, which are gaining traction for rapid, high-throughput screening applications, according to Analytik Jena AG.

- Enhanced Sensitivity through Advanced Interrogation: The adoption of advanced optical interrogation techniques, such as tunable laser sources and high-resolution spectrometers, is pushing the detection limits of FBG biosensors. These improvements are enabling the quantification of analytes at picomolar or even femtomolar concentrations, as demonstrated in recent studies and by instrumentation leaders like Ocean Insight.

- Wireless and Remote Sensing Capabilities: The integration of FBG biosensors with wireless data transmission modules is enabling remote, real-time monitoring in challenging environments, such as in vivo biomedical applications or hazardous industrial sites. This trend is supported by developments from companies like Hottinger Brüel & Kjær (HBK).

Collectively, these technology trends are driving the rapid advancement and commercialization of fiber Bragg-based biosensing technologies, positioning them as a pivotal solution for next-generation biosensing challenges in 2025 and beyond.

Competitive Landscape and Leading Players

The competitive landscape for fiber Bragg-based biosensing technologies in 2025 is characterized by a dynamic mix of established photonics companies, innovative startups, and academic spin-offs, all vying for leadership in a rapidly evolving market. The sector is driven by increasing demand for highly sensitive, real-time, and multiplexed biosensing solutions across healthcare, environmental monitoring, and industrial applications.

Key players in this space include Hottinger Brüel & Kjær (HBK), which leverages its expertise in optical measurement to offer advanced fiber Bragg grating (FBG) sensor platforms for biomedical and life sciences applications. Luna Innovations is another prominent company, providing FBG-based sensing systems with a focus on medical diagnostics and structural health monitoring. Their solutions are recognized for high sensitivity and integration capabilities, making them suitable for both research and commercial deployment.

Emerging players such as FBGS Technologies and Osensa Innovations are gaining traction by developing miniaturized, multiplexed FBG biosensors tailored for point-of-care diagnostics and wearable health monitoring. These companies emphasize cost-effective manufacturing and robust sensor packaging, addressing key barriers to widespread adoption in clinical and field settings.

Academic spin-offs, notably from institutions like the Imperial College London and Massachusetts Institute of Technology (MIT), are also contributing to the competitive landscape. These entities often focus on novel functionalization techniques and integration of FBGs with microfluidic platforms, pushing the boundaries of sensitivity and specificity in biosensing.

Strategic collaborations and licensing agreements are common, as established photonics firms partner with biotechnology companies to accelerate commercialization. For example, Thorlabs has expanded its biosensing portfolio through partnerships with research institutions, enabling rapid prototyping and validation of new FBG-based biosensors.

Overall, the competitive environment is marked by continuous innovation, with leading players investing in R&D to enhance sensor performance, multiplexing capabilities, and integration with digital health platforms. The market is expected to see further consolidation as larger firms acquire niche technology providers to strengthen their biosensing offerings and global reach.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The global market for Fiber Bragg-based biosensing technologies is poised for robust expansion between 2025 and 2030, driven by increasing demand for advanced, real-time, and minimally invasive biosensing solutions across healthcare, environmental monitoring, and industrial applications. According to projections by MarketsandMarkets, the fiber optic sensor market—which includes Fiber Bragg Grating (FBG) biosensors—is expected to register a compound annual growth rate (CAGR) of approximately 10–12% during this period, with biosensing applications representing one of the fastest-growing segments.

Revenue forecasts indicate that the global market for FBG-based biosensing technologies will surpass USD 1.2 billion by 2030, up from an estimated USD 650 million in 2025. This growth is underpinned by the increasing adoption of FBG biosensors in medical diagnostics, such as continuous glucose monitoring, cancer biomarker detection, and wearable health devices. The integration of FBG sensors into point-of-care diagnostics and telemedicine platforms is also expected to accelerate market penetration, particularly in North America, Europe, and parts of Asia-Pacific (Grand View Research).

In terms of volume, the annual shipment of FBG biosensing units is projected to grow from approximately 1.8 million units in 2025 to over 4.5 million units by 2030. This surge is attributed to technological advancements that have reduced the cost and complexity of FBG sensor fabrication, as well as the miniaturization of optical components, making these sensors more accessible for integration into compact and portable devices (IDTechEx).

- Healthcare Sector: The healthcare industry will remain the dominant end-user, accounting for over 60% of total market revenue by 2030, fueled by the growing prevalence of chronic diseases and the need for continuous patient monitoring.

- Geographical Trends: North America is expected to maintain its lead due to strong R&D investments and early adoption, while Asia-Pacific will exhibit the highest CAGR, driven by expanding healthcare infrastructure and government initiatives supporting biosensor innovation.

- Competitive Landscape: Key players such as HBM FiberSensing, Luna Innovations, and OFS Fitel are intensifying their focus on product development and strategic partnerships to capture emerging opportunities.

Overall, the period from 2025 to 2030 will be marked by significant revenue and volume growth for Fiber Bragg-based biosensing technologies, underpinned by technological innovation and expanding application horizons.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The regional landscape for fiber Bragg-based biosensing technologies in 2025 is shaped by varying levels of technological adoption, research intensity, and healthcare infrastructure across North America, Europe, Asia-Pacific, and the Rest of the World (RoW).

- North America: North America, led by the United States, remains at the forefront of fiber Bragg-based biosensing technology development and commercialization. The region benefits from robust investments in biomedical research, a strong presence of leading photonics companies, and active collaborations between academia and industry. The U.S. National Institutes of Health and agencies like the National Science Foundation have funded multiple projects focused on advanced biosensing platforms, accelerating innovation. The region’s mature healthcare market and early adoption of precision diagnostics further drive demand, with applications expanding in point-of-care diagnostics and continuous health monitoring.

- Europe: Europe is characterized by a strong emphasis on research and regulatory harmonization. Countries such as Germany, the UK, and France are home to leading photonics research centers and startups specializing in fiber Bragg grating (FBG) biosensors. The European Union’s Horizon Europe program has provided significant funding for biosensing innovation, fostering cross-border collaborations. The region’s focus on personalized medicine and stringent regulatory standards has encouraged the development of highly sensitive and reliable FBG-based biosensors, particularly for clinical diagnostics and environmental monitoring (European Commission).

- Asia-Pacific: The Asia-Pacific region is witnessing rapid growth, driven by increasing healthcare expenditure, expanding biotechnology sectors, and government initiatives to modernize healthcare infrastructure. China, Japan, and South Korea are leading adopters, with significant investments in photonics and biosensor manufacturing. The region’s large population base and rising prevalence of chronic diseases are fueling demand for advanced diagnostic tools. Local companies and research institutes are increasingly collaborating with global players to accelerate technology transfer and commercialization (Asia-Pacific Economic Cooperation).

- Rest of World (RoW): In regions such as Latin America, the Middle East, and Africa, adoption of fiber Bragg-based biosensing technologies is at an earlier stage. Growth is primarily driven by pilot projects, international partnerships, and the gradual modernization of healthcare systems. While market penetration remains limited, increasing awareness and targeted investments are expected to create new opportunities, particularly in resource-limited settings where robust, low-maintenance biosensors are in demand.

Overall, regional disparities in research funding, regulatory environments, and healthcare priorities will continue to shape the global trajectory of fiber Bragg-based biosensing technologies through 2025.

Challenges, Risks, and Emerging Opportunities

Fiber Bragg-based biosensing technologies, which leverage the unique properties of Fiber Bragg Gratings (FBGs) for highly sensitive and selective detection of biological analytes, are gaining traction in medical diagnostics, environmental monitoring, and food safety. However, the sector faces several challenges and risks that could impact its growth trajectory in 2025, while also presenting emerging opportunities for innovation and market expansion.

Challenges and Risks

- Technical Complexity and Integration: The integration of FBG sensors into compact, user-friendly biosensing platforms remains a significant hurdle. Achieving reliable biofunctionalization of the fiber surface without compromising the optical properties is technically demanding, often requiring advanced surface chemistry and precise fabrication processes. This complexity can increase production costs and limit scalability, as noted by Optica.

- Standardization and Regulatory Barriers: The lack of standardized protocols for calibration, validation, and quality assurance of FBG-based biosensors poses a risk for widespread adoption, especially in clinical and regulatory-sensitive environments. Regulatory approval processes can be lengthy and costly, as highlighted by U.S. Food and Drug Administration (FDA) guidelines for novel diagnostic devices.

- Market Competition: FBG biosensors face stiff competition from established optical and electrochemical biosensing technologies, such as surface plasmon resonance (SPR) and enzyme-linked immunosorbent assays (ELISA). These alternatives often have more mature supply chains and broader user familiarity, as reported by MarketsandMarkets.

- Environmental Sensitivity: FBG sensors are inherently sensitive to temperature and strain, which can introduce noise or false positives in biosensing applications. Advanced compensation techniques are required to mitigate these effects, adding to system complexity and cost, according to IEEE research.

Emerging Opportunities

- Multiplexed and Remote Sensing: The ability of FBG arrays to perform multiplexed detection and remote monitoring via optical fibers opens new opportunities in point-of-care diagnostics and in situ environmental biosensing, as explored by Nature Publishing Group.

- Integration with AI and IoT: The convergence of FBG biosensors with artificial intelligence (AI) and Internet of Things (IoT) platforms can enable real-time data analytics, predictive diagnostics, and automated monitoring, creating new value propositions for healthcare and industrial applications, as forecasted by Gartner.

- Personalized Medicine: Advances in FBG biosensor specificity and miniaturization are paving the way for personalized health monitoring devices, which could transform chronic disease management and preventive care, as discussed by McKinsey & Company.

Future Outlook: Strategic Recommendations and Innovation Pathways

The future outlook for Fiber Bragg-based biosensing technologies in 2025 is shaped by a convergence of strategic imperatives and innovation pathways that are poised to accelerate market adoption and technological advancement. As the demand for rapid, sensitive, and multiplexed biosensing solutions intensifies across healthcare, environmental monitoring, and food safety, stakeholders must prioritize both incremental and disruptive innovation to maintain competitiveness.

Strategic Recommendations:

- Integration with Digital Health Platforms: Fiber Bragg-based biosensors should be designed for seamless integration with digital health ecosystems, enabling real-time data transmission and remote diagnostics. Partnerships with digital health companies and cloud service providers can facilitate this transition, enhancing the value proposition for end-users.

- Miniaturization and Multiplexing: Continued investment in miniaturization and the development of multiplexed sensor arrays will be critical. This will allow simultaneous detection of multiple biomarkers, addressing the growing need for comprehensive point-of-care diagnostics in both clinical and field settings.

- Standardization and Regulatory Alignment: Proactive engagement with regulatory bodies to establish standards for performance, safety, and interoperability will streamline market entry and foster trust among healthcare providers and patients. Early alignment with evolving regulatory frameworks, such as those outlined by the U.S. Food and Drug Administration and European Commission Health and Food Safety, is recommended.

- Cost Reduction through Scalable Manufacturing: Leveraging advances in photonic integration and automated manufacturing processes can drive down production costs, making Fiber Bragg-based biosensors more accessible for large-scale deployment. Collaboration with manufacturing partners and investment in pilot production lines will be essential.

Innovation Pathways:

- Advanced Functionalization Techniques: Research into novel surface chemistries and nanomaterial coatings can enhance the selectivity and sensitivity of Fiber Bragg-based biosensors, opening new application domains such as early cancer detection and infectious disease surveillance.

- AI-Driven Data Analytics: Incorporating artificial intelligence and machine learning algorithms for signal processing and pattern recognition will enable more accurate interpretation of complex biosensing data, as highlighted by recent initiatives from IBM and Microsoft in healthcare analytics.

- Collaborative R&D Ecosystems: Fostering open innovation through partnerships with academic institutions, research consortia, and industry leaders—such as those supported by the European Commission Research & Innovation—will accelerate the translation of laboratory breakthroughs into commercial products.

In summary, the strategic focus for 2025 should be on digital integration, regulatory foresight, scalable manufacturing, and cross-sector collaboration, underpinned by continuous innovation in sensor design and data analytics. These pathways will position Fiber Bragg-based biosensing technologies at the forefront of next-generation diagnostic and monitoring solutions.

Sources & References

- MarketsandMarkets

- Grand View Research

- Fortune Business Insights

- Carl Zeiss AG

- Thermo Fisher Scientific Inc.

- Analytik Jena AG

- Ocean Insight

- Hottinger Brüel & Kjær (HBK)

- Luna Innovations

- FBGS Technologies

- Osensa Innovations

- Imperial College London

- Massachusetts Institute of Technology (MIT)

- Thorlabs

- IDTechEx

- Luna Innovations

- National Science Foundation

- European Commission

- Asia-Pacific Economic Cooperation

- IEEE

- Nature Publishing Group

- McKinsey & Company

- IBM

- Microsoft