Optofluidic Biosensors Industry Report 2025: Market Dynamics, Technology Innovations, and Strategic Forecasts Through 2030. Explore Key Drivers, Regional Insights, and Competitive Analysis Shaping the Future of Biosensing.

- Executive Summary & Market Overview

- Key Technology Trends in Optofluidic Biosensors

- Market Size, Segmentation, and Growth Forecasts (2025–2030)

- Competitive Landscape and Leading Players

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Challenges, Risks, and Market Barriers

- Opportunities and Emerging Applications

- Future Outlook and Strategic Recommendations

- Sources & References

Executive Summary & Market Overview

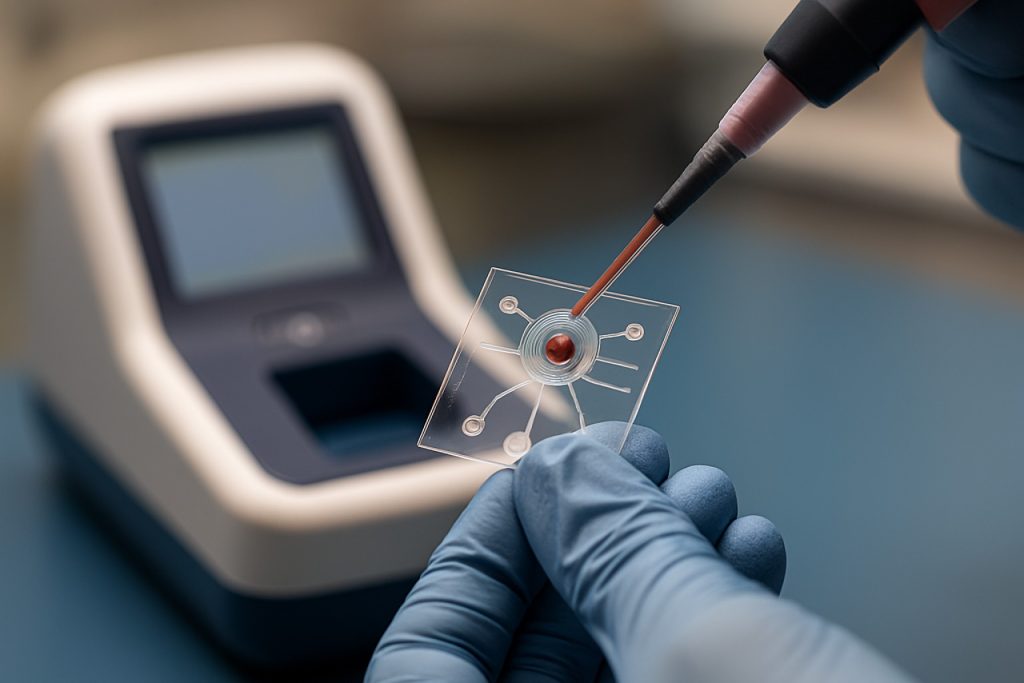

Optofluidic biosensors represent a convergence of optical and microfluidic technologies, enabling highly sensitive, real-time detection of biological and chemical substances. These devices leverage the manipulation of light within microfluidic environments to achieve rapid, label-free, and multiplexed analysis, making them increasingly vital in diagnostics, environmental monitoring, and life sciences research. The global optofluidic biosensors market is poised for robust growth, driven by advancements in photonic integration, miniaturization, and the rising demand for point-of-care (POC) diagnostics.

According to MarketsandMarkets, the broader optofluidics market is projected to reach USD 3.8 billion by 2025, with biosensing applications constituting a significant share due to their adoption in medical diagnostics and environmental testing. The COVID-19 pandemic has further accelerated the adoption of rapid, sensitive biosensing platforms, highlighting the need for portable and accurate diagnostic tools. Optofluidic biosensors, with their ability to integrate sample preparation, detection, and analysis on a single chip, are well-positioned to address these needs.

Key market drivers include the increasing prevalence of infectious diseases, the push for decentralized healthcare, and the growing emphasis on early disease detection. Technological innovations—such as the integration of silicon photonics, plasmonic nanostructures, and advanced microfluidic architectures—are enhancing the sensitivity and specificity of these biosensors. Leading research institutions and companies, including imec and Carl Zeiss AG, are actively developing next-generation optofluidic platforms for clinical and research applications.

Regionally, North America and Europe dominate the market, supported by strong R&D infrastructure, government funding, and the presence of key industry players. However, Asia-Pacific is expected to witness the fastest growth through 2025, fueled by expanding healthcare infrastructure, increasing investments in biotechnology, and rising awareness of advanced diagnostic technologies (Grand View Research).

In summary, the optofluidic biosensors market in 2025 is characterized by rapid technological progress, expanding application scope, and a favorable funding environment. The sector is set to play a pivotal role in the evolution of next-generation diagnostic and monitoring solutions, with significant opportunities for innovation and commercialization.

Key Technology Trends in Optofluidic Biosensors

Optofluidic biosensors, which integrate optical and microfluidic technologies for sensitive biological detection, are experiencing rapid technological evolution in 2025. Several key trends are shaping the landscape, driven by the demand for faster, more accurate, and miniaturized diagnostic solutions.

- Integration of Photonic Chips: The adoption of silicon photonics and integrated photonic circuits is enabling the development of highly compact and multiplexed optofluidic biosensors. These chips allow for parallel detection of multiple analytes, improving throughput and reducing sample volumes. Companies such as Intel and research institutions like MIT are at the forefront of integrating photonic elements with microfluidic channels for real-time, label-free detection.

- Advancements in Nanomaterials: The use of nanostructured materials, including plasmonic nanoparticles and 2D materials like graphene, is enhancing the sensitivity and specificity of optofluidic biosensors. These materials enable stronger light-matter interactions, leading to lower detection limits for biomarkers and pathogens. Recent studies published by Nature Publishing Group highlight breakthroughs in using gold nanostructures for single-molecule detection.

- AI-Driven Data Analysis: Artificial intelligence and machine learning algorithms are increasingly being integrated into optofluidic biosensor platforms. These tools facilitate rapid interpretation of complex optical signals, pattern recognition, and predictive diagnostics, as reported by IBM and Microsoft in their healthcare technology initiatives.

- Point-of-Care and Wearable Devices: There is a significant push towards portable, user-friendly optofluidic biosensors for point-of-care and even wearable applications. Startups and established firms such as Abbott are developing devices that can provide real-time health monitoring outside traditional laboratory settings, leveraging advances in microfluidics and miniaturized optics.

- Multiplexed and High-Throughput Platforms: The trend towards multiplexing—simultaneous detection of multiple targets—continues to accelerate. Companies like Illumina are investing in high-throughput optofluidic platforms for genomics and proteomics, enabling comprehensive biomarker panels in a single assay.

These technology trends are collectively driving the optofluidic biosensor market towards greater accessibility, precision, and scalability, with significant implications for diagnostics, environmental monitoring, and personalized medicine in 2025 and beyond.

Market Size, Segmentation, and Growth Forecasts (2025–2030)

The global optofluidic biosensors market is poised for robust growth between 2025 and 2030, driven by increasing demand for rapid, sensitive, and miniaturized diagnostic solutions across healthcare, environmental monitoring, and food safety sectors. Optofluidic biosensors, which integrate optical and microfluidic technologies for real-time biomolecular detection, are gaining traction due to their high sensitivity, multiplexing capabilities, and potential for point-of-care applications.

Market Size and Growth Projections

According to recent analyses, the optofluidic biosensors market was valued at approximately USD 1.2 billion in 2024 and is projected to reach USD 3.1 billion by 2030, registering a compound annual growth rate (CAGR) of around 17% during the forecast period MarketsandMarkets. This growth is underpinned by technological advancements, rising investments in biosensor R&D, and the expanding adoption of lab-on-a-chip platforms in clinical diagnostics.

Segmentation Analysis

- By Application: The healthcare segment dominates the market, accounting for over 60% of total revenue in 2025, primarily due to the increasing use of optofluidic biosensors in infectious disease diagnostics, cancer biomarker detection, and personalized medicine. Environmental monitoring and food safety are emerging segments, expected to grow at CAGRs of 18% and 16%, respectively, as regulatory scrutiny and public health concerns intensify Grand View Research.

- By Technology: Surface plasmon resonance (SPR)-based optofluidic biosensors hold the largest market share, followed by fluorescence and interferometric technologies. Innovations in photonic crystal and waveguide-based platforms are anticipated to drive the next wave of growth, offering enhanced sensitivity and multiplexing.

- By End User: Hospitals and diagnostic laboratories represent the largest end-user segment, while research institutes and environmental agencies are expected to witness the fastest growth, fueled by increased funding and collaborative projects.

- By Region: North America leads the market, supported by a strong biotechnology sector and favorable regulatory environment. Asia-Pacific is projected to exhibit the highest CAGR (over 19%) through 2030, driven by expanding healthcare infrastructure and government initiatives in China, Japan, and India Fortune Business Insights.

In summary, the optofluidic biosensors market is set for significant expansion through 2030, with growth opportunities across diverse applications and geographies, propelled by ongoing innovation and increasing demand for rapid, accurate biosensing solutions.

Competitive Landscape and Leading Players

The competitive landscape of the optofluidic biosensors market in 2025 is characterized by a dynamic mix of established technology conglomerates, specialized biosensor firms, and innovative startups. The sector is witnessing rapid advancements driven by the convergence of photonics, microfluidics, and biotechnology, resulting in highly sensitive, miniaturized, and multiplexed biosensing platforms. Key players are focusing on expanding their product portfolios, strategic collaborations, and investments in R&D to maintain a competitive edge.

Among the leading companies, Thermo Fisher Scientific stands out for its robust biosensor technology portfolio and global distribution network. The company has been actively integrating optofluidic components into its diagnostic platforms, targeting applications in clinical diagnostics and life sciences research. Carl Zeiss AG is another major player, leveraging its expertise in optics and imaging to develop advanced optofluidic biosensing solutions, particularly for point-of-care and in vitro diagnostics.

Startups and university spin-offs are also shaping the competitive landscape. Companies such as Luxmux Technology and Optofluidics, Inc. are pioneering novel optofluidic sensor designs, focusing on high-throughput and label-free detection methods. These firms often collaborate with academic institutions and research organizations to accelerate innovation and commercialization.

Strategic partnerships and acquisitions are prevalent as companies seek to enhance their technological capabilities and market reach. For example, Abbott Laboratories has entered into collaborations with microfluidics startups to integrate optofluidic biosensors into its diagnostic devices, aiming to improve sensitivity and reduce assay times. Similarly, Siemens Healthineers is investing in optofluidic R&D to strengthen its position in the molecular diagnostics segment.

- Thermo Fisher Scientific: Global leader with a broad biosensor portfolio and strong R&D investment.

- Carl Zeiss AG: Focused on optical innovation and integration of optofluidics in diagnostics.

- Luxmux Technology & Optofluidics, Inc.: Startups driving disruptive sensor technologies.

- Abbott Laboratories & Siemens Healthineers: Expanding through partnerships and technology integration.

Overall, the market is highly competitive, with innovation cycles accelerating as companies race to address emerging needs in healthcare, environmental monitoring, and food safety. The ability to offer scalable, cost-effective, and highly sensitive optofluidic biosensors will be a key differentiator for leading players in 2025.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global optofluidic biosensors market demonstrates significant regional variation in terms of adoption, research activity, and commercial deployment. In 2025, North America remains the dominant region, driven by robust investments in healthcare innovation, a strong presence of biotechnology firms, and extensive academic research. The United States, in particular, benefits from funding initiatives by agencies such as the National Institutes of Health and partnerships with leading universities, fostering rapid prototyping and commercialization of optofluidic biosensor technologies. The region’s focus on early disease detection and personalized medicine further accelerates market growth.

Europe follows closely, with countries like Germany, the United Kingdom, and France leading in optofluidic biosensor research and development. The European Union’s Horizon Europe program and national funding bodies support collaborative projects between academia and industry, enhancing the region’s innovation ecosystem. Regulatory harmonization across the EU facilitates smoother market entry for new biosensor products, while a strong emphasis on point-of-care diagnostics in public health systems drives demand. Companies such as Siemens Healthineers and Thermo Fisher Scientific have expanded their biosensor portfolios to address emerging healthcare needs in the region.

The Asia-Pacific region is experiencing the fastest growth rate, propelled by increasing healthcare expenditure, expanding biotechnology sectors, and government initiatives to modernize healthcare infrastructure. China, Japan, and South Korea are at the forefront, with significant investments in microfluidics and photonics research. The Chinese government’s support for domestic innovation and the presence of large-scale manufacturing capabilities enable rapid scaling and cost-effective production of optofluidic biosensors. Additionally, the region’s high population density and rising prevalence of chronic diseases create a substantial market for rapid, sensitive diagnostic tools. Companies such as Shimadzu Corporation and Huawei Technologies (in digital health) are increasingly active in this space.

The Rest of the World, including Latin America, the Middle East, and Africa, is characterized by slower adoption due to limited healthcare infrastructure and lower R&D investment. However, international collaborations and the introduction of affordable, portable biosensor solutions are gradually improving market penetration. Non-governmental organizations and global health initiatives are playing a pivotal role in deploying optofluidic biosensors for infectious disease monitoring and public health surveillance in these regions.

Challenges, Risks, and Market Barriers

The optofluidic biosensors market in 2025 faces a complex landscape of challenges, risks, and barriers that could impede its growth and widespread adoption. Despite their promise for high sensitivity, miniaturization, and integration in diagnostics, several factors continue to constrain market expansion.

- Technical Complexity and Integration: Optofluidic biosensors require the seamless integration of optical and microfluidic components, which presents significant engineering challenges. Achieving reliable alignment, minimizing signal loss, and ensuring reproducibility at scale remain persistent hurdles. The need for advanced fabrication techniques and precise control over microfluidic environments increases production costs and limits scalability, especially for mass-market applications (Nature Nanotechnology).

- Standardization and Regulatory Hurdles: The lack of standardized protocols for device performance, calibration, and validation complicates regulatory approval processes. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Commission require rigorous clinical validation, which can be time-consuming and costly. This is particularly challenging for startups and smaller companies with limited resources.

- Market Fragmentation and Adoption Barriers: The optofluidic biosensor market is highly fragmented, with numerous small players and academic spin-offs. This fragmentation leads to a lack of interoperability and hinders the development of universal platforms. Additionally, end-users in clinical and industrial settings may be hesitant to adopt new technologies due to concerns about reliability, integration with existing workflows, and long-term support (MarketsandMarkets).

- Cost Constraints and Commercialization Risks: High R&D and manufacturing costs, coupled with uncertain reimbursement pathways for diagnostic applications, pose significant commercialization risks. The return on investment is often unclear, especially in price-sensitive markets or regions with limited healthcare infrastructure (Grand View Research).

- Intellectual Property and Competitive Pressures: The rapid pace of innovation in optofluidics has led to a crowded intellectual property landscape. Patent disputes and freedom-to-operate issues can delay product launches and increase legal costs, further complicating market entry for new entrants (World Intellectual Property Organization (WIPO)).

Addressing these challenges will require coordinated efforts among industry stakeholders, regulatory agencies, and research institutions to foster standardization, streamline regulatory pathways, and reduce technical and commercial risks.

Opportunities and Emerging Applications

Optofluidic biosensors, which integrate optical and microfluidic technologies for sensitive biological detection, are poised for significant growth in 2025, driven by expanding opportunities and emerging applications across healthcare, environmental monitoring, and food safety. The convergence of miniaturized optics and fluidics enables real-time, label-free, and multiplexed detection, opening new frontiers for rapid diagnostics and point-of-care testing.

In healthcare, the demand for decentralized diagnostics is accelerating the adoption of optofluidic biosensors. These devices offer rapid pathogen detection, early disease diagnosis, and personalized medicine applications. For instance, the COVID-19 pandemic underscored the need for portable, high-throughput biosensors, prompting increased investment in optofluidic platforms for viral and bacterial detection. The integration of optofluidics with smartphone-based readouts and artificial intelligence is further enhancing usability and data analysis, making these sensors attractive for both clinical and home-based testing scenarios. According to MarketsandMarkets, the global optofluidics market is projected to reach $3.3 billion by 2025, with biosensing applications representing a significant share.

Environmental monitoring is another promising area, as optofluidic biosensors enable real-time detection of contaminants, toxins, and pathogens in water and air. Their high sensitivity and portability make them ideal for on-site monitoring, supporting regulatory compliance and public health initiatives. Recent advances in nanomaterial integration and surface functionalization are improving detection limits and specificity, broadening the range of detectable analytes. Organizations such as the U.S. Environmental Protection Agency are exploring optofluidic solutions for rapid water quality assessment and early warning systems.

In the food and beverage industry, optofluidic biosensors are being deployed for the detection of foodborne pathogens, allergens, and chemical residues. Their ability to deliver rapid, multiplexed results is streamlining quality control processes and reducing the risk of contamination outbreaks. Companies like Thermo Fisher Scientific are investing in optofluidic-based platforms to enhance food safety testing capabilities.

Looking ahead to 2025, the integration of optofluidic biosensors with Internet of Things (IoT) networks and cloud-based analytics is expected to unlock new applications in remote monitoring and data-driven decision-making. As fabrication costs decrease and device robustness improves, optofluidic biosensors are set to play a pivotal role in next-generation diagnostics and monitoring solutions across multiple sectors.

Future Outlook and Strategic Recommendations

The future outlook for optofluidic biosensors in 2025 is marked by rapid technological advancements, expanding application domains, and increasing commercial interest. As the convergence of photonics and microfluidics matures, optofluidic biosensors are poised to play a pivotal role in next-generation diagnostics, environmental monitoring, and bioprocessing. The global optofluidics market is projected to grow at a CAGR exceeding 15% through 2025, driven by demand for miniaturized, high-sensitivity, and multiplexed biosensing platforms MarketsandMarkets.

Key growth drivers include the rising prevalence of infectious diseases, the need for rapid point-of-care diagnostics, and the push for decentralized healthcare solutions. The COVID-19 pandemic has accelerated investment in biosensor technologies, with optofluidic platforms demonstrating superior performance in terms of speed, sensitivity, and integration with digital health systems Grand View Research. Additionally, the integration of artificial intelligence and machine learning with optofluidic biosensors is expected to enhance data analysis, enabling real-time, actionable insights for clinicians and researchers.

Strategically, stakeholders should focus on the following recommendations to capitalize on emerging opportunities:

- Invest in R&D for Multiplexed Detection: Developing optofluidic biosensors capable of simultaneous detection of multiple biomarkers will address unmet needs in disease diagnostics and environmental monitoring.

- Enhance Integration with Digital Platforms: Collaborate with software and cloud service providers to enable seamless data transmission, remote monitoring, and telemedicine applications.

- Prioritize Regulatory Compliance: Engage early with regulatory bodies such as the FDA and EMA to streamline approval processes, particularly for clinical and point-of-care applications U.S. Food and Drug Administration.

- Expand Strategic Partnerships: Form alliances with academic institutions, healthcare providers, and industry leaders to accelerate innovation and market adoption.

- Focus on Cost Reduction and Scalability: Invest in scalable manufacturing processes and cost-effective materials to facilitate widespread adoption, especially in resource-limited settings.

In summary, the optofluidic biosensor market in 2025 is set for robust growth, underpinned by technological innovation and expanding use cases. Companies that prioritize R&D, regulatory strategy, and ecosystem partnerships will be best positioned to capture value in this dynamic landscape.

Sources & References

- MarketsandMarkets

- imec

- Carl Zeiss AG

- Grand View Research

- MIT

- Nature Publishing Group

- IBM

- Microsoft

- Illumina

- Fortune Business Insights

- Thermo Fisher Scientific

- Luxmux Technology

- Siemens Healthineers

- National Institutes of Health

- Shimadzu Corporation

- Huawei Technologies

- European Commission

- World Intellectual Property Organization (WIPO)