SES Makes Power Move: Aerospace Veteran Elisabeth Pataki Named CFO as Satellite War Heats Up in 2025

SES appoints Elisabeth Pataki as CFO to steer its $3.1B Intelsat takeover, setting up a fierce showdown with Starlink in a high-stakes satellite market.

- New CFO Start Date: June 16, 2025

- Intelsat Acquisition Value: $3.1 Billion

- Total SES Debt (2024): Over $5 Billion

- Latest CDS Spread: 235 Basis Points

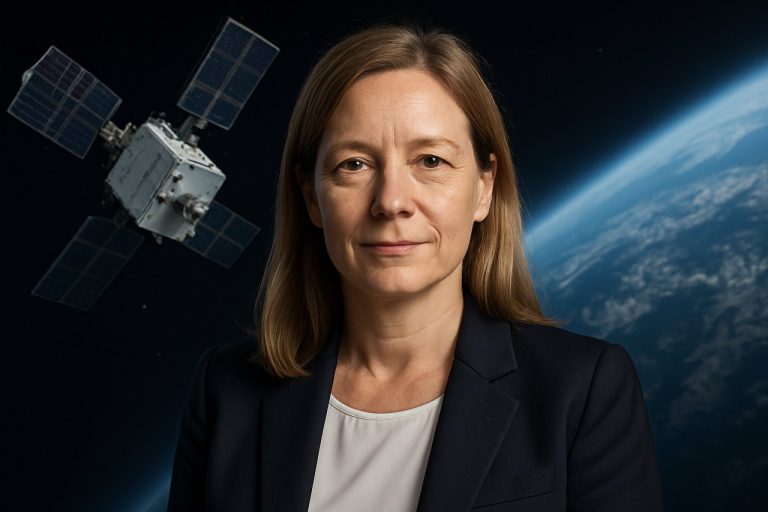

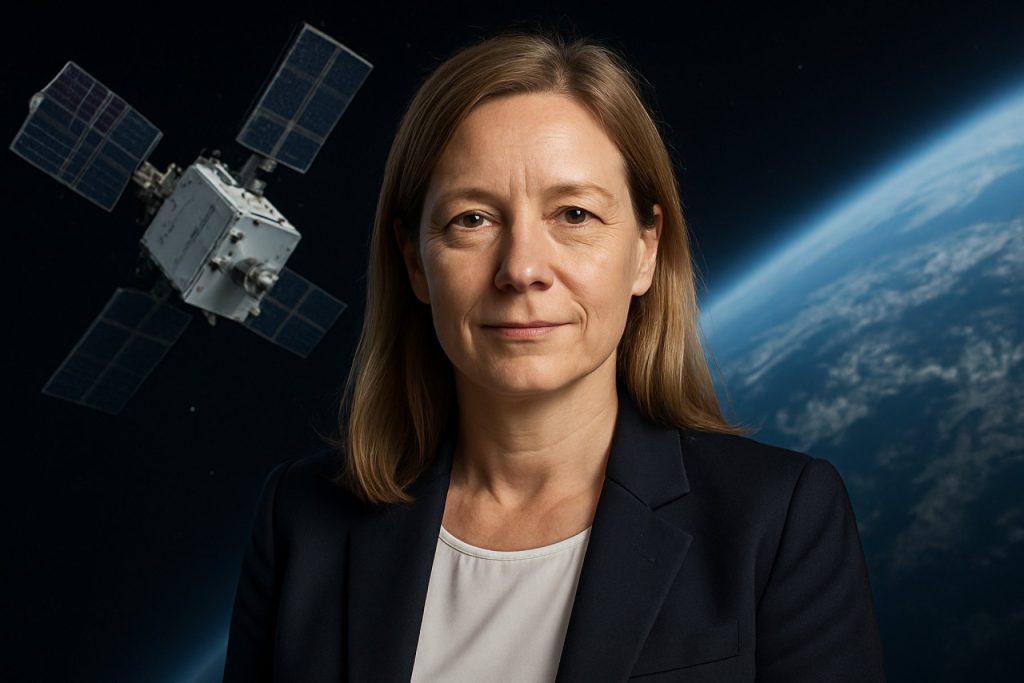

SES, one of Europe’s satellite powerhouses, just made headlines by appointing seasoned aerospace and defense executive Elisabeth Pataki as Chief Financial Officer. Pataki, who previously steered finances at L3Harris’s Aerojet Rocketdyne unit, takes the SES CFO baton on June 16, 2025, right as the company pulls the trigger on a $3.1 billion mega-acquisition of U.S. rival Intelsat.

This seismic boardroom shake-up comes as the skies above are getting crowded and competition, especially from Elon Musk’s SpaceX-owned Starlink, intensifies. The satellite-broadband industry is undergoing rapid transformation, and SES is fighting to keep its orbit.

Who Is Elisabeth Pataki, SES’s New Financial Navigator?

Elisabeth Pataki brings a battle-tested resume to the SES top team. As the outgoing CFO of Aerojet Rocketdyne, a key L3Harris arm, she orchestrated complex mergers and acquisitions, seamlessly integrating businesses even under fierce industry pressure.

SES CEO Adel Al-Saleh highlights Pataki’s ability to steer high-stakes deals—a critical skill as SES integrates Intelsat and faces multi-billion-dollar balance sheet challenges. As the company retools its strategy, Pataki’s blend of financial acumen and deal-making experience puts her squarely in the hot seat to guide SES through one of its most crucial years ever.

Why Is SES Buying Intelsat—and How Will It Change the Satellite Game?

SES’s $3.1 billion bid for Intelsat isn’t just another merger. It’s a calculated strike to bulk up and confront new market realities as rival operators like Starlink rewrite the rules with mega-constellations and direct-to-device services.

The Intelsat merger, already fully financed and on track for regulatory approval by European antitrust authorities, creates one of the largest non-U.S. satellite fleets and opens new doors in global connectivity, media distribution, and government contracts.

Industry experts at Reuters and Bloomberg say the deal’s massive scale could redefine cross-continental broadband—if SES navigates the financial headwinds.

Can SES Withstand Rising Debt and Starlink’s Pressure?

But big opportunities come with big risks. SES now carries more than $5 billion in total debt, and its five-year credit default swaps hit a record earlier this year, signaling that financial markets are watching closely. The current CDS spread at 235 basis points means investors are wary; the perception of SES default risk has spiked in the face of aggressive Starlink expansion and industry upheaval.

SES must now implement razor-sharp cost controls, swiftly capture synergies from the Intelsat deal, and launch innovative satellite services to outmaneuver Starlink’s relentless advance.

How Will This Move Impact the Satellite Internet Market in 2025?

With Pataki at the financial helm and the Intelsat integration underway, SES aims to accelerate innovation, stabilize its finances, and win back investor confidence. The eyes of the satellite industry are on SES as 2025 shapes up to be a make-or-break year.

Rivals like Starlink and Eutelsat aren’t slowing down. Expect more consolidation and technology one-upmanship as the race toward universal coverage reaches fever pitch.

What Comes Next for SES, Pataki, and Satellite Broadband?

SES’s gamble is clear: double down on scale, bring in top-tier financial leadership, and launch bold new services. The question is whether this high-risk, high-reward strategy will pay off before Starlink extends its lead even further.

Stay tuned as SES redraws the satellite broadband map—sign up for updates on the next big move in space telecom!

Actionable Summary: Are You Tracking the Satellite Shake-Up?

- Watch for Elisabeth Pataki’s official CFO transition on June 16.

- Follow regulatory approval updates for the Intelsat merger.

- Monitor SES and Starlink’s competitive moves in the satellite internet sector.

- Check market indicators like SES’s credit default swaps for ongoing financial health signals.