Mass Spectrometry Imaging Systems in 2025: Transforming Biomedical Research and Diagnostics. Explore the Innovations, Market Dynamics, and Future Growth Trajectory of This High-Impact Technology.

- Executive Summary: Key Insights for 2025 and Beyond

- Market Size and Growth Forecast (2025–2030): CAGR and Revenue Projections

- Technological Advancements: Next-Gen Imaging and Analytical Capabilities

- Major Players and Competitive Landscape (e.g., bruker.com, waters.com, thermo.com)

- Emerging Applications: From Oncology to Drug Discovery

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Regulatory Environment and Industry Standards (e.g., msacl.org, fda.gov)

- Challenges and Barriers: Cost, Complexity, and Data Management

- Investment Trends and Strategic Partnerships

- Future Outlook: Innovations, Market Drivers, and Long-Term Opportunities

- Sources & References

Executive Summary: Key Insights for 2025 and Beyond

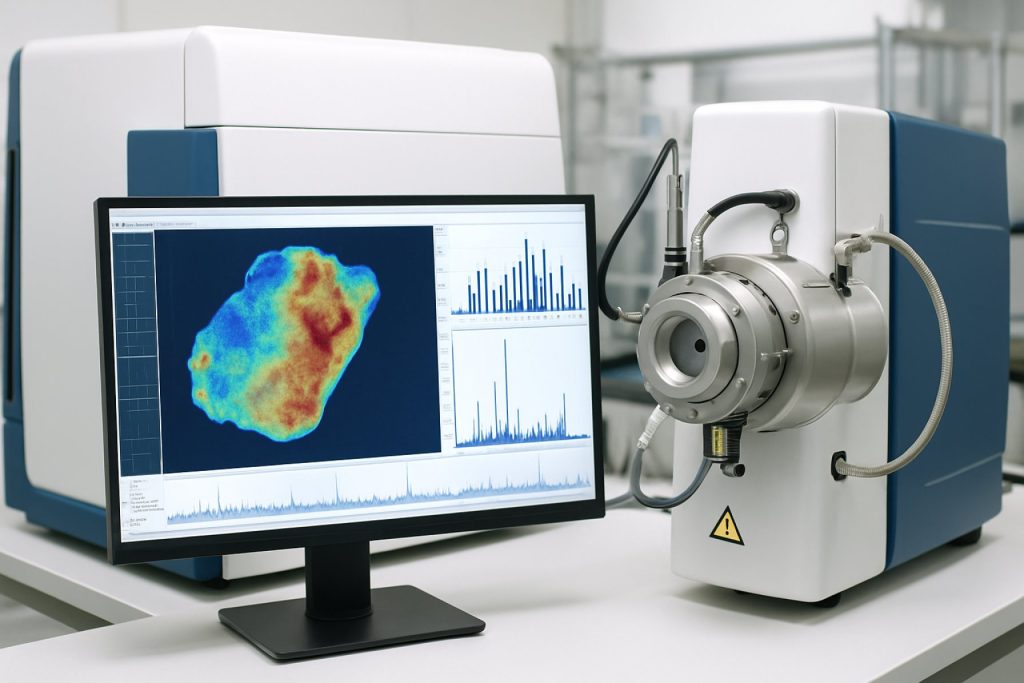

Mass spectrometry imaging (MSI) systems are poised for significant advancements and broader adoption in 2025 and the coming years, driven by technological innovation, expanding application areas, and increased investment from both public and private sectors. MSI enables spatially resolved molecular analysis of biological and material samples, making it indispensable in fields such as pharmaceutical research, clinical diagnostics, biomarker discovery, and materials science.

Key industry leaders, including Bruker Corporation, Thermo Fisher Scientific, Agilent Technologies, and Shimadzu Corporation, continue to invest heavily in R&D to enhance the sensitivity, spatial resolution, and throughput of their MSI platforms. For example, Bruker’s MALDI-TOF/TOF and MALDI-FTICR systems are widely recognized for their high spatial resolution and mass accuracy, supporting advanced research in tissue imaging and drug distribution studies. Thermo Fisher Scientific’s portfolio includes Orbitrap-based imaging systems, which are increasingly adopted for their high mass resolution and compatibility with complex biological samples.

Recent years have seen a surge in the integration of artificial intelligence (AI) and machine learning algorithms into MSI workflows, enabling more efficient data analysis and interpretation. This trend is expected to accelerate, with companies like Agilent Technologies and Shimadzu Corporation developing software solutions that streamline image processing and facilitate multi-omics integration. The convergence of MSI with other imaging modalities, such as optical and electron microscopy, is also anticipated to expand, offering researchers richer, multi-dimensional datasets.

On the regulatory and clinical front, MSI is gaining traction as a tool for digital pathology and personalized medicine. The ability to map drug and metabolite distributions at the cellular level is particularly valuable for oncology and neuroscience research. As regulatory agencies increasingly recognize the value of MSI data, adoption in clinical settings is expected to rise, especially in Europe and North America.

Looking ahead, the MSI market is expected to benefit from growing demand in pharmaceutical development, biomarker validation, and translational research. The entry of new players and collaborations between instrument manufacturers and academic institutions are likely to foster innovation and lower barriers to adoption. As a result, mass spectrometry imaging systems are set to play a pivotal role in the next generation of molecular diagnostics and precision medicine.

Market Size and Growth Forecast (2025–2030): CAGR and Revenue Projections

The global market for Mass Spectrometry Imaging (MSI) systems is poised for robust growth between 2025 and 2030, driven by expanding applications in pharmaceutical research, clinical diagnostics, and life sciences. As of 2025, the market is estimated to be valued in the low single-digit billions (USD), with leading industry participants reporting strong order books and ongoing investments in R&D. The compound annual growth rate (CAGR) for MSI systems is projected to range between 7% and 10% over the next five years, reflecting both technological advancements and increasing adoption across academic, industrial, and clinical settings.

Key players such as Bruker Corporation, Thermo Fisher Scientific, and Agilent Technologies continue to dominate the market, each offering a portfolio of high-resolution MSI platforms tailored for diverse research and diagnostic needs. Bruker Corporation is recognized for its MALDI-TOF and MALDI-FTMS systems, which are widely used in biomarker discovery and spatial omics. Thermo Fisher Scientific provides advanced Orbitrap-based imaging solutions, while Agilent Technologies focuses on integrating mass spectrometry with innovative sample preparation and data analysis workflows.

The market outlook is further strengthened by the increasing prevalence of chronic diseases, which is fueling demand for advanced tissue imaging and molecular pathology tools. Pharmaceutical and biotechnology companies are investing in MSI to accelerate drug discovery and development, particularly in the context of precision medicine and targeted therapies. Additionally, government and academic funding for spatial biology and multi-omics research is expected to sustain market momentum through 2030.

Geographically, North America and Europe are anticipated to maintain their leadership positions due to established research infrastructure and early adoption of cutting-edge analytical technologies. However, the Asia-Pacific region is projected to exhibit the fastest CAGR, supported by expanding healthcare investments, growing pharmaceutical manufacturing, and rising academic research output.

- 2025 market size: Estimated in the low single-digit billions (USD)

- 2025–2030 CAGR: Projected at 7–10%

- Key drivers: Pharmaceutical R&D, clinical diagnostics, spatial omics, and government funding

- Leading companies: Bruker Corporation, Thermo Fisher Scientific, Agilent Technologies

Looking ahead, the MSI systems market is expected to benefit from ongoing instrument innovation, automation, and integration with artificial intelligence for data analysis, further expanding its reach and impact across biomedical and industrial domains.

Technological Advancements: Next-Gen Imaging and Analytical Capabilities

Mass spectrometry imaging (MSI) systems are undergoing rapid technological evolution, with 2025 marking a pivotal year for next-generation imaging and analytical capabilities. The sector is witnessing a convergence of hardware innovation, software sophistication, and integration with complementary modalities, all aimed at enhancing spatial resolution, sensitivity, and throughput.

A major trend is the refinement of high-resolution mass analyzers, such as Orbitrap and time-of-flight (TOF) platforms, which are now being engineered for faster acquisition rates and improved mass accuracy. Thermo Fisher Scientific has introduced advanced Orbitrap-based systems that enable sub-cellular spatial resolution, supporting applications in tissue pathology and drug distribution studies. Similarly, Bruker continues to expand its MALDI-TOF and MALDI-TOF/TOF portfolio, with recent launches focusing on higher speed and enhanced imaging depth, facilitating large-scale biomarker discovery and molecular histology.

Another significant advancement is the integration of ion mobility spectrometry (IMS) with MSI platforms. This hybridization, championed by companies like Waters Corporation, allows for the separation of isobaric and isomeric species, providing an additional dimension of molecular information. The result is more confident identification of complex biomolecules in heterogeneous samples, a capability increasingly demanded in pharmaceutical and clinical research.

Automation and artificial intelligence (AI) are also reshaping the MSI landscape. Automated sample preparation and robotic spotting systems are reducing variability and increasing throughput, while AI-driven image analysis tools are enabling more precise interpretation of spatial molecular data. Shimadzu Corporation has incorporated machine learning algorithms into its imaging software suites, streamlining the workflow from data acquisition to actionable insights.

Looking ahead, the next few years are expected to see further miniaturization of MSI instruments, making them more accessible for in situ and point-of-care applications. There is also a growing emphasis on multimodal imaging, where MSI is combined with optical or fluorescence microscopy to provide comprehensive molecular and morphological information. Industry leaders are investing in open-source data formats and cloud-based platforms to facilitate data sharing and collaborative research, as seen in initiatives supported by Agilent Technologies.

In summary, 2025 and the near future will be characterized by MSI systems that are faster, more sensitive, and increasingly integrated with digital and multimodal technologies. These advancements are poised to accelerate discoveries in life sciences, personalized medicine, and beyond.

Major Players and Competitive Landscape (e.g., bruker.com, waters.com, thermo.com)

The competitive landscape of the mass spectrometry imaging (MSI) systems market in 2025 is characterized by a concentration of established analytical instrumentation companies, each leveraging decades of expertise in mass spectrometry and related technologies. The sector is marked by ongoing innovation, strategic partnerships, and a focus on expanding application areas such as clinical research, pharmaceuticals, and life sciences.

Bruker Corporation remains a dominant force in MSI, with its rapifleX MALDI Tissuetyper and scimaX MRMS platforms widely adopted in both research and clinical settings. Bruker’s systems are recognized for their high spatial resolution and throughput, supporting applications from biomarker discovery to drug distribution studies. The company continues to invest in software enhancements and workflow automation, aiming to streamline data analysis and interpretation for end-users. Bruker’s global presence and dedicated support infrastructure further solidify its leadership position (Bruker Corporation).

Waters Corporation is another key player, known for its Synapt G2-Si and MALDI SYNAPT HDMS platforms, which integrate ion mobility separation with mass spectrometry imaging. Waters emphasizes the versatility of its systems, enabling detailed molecular mapping in complex biological samples. The company’s focus on user-friendly interfaces and robust data management tools has broadened its appeal across academic and industrial laboratories. Waters also actively collaborates with research institutions to advance MSI methodologies and expand its application portfolio (Waters Corporation).

Thermo Fisher Scientific is a global leader in analytical instrumentation, offering MSI solutions such as the Orbitrap-based mass spectrometers. Thermo Fisher’s systems are lauded for their high mass accuracy and sensitivity, supporting advanced imaging workflows in proteomics, metabolomics, and pharmaceutical research. The company’s commitment to innovation is evident in its continuous product updates and integration of artificial intelligence for data processing. Thermo Fisher’s extensive distribution network and comprehensive service offerings enhance its competitive edge (Thermo Fisher Scientific).

Other notable participants include Shimadzu Corporation, which offers MALDI-based imaging platforms with a focus on clinical and pharmaceutical applications, and JEOL Ltd., recognized for its high-resolution mass spectrometers tailored for imaging. Both companies are expanding their MSI portfolios through technological upgrades and strategic collaborations (Shimadzu Corporation; JEOL Ltd.).

Looking ahead, the competitive landscape is expected to intensify as companies invest in higher spatial resolution, faster acquisition speeds, and enhanced data analytics. Strategic alliances, particularly with software developers and clinical research organizations, are likely to shape the next phase of growth in the MSI systems market.

Emerging Applications: From Oncology to Drug Discovery

Mass spectrometry imaging (MSI) systems are rapidly expanding their footprint across a spectrum of biomedical and pharmaceutical applications, with 2025 marking a pivotal year for their integration into both research and clinical workflows. The technology’s ability to spatially resolve molecular distributions in tissue sections without the need for labeling has positioned it as a transformative tool, particularly in oncology and drug discovery.

In oncology, MSI is increasingly leveraged for tumor heterogeneity analysis, biomarker discovery, and the mapping of drug distribution within tissues. Recent advancements in high-resolution and high-throughput MSI platforms, such as those developed by Bruker and Thermo Fisher Scientific, have enabled researchers to visualize and quantify hundreds of biomolecules simultaneously. These capabilities are being translated into clinical research, where MSI is used to differentiate tumor subtypes, predict therapeutic response, and guide surgical margins in real time. For example, Bruker’s MALDI imaging systems are now routinely employed in translational cancer studies, and the company is actively collaborating with academic medical centers to validate MSI-based diagnostics.

Drug discovery and development pipelines are also being reshaped by MSI. The technology allows for direct visualization of drug and metabolite localization in tissues, providing critical insights into pharmacokinetics and pharmacodynamics. Companies such as Shimadzu Corporation and JEOL Ltd. have introduced MSI platforms tailored for pharmaceutical research, supporting applications from early-stage compound screening to late-stage toxicology studies. These systems are increasingly integrated with automated sample preparation and data analysis workflows, accelerating the pace of preclinical studies and reducing the reliance on animal models.

Beyond oncology and drug discovery, emerging applications in neurology, infectious disease, and metabolic research are gaining momentum. MSI is being used to map neurotransmitter distributions in brain tissue, track pathogen spread in infected organs, and profile lipid metabolism in metabolic disorders. The flexibility of MSI platforms from leading manufacturers, including Agilent Technologies, is enabling researchers to adapt the technology to a wide array of biological questions.

Looking ahead, the next few years are expected to see further integration of MSI with artificial intelligence and digital pathology, enhancing data interpretation and clinical decision-making. Industry leaders are investing in cloud-based data management and collaborative platforms, aiming to standardize MSI workflows and facilitate multi-center studies. As regulatory frameworks evolve and validation studies mature, MSI is poised to transition from a primarily research-focused tool to a routine component of clinical diagnostics and personalized medicine.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global landscape for mass spectrometry imaging (MSI) systems in 2025 is characterized by dynamic regional trends, with North America, Europe, Asia-Pacific, and the Rest of World (RoW) each exhibiting distinct growth drivers and adoption patterns. These differences are shaped by factors such as research funding, healthcare infrastructure, regulatory environments, and the presence of leading manufacturers.

- North America: North America, particularly the United States, remains at the forefront of MSI system adoption and innovation. The region benefits from robust investments in biomedical research, a strong pharmaceutical sector, and a concentration of leading academic institutions. Major manufacturers such as Thermo Fisher Scientific and Agilent Technologies are headquartered in the US, driving local development and deployment of advanced MSI platforms. The National Institutes of Health (NIH) and other federal agencies continue to fund large-scale projects utilizing MSI for disease biomarker discovery and drug development. In 2025, North America is expected to maintain its leadership, with increasing integration of MSI in clinical research and translational medicine.

- Europe: Europe is a significant hub for MSI research, supported by collaborative networks and public funding from entities such as the European Union. Countries like Germany, the UK, and France host prominent research centers and universities actively employing MSI technologies. Companies such as Bruker (Germany) and Waters Corporation (UK/US) play pivotal roles in supplying advanced MSI systems to the region. The European market is also characterized by a strong emphasis on regulatory compliance and standardization, which is expected to drive further adoption in pharmaceutical quality control and clinical diagnostics through 2025 and beyond.

- Asia-Pacific: The Asia-Pacific region is experiencing rapid growth in MSI adoption, fueled by expanding pharmaceutical and biotechnology sectors, increasing healthcare expenditure, and government initiatives to boost life sciences research. Japan and China are leading the region, with significant investments in research infrastructure and a growing number of collaborations with global instrument manufacturers. Companies such as Shimadzu Corporation (Japan) and JEOL Ltd. (Japan) are prominent regional suppliers, while international players are also expanding their presence. The outlook for Asia-Pacific is robust, with double-digit growth rates anticipated in the next few years as MSI becomes more accessible and integrated into clinical and pharmaceutical workflows.

- Rest of World (RoW): In regions outside the major markets, including Latin America, the Middle East, and Africa, MSI adoption is at an earlier stage but is gradually increasing. Growth is driven by rising awareness of advanced analytical technologies and efforts to modernize healthcare and research infrastructure. While local manufacturing is limited, global suppliers such as Thermo Fisher Scientific and Agilent Technologies are expanding distribution and support networks to tap into emerging opportunities. Over the next few years, RoW is expected to see steady, albeit moderate, growth as barriers to entry decrease and local expertise develops.

Overall, the regional outlook for mass spectrometry imaging systems in 2025 and the near future is positive, with North America and Europe maintaining leadership in innovation and adoption, while Asia-Pacific emerges as a high-growth market and RoW gradually expands its footprint in the sector.

Regulatory Environment and Industry Standards (e.g., msacl.org, fda.gov)

The regulatory environment and industry standards for Mass Spectrometry Imaging (MSI) systems are evolving rapidly as these technologies gain traction in clinical diagnostics, pharmaceutical research, and biomarker discovery. In 2025, regulatory agencies and industry consortia are focusing on harmonizing protocols, ensuring data integrity, and establishing clear pathways for clinical adoption.

In the United States, the U.S. Food and Drug Administration (FDA) continues to play a pivotal role in shaping the regulatory landscape for MSI systems. The FDA classifies most MSI instruments as Class I or II medical devices, depending on their intended use, and requires manufacturers to comply with Quality System Regulations (QSR) and, where applicable, premarket notification (510(k)) or premarket approval (PMA) processes. In recent years, the FDA has increased its engagement with stakeholders to clarify requirements for software-driven analysis and the integration of MSI data into clinical workflows, reflecting the growing importance of digital pathology and artificial intelligence in this field.

Internationally, the International Organization for Standardization (ISO) and the Clinical and Laboratory Standards Institute (CLSI) are actively developing and updating standards relevant to MSI, such as ISO 15189 for medical laboratories and ISO/IEC 17025 for testing and calibration. These standards emphasize traceability, reproducibility, and robust quality management systems, which are critical for the acceptance of MSI data in regulated environments.

Industry-driven initiatives are also shaping best practices. The Association for Mass Spectrometry: Applications to the Clinical Lab (MSACL) continues to serve as a key forum for the discussion and dissemination of guidelines, validation protocols, and proficiency testing schemes. MSACL’s annual conferences in North America and Europe bring together instrument manufacturers, clinical laboratories, and regulatory experts to address challenges such as sample preparation standardization, data format interoperability, and the validation of new imaging modalities.

Leading manufacturers, including Bruker, Thermo Fisher Scientific, and Agilent Technologies, are actively collaborating with regulatory bodies and standards organizations to ensure their MSI platforms meet evolving requirements. These companies are investing in compliance infrastructure, supporting open data standards, and participating in working groups to facilitate the clinical translation of MSI technologies.

Looking ahead, the next few years are expected to see further alignment of global regulatory frameworks, increased emphasis on software validation, and the emergence of new standards for high-throughput and multiplexed MSI applications. As MSI systems become more integrated into clinical and pharmaceutical workflows, robust regulatory oversight and harmonized standards will be essential to ensure data quality, patient safety, and widespread adoption.

Challenges and Barriers: Cost, Complexity, and Data Management

Mass spectrometry imaging (MSI) systems are at the forefront of spatially resolved molecular analysis, but their broader adoption in research and clinical settings continues to be hampered by several persistent challenges. As of 2025, the most significant barriers include high system costs, operational complexity, and the management of vast and intricate datasets.

The initial investment required for advanced MSI platforms remains substantial. Leading manufacturers such as Bruker, Thermo Fisher Scientific, and Shimadzu Corporation offer state-of-the-art instruments, but these systems often cost several hundred thousand dollars, with high-end models exceeding one million dollars depending on configuration and capabilities. This price point restricts access primarily to well-funded academic institutions, core facilities, and pharmaceutical companies, limiting the technology’s penetration into smaller laboratories and clinical environments.

Operational complexity is another major hurdle. MSI workflows require expertise in sample preparation, instrument calibration, and data acquisition. The integration of multiple ionization techniques (such as MALDI, DESI, and SIMS) and the need for precise spatial resolution demand highly trained personnel. Companies like Bruker and Thermo Fisher Scientific have responded by developing more user-friendly interfaces and partially automated workflows, but the learning curve remains steep for new users. Additionally, the lack of standardized protocols across platforms complicates reproducibility and cross-laboratory comparisons.

Data management represents a growing challenge as MSI generates extremely large and complex datasets. A single experiment can produce terabytes of spatially resolved molecular information, necessitating robust computational infrastructure for storage, processing, and analysis. The need for advanced software solutions is acute; while vendors such as Bruker and Thermo Fisher Scientific provide proprietary analysis tools, interoperability and scalability remain issues. The development of open-source platforms and cloud-based solutions is underway, but widespread adoption is still in its early stages.

Looking ahead, the industry is expected to focus on reducing costs through modular system designs and increased automation, as well as on improving data handling capabilities. Collaborative efforts between instrument manufacturers, software developers, and research consortia are likely to accelerate the standardization of protocols and the creation of interoperable data formats. However, overcoming these barriers will require sustained investment and cross-sector collaboration over the next several years.

Investment Trends and Strategic Partnerships

The mass spectrometry imaging (MSI) systems sector is experiencing a dynamic phase of investment and strategic partnership activity as of 2025, driven by the growing demand for advanced spatial omics, pharmaceutical R&D, and clinical diagnostics. Major instrument manufacturers and technology developers are actively expanding their portfolios and global reach through targeted investments, collaborations, and acquisitions.

Key industry leaders such as Bruker Corporation, Thermo Fisher Scientific, and Agilent Technologies continue to allocate significant resources to MSI innovation. Bruker Corporation has notably increased its investment in MALDI imaging platforms, integrating artificial intelligence and automation to enhance throughput and data analysis. In 2024 and early 2025, Bruker announced new partnerships with academic medical centers and pharmaceutical companies to co-develop next-generation imaging workflows, aiming to accelerate biomarker discovery and drug development.

Thermo Fisher Scientific has focused on expanding its MSI capabilities through both organic R&D and strategic acquisitions. The company’s recent collaborations with biopharma firms and contract research organizations (CROs) are designed to integrate MSI into multi-omics pipelines, supporting precision medicine initiatives. Thermo Fisher’s investment in cloud-based data management and remote analysis tools is also facilitating broader adoption of MSI in decentralized research environments.

Meanwhile, Agilent Technologies has strengthened its position in the MSI market by forming alliances with software developers and imaging specialists. These partnerships are aimed at improving the interoperability of MSI systems with digital pathology and laboratory information management systems (LIMS), a key requirement for clinical and translational research applications.

Emerging players and specialized firms are also attracting venture capital and strategic funding. Companies such as Shimadzu Corporation and JEOL Ltd. are investing in high-resolution and high-throughput MSI platforms, targeting both academic and industrial users. In parallel, several start-ups are entering the field with novel ionization techniques and miniaturized imaging systems, often supported by partnerships with established instrument manufacturers.

Looking ahead, the next few years are expected to see continued consolidation and cross-sector collaboration, particularly as MSI technologies become more integrated with genomics, proteomics, and digital health platforms. Strategic partnerships between instrument vendors, software companies, and healthcare providers will likely accelerate the translation of MSI from research to routine clinical practice, further stimulating investment and innovation in the sector.

Future Outlook: Innovations, Market Drivers, and Long-Term Opportunities

The future outlook for mass spectrometry imaging (MSI) systems in 2025 and the coming years is shaped by rapid technological innovation, expanding application domains, and increasing demand for high-resolution, label-free molecular imaging. Key drivers include the need for advanced spatially resolved molecular analysis in pharmaceutical research, clinical diagnostics, and life sciences, as well as the integration of artificial intelligence (AI) and automation to enhance data interpretation and throughput.

Technological advancements are expected to focus on improving spatial resolution, sensitivity, and speed. Leading manufacturers such as Bruker Corporation and Thermo Fisher Scientific are investing in next-generation instruments that offer sub-cellular resolution and faster acquisition rates. For example, Bruker’s MALDI-2 technology and Thermo Fisher’s Orbitrap-based platforms are being refined to deliver higher sensitivity and more comprehensive molecular coverage, supporting applications from drug distribution studies to biomarker discovery.

Automation and AI-driven data analysis are poised to address one of the major bottlenecks in MSI: the complexity and volume of data generated. Companies like Waters Corporation are developing integrated software solutions that streamline data processing, visualization, and interpretation, making MSI more accessible to non-expert users and enabling high-throughput workflows. This trend is expected to accelerate as laboratories seek to maximize productivity and reproducibility.

The clinical adoption of MSI is anticipated to grow, particularly in pathology and personalized medicine. The ability of MSI to provide spatially resolved molecular information without the need for labels or antibodies positions it as a powerful complement to traditional histology. Regulatory progress and validation studies, often in collaboration with academic medical centers and industry partners, are likely to drive the translation of MSI from research to routine clinical practice.

Geographically, North America and Europe are expected to remain at the forefront of MSI innovation and adoption, supported by strong research infrastructure and funding. However, increasing investment in biomedical research in Asia-Pacific, particularly in China and Japan, is likely to expand the global market and foster new collaborations.

- Continued miniaturization and portability of MSI systems are anticipated, enabling point-of-care and intraoperative applications.

- Emerging modalities, such as ambient ionization techniques and multimodal imaging, will broaden the scope of MSI in both research and clinical settings.

- Strategic partnerships between instrument manufacturers, software developers, and healthcare providers will be crucial for driving innovation and market penetration.

Overall, the next few years are set to witness significant growth and transformation in the MSI sector, with leading companies like Bruker Corporation, Thermo Fisher Scientific, and Waters Corporation playing pivotal roles in shaping the future landscape.

Sources & References

- Bruker Corporation

- Thermo Fisher Scientific

- Shimadzu Corporation

- JEOL Ltd.

- International Organization for Standardization

- Clinical and Laboratory Standards Institute