Revolutionizing Gastrointestinal Surgery: How Endoluminal Robotics Will Transform Patient Outcomes and Market Dynamics in 2025 and Beyond. Explore the Breakthroughs, Key Players, and Forecasted Growth Shaping the Next Era of Minimally Invasive GI Procedures.

- Executive Summary: Key Trends and Market Drivers in 2025

- Market Size and Growth Forecast (2025–2030): CAGR and Revenue Projections

- Technological Innovations: Robotics Platforms and Endoluminal Tools

- Clinical Applications: Expanding Indications in GI Surgery

- Competitive Landscape: Leading Companies and Strategic Alliances

- Regulatory Pathways and Reimbursement Trends

- Adoption Barriers and Enablers: Training, Workflow, and Cost

- Case Studies: Real-World Deployments and Patient Outcomes

- Future Outlook: Emerging Technologies and Next-Gen Robotics

- Appendix: Company Profiles and Official Resources

- Sources & References

Executive Summary: Key Trends and Market Drivers in 2025

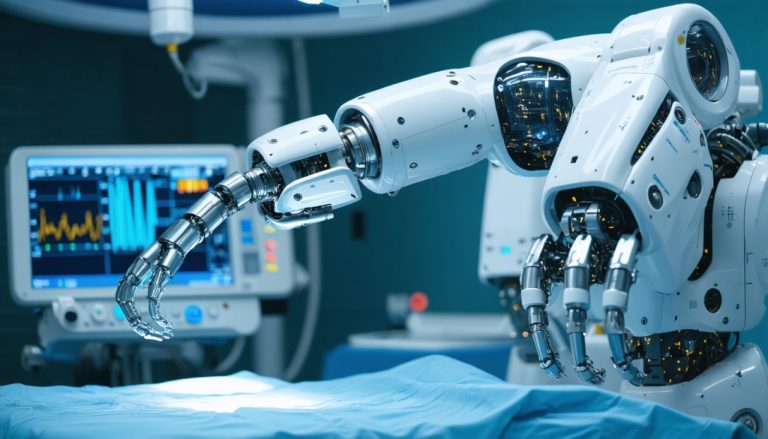

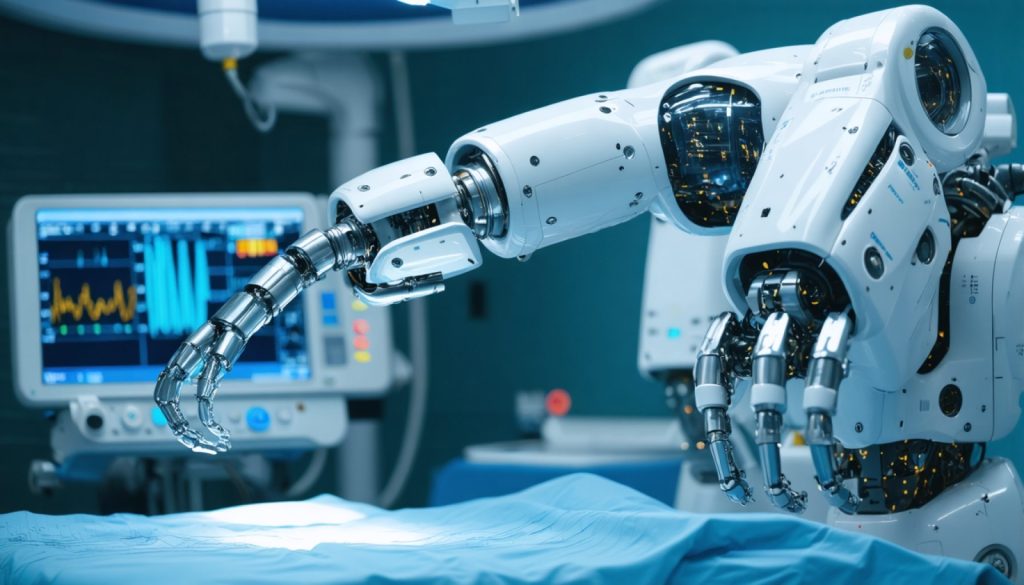

The field of endoluminal robotics for gastrointestinal (GI) surgery is experiencing rapid evolution in 2025, driven by technological innovation, increasing clinical adoption, and a growing demand for minimally invasive procedures. Endoluminal robotic systems, designed to navigate and operate within the GI tract without external incisions, are transforming the landscape of digestive disease management. Key trends and market drivers shaping this sector in 2025 include advancements in robotic flexibility, improved imaging integration, and expanding indications for complex therapeutic interventions.

One of the most significant trends is the commercialization and clinical deployment of next-generation flexible robotic platforms. Companies such as Intuitive Surgical—renowned for its da Vinci systems—have expanded their focus to include endoluminal applications, leveraging their expertise in robotic-assisted surgery to develop systems tailored for GI endoscopy. Similarly, Medtronic is advancing its minimally invasive technologies, with ongoing development of robotic platforms that integrate high-definition imaging and precision instrumentation for endoluminal procedures.

Emerging players are also making notable contributions. EndoMaster, a Singapore-based company, has developed a robotic system specifically for endoscopic submucosal dissection (ESD) and other complex GI interventions, aiming to reduce procedure time and improve safety. Auris Health (a subsidiary of Johnson & Johnson) continues to innovate in flexible robotics, with its Monarch platform being adapted for GI applications, building on its initial success in bronchoscopy.

Market growth is further propelled by the rising incidence of GI cancers and the increasing preference for organ-preserving, minimally invasive treatments. Hospitals and ambulatory surgery centers are investing in robotic endoluminal systems to enhance patient outcomes, reduce recovery times, and address the shortage of highly skilled endoscopists. Regulatory approvals in the US, Europe, and Asia are accelerating, with several systems receiving CE Mark and FDA clearances for expanded indications in 2024 and 2025.

Looking ahead, the next few years are expected to see broader adoption of endoluminal robotics, with ongoing clinical trials and real-world evidence supporting their efficacy and safety. Integration of artificial intelligence for navigation and decision support, as well as interoperability with digital health platforms, will further drive innovation. Strategic partnerships between device manufacturers, healthcare providers, and research institutions are anticipated to accelerate the translation of these technologies from research to routine clinical practice, solidifying endoluminal robotics as a cornerstone of advanced GI surgery.

Market Size and Growth Forecast (2025–2030): CAGR and Revenue Projections

The market for endoluminal robotics in gastrointestinal (GI) surgery is poised for significant expansion between 2025 and 2030, driven by technological advancements, increasing adoption of minimally invasive procedures, and a growing prevalence of GI diseases globally. As of 2025, the sector is transitioning from early clinical adoption to broader commercialization, with several key players actively scaling up production and distribution.

Current estimates from industry sources and company disclosures suggest that the global market size for endoluminal robotic systems dedicated to GI surgery is expected to surpass $500 million in 2025, with projections indicating a compound annual growth rate (CAGR) ranging from 18% to 25% through 2030. This robust growth is underpinned by the increasing clinical validation of robotic platforms, expanding regulatory approvals, and rising demand for advanced endoscopic interventions that reduce patient recovery times and hospital stays.

Leading companies such as Intuitive Surgical, renowned for its da Vinci platform, are investing in next-generation flexible robotic systems tailored for endoluminal applications. Meanwhile, Medtronic is advancing its Hugo™ robotic-assisted surgery system, with a focus on expanding indications to include complex GI procedures. Olympus Corporation is also a prominent player, leveraging its expertise in endoscopy to develop robotic solutions that integrate seamlessly with existing GI workflows.

Emerging innovators such as Asensus Surgical (formerly TransEnterix) are introducing digital laparoscopy and AI-driven robotic platforms, aiming to enhance precision and reproducibility in endoluminal interventions. Additionally, EndoMaster and Medrobotics are commercializing flexible robotic systems specifically designed for natural orifice transluminal endoscopic surgery (NOTES) and other advanced GI procedures.

The outlook for 2025–2030 is characterized by increasing hospital adoption, especially in North America, Europe, and parts of Asia-Pacific, where healthcare systems are investing in minimally invasive technologies to improve patient outcomes and operational efficiency. As more clinical data emerges supporting the safety and efficacy of endoluminal robotics, reimbursement frameworks are expected to evolve, further accelerating market penetration.

In summary, the endoluminal robotics market for GI surgery is set for rapid growth, with revenue projections likely to exceed $1.5 billion by 2030 if current trends continue. The sector’s trajectory will be shaped by ongoing innovation, regulatory milestones, and the ability of manufacturers to demonstrate clear clinical and economic value to healthcare providers.

Technological Innovations: Robotics Platforms and Endoluminal Tools

The field of endoluminal robotics for gastrointestinal (GI) surgery is experiencing rapid technological advancement, with 2025 marking a pivotal year for the clinical adoption and refinement of robotic platforms and tools. These innovations are driven by the need for less invasive procedures, improved precision, and enhanced patient outcomes in the management of GI diseases, including early cancers, polyps, and complex lesions.

A leading player in this space is Intuitive Surgical, whose da Vinci platform, while primarily designed for laparoscopic surgery, has inspired the development of flexible, miniaturized robotic systems for endoluminal applications. The company continues to invest in research and development for next-generation flexible robotics, aiming to expand indications for GI interventions.

Another significant innovator is Medtronic, which has developed the GI Genius™ intelligent endoscopy module and is actively collaborating with robotics startups to integrate AI and robotics for advanced endoluminal procedures. Medtronic’s focus is on enhancing polyp detection and supporting complex endoscopic resections, with ongoing clinical trials in 2025 expected to broaden the clinical utility of these systems.

In Europe, Auris Health (a subsidiary of Johnson & Johnson) is advancing the Monarch™ Platform, a flexible robotic endoscopy system initially approved for bronchoscopy but now being adapted for GI applications. The Monarch system’s robotic arms and advanced visualization are designed to facilitate precise navigation and intervention within the GI tract, with pilot studies in 2025 targeting early esophageal and colorectal lesions.

Emerging companies such as EndoMaster are also making strides with their robotic-assisted endoscopic platforms, which enable complex endoluminal suturing and dissection. EndoMaster’s system, which received regulatory clearance in select Asian markets, is undergoing multicenter trials in 2025 to validate its efficacy for endoscopic submucosal dissection (ESD) and full-thickness resection.

Key technological trends in 2025 include the miniaturization of robotic arms, integration of haptic feedback, and the use of AI-driven navigation and lesion recognition. These advances are expected to reduce procedure times, minimize complications, and expand the range of treatable GI conditions. Industry collaborations between device manufacturers and academic centers are accelerating the translation of prototypes into clinical practice.

Looking ahead, the next few years will likely see the first large-scale, randomized studies comparing robotic endoluminal surgery to conventional endoscopy and laparoscopy. Regulatory approvals in the US, EU, and Asia are anticipated to increase, paving the way for broader adoption. As these platforms mature, the outlook for endoluminal robotics in GI surgery is one of continued innovation, with the potential to redefine standards of care for minimally invasive gastrointestinal interventions.

Clinical Applications: Expanding Indications in GI Surgery

Endoluminal robotics is rapidly transforming the landscape of gastrointestinal (GI) surgery, with 2025 marking a pivotal year for the expansion of clinical applications and indications. Traditionally, GI interventions such as polypectomy, endoscopic submucosal dissection (ESD), and full-thickness resection have been limited by the dexterity and reach of conventional endoscopic tools. Robotic platforms are now overcoming these barriers, enabling more complex, minimally invasive procedures within the GI tract.

One of the most prominent systems in this field is the Intuitive Surgical Ion and da Vinci platforms, which, while initially designed for laparoscopic surgery, are being adapted for endoluminal approaches. In parallel, dedicated endoluminal robotic systems such as the Flex Robotic System by Medrobotics and the Endomaster EASE System from EndoMaster are gaining regulatory clearances and entering clinical practice. These systems offer enhanced articulation, stability, and precision, allowing for the safe resection of early GI cancers, closure of perforations, and complex suturing tasks that were previously challenging or impossible with manual endoscopy.

Recent clinical studies and early commercial deployments in 2024–2025 have demonstrated the feasibility and safety of robotic endoluminal interventions for a growing range of indications. For example, robotic-assisted ESD and endoscopic full-thickness resection (EFTR) are being performed in the esophagus, stomach, and colon, with early data suggesting reduced procedure times and improved en bloc resection rates compared to conventional techniques. The Medrobotics Flex system, already in use for transoral and colorectal procedures, is expanding its indications to include more complex GI lesions, while EndoMaster is actively pursuing multicenter trials in Asia and Europe for robotic ESD and EFTR.

Looking ahead, the next few years are expected to see further expansion of endoluminal robotic indications, including the management of submucosal tumors, early-stage cancers, and even bariatric interventions. The integration of advanced imaging, artificial intelligence, and haptic feedback is anticipated to further enhance the capabilities of these platforms. Major manufacturers are investing in clinical research and partnerships with leading hospitals to validate new applications and secure broader regulatory approvals. As a result, endoluminal robotics is poised to become a standard of care for a wide array of GI surgical procedures, offering patients less invasive options with faster recovery and potentially better outcomes.

Competitive Landscape: Leading Companies and Strategic Alliances

The competitive landscape for endoluminal robotics in gastrointestinal (GI) surgery is rapidly evolving as established medtech giants and innovative startups race to commercialize next-generation platforms. As of 2025, the sector is characterized by a mix of FDA-cleared systems, ongoing clinical trials, and strategic alliances aimed at accelerating adoption and expanding indications.

Key Players and Technologies

- Intuitive Surgical remains a dominant force in surgical robotics, leveraging its da Vinci platform and expanding into flexible endoluminal applications. The company’s Ion endoluminal system, initially developed for lung biopsy, is being adapted for GI interventions, reflecting Intuitive’s commitment to broadening its minimally invasive portfolio (Intuitive Surgical).

- Medtronic has made significant strides with its GI Genius intelligent endoscopy module and continues to invest in robotic-assisted endoluminal technologies. Medtronic’s strategic collaborations with hospitals and research centers are aimed at integrating AI and robotics for enhanced polyp detection and therapeutic interventions (Medtronic).

- Johnson & Johnson (Ethicon) is advancing its Ottava robotic platform, with a focus on flexible robotics for endoluminal and natural orifice procedures. The company’s acquisition of Auris Health in 2019 brought the Monarch platform, which is being explored for GI applications, into its portfolio (Johnson & Johnson).

- EndoMaster, a Singapore-based company, has developed a robotic-assisted endoscopic system designed for complex GI procedures such as endoscopic submucosal dissection (ESD). The system is undergoing clinical evaluation in Asia and Europe, with commercialization efforts expected to intensify through 2025 (EndoMaster).

- Virtuoso Surgical and EndoTheia are among the emerging startups developing highly dexterous, miniaturized robotic tools for endoluminal surgery, targeting improved precision and reduced invasiveness.

Strategic Alliances and Collaborations

- Partnerships between device manufacturers and academic medical centers are accelerating clinical validation and workflow integration. For example, collaborations between Intuitive Surgical and leading hospitals are facilitating multi-center trials for new endoluminal indications.

- Cross-industry alliances, such as those between Medtronic and AI developers, are driving the convergence of robotics, imaging, and data analytics to enhance intraoperative decision-making.

Outlook

By 2025 and beyond, the competitive landscape is expected to intensify as more systems achieve regulatory milestones and enter global markets. Strategic alliances, technology licensing, and mergers and acquisitions will likely shape the sector, with a focus on expanding clinical indications, improving usability, and demonstrating cost-effectiveness. The next few years will be pivotal as endoluminal robotics transitions from early adoption to broader clinical integration in GI surgery.

Regulatory Pathways and Reimbursement Trends

The regulatory landscape for endoluminal robotics in gastrointestinal (GI) surgery is rapidly evolving as these technologies transition from research and early clinical adoption to broader commercial deployment. In 2025, regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are increasingly focused on establishing clear pathways for the approval of robotic endoluminal systems, balancing innovation with patient safety.

In the United States, the FDA continues to utilize the 510(k) premarket notification and De Novo classification processes for most endoluminal robotic platforms. Recent years have seen several notable clearances, including the Intuitive Surgical Ion endoluminal system for minimally invasive lung biopsy, which set precedents for similar GI applications. For GI-specific robotics, companies such as Medtronic and Olympus Corporation are actively engaging with the FDA to demonstrate substantial equivalence or novel device safety and efficacy, often through multi-center clinical trials. The FDA is also piloting new guidance for digital health and robotic-assisted surgical devices, which is expected to further clarify requirements for software validation, human factors, and post-market surveillance.

In Europe, the Medical Device Regulation (MDR) framework, fully implemented in 2021, governs the approval of endoluminal robotic systems. Companies must now provide more robust clinical evidence and post-market data, which has led to increased collaboration between manufacturers and notified bodies. Medtronic and Intuitive Surgical have both reported ongoing MDR conformity assessments for their next-generation endoluminal platforms. The United Kingdom’s Medicines and Healthcare products Regulatory Agency (MHRA) is also developing its own post-Brexit regulatory pathway, with a focus on digital and robotic health technologies.

Reimbursement remains a critical factor for widespread adoption. In the U.S., the Centers for Medicare & Medicaid Services (CMS) have begun to issue new Current Procedural Terminology (CPT) codes for robotic-assisted endoluminal procedures, particularly in colorectal and upper GI interventions. However, reimbursement rates are still being evaluated, and payers are demanding robust real-world evidence of improved outcomes and cost-effectiveness. Companies like Medtronic and Intuitive Surgical are investing in health economics studies to support favorable coverage decisions.

Looking ahead, the next few years are expected to bring further harmonization of regulatory requirements across major markets, as well as expanded reimbursement frameworks that recognize the clinical and economic value of endoluminal robotics. Industry stakeholders are optimistic that ongoing dialogue with regulators and payers will accelerate patient access to these transformative technologies.

Adoption Barriers and Enablers: Training, Workflow, and Cost

The adoption of endoluminal robotics in gastrointestinal (GI) surgery is accelerating, yet several barriers and enablers are shaping its integration into clinical practice as of 2025 and the near future. Key factors include the need for specialized training, workflow adaptation, and cost considerations.

Training and Skill Acquisition

A primary barrier remains the steep learning curve associated with robotic endoluminal platforms. Unlike conventional endoscopy, these systems require proficiency in robotic controls, haptic feedback interpretation, and advanced navigation. Companies such as Intuitive Surgical and Medtronic have responded by developing dedicated training modules and simulation environments for their respective platforms. For example, Intuitive Surgical’s da Vinci system, while more established in laparoscopic surgery, is being adapted for endoluminal applications, and their training programs are evolving accordingly. Similarly, Medtronic’s GI Genius and Hugo platforms are supported by structured curricula and hands-on workshops. The emergence of these educational resources is expected to lower the entry barrier for new users over the next few years.

Workflow Integration

Integrating robotic systems into existing endoscopy suites presents logistical and workflow challenges. The size and complexity of some platforms can disrupt established procedures, requiring adjustments in room setup, staff roles, and scheduling. Companies like Medrobotics, with their Flex Robotic System, emphasize compact design and flexible deployment to minimize workflow disruption. Additionally, the trend toward modular and portable systems is likely to continue, as manufacturers respond to clinician feedback and the need for seamless integration. The next few years are expected to see further refinement in system ergonomics and interoperability with hospital IT infrastructure.

Cost and Reimbursement

High upfront costs and uncertain reimbursement remain significant barriers. Robotic endoluminal platforms often require substantial capital investment, ongoing maintenance, and consumable expenses. While early adopters may benefit from improved procedural capabilities and patient outcomes, widespread adoption depends on clear evidence of cost-effectiveness. Companies such as Auris Health (a subsidiary of Johnson & Johnson) and Medtronic are actively engaging with payers and regulatory bodies to establish reimbursement pathways for robotic GI procedures. As clinical data accumulates and health systems recognize the value proposition—such as reduced complication rates and shorter hospital stays—broader reimbursement is anticipated, potentially lowering the financial barrier for hospitals and ambulatory centers.

Outlook

Looking ahead, the convergence of improved training, workflow-friendly designs, and evolving reimbursement models is expected to accelerate the adoption of endoluminal robotics in GI surgery. As leading manufacturers continue to innovate and collaborate with clinical stakeholders, the next few years will likely see a transition from early adoption to broader clinical integration, particularly in high-volume centers and specialized GI units.

Case Studies: Real-World Deployments and Patient Outcomes

The deployment of endoluminal robotics in gastrointestinal (GI) surgery has accelerated in recent years, with 2025 marking a period of significant clinical adoption and outcome reporting. These systems, designed to navigate and operate within the GI tract via natural orifices, are demonstrating tangible benefits in minimally invasive procedures, particularly for early-stage cancers, complex polyp removal, and submucosal dissections.

One of the most prominent platforms, the Flex® Robotic System from Medrobotics Corporation, has been utilized in hundreds of cases across Europe and the United States. Clinical case series published in 2024 and early 2025 highlight its use in transanal minimally invasive surgery (TAMIS) and transoral procedures, with reported outcomes showing reduced operative times, lower complication rates, and shorter hospital stays compared to conventional techniques. Surgeons have noted the system’s flexible, steerable scope and multi-instrument capability as key factors in accessing difficult-to-reach lesions in the rectum and colon.

Another notable system, the Endoluminal Surgical System (ESS) by Intuitive Surgical, has entered clinical pilot programs in select centers. Early data from these deployments indicate successful en bloc resection of large colorectal polyps and early neoplasms, with high rates of R0 resection and minimal need for conversion to open surgery. The system’s robotic articulation and advanced visualization are credited with improving precision and reducing operator fatigue.

In Asia, OO Medical has advanced its endoluminal robotic platform for endoscopic submucosal dissection (ESD) in the upper GI tract. Initial multicenter studies in 2024–2025 report technical success rates above 95% for esophageal and gastric lesions, with a marked reduction in perforation and bleeding complications compared to manual ESD. These outcomes are driving broader adoption in high-volume centers, particularly in Japan and South Korea.

Patient-reported outcomes from these deployments consistently show faster recovery, less postoperative pain, and earlier return to normal activities. Health systems are also reporting economic benefits, including reduced length of stay and lower readmission rates. As regulatory approvals expand and training programs mature, the next few years are expected to see further integration of endoluminal robotics into routine GI surgical practice, with ongoing multicenter registries and randomized trials set to provide more robust comparative data.

Future Outlook: Emerging Technologies and Next-Gen Robotics

The landscape of endoluminal robotics for gastrointestinal (GI) surgery is poised for significant transformation in 2025 and the following years, driven by rapid technological advancements and increasing clinical adoption. Endoluminal robotic systems, designed to navigate and operate within the GI tract via natural orifices, are at the forefront of minimally invasive surgery, offering the potential for reduced patient trauma, faster recovery, and expanded therapeutic options.

Several pioneering companies are leading the development and commercialization of next-generation endoluminal robotic platforms. Intuitive Surgical, renowned for its da Vinci systems, has been actively exploring flexible robotic endoscopy, with ongoing research and early clinical studies focusing on applications such as endoscopic submucosal dissection and full-thickness resection. Meanwhile, Medtronic is advancing its GI portfolio with robotic-assisted endoscopy solutions, building on its acquisition of companies specializing in minimally invasive GI technologies.

A notable emerging player is Medrobotics, whose Flex® Robotic System is already CE-marked and FDA-cleared for transoral and transanal procedures. The company is expected to expand its indications and geographic reach in 2025, leveraging its unique flexible robotic platform to address complex GI lesions that are challenging for conventional endoscopy. Similarly, Auris Health (a subsidiary of Johnson & Johnson) is developing the Monarch™ Platform, which integrates robotics, micro-instrumentation, and advanced visualization for endoluminal interventions, with ongoing clinical trials in GI applications.

In Asia, Olympus Corporation is investing heavily in robotic endoscopy, with prototypes and early-stage systems targeting colorectal and upper GI procedures. The company’s collaborations with academic centers and technology partners are expected to yield commercial products within the next few years, further intensifying competition and innovation in the sector.

Looking ahead, the integration of artificial intelligence (AI) for real-time lesion detection, haptic feedback for enhanced operator control, and miniaturized robotic arms are anticipated to be key trends. These advances aim to improve precision, safety, and accessibility of complex GI interventions. Regulatory approvals and reimbursement pathways will be critical determinants of market adoption, with several pivotal trials and multicenter studies anticipated in 2025 and beyond.

Overall, the next few years are likely to witness a shift from proof-of-concept and early clinical use to broader adoption of endoluminal robotics in GI surgery, driven by the efforts of established medtech leaders and innovative startups alike. The convergence of robotics, AI, and flexible endoscopy is set to redefine the standard of care for gastrointestinal diseases.

Appendix: Company Profiles and Official Resources

The landscape of endoluminal robotics for gastrointestinal (GI) surgery is rapidly evolving, with several pioneering companies and organizations shaping the field as of 2025. This appendix provides concise profiles of key industry players and official resources, focusing on their contributions, product portfolios, and ongoing developments.

- Medtronic plc: As a global leader in medical technology, Medtronic has expanded its minimally invasive surgery portfolio to include robotic-assisted platforms. The company’s GI solutions integrate advanced endoscopic tools and digital platforms, supporting both diagnostic and therapeutic procedures. Medtronic’s investments in robotics and AI-driven navigation are expected to further enhance precision and outcomes in endoluminal GI interventions.

- Intuitive Surgical, Inc.: Intuitive Surgical is renowned for its da Vinci robotic systems, which have set benchmarks in minimally invasive surgery. While primarily focused on laparoscopic applications, Intuitive has signaled interest in expanding its technology to endoluminal and natural orifice transluminal endoscopic surgery (NOTES), leveraging its expertise in robotic control and visualization.

- EndoMaster Pte Ltd: Based in Singapore, EndoMaster specializes in robotic-assisted endoscopic systems designed for complex GI procedures such as endoscopic submucosal dissection (ESD). Their platforms offer multi-degree-of-freedom instruments and intuitive control, aiming to reduce procedure time and improve safety.

- Virtuoso Surgical, Inc.: Virtuoso Surgical is developing a next-generation robotic system for endoluminal surgery, featuring highly dexterous, miniature robotic arms. Their technology is designed to enable precise manipulation within the GI tract, targeting applications such as polyp removal and tumor resection.

- Asensus Surgical, Inc.: Asensus Surgical (formerly TransEnterix) is advancing digital laparoscopy and has announced intentions to adapt its Senhance Surgical System for endoluminal and flexible endoscopic procedures, integrating haptic feedback and machine vision.

- Olympus Corporation: Olympus is a dominant force in endoscopy, offering a broad range of flexible endoscopes and therapeutic devices. The company is actively investing in robotic endoscopy platforms, collaborating with partners to develop systems that enhance maneuverability and therapeutic capabilities for GI surgery.

- Society of American Gastrointestinal and Endoscopic Surgeons (SAGES): SAGES is a leading professional society providing guidelines, training, and resources on minimally invasive and robotic GI surgery, including endoluminal approaches.

These organizations are expected to drive innovation and adoption of endoluminal robotics in GI surgery through 2025 and beyond, with ongoing clinical trials, regulatory submissions, and product launches anticipated in the near future.