Inkjet Bioprinting for Tissue Engineering in 2025: Transforming Regenerative Medicine with Precision and Speed. Explore Market Dynamics, Breakthrough Technologies, and the Road Ahead.

- Executive Summary: 2025 Outlook and Key Takeaways

- Market Size and Growth Forecast (2025–2030): CAGR and Revenue Projections

- Technological Innovations in Inkjet Bioprinting: Printheads, Bioinks, and Automation

- Key Applications: Tissue Engineering, Organ Models, and Regenerative Therapies

- Competitive Landscape: Leading Companies and Strategic Partnerships

- Regulatory Environment and Industry Standards

- Challenges: Scalability, Cell Viability, and Material Compatibility

- Emerging Trends: AI Integration, Multi-Material Printing, and Customization

- Investment, Funding, and M&A Activity in 2025

- Future Outlook: Opportunities, Risks, and Strategic Recommendations

- Sources & References

Executive Summary: 2025 Outlook and Key Takeaways

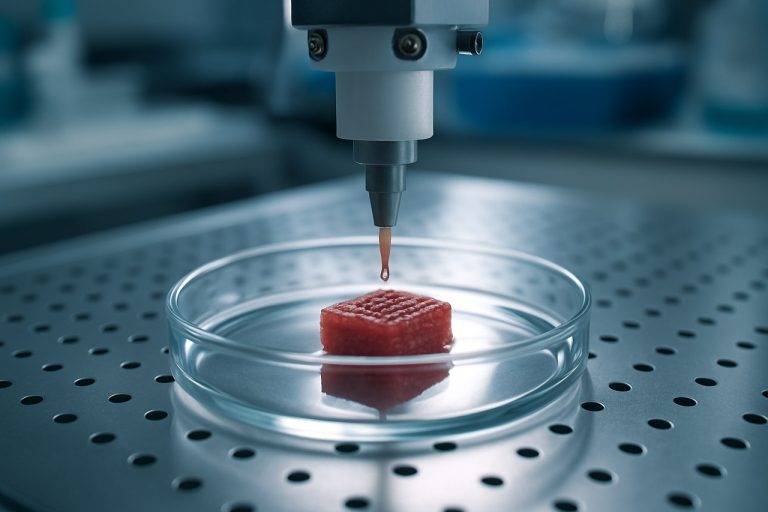

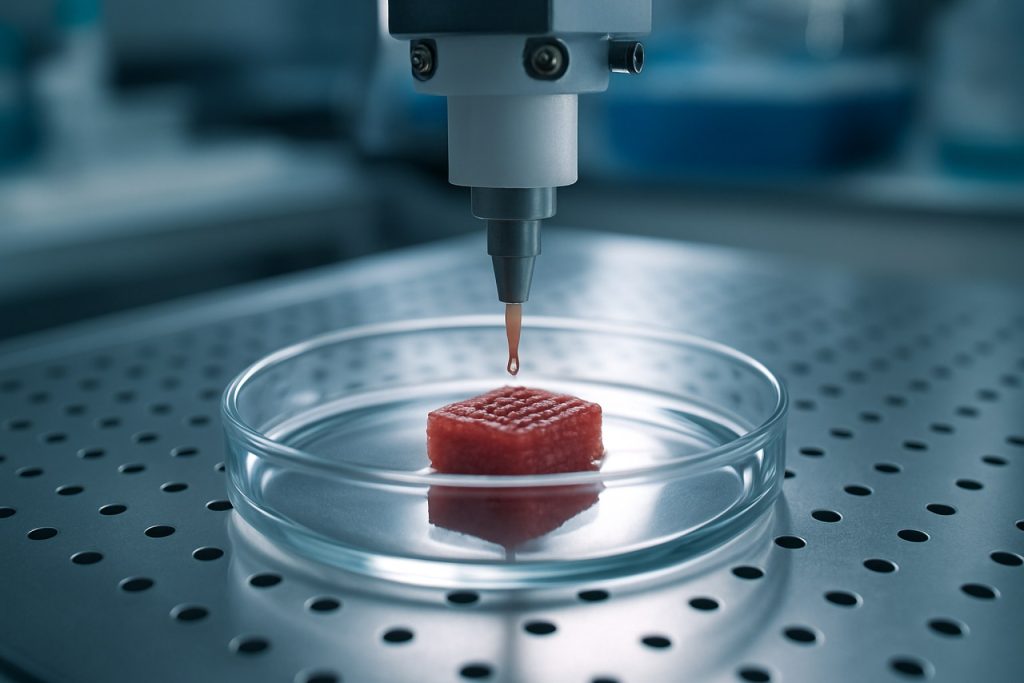

Inkjet bioprinting has rapidly emerged as a pivotal technology in the field of tissue engineering, offering precise, scalable, and cost-effective solutions for fabricating complex biological structures. As of 2025, the sector is witnessing accelerated advancements driven by both established industry leaders and innovative startups, with a focus on improving print resolution, cell viability, and the range of printable biomaterials.

Key players such as HP Inc. and Stratasys Ltd. have leveraged their expertise in traditional inkjet and 3D printing to develop specialized bioprinting platforms. HP Inc. has expanded its research collaborations with academic and clinical partners to adapt its thermal inkjet technology for bioprinting applications, emphasizing high-throughput and reproducibility. Meanwhile, Stratasys Ltd. continues to invest in multi-material printing capabilities, enabling the fabrication of heterogeneous tissue constructs with improved structural fidelity.

Emerging companies such as Organovo Holdings, Inc. and CELLINK (BICO Group) are at the forefront of commercializing inkjet-based bioprinters tailored for tissue engineering research and preclinical studies. CELLINK has introduced modular bioprinting systems compatible with a wide array of bioinks, supporting the creation of vascularized tissues and organoids. Organovo Holdings, Inc. continues to focus on developing functional human tissues for drug discovery and disease modeling, with ongoing efforts to scale up production for regenerative medicine applications.

Recent data from industry collaborations indicate a marked increase in the adoption of inkjet bioprinting for the fabrication of skin, cartilage, and liver tissue models. The technology’s non-contact, drop-on-demand approach minimizes cell damage and allows for the precise placement of multiple cell types, which is critical for replicating native tissue architecture. In 2025, ongoing improvements in printhead design and bioink formulation are expected to further enhance cell viability and functional integration of printed tissues.

Looking ahead, the next few years are poised to see inkjet bioprinting transition from primarily research-focused applications to early-stage clinical translation. Regulatory engagement is intensifying, with industry bodies and manufacturers working to establish standards for bioprinted tissue characterization and safety. As the ecosystem matures, partnerships between bioprinter manufacturers, biomaterial suppliers, and healthcare providers will be crucial in driving the commercialization of tissue-engineered products. The outlook for 2025 and beyond is one of cautious optimism, with inkjet bioprinting positioned as a cornerstone technology in the evolving landscape of regenerative medicine.

Market Size and Growth Forecast (2025–2030): CAGR and Revenue Projections

The inkjet bioprinting market for tissue engineering is poised for robust growth between 2025 and 2030, driven by accelerating demand for regenerative medicine, advancements in bio-ink formulations, and increasing adoption by research institutions and industry. As of 2025, the global market for inkjet bioprinting in tissue engineering is estimated to be valued in the low hundreds of millions USD, with projections indicating a compound annual growth rate (CAGR) ranging from 15% to 20% through 2030. This growth is underpinned by the expanding application of inkjet bioprinting in the fabrication of complex tissue constructs, organoids, and microfluidic models for drug testing and disease modeling.

Key industry players are investing heavily in R&D and commercialization. Organovo Holdings, Inc., a pioneer in 3D bioprinting, continues to develop proprietary inkjet-based bioprinting platforms for creating functional human tissues, with a focus on liver and kidney models. CELLINK (a BICO company), recognized for its modular bioprinters and bio-inks, has expanded its portfolio to include inkjet-based systems tailored for high-throughput tissue engineering applications. 3D Systems has also entered the bioprinting space, leveraging its expertise in additive manufacturing to develop bioprinting solutions for tissue engineering and regenerative medicine.

The market outlook is further strengthened by collaborations between bioprinter manufacturers and academic or clinical research centers. For example, Stratasys has partnered with leading medical institutions to advance the use of inkjet bioprinting in personalized medicine and tissue repair. Additionally, the entry of established life sciences companies such as Thermo Fisher Scientific into the bioprinting ecosystem is expected to accelerate technology adoption and market expansion.

Geographically, North America and Europe are anticipated to maintain leading market shares due to strong funding environments, regulatory support, and a concentration of bioprinting innovators. However, Asia-Pacific is projected to exhibit the fastest growth, fueled by increasing investments in biomedical research and government initiatives supporting advanced manufacturing technologies.

Looking ahead, the inkjet bioprinting market for tissue engineering is expected to surpass USD 1 billion in annual revenues by 2030, as clinical translation of bioprinted tissues progresses and commercial-scale manufacturing becomes feasible. The next few years will likely see a surge in partnerships, product launches, and regulatory milestones, positioning inkjet bioprinting as a cornerstone technology in the future of regenerative medicine.

Technological Innovations in Inkjet Bioprinting: Printheads, Bioinks, and Automation

Inkjet bioprinting has rapidly evolved as a pivotal technology in tissue engineering, with 2025 marking a period of significant innovation in printhead design, bioink formulation, and automation. The sector is witnessing a convergence of precision engineering and biological science, enabling the fabrication of increasingly complex tissue constructs.

A major focus in 2025 is the advancement of printhead technology. Piezoelectric and thermal inkjet printheads, originally developed for the graphics industry, have been adapted for bioprinting to deliver high-resolution, cell-friendly droplet deposition. Companies such as HP Inc. and Seiko Epson Corporation are leveraging their expertise in microfluidics and printhead miniaturization to support the bioprinting sector, providing customizable printhead modules that can handle a range of viscosities and cell types. These innovations are crucial for maintaining cell viability and function during the printing process, a key requirement for tissue engineering applications.

Bioink development is another area of rapid progress. The demand for bioinks that combine printability, biocompatibility, and tunable mechanical properties has led to the emergence of specialized suppliers. CELLINK, a subsidiary of BICO Group, remains a leader in commercial bioinks, offering a portfolio that includes gelatin methacryloyl (GelMA), alginate blends, and tissue-specific formulations. In 2025, the focus is on bioinks that support vascularization and long-term cell survival, with companies collaborating with academic and clinical partners to validate new formulations in preclinical models.

Automation and workflow integration are transforming the scalability and reproducibility of inkjet bioprinting. Robotic platforms and integrated quality control systems are being adopted to streamline multi-material printing and real-time monitoring. Stratasys, known for its additive manufacturing solutions, is expanding its bioprinting portfolio with automated systems designed for high-throughput tissue fabrication. These platforms incorporate machine vision and AI-driven feedback loops to ensure precise layer-by-layer deposition and minimize human error.

Looking ahead, the next few years are expected to bring further convergence between hardware, software, and biological materials. The integration of advanced sensors, closed-loop control, and cloud-based data management is anticipated to accelerate the translation of inkjet bioprinting from research labs to clinical and industrial settings. As regulatory frameworks evolve and partnerships between technology providers and healthcare institutions deepen, inkjet bioprinting is poised to play a central role in the scalable production of engineered tissues for regenerative medicine and drug discovery.

Key Applications: Tissue Engineering, Organ Models, and Regenerative Therapies

Inkjet bioprinting has rapidly advanced as a pivotal technology in tissue engineering, offering precise, scalable, and cost-effective fabrication of complex biological structures. As of 2025, the field is witnessing significant momentum, with both established companies and emerging startups driving innovation in the development of functional tissues and organ models.

A key application of inkjet bioprinting is the creation of engineered tissues for regenerative medicine. The technology’s ability to deposit living cells, growth factors, and biomaterials in highly controlled patterns enables the fabrication of tissue constructs that closely mimic native tissue architecture. Companies such as Organovo Holdings, Inc. have been at the forefront, leveraging proprietary inkjet-based bioprinting platforms to produce 3D human tissues for drug discovery and disease modeling. Their bioprinted liver and kidney tissues are being evaluated for use in preclinical testing, with the potential to reduce reliance on animal models and improve the predictive accuracy of drug toxicity studies.

In parallel, the demand for physiologically relevant organ models is accelerating, particularly in pharmaceutical research and personalized medicine. Inkjet bioprinting’s high-throughput capabilities make it well-suited for producing microtissues and organoids at scale. CELLINK, a subsidiary of BICO Group AB, has developed a range of inkjet bioprinters and bioinks tailored for tissue engineering applications. Their systems are widely adopted in academic and industrial laboratories for the fabrication of skin, cartilage, and vascularized tissue models, supporting both basic research and translational studies.

Looking ahead, the next few years are expected to bring further integration of inkjet bioprinting with advanced biomaterials and stem cell technologies. Collaborative efforts between bioprinting companies and healthcare providers are underway to accelerate the translation of engineered tissues into clinical therapies. For example, 3D Systems has expanded its bioprinting portfolio through partnerships aimed at developing patient-specific tissue grafts and regenerative implants. The company’s investments in regulatory compliance and quality assurance signal a move toward eventual commercialization of bioprinted tissue products.

Despite these advances, challenges remain in scaling up production, ensuring long-term functionality, and meeting regulatory requirements for clinical use. However, with ongoing investment and cross-sector collaboration, inkjet bioprinting is poised to play a transformative role in tissue engineering, organ modeling, and regenerative therapies through 2025 and beyond.

Competitive Landscape: Leading Companies and Strategic Partnerships

The competitive landscape of inkjet bioprinting for tissue engineering in 2025 is characterized by a dynamic interplay of established industry leaders, innovative startups, and strategic collaborations. The sector is witnessing rapid technological advancements, with companies focusing on improving print resolution, cell viability, and scalability for clinical and research applications.

Among the prominent players, Organovo Holdings, Inc. continues to be a pioneer, leveraging its proprietary inkjet-based bioprinting platforms to develop functional human tissues for drug discovery and preclinical testing. Organovo’s partnerships with pharmaceutical companies and research institutions have positioned it at the forefront of commercializing bioprinted tissue models. The company’s ongoing efforts to expand its portfolio into therapeutic tissue implants are expected to intensify competition in the coming years.

Another key competitor, CELLINK (a BICO company), has established itself as a global leader in bioprinting hardware and bioinks. CELLINK’s inkjet bioprinters, such as the BIO X series, are widely adopted in academic and industrial laboratories. The company’s strategy involves frequent collaborations with universities and biotech firms to co-develop new tissue engineering applications, and its acquisition of complementary technology providers has further strengthened its market position.

In Asia, Regenovo Biotechnology is gaining traction with its advanced inkjet bioprinting systems tailored for tissue engineering and regenerative medicine. Regenovo’s focus on high-throughput, multi-material printing and its partnerships with Chinese research hospitals are accelerating the translation of bioprinted tissues into preclinical and clinical studies.

Strategic partnerships are a defining feature of the current landscape. For example, collaborations between hardware manufacturers and bioink developers are common, as seen in alliances between CELLINK and various biomaterial suppliers. These partnerships aim to optimize the compatibility of bioinks with inkjet platforms, enhancing print fidelity and biological functionality.

Looking ahead, the next few years are expected to see increased investment in R&D, with companies racing to achieve regulatory milestones for bioprinted tissue products. The competitive environment is likely to intensify as new entrants, particularly from the Asia-Pacific region, introduce cost-effective and scalable solutions. Additionally, cross-sector partnerships—linking bioprinting firms with pharmaceutical, medical device, and academic stakeholders—are anticipated to drive innovation and accelerate the commercialization of inkjet bioprinted tissues for both research and therapeutic use.

Regulatory Environment and Industry Standards

The regulatory environment for inkjet bioprinting in tissue engineering is rapidly evolving as the technology matures and moves closer to clinical and commercial applications. In 2025, regulatory agencies are increasingly focused on establishing clear frameworks to ensure the safety, efficacy, and quality of bioprinted tissues and organs. The U.S. Food and Drug Administration (FDA) has been at the forefront, providing guidance for additive manufacturing in medical devices and, more recently, for bioprinted products. The FDA’s Center for Devices and Radiological Health (CDRH) continues to engage with stakeholders through public workshops and collaborative research, aiming to address unique challenges such as cell viability, bioink composition, and post-printing maturation processes.

In the European Union, the European Medicines Agency (EMA) and national competent authorities are working to harmonize standards for advanced therapy medicinal products (ATMPs), which include bioprinted tissues. The Medical Device Regulation (MDR) and the Advanced Therapy Medicinal Products Regulation (ATMP Regulation) are the primary legislative frameworks guiding the approval process. These regulations require rigorous preclinical and clinical data, as well as robust quality management systems, to ensure patient safety.

Industry standards are also being developed in parallel with regulatory efforts. Organizations such as the International Organization for Standardization (ISO) and ASTM International (ASTM International) are actively working on standards specific to bioprinting, including terminology, testing methods, and quality assurance protocols. For example, ASTM’s F42 committee on Additive Manufacturing Technologies is collaborating with industry leaders to define standards for bioink characterization and printed construct validation.

Key industry players are closely involved in shaping these standards. Companies like CELLINK (a BICO company), a global leader in bioprinting hardware and bioinks, are participating in standardization initiatives and regulatory consultations. Organovo, known for its pioneering work in 3D bioprinted human tissues, is also engaged in regulatory discussions, particularly around preclinical validation and clinical translation. These companies, along with others such as 3D Systems (which acquired Allevi), are contributing technical expertise and real-world data to inform regulatory pathways.

Looking ahead, the next few years are expected to bring greater regulatory clarity and the introduction of more formalized standards for inkjet bioprinting in tissue engineering. This will likely accelerate the translation of bioprinted tissues from research to clinical trials and, eventually, to routine medical use. Ongoing collaboration between regulators, standards bodies, and industry stakeholders will be critical to address emerging challenges and ensure the safe integration of bioprinted products into healthcare systems worldwide.

Challenges: Scalability, Cell Viability, and Material Compatibility

Inkjet bioprinting has emerged as a promising technology for tissue engineering, but as of 2025, several critical challenges remain in the areas of scalability, cell viability, and material compatibility. These factors are central to the translation of inkjet bioprinting from laboratory research to clinical and industrial applications.

Scalability is a persistent hurdle. While inkjet bioprinting excels at high-resolution patterning and rapid prototyping, scaling up to produce clinically relevant tissue constructs—such as large, vascularized tissues or organ-scale structures—remains difficult. The droplet-based nature of inkjet systems, which typically deposit picoliter volumes, limits the speed and volume of material that can be deposited in a reasonable timeframe. Leading manufacturers such as HP Inc. and Seiko Epson Corporation have developed advanced piezoelectric and thermal inkjet printheads, but adapting these for biofabrication at scale requires further innovation in printhead design, multi-nozzle arrays, and integrated automation. Companies like CELLINK (a BICO company) are actively developing modular bioprinting platforms that aim to address throughput and scalability, but widespread adoption in tissue engineering is still in its early stages.

Cell viability during and after the printing process is another major concern. The mechanical and thermal stresses imposed by inkjet printheads can compromise cell membrane integrity, leading to reduced viability and function. Recent advances in printhead technology, such as low-shear piezoelectric actuation and temperature-controlled systems, have improved outcomes, but maintaining high cell viability (>85%) across diverse cell types and bioinks remains a challenge. Organovo Holdings, Inc. and Ricoh Company, Ltd. are among the organizations investing in optimizing print parameters and bioink formulations to enhance post-printing cell survival and proliferation.

Material compatibility is equally critical. Inkjet bioprinting requires bioinks with precise rheological properties—low viscosity for jetting, yet sufficient mechanical strength post-deposition. Many natural and synthetic hydrogels are being explored, but few meet all requirements for printability, biocompatibility, and tissue-specific function. Companies such as CELLINK and Allevi, Inc. (now part of 3D Systems) are expanding their bioink portfolios to include tunable, tissue-specific formulations, but the field still lacks standardized, widely accepted materials for complex tissue engineering applications.

Looking ahead, the next few years are expected to bring incremental improvements in printhead engineering, bioink development, and integrated bioprinting workflows. However, overcoming the intertwined challenges of scalability, cell viability, and material compatibility will require coordinated efforts between hardware manufacturers, biomaterials developers, and tissue engineering researchers. The outlook for 2025 and beyond is cautiously optimistic, with the expectation that continued investment and cross-disciplinary collaboration will gradually unlock the full potential of inkjet bioprinting for regenerative medicine.

Emerging Trends: AI Integration, Multi-Material Printing, and Customization

Inkjet bioprinting is rapidly evolving, with 2025 marking a pivotal year for the integration of artificial intelligence (AI), multi-material printing, and advanced customization in tissue engineering. These trends are reshaping the landscape, enabling more precise, functional, and patient-specific tissue constructs.

AI-driven design and process optimization are at the forefront of this transformation. Machine learning algorithms are increasingly used to predict cell viability, optimize droplet formation, and control deposition patterns in real time. This is particularly relevant for companies like HP Inc., which has leveraged its expertise in inkjet technology to develop bioprinting platforms that incorporate AI for quality control and process automation. Similarly, Stratasys is exploring AI-enhanced software to improve the fidelity and reproducibility of bioprinted tissues, aiming to reduce variability and accelerate the translation of engineered tissues to clinical applications.

Multi-material printing is another significant trend, enabling the simultaneous deposition of different cell types, hydrogels, and bioactive molecules. This capability is crucial for mimicking the complex architecture of native tissues. CELLINK, a subsidiary of BICO Group, has introduced bioprinters capable of dispensing multiple bioinks with high spatial resolution, supporting the fabrication of heterogeneous tissue constructs. Their platforms are being adopted by research institutions and pharmaceutical companies worldwide to create more physiologically relevant tissue models for drug testing and regenerative medicine.

Customization is becoming increasingly sophisticated, driven by advances in imaging, data processing, and bioprinting hardware. Patient-specific tissue engineering is now feasible, with workflows that integrate medical imaging data (such as MRI or CT scans) to design constructs tailored to individual anatomical and pathological features. Organovo Holdings, Inc. is a notable player in this space, focusing on the development of customized, functional human tissues for therapeutic and research applications. Their approach combines proprietary bioprinting technology with advanced computational modeling to deliver personalized solutions.

Looking ahead, the convergence of AI, multi-material capabilities, and customization is expected to accelerate the commercialization of bioprinted tissues. Regulatory engagement is also increasing, with industry bodies and companies collaborating to establish standards for quality and safety. As these trends mature, the next few years will likely see the emergence of more complex, functional tissue constructs, moving closer to the goal of on-demand, patient-specific tissue replacement and disease modeling.

Investment, Funding, and M&A Activity in 2025

The inkjet bioprinting sector for tissue engineering is experiencing a dynamic phase of investment, funding, and merger and acquisition (M&A) activity as of 2025. This momentum is driven by the convergence of advanced biofabrication technologies, increasing demand for regenerative medicine, and the maturation of bioprinting platforms. Key players in the industry, including established bioprinting companies and emerging startups, are attracting significant capital to accelerate research, scale manufacturing, and expand commercial applications.

In early 2025, several leading bioprinting companies have reported successful funding rounds. CELLINK, a subsidiary of BICO Group and a pioneer in inkjet and extrusion-based bioprinters, continues to secure strategic investments to enhance its portfolio of bioinks and printing systems tailored for tissue engineering. The company’s focus on modular, scalable platforms has attracted both venture capital and corporate investors, aiming to support the translation of bioprinted tissues from laboratory to clinical settings.

Similarly, RegenHU, a Swiss-based developer of multi-material bioprinting solutions, has expanded its partnerships with pharmaceutical and biotechnology firms. In 2025, RegenHU announced a new funding round led by industry stakeholders seeking to leverage its inkjet bioprinting technology for drug discovery and tissue model development. This influx of capital is expected to accelerate the commercialization of advanced tissue engineering applications, including vascularized constructs and organ-on-chip systems.

M&A activity is also intensifying as larger life sciences and medical device companies seek to integrate bioprinting capabilities. Stratasys, a global leader in additive manufacturing, has continued its strategic acquisitions in the bioprinting space, targeting companies with proprietary inkjet-based tissue engineering platforms. These acquisitions are designed to broaden Stratasys’ portfolio and position the company at the forefront of regenerative medicine manufacturing.

In addition, cross-sector collaborations are emerging, with pharmaceutical giants and healthcare providers investing in bioprinting startups to secure early access to next-generation tissue models for drug screening and personalized medicine. The sector is also witnessing increased interest from government-backed innovation funds and public-private partnerships, particularly in North America and Europe, where regulatory frameworks for bioprinted tissues are evolving.

Looking ahead, the outlook for investment and M&A in inkjet bioprinting for tissue engineering remains robust. The sector is expected to see continued capital inflows as clinical translation milestones are achieved and as the demand for engineered tissues in research, transplantation, and drug development grows. Companies with scalable, GMP-compliant inkjet bioprinting platforms and strong intellectual property portfolios are likely to be prime targets for both investors and acquirers in the coming years.

Future Outlook: Opportunities, Risks, and Strategic Recommendations

As inkjet bioprinting continues to mature in 2025, the technology is positioned at a pivotal point for tissue engineering applications. The next few years are expected to see significant advancements, driven by both technological innovation and increased industry collaboration. Key opportunities, risks, and strategic recommendations are outlined below.

- Opportunities: Inkjet bioprinting offers high-resolution, scalable, and cost-effective fabrication of complex tissue constructs. The ability to precisely deposit multiple cell types and biomaterials is accelerating the development of functional tissues for regenerative medicine, drug screening, and disease modeling. Companies such as HP Inc. and Stratasys are leveraging their expertise in inkjet and additive manufacturing to develop specialized bioprinters and bioinks tailored for tissue engineering. Additionally, Organovo Holdings, Inc. continues to advance 3D bioprinted tissue models for preclinical testing, with a focus on liver and kidney tissues. The convergence of bioprinting with artificial intelligence and automation is expected to further enhance reproducibility and throughput, opening new avenues for personalized medicine and large-scale tissue manufacturing.

- Risks: Despite rapid progress, several challenges remain. Ensuring cell viability and function during and after printing is a persistent concern, particularly for thick or vascularized tissues. The limited availability of clinically approved bioinks and the need for standardized protocols hinder widespread adoption. Regulatory uncertainty also poses a risk, as agencies such as the U.S. Food and Drug Administration (FDA) are still developing frameworks for bioprinted tissues. Intellectual property disputes and the high cost of R&D may slow commercialization. Furthermore, the integration of bioprinted tissues into existing clinical workflows requires robust validation and long-term safety data.

- Strategic Recommendations: To capitalize on emerging opportunities, stakeholders should prioritize cross-disciplinary collaboration among biologists, engineers, and material scientists. Partnerships with established printing technology leaders like HP Inc. and Stratasys can accelerate the translation of inkjet bioprinting from research to clinical settings. Investment in the development of standardized, GMP-compliant bioinks and printing protocols will be critical. Engaging proactively with regulatory bodies and participating in industry consortia can help shape evolving standards and facilitate market entry. Finally, focusing on high-value applications such as organ-on-chip systems and patient-specific implants may provide a clear path to early commercialization and clinical impact.

In summary, the outlook for inkjet bioprinting in tissue engineering is promising, with substantial opportunities for innovation and growth. Strategic investment, collaboration, and regulatory engagement will be essential to overcome current risks and realize the full potential of this transformative technology in the coming years.

Sources & References

- Stratasys Ltd.

- Organovo Holdings, Inc.

- CELLINK (BICO Group)

- 3D Systems

- Thermo Fisher Scientific

- Seiko Epson Corporation

- BICO Group AB

- ISO

- Ricoh Company, Ltd.

- Allevi, Inc.

- CELLINK

- Stratasys