Quantum Dot Display Technology in 2025: Revolutionizing Visual Experiences and Powering a 30% Market Surge Through 2030. Discover the Innovations, Key Players, and Strategic Shifts Shaping the Future of Displays.

- Executive Summary: Quantum Dot Display Market in 2025

- Technology Overview: How Quantum Dots Transform Displays

- Key Manufacturers and Industry Leaders (e.g., samsung.com, lg.com, tcl.com)

- Market Size, Segmentation, and 2025–2030 Growth Forecasts

- Emerging Applications: TVs, Monitors, Mobile Devices, and Beyond

- Competitive Landscape and Strategic Partnerships

- Supply Chain Dynamics and Material Innovations

- Regulatory Standards and Environmental Considerations (e.g., ieee.org)

- Challenges, Risks, and Barriers to Adoption

- Future Outlook: Disruptive Trends and Opportunities Through 2030

- Sources & References

Executive Summary: Quantum Dot Display Market in 2025

Quantum dot (QD) display technology is poised for significant growth and transformation in 2025, driven by advancements in material science, manufacturing processes, and expanding applications across consumer electronics and beyond. Quantum dots—nanoscale semiconductor particles—enable displays with enhanced color accuracy, higher brightness, and improved energy efficiency compared to traditional LCD and OLED technologies. In 2025, the market is characterized by the increasing adoption of QD-enhanced LCDs (QLEDs), the emergence of quantum dot OLED (QD-OLED) panels, and early commercialization of quantum dot microLED displays.

Major display manufacturers are at the forefront of this evolution. Samsung Electronics continues to lead the QLED TV segment, leveraging its proprietary quantum dot technology to deliver premium displays with wide color gamuts and high dynamic range. In 2025, Samsung is also expanding its QD-OLED offerings, which combine the self-emissive benefits of OLED with the color purity of quantum dots, targeting both high-end televisions and professional monitors. LG Electronics is investing in hybrid QD technologies, including QNED (Quantum NanoCell Emitting Diode), which integrates quantum dots with NanoCell and Mini LED backlighting for enhanced performance.

On the materials side, Nanosys, Inc. remains a key supplier of quantum dot materials, supporting a broad ecosystem of display manufacturers. The company’s innovations in cadmium-free quantum dots are particularly relevant as environmental regulations tighten globally. Sony Corporation continues to utilize quantum dot technology in its premium television lines, notably under the “Triluminos” branding, and is exploring QD integration in professional and medical displays.

The outlook for 2025 and the following years is marked by several trends:

- Wider adoption of QD-OLED and QD-microLED displays, with commercial products expected from leading brands.

- Continued improvements in quantum dot material stability, efficiency, and environmental safety, with a shift toward heavy-metal-free formulations.

- Expansion of quantum dot applications beyond TVs and monitors to include tablets, laptops, automotive displays, and potentially AR/VR devices.

- Increased investment in manufacturing capacity and supply chain integration by major players such as Samsung Electronics, LG Electronics, and Nanosys, Inc..

In summary, 2025 represents a pivotal year for quantum dot display technology, with industry leaders accelerating innovation and commercialization. The sector is set to benefit from both technological breakthroughs and expanding market demand, positioning quantum dots as a cornerstone of next-generation display solutions.

Technology Overview: How Quantum Dots Transform Displays

Quantum dot (QD) display technology has rapidly evolved into a cornerstone of premium visual experiences, with 2025 marking a pivotal year for its mainstream adoption and technical refinement. Quantum dots are semiconductor nanocrystals that emit precise wavelengths of light when excited, enabling displays to achieve higher color purity, brightness, and energy efficiency compared to traditional LCD and OLED panels. The unique optical properties of quantum dots stem from their tunable size, which allows manufacturers to engineer specific emission spectra for red, green, and blue subpixels, resulting in displays that cover a wider color gamut and deliver more lifelike images.

The most prevalent implementation in 2025 is the quantum dot enhancement film (QDEF) layered over blue LED backlights in LCD panels. This approach, pioneered and commercialized by companies such as Samsung Electronics and LG Electronics, has enabled the mass production of QLED TVs and monitors. These displays offer up to 100% DCI-P3 color space coverage and peak brightness levels exceeding 2,000 nits, making them highly competitive for both consumer and professional applications.

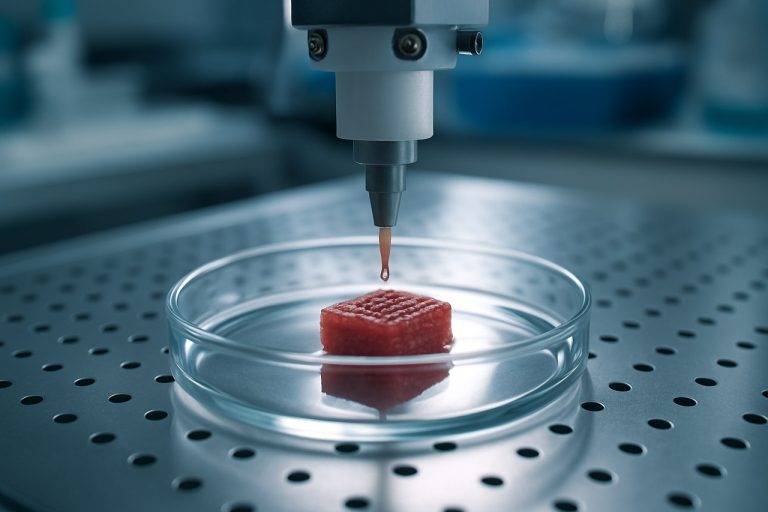

A significant technological leap is underway with the development of electroluminescent quantum dot (EL-QLED) displays, where quantum dots serve as the direct light-emitting layer, eliminating the need for backlights and color filters. This architecture promises even greater efficiency, thinner form factors, and improved contrast ratios. Samsung Electronics and TCL Technology are actively investing in EL-QLED research, with pilot production lines expected to scale in the next few years. These advancements are supported by material suppliers such as Nanosys, Inc., which provides cadmium-free quantum dot materials to meet global environmental regulations.

In parallel, the industry is addressing challenges related to quantum dot stability, manufacturing yield, and cost reduction. The transition to heavy-metal-free quantum dots, such as indium phosphide (InP), is accelerating, driven by regulatory pressures and sustainability goals. Companies like Merck KGaA are scaling up production of eco-friendly QD materials to support this shift.

Looking ahead, quantum dot technology is poised to further transform display markets through integration with flexible substrates, transparent displays, and augmented reality devices. As manufacturing processes mature and costs decline, quantum dot displays are expected to expand beyond high-end TVs into mainstream monitors, laptops, and mobile devices, solidifying their role as a foundational display technology for the coming years.

Key Manufacturers and Industry Leaders (e.g., samsung.com, lg.com, tcl.com)

As of 2025, the quantum dot display technology sector is characterized by rapid innovation and intense competition among several global electronics giants. The technology, which leverages semiconductor nanocrystals to enhance color accuracy and brightness in displays, has become a cornerstone in the premium television and monitor markets. Key manufacturers are investing heavily in research and development to push the boundaries of performance, efficiency, and sustainability.

Samsung Electronics Co., Ltd. remains the undisputed leader in quantum dot display technology. The company pioneered the commercialization of Quantum Dot Light Emitting Diode (QLED) TVs and continues to expand its portfolio with advanced models featuring improved color volume, higher peak brightness, and energy efficiency. In 2024, Samsung Electronics introduced its latest QD-OLED panels, combining quantum dots with organic light-emitting diodes to achieve deeper blacks and wider viewing angles. The company’s manufacturing scale and vertical integration allow it to maintain a dominant market share and set industry standards.

LG Electronics Inc. is another major player, focusing on hybrid technologies that blend quantum dots with its renowned OLED panels. LG Electronics has launched “QNED” TVs, which utilize Quantum NanoCell technology to deliver enhanced color reproduction and contrast. LG’s strategy emphasizes both premium and mid-range segments, leveraging its expertise in large-format displays and panel manufacturing.

TCL Technology Group Corporation has rapidly ascended as a global force in quantum dot displays, particularly in value-driven markets. TCL has invested in its own panel production facilities and collaborates with material suppliers to optimize quantum dot integration. The company’s 2025 lineup features Mini-LED backlighting combined with quantum dots, offering high dynamic range and competitive pricing.

Other notable contributors include Hisense Group, which markets ULED TVs incorporating quantum dot layers for improved color performance, and BOE Technology Group Co., Ltd., a leading display panel manufacturer supplying quantum dot-enhanced panels to various brands. Both Hisense and BOE Technology Group are expanding their global reach and investing in next-generation quantum dot materials.

Looking ahead, the industry is expected to see further advancements in quantum dot materials—such as cadmium-free and perovskite-based solutions—driven by environmental regulations and consumer demand for greener products. Strategic partnerships between material suppliers and display manufacturers will likely accelerate innovation, with the potential for quantum dot technology to expand into new applications, including automotive displays and augmented reality devices.

Market Size, Segmentation, and 2025–2030 Growth Forecasts

Quantum Dot Display Technology (QDDT) continues to gain momentum in the global display market, driven by its superior color accuracy, energy efficiency, and expanding applications across consumer electronics, automotive, and commercial sectors. As of 2025, the market is characterized by robust growth, with leading manufacturers such as Samsung Electronics, LG Electronics, and TCL Technology investing heavily in quantum dot-enhanced displays for televisions, monitors, and signage. The technology is also being adopted in premium laptops and tablets, with companies like HP Inc. and Dell Technologies integrating quantum dot panels into select product lines.

In terms of market segmentation, QDDT is primarily divided by application (television, monitors, mobile devices, automotive displays, and signage), material type (cadmium-based, cadmium-free), and region (Asia-Pacific, North America, Europe, and others). The television segment remains the largest, accounting for the majority of shipments, as evidenced by the continued rollout of QLED TVs by Samsung Electronics and TCL Technology. The Asia-Pacific region, led by China and South Korea, dominates production and consumption, with BOE Technology Group and China Star Optoelectronics Technology (CSOT) expanding their quantum dot display manufacturing capacities.

Looking ahead to 2025–2030, the quantum dot display market is projected to experience double-digit compound annual growth rates, fueled by ongoing advancements in quantum dot materials and manufacturing processes. The transition from cadmium-based to cadmium-free quantum dots, spearheaded by suppliers such as Nanosys, Inc. and Nanoco Group plc, is expected to accelerate, aligning with global environmental regulations and consumer demand for sustainable products. Additionally, the emergence of quantum dot OLED (QD-OLED) and quantum dot on microLED technologies is anticipated to open new high-end market segments, with Samsung Electronics and Sony Group Corporation already showcasing QD-OLED displays in flagship products.

By 2030, the market outlook suggests that quantum dot displays will capture a significant share of the premium display segment, with further penetration into automotive and commercial applications. Strategic partnerships between quantum dot material suppliers and panel manufacturers, such as those between Nanosys, Inc. and Samsung Electronics, are expected to drive innovation and cost reductions, making QDDT more accessible across a broader range of devices and price points.

Emerging Applications: TVs, Monitors, Mobile Devices, and Beyond

Quantum dot (QD) display technology is rapidly advancing, with 2025 poised to be a pivotal year for its integration across a spectrum of consumer electronics. Quantum dots—semiconductor nanocrystals that emit precise wavelengths of light—are increasingly being adopted to enhance color accuracy, brightness, and energy efficiency in displays. The most prominent application remains in televisions, where QD-enhanced LCDs (often branded as QLED) have become a mainstay for premium models. Samsung Electronics, a global leader in QD display commercialization, continues to expand its QLED TV lineup, leveraging quantum dots to achieve wider color gamuts and higher peak brightness. In 2025, Samsung is expected to further refine its QD-OLED hybrid panels, which combine the self-emissive benefits of OLED with the color purity of quantum dots.

Another major player, LG Electronics, is investing in QNED (Quantum NanoCell Emitting Diode) technology, which integrates quantum dots with Mini LED backlighting to deliver improved contrast and color performance. LG’s 2025 roadmap includes broader deployment of QNED in both high-end TVs and large-format monitors, targeting professional and gaming markets.

In the monitor segment, Dell Technologies and HP Inc. are incorporating QD technology into their premium displays, aiming to meet the demands of content creators and gamers who require high color fidelity and fast response times. These companies are expected to introduce new QD-based monitors in 2025, with features such as higher refresh rates and expanded color coverage.

Mobile devices are also beginning to benefit from quantum dot advancements. TCL Technology has announced plans to integrate QD displays into smartphones and tablets, focusing on delivering enhanced visual experiences while maintaining power efficiency. TCL’s proprietary inkjet printing process for QD materials is anticipated to lower production costs and enable flexible and foldable display formats in the near future.

Beyond traditional consumer electronics, quantum dot technology is finding emerging applications in automotive displays, augmented and virtual reality (AR/VR) headsets, and even medical imaging equipment. Companies such as Nanosys, Inc., a leading supplier of quantum dot materials, are collaborating with display manufacturers to develop next-generation QD solutions tailored for these specialized markets.

Looking ahead, the outlook for quantum dot display technology in 2025 and beyond is robust. Ongoing improvements in material stability, cadmium-free formulations, and scalable manufacturing processes are expected to drive broader adoption across diverse applications. As industry leaders continue to innovate, quantum dot displays are set to redefine visual quality standards in TVs, monitors, mobile devices, and a growing array of new use cases.

Competitive Landscape and Strategic Partnerships

The competitive landscape for quantum dot (QD) display technology in 2025 is characterized by intense innovation, strategic alliances, and a clear focus on next-generation display performance. Major display manufacturers are leveraging quantum dots to enhance color gamut, brightness, and energy efficiency in both consumer and professional applications. The sector is dominated by a handful of global players, with significant activity in both the development of QD materials and the integration of these materials into commercial products.

Samsung Electronics remains a leader in the commercialization of QD displays, particularly through its QLED television lineup. The company has invested heavily in QD-OLED hybrid panels, which combine the self-emissive properties of OLED with the color purity of quantum dots. In 2024, Samsung announced expanded production capacity for QD-OLED panels, signaling its commitment to maintaining technological leadership in this segment. The company’s partnerships with material suppliers and equipment manufacturers are central to its strategy, ensuring a robust supply chain for advanced QD materials (Samsung Electronics).

LG Display is also advancing its QD technology, focusing on QNED (Quantum Nano Emitting Diode) displays, which utilize quantum dots in conjunction with mini-LED backlighting. LG’s approach aims to bridge the gap between OLED and QLED, offering improved brightness and color accuracy. The company has announced collaborations with quantum dot material specialists to accelerate the commercialization of QNED panels, with mass production expected to ramp up in 2025 (LG Display).

On the materials front, Nanosys, Inc. is a key supplier of quantum dot materials, providing solutions to several major display manufacturers. Nanosys has formed strategic partnerships with both panel makers and chemical companies to scale up production and develop cadmium-free quantum dots, addressing regulatory and environmental concerns. The company’s collaborations are expected to drive broader adoption of QD technology in monitors, tablets, and automotive displays (Nanosys, Inc.).

In China, BOE Technology Group and TCL China Star Optoelectronics Technology are aggressively investing in QD display R&D and manufacturing. BOE is integrating quantum dots into its high-end LCD and OLED panels, while TCL is advancing its own QLED TV lines and exploring inkjet printing techniques for QD-OLED displays. Both companies have announced joint ventures and research collaborations with domestic and international partners to secure access to next-generation QD materials and manufacturing processes (BOE Technology Group, TCL China Star Optoelectronics Technology).

Looking ahead, the next few years are expected to see further consolidation and cross-industry partnerships, as display makers, material suppliers, and equipment manufacturers align to accelerate the commercialization of quantum dot technologies. The competitive landscape will likely be shaped by advances in material science, cost reduction strategies, and the ability to scale production for emerging applications such as AR/VR and automotive displays.

Supply Chain Dynamics and Material Innovations

Quantum dot (QD) display technology continues to reshape the display industry’s supply chain and material landscape as it matures into 2025. The sector is characterized by a complex network of material suppliers, display panel manufacturers, and consumer electronics brands, all responding to rapid innovation and shifting regulatory requirements.

A key trend in 2025 is the transition from cadmium-based quantum dots to cadmium-free alternatives, primarily driven by environmental regulations in major markets such as the European Union. Leading material suppliers like Nanosys, Inc. and Samsung Electronics have accelerated the development and commercialization of indium phosphide (InP) and perovskite-based QDs, which offer high color purity and efficiency without the toxicity concerns of cadmium. Nanosys, Inc. remains a pivotal supplier, providing QD materials to a broad range of panel makers and collaborating with display giants to scale up production of next-generation QD-OLED and QD-LED panels.

On the manufacturing front, Samsung Electronics continues to lead with its QD-OLED technology, integrating quantum dots directly into OLED panels for enhanced color performance and energy efficiency. LG Electronics and TCL Technology are also investing in QD-enhanced LCDs and exploring QD-EL (electroluminescent) displays, which promise self-emissive properties and simplified panel structures. These advancements are driving demand for high-quality QD materials and pushing suppliers to innovate in synthesis methods, scalability, and cost reduction.

Supply chain resilience is a focal point in 2025, as geopolitical tensions and raw material constraints—particularly for indium and rare earth elements—impact sourcing strategies. Companies are diversifying suppliers and investing in recycling and recovery technologies to secure critical materials. Merck KGaA, a major supplier of display chemicals and QD materials, is expanding its global production footprint and developing sustainable QD synthesis processes to address both supply security and environmental impact.

Looking ahead, the next few years are expected to see further integration of QD technology into a wider array of devices, including monitors, tablets, and automotive displays. The supply chain will likely become more vertically integrated, with leading brands forming closer partnerships with material innovators to accelerate time-to-market and ensure quality control. As QD-EL and perovskite QDs approach commercial viability, the industry anticipates a new wave of material innovation, potentially lowering costs and expanding the application space for quantum dot displays.

Regulatory Standards and Environmental Considerations (e.g., ieee.org)

Quantum dot (QD) display technology, renowned for its vibrant color reproduction and energy efficiency, is increasingly subject to evolving regulatory standards and environmental scrutiny as it matures in 2025 and beyond. A primary concern centers on the use of cadmium-based quantum dots, which, despite their superior optical properties, pose significant environmental and health risks due to cadmium’s toxicity. The European Union’s Restriction of Hazardous Substances (RoHS) directive has long restricted cadmium content in electronic displays, with only limited exemptions for quantum dots under strict conditions. These exemptions are under continuous review, and the trend in 2025 is toward further tightening, compelling manufacturers to accelerate the shift toward cadmium-free alternatives such as indium phosphide (InP) and perovskite-based quantum dots.

Major display manufacturers, including Samsung Electronics and LG Electronics, have publicly committed to reducing or eliminating hazardous substances in their QD product lines. Samsung Electronics has notably advanced its “Quantum Dot OLED” (QD-OLED) displays, which utilize cadmium-free quantum dots, aligning with both regulatory requirements and consumer demand for greener electronics. Similarly, Nanosys, Inc., a leading quantum dot material supplier, has developed and commercialized cadmium-free quantum dot materials, supporting the industry’s transition to safer alternatives.

On the standards front, organizations such as the IEEE and the International Electrotechnical Commission (IEC) are actively developing and updating technical standards for quantum dot displays. These standards address not only performance metrics—such as color gamut, brightness, and energy efficiency—but also environmental and safety considerations, including material composition and end-of-life recycling protocols. In 2025, the focus is on harmonizing global standards to facilitate international trade and ensure consistent environmental protections.

Looking ahead, the next few years are expected to see increased regulatory pressure on the use of heavy metals in display technologies, driving further innovation in quantum dot synthesis and encapsulation methods. Industry leaders are investing in research to improve the stability and performance of cadmium-free quantum dots, while also exploring new materials with lower environmental impact. The convergence of stricter regulations, evolving standards, and consumer preference for sustainable products is set to shape the quantum dot display market, with compliance and eco-innovation becoming key competitive differentiators.

Challenges, Risks, and Barriers to Adoption

Quantum Dot Display Technology (QDDT) has rapidly advanced, but several challenges, risks, and barriers continue to shape its adoption trajectory in 2025 and the near future. One of the primary technical hurdles remains the reliance on cadmium-based quantum dots, which offer superior color performance but face stringent environmental regulations due to toxicity concerns. The European Union’s RoHS directive restricts the use of cadmium, compelling manufacturers to accelerate the development of cadmium-free alternatives. Companies such as Samsung Electronics and LG Electronics have invested heavily in indium phosphide and other non-toxic quantum dot materials, but these alternatives often lag behind in efficiency and color purity, presenting a significant barrier to mass adoption.

Manufacturing scalability and cost are additional obstacles. Quantum dot synthesis and integration into display panels require precise, high-purity processes, which can be expensive and difficult to scale for large-format displays. Nanosys, Inc., a leading supplier of quantum dot materials, has made progress in roll-to-roll manufacturing and inkjet printing techniques, but widespread adoption depends on further cost reductions and yield improvements. The complexity of integrating quantum dots into OLED or microLED architectures also introduces new engineering challenges, particularly in achieving uniformity and long-term stability.

Intellectual property (IP) and supply chain risks are also notable. The quantum dot sector is characterized by a dense web of patents, with key players such as Samsung Electronics, LG Electronics, and Nanosys, Inc. holding significant portfolios. This can lead to licensing disputes or barriers for new entrants, potentially slowing innovation and market expansion. Furthermore, the supply chain for high-quality quantum dot materials is still maturing, with only a handful of suppliers capable of meeting the stringent requirements for display-grade materials.

Market risks also persist. While consumer awareness of QDDT’s benefits—such as enhanced color gamut and energy efficiency—has grown, price sensitivity remains high, especially in the competitive television and monitor segments. The technology faces stiff competition from OLED and emerging microLED displays, both of which are also improving rapidly in terms of performance and cost. As a result, manufacturers must balance investment in QDDT with the risk of shifting market preferences.

Looking ahead, overcoming these challenges will require continued innovation in materials science, manufacturing processes, and supply chain development. Regulatory compliance, particularly regarding environmental safety, will remain a critical factor influencing the pace and scale of QDDT adoption through 2025 and beyond.

Future Outlook: Disruptive Trends and Opportunities Through 2030

Quantum dot (QD) display technology is poised for significant evolution through 2030, driven by advances in material science, manufacturing processes, and integration with emerging display architectures. As of 2025, QD displays—primarily in the form of QLED (quantum dot light-emitting diode) and QD-OLED (quantum dot organic light-emitting diode)—are widely commercialized in premium televisions, monitors, and some mobile devices. Major display manufacturers such as Samsung Electronics, LG Electronics, and TCL Technology are actively investing in next-generation QD technologies, aiming to enhance color gamut, brightness, and energy efficiency.

A key disruptive trend is the transition from cadmium-based quantum dots to cadmium-free alternatives, such as indium phosphide, in response to global environmental regulations and consumer demand for greener electronics. Nanosys, Inc., a leading QD material supplier, has reported rapid scaling of cadmium-free QD production, enabling broader adoption across display segments. This shift is expected to accelerate as regulatory pressures increase and as more manufacturers seek to differentiate their products on sustainability.

Another major opportunity lies in the development of electroluminescent quantum dot (EL-QLED) displays, which use quantum dots as the direct light-emitting layer, eliminating the need for backlights or color filters. This architecture promises even higher efficiency, deeper blacks, and potentially lower manufacturing costs. Companies such as Samsung Electronics and Nanosys, Inc. have announced ongoing research and pilot production lines for EL-QLED, with commercial products anticipated in the latter half of the decade.

Integration of QD technology with flexible and transparent substrates is also on the horizon, opening new applications in automotive displays, wearable devices, and augmented reality. TCL Technology and LG Electronics have demonstrated prototypes of rollable and transparent QD displays, signaling a move toward more versatile form factors.

Looking ahead to 2030, the quantum dot display market is expected to benefit from continued improvements in quantum dot stability, emission efficiency, and cost reduction. Strategic partnerships between material suppliers, such as Nanosys, Inc., and major panel makers will likely accelerate commercialization of advanced QD technologies. As a result, quantum dot displays are positioned to capture a growing share of the global display market, particularly in high-end and emerging application segments.