Quantum Dot Spectroscopy Equipment Manufacturing in 2025: Unleashing Next-Gen Precision and Market Expansion. Explore the Innovations, Competitive Dynamics, and Forecasts Shaping the Industry’s Future.

- Executive Summary: 2025 Market Highlights and Key Takeaways

- Industry Overview: Quantum Dot Spectroscopy Equipment Landscape

- Technology Innovations: Advances in Quantum Dot Spectroscopy Hardware

- Key Manufacturers and Strategic Partnerships (e.g., thermofisher.com, horiba.com, perkinelmer.com)

- Market Size, Segmentation, and 2025–2030 Growth Forecasts

- Emerging Applications: Healthcare, Semiconductors, and Energy

- Competitive Analysis: Leading Players and New Entrants

- Regulatory Environment and Industry Standards (e.g., ieee.org, iso.org)

- Challenges and Opportunities: Supply Chain, Scalability, and R&D

- Future Outlook: Disruptive Trends and Long-Term Market Potential

- Sources & References

Executive Summary: 2025 Market Highlights and Key Takeaways

The quantum dot spectroscopy equipment manufacturing sector is poised for significant advancements and expansion in 2025, driven by surging demand from the semiconductor, display, and biomedical industries. Quantum dot (QD) technology, which leverages the unique optical and electronic properties of nanoscale semiconductor particles, is increasingly central to next-generation analytical instrumentation. In 2025, the market is characterized by rapid innovation, strategic investments, and the entrance of new players, particularly in Asia, North America, and Europe.

Key manufacturers such as Thermo Fisher Scientific, Oxford Instruments, and Bruker Corporation continue to lead the field, offering advanced spectrometers and integrated systems tailored for quantum dot analysis. These companies are investing heavily in R&D to enhance sensitivity, resolution, and automation, responding to the growing need for high-throughput and precise characterization of QDs in both research and industrial settings. Notably, Thermo Fisher Scientific has expanded its product lines to include modular spectroscopy platforms compatible with a wide range of QD materials, while Oxford Instruments is focusing on cryogenic and in situ solutions for real-time QD monitoring.

The year 2025 also sees increased collaboration between equipment manufacturers and quantum dot producers, such as Nanosys and Nanoco Group, to ensure that spectroscopy tools are optimized for the latest QD formulations and applications. This synergy is particularly evident in the display and photonics sectors, where precise QD characterization is critical for product quality and regulatory compliance.

Geographically, China and South Korea are emerging as major hubs for both QD production and spectroscopy equipment manufacturing, with companies like HORIBA and Samsung Electronics investing in local R&D and manufacturing capacity. European and US firms maintain a strong presence, particularly in high-end research instrumentation and custom solutions.

Looking ahead, the outlook for the next few years is robust, with market growth underpinned by expanding applications in quantum computing, medical diagnostics, and environmental sensing. The sector is expected to benefit from ongoing miniaturization, integration of AI-driven analytics, and the push for greener, cadmium-free QD materials. As a result, manufacturers are likely to prioritize flexible, scalable equipment platforms and strategic partnerships to capture emerging opportunities in this dynamic field.

Industry Overview: Quantum Dot Spectroscopy Equipment Landscape

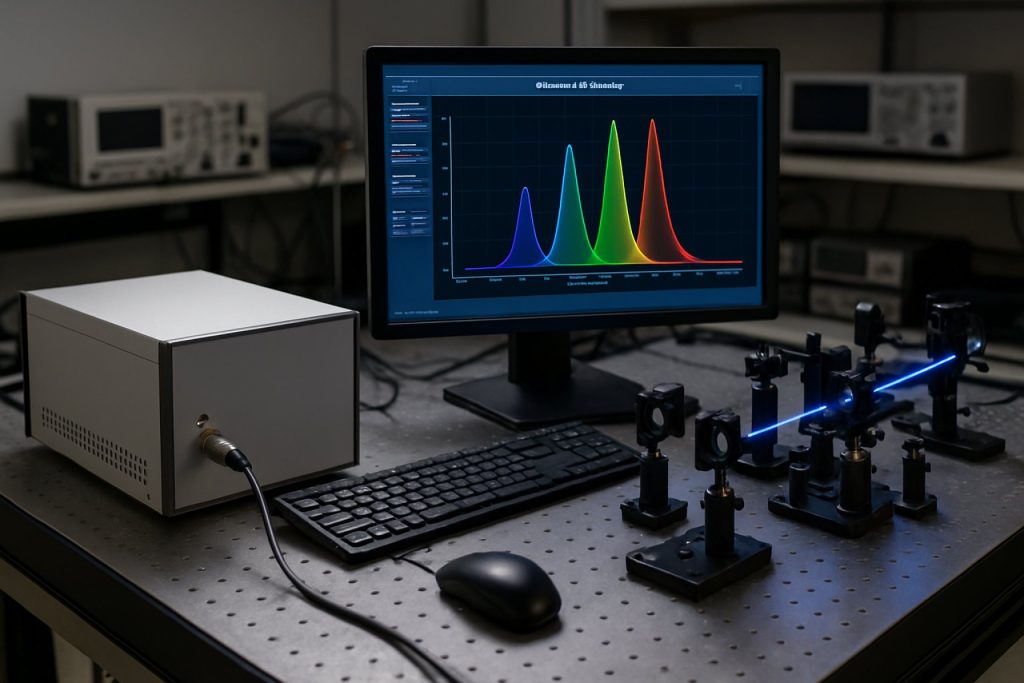

The manufacturing landscape for quantum dot spectroscopy equipment in 2025 is characterized by rapid technological advancements, increased investment, and a growing roster of specialized manufacturers. Quantum dot spectroscopy, which leverages the unique optical properties of quantum dots for high-sensitivity detection and analysis, is seeing heightened demand across sectors such as materials science, biomedical research, and optoelectronics. This demand is driving both established instrumentation companies and emerging players to expand their product portfolios and manufacturing capabilities.

Key industry leaders such as Thermo Fisher Scientific and Agilent Technologies continue to dominate the high-end spectroscopy equipment market, offering advanced systems that integrate quantum dot-compatible modules. These companies are investing in R&D to improve sensitivity, automation, and data analysis features, responding to the needs of research institutions and industrial laboratories. HORIBA, with its long-standing expertise in optical spectroscopy, has also expanded its manufacturing lines to include instruments specifically optimized for quantum dot characterization, such as time-resolved photoluminescence and fluorescence spectrometers.

In parallel, specialized manufacturers are emerging to address niche requirements. Edinburgh Instruments and Ocean Insight are notable for their modular and customizable spectroscopy platforms, which are increasingly adopted by quantum dot researchers for their flexibility and precision. These companies are focusing on miniaturization and integration with microfluidic and automated sample handling systems, reflecting a broader industry trend toward compact, user-friendly equipment.

The supply chain for critical components—such as high-sensitivity detectors, tunable light sources, and advanced optical filters—remains robust, with suppliers like Hamamatsu Photonics playing a pivotal role in enabling next-generation instrument performance. Collaborative efforts between component suppliers and system integrators are expected to accelerate innovation, particularly in the development of turnkey solutions for quantum dot analysis.

Looking ahead, the quantum dot spectroscopy equipment market is projected to experience sustained growth through the late 2020s, driven by expanding applications in quantum computing, display technology, and medical diagnostics. Manufacturers are expected to prioritize automation, AI-driven data interpretation, and cloud connectivity to meet evolving user expectations. As regulatory standards for nanomaterials tighten, equipment makers will also focus on compliance and traceability features. The competitive landscape will likely see further consolidation, with strategic partnerships and acquisitions shaping the next phase of industry evolution.

Technology Innovations: Advances in Quantum Dot Spectroscopy Hardware

The manufacturing landscape for quantum dot (QD) spectroscopy equipment is undergoing rapid transformation in 2025, driven by the convergence of nanomaterials science, photonics, and precision engineering. Quantum dot spectroscopy, which leverages the unique optical properties of semiconductor nanocrystals, demands highly specialized instrumentation for both research and industrial applications. Recent years have seen a surge in innovation, with manufacturers focusing on higher sensitivity, miniaturization, and integration with automated and AI-driven analysis systems.

Key players in the sector, such as HORIBA and Oxford Instruments, have introduced new spectrometers and modular platforms tailored for QD characterization. HORIBA has expanded its suite of fluorescence and photoluminescence spectrometers, incorporating advanced detectors and time-resolved capabilities to resolve the fast dynamics of quantum dots. Meanwhile, Oxford Instruments continues to develop cryogenic and high-vacuum systems, essential for probing QD behavior at low temperatures and in controlled environments.

A notable trend in 2025 is the integration of quantum dot spectroscopy modules into existing microscopy and imaging platforms. Companies like Carl Zeiss AG and Leica Microsystems are collaborating with QD specialists to enable high-resolution, multi-modal imaging, combining spectral and spatial data for advanced materials and life sciences research. This modular approach allows laboratories to upgrade their existing infrastructure, reducing costs and accelerating adoption.

On the component side, detector and laser manufacturers such as Hamamatsu Photonics and Coherent Corp. are supplying next-generation photodetectors and tunable laser sources, which are critical for achieving the high signal-to-noise ratios and spectral resolution required for QD analysis. These advances are enabling the detection of single quantum dots and the study of their emission properties with unprecedented precision.

Looking ahead, the outlook for quantum dot spectroscopy equipment manufacturing is robust. The demand is fueled by expanding applications in quantum computing, display technology, and biomedical diagnostics. Manufacturers are expected to further automate sample handling and data analysis, leveraging AI and machine learning to interpret complex spectral signatures. Additionally, sustainability is becoming a priority, with companies exploring eco-friendly materials and energy-efficient designs in their manufacturing processes.

As the field matures, collaborations between equipment manufacturers, quantum dot producers, and end-users are likely to intensify, fostering the development of standardized platforms and protocols. This will be crucial for scaling up production and ensuring reproducibility in both research and industrial settings.

Key Manufacturers and Strategic Partnerships (e.g., thermofisher.com, horiba.com, perkinelmer.com)

The landscape of quantum dot spectroscopy equipment manufacturing in 2025 is characterized by a blend of established analytical instrumentation giants and innovative niche players, all vying to address the growing demand for high-precision, high-sensitivity tools in quantum dot research and industrial applications. The sector is marked by strategic partnerships, technology integration, and a focus on automation and miniaturization.

Among the global leaders, Thermo Fisher Scientific continues to play a pivotal role. The company’s extensive portfolio includes advanced spectrophotometers and fluorescence spectrometers, which are widely adopted in quantum dot characterization for their reliability and integration with automated workflows. Thermo Fisher’s ongoing collaborations with academic and industrial research centers are expected to yield further enhancements in sensitivity and throughput, particularly as quantum dot applications expand in biomedical imaging and display technologies.

HORIBA, a Japanese multinational, remains at the forefront of optical spectroscopy instrumentation. Its modular spectrofluorometers and time-resolved fluorescence systems are frequently cited in quantum dot research for their precision and adaptability. In 2025, HORIBA is investing in the development of hybrid systems that combine Raman and photoluminescence spectroscopy, aiming to provide comprehensive solutions for quantum dot synthesis and quality control. The company’s strategic alliances with semiconductor manufacturers and research consortia are expected to accelerate the commercialization of next-generation quantum dot devices.

PerkinElmer is another key player, leveraging its expertise in analytical instrumentation to deliver high-throughput, user-friendly spectroscopic platforms. The company’s focus on automation and data analytics is particularly relevant as quantum dot production scales up for commercial applications. PerkinElmer’s partnerships with display and lighting manufacturers are driving the development of tailored spectroscopy solutions that address the unique challenges of quantum dot integration in consumer electronics.

Other notable manufacturers include Agilent Technologies, which offers a range of UV-Vis and fluorescence spectrometers, and Bruker, known for its advanced photoluminescence and Raman spectroscopy systems. Both companies are actively pursuing collaborations with quantum dot startups and research institutes to refine their offerings for emerging applications in quantum computing and biosensing.

Looking ahead, the quantum dot spectroscopy equipment market is expected to see increased consolidation and cross-sector partnerships, as manufacturers seek to integrate AI-driven data analysis, miniaturized components, and cloud connectivity. These trends are likely to enhance the accessibility and versatility of quantum dot characterization tools, supporting rapid innovation across multiple industries.

Market Size, Segmentation, and 2025–2030 Growth Forecasts

The global market for quantum dot spectroscopy equipment is poised for significant expansion between 2025 and 2030, driven by rapid advancements in quantum dot (QD) materials, increasing adoption in research and industry, and the growing need for high-precision analytical instrumentation. Quantum dot spectroscopy equipment—encompassing spectrometers, fluorescence analyzers, and related optical systems—serves critical roles in materials science, biomedical research, display technology, and semiconductor manufacturing.

As of 2025, the market is characterized by a robust presence of established scientific instrument manufacturers and a growing number of specialized firms focusing on quantum dot applications. Key players include Thermo Fisher Scientific, which offers advanced spectroscopic solutions for nanomaterial analysis, and HORIBA, recognized for its modular and high-sensitivity fluorescence spectrometers tailored for QD research. Oxford Instruments and Bruker are also notable for their contributions to high-resolution spectroscopy and nanomaterial characterization platforms.

Market segmentation reveals strong demand from academic and government research institutions, which account for a substantial share of equipment purchases, particularly in North America, Europe, and East Asia. The semiconductor and display industries are emerging as major commercial end-users, leveraging QD spectroscopy for quality control and R&D in next-generation displays and photonic devices. Biomedical applications, such as QD-based imaging and diagnostics, are expected to drive further growth, especially as clinical translation of QD technologies accelerates.

From 2025 through 2030, the quantum dot spectroscopy equipment market is forecast to grow at a compound annual growth rate (CAGR) in the high single digits, with some segments—such as automated, high-throughput systems—potentially outpacing the overall market. This growth is underpinned by ongoing improvements in detector sensitivity, miniaturization, and integration with artificial intelligence for data analysis. Companies like Thermo Fisher Scientific and HORIBA are investing in R&D to enhance instrument performance and user accessibility, while new entrants are expected to introduce innovative, application-specific solutions.

Looking ahead, the market outlook remains positive, with increasing cross-sector collaboration and government funding for quantum technologies likely to stimulate further demand. The Asia-Pacific region, led by China, Japan, and South Korea, is anticipated to see the fastest growth, driven by large-scale investments in nanotechnology and advanced manufacturing infrastructure.

Emerging Applications: Healthcare, Semiconductors, and Energy

Quantum dot spectroscopy equipment manufacturing is experiencing rapid evolution in 2025, driven by the expanding adoption of quantum dots (QDs) across healthcare, semiconductor, and energy sectors. The unique optical and electronic properties of QDs—such as size-tunable emission and high photostability—are fueling demand for advanced spectroscopic tools capable of precise characterization and quality control. This demand is shaping the strategies of leading equipment manufacturers and spurring innovation in instrumentation.

In healthcare, quantum dot-based diagnostics and imaging are gaining momentum, necessitating highly sensitive and reliable spectroscopy systems. Major manufacturers such as Thermo Fisher Scientific and Agilent Technologies are expanding their product lines to include spectrometers and fluorometers optimized for QD analysis. These systems are being integrated into workflows for early disease detection, biomarker quantification, and in vitro diagnostics, where the reproducibility and sensitivity of QD-based assays are critical. The trend is expected to accelerate as regulatory approvals for QD-enabled medical devices increase and as personalized medicine initiatives drive demand for multiplexed detection platforms.

In the semiconductor industry, QDs are being explored for next-generation displays, photodetectors, and quantum computing components. This is prompting equipment manufacturers to develop spectroscopy solutions with higher spatial and spectral resolution. Companies like Bruker Corporation and HORIBA are investing in Raman and photoluminescence spectroscopy systems tailored for nanoscale material analysis. These tools are essential for process monitoring, defect analysis, and quality assurance in QD fabrication, especially as the industry moves toward mass production of QD-based microLEDs and quantum information devices.

The energy sector is also a significant driver, with QDs being incorporated into solar cells, LEDs, and photocatalysts. Manufacturers such as PerkinElmer are responding by enhancing their spectroscopy platforms to support high-throughput screening and in situ monitoring of QD synthesis and device integration. The push for higher efficiency and stability in QD-based photovoltaics and lighting is expected to sustain demand for advanced analytical equipment through the next several years.

Looking ahead, the quantum dot spectroscopy equipment market is poised for continued growth, underpinned by cross-sector innovation and increasing investment in nanotechnology infrastructure. Equipment manufacturers are likely to focus on automation, miniaturization, and integration with AI-driven data analysis to meet the evolving needs of research and industry. Strategic collaborations between instrument makers and end-users in healthcare, semiconductors, and energy will further accelerate the development and adoption of next-generation spectroscopy solutions.

Competitive Analysis: Leading Players and New Entrants

The competitive landscape of quantum dot spectroscopy equipment manufacturing in 2025 is characterized by a mix of established instrumentation giants and agile new entrants, each leveraging advances in nanomaterials and photonics. The sector is driven by demand from research institutions, semiconductor manufacturers, and display technology developers, with a focus on higher sensitivity, automation, and integration with AI-driven data analysis.

Among the leading players, Thermo Fisher Scientific continues to dominate the spectroscopy instrumentation market, offering modular and high-throughput systems tailored for quantum dot analysis. Their recent product lines emphasize enhanced spectral resolution and compatibility with a range of quantum dot materials, including perovskite and III-V compounds. Bruker Corporation maintains a strong presence with its advanced photoluminescence and Raman spectroscopy platforms, which are widely adopted in both academic and industrial quantum dot research. Bruker’s focus on automation and user-friendly interfaces has positioned it as a preferred supplier for high-volume laboratories.

Another significant player is HORIBA, which has expanded its modular spectroscopy solutions to address the specific needs of quantum dot characterization, such as time-resolved photoluminescence and quantum yield measurements. HORIBA’s global network and partnerships with leading research centers have enabled rapid deployment of new features, including AI-assisted spectral deconvolution.

In parallel, Oxford Instruments has leveraged its expertise in cryogenic and low-temperature spectroscopy systems, catering to the growing interest in quantum dot applications for quantum computing and single-photon sources. Their integration of spectroscopy modules with cryostats and superconducting magnets is particularly valued in fundamental physics research.

New entrants are also making notable strides. Startups such as Quantum Design and PicoQuant are introducing compact, cost-effective spectroscopy solutions with advanced time-correlated single-photon counting (TCSPC) capabilities, targeting university labs and emerging markets. These companies are focusing on modularity and cloud-based data analysis, aiming to lower the barrier to entry for quantum dot research.

Looking ahead, the competitive dynamics are expected to intensify as demand for quantum dot-enabled technologies in displays, solar cells, and quantum information processing accelerates. Established manufacturers are investing in R&D to improve sensitivity and throughput, while new entrants are likely to drive innovation in miniaturization and software integration. Strategic collaborations between equipment makers and quantum dot material suppliers are anticipated to further shape the market landscape through 2027.

Regulatory Environment and Industry Standards (e.g., ieee.org, iso.org)

The regulatory environment and industry standards for quantum dot spectroscopy equipment manufacturing are evolving rapidly as the technology matures and finds broader applications in fields such as biomedical imaging, display technology, and materials science. In 2025, the sector is witnessing increased attention from international standards organizations and regulatory bodies, aiming to ensure product safety, measurement accuracy, and interoperability.

A key player in the development of global standards is the International Organization for Standardization (ISO), which has established technical committees such as ISO/TC 229 for nanotechnologies. These committees are actively working on standards that address the characterization, measurement, and environmental health and safety aspects of nanomaterials, including quantum dots. For spectroscopy equipment, ISO standards focus on calibration procedures, performance metrics, and data reporting formats, which are critical for ensuring consistency across manufacturers and users.

The Institute of Electrical and Electronics Engineers (IEEE) is also contributing to the standardization landscape, particularly through its Nanotechnology Council. IEEE standards are being developed to address the electrical and optical measurement protocols relevant to quantum dot-based devices and instrumentation. These standards are expected to facilitate interoperability between equipment from different manufacturers and support the integration of quantum dot spectroscopy systems into broader analytical workflows.

In the United States, the National Institute of Standards and Technology (NIST) plays a pivotal role in providing reference materials and measurement methodologies for quantum dot characterization. NIST’s efforts are crucial for manufacturers seeking to validate the performance of their spectroscopy equipment and to comply with both domestic and international regulatory requirements.

Manufacturers such as Thermo Fisher Scientific and HORIBA are actively engaging with these standards bodies, contributing technical expertise and aligning their product development with emerging guidelines. This collaboration ensures that new equipment models introduced in 2025 and beyond will meet the rigorous demands of both scientific research and industrial quality control.

Looking ahead, the regulatory environment is expected to become more stringent as quantum dot applications proliferate, particularly in sensitive areas like medical diagnostics and environmental monitoring. Industry stakeholders anticipate the introduction of more comprehensive standards covering lifecycle management, traceability, and end-of-life disposal of quantum dot-containing devices. Compliance with these evolving standards will be essential for manufacturers to access global markets and to maintain customer trust in the reliability and safety of their spectroscopy equipment.

Challenges and Opportunities: Supply Chain, Scalability, and R&D

The manufacturing of quantum dot spectroscopy equipment in 2025 is shaped by a complex interplay of supply chain dynamics, scalability hurdles, and intensive research and development (R&D) demands. As quantum dot applications proliferate in fields such as biomedical imaging, display technology, and advanced materials analysis, the sector faces both significant challenges and promising opportunities.

Supply Chain Challenges

The supply chain for quantum dot spectroscopy equipment is highly specialized, relying on the availability of high-purity raw materials, precision optical components, and advanced semiconductor fabrication processes. Disruptions in the global supply of critical elements such as cadmium, indium, and tellurium—essential for many quantum dot formulations—can impact production timelines and costs. Leading manufacturers like Thermo Fisher Scientific and HORIBA have responded by diversifying supplier bases and investing in vertical integration to secure critical materials and components. However, geopolitical tensions and export restrictions remain ongoing risks, particularly for rare earth elements and specialty chemicals.

Scalability and Manufacturing Bottlenecks

Scaling up quantum dot spectroscopy equipment from laboratory prototypes to commercial-scale production presents technical and economic challenges. The precision required in quantum dot synthesis and device assembly demands advanced automation and stringent quality control. Companies such as Oxford Instruments and Bruker are investing in modular manufacturing platforms and digital process monitoring to enhance throughput and reproducibility. Despite these advances, the high capital expenditure for cleanroom facilities and specialized fabrication tools remains a barrier for new entrants and smaller firms.

R&D: Innovation and Collaboration

Continuous R&D is vital for improving the sensitivity, resolution, and reliability of quantum dot spectroscopy systems. In 2025, industry leaders are increasingly collaborating with academic institutions and government research labs to accelerate innovation. For example, Thermo Fisher Scientific and HORIBA have announced joint research initiatives focused on next-generation quantum dot materials and integrated photonic detection modules. Open innovation models and public-private partnerships are expected to drive breakthroughs in environmentally friendly quantum dot synthesis and scalable device architectures.

Outlook

Looking ahead, the sector is poised for growth as demand for high-performance analytical instrumentation rises in life sciences, nanotechnology, and materials research. The ability of manufacturers to navigate supply chain volatility, invest in scalable production, and sustain R&D momentum will determine their competitive positioning. Companies that successfully address these challenges are likely to capture expanding market opportunities as quantum dot spectroscopy becomes increasingly central to advanced scientific and industrial applications.

Future Outlook: Disruptive Trends and Long-Term Market Potential

The future outlook for quantum dot spectroscopy equipment manufacturing in 2025 and the following years is shaped by rapid technological advancements, increasing demand for high-precision analytical tools, and the expanding application landscape of quantum dots. As quantum dots continue to revolutionize fields such as biomedical imaging, display technology, and photovoltaics, the need for advanced spectroscopy equipment tailored to their unique properties is intensifying.

One of the most disruptive trends is the integration of artificial intelligence (AI) and machine learning algorithms into spectroscopy systems. These technologies enable real-time data analysis, improved signal-to-noise ratios, and automated calibration, significantly enhancing throughput and accuracy. Leading manufacturers such as HORIBA and Oxford Instruments are actively developing next-generation spectrometers with embedded AI capabilities, aiming to streamline quantum dot characterization and accelerate research and development cycles.

Miniaturization and modularity are also driving innovation. Compact, portable spectrometers are becoming increasingly viable due to advances in photonic integration and detector sensitivity. Companies like Ocean Insight are pioneering modular spectroscopy platforms that can be customized for quantum dot analysis, enabling flexible deployment in both laboratory and industrial settings. This trend is expected to lower barriers to entry for smaller research institutions and startups, democratizing access to high-end quantum dot characterization tools.

Another key development is the push towards automation and high-throughput screening. Automated sample handling and multiplexed detection systems are being incorporated to meet the growing demand for rapid, large-scale quantum dot screening, particularly in pharmaceutical and materials science applications. Bruker and Thermo Fisher Scientific are expanding their product lines to include automated spectroscopy solutions, anticipating increased adoption in both academic and industrial laboratories.

Looking ahead, the market potential for quantum dot spectroscopy equipment is poised for robust growth. The convergence of quantum dot research with emerging sectors such as quantum computing, advanced sensing, and next-generation displays is expected to drive sustained investment in specialized analytical instrumentation. Strategic partnerships between equipment manufacturers and quantum dot producers are likely to accelerate innovation, with companies such as Nanosys and Nanoco Group collaborating closely with instrument makers to optimize equipment for new quantum dot formulations and applications.

In summary, the next few years will see quantum dot spectroscopy equipment manufacturing characterized by rapid technological evolution, increased automation, and expanding market opportunities, positioning the sector for significant long-term growth and disruptive impact across multiple industries.

Sources & References

- Thermo Fisher Scientific

- Oxford Instruments

- HORIBA

- Ocean Insight

- Hamamatsu Photonics

- Carl Zeiss AG

- Leica Microsystems

- Coherent Corp.

- PerkinElmer

- International Organization for Standardization (ISO)

- Institute of Electrical and Electronics Engineers (IEEE)

- National Institute of Standards and Technology (NIST)