Hydrogel Drug Delivery Systems in 2025: Transforming Targeted Therapies and Shaping the Future of Advanced Drug Delivery. Explore the Breakthroughs, Market Dynamics, and Strategic Opportunities Driving This High-Impact Sector.

- Executive Summary: Key Trends and Market Drivers in 2025

- Technology Overview: Innovations in Hydrogel Drug Delivery

- Market Size and Forecast (2025–2030): Growth Projections and Segmentation

- Competitive Landscape: Leading Companies and Strategic Initiatives

- Emerging Applications: Oncology, Regenerative Medicine, and Beyond

- Regulatory Environment and Compliance Considerations

- Challenges and Barriers to Adoption

- Strategic Partnerships and Collaborations

- Investment Trends and Funding Landscape

- Future Outlook: Disruptive Technologies and Long-Term Opportunities

- Sources & References

Executive Summary: Key Trends and Market Drivers in 2025

Hydrogel drug delivery systems are poised for significant growth and innovation in 2025, driven by advances in biomaterials, increasing demand for targeted therapies, and the expanding pipeline of biologics and regenerative medicines. Hydrogels—three-dimensional, hydrophilic polymer networks—offer unique advantages such as high biocompatibility, tunable release profiles, and the ability to encapsulate a wide range of therapeutic agents, including small molecules, proteins, and nucleic acids. These properties are fueling their adoption across multiple therapeutic areas, notably oncology, wound care, ophthalmology, and chronic disease management.

A key trend in 2025 is the integration of smart and stimuli-responsive hydrogels, which can release drugs in response to specific physiological triggers such as pH, temperature, or enzymatic activity. This approach is being actively explored by leading biomaterials companies and research-driven pharmaceutical manufacturers. For example, Evonik Industries—a major supplier of specialty polymers—has expanded its portfolio to include advanced hydrogel platforms designed for controlled and sustained drug release. Similarly, Ashland Global Holdings is developing hydrogel excipients tailored for injectable and implantable drug delivery systems, supporting the trend toward minimally invasive therapies.

The regulatory landscape is also evolving to accommodate the complexity of hydrogel-based products. In 2025, regulatory agencies are expected to provide clearer guidance on the characterization, safety, and efficacy of hydrogel drug delivery systems, facilitating faster development timelines and market entry. This is particularly relevant for combination products and personalized medicine applications, where hydrogels are used as carriers for cell therapies or gene editing tools.

Strategic collaborations between pharmaceutical companies, biomaterials suppliers, and academic institutions are accelerating innovation. For instance, Baxter International continues to invest in hydrogel-based wound care and hemostatic products, leveraging its expertise in biocompatible materials. Meanwhile, DuPont is advancing hydrogel technologies for transdermal and mucosal drug delivery, focusing on improved patient compliance and therapeutic outcomes.

Looking ahead, the outlook for hydrogel drug delivery systems in the next few years is robust. The convergence of material science, biotechnology, and digital health is expected to yield next-generation hydrogels with enhanced functionality, such as real-time monitoring and adaptive drug release. As the global healthcare sector prioritizes patient-centric and precision medicine solutions, hydrogel-based delivery platforms are set to play a pivotal role in shaping the future of therapeutics.

Technology Overview: Innovations in Hydrogel Drug Delivery

Hydrogel drug delivery systems are at the forefront of biomedical innovation, offering unique advantages such as high water content, biocompatibility, and tunable release profiles. In 2025, the field is witnessing rapid technological advancements, with a focus on smart hydrogels, injectable formulations, and stimuli-responsive systems. These innovations are driven by the need for targeted, controlled, and patient-friendly drug delivery, particularly in oncology, wound care, and chronic disease management.

A major trend is the development of stimuli-responsive hydrogels that release therapeutic agents in response to specific physiological triggers such as pH, temperature, or enzymatic activity. For example, companies like Evonik Industries are advancing hydrogel platforms that respond to environmental changes, enabling precise drug release at the site of disease. These systems are particularly promising for cancer therapies, where localized and on-demand drug delivery can minimize systemic toxicity.

Another significant innovation is the rise of injectable hydrogel systems, which can be administered minimally invasively and conform to irregular tissue shapes. Ashland, a global specialty materials company, is actively developing hydrogel excipients for injectable formulations, focusing on improving drug stability and patient compliance. These injectable hydrogels are being explored for applications ranging from sustained-release pain medications to regenerative medicine.

The integration of nanotechnology with hydrogels is also gaining momentum. By embedding nanoparticles or nanofibers within hydrogel matrices, companies such as DSM are enhancing the mechanical strength and functional versatility of these systems. This approach allows for the co-delivery of multiple drugs or the incorporation of imaging agents, paving the way for theranostic (therapy + diagnostic) applications.

In the regulatory and manufacturing landscape, established players like DuPont and BASF are investing in scalable production methods and quality control for medical-grade hydrogels. Their efforts are crucial for meeting the stringent requirements of pharmaceutical and medical device markets, ensuring that new hydrogel-based products can transition from laboratory to clinic efficiently.

Looking ahead, the next few years are expected to bring further convergence of hydrogel technology with digital health and personalized medicine. Smart hydrogels capable of real-time monitoring and adaptive drug release are under development, with collaborations between material science leaders and biotech startups accelerating progress. As these innovations mature, hydrogel drug delivery systems are poised to play a transformative role in precision therapeutics and patient-centric care.

Market Size and Forecast (2025–2030): Growth Projections and Segmentation

The hydrogel drug delivery systems market is poised for robust growth between 2025 and 2030, driven by increasing demand for advanced therapeutics, rising prevalence of chronic diseases, and ongoing innovation in biomaterials. Hydrogels—three-dimensional, hydrophilic polymer networks—are gaining traction due to their biocompatibility, tunable release profiles, and ability to encapsulate a wide range of therapeutic agents, from small molecules to biologics.

By 2025, the global hydrogel drug delivery market is expected to reach several billion USD in annual revenues, with projections indicating a compound annual growth rate (CAGR) in the high single digits through 2030. This expansion is underpinned by the growing adoption of hydrogel-based formulations in oncology, wound care, ophthalmology, and vaccine delivery. The market is segmented by product type (natural, synthetic, and hybrid hydrogels), route of administration (oral, topical, injectable, ocular, and others), and therapeutic application.

- Product Type: Synthetic hydrogels, such as those based on poly(ethylene glycol) (PEG) and poly(vinyl alcohol) (PVA), are expected to dominate due to their customizable properties and scalability. However, natural hydrogels—derived from materials like alginate, chitosan, and hyaluronic acid—are gaining momentum for their superior biocompatibility and use in sensitive applications, such as ophthalmic and wound healing products.

- Route of Administration: Injectable hydrogels are projected to see the fastest growth, particularly in localized cancer therapy and regenerative medicine. Topical and ocular hydrogel systems are also expanding, supported by the success of products like contact lens drug delivery platforms and wound dressings.

- Therapeutic Application: Oncology remains a leading segment, with hydrogel systems enabling sustained and targeted delivery of chemotherapeutics. Other high-growth areas include diabetes management (e.g., insulin delivery), ophthalmology (e.g., sustained-release eye drops), and vaccine delivery, where hydrogels can enhance stability and immunogenicity.

Key industry players are investing in R&D and strategic collaborations to expand their hydrogel portfolios. Baxter International Inc. is advancing hydrogel-based wound care and injectable systems, while Alcon is a leader in ophthalmic hydrogel technologies. Smith & Nephew and ConvaTec Group are prominent in wound management, leveraging hydrogel dressings for controlled drug release. Additionally, Bausch Health Companies is active in hydrogel-based ocular therapeutics.

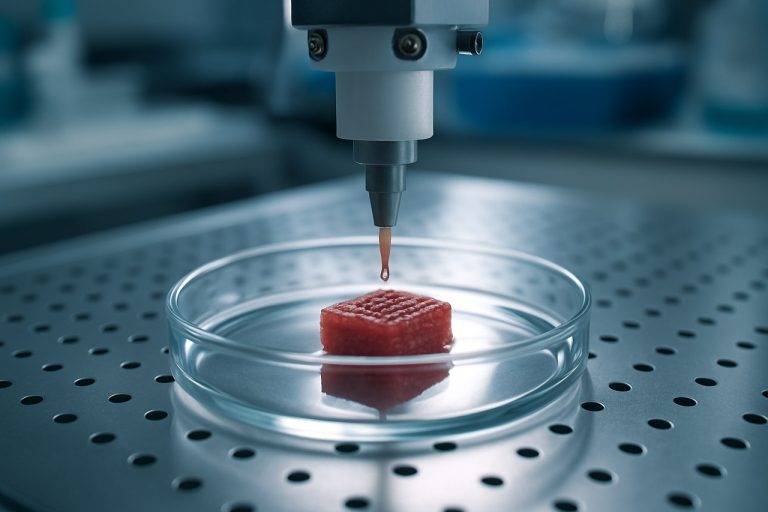

Looking ahead, the market outlook remains positive, with regulatory approvals for novel hydrogel formulations anticipated to accelerate commercialization. The convergence of hydrogel technology with personalized medicine, 3D printing, and smart drug delivery systems is expected to unlock new opportunities and further segment growth through 2030.

Competitive Landscape: Leading Companies and Strategic Initiatives

The competitive landscape for hydrogel drug delivery systems in 2025 is characterized by a dynamic mix of established pharmaceutical giants, specialized biomaterials firms, and innovative startups. These players are leveraging advances in polymer science, biocompatibility, and controlled release technologies to develop next-generation hydrogel platforms for a range of therapeutic applications.

Among the global leaders, Johnson & Johnson continues to invest in hydrogel-based delivery systems, particularly for ophthalmic and wound care products. Their subsidiary, Ethicon, has a history of commercializing hydrogel dressings and is actively exploring injectable hydrogel matrices for localized drug delivery. Similarly, Baxter International maintains a strong presence in the hydrogel space, focusing on hemostatic agents and sustained-release formulations for surgical and chronic care settings.

In the Asia-Pacific region, Otsuka Pharmaceutical is advancing hydrogel technologies for targeted cancer therapies and long-acting injectables, building on its expertise in drug formulation and delivery. Meanwhile, Smith & Nephew is expanding its hydrogel wound care portfolio, integrating antimicrobial agents and growth factors to enhance healing outcomes.

Specialized biomaterials companies are also shaping the competitive landscape. Evonik Industries is a key supplier of medical-grade polymers and custom hydrogel formulations, collaborating with pharmaceutical partners to develop tailored drug delivery solutions. Pfizer has entered strategic partnerships to explore hydrogel-based sustained-release injectables, particularly for pain management and oncology indications.

Startups and university spin-offs are driving innovation through novel hydrogel chemistries and smart delivery systems. Companies such as Corbion (formerly Purac Biochem) are developing biodegradable hydrogels for controlled release of biologics and peptides. Additionally, Ashland is expanding its pharmaceutical excipients portfolio to include advanced hydrogel carriers, supporting the formulation needs of both large and emerging drug developers.

Strategic initiatives in 2025 include increased investment in R&D, cross-sector collaborations, and licensing agreements to accelerate clinical translation. Companies are also focusing on regulatory compliance and scalable manufacturing processes to meet anticipated demand for hydrogel-based therapeutics. Looking ahead, the competitive landscape is expected to intensify as more hydrogel drug delivery products approach late-stage clinical trials and commercialization, with a strong emphasis on personalized medicine and minimally invasive therapies.

Emerging Applications: Oncology, Regenerative Medicine, and Beyond

Hydrogel drug delivery systems are rapidly advancing as versatile platforms for controlled and targeted therapeutic delivery, with significant momentum in oncology, regenerative medicine, and other emerging biomedical fields. As of 2025, the convergence of material science innovation and clinical demand is driving both the expansion of hydrogel-based products and the initiation of new clinical trials.

In oncology, hydrogels are being engineered to provide localized, sustained release of chemotherapeutics, immunotherapies, and gene-editing agents. This approach aims to maximize drug concentration at tumor sites while minimizing systemic toxicity. Companies such as Boston Scientific Corporation are actively developing hydrogel-based platforms for intratumoral drug delivery, leveraging their expertise in minimally invasive medical technologies. Similarly, Baxter International Inc. is exploring hydrogel matrices for encapsulating and delivering anti-cancer agents, with a focus on improving patient outcomes in solid tumor indications.

Regenerative medicine represents another frontier for hydrogel drug delivery. Hydrogels’ biocompatibility and tunable physical properties make them ideal scaffolds for cell and growth factor delivery, supporting tissue repair and regeneration. 3M has expanded its biomedical materials portfolio to include hydrogel-based wound care and tissue engineering products, integrating controlled release of bioactive molecules to accelerate healing. Meanwhile, Abbott Laboratories is investing in hydrogel systems for cardiac and orthopedic regenerative therapies, aiming to enhance the integration and survival of transplanted cells.

Beyond oncology and regenerative medicine, hydrogel drug delivery is gaining traction in ophthalmology, diabetes management, and vaccine delivery. For example, Alcon is developing hydrogel-based ocular inserts for sustained drug release in glaucoma and post-surgical care. In diabetes, companies like Medtronic are investigating hydrogel depots for long-acting insulin and peptide therapeutics, seeking to reduce injection frequency and improve glycemic control.

Looking ahead, the next few years are expected to see increased regulatory approvals and commercial launches of hydrogel-based drug delivery products, as well as expanded partnerships between device manufacturers and pharmaceutical companies. The integration of smart hydrogels—responsive to physiological stimuli such as pH, temperature, or enzymes—will further enhance precision and personalization in therapy. As clinical data accumulates and manufacturing scalability improves, hydrogel drug delivery systems are poised to become a cornerstone technology across multiple therapeutic areas.

Regulatory Environment and Compliance Considerations

The regulatory environment for hydrogel drug delivery systems is evolving rapidly as these advanced materials gain traction in pharmaceutical and biomedical applications. In 2025, regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are intensifying their focus on the unique challenges posed by hydrogels, particularly regarding biocompatibility, sterility, and controlled drug release profiles. Hydrogel-based systems, which can be composed of natural or synthetic polymers, are subject to rigorous scrutiny to ensure patient safety and therapeutic efficacy.

A key regulatory consideration is the classification of hydrogel drug delivery products. Depending on their primary mode of action, these products may be regulated as medical devices, combination products, or pharmaceuticals. For example, injectable hydrogel formulations for localized drug delivery are often reviewed as combination products, requiring compliance with both device and drug regulations. The FDA’s Office of Combination Products provides guidance on such submissions, emphasizing the need for robust preclinical and clinical data to demonstrate safety and performance.

Manufacturers such as Baxter International and Becton, Dickinson and Company (BD) are actively engaged in developing hydrogel-based delivery platforms and have established internal regulatory teams to navigate the complex approval pathways. These companies invest in comprehensive biocompatibility testing, in line with ISO 10993 standards, and conduct extensive stability and leachables studies to meet regulatory expectations. Additionally, sterility assurance is a critical requirement, especially for hydrogels intended for parenteral administration, necessitating validated sterilization processes and aseptic manufacturing environments.

In the European Union, the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) have introduced stricter requirements for clinical evidence and post-market surveillance, impacting hydrogel-based products classified as medical devices. Companies must now provide more detailed technical documentation and implement robust risk management systems throughout the product lifecycle. Organizations such as Smith & Nephew, which markets hydrogel wound care products, are adapting to these changes by enhancing their regulatory compliance frameworks and investing in real-world evidence generation.

Looking ahead, the regulatory landscape for hydrogel drug delivery systems is expected to become more harmonized globally, with increased collaboration between agencies to address emerging technologies. The next few years will likely see the introduction of new guidance documents specific to hydrogels, reflecting advances in material science and drug-device integration. Companies that proactively engage with regulators and invest in compliance infrastructure will be better positioned to bring innovative hydrogel-based therapies to market efficiently and safely.

Challenges and Barriers to Adoption

Hydrogel drug delivery systems have garnered significant attention for their potential to revolutionize controlled and targeted drug release. However, as of 2025, several challenges and barriers continue to impede their widespread adoption in clinical and commercial settings.

One of the primary challenges is the complexity of hydrogel formulation and manufacturing. Achieving consistent quality, reproducibility, and scalability remains difficult, especially for hydrogels incorporating sensitive biologics or complex release profiles. Leading suppliers such as Evonik Industries and BASF have invested in advanced polymer synthesis and process control, but translating laboratory-scale innovations to industrial production still faces hurdles related to batch variability and regulatory compliance.

Biocompatibility and long-term safety are also critical concerns. While many hydrogels are designed to be non-toxic and biodegradable, the risk of immune reactions, inflammation, or unintended interactions with encapsulated drugs persists. Regulatory agencies require extensive preclinical and clinical data to demonstrate safety, which can prolong development timelines and increase costs. Companies such as Ashland and Lubrizol are actively working to develop medical-grade hydrogels with improved safety profiles, but regulatory approval remains a significant barrier.

Another barrier is the limited range of drugs that can be effectively delivered using hydrogel systems. Hydrogels are particularly well-suited for hydrophilic molecules, peptides, and proteins, but their ability to encapsulate and release hydrophobic drugs or large biologics is still under development. This restricts the therapeutic areas where hydrogel systems can be applied. Efforts by companies like Pfizer and Johnson & Johnson to expand the versatility of hydrogel platforms are ongoing, with several preclinical and early clinical programs exploring new drug-hydrogel combinations.

Cost and reimbursement issues also pose significant challenges. The production of high-purity, medical-grade hydrogels is often more expensive than traditional drug formulations, and payers may be reluctant to reimburse for novel delivery systems without clear evidence of superior outcomes. This is particularly relevant in markets with strict cost-containment policies.

Looking ahead, the outlook for hydrogel drug delivery systems will depend on continued advances in material science, manufacturing technology, and regulatory science. Industry leaders and organizations such as PhRMA are advocating for streamlined regulatory pathways and increased investment in translational research. Over the next few years, successful navigation of these challenges will be crucial for broader adoption and commercialization of hydrogel-based therapeutics.

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations are playing a pivotal role in advancing hydrogel drug delivery systems as the sector matures in 2025. These alliances are enabling the translation of laboratory innovations into scalable, clinically relevant products, while also addressing regulatory, manufacturing, and commercialization challenges. The current landscape is characterized by cross-sector collaborations between biotechnology firms, pharmaceutical companies, academic institutions, and materials science leaders.

One of the most notable trends is the increasing number of joint development agreements between established pharmaceutical companies and hydrogel technology specialists. For example, Evonik Industries, a global leader in specialty chemicals and advanced drug delivery materials, has expanded its partnerships with biotech firms to co-develop hydrogel-based injectable formulations for sustained release of biologics and small molecules. These collaborations leverage Evonik’s expertise in polymer chemistry and scale-up manufacturing, accelerating the path from proof-of-concept to clinical trials.

Similarly, Ashland, known for its pharmaceutical excipients and hydrogel technologies, has entered into strategic alliances with both startups and established drug developers to create next-generation wound care and ophthalmic drug delivery systems. These partnerships are focused on integrating Ashland’s proprietary hydrogel platforms with novel therapeutic agents, aiming to improve patient compliance and therapeutic efficacy.

Academic-industry collaborations remain a cornerstone of innovation in this field. Leading research universities are increasingly partnering with industry players to bridge the gap between fundamental research and commercial application. For instance, several North American and European universities have established joint research centers with companies like DuPont, which brings its expertise in biomaterials and regulatory navigation to accelerate the development of hydrogel-based drug delivery devices.

In Asia, companies such as Nippon Kayaku are collaborating with regional biotech startups and academic institutions to develop hydrogel systems tailored for local therapeutic needs, including cancer therapies and regenerative medicine. These partnerships are supported by government initiatives aimed at fostering innovation in advanced drug delivery.

Looking ahead, the next few years are expected to see a further intensification of strategic collaborations, particularly as hydrogel drug delivery systems move toward commercialization and regulatory approval. Companies are increasingly seeking partners with complementary capabilities in clinical development, regulatory affairs, and global distribution. The formation of consortia and public-private partnerships is also anticipated to address common challenges such as standardization, scalability, and long-term biocompatibility, ensuring that hydrogel drug delivery technologies can reach broader patient populations worldwide.

Investment Trends and Funding Landscape

The investment landscape for hydrogel drug delivery systems in 2025 is characterized by a surge in both venture capital and strategic corporate funding, reflecting the sector’s maturation and the growing recognition of hydrogels’ potential in precision medicine and controlled drug release. The global push for advanced drug delivery technologies, particularly those enabling sustained and targeted release, has positioned hydrogels as a focal point for investors seeking high-growth opportunities in the biopharmaceutical and medical device sectors.

In recent years, several major pharmaceutical and biotechnology companies have increased their direct investments and partnership activities in hydrogel-based platforms. For example, Johnson & Johnson has expanded its innovation pipeline to include hydrogel-based ocular and wound care drug delivery systems, leveraging both internal R&D and external collaborations. Similarly, Baxter International has continued to support hydrogel research for injectable therapeutics and regenerative medicine applications, signaling confidence in the scalability and clinical relevance of these materials.

Venture capital activity remains robust, with early- and mid-stage startups attracting significant rounds to advance hydrogel formulations for oncology, ophthalmology, and chronic disease management. Notably, companies such as Boston Scientific have made strategic investments in startups developing hydrogel-based implantable devices, aiming to diversify their therapeutic portfolios and address unmet clinical needs. The presence of dedicated healthcare funds and corporate venture arms, including those from Medtronic and Abbott Laboratories, further underscores the sector’s appeal.

Government and public sector funding also play a pivotal role, particularly in North America, Europe, and parts of Asia. Agencies such as the U.S. National Institutes of Health (NIH) and the European Innovation Council have issued targeted grants and calls for proposals focused on hydrogel drug delivery, supporting translational research and early clinical trials. This public investment is often matched by private capital, accelerating the path from laboratory innovation to commercial product.

Looking ahead to the next few years, the outlook for hydrogel drug delivery investment remains positive. The convergence of biomaterials science, personalized medicine, and digital health is expected to drive further funding, especially as hydrogel systems demonstrate improved biocompatibility, tunable release profiles, and integration with smart devices. Strategic acquisitions and licensing deals are anticipated as established players seek to secure proprietary hydrogel technologies and expand their market share. Overall, the funding environment in 2025 and beyond is set to foster continued innovation and commercialization in hydrogel drug delivery systems.

Future Outlook: Disruptive Technologies and Long-Term Opportunities

The future of hydrogel drug delivery systems is poised for significant transformation, driven by advances in material science, bioengineering, and precision medicine. As of 2025, the field is witnessing a convergence of disruptive technologies that promise to expand the therapeutic potential of hydrogels, particularly in areas such as oncology, regenerative medicine, and chronic disease management.

One of the most promising trends is the development of “smart” hydrogels—materials engineered to respond to specific physiological stimuli such as pH, temperature, or enzymatic activity. These hydrogels enable on-demand, site-specific drug release, reducing systemic side effects and improving patient outcomes. Companies like Evonik Industries are actively developing advanced hydrogel platforms with tunable properties for controlled drug delivery, leveraging their expertise in specialty chemicals and biomaterials.

Another disruptive direction is the integration of hydrogel systems with digital health technologies. Researchers and manufacturers are exploring hydrogels embedded with biosensors or wireless communication modules, enabling real-time monitoring of drug release and patient response. This approach aligns with the broader trend toward personalized medicine and remote patient management, which is being pursued by innovators such as Boston Scientific, known for their work in implantable drug delivery devices and bioelectronics.

In the near term, injectable and implantable hydrogel formulations are expected to gain regulatory traction, particularly for localized cancer therapies and regenerative applications. For example, Ashland is advancing hydrogel excipients designed for sustained release in parenteral formulations, while DuPont is investing in biocompatible hydrogel materials for tissue engineering and wound care. These efforts are supported by ongoing collaborations with academic institutions and clinical partners to accelerate translation from bench to bedside.

Looking ahead, the long-term opportunities for hydrogel drug delivery systems extend beyond pharmaceuticals. There is growing interest in using hydrogels as platforms for cell and gene therapies, as well as for the delivery of biologics and vaccines. The scalability and versatility of hydrogel manufacturing processes, championed by companies like 3M in their healthcare division, are expected to facilitate broader adoption across therapeutic areas.

Overall, the next few years will likely see hydrogel drug delivery systems move from niche applications to mainstream clinical practice, driven by technological innovation, regulatory support, and increasing demand for targeted, patient-centric therapies.

Sources & References

- Evonik Industries

- Baxter International

- DuPont

- DSM

- BASF

- Alcon

- Smith & Nephew

- ConvaTec Group

- Bausch Health Companies

- Boston Scientific Corporation

- Medtronic

- Lubrizol

- PhRMA

- Nippon Kayaku