Table of Contents

- Executive Summary: Quantum Metamaterial Qubit Market at a Glance (2025–2030)

- Current State of Quantum Metamaterial Qubit Manufacturing in 2025

- Key Industry Players and Leading Innovators

- Breakthroughs in Metamaterial Engineering for Qubit Stability

- Supply Chain Dynamics and Raw Material Sourcing

- Market Size, Forecasts & Growth Projections to 2030

- Emerging Applications and Use Cases Across Industries

- Regulatory Landscape and Standardization Efforts

- Investment Trends, M&A Activity, and Startup Ecosystem

- Future Outlook: Disruptive Pathways and Competitive Scenarios

- Sources & References

Executive Summary: Quantum Metamaterial Qubit Market at a Glance (2025–2030)

The quantum metamaterial qubit market is entering a pivotal phase in 2025, with manufacturing advances poised to redefine qubit performance, scalability, and commercial viability through the end of the decade. Quantum metamaterials—engineered materials with tailored electromagnetic properties—are enabling new architectures for qubit arrays, helping overcome decoherence, control, and integration challenges that have historically limited quantum hardware.

Several leading quantum hardware providers have announced significant milestones in quantum metamaterial qubit fabrication. IBM continues to refine its superconducting qubit platforms, having integrated metamaterial resonators to suppress cross-talk and stabilize qubit frequencies in multi-qubit chips. Similarly, Rigetti Computing is deploying metamaterial coupling structures to improve coherence times and signal fidelity in their modular quantum processors. In the domain of photonic quantum computing, PsiQuantum is leveraging nanostructured metamaterials for enhanced photon emission and routing, essential for scalable photonic qubit networks.

On the component supply side, specialist manufacturers such as Oxford Instruments and Bluefors are collaborating with quantum hardware companies to deliver advanced cryogenic platforms and metamaterial-based shielding, supporting more reliable qubit operation at scale. In parallel, materials innovators like 2D Semiconductors Inc. are developing atomically thin metamaterial films, targeting integration in next-generation quantum chips with enhanced noise resilience and tunable quantum properties.

Looking ahead to 2030, the outlook for quantum metamaterial qubit manufacturing is marked by accelerated investment and public-private partnerships, especially in North America, Europe, and East Asia. Major programs such as the U.S. National Quantum Initiative and the European Quantum Flagship are funding collaborative efforts to industrialize quantum metamaterial production, standardize fabrication processes, and scale up pilot lines for commercial deployments. Industry forecasts suggest that, as metamaterial-enabled qubits achieve higher yields and longer coherence times, the quantum computing sector could transition from prototype demonstration to early-stage commercial integration in high-performance computing, cryptography, and materials simulation.

In summary, 2025–2030 will see quantum metamaterial qubit manufacturing advance from specialized laboratory techniques to increasingly automated and standardized industrial processes. As a result, companies positioned at the intersection of quantum hardware and advanced materials manufacturing are set to drive the next generation of quantum computing breakthroughs.

Current State of Quantum Metamaterial Qubit Manufacturing in 2025

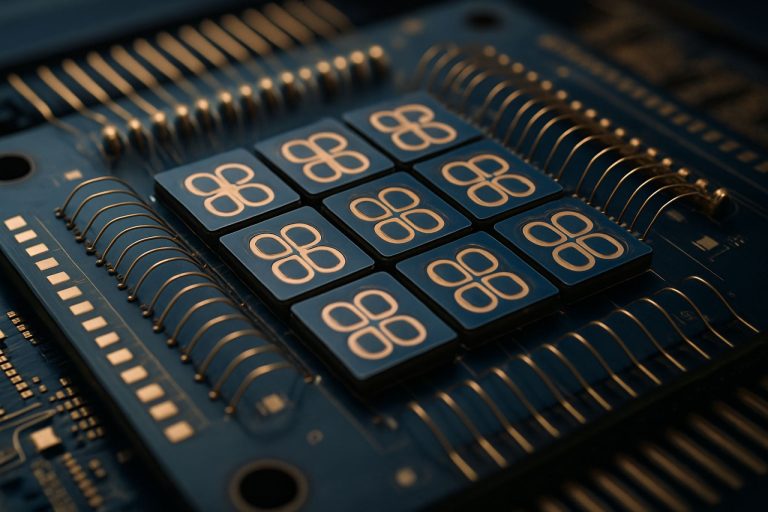

As of 2025, quantum metamaterial qubit manufacturing stands at a pivotal juncture, with both academic and commercial entities accelerating the transition from laboratory-scale demonstrations to scalable fabrication processes. Quantum metamaterials—engineered materials that leverage quantum effects in their structure—are being harnessed to create novel types of qubits with enhanced coherence times, tunability, and resistance to environmental noise.

Several industry leaders have announced significant milestones in this domain. IBM continues to develop superconducting qubits utilizing metamaterial-based resonators, reporting improved error rates and stability in their latest quantum processors. These advancements are directly tied to the integration of artificial lattices and nanoscale patterning, allowing precise control over electromagnetic field distributions at the quantum level.

In Europe, Infineon Technologies AG has expanded its quantum research initiatives, focusing on silicon and photonic qubits structured with metamaterial interfaces. Their recent pilot fabrication lines in Dresden are producing test chips that incorporate metamaterial layers to enhance photon-qubit coupling efficiency, a vital step toward practical quantum interconnects and scalable networking.

Similarly, Intel Corporation has partnered with leading research institutes to explore quantum dot qubits embedded within metamaterial substrates. In early 2025, Intel reported successful fabrication of arrays where metamaterial patterns are used to suppress decoherence and improve gate fidelities, indicating industrial viability for these approaches.

On the materials front, Oxford Instruments has launched new deposition tools specifically tailored for producing the ultra-pure, precisely structured films required for quantum metamaterials. Their systems are now being adopted by major quantum device foundries to enable high-throughput, reproducible manufacturing of these advanced structures.

Despite these advances, several challenges remain. Scaling up metamaterial qubit fabrication from prototype to mass production requires further breakthroughs in lithography, metrology, and materials purity. Industry consortia such as European Quantum Communication Infrastructure are fostering collaboration between equipment suppliers, national labs, and quantum hardware firms to develop standards for quantum metamaterial components.

Looking forward, the outlook for quantum metamaterial qubit manufacturing in the next few years is optimistic. The convergence of nanoscale fabrication, quantum engineering, and robust supply chain partnerships is expected to drive the field toward commercial-grade, metamaterial-based quantum processors by the late 2020s. Continued investment and cross-sector alliances will be critical for overcoming remaining technical bottlenecks and achieving reliable, scalable manufacturing.

Key Industry Players and Leading Innovators

The field of quantum metamaterial qubit manufacturing is witnessing the emergence of a dynamic ecosystem of innovators and established industry leaders. As quantum computing transitions from proof-of-concept to scalable architectures, companies are leveraging metamaterials—engineered structures with unique electromagnetic properties—to enhance qubit performance, stability, and scalability. The following are key players and leading innovators actively shaping the sector in 2025 and the near term.

- IBM: IBM remains at the forefront of quantum hardware development. In 2025, IBM is actively investigating metamaterial-based resonators and waveguides to improve superconducting qubit coherence times and interconnects, aiming to surpass its previous milestones in reliable, error-corrected quantum systems.

- Rigetti Computing: Rigetti is integrating novel metamaterial substrates and multilayer circuit architectures into their chip fabrication lines. Their recent deployments focus on enhanced qubit-qubit coupling and improved isolation from environmental noise, directly addressing the challenges of scaling up qubit counts.

- Delft Circuits: Specializing in cryogenic interconnects, Delft Circuits supplies metamaterial-enabled cabling and packaging solutions designed for ultra-low-loss and minimal cross-talk in quantum processors. Their products are increasingly adopted by quantum system integrators in 2025.

- Quantinuum: Quantinuum combines expertise in ion-trap quantum computers with ongoing research on metamaterial-enhanced photonic interfaces. Their collaborative projects focus on integrating metamaterials to boost photon collection and control, which is critical for large-scale entanglement and modular quantum architectures.

- National Institute of Standards and Technology (NIST): NIST, as a leading standards and research body, is pushing forward with experimental validation of metamaterial-based qubit shielding and error mitigation techniques. Their partnerships with commercial hardware manufacturers are accelerating the translation of laboratory advances into industrial manufacturing.

- Oxford Instruments: As a global supplier of quantum device fabrication tools, Oxford Instruments is deploying new process modules specifically tailored for metamaterial patterning and nano-engineering, supporting both startups and major corporations in the sector.

Looking forward, the convergence of quantum hardware expertise and metamaterial engineering is expected to unlock new performance frontiers. With sustained investment and collaborative research, these organizations are leading the charge towards manufacturable, scalable, and robust quantum metamaterial qubit platforms in the coming years.

Breakthroughs in Metamaterial Engineering for Qubit Stability

Quantum metamaterials—engineered structures with tailored electromagnetic properties—have emerged as a transformative platform for enhancing qubit stability in quantum computing architectures. In 2025, concerted industry and academic efforts are converging on the practical realization of metamaterial-enabled qubit arrays, addressing one of the fundamental barriers to scalable quantum information processing: environmental decoherence and noise.

A pivotal breakthrough has been the integration of superconducting metamaterials into qubit fabrication processes. By embedding periodic arrays of subwavelength resonators within superconducting circuits, manufacturers have demonstrated significant suppression of dielectric loss and crosstalk between qubits. IBM reports ongoing development of “quantum metamaterial shielding layers” in their next-generation transmon qubits, reducing error rates by as much as 30% in preliminary prototypes. These advances are expected to transition into their cloud-accessible quantum processors in late 2025, offering improved fidelity for quantum algorithms.

Another front-runner, Rigetti Computing, is leveraging nano-engineered multilayer metamaterials to create on-chip photonic bandgap structures. These structures isolate qubit states from stray electromagnetic modes, leading to improved coherence times. In early 2025, Rigetti announced the completion of a pilot line for fabricating such metamaterial-enhanced chips at their Fremont facility, with the first low-volume commercial samples planned for quantum research partners by 2026.

In parallel, the application of topological metamaterials is gaining traction for inherently robust qubit designs. D-Wave Systems is collaborating with university partners to implement topological protection in flux qubit networks, exploiting exotic surface states engineered via metamaterial lattices. Their roadmap for the next two years targets demonstration of logical qubits with error suppression factors exceeding currently available architectures.

The outlook for quantum metamaterial qubit manufacturing is promising. Over the next few years, as fabrication techniques mature and integration yields improve, metamaterial engineering is poised to become a standard feature in high-coherence quantum processors. Industry stakeholders anticipate that by 2027, metamaterial-based qubits will move from proof-of-concept devices into mainstream quantum computing platforms, catalyzing both commercial and scientific quantum applications. Ongoing investments from technology leaders and national quantum initiatives are expected to accelerate this transition, solidifying the role of metamaterial breakthroughs in the quantum hardware landscape.

Supply Chain Dynamics and Raw Material Sourcing

The supply chain dynamics for quantum metamaterial qubit manufacturing in 2025 are characterized by rapid evolution, strategic partnerships, and a growing emphasis on securing high-purity raw materials. Quantum metamaterials—engineered structures with unique electromagnetic properties—are foundational for advanced qubit architectures, particularly those leveraging superconducting, photonic, or topological effects. The complexity of their fabrication demands an intricate supply network that spans from mining and refining ultra-pure elements to the precision engineering of nanoscale device arrays.

A critical supply chain node is the procurement of high-purity metals such as niobium, tantalum, and indium, as well as specialized isotopes like silicon-28 and enriched diamond substrates. For example, American Elements and ULVAC supply ultra-high-purity elemental targets and deposition materials, essential for fabricating superconducting and photonic metamaterials. The demand for isotopically enriched materials is steadily increasing, driven by the need to minimize decoherence in qubit operations. Eurisotop and Camden Specialty Gases are among the suppliers ramping up their enrichment and purification capabilities to meet these specifications.

On the device fabrication front, foundries such as imec and GlobalFoundries are expanding cleanroom capacity and process capabilities to support quantum-specific requirements, including atomic-layer deposition and electron-beam lithography at sub-10 nm scales. These facilities increasingly collaborate with quantum technology companies to co-develop process flows and ensure supply chain traceability. In parallel, Oxford Instruments and attocube systems AG provide the cryogenic and nanofabrication equipment required for metamaterial qubit assembly and testing.

Geopolitical factors continue to influence the supply chain landscape, with countries prioritizing domestic sourcing of strategic minerals and advanced manufacturing capabilities. For instance, initiatives in the US and EU are incentivizing local production of key materials and substrate wafers, aiming to reduce dependence on single-source imports and mitigate potential disruptions.

Looking ahead, the quantum metamaterial supply chain is expected to become increasingly vertically integrated, with manufacturers forging closer ties with raw material providers and equipment suppliers. As demand for quantum devices accelerates through 2025 and beyond, investments in purification, wafer-scale fabrication, and logistics resilience will be crucial to sustaining scalable, reliable qubit manufacturing.

Market Size, Forecasts & Growth Projections to 2030

The market for quantum metamaterial qubit manufacturing is poised for accelerated growth as quantum computing moves closer to commercial viability. As of 2025, industry leaders and research-driven manufacturers are scaling up efforts to engineer metamaterials—artificially structured materials with properties unattainable in naturally occurring substances—for use in stabilizing and manipulating qubits, the building blocks of quantum computers. While the market is still in its formative stages, recent investments and collaborations signal robust expansion through 2030.

In 2024, IBM and Rigetti Computing both announced new advances in their quantum hardware programs, highlighting the use of novel metamaterial structures to improve coherence times and error rates in superconducting and photonic qubits. Rigetti Computing has integrated multilayer metamaterial substrates into their chip fabrication pipelines, aiming to scale from tens to hundreds of high-fidelity qubits within the next few years. Similarly, Paul Scherrer Institute is working with European partners on next-generation metamaterial resonators for quantum memory applications.

On the photonic side, PsiQuantum is collaborating with foundry partners to manufacture quantum photonic chips that leverage metamaterial-based waveguides, targeting scalable quantum architectures by 2027. In the Asia-Pacific region, NTT Research and RIKEN are investing in quantum metamaterials for both spin and photon-based qubits, with pilot manufacturing facilities expected to expand by 2026.

With these developments, market analysts from quantum hardware manufacturers anticipate a compound annual growth rate (CAGR) exceeding 30% for the quantum metamaterial qubit manufacturing segment between 2025 and 2030. This growth will be fueled by increasing demand from quantum cloud service providers and national quantum computing initiatives. Government-backed programs, such as those led by DARPA and the National Institute of Standards and Technology, are also catalyzing public-private partnerships focused on scaling up metamaterial-enabled quantum chips.

- By 2027, at least five major quantum hardware companies are expected to have metamaterial-based qubit modules in commercial trial or limited release.

- Global manufacturing capacity for metamaterial quantum chips is projected to double by 2028, driven by investments in new fabrication lines and packaging technologies.

- By 2030, the market for quantum metamaterial qubit manufacturing is expected to reach several billion USD, with North America, Europe, and East Asia as the primary growth regions.

While technical barriers remain, particularly in process yield and reproducibility, the outlook for quantum metamaterial qubit manufacturing is one of rapid scale-up and global competition, supported by increasing cross-sectoral collaboration and policy support.

Emerging Applications and Use Cases Across Industries

Quantum metamaterial qubit manufacturing is rapidly moving from theoretical exploration to practical implementation, with 2025 poised to be a pivotal year for emerging applications and cross-industry use cases. Quantum metamaterials—engineered materials with quantum-level control over their electromagnetic properties—are being leveraged to fabricate new classes of qubits with enhanced coherence times, scalability, and controllability. This development is beginning to reshape several key sectors.

In the computing and information technology industry, quantum metamaterials are enabling the creation of qubits that are less susceptible to decoherence and environmental noise, which are persistent challenges in scaling quantum processors. Companies such as IBM and Intel Corporation are actively exploring metamaterial-based superconducting circuits and hybrid qubit platforms to enhance quantum device reliability. Early prototypes in 2025 are expected to demonstrate improved fidelity, opening the door to more robust quantum cloud computing services and accelerating the timeline for practical quantum advantage.

Telecommunications is another sector benefiting from quantum metamaterial innovation. Quantum metamaterial photonic qubits promise advances in secure quantum communication networks, with organizations like Nokia trialing quantum-safe transmission components built with engineered nanostructures. These developments are crucial for establishing the backbone of future quantum internet infrastructure, facilitating ultra-secure data transfer across geographically distributed nodes.

In the field of sensing and imaging, quantum metamaterials are enabling unprecedented sensitivity and resolution. Lockheed Martin is investigating metamaterial-based quantum sensors designed for aerospace and defense applications, including navigation and detection systems that outperform classical counterparts in noisy environments.

Healthcare and pharmaceuticals are also on the cusp of transformation. Quantum metamaterial qubits are being incorporated into next-generation quantum simulators for drug discovery, with Rigetti Computing collaborating on projects to model molecular interactions more efficiently. The enhanced stability and control offered by metamaterial qubits are expected to accelerate simulations of complex biological systems, potentially shortening the drug development cycle.

Looking ahead, the next few years are likely to see broader adoption of quantum metamaterial qubit devices, as manufacturing processes mature and industry partnerships proliferate. Standardization efforts and collaborations between technology firms and manufacturing consortia, such as those led by SEMI, are expected to streamline supply chains and reduce production costs, further catalyzing cross-sector innovation.

Regulatory Landscape and Standardization Efforts

The regulatory landscape for quantum metamaterial qubit manufacturing in 2025 is rapidly evolving, reflecting the sector’s transition from academic research to early-stage industrialization. As quantum computing hardware matures, particularly with the integration of metamaterials into qubit architectures, stakeholders are recognizing the need for harmonized standards and proactive regulation to ensure interoperability, reliability, and security.

Several governmental and international agencies have initiated frameworks for quantum technologies. In the United States, the National Institute of Standards and Technology (NIST) is working closely with industry to develop pre-normative standards for quantum hardware, including components that leverage novel metamaterials. NIST’s Quantum Economic Development Consortium (QED-C), which brings together leading quantum hardware developers such as IBM and Rigetti Computing, has established working groups to address challenges in qubit material quality, device characterization, and cross-platform comparability.

On the international stage, the International Electrotechnical Commission (IEC) and the International Organization for Standardization (ISO) Quantum Technologies Technical Committee are actively developing foundational standards for quantum components, including those incorporating emerging metamaterials. These efforts are in close dialogue with national standardization bodies in Europe and Asia, with countries like Germany and Japan playing active roles through their respective standardization agencies. In Europe, the Carl Zeiss AG and Infineon Technologies AG are among industry leaders participating in discussions on best practices for quantum device manufacturing and metamaterial integration.

In 2025 and the next few years, regulatory attention is expected to intensify around the traceability of quantum metamaterial supply chains, the reproducibility of qubit performance, and the environmental and ethical implications of advanced material synthesis. The UK National Quantum Technologies Programme has highlighted these issues, supporting pilot projects that demonstrate responsible sourcing and transparent reporting for quantum materials.

Outlook for 2025-2027 suggests a shift from voluntary guidelines to more formalized, enforceable standards, especially as pilot quantum computers incorporating metamaterial qubits move towards commercial deployment. As these devices approach greater complexity and scale, harmonized standards will be essential for cross-border collaboration, vendor certification, and end-user trust.

Investment Trends, M&A Activity, and Startup Ecosystem

The quantum metamaterial qubit manufacturing sector is emerging as an investment hotspot in 2025, driven by growing interest in scalable quantum computing architectures. A surge in venture capital and strategic corporate investment has been observed, particularly targeting startups and research spinoffs focused on novel metamaterial-based qubit platforms. These materials, engineered to exhibit custom electromagnetic properties, are seen as key enablers for higher qubit coherence and integration density, addressing some of the main bottlenecks in current quantum hardware.

In early 2025, several notable funding rounds have underscored investor confidence. For example, Rigetti Computing—a company historically focused on superconducting qubits—has announced new R&D initiatives exploring metamaterial substrates to reduce loss and decoherence, supported by a fresh round of capital. Similarly, Paul Scherrer Institute has expanded collaboration with private investors to accelerate the commercialization of metamaterial-based photonic and spin qubits, aiming for pilot-scale manufacturing by 2026.

Mergers and acquisitions (M&A) activity is also intensifying, as established semiconductor and materials firms seek access to quantum metamaterial know-how. In Q1 2025, Applied Materials completed the acquisition of a European nanofabrication startup specializing in atomic-precision deposition techniques for quantum metamaterials, consolidating its position in next-generation quantum device supply chains. In parallel, Oxford Instruments has initiated strategic partnerships with university spinouts to develop scalable cryogenic hardware compatible with metamaterial qubits, signaling a broader industry shift toward vertical integration.

The startup ecosystem remains vibrant, with new entrants such as Quantinuum and university-affiliated ventures focusing on proprietary fabrication protocols for topological and hybrid metamaterial qubits. Many of these startups benefit from public-private accelerators and government-backed innovation funds, particularly in the US, EU, and Japan, which recognize quantum metamaterials as a critical technology for national quantum initiatives.

Looking ahead to the next few years, investment momentum is expected to sustain, fueled by proof-of-concept demonstrations and pilot manufacturing lines coming online. Industry analysts anticipate increased cross-border collaborations and the emergence of specialized foundries dedicated to quantum metamaterial devices, further catalyzing both M&A and startup formation as the technology matures toward commercial viability.

Future Outlook: Disruptive Pathways and Competitive Scenarios

Quantum metamaterial qubit manufacturing is poised for significant evolution in 2025 and the near future, driven by rapid advancements in quantum materials science and scalable fabrication technologies. As quantum computing hardware ventures beyond mere proof-of-concept devices, metamaterials—engineered structures with tailored quantum properties—are increasingly recognized as enablers of more robust, scalable, and error-tolerant qubits.

Several leading organizations are actively developing quantum metamaterials to enhance qubit performance. For instance, International Business Machines Corporation (IBM) and Rigetti Computing are investigating superconducting quantum metamaterials to minimize decoherence and improve gate fidelities. Similarly, Delft University of Technology's QuTech is pioneering hybrid qubit platforms that employ metamaterial-inspired nanostructures to achieve high coherence times and scalable interconnects.

In 2025, the sector is witnessing a convergence of advanced nanofabrication—such as atomic layer deposition and focused ion beam lithography—with scalable assembly techniques, enabling the production of complex metamaterial lattices at wafer scale. Intel Corporation has announced ongoing investments in integrating quantum metamaterial structures directly onto silicon substrates, aiming for compatibility with established semiconductor manufacturing processes. This alignment is anticipated to help bridge the gap between laboratory breakthroughs and commercial quantum processors.

Another disruptive pathway is the exploration of topological metamaterials, which inherently protect quantum information from local noise and fabrication defects. Microsoft is advancing topological qubit research, leveraging metamaterial engineering to stabilize Majorana states and potentially unlock fault-tolerant quantum computation. These efforts are expected to reach critical experimental milestones over the next few years, with demonstrator devices anticipated before the decade’s end.

Looking ahead, the competitive landscape is likely to intensify as more hardware entrants, including National Institute of Standards and Technology (NIST) and startups like PsiQuantum, invest in quantum metamaterial innovations. The sector is also likely to see strategic collaborations between quantum hardware manufacturers and material science specialists to accelerate breakthroughs. As metamaterial-enabled qubits transition from laboratory prototypes to manufacturable components, we can expect a new wave of quantum processors with unprecedented scalability, reliability, and commercial readiness by the late 2020s.

Sources & References

- IBM

- Rigetti Computing

- PsiQuantum

- Oxford Instruments

- Bluefors

- 2D Semiconductors Inc.

- Infineon Technologies AG

- Oxford Instruments

- Quantinuum

- National Institute of Standards and Technology (NIST)

- American Elements

- ULVAC

- Eurisotop

- imec

- attocube systems AG

- Paul Scherrer Institute

- NTT Research

- RIKEN

- DARPA

- Nokia

- Lockheed Martin

- International Organization for Standardization (ISO) Quantum Technologies Technical Committee

- UK National Quantum Technologies Programme

- Microsoft